Insular area

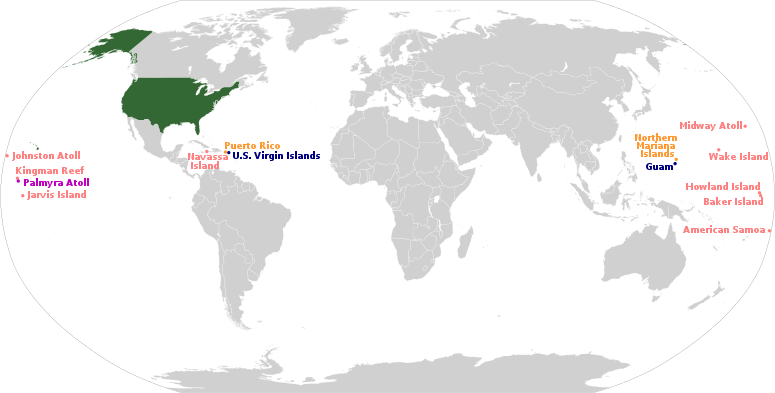

An insular area of the United States is a U.S. territory that is not one of the 50 states and is not a Federal district. Article IV, Section 3, Clause 2 of the United States Constitution grants to the United States Congress the responsibility of overseeing these territories.[lower-alpha 1] There are 14 U.S. Territories as of 2018: three in the Caribbean Sea and 11 in the Pacific Ocean.[1] These territories are classified by whether they are incorporated (by Congress extending the full body of the Constitution to the territory as it applies to the several states) and whether they have an organized territorial government established by the U.S. Congress through an organic act.[2] All territories but one are unincorporated, and all but four are considered to be unorganized. Five U.S. territories have a permanent, nonmilitary population. Each of them has a civilian government, a constitution, and enjoys some degree of local political autonomy.

Citizenship

Congress has extended citizenship rights by birth to all inhabited territories except American Samoa, and these citizens may vote and run for office in any U.S. jurisdiction in which they are residents. The people of American Samoa are U.S. nationals by place of birth, or they are U.S. citizens by parentage, or naturalization after residing in a State for three months.[3] Nationals are free to move around and seek employment within the United States without immigration restrictions, but cannot vote or hold office outside American Samoa.[4]

Taxation

Residents of the five major populated insular areas do not pay U.S. federal income taxes but are required to pay other U.S. federal taxes such as import and export taxes,[5][6] federal commodity taxes,[7] social security taxes, etc. Individuals working for the federal government pay federal income taxes while all residents are required to pay federal payroll taxes (Social Security[8] and Medicare). According to IRS Publication 570, income from other U.S. Pacific Ocean insular areas (Howland, Baker, Jarvis, Johnston, Midway, Palmyra, and Wake Islands, and Kingman Reef) is fully taxable as income of United States residents.[9]

Associated states

The U.S. State Department also uses the term insular area to refer not only to territories under the sovereignty of the United States, but also those independent nations that have signed a Compact of Free Association with the United States. While these nations participate in many otherwise domestic programs, and full responsibility for their military defense rests with the United States, they are legally distinct from the United States and their inhabitants are neither U.S. citizens nor nationals.[1]

Current U.S. insular areas by status

The following islands, or island groups, are considered insular areas:

Organized incorporated territories

None

Unorganized incorporated territories

One (uninhabited)

.svg.png)

Organized unincorporated territories

Four (inhabited)

Unorganized unincorporated territories

One (inhabited)

Ten (uninhabited)

- Bajo Nuevo Bank (disputed with Colombia and Jamaica; administered by Colombia)

.svg.png)

.svg.png)

.svg.png)

- Serranilla Bank (disputed with Colombia, Honduras and Jamaica; administered by Colombia)

Freely associated states

Three sovereign UN member states which were all formerly in the U.S. administered United Nations Trust Territory and are currently in free association with the U.S. The U.S. provides national defense, funding, and access to social services.

Former territories

See also

- Dependent territory

- Guano Islands Act

- Guantanamo Bay Naval Base

- Insular Cases

- Political divisions of the United States

- Territorial acquisitions of the United States

- Territories of the United States on stamps

Notes

- Although an archaism, some older federal statutes and regulations still in force refer to insular areas as possessions.

- The Panama Canal itself was under joint U.S.–Panamanian control from 1979 until it was fully turned over to Panama on December 31, 1999.

References

- "Definitions of Insular Area Political Organizations". Washington, D.C.: U.S. Department of the Interior. Retrieved March 3, 2018.

- "Definitions of Insular Area Political Organizations". Washington, D.C.: U.S. Department of the Interior. Retrieved March 11, 2018.

- PBS Newshour, "American Samoans don't have right to U.S. citizenship", Associated Press, June 5, 2015, viewed August 13, 2015.

- US Department of Interior. "Insular Area Summary for American Samoa" Archived 2015-08-20 at the Wayback Machine. viewed August 13, 2015.

- "Puerto Ricans pay import/export taxes". Stanford.wellsphere.com. Archived from the original on April 1, 2010. Retrieved August 14, 2010.

- U.S. State Dept. "Foreign Relations of the United States". Retrieved May 18, 2016.

The people of Puerto Rico will continue to be exempt from Federal income taxes on the income they derive from sources within Puerto Rico, and into their treasury, for appropriation and expenditure as their legislature may decide, will be deposited the proceeds of United States internal revenue taxes collected on articles produced in Puerto Rico and the proceeds of United States tariffs and customs collected on foreign merchandise entering Puerto Rico.

- "Puerto Ricans pay federal commodity taxes". Stanford.wellsphere.com. Archived from the original on 2010-04-01. Retrieved 2011-10-30.

- "'Topic Number 903 - U.S. Employment Tax in Puerto Rico'". Irs.gov. December 18, 2009. Retrieved January 11, 2019.

- Publication 570 (PDF). Washington, D.C.: U.S. Internal Revenue Service. 2017. Retrieved April 12, 2018.

External links

| Wikimedia Commons has media related to Insular areas of the United States. |

- Department of Interior Office of Insular Affairs

- Department of the Interior Definitions of Insular Area Political Organizations

- Rubin, Richard, "The Lost Islands", The Atlantic Monthly, February 2001

- Chapter 7: Puerto Rico and the Outlying Areas, U.S. Census Bureau, Geographic Areas Reference Manual