Redlining

In the United States, redlining is the systematic denial of various services by federal government agencies, local governments as well as the private sector either directly or through the selective raising of prices.[2][3] Neighborhoods with high proportion of minority residents are more likely to be redlined than other neighborhoods with similar household incomes, housing age and type, and other determinants of risk, but different racial composition.[4] While the best known examples of redlining have involved denial of financial services such as banking or insurance,[5] other services such as health care (see also Race and health) or even supermarkets[6] have been denied to residents. In the case of retail businesses like supermarkets, purposely locating stores impractically far away from targeted residents results in a redlining effect.[7] Reverse redlining occurs when a lender or insurer particularly targets minority consumers in a non-redlined area, not to deny them loans or insurance, but to charge them more than would be charged to a similarly situated white consumer.[8][9]

In the 1960s, sociologist John McKnight coined the term "redlining" to describe the discriminatory practice of fencing off areas where banks would avoid investments based on community demographics.[10] During the heyday of redlining, the areas most frequently discriminated against were black inner city neighborhoods. For example, in Atlanta in the 1980s, a Pulitzer Prize-winning series of articles by investigative reporter Bill Dedman showed that banks would often lend to lower-income whites but not to middle-income or upper-income blacks.[11] The use of blacklists is a related mechanism also used by redliners to keep track of groups, areas, and people that the discriminating party feels should be denied business or aid or other transactions. In the academic literature, redlining falls under the broader category of credit rationing.

History

| Part of a series of articles on |

| Racial segregation |

|---|

|

| Segregation by region |

| Similar practices by region |

Although informal discrimination and segregation had existed in the United States, the specific practice called "redlining" began with the National Housing Act of 1934, which established the Federal Housing Administration (FHA).[12][13] Racial segregation and discrimination against minorities and minority communities predated this policy. The implementation of this federal policy aggravated the decay of minority inner-city neighborhoods caused by the withholding of mortgage capital, and made it even more difficult for neighborhoods to attract and retain families able to purchase homes.[14] The assumptions in redlining resulted in a large increase in residential racial segregation and urban decay in the United States.

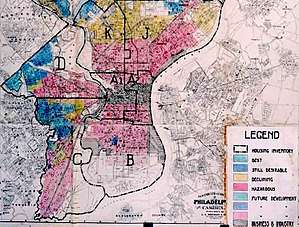

In 1935, the Federal Home Loan Bank Board (FHLBB) asked the Home Owners' Loan Corporation (HOLC) to look at 239 cities and create "residential security maps" to indicate the level of security for real-estate investments in each surveyed city. On the maps, the newest areas—those considered desirable for lending purposes—were outlined in green and known as "Type A". These were typically affluent suburbs on the outskirts of cities. "Type B" neighborhoods, outlined in blue, were considered "Still Desirable", whereas older "Type C" were labeled "Declining" and outlined in yellow. "Type D" neighborhoods were outlined in red and were considered the most risky for mortgage support. These neighborhoods tended to be the older districts in the center of cities; often they were also black neighborhoods.[12] Urban planning historians theorize that the maps were used by private and public entities for years afterward to deny loans to people in black communities.[12] But, recent research has indicated that the HOLC did not redline in its own lending activities and that the racist language reflected the bias of the private sector and experts hired to conduct the appraisals.[15][16][17]

Some redlined maps were also created by private organizations, such as J. M. Brewer's 1934 map of Philadelphia. Private organizations created maps designed to meet the requirements of the Federal Housing Administration's underwriting manual. The lenders had to consider FHA standards if they wanted to receive FHA insurance for their loans. FHA appraisal manuals instructed banks to steer clear of areas with "inharmonious racial groups", and recommended that municipalities enact racially restrictive zoning ordinances.[18][19]

Following a National Housing Conference in 1973, a group of Chicago community organizations led by The Northwest Community Organization (NCO) formed National People's Action (NPA), to broaden the fight against disinvestment and mortgage redlining in neighborhoods all over the country. This organization, led by Chicago housewife Gale Cincotta and Shel Trapp, a professional community organizer, targeted The Federal Home Loan Bank Board, the governing authority over federally chartered Savings & Loan institutions (S&L) that held at that time the bulk of the country's home mortgages. NPA embarked on an effort to build a national coalition of urban community organizations to pass a national disclosure regulation or law to require banks to reveal their lending patterns.[20]

For many years, urban community organizations had battled neighborhood decay by attacking blockbusting, forcing landlords to maintain properties, and requiring cities to board up and tear down abandoned properties. These actions addressed the short-term issues of neighborhood decline. Neighborhood leaders began to learn that these issues and conditions were symptoms of a disinvestment that was the true, though hidden, underlying cause of these problems. They changed their strategy as more data was gathered.[21]

With the help of NPA, a coalition of loosely affiliated community organizations began to form. At the Third Annual Housing Conference held in Chicago in 1974, eight hundred delegates representing 25 states and 35 cities attended. The strategy focused on the Federal Home Loan Bank Board (FHLBB), which oversaw S&Ls in cities all over the country.

In 1974, Chicago's Metropolitan Area Housing Association (MAHA), made up of representatives of local organizations, succeeded in having the Illinois State Legislature pass laws mandating disclosure and outlawing redlining. In Massachusetts, organizers allied with NPA confronted a unique situation. Over 90% of home mortgages were held by state-chartered savings banks. A Jamaica Plain neighborhood organization pushed the disinvestment issue into the statewide gubernatorial race. The Jamaica Plain Banking & Mortgage Committee and its citywide affiliate, The Boston Anti-redlining Coalition (BARC), won a commitment from Democratic candidate Michael S. Dukakis to order statewide disclosure through the Massachusetts State Banking Commission. After Dukakis was elected, his new Banking Commissioner ordered banks to disclose mortgage-lending patterns by ZIP code. The suspected redlining was revealed.[22]A former community organizer, Richard W. "Rick" Wise who led the Boston organizing, has published a novel, Redlined, which gives a somewhat fictionalized account of the anti-redlining campaign.[23]

NPA and its affiliates achieved disclosure of lending practices with the passage of The Home Mortgage Disclosure Act of 1975. The required transparency and review of loan practices began to change lending practices. NPA began to work on reinvestment in areas that had been neglected. Their support helped gain passage in 1977 of the Community Reinvestment Act.

Challenges

| Part of a series on | ||||||||||||

| African Americans | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

|

||||||||||||

|

Religion

|

||||||||||||

|

Politics

|

||||||||||||

|

Civic / economic groups

|

||||||||||||

|

Sports

|

||||||||||||

|

Sub-communities

|

||||||||||||

|

Dialects and languages

|

||||||||||||

|

Population

|

||||||||||||

| ||||||||||||

Court system

The U.S. Department of Housing and Urban Development announced a $200 million settlement with Associated Bank over redlining in Chicago and Milwaukee in May 2015. The three-year HUD observation led to the complaint that the bank purposely rejected mortgage applications from black and Latino applicants.[24] The final settlement required AB to open branches in non-white neighborhoods, just like HSBC.[25]

New York Attorney General Eric Schneiderman announced a settlement with Evans Bank for $825,000 on September 10, 2015. An investigation had uncovered the erasure of black neighborhoods from mortgage lending maps.[26] According to Schneiderman, of the over 1,100 mortgage applications the bank received between 2009 and 2012, only four were from African Americans.[27] Following this investigation, the Buffalo News reported that more banks could be investigated for the same reasons in the near future. The most notable examples of such DOJ and HUD settlements have focused heavily on community banks in large metropolitan areas, but banks in other regions have been the subject of such orders as well, including First United Security Bank in Thomasville, Alabama, and Community State Bank in Saginaw, Michigan.[28]

The United States Department of Justice announced a $33 million settlement with Hudson City Savings Bank, which services New Jersey, New York, and Pennsylvania, on September 24, 2015.[29] The six-year DOJ investigation had proven that the company was intentionally avoiding granting mortgages to Latinos and African Americans and purposely avoided expanding into minority-majority communities. The Justice Department called it the "largest residential mortgage redlining settlement in its history."[30] As a part of the settlement agreement, HCSB was forced to open branches in non-white communities. As U.S. Attorney Paul Fishman explained to Emily Badger for The Washington Post, "[i]f you lived in a majority-black or Hispanic neighborhood and you wanted to apply for a mortgage, Hudson City Savings Bank was not the place to go." The enforcement agencies cited additional evidence of discrimination in Hudson City's broker selection practices, noting that the bank received 80 percent of its mortgage applications from mortgage brokers but that the brokers with whom the bank worked were not located in majority African-American and Hispanic areas.[31]

Legislative action

In the United States, the Fair Housing Act of 1968 was passed to fight the practice. According to the Department of Housing and Urban Development, "The Fair Housing Act makes it unlawful to discriminate in the terms, conditions, or privileges of sale of a dwelling because of race or national origin. The Act also makes it unlawful for any person or other entity whose business includes residential real estate-related transactions to discriminate against any person in making available such a transaction, or in the terms or conditions of such a transaction, because of race or national origin."[32] The Office of Fair Housing and Equal Opportunity was tasked with administering and enforcing this law. Anyone who suspects that their neighborhood has been redlined is able to file a housing discrimination complaint.

The Community Reinvestment Act passed by Congress in 1977 to reduce discriminatory credit practices against low-income neighborhoods further required banks to apply the same lending criteria in all communities.[33] Although open redlining was made illegal in the 1970s through community reinvestment legislation, the practice may have continued in less overt ways.[14] AIDS activists allege redlining of health insurance against the LGBT community in response to the AIDS crisis.[34]

Community organizations

ShoreBank, a community-development bank in Chicago's South Shore neighborhood, was a part of the private-sector fight against redlining.[35] Founded in 1973, ShoreBank sought to combat racist lending practices in Chicago's African-American communities by providing financial services, especially mortgage loans, to local residents.[36] In a 1992 speech, then-Presidential candidate Bill Clinton called ShoreBank "the most important bank in America."[35] On August 20, 2010, the bank was declared insolvent, closed by regulators and most of its assets were acquired by Urban Partnership Bank.

In the mid-1970s, community organizations, under the banner of the NPA, worked to fight against redlining in South Austin, Illinois. One of these organizations was SACCC (South Austin Coalition Community Council), formed to restore South Austin's neighborhood and to fight against financial institutions accused of propagating redlining. This got the attention of insurance regulators in the Illinois Department of Insurance, as well as federal officers enforcing anti-racial discrimination laws.[37]

Current issues

Racial segregation in American cities

The United States Federal Government has enacted legislation since the 1970s to reduce the segregation of American cities. While many cities have reduced the amount of segregated neighborhoods, some still have clearly defined racial boundaries. Since 1990, the City of Chicago has been one of the most persistently racially segregated cities, despite efforts to improve mobility and reduce barriers. Other cities like Detroit, Houston, and Atlanta likewise have very pronounced black and white neighborhoods, the same neighborhoods that were originally redlined by financial institutions decades ago.[38] While other cities have made progress, this continued racial segregation has contributed to reduced economic mobility for millions of people.

Race wealth gap

The practice of redlining actively helped to create what is now known as the Racial Wealth Gap seen in the United States.[39]

Black families in America earned just $57.30 for every $100 in income earned by white families, according to the Census Bureau's Current Population Survey. For every $100 in white family wealth, black families hold just $5.04.[40] In 2016, the median wealth for black and Hispanic families was $17,600 and $20,700, respectively, compared with white families' median wealth of $171,000.[39] The black-white wealth gap has not recovered from the Great Recession. In 2007, immediately before the Great Recession, the median wealth of blacks was nearly 14 percent that of whites. Although black wealth increased at a faster rate than white wealth in 2016, blacks still owned less than 10 percent of whites' wealth at the median.[39]

A multigenerational study of people from five race groups analyzed upward mobility trends in American Cities.[41] The study concluded that black men who grew up in racially segregated neighborhoods were substantially less likely to gain upward economic mobility, finding "black children born to parents in the bottom household income quintile have a 2.5% chance of rising to the top quintile of household income, compared with 10.6% for whites." Because of this intergenerational poverty, black households are "stuck in place" and are unable to grow wealth.

A 2017 study by Federal Reserve Bank of Chicago economists found that the practice of redlining—the practice whereby banks discriminated against the inhabitants of certain neighborhoods—had a persistent adverse impact on the neighborhoods, with redlining affecting homeownership rates, home values and credit scores in 2010.[42][43] Since many African-Americans could not access conventional home loans, they had to turn to predatory lenders (who charged high interest rates).[43] Due to lower home ownership rates, slumlords were able to rent out apartments that would otherwise be owned.[43]

Retail

Brick and mortar

Retail redlining is a spatially discriminatory practice among retailers. Taxicab services and delivery food may not serve certain areas, based on their ethnic-minority composition and assumptions about business (and perceived crime), rather than data and economic criteria, such as the potential profitability of operating in those areas. Consequently, consumers in these areas are vulnerable to prices set by fewer retailers. They may be exploited by retailers who charge higher prices and/or offer them inferior goods. Critics, however, argue that if such practices were causing retailers to avoid doing business in otherwise profitable areas (due to the racial demographics of these locations), retailers who avoided this practice and continued to do business in these areas would be at an economic advantage over their competition. Therefore, by choosing not to service a potentially profitable area, retailers would be lowering the quantity supplied of their good or service to below the market equilibrium quantity. This would allow any businesses that stayed in the area to make an economic profit. The presence of economic profits for retailers in that area would create a strong market incentive for new firms to move into this area. Because of these economic incentives, critics argue that the businesses discriminating based on race when choosing their customers were doing so for economic reasons in order to maximize their profits. If these businesses were avoiding potentially profitable areas, new businesses would quickly take advantage of the resulting presence of economic profits and decreased competition in the area.[44]

Online

A 2012 study by The Wall Street Journal found that Staples, The Home Depot, Rosetta Stone and some other online retailers displayed different prices to customers in different locations (distinct from shipping prices). Staples based discounts on proximity to competitors like OfficeMax and Office Depot. This generally resulted in higher prices for customers in more rural areas, who were on average less wealthy than customers seeing lower prices.[45][46][47]

Liquorlining

Some service providers target low-income neighborhoods for nuisance sales. When those services are believed to have adverse effects on a community, they may considered to be a form of "reverse redlining". The term "liquorlining" is sometimes used to describe high densities of liquor stores in low income and/or minority communities relative to surrounding areas. High densities of liquor stores are associated with crime and public health issues, which may in turn drive away supermarkets, grocery stores, and other retail outlets, contributing to low levels of economic development.[48] Controlled for income, nonwhites face higher concentrations of liquor stores than do whites.[49]

Financial services

Student loans

In December 2007, a class action lawsuit was brought against student loan lending giant Sallie Mae in the United States District Court for the District of Connecticut. The class alleged that Sallie Mae discriminated against African American and Hispanic private student loan applicants.[50]

The case alleged that the factors Sallie Mae used to underwrite private student loans caused a disparate impact on students attending schools with higher minority populations. The suit also alleged that Sallie Mae failed to properly disclose loan terms to private student loan borrowers.

The lawsuit was settled in 2011. The terms of the settlement included Sallie Mae agreeing to make a $500,000 donation to the United Negro College Fund and the attorneys for the plaintiffs receiving $1.8 million in attorneys' fees.[51][52]

Credit cards

Credit card redlining is a spatially discriminatory practice among credit card issuers, of providing different amounts of credit to different areas, based on their ethnic-minority composition, rather than on economic criteria, such as the potential profitability of operating in those areas.[53] Scholars assess certain policies, such as credit card issuers reducing credit lines of individuals with a record of purchases at retailers frequented by so-called "high-risk" customers, to be akin to redlining.[53]

Banks

Much of the economic impacts we find as a result of redlining and the banking system directly impacts that of the African American / Black Community. Beginning in the 1960s, there was a large influx of Black Veterans and their families moving into suburban White communities. As Blacks moved in, Whites moved out and the market value of these homes dropped dramatically. In observation of said market values, bank lenders were able to keep close track by literally drawing red lines around the neighborhoods on a map. These lines signified areas that they would not invest in. By way of racial redlining, not only banks but savings and loans, insurance companies, grocery chains, and even pizza delivery companies thwarts economic vitality in black communities.[54] The severe lacking in civil rights laws in combination with the economic impact led to the passing of the Community Reinvestment Act in 1977.

Racial and economic redlining sets the people who lived in these communities up for failure from the start. So much that banks would often deny people who came from these areas bank loans or offered them at stricter repayment rates. As a result, there was a very low rate at which people (in particular Blacks / African Americans) were able to own their homes; opening the door for slum landlords (who could get approved for low interest loans in those communities) to take over and do as they saw fit.[55]

Insurance

Gregory D. Squires wrote in 2003 that data showed that race continues to affect the policies and practices of the insurance industry.[56] Racial profiling or redlining has a long history in the property-insurance industry in the United States. From a review of industry underwriting and marketing materials, court documents, and research by government agencies, industry and community groups, and academics, it is clear that race has long affected and continues to affect the policies and practices of the insurance industry.[56] Home-insurance agents may try to assess the ethnicity of a potential customer just by telephone, affecting what services they offer to inquiries about purchasing a home insurance policy. This type of discrimination is called linguistic profiling.[57] There have also been concerns raised about redlining in the automotive insurance industry.[58] Reviews of insurance scores based on credit are shown to have unequal results by ethnic group. The Ohio Department of Insurance in the early 21st century allows insurance providers to use maps and collection of demographic data by ZIP code in determining insurance rates. The FHEO Director of Investigations at the Department of Housing and Urban Development, Sara Pratt, wrote:

Like other forms of discrimination, the history of insurance redlining began in conscious, overt racial discrimination practiced openly and with significant community support in communities throughout the country. There was documented overt discrimination in practices relating to residential housing—from the appraisal manuals which established an articulated "policy" of preferences based on race, religion and national origin. to lending practices which only made loans available in certain parts of town or to certain borrowers, to the decision-making process in loans and insurance which allowed the insertion of discriminatory assessments into final decisions about either.[59]

Mortgages

Reverse redlining occurs when a lender or insurer particularly targets minority consumers, not to deny them loans or insurance, but to charge them more than would be charged to a similarly situated white consumer, specifically marketing the most expensive and onerous loan products. These communities had largely been ignored by most lenders just a couple of decades earlier. In the 2000s some financial institutions considered black communities as suitable for subprime mortgages. Wells Fargo partnered with churches in black communities, where the pastor would deliver "wealth building" seminars in their sermons, and the bank would make a donation to the church in return for every new mortgage application. Working-class blacks wanted a part of the nation's home-owning trend. Instead of contributing to homeownership and community progress, predatory lending practices through reverse redlining stripped the equity homeowners struggled to build and drained the wealth of those communities for the enrichment of financial firms. The growth of subprime lending (higher cost loans to borrowers with flaws on their credit records) prior to the 2008 financial crisis, coupled with growing law enforcement activity in those areas, clearly showed a surge in a range of manipulative practices. Not all subprime loans were predatory, but virtually all predatory loans were subprime. Some subprime loans certainly benefit high-risk borrowers who would not qualify for conventional, prime loans. Predatory loans, however, charge unreasonably higher rates and fees by compared to the risk, trapping homeowners in unaffordable debt and often costing them their homes and life savings.[8][9]

A survey of two districts of similar incomes, one being largely white and the other largely black, found that bank branches in the black community offered largely subprime loans and almost no prime loans. Studies found out that high-income blacks were almost twice as likely to end up with subprime home-purchase mortgages as did low-income whites. Some loan officers referred to blacks as "mud people" and to subprime lending as "ghetto loans."[8][9][60] A lower savings rate and a distrust of banks, stemming from a legacy of redlining, may help explain why there are fewer branches in minority neighborhoods. In the early 21st century, brokers and telemarketers actively pushed subprime mortgages. A majority of the loans were refinance transactions, allowing homeowners to take cash out of their appreciating property or pay off credit card and other debt.[61]

Redlining has helped preserve segregated living patterns for blacks and whites in the United States, as discrimination is often contingent on the racial composition of neighborhoods and the race of the applicant. Lending institutions such as Wells Fargo have been shown to treat black mortgage applicants differently when they are buying homes in white neighborhoods than when buying homes in black neighborhoods.[8][9][62]

Dan Immergluck writes that in 2002 small businesses in black neighborhoods received fewer loans, even after accounting for business density, business size, industrial mix, neighborhood income, and the credit quality of local businesses.[63]

Several state attorneys general have begun investigating these practices, which may violate fair lending laws. The NAACP filed a class-action lawsuit charging systematic racial discrimination by more than a dozen banks.

Environmental racism

Policies related to redlining and urban decay can also act as a form of environmental racism, which in turn affect public health. Urban minority communities may face environmental racism in the form of parks that are smaller, less accessible and of poorer quality than those in more affluent or white areas in some cities.[64] This may have an indirect effect on health, since young people have fewer places to play, and adults have fewer opportunities for exercise.[64]

Robert Wallace writes that the pattern of the AIDS outbreak during the 80s was affected by the outcomes of a program of "planned shrinkage" directed at African-American and Hispanic communities. It was implemented through systematic denial of municipal services, particularly fire protection resources, essential to maintain urban levels of population density and ensure community stability.[65] Institutionalized racism affects general health care as well as the quality of AIDS health intervention and services in minority communities. The over-representation of minorities in various disease categories, including AIDS, is partially related to environmental racism. The national response to the AIDS epidemic in minority communities was slow during the 80s and 90s, showing an insensitivity to ethnic diversity in prevention efforts and AIDS health services.[66]

Workforce

Workers living in American inner cities have more difficulty finding jobs than suburban workers do.[67]

Digital redlining

Digital redlining is a term used to refer to the practice of creating and perpetuating inequities between racial, cultural, and class groups specifically through the use of digital technologies, digital content, and the internet.[68][69] Digital redlining is an extension of the historical housing discrimination practice of redlining to include an ability to discriminate against vulnerable classes of society using algorithms, connected digital technologies, and big data.[70][71] This extension of the term tends to include both geographically based and non-geographically based discrimination. For example, in March 2019 the United States Department of Housing and Urban Development (HUD) charged Facebook with housing discrimination over the company's targeted advertising practices.[72] While these charges included geographically based targeting in the form of a tool that allowed advertisers to draw a red line on a map; they also included non-geographically based methods that did not use maps but rather utilized algorithmic targeting using Facebook's user profile information to directly exclude specific groups of people. A press release from HUD on March 28, 2019 stated that HUD was charging that "Facebook enabled advertisers to exclude people whom Facebook classified as parents; non-American-born; non-Christian; interested in accessibility; interested in Hispanic culture; or a wide variety of other interests that closely align with the Fair Housing Act’s protected classes."[72]

Political redlining

Political redlining is the process of restricting the supply of political information with assumptions about demographics and present or past opinions.[73] It occurs when political campaign managers delimit which population is less likely to vote and design information campaigns only with likely voters in mind. It can also occur when politicians, lobbyists, or political campaign managers identify which communities to actively discourage from voting through voter suppression campaigns.[74][75]

Strategies to reverse effects of redlining

Redlining has contributed to the long term decline of low-income, inner city neighborhoods and the continuation of ethnic minority enclaves. Compared to prospering ethnic minority areas, historically redlined or other struggling black communities need targeted investments in infrastructure and services in order to prosper.[76]

Some of these strategies include:

- Targeting planning resources to improve employment, incomes, wealth, the built environment, and social services in struggling communities.

- Recognize the importance of public transportation as a means for low-income communities to access jobs and services.

- Provide jobs near the labor supply through targeted economic development.

- Invest in the housing stock through neighborhood revitalization programs.

- Utilize inclusionary zoning (IZ) ordinances to improve amounts of high quality housing.

- Equitably distribute hazardous waste sites so they are not concentrated in low-income and minority areas.

See also

- Black flight

- Computer-assisted reporting

- Cream skimming

- Financial crisis of 2007–08

- Greenlining Institute

- Housing segregation

- Inclusionary zoning

- Price discrimination

- Racial steering

- Racial views of Donald Trump#Housing discrimination cases

- Sundown town

- Timeline of racial tension in Omaha, Nebraska

- Urban renewal

- Urban decay

- White flight

Citations

- The HOLC maps are part of the records of the FHLBB (RG195) at the National Archives II Archived 2016-10-11 at the Wayback Machine.

- Gross, Terry. "A 'Forgotten History' of How the U.S. Government Segregated America". Fresh Air. NPR. Retrieved 2019-03-31.

- Harris, Richard; Forrester, Doris (2 July 2016). "The Suburban Origins of Redlining: A Canadian Case Study, 1935–54". Urban Studies. 40 (13): 2661–2686. doi:10.1080/0042098032000146830.

- Caves, R. W. (2004). Encyclopedia of the City. Routledge. p. 560. ISBN 9780415252256.

- Zenou, Yves; Boccard, Nicolas (September 2000). "Racial Discrimination and Redlining in Cities". Journal of Urban Economics. 48 (2): 260–285. doi:10.1006/juec.1999.2166.

- Eisenhauer, Elizabeth (2001). "In poor health: Supermarket redlining and urban nutrition". GeoJournal. 53 (2): 125–133. doi:10.1023/A:1015772503007.

- How East New York Became a Ghetto by Walter Thabit. ISBN 0-8147-8267-1. Page 42.

- Ehrenreich, Barbara; Muhammad, Dedrick (September 13, 2009). "The Recession's Racial Divide". The New York Times.

- Powell, Michael (June 7, 2009). "Bank Accused of Pushing Mortgage Deals on Blacks". The New York Times.

- Norton, William (2013). Cultural Geography: Environments, Landscapes, Identities, Inequalities (3rd ed.). Oxford: Oxford University Press. ISBN 978-0195429541.

- Dedman, Bill (1988-05-01). "The Color of Money". The Atlanta Journal-Constitution. Retrieved 2009-01-05.

- Jackson, Kenneth T. (1985), Crabgrass Frontier: The Suburbanization of the United States, New York: Oxford University Press, ISBN 0-19-504983-7

- Madrigal, Alexis C. (2014-05-22). "The Racist Housing Policy That Made Your Neighborhood". The Atlantic. Retrieved 2018-11-10.

- When Work Disappears: The World of the New Urban Poor By William Julius Wilson. 1996. ISBN 0-679-72417-6

- Hillier, Amy E. (2003). "Redlining and the Home Owners' Loan Corporation". Journal of Urban History. 29 (4): 394–420. doi:10.1177/0096144203029004002.

- Crossney, Kristen B.; Bartelt, David W. (16 May 2013). "Residential Security, Risk, and Race: The Home Owners' Loan Corporation and Mortgage Access in Two Cities". Urban Geography. 26 (8): 707–736. doi:10.2747/0272-3638.26.8.707.

- Crossney, Kristen B.; Bartelt, David W. (January 2005). "The legacy of the home owners' loan corporation". Housing Policy Debate. 16 (3–4): 547–574. doi:10.1080/10511482.2005.9521555.

- Schill, Michael H.; Wachter, Susan M. (2001). "Principles to Guide Housing Policy at the Beginning of the Millennium" (PDF). Cityscape. 5 (2): 5–19. CiteSeerX 10.1.1.536.5952. JSTOR 20868512.

- "Part II, Section 9, Rating of Location". Underwriting Manual: Underwriting and Valuation Procedure Under Title II of the National Housing Act With Revisions to February 1938. Washington, D.C.: Federal Housing Administration.

Recommended restrictions should include provision for the following: Prohibition of the occupancy of properties except by the race for which they are intended ... Schools should be appropriate to the needs of the new community and they should not be attended in large numbers by inharmonious racial groups

- Hallahan, Kirk (1992). "The mortgage redlining controversy, 1972-75" (PDF). Proceedings of the Annual Meeting of the Association for Education in Journalism and Mass Communication (75th, Montreal, Quebec, Canada, August 5-8, 1992). OCLC 31165884. Archived from the original (PDF) on 2013-08-09.

- Michael Westgate and Ann Vick-Westgate (2011). Gale Force, The Battles for Disclosure and Community Reinvestment. Cambridge, Ma.: Harvard Bookstore. pp. 40–41. ISBN 978-0615449012.CS1 maint: uses authors parameter (link)

- Jordan, Patricia (June 12, 1975). "Mass Thrifts Plan Suit Over Redlining, Commissioner Stands Firm". American Banker.

- Wise, Richard W. (1 October 2019). Redlined; a novel of Boston (1st. ed.). New York: Adelaide Books. p. 335. ISBN 978-1950437245.

- "HUDNo_15-064". portal.hud.gov. Archived from the original on 2017-03-08. Retrieved 2017-03-08.

- "Associated Bank settles with HUD over discriminatory lending". Retrieved 2017-03-08.

- Silver-greenberg, Jessica; Corkery, Michael (2015-09-10). "Evans Bank Settles New York 'Redlining' Lawsuit". The New York Times. ISSN 0362-4331. Retrieved 2017-03-08.

- "A.G. Schneiderman Secures Agreement With Evans Bank Ending Discriminatory Mortgage Redlining In Buffalo | New York State Attorney General". ag.ny.gov. Archived from the original on 2018-01-30. Retrieved 2017-03-08.

- Glynn, Matt (2014-09-02). "Evans Bancorp isn't only lender at risk of redlining lawsuit". The Buffalo News. Retrieved 2017-03-08.

- "CONSUMER FINANCIAL PROTECTION BUREAU, and UNITED STATES OF AMERICA, v. HUDSON CITY SAVINGS BANK, F.S.B."

- "Justice Department and Consumer Financial Protection Bureau Reach Settlement with Hudson City Savings Bank to Resolve Allegations of Mortgage Lending Discrimination". www.justice.gov. 2015-09-24. Retrieved 2017-03-08.

- "What it looks like when a bank goes out of its way to avoid minorities". The Washington Post. Retrieved 2017-03-08.

- "HUDNo_15-064". portal.hud.gov. Archived from the original on 2015-09-05. Retrieved 2015-11-04.

- Comeback Cities: A Blueprint for Urban Neighborhood Revival By Paul S. Grogan, Tony Proscio. ISBN 0-8133-3952-9. Published 2002. Page 114.

The goal was not to relax lending restrictions but rather to get banks to apply the same criteria to residents in the inner-city as in the suburbs.

- Levine, Martin P.; Nardi, Peter M.; Gagnon, John H. (18 August 1997). In Changing Times: Gay Men and Lesbians Encounter HIV/AIDS. University of Chicago Press. ISBN 9780226278575. Retrieved 26 April 2018 – via Google Books.

- Douthwaite, Richard. "HOW A BANK CAN TRANSFORM A NEIGHBOURHOOD", "Short Circuit". Retrieved January 8, 2007

- Thomsen, Mark. "ShoreBank Surpasses $1 Billion in Community Development Investment Archived 2012-09-10 at Archive.today", "Social Funds", 2001-11-1. Retrieved January 8, 2007.

- "Combatting redlining in Austin". Chicago Tribune. February 14, 1981. Retrieved 2017-03-16.

- Williams, Aaron; Emamdjomeh, Armand (2018). "America is more diverse than ever — but still segregated". The Washington Post. Retrieved 2019-05-13.

- Hanks, Angela; Solomon, Danyelle; Weller, Christian E. "Systematic Inequality". Center for American Progress. Retrieved 2018-12-17.

- Badger, Emily (2017-09-18). "Whites Have Huge Wealth Edge Over Blacks (but Don't Know It)". The New York Times. ISSN 0362-4331. Retrieved 2018-12-18.

- Chetty, Raj; Hendren, Nathaniel; Jones, Maggie R.; Porter, Sonya R. (2018). "Race and Economic Opportunity in the United States: An Intergenerational Perspective" (NBER Working Paper No. w24441). doi:10.3386/w24441. Cite journal requires

|journal=(help) Later published as: Chetty, Raj; Hendren, Nathaniel; Jones, Maggie R.; Porter, Sonya R. (2019). "Race and Economic Opportunity in the United States: An Intergenerational Perspective". The Quarterly Journal of Economics. doi:10.1093/qje/qjz042. - Mazumder, Bhashkar; Hartley, Daniel A.; Aaronson, Daniel (2017). "The Effects of the 1930s HOLC "Redlining" Maps" (FRB of Chicago Working Paper No. WP–2017–12). SSRN 3038733. Cite journal requires

|journal=(help) - Badger, Emily (2017-08-24). "How Redlining's Racist Effects Lasted for Decades". The New York Times. ISSN 0362-4331. Retrieved 2017-08-26.

- d'Rozario, Denver; Williams, Jerome D. (2005). "Retail Redlining: Definition, Theory, Typology, and Measurement". Journal of Macromarketing. 25 (2): 175–186. doi:10.1177/0276146705280632.

- Jennifer Valentino-DeVries, Jeremy Singer-Vine, Ashkan Soltani (24 Dec 2012). "Websites Vary Prices, Deals Based on Users' Information". Wall Street Journal.CS1 maint: uses authors parameter (link)

- "Staples, Home Depot, and other online stores change prices based on your location". 24 December 2012. Retrieved 26 April 2018.

- "Online price discrimination: a surprising reality in ecommerce". 2013-05-09. Retrieved 26 April 2018.

- Maxwell, Ann; Daniel, Immergluck (January 1997). "Liquorlining: Liquor Store Concentration and Community Development in Lower-income Cook County Neighborhoods" (PDF). Woodstock Institute. Archived from the original (PDF) on 16 April 2012. Retrieved 14 March 2015.

- Romley, John A.; Cohen, Deborah; et al. (January 2007). Schuckit, Mark A. (ed.). "Alcohol and Environmental Justice:The Density of Liquor Stores and Bars in Urban Neighborhoods in the United States" (PDF). Journal of Studies on Alcohol and Drugs. 68 (1): 48–55. doi:10.15288/jsad.2007.68.48. PMID 17149517. Retrieved 14 March 2015 – via RAND Corporation.

- "Sasha Rodriguez & Cathelyn Gregoire on Behalf of All Persons Similarly Situated vs. Sallie Mae (SLM) Corporation" (PDF). New America Foundation. December 17, 2007. Archived from the original (PDF) on 2014-10-06. Retrieved March 6, 2017.

- "SDSD District Version 1.3". United States District Court for the District of Connecticut. Retrieved July 25, 2014.(subscription required)

- "FinAid | Loans | Anti-Discrimination Rules for Education Lenders". www.finaid.org. Retrieved 2020-02-18.

- Cohen-Cole, Ethan (2011). "Credit Card Redlining". Review of Economics and Statistics. 93 (2): 700–713. doi:10.1162/REST_a_00052. SSRN 1098403.

- Bullard, Robert D. (2001). "Environmental Justice in the 21st Century: Race Still Matters" (PDF). Phylon (1960-). 49 (3/4): 151–171. doi:10.2307/3132626. JSTOR 3132626.

- Ross, Stephen L.; Tootell, Geoffrey M.B. (2004). "Redlining, the Community Reinvestment Act, and private mortgage insurance". Journal of Urban Economics. 55 (2): 278–297. CiteSeerX 10.1.1.194.5280. doi:10.1016/S0094-1190(02)00508-9.

- Squires, Gregory D (2016). "Racial Profiling, Insurance Style: Insurance Redlining and the Uneven Development of Metropolitan Areas". Journal of Urban Affairs. 25 (4): 391–410. doi:10.1111/1467-9906.t01-1-00168.

- Squires, Gregory D; Chadwick, Jan (2016). "Linguistic Profiling". Urban Affairs Review. 41 (3): 400–15. doi:10.1177/1078087405281064.

- Karen Bouffard, "Michigan to crack down on uninsured drivers" Archived 2007-11-28 at the Wayback Machine, The Detroit News

- "The History of Insurance Redlining | National Fair Housing Advocate Online". fairhousing.com. Retrieved 2017-03-16.

- Mantell, Ruth (July 6, 2007). "Minority families face wave of foreclosures: Consumer groups urge more 'teeth' in laws combating predators". marketwatch. Retrieved December 22, 2009.

- Bajaj, Vikas; Fessenden, Ford (November 4, 2007). "What's Behind the Race Gap?". The New York Times.

- Holloway, Steven R. (1998). "Exploring the Neighborhood Contingency of Race Discrimination in Mortgage Lending in Columbus, Ohio". Annals of the Association of American Geographers. 88 (2): 252–276. doi:10.1111/1467-8306.00093. JSTOR 2564210.

- Immergluck, Dan (2002). "Redlining Redux: Black Neighborhoods, Black-Owned Firms, and the Regulatory Cold Shoulder". Urban Affairs Review. 38 (1): 22–41. doi:10.1177/107808702401097781.

- Minority Communities Need More Parks, Report Says by Angela Rowen The Berkeley Daily Planet

- Wallace, R. (1990). "Urban desertification, public health and public order: 'planned shrinkage', violent death, substance abuse and AIDS in the Bronx". Social Science & Medicine. 31 (7): 801–13. doi:10.1016/0277-9536(90)90175-r. PMID 2244222.

- Hutchinson, J. (1992). "AIDS and racism in America". Journal of the National Medical Association. 84 (2): 119–124. PMC 2637751. PMID 1602509.

- Zenou, Yves; Boccard, Nicolas (2000). "Racial Discrimination and Redlining in Cities". Journal of Urban Economics. 48 (2): 260–285. CiteSeerX 10.1.1.70.1487. doi:10.1006/juec.1999.2166.

- Gilliard, Chris (2016-05-24). "Digital Redlining, Access, and Privacy". Common Sense Education. Retrieved 2019-03-31.

- Taylor, Astra; Sadowski, Jathan (2015-05-27). "How Companies Turn Your Facebook Activity Into a Credit Score". The Nation. ISSN 0027-8378. Retrieved 2019-03-31.

- Podesta, John; Penny, Pritzker; Moniz, Earnest, J.; Holdren, John; Zients, Jeffery (May 2014). "Big Data: Seizing Opportunities, Preserving Values" Pg. 46. Whitehouse.gov. Retrieved March 30, 2019

- Gilliard, Chris (2017-03-07). "Pedagogy and the Logic of Platforms". er.educause.edu. EDUCAUSE Review. Retrieved 2019-04-04.

- "HUD Charges Facebook With Housing Discrimination Over Company's Targeted Advertising Practices". www.hud.gov. 2019-03-28. Retrieved 2019-03-31.

- Howard, Philip (2005). New Media Campaigns and the Managed Citizen. New York: Cambridge University Press. p. 132. ISBN 9780521612272.

- Timberg, Craig; Romm, Tony (2018). "New report on Russian disinformation, prepared for the Senate, shows the operation's scale and sweep". The Washington Post. Retrieved 2019-07-21.

- Graham, David (2016). "Trump's 'Voter Suppression Operation' Targets Black Voters". The Atlantic. Retrieved 2019-07-21.

- Height, Tatiana (2017). Analyzing Communities in Black America: How Urban and Regional Planners Can Plan for Prosperous Black Communities (Thesis). University of Nebraska-Lincoln. pp. 57–63. Retrieved 2019-05-11.

Further reading and external links

Books

- Greenwald, Carol S. (1980). Banks Are Dangerous to Your Wealth. Prentice-Hall.

- Rothstein, Richard (May 2017). The Color of Law: A Forgotten History of How Our Government Segregated America (1st ed.). Liveright. ISBN 9781631492860.

- Westgate, Michael & Vick, Ann (2011). Gale Force: The Battles for Disclosure and Community Reinvestment (2nd ed.). Harvard Book Store. ISBN 978-0-615-44901-2.CS1 maint: uses authors parameter (link)

- Wise, Richard W. (2019). Redlined: A Novel of Boston. New York: Adelaide Books. ISBN 978-1950437245.

Articles and websites

- Dedman, Bill. "The Color of Money". powerreporting.com/color. Bill Dedman received the Pulitzer Prize for Investigative Reporting in 1989 for this series of articles, which described racial discrimination in mortgage lending in the Atlanta area.

- Egan, Matt (January 12, 2018). "Trump may weaken 'outdated' rules that force banks to lend to the poor". CNNMoney.

- "Fair Housing Equal Opportunity". HUD.gov. Archived from the original on 2012-04-02. Learn more about housing discrimination.

- "File a housing discrimination complaint". HUD.gov. Archived from the original on 2013-10-05.

- Hillier, Amy. Redlining in Philadelphia. UPenn.edu. Archived from the original on 2017-06-14.

- "HOLC Maps for several U.S. cities". UrbanOasis.org. Archived from the original on 2015-03-31. Retrieved 2012-08-01.

- "Intro". Redlining, and Neighborhood Appraisals in Philadelphia. UPenn.edu. Archived from the original on 2011-09-28.

- "Mapping Inequality: Redlining in New Deal America". Richmond.edu.

- Crossney, Kristen B.; Bartelt, David W. (16 May 2013). "Residential Security, Risk, and Race: The Home Owners' Loan Corporation and Mortgage Access in Two Cities". Urban Geography. 26 (8): 707–736. doi:10.2747/0272-3638.26.8.707.

- "Roundtable on Redlining in Minneapolis". UMN.edu. Archived from the original on 2012-12-11.

Lessons

- Wolfe-Rocca, Ursula. "How Red Lines Built White Wealth: A Lesson on Housing Segregation in the 20th Century". Zinn Education Project.