Home-ownership in the United States

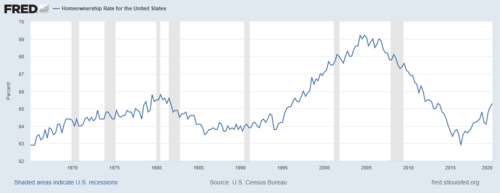

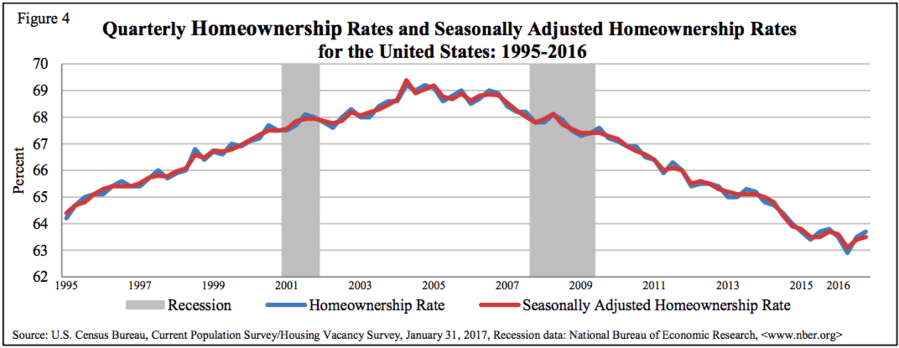

The home-ownership rate in the United States[1][2] is percentage of homes that are owned by their occupants.[3] In 2009, it remained similar to that in some other post-industrial nations[4] with 67.4% of all occupied housing units being occupied by the unit's owner. Home ownership rates vary depending on demographic characteristics of households such as ethnicity, race, type of household as well as location and type of settlement. In 2018, homeownership dropped to a lower rate than it was in 1994, with a rate of 64.2%.[5]

Since 1960, the homeownership rate in the United States has remained relatively stable having decreased 1.0% since 1960 when 65.2% of American households owned their own home. Additionally, homeowner equity has fallen steadily since World War II and is now less than 50% of the value of homes on average.[6] Homeownership was most common in rural areas and suburbs with three quarters of suburban households being homeowners. Among the country's regions the Midwestern states had the highest homeownership rate with the Western states having the lowest.[2] Recent research has examined the decline in homeownership rates among households with "heads" aged 25 to 44 years, which fell substantially between 1980 and 2000 and recovered only partially during the 2001-05 housing boom. This research indicates that a trend toward marrying later and the increase in household earnings risk that occurred after 1980 account for a large share of the decline in young homeownership.[7]

In general, homeowners in the United States also tend to have higher incomes and households residing in their own home were more likely to be families (as opposed to individuals) than were their tenant counterparts.[8] Among racial demographics, European Americans had the country's highest homeownership rate, while those identifying as being African American had the lowest homeownership rate. One study shows that homeownership rates appear correlated with higher school attainment.[9]

The name "homeownership rate" can be misleading. As defined by the US Census Bureau, it is the percentage of homes that are occupied by the owner. It is not the percentage of adults that own their own home. This latter percentage will be significantly lower than the homeownership rate because many households that are owner-occupied contain adult relatives (often young adults, descendants of the owner) who do not own their own home, and because single building multi-bedroom rental units can contain more than one adult, all of whom do not own a home.

The term "homeownership rate" can also be misleading because it includes households that owe on a mortgage and do not fully own the equity in their own that they are said to "own". According to ATTOM Data Research, only "34 percent of all American homeowners have 100 percent equity in their properties — they’ve either paid off their entire mortgage debt or they never had a mortgage".[10]

According to the Financial Post the cost of the average U.S. house in 2016 was US$187,000.[11]

Measuring method

In the US, the homeownership rate is created through the Housing Vacancy Survey by the US Census Bureau. It is created by dividing the owner occupied units by the total number of occupied units. This is an important point to understand changes in the homeownership rate over time. The bust of the housing bubble resulted in many houses becoming foreclosed. However, the decrease in the homeownership rate from 3Q2007 to 4Q2007 was mostly a result of an increase in the renter's population and less due to a decrease in the homeowner population.

Government policy

Homeownership has been promoted as government policy using several means involving mortgage debt and the government sponsored entities Freddie Mac, Fannie Mae, and the Federal Home Loan Banks, which fund or guarantee $6.5 trillion of assets with the purpose of directly or indirectly promoting homeownership. Homeownership has been further promoted through tax policy which allows a tax deduction for mortgage interest payments on a primary residence. The Community Reinvestment Act also encourages homeownership for low-income earners. The promotion of homeownership by the government through encouraging mortgage borrowing and lending has given rise to debates regarding government policies and the subprime mortgage crisis.

Race

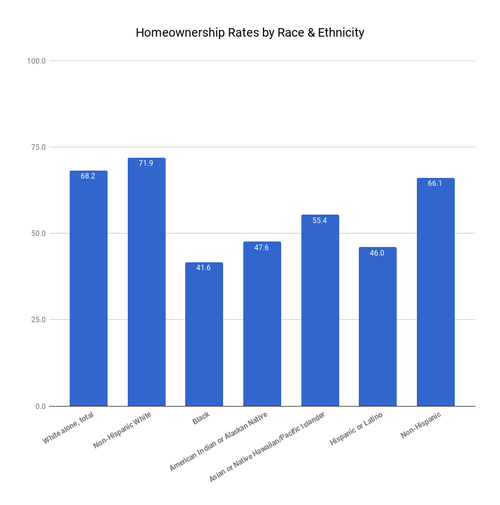

Homeownership rate according to race & ethnicity in 2016.[12]

Homeownership rate according to race & ethnicity in 2016.[12]

The homeownership rate, as well as its change over time, has varied significantly by race.[13] While homeowners constitute the majority of white, Asian and Native American households, the homeownership rate for African Americans and those identifying as Hispanic or Latino has typically fallen short of the fifty percent threshold. Whites have had the highest homeownership rate, followed by Asians and Native Americans.[13]

Hispanics had the lowest homeownership rate in the country in all years, except for 2002, up until 2005. For the last half of the decade of the 2000s the homeownership rate for Hispanics exceeded that of African Americans. Temporal fluctuations were slight for all races, with rates commonly not changing more than two percentage points per year.[13]

The strongest increase in the percentage of homeowners in the first half of the decade of the 2000s was among non-white minorities. The homeownership rate for minorities approached the sixty percent mark in 2006, which was a significant change because less than half of all minority households owned homes as recently as 1994. The ownership rate for minorities increased by 25.6%, from 47.7% in 1993 to 59.9% in 2006. This rate fell after the 2006 peak, consistent with overall homeownership rates.[13]

The increase among white Americans was less substantial. In 2005, 75.8% of white Americans owned their own homes, compared to 70% in 1993, and the rate fell during the last half of the decade of the 2000s, slightly more slowly than for the rest of the population. Thus one can conclude that despite a large remaining discrepancy between the homeownership rates among different racial groups, the gap had been closing up until the peak, with ownership rates increasing more substantially for minorities than for whites, but subsequently began slightly widening.[13]

| Race | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | % change

since '94 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| White (non-Hispanic) | 70.0 | 70.9 | 71.7 | 72.0 | 72.6 | 73.2 | 73.8 | 74.3 | 74.5 | 75.4 | 76.0 | 75.8 | 75.8 | 75.2 | 75.0 | 74.8 | 74.4 | 73.8 | 73.5 | 73.3 | 72.6 | 71.9 | +2.71% |

| Asian American | 51.3 | 50.8 | 50.8 | 52.8 | 52.6 | 53.1 | 52.8 | 53.9 | 54.7 | 56.3 | 59.8 | 60.1 | 60.8 | 60.0 | 59.5 | 59.3 | 58.9 | 58.0 | 56.6 | 57.4 | 57.3 | 56.1 | +9.35% |

| Native American | 51.7 | 55.8 | 51.6 | 51.7 | 54.3 | 56.1 | 56.2 | 55.4 | 54.6 | 54.3 | 55.6 | 58.2 | 58.2 | 56.9 | 56.5 | 56.2 | 52.3 | 53.5 | 51.1 | 51.0 | 52.2 | 50.3 | (-2.08%) |

| African American | 42.3 | 42.7 | 44.1 | 44.8 | 45.6 | 46.3 | 47.2 | 47.7 | 47.3 | 48.1 | 49.1 | 48.2 | 47.9 | 47.2 | 47.4 | 46.2 | 45.4 | 44.9 | 43.9 | 43.1 | 43.0 | 42.3 | 0.00% |

| Hispanic or Latino | 41.2 | 42.1 | 42.8 | 43.3 | 44.7 | 45.5 | 46.3 | 47.3 | 48.2 | 46.7 | 48.1 | 49.5 | 49.7 | 49.7 | 49.1 | 48.4 | 47.5 | 46.9 | 46.1 | 46.1 | 45.4 | 45.6 | +10.68% |

SOURCE: US Census Bureau, 2016[13]

Type of household

There is a strong correlation between the type and age of a household's family structure and homeownership.[14] As of 2006, married couple families, which also have the highest median income of any household type, were most likely to own a home. Age played a significant role as well with homeownership increasing with the age of the householder until age 65, when a slight decrease becomes visible. While only 43% of households with a householder under the age of thirty-five owned a home, 81.6% of those with a householder between the ages of 55 and 64 did.[14]

This means that households with a middle-aged householder were nearly twice as likely to own a home as those with a young householder. Overall married couple families with a householder age 70 to 74 had the highest homeownership rate with 93.3% being homeowners. The lowest homeownership rate was recorded for single females under the age of twenty-five of whom only 13.6%, were homeowners. Yet, single females had an overall higher homeownership rate than single males and single mothers.[14]

Income

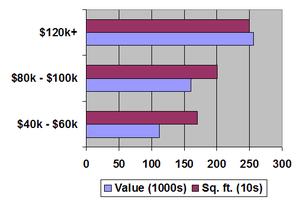

There are considerable correlations between income, homeownership rate and housing characteristics. As income is closely linked to social status, sociologist Leonard Beeghley has made the hypothesis that "the lower the social class, then the fewer amenities built into housing." According to 2002, US Census Bureau data housing characteristics vary considerably with income. For homeowners with middle-range household incomes, ranging from $40,000 to $60,000, the median home value was $112,000, while the median size was 1,700 square feet (160 m2) and the median year of construction was 1970. A slight majority, 54% of homes occupied by owners in this group had two or more bathrooms.[15]

Among homeowners with household incomes in the top 10%, those earning more than $120,000 a year, home values were considerably higher while houses were larger and newer. The median value for homes in this demographic was $256,000 while median square footage was 2,500 and the median year of construction was 1977. The vast majority, 80%, had two or more bathrooms. Overall, houses of those with higher incomes were larger, newer, more expensive with more amenities.[15]

Historical

| Year | Home ownership rate[18] |

|---|---|

| 1960 | 62.1 |

| 1961 | 62.4 |

| 1962 | 63.0 |

| 1963 | 63.1 |

| 1964 | 63.1 |

| 1965 | 63.3 |

| 1966 | 63.4 |

| 1967 | 63.6 |

| 1968 | 63.9 |

| 1969 | 64.3 |

| 1970 | 64.2 |

| 1971 | 64.2 |

| 1972 | 64.4 |

| 1973 | 64.5 |

| 1974 | 64.6 |

| 1975 | 64.6 |

| 1976 | 64.7 |

| 1977 | 64.8 |

| 1978 | 65.0 |

| 1979 | 65.6 |

| 1980 | 65.6 |

| 1981 | 65.4 |

| 1982 | 64.8 |

| 1983 | 64.6 |

| 1984 | 64.5 |

| 1985 | 63.9 |

| 1986 | 63.8 |

| 1987 | 64.0 |

| 1988 | 63.8 |

| 1989 | 63.9 |

| 1990 | 63.9 |

| 1991 | 64.1 |

| 1992 | 64.1 |

| 1993 | 64.0 |

| 1994 | 64.0 |

| 1995 | 64.7 |

| 1996 | 65.4 |

| 1997 | 65.7 |

| 1998 | 66.3 |

| 1999 | 66.8 |

| 2000 | 67.4 |

| 2001 | 67.8 |

| 2002 | 67.9 |

| 2003 | 68.3 |

| 2004 | 69.0 |

| 2005 | 68.9 |

| 2006 | 68.8 |

| 2007 | 68.1 |

| 2008 | 67.8 |

| 2009 | 67.4 |

| 2010 | 66.9 |

| 2011 | 66.1 |

| 2012 | 65.4 |

| 2013 | 65.1 |

| 2014 | 64.5 |

| 2015 | 63.7 |

International Comparison=(2002)

| Country | Austria | Belgium | Denmark | France | Germany | Ireland | Norway | Spain | Portugal | UK | US | Slovenia | Israel | Canada |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Home ownership rate[4] | 56% | 71% | 51% | 55% | 42% | 77% | 77% | 85% | 64% | 69% | 68% | 82% | 71% | 67% |

See also

References

- "US Census Bureau, Homeownership by Area". Census.gov. Retrieved 2010-01-06.

- "US Census Bureau, Homeownership in the United States, 1960-2004". Census.gov. Retrieved 2006-10-05.

- "What is homeownership rate? definition and meaning". BusinessDictionary.com. Retrieved 14 October 2017.

- "EU homeownership rates, 2002" (PDF). Archived from the original (PDF) on 2007-06-16. Retrieved 2007-02-15.

- "QUARTERLY RESIDENTIAL VACANCIES AND HOMEOWNERSHIP, FIRST QUARTER 2018" (PDF). Census.gov. April 26, 2018.

- Federal Reserve report shows homeowner equity dipping below 50 percent, lowest on record, SignOnSanDiego.com, URL accessed 28 December 2008

- "Why Has Home Ownership Fallen Among the Young?" (PDF). Chicagofed.org. Retrieved 14 October 2017.

- "US Census Bureau, distribution of homeowners among the income quitniles". Archived from the original on 2006-07-07. Retrieved 2006-10-05.

- "A Note on the Benefits of Homeownership, Federal Reserve Bank of Chicago" (PDF). Chicagofed.org. Retrieved 14 October 2017.

- "American homeowners are making headway on mortgage debt, report finds". WashingtonPost.com. 23 August 2017. Retrieved 7 July 2019.

- "Zero down on a $2 million house is no problem in Silicon Valley's 'weird and scary' real estate market". Business.financialpost.com. 29 July 2016. Retrieved 14 October 2017.

- "US Census Bureau, homeownership by race". Census.gov. Retrieved 2017-10-29.

- "US Census Bureau, homeownership by race". Retrieved 2017-10-29.

- "US Census Bureau, homeownership according to age and type of household". Retrieved 2006-10-05.

- Beeghley, Leonard (2004). The Structure of Social Stratification in the United States. Boston, MA: Pearson.

- "QUARTERLY RESIDENTIAL VACANCIES AND HOMEOWNERSHIP, FOURTH QUARTER 2016" (PDF). Census.gov. Retrieved 29 October 2017.

- "US Census Bureau, Housing Vacancies and Homeownership". Census.gov. Retrieved 14 October 2017.

- "US Census Bureau, homeownership rate by area". Census.gov. Retrieved 2016-10-24.

Further reading

- Kwak, Nancy H. A World of Homeowners: American Power and the Politics of Housing Aid ( University of Chicago Press, 2015). 328 pp.