Economy of Saudi Arabia

The economy of Saudi Arabia is one of the top twenty economies in the world, and the largest economy in the Arab world and the Middle East.[12] Saudi Arabia is part of the G20 group of countries.[13]

Riyadh, the financial center of Saudi Arabia | |

| Currency | Saudi Riyal (SAR) |

|---|---|

| Calendar year | |

Trade organizations | WTO, OPEC, G-20 major economies, BIS, ICS, IOS, WCO, GCC, World Bank IMF |

Country group | |

| Statistics | |

| Population | |

| GDP | |

| GDP rank | |

GDP growth |

|

GDP per capita | |

GDP per capita rank | |

GDP by sector |

|

| 2.2% (2020 est.)[4] | |

| 45.9 medium (2013 est.)[3] | |

Labor force | |

Labor force by occupation |

|

| Unemployment | |

Main industries |

|

| External | |

| Exports | |

Export goods | petroleum and petroleum products 90% (2012 est.)[3] |

Main export partners |

|

| Imports | |

Import goods | machinery and equipment, foodstuffs, chemicals, motor vehicles, textiles[3] |

Main import partners |

|

Gross external debt | |

| Public finances | |

| −8.9% (of GDP) (2017 est.)[3] | |

| Revenues | 181 billion (2017 est.)[3] |

| Expenses | 241.8 billion (2017 est.)[3] |

Foreign reserves | |

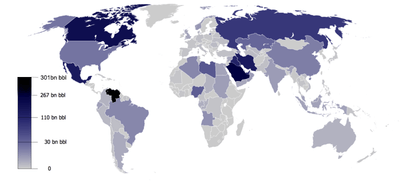

With a total worth of US$33.2 trillion, Saudi Arabia has the second most valuable natural resources in the world.[14] The country has the second-largest proven petroleum reserves,[15] and is the largest exporter of petroleum in the world.[16] It also has the fifth-largest proven natural gas reserves[17] and is considered an "Energy Superpower".

The economy of Saudi Arabia is heavily dependent on oil,[18] and is a member of OPEC. In 2016 the Saudi Government launched its Saudi Vision 2030 to reduce the country's dependency on oil and diversify its economic resources. In the first quarter of 2019, Saudi Arabia's budget has accomplished its first surplus since 2014. This surplus that is accounted for $10.40 billion has been achieved due to the increase of the oil and non-oil revenues.[19]

Economic overview

Saudi oil reserves are the second largest in the world, and Saudi Arabia is the world's leading oil exporter and second largest producer. Proven reserves, according to figures provided by the Saudi government, are estimated to be 260 billion barrels (41 km3), which is about one-quarter of world oil reserves. Petroleum in Saudi Arabia is not only plentiful but under pressure and close to the earth's surface. This makes it far cheaper and thus far more profitable to extract petroleum in Saudi Arabia than in many other places.[20] The petroleum sector accounts for roughly 87% of Saudi budget revenues, 90% of export earnings, and 42% of GDP.[21] Saudi Arabia's oil reserves and production are largely managed by the state-owned corporation Saudi Aramco.[22]

Another 40% of GDP comes from the private sector. An estimated 7.5 (2013) million foreigners work legally in Saudi Arabia,[23] playing a crucial role in the Saudi economy, for example, in the oil and service sectors. The government has encouraged private sector growth for many years to lessen the kingdom's dependence on oil, and to increase employment opportunities for the swelling Saudi population. In recent decades the government has begun to permit private sector and foreign investor participation in sectors such as power generation and telecom, and acceded to the WTO. During much of the 2000s, high oil prices[24] enabled the government to post budget surpluses, boost spending on job training and education, infrastructure development, and government salaries.

With its absolute monarchy system of government, large state sector and supply of welfare benefits, the Saudi economy has been described as

a bewildering (at least to outsiders) combination of a feudal fealty system and a more modern political patronage one. At every level in every sphere of activity, Saudis maneuver through life manipulating individual privileges, favors, obligations, and connections. By the same token, the government bureaucracy is a maze of overlapping or conflicting power center under the patronage of various royal princes with their own priorities and agendas to pursue and dependents to satisfy.[25]

The gross domestic product of Saudi Arabia fluctuates dramatically according to the price of oil (see below).

| Year[26] | Gross Domestic Product (GDP)[27] (in billions of current USD) | GDP per capita[27] (in current USD) | US Dollar Exchange (in millions of Saudi Riyals) | Inflation Index (2000=100) | Population[28] (millions) | Per Capita Income (as % of USA) |

|---|---|---|---|---|---|---|

| 1970 | 5.3773 | 921.35 | 4.50 | 5.836 | ||

| 1975 | 46.7734 | 6,296.30 | 3.52 | 7.429 | ||

| 1980 | 164.5417 | 16,892.36 | 3.59 | 95 | 9.741 | 43.84 |

| 1985 | 103.8978 | 7,877.54 | 3.62 | 92 | 13.189 | 49.33 |

| 1990 | 117.6303 | 7,204.73 | 3.74 | 91 | 16.326 | 33.13 |

| 1995 | 143.3430 | 7,650.74 | 3.74 | 101 | 18.736 | 28.29 |

| 2000 | 189.5149 | 9,126.95 | 3.74 | 100 | 20.764 | 26.50 |

| 2005 | 328.4596 | 13,739.83 | 3.74 | 100 | 23.906 | 32.53 |

| 2010 | 528.2072 | 19,259.59 | 3.75 | 27.426 | ||

| 2015 | 654.2699 | 20,732.86 | 3.75 | 31.557 | ||

| 2017 | 688.586 | 21,113.957 | 3.75 | 104.168 | 32.613 | |

| 2018 | 786.522 | 23,538.940 | 3.75 | 106.562 | 33.414 | |

| 2019 | 779.289 | 22,865.178 | 3.75 | 105.441 | 34.082 |

Market prices estimated by the International Monetary Fund and other sources, with figures in millions of Saudi Arabian Riyals (SR).[29] Mean wages were $14.74 per man-hour in 2009.

History

| Year | GDP (in Bil. US$ PPP) |

GDP per capita (in US$ PPP) |

GDP growth (real) |

Inflation rate (in Percent) |

Government debt (in % of GDP) |

|---|---|---|---|---|---|

| 1980 | 360.3 | 38,665 | n/a | ||

| 1981 | n/a | ||||

| 1982 | n/a | ||||

| 1983 | n/a | ||||

| 1984 | n/a | ||||

| 1985 | n/a | ||||

| 1986 | n/a | ||||

| 1987 | n/a | ||||

| 1988 | n/a | ||||

| 1989 | n/a | ||||

| 1990 | n/a | ||||

| 1991 | 39.4 % | ||||

| 1992 | |||||

| 1993 | |||||

| 1994 | |||||

| 1995 | |||||

| 1996 | |||||

| 1997 | |||||

| 1998 | |||||

| 1999 | |||||

| 2000 | |||||

| 2001 | |||||

| 2002 | |||||

| 2003 | |||||

| 2004 | |||||

| 2005 | |||||

| 2006 | |||||

| 2007 | |||||

| 2008 | |||||

| 2009 | |||||

| 2010 | |||||

| 2011 | |||||

| 2012 | |||||

| 2013 | |||||

| 2014 | |||||

| 2015 | |||||

| 2016 | |||||

| 2017 |

Saudi Arabia was a subsistence economy until the 1930s. In 1933, the Saudi government signed an oil concession agreement with Standard Oil Company of California.[31] Development of oil fields continued in Saudi Arabia, managed mainly by Aramco, company formed by the partnership of Texaco and Chevron.[32] In 1951, the first offshore field in the middle east was found by the Arabian American Oil Company (Aramco) at Raʾs Al-Saffāniyyah area.[33] By 1949 Saudi oil production reached 500,000 barrels per day (bpd), and rose rapidly to 1 million bpd in 1954.[34][35] Moreover, in 1951, Aramco started operating Trans-Arabian Pipeline that used to transform oil from the eastern region of Saudi Arabia to the Mediterranean Sea, passing by Jordan, Syria and Lebanon. However, in 1981 the operations in this line was ceased as a new one was put into operation that linked between Jubail on the Persian Gulf and Yunbu on the Red Sea which highly contributed inc shortening the destination of oil transform.[33] In 1960, OPEC was created with Saudi Arabia as one of its founding members.[36] During the 1973 oil crisis, the price of oil rose from $3 per barrel to nearly $12, and the Saudi economy began to grow rapidly,[37] with GDP increasing from approximately $15 billion in 1973, to approximately $184 billion by 1981.[38] After gradually purchasing Aramco's assets, the Saudi government nationalized the company in 1980. In 1988, Saudi Aramco was established to take over the responsibilities of Aramco.[39]

In 1980, the price of oil peaked, and demand began to fall as a result of recessions in industrialized nations and more efficient use of oil which produced surpluses.[40] This created a worldwide oil glut, with the price of oil dropping from approximately $36 per barrel in 1980, to approximately $14 by 1986.[41] Saudi oil production, which had increased to almost 10 million barrels (1,600,000 m3) per day during 1980–81, dropped to about 2 million barrels per day (320,000 m3/d) in 1985.[42] Budgetary deficits developed, and the government drew down its foreign assets.[43] As a result of the oil glut and the pressures of declines in production, after 1985 Saudi Arabia began enforcing production quotas more harshly for OPEC members.[44]

In June 1993, Saudi Aramco absorbed the state marketing and refining company (SAMAREC), becoming the world's largest fully integrated oil company. Most Saudi oil exports move by tanker from oil terminals at Ras Tanura and Ju'aymah in the Persian Gulf. The remaining oil exports are transported via the east–west pipeline across the kingdom to the Red Sea port of Yanbu. A major new gas initiative promises to bring significant investment by U.S. and European oil companies to develop non-associated gas fields in three separate parts of Saudi Arabia. Following final technical agreements with concession awardees in December 2001, development should begin in 2002.

However, beginning in late 1997, Saudi Arabia again faced the challenge of low oil prices. Due to a combination of factors—the East Asian economic crises, a warm winter in the West caused by El Niño, and an increase in non-OPEC oil production—demand for oil slowed and pulled oil prices down by more than one-third.

Saudi Arabia was a key player in coordinating the successful 1999 campaign of OPEC and other oil-producing countries to raise the price of oil to its highest level since the (Persian) Gulf War by managing production and supply of petroleum. That same year, Saudi Arabia established the Supreme Economic Council to formulate and better coordinate economic development policies in order to accelerate institutional and industrial reform.

Saudi Arabia acceded to the WTO (World Trade Organization) in 2005 after many years of negotiations.

Foreign investment

The mid-1980s was also the time that foreign ownership of business was allowed. In the mid-1990s, foreign ownership rules were relaxed again, with investment sought in telecommunications, utilities, and financial services. In 2000, 100% foreign-owned businesses were allowed in the kingdom.[45]

Since 2008, extensive land investment has taken place, especially in Africa - see paragraph Non-petroleum sector.

As per the report released by UNCTAD in June 2018, Saudi Arabia's foreign direct investment was only $1.4 billion in 2017, down from $7.5 billion the year before and as much as $12.2 billion in 2012. The fall in investment is attributed to negative intra-company loans by foreign multinationals and various divestment.[46] In the first quarter of 2018, net capital outflows were running at approximately 5% of GDP, compared to less than 2% of GDP in late 2016.[47] However, according to a report published in Trading Economics, in the second quarter of 2018, foreign direct investment in the country raised by $882 million.[48] Moreover, SAGIA's data indicate that licenses provided to foreign investment have been increased by 130% in the first quarter or 2018 as a result to the current reforms in economy.[49]

After the finance budget was released for 2019, Saudi Arabia planned to issue bonds worth approx. 120 billion riyals ($32 billion) in order to cover up for its 4.2% GDP deficit of 131 billion riyals.[50]

In January 2019 itself the kingdom sold bonds worth $7.5 billion.[51] Saudi Arabia turned towards international debts following a decline in its oil income. In almost two and a half years, bonds worth $60 billion have been sold by Saudi, becoming one of the biggest borrowers globally.[52]

The foreign investments in the Kingdom have witnessed a rapid increase in the first quarter of 2019. The number of new licenses approved for foreign businesses has grown by 70% compared with 2018. Most licenses were approved for British and Chinese companies which have driven this increase.[53] In the first quarter of 2019, foreign investment in Saudi Arabia has jumped by 28%.[54]

Diversification and the development plans

The government has sought to allocate its petroleum income to transform its relatively undeveloped, oil-based economy into that of a modern industrial state while maintaining the kingdom's traditional Islamic values and customs. Although economic planners have not achieved all their goals, the economy has progressed rapidly. Oil wealth has increased the standard of living of most Saudis. However, significant population growth has strained the government's ability to finance further improvements in the country's standard of living. Heavy dependence on petroleum revenue continues, but industry and agriculture now account for a larger share of economic activity. The mismatch between the job skills of Saudi graduates and the needs of the private job market at all levels remains the principal obstacle to economic diversification and development; about 4.6 million non-Saudis are employed in the economy.[55]

Saudi Arabia first began to diversify its economy to reduce dependency on oil in the 1970s as part of its first five-year development plan. Basic petrochemical industries using petroleum byproducts as feedstock were developed.[56] The fishing villages of al-Jubail on the Persian Gulf and Yanbu on the Red Sea were developed. However, their effect on Saudi Arabia's economic fortunes has been small.[57]

Saudi Arabia's first two development plans, covering the 1970s, emphasized infrastructure. The results were impressive—the total length of paved highways tripled, power generation increased by a multiple of 28, and the capacity of the seaports grew tenfold. For the third plan (1980–85), the emphasis changed. Spending on infrastructure declined, but it rose markedly on education, health, and social services. The share for diversifying and expanding productive sectors of the economy (primarily industry) did not rise as planned, but the two industrial cities of Jubail and Yanbu—built around the use of the country's oil and gas to produce steel, petrochemicals, fertilizer, and refined oil products—were largely completed.[55]

In the fourth plan (1985–90), the country's basic infrastructure was viewed as largely complete, but education and training remained areas of concern. Private enterprise was encouraged, and foreign investment in the form of joint ventures with Saudi public and private companies was welcomed. The private sector became more important, rising to 70% of non-oil GDP by 1987. While still concentrated in trade and commerce, private investment increased in industry, agriculture, banking, and construction companies. These private investments were supported by generous government financing and incentive programs. The objective was for the private sector to have 70% to 90% ownership in most joint venture enterprises.[55]

The fifth plan (1990–95) emphasized consolidation of the country's defenses; improved and more efficient government social services; regional development; and, most importantly, creating greater private-sector employment opportunities for Saudis by reducing the number of foreign workers.[55]

The sixth plan (1996–2000) focused on lowering the cost of government services without cutting them and sought to expand educational training programs. The plan called for reducing the kingdom's dependence on the petroleum sector by diversifying economic activity, particularly in the private sector, with special emphasis on industry and agriculture. It also continued the effort to "Saudiize" the labor force.[55]

The seventh plan (2000–2004) focuses more on economic diversification and a greater role of the private sector in the Saudi economy. For 2000–04, the government aims at an average GDP growth rate of 3.16% each year, with projected growths of 5.04% for the private sector and 4.01% for the non-oil sector. The government also has set a target of creating 817,300 new jobs for Saudi nationals.[55]

.jpg)

Advertising expenditures have reached new peaks due to emphasis on value-added manufacturing.[58]

The main investing countries in Saudi Arabia in 2016 were the US, UAE, France, Singapore, Kuwait and Malaysia. They mainly invested in chemical industry, real estate, tourism, fossil fuels, automobiles and machinery.[59] As part of its diversification, Saudi Arabia has been inking major refinery contracts with Chinese and other companies.[60]

As Saudi Arabia became a member of the World Trade Organization (WTO) in 2005, an improvement took place in the overall environment of foreign investment in Saudi Arabia due to many reasons including, the stable economy, the fact that the kingdom has the largest oil reserves worldwide, the high power of expenditure, the good infrastructure system, reinforced finance and a good banking system. Since that time and pursuant to its commitment to the WTO, Saudi Arabia has been developing trade-related policies and legislations. Moreover, foreign investment has been highly encouraged recently with the announcement of The Saudi vision 2030 as it promises of a better economic diversification.[59]

Since 2017, in order to boost the economy and decrease the country's dependency on oil, Mohammed bin Salman has brought in multiple changes, including the raising of prices of gasoline and electricity, introduction of new taxes, and policy of Saudi workers over foreign workers. However, the government officials said the policies were causing serious effects on the economy. Saudi businessmen reported a decline in sales for 2018, blaming the government.[61]

In 2019, Financial Times reported that the plans to float state-owned oil beneficiary Saudi Aramco were stranded between the company's attachment to the ministry and the need to meet the International standards. A person close to the firm stated, "The IPO is seen as a sensible way to clear up the company." On the other hand, Energy Minister Khalid Al Falih has long maintained that the Aramco's association with the state is a "win-win policy" for both parties.[62]

Future plans

Saudi Arabia has announced plans to invest about $47 billion in three of the world's largest and most ambitious petrochemical projects. These include the $27 billion Ras Tanura integrated refinery and petrochemical project, the $9 billion Saudi Kayan[63] petrochemical complex at Jubail Industrial City, and the $10 billion Petro Rabigh refinery upgrade project. Together, the three projects will employ more than 150,000 technicians and engineers working around the clock.[64] Upon completion in 2015–16, the Ras Tanura integrated refinery and petrochemicals project will become the world's largest petrochemical facility of its kind with a combined production capacity of 11 million tons per year of different petrochemical and chemical products. The products will include ethylene, propylene, aromatics, polyethylene, ethylene oxide, chlorine derivatives, and glycol.[64]

Saudi Arabia had plans to launch six "economic cities" (e.g. King Abdullah Economic City, to be completed by 2020) in an effort to diversify the economy and provide jobs.[65] They are being built at a cost of $60bn (2013)and are "expected to contribute $150bn to the economy".[66] As of 2013 four cities were being developed.[67]

Privatization program, a part of Crown Prince Mohammad bin Salman's Vision 2030, is running behind the schedule. The oil prices have gone up by double since the government began to consider the program in 2015. Delay in Aramco's initial public offering further highlights the less urgency in privatization, even though in July 2018, the International Monetary Fund urged to accelerate the process.[68]

According to many reports, the Saudi government is greatly interested in giving more liberty to the foreign investment system and in giving a 100% allowance to the foreign investors to work in the wholesale and retail sector in particular cases.[59]

The Saudi Ministry of Commerce and Investment expects the Kingdom will witness an increase in the GDP per capita from US$20,700 to 33,500 by 2020.[69]

As Vision 2030 has been recently adapted by the Saudi government several reforms has been undertaken including improving the business environment and reform in the financial sector. Moreover, the government has been seeking to achieve greater transparency by issuing a draft law regarding the involvement of private sector. Another reform move has been undertaken to increase the number of national manpower working in the private sector.[70]

Employment

As of 2008, roughly two thirds of workers employed in Saudi Arabia were foreigners, and in the private sector approximately 90%.[71] In January 2014, the Saudi government claimed it had lowered the 90% rate, doubling the number of Saudi citizens working in the private sector employment to 1.5 million. (This compares to 10 million foreign expatriates working in the kingdom.)[72]

According to Reuters, economists "estimate only 30–40 percent of working-age Saudis hold jobs or actively seek work," although the official unemployment rate is only around 12 percent. Most Saudis with jobs are employed by the government, but the International Monetary Fund has warned the government cannot support such a large wage bill in the long term.[72][73] The government has announced a succession of plans since 2000 to deal with the imbalance by "Saudizing" the economy, However, the foreign workforce and unemployment continued to grow.[74] Since the beginning of 2017, however, Saudi Arabia has seen record numbers of foreign workers leaving the country as the Saudi government imposed higher fees on expatriate workers, with more than 677,000 foreigners leaving the kingdom. This has done little to lower the unemployment rate, which rose to 12.9 percent, its highest on record.[75]

One obstacle is social resistance to certain types of employment. Jobs in service and sales are considered totally unacceptable for citizens of Saudi Arabia—both potential employees and customers.[76]

Non-petroleum sector

Saudi Arabia has natural resources other than oil, including small mineral deposits of gold, silver, iron, copper, zinc, manganese, tungsten, lead, sulphur, phosphate, soapstone and feldspar.[57] The country has a small agricultural sector, primarily in the southwest where annual rainfall averages 400 mm (16"). The country is one of the world's largest producers of dates. For some years it grew very expensive wheat using desalinated water for irrigation,[57] but plans to stop by 2016.[77] As of 2009, livestock population amounted to 7.4 million sheep, 4.2 million goats, half a million camels and a quarter of a million cattle.

Although jobs created by the roughly two million annual hajj pilgrims do not last long, the hajj employs more people than the oil industry—40,000 temporary jobs (butchers, barbers, coach drivers, etc.)—and US$2–3 billion in revenue.[78]

In 2008, the "Initiative for Saudi Agricultural Investment Abroad" was launched, leading to extensive billion-dollar purchases of large tracts of land around the world: Ethiopia, Indonesia, Mali, Senegal, Sudan and others. Critics see cases of land-grabbing in various instances that also lead to uproars in the respective countries. Competing industrialising nations with food security problems in the quest for agricultural land are China, South Korea and India as well as the Gulf States Kuwait, Qatar and the UAE.[79][80][81][82][83]

In 2016, Mohammad bin Salman announced Saudi Vision 2030, a plan to reduce Saudi Arabia's dependence on oil, diversify its economy, and develop public service sectors such as health, education, infrastructure, recreation and tourism.

Real estate

One of the fastest growing sectors in the country has been real estate supported by the introduction of real estate investment trusts (REITs) market which has witnessed a significant growth in the number of REITs,[84][85] although this is yet to achieve its full potential despite some shortages in both residential and commercial real estate. A number of regional experts believe that most issues will be resolved as the market becomes more mature.

Real estate plays a fundamental role in the country's non-oil economy. In 2016, the value of real estate transactions including sales of existing units amounted to $74.91 billion from October 15 to September 16.[86] That is a major drop compared to the number of transactions recorded a decade earlier, which reached $239.93 billion. The real estate sector has been driven recently by strong local demand fundamentals and only a small amount by speculation.

Ownership of land property in Saudi Arabia is generally restricted to Saudis, but this is subject to certain qualifications. For example, Gulf Cooperation Council (‘GCC’) nationals and GCC companies have certain rights to own land, subject to a number of restrictions.[87] Foreigners (being non-GCC nationals) are entitled to ownership and investment of in real estate with some conditions. A foreign company needs to have a foreign investment licence from the Saudi Arabian General Investment Authority (‘SAGIA’) and the owned real estate must be related to particular investment project for property development.[88] Where a foreign individual needs to have a normal legal residency status and a permit from the Ministry of the Interior to own a land or property.[88]

The major expansion in this sector attracted the top real estate consultancies such as Jones Lang LaSalle,[89] Knight Frank[90] and Cluttons[91] to the country who have now opened offices in the country. Beyond this, demand for professional real estate services is attracting regional educators such as DREI to provide courses on Saudi real estate, and even dedicated books focused on the market such as Saudi Real Estate Companion.

Real Estate plays an important role in the Saudi Vision 2030 which maps out significant commitments by the Saudi Government relating to housing and the development of land for a variety of uses. In particular, Vision 2030 states: ‘Where it exists in strategic locations, we will also capitalize on the government’s reserves of real estate. We will allocate prime areas within cities for educational institutions, retail, and entertainment centres, large areas along our coasts will be dedicated to tourist projects and appropriate lands will be allocated for industrial projects.[92]

In 2016, new rules were introduced by the Capital Market Authority to form REITs. This aims at opening the real estate market to a wide range of investor.[87][85] The REITs consist of units representing the ownership of the underlying real estate. These units are offered to the public and traded on the Saudi Stock Exchange.[87][93]

The introduction of REITs was a part of the National Transformation program, one of the Saudi Arabia’s Vision 2030 programs, and has targets of

- Increasing the real estate sector contribution from GDP five per cent to 10 per cent annually.[87]

- Supporting the construction of 1.5 million homes by providing the required private capital.[87]

- Establishing partnerships with private sector developers to develop government land for housing projects.

- Establishing fast-track licenses and special finance packages to encourage private sector investment in housing projects.

Private sector

Saudi Arabia's private sector is dominated by a handful of big businesses in the service sector, primarily in construction and real estate— Olayan, Zamil, Almarai, Mobily, STC, SABIC, Sadara, Halliburton, Baker Hughes, Flynas, Hilton, Zain, Yanbu Cement, Alhokair, MBC, Mahfouz, Al Rajhi and Alfanar. These firms are "heavily dependent on government spending", which is dependent on oil revenues.[94]

From 2003–2013, "several key services" were privatized—municipal water supply, electricity, telecommunications—and parts of education and health care, traffic control and car accident reporting were also privatized. According to Arab News columnist Abdel Aziz Aluwaisheg, "in almost every one of these areas, consumers have raised serious concerns about the performance of these privatized entities."[95]

To provide the best support for the private sector and entrepreneurs, The Kingdom announced a decision approved by the Saudi Cabinet, In July 2019, allowing businesses in the country to be given the option to remain open 24 hours a day.[96]

Trade

In April 2000, the government established the Saudi Arabian General Investment Authority to encourage foreign direct investment in Saudi Arabia. Saudi Arabia maintains a negative list of sectors in which foreign investment is prohibited, but the government plans to open some closed sectors such as telecommunications, insurance, and power transmission/distribution over time.

Saudi Arabia became a full WTO Member on 11 December 2005. In 2019, the government established the General Authority for Foreign Trade to enhance the kingdom's international commercial and investment activities.[97]

Saudi Arabia is part of the following trade organizations:

- World Trade Organization (WTO)[98]

- International Monetary Fund (IMF)[99]

- International Chamber of Commerce (ICC)[100]

- International Organization for Standardization (ISO)[101]

- World Customs Organization (WCO)[102]

- Gulf Cooperation Council (GCC)[103]

Challenges

Among the challenges to Saudi economy include halting or reversing the decline in per capita income, improving education to prepare youth for the workforce and providing them with employment, diversifying the economy, stimulating the private sector and housing construction, diminishing corruption and inequality. In answer to the question of why the Saudi economy is so dependent on foreign labor, the UN Arab Human Development Report blamed stunted social and economic development inhibited by lack of personal freedom, poor education and government hiring based on factors other than merit, and exclusion of women.[104]

Income drop

Despite possessing the largest petroleum reserves in the world, per capita income dropped from approximately $18,000 at the height of the oil boom (1981) to $7,000 in 2001, according to one estimate.[105] As of 2013, due to the rapid population growth of Saudi Arabia,[106] per capita income in Saudi was "a fraction of that of smaller Persian gulf neighbors", even less than petroleum-poor Bahrain.[107]

Unlike most developed countries where gross domestic product growth is a function of increases in productivity and inputs such as employment, in Saudi the fluctuation of oil prices is the most important factor in the growth or decline of domestic production. "Saudi reserves are steadily being depleted, and no significant new discoveries have been found to replace them," according to Middle East journalist Karen House. Saudi population grew sevenfold from 1960 to 2010,[108] and petrol prices are subsidized and cost users less than equivalent quantities of bottled water.[109] With production stagnant, growth in population and domestic energy consumption means a decline in per capita income unless oil prices rise to match that growth.[107]

Demographics

Saudi population is young. About 51% are under the age of 25 (as of Feb 2012).[110] According to a 2013 report by the International Monetary Fund, up to 1.6 million young nationals of the Persian Gulf countries (of which Saudi Arabia is the largest) will enter the workforce from 2013 to 2018, but the economies of those countries will have jobs in the private sector for less than half (approximately 600,000).[111]

Education

According to The Economist magazine, the Saudi government has attempted in years past to raise employment by forcing "companies to fill at least 30% of their positions" with Saudi citizens. However, "employers complained bitterly about the lack of skills among young locals; years of rote-learning and religious instruction fail to prepare them for the job market." As a consequence, "the quota has now been dropped and replaced with a more flexible system."[112]

According to another source (scholar David Commins), the kingdom depends "on huge numbers of expatriates workers to fill technical and administrative positions" in part because of an educational system that in spite of "generous budgets", has suffered from "poorly trained teachers, low retention rates, lack of rigorous standards, weak scientific and technical instruction and excessive attention to religious subjects".[113][114][115]

Another statistic conducted by Bayt.com shows that over a quarter (28%) of professionals believe that there is a skills shortage in their country of residence. This belief is more prominent among respondents in Saudi Arabia (39%).[116]

Innovation

Saudi has not been a hotbed of technological innovation. The number of Saudi patents registered in the United States between 1977 and 2010 came to 382—less than twelve per year—compared to 84,840 patents for South Korea or 20,620 for Israel during that period.[117][118] However, in 2017 Saudi Arabia was granted 664 patents by the United States Patent and Trademark Office (USPTO) ranking the 23rd among 92 countries.[119][120] The number of granted patents was double that of all Arab countries combined during the same period.[121] Saudi hopes to increase technological innovation, particularly with the King Abdullah University of Science and Technology, and thus to stimulate the economy.

Bureaucracy

A business journalist (Karen House) criticizing the Saudi bureaucracy complained that someone seeking to start a business in Saudi Arabia

has to complete innumerable applications and documents at multiple layers of multiple ministries, which invariably requires seeking favors from various patronage networks and accumulating obligations along the way, most probably including having to hire less-than-competent dependents of his patrons. Then, for any business of any size, government contracts, not private competition, are the financial lifeblood. So this means more patrons, more favors, and more obligations. Not surprisingly, Saudi businesses that can compete outside the protected Saudi market are few.[122]

Corruption

The cost of maintaining the Royal Family is estimated by some to be about US$10 billion per year.[57] A 2005 survey by the Riyadh Chamber of Commerce found 77% of businessmen polled felt they had to `bypass` the law to conduct their operations. Since then "businessmen say it has only gotten worse."[123]

Saudi Arabia has been severely criticized for failing to tackle money laundering and international terrorism financing. A report released by the Financial Action Task Force on 24 September 2018, says, “Saudi Arabia is not effectively investigating and prosecuting individuals involved in larger scale or professional [money laundering] activity” and is “not effectively confiscating the proceeds of crime”.[124]

Poverty

Estimates of the number of Saudis below the poverty line range from between 12.7%[125] and 25%.[126] Press reports and private estimates as of 2013 "suggest that between 2 million and 4 million" of the country's native Saudis live on "less than about $530 a month" – about $17 a day – considered the poverty line in Saudi Arabia.[126][127]

The Saudi state discourages calling attention to or complaining about poverty. In December 2011, days after the Arab Spring uprisings, the Saudi interior ministry detained reporter Feros Boqna and two colleagues (Hussam al-Drewesh and Khaled al-Rasheed) and held them for almost two weeks for questioning after they uploaded a 10-minute video on the topic (Mal3ob 3alena, or 'We are being cheated') to YouTube.[128][129] Authors of the video claim that 22% of Saudis are considered to be poor (2009) and 70% of Saudis do not own their houses.[130] Statistics on the issue are not available through the UN resources because the Saudi government does not issue poverty figures.[131] Observers researching the issue prefer to stay anonymous[132] because of the risk of being arrested, like Feras Boqna.[129][133]

Housing

50% of Saudi Arabia's citizens own their own home, compared to the international average rate of 70% ownership, even though, it is beneath the international average, but it raised from 30% in 2011 according to the most recent census results.[134] In 2011, analysts estimated 500,000 new homes/year were needed to match the growth in Saudi population, but as of early 2014 only 300,000 to 400,000 houses/year were being built.[135]

One problem is that the government Real Estate Development Fund (REDF)—which provides 81% of all loans for housing—had an 18-year waiting list for loans due to pent-up demand. Another is that the REDF's maximum loan is 500,000 SR ($133,000), while in 2012 the average price for a small free-standing home in Riyadh is more than double that—1.23 million SR ($328,000).[136] However, as a part of the economic reforms that has been undertaken by the government to enhance the living standards within the country, new funding solutions have been established to boost the mortgages for existing and new borrowers in order to help financing their housing plans. This was announced in August 2018 by the minister of Housing Mr. Majed Al-Hogail.[137]

A major reason for the high cost of housing is the high cost of land. In urban areas the price of land has been bid up because nearly all of it is owned by the Saudi elite (members of the royal family or other wealthy Saudis), who have lobbied the government for land "giveaways".[135] Landlords have seen prices rocket by 50% from 2011 to 2013.[135] The owners benefit from these price increases as they hold the land for future development.[138] [139] To deal with the key "land banking" issue the Housing Minister suggested in 2013 that landowners of vacant within city limits could be subject to a tax. However, no firm plans for any tax have been unveiled.[135]

Further diversification

According to journalist Karen House, "every" Saudi five-year plan "since the first one in 1970" has called for diversifying the economy beyond oil, but with marginal success.[140]

As of 2007, manufacturing outside of the petroleum industry contributed 10% to Saudi Arabian GDP and less than 6% of total employment.[141]

Private sector growth

In 2018, an imposition of 5% value-added tax brought the private-sector growth to a halt. Consumer spending was also restrained after a sharp increase in prices for energy, electricity and water earlier in 2018. The kingdom witnessed a mass departure of around 750,000 foreign workers after imposing new government levies on expat workers. The government is also forcing small-business owners to hire Saudi nationals at comparatively higher wages than the foreign workers. Gaining money from large foreign direct investments is also not working in the favor of the government. Rich Saudis are reluctant to invest within the kingdom due to the fear of triggering government scrutiny.[142] On May 11, 2020, the government announced that it would threefold the kingdom’s VAT on goods and services, raising it from a current 5% to 15%. It also stated that the increase in VAT introduced due to the country’s current financial crisis due to plummeting oil prices and impact of coronavirus, will also be followed by cut in monthly allowance for state workers worth approximately $266, and financial benefits for contractors.[143]

Investment

Saudi Arabia has two stock exchanges, the Tadawul and The Saudi Parallel Market (Nomu) whose financial markets are regulated by the Capital Market Authority.[144][145] The stock market capitalisation of listed companies in Saudi Arabia was valued at $646 billion in 2005 by the World Bank.[146] According to the International Institute for Management Development (IMD), Business competitiveness in Saudi Arabia has witnessed an improvement better than any other country in the world as the Kingdom has jumped to 26th in the world with respect Business competitiveness.[147]

Doing business

Saudi Arabia is among the countries with the most notable improvement in doing business according to the World Bank Group's Doing Business 2020 report. The country jumped 30 places to rank 62nd in ease of doing business compared to the last year.[148][149][150]

According to the World Bank, Saudi Arabia has conducted several reforms. These reforms have been made in eight business areas which are: starting a business, getting construction permits, getting electricity, getting credit, protecting minority investors, trading across borders, enforcing contracts, and resolving insolvency.[149]

Previously, the country rated as the 92nd for ease of doing business, according to the World Bank in its annual "Doing Business" report issued for 2018.[151] Since 2013, the Kingdom has declined in the overall Doing Business rankings, from 22nd to 92nd.[152]

Saudi Arabian companies dominate 2009's "MEED 100", with companies listed on the Tadawul, accounting for 29 out of the region's 100 biggest publicly quoted companies ranked by market capitalisation. Just three of the 20 companies that have dropped out of the top 100 over the past year are listed on the Saudi stock exchange.[153]

Foreigners are allowed to wholly own limited liability companies in the majority of industries. Non-Saudi nationals are required to obtain a foreign capital investment license from the Saudi Arabian General Investment Authority (SAGIA).[154]

With a total of 291 foreign investor licenses were issued in the second quarter of 2019, the Kingdom has witnessed an increase in international investment, reflecting the economic reforms under the Saudi Vision 2030. Obtaining a foreign investor license became more straightforward as it requires only two documents, and it is processed in three hours.[155]

Companies

Saudi ARAMCO

Saudi Aramco (officially the Saudi Arabian Oil Co.), is a Saudi Arabian national petroleum and natural gas company based in Dhahran, Saudi Arabia.[156][157] Saudi Aramco has been listed for public trading on 10 December 2019 and has a valuation as of US$2 trillion as of 12 December 2019.

Saudi Aramco has both the largest proven crude oil reserves, which it claims to be more than 260 billion barrels (4.1×1010 m3), and largest daily oil production.[158] Headquartered in Dhahran, Saudi Arabia,[159] Saudi Aramco operates the world's largest single hydrocarbon network, the Master Gas System. Its yearly production is 3.479 billion barrels (553,100,000 m3),[160] and it managed over 100 oil and gas fields in Saudi Arabia, including 284.8 trillion standard cubic feet (scf) of natural gas reserves.[160] Saudi Aramco owns the Ghawar Field, the world's largest oil field, and the Shaybah Field, another one of the world's largest oil fields.[161]

SABIC

The Saudi Arabian Basic Industries Corporation SABIC was established by a royal decree in 1976 to produce chemicals, polymers, and fertilizers. In 2008, SABIC was Asia's largest (in terms of market capitalization) and most profitable publicly listed non-oil company, the world's fourth-largest petrochemical company, ranked 186th as world's largest corporation on the Fortune Global 500 for 2009, the second largest producer of ethylene glycol and methanol in the world, the third largest producer of polyethylene and overall the fourth-largest producer of polypropylene and polyolefin. Standard & Poor's and Fitch Ratings claimed SABIC to be the world's largest producer of polymers and the Persian Gulf region's largest steel producer for 2005 and assigned SABIC an "A" corporate credit rating. In 2008, Fortune 500 ranking records SABIC revenues at $40.2 billion, profits at $5.8 billion and assets standing at $72.4 billion.[162]

Ma'aden (company)

Ma'aden was formed as a Saudi joint stock company on 23 March 1997 for the purpose of facilitating the development of Saudi Arabia's mineral resources. Ma'aden's activities have focused on its active gold business which has grown in recent years to include the operation of five gold mines: Mahd Ad Dahab, Al Hajar, Sukhaybarat, Bulghah, and Al Amar. Ma'aden is now expanding its activities beyond its gold business with the development of phosphates, aluminum, and other projects. In addition, since its formation, Ma'aden (through the Ministry of Petroleum and Mineral Resources) has collaborated with the government and local legislators to develop a regulatory framework for the governance of the mining industry.

ICT Services

Saudi Arabia is currently enjoying a massive boom in its personal computer industry since the deregulation of 2002. The amount of PCs per capita has grown exponentially to nearly 43% of the population in 2005 from just 13% in 2002 leapfrogging over the rest of West Asia. The electrical and electronic market was estimated to be around $3.5 billion in 2004.[163]

The Saudi ICT sector has grown significantly over the last decade and is still showing strong growth. In 2012, ICT sector spending was recorded at SAR 94 billion, with 13.9% annual growth, and reached approximately SAR 102 billion in 2013, with approximately 14% annual growth.[164]

The e-commerce market was estimated at just over $1 billion in 2001.[165]

References

- "World Economic Outlook Database, April 2019". IMF.org. International Monetary Fund. Retrieved 29 September 2019.

- "World Bank Country and Lending Groups". datahelpdesk.worldbank.org. World Bank. Retrieved 29 September 2019.

- "MIDDLE EAST :: SAUDI ARABIA". CIA.gov. Central Intelligence Agency. Retrieved 5 March 2020.

- "World Economic Outlook Database, October 2019". IMF.org. International Monetary Fund. Retrieved 7 November 2019.

- "World Economic Outlook Update, June 2020". www.imf.org. International Monetary Fund. p. 10. Retrieved 10 July 2020.

- "Human Development Index (HDI)". hdr.undp.org. HDRO (Human Development Report Office) United Nations Development Programme. Retrieved 11 December 2019.

- "Inequality-adjusted Human Development Index (IHDI)". hdr.undp.org. HDRO (Human Development Report Office) United Nations Development Programme. Retrieved 11 December 2019.

- "Employment to population ratio, 15+, total (%) (national estimate) - Saudi Arabia". data.worldbank.org. World Bank. Retrieved 5 March 2020.

- "Ease of Doing Business in Saudi Arabia". Doingbusiness.org. Retrieved 24 November 2017.

- "Sovereign Ratings List". Standard & Poor's. 6 January 2017. Retrieved 6 June 2015. Note: this source is continually updated.

- "Monthly Statistics".

- "GDP (current US$) | Data". data.worldbank.org. Retrieved 9 September 2019.

- "Group of Twenty members".

- Anthony, Craig. "Which 10 Countries Have the Most Natural Resources?". Investopedia. Retrieved 12 December 2018.

- "The World's Largest Oil Reserves By Country". WorldAtlas. Retrieved 12 December 2018.

- Workman, Daniel (30 November 2018). "Crude Oil Exports by Country". World's Top Exports. Retrieved 12 December 2018.

- "World Natural Gas Reserves by Country (Trillion Cubic Feet)". indexmundi.com. Retrieved 12 December 2018.

- Department, Knowledge Management. "Kingdom of Saudi Arabia - Ministry of Commerce and Investment". mci.gov.sa. Archived from the original on 28 October 2017. Retrieved 12 December 2018.

- "Saudi Arabia sees first budget surplus since 2014". Arab News. 24 April 2019. Retrieved 1 May 2019.

- Tripp, Culture Shock, 2003: p.113

- "Saudi Arabia". Forbes. Retrieved 23 February 2018.

- "Who we are". Saudi Aramco. Retrieved 18 August 2018.

- "New plan to nab illegals revealed". Arab News. 16 April 2013. Retrieved 30 April 2013.

- Tripp, Culture Shock, 2009: p. vii

- House, Karen Elliott (2012). On Saudi Arabia : Its People, past, Religion, Fault Lines and Future. Knopf. p. 174.

- "Report for Selected Countries and Subjects". www.imf.org. Retrieved 17 January 2020.

- "Gross Domestic Product". 1 August 2018. Retrieved 1 August 2018.

- "World Population Prospects 2017". United Nations. 1 August 2018. Retrieved 1 August 2018.

- "Saudi Arabia – gdp". Indexmundi.com. Retrieved 28 September 2012.

- "Report for Selected Countries and Subjects". imf.org. Retrieved 11 September 2018.

- "1930s". Saudi Aramco. Archived from the original on 15 September 2018. Retrieved 18 August 2018.

- Graphics, WSJ.com News. "Aramco: How The World's Most Important Energy Company Works". WSJ. Retrieved 18 August 2018.

- "Saudi Arabia - Economy". Encyclopedia Britannica. Retrieved 4 February 2019.

- "1940s". Saudi Aramco. Archived from the original on 19 August 2018. Retrieved 18 August 2018.

- "1950s". Saudi Aramco. Archived from the original on 19 August 2018. Retrieved 18 August 2018.

- "OPEC : Brief History". opec.org. Retrieved 18 August 2018.

- Tripp, Culture Shock, 2009: p. vi

- "Saudi Arabia | Data". data.worldbank.org. Retrieved 18 August 2018.

- "1980s". Saudi Aramco. Archived from the original on 19 August 2018. Retrieved 18 August 2018.

- HERSHEY, ROBERT (21 March 1982). "THE DARK SIDE OF THE OIL GLUT". New York Times. Retrieved 18 August 2018.

- "OPEC crude oil price statistics annually 1960-2018 | Statistic". Statista. Retrieved 18 August 2018.

- Gamal, Rania El. "Facing new oil glut, Saudis avoid 1980s mistakes to halt price slide". U.S. Retrieved 19 August 2018.

- GDP per capita (PPP) shrunk by 0.8% on average during the 1980s, grew 2.1% during the 1990s and 4.4% during the 2000s. (source: GDP (PPP) per capita trend during 1980-2010) Annual imports grew 44% on average during the 1970s, but shrunk 1.9% during the 1980s, grew again 2.4% during the 1990s and 14% during the 2000s.(source: Saudi Arabian imports grew 14% during the 2000s)

- Molchanov, Pavel (April 2003). "A Statistical Analysis of OPEC Quota Violations" (PDF). Duke Journal of Economics. XV: 9.

- Tripp, Culture Shock, 2009: p. 225

- "Saudi Arabia Suffers Shock Collapse In Inward Investment". Forbes. Retrieved 7 June 2018.

- "Is Saudi Arabia Unable Or Just Unwilling To Stem The Flow Of Money Leaving The Country?". Forbes. Retrieved 21 September 2018.

- "Saudi Arabia Foreign Direct Investment (FDI) [2006 - 2018] [Chart-Data-Forecast]". ceicdata.com. Retrieved 23 December 2018.

- "New Measures of foreign Investment in Saudi Arabia".

- "Saudi Arabia wants to sell $32 billion of bonds in 2019". Bloomberg. Retrieved 20 December 2018.

- "Saudi Arabia to Sell $7.5 Billion of Bonds in Two Parts". Bloomberg. Retrieved 9 January 2019.

- "Saudi Arabia Sells More Than $7 Billion in Bonds". The Wall Street Journal. Retrieved 9 January 2019.

- "Bloomberg - Britain, China Lead Way in New Saudi Business Licenses". www.bloomberg.com. Retrieved 28 April 2019.

- "Saudi Arabia sees first budget surplus since 2014". Arab News. 24 April 2019. Retrieved 1 May 2019.

- "Saudi Arabia. Profile". 11/2001. US government. Retrieved 12 May 2014.

- "The Petrochemicals and Plastics Sector in the Kingdom of Saudi Arabia" (PDF). U.S.–Saudi Arabian Business Council. Archived from the original (PDF) on 12 December 2014. Retrieved 12 February 2015.

- Tripp, Culture Shock, 2009: p. 44

- "Archived copy" (PDF). Archived from the original on 26 March 2009. Retrieved 20 December 2007.CS1 maint: archived copy as title (link) CS1 maint: BOT: original-url status unknown (link)

- "SAUDI ARABIA: FOREIGN INVESTMENT". Santander, TradePortal. 2019. Retrieved 4 February 2019.

- Wael Mahdi (17 January 2012). "Saudi Aramco to Invest $200 Billion in Refining, Exploration". Bloomberg. Retrieved 19 January 2012.

- "Saudi Arabia's Economic Overhaul Is Backfiring". The Wall Street Journal. Retrieved 5 April 2019.

- "Saudi Aramco battles oil ministry over use of company funds". Financial Times. Retrieved 20 June 2019.

- "Saudi Kayan". Archived from the original on 15 March 2009. Retrieved 28 September 2012.CS1 maint: BOT: original-url status unknown (link)

- Archived 14 March 2016 at the Wayback Machine

- "Construction boom of Saudi Arabia and the UAE". Archived from the original on 11 October 2007. Retrieved 7 December 2016.CS1 maint: BOT: original-url status unknown (link). tdctrade.com. 2 August 2007

- "Saudi Arabia economic zones". MEED. 21 August 2013. Archived from the original on 2 April 2015. Retrieved 16 March 2015.

- "Saudi Arabia's Four New Economic Cities". The Metropolitan Corporate Counsel. 6 February 2013. Retrieved 16 March 2015.

- "It's Not Just Aramco, Saudi's Privatization Push Is Slowing Down". Bloomberg News. Retrieved 20 September 2018.

- Department, Knowledge Management. "Kingdom of Saudi Arabia - Ministry of Commerce and Investment". mci.gov.sa. Archived from the original on 6 November 2017. Retrieved 4 February 2019.

- "Saudi Arabia, Recent developments" (PDF). World bank. 2017. Retrieved 4 February 2019.

- House, Karen Elliott (2012). On Saudi Arabia : Its People, past, Religion, Fault Lines and Future. Knopf. p. 157.

- McDowall, Angus (19 January 2014). "Saudi Arabia doubles private sector jobs in 30-month period". Reuters. Retrieved 12 May 2014.

- House, Karen Elliott (2012). On Saudi Arabia : Its People, past, Religion, Fault Lines and Future. Knopf. p. 159.

- House, Karen Elliott (2012). On Saudi Arabia : Its People, past, Religion, Fault Lines and Future. Knopf. p. 161.

Over the past decade, the government has announced one plan after another to `Saudize` the economy, but to no avail. The foreign workforce grows, and so does unemployment among Saudis. .... The previous plan called for slashing unemployment to 2.8% only to see it rise to 10.5% in 2009, the end of that plan period. Government plans in Saudi are like those in the old Soviet Union, grandiose but unmet. (Also, as in the old Soviet Union, nearly all Saudi official statistics are unreliable, so economists believe the real Saudi unemployment rate is closer to 40%)

- Al Omran, Ahmed (10 July 2018). "Record numbers of foreign workers leave Saudi Arabia". Financial Times. Retrieved 17 August 2018.

- House, Karen Elliott (2012). On Saudi Arabia : Its People, past, Religion, Fault Lines and Future. Knopf. p. 172.

[At one department store, Al Haram, of] 150 employees, only 25 ... are Saudi. All the Saudis are either cashiers or managers. The store manager, Ali al Qahtani, a Saudi, insists that even if a Saudi asked to work in sales (and none has ...) he would not permit it. `I would put him at reception or cashier,` he says, `because Saudi society wouldn't accept a Saudi sales person.` Indeed, a Saudi intellectual who lives in the kingdom but travels often to Europe and the United State recounts his embarrassment at being served by a Saudi waiter in a restaurant. `... I didn't know what to do, it was so embarrassing.`

- Muhammad, Fatima (11 December 2014). "Saudi Arabia to stop wheat production by 2016". Saudi Gazette. Retrieved 12 February 2015.

- Tripp, Culture Shock, 2009: p. 150

- "Saudi agricultural investment abroad - land grab or benign strategy?". Middle East Eye. Retrieved 23 January 2018.

- "Africa up for grabs, Saudi Arabia takes its share". Africa Faith and Justice Network. Retrieved 23 January 2018.

- Pearce, Fred (19 May 2012). "Land grabbers: Africa's hidden revolution". the Guardian. Retrieved 23 January 2018.

- "King Abdullah's Initiative for Saudi Agricultural Investment Abroad: A way of enhancing Saudi food security". farmlandgrab.org. 3 May 2010. Retrieved 23 January 2018.

- "What you should know about Saudi investment in African farmland". How We Made It In Africa. 4 July 2012. Retrieved 23 January 2018.

- "KSA Business: Saudi REITs market worth over $2bn in Q1". www.gdnonline.com. Retrieved 22 January 2019.

- "The rise of REITs in the Gulf region". ArabianBusiness.com. Retrieved 22 January 2019.

- "Value of Saudi real estate deals drops 24%". ArgaamPlus. Retrieved 22 January 2019.

- "Real Estate Ownership and Investment in Saudi Arabia". Al Tamimi & Company. Retrieved 22 January 2019.

- "Overview of Saudi Real Estate Laws and Practice". Al Tamimi & Company. Retrieved 22 January 2019.

- "Saudi Arabia". JLL. Retrieved 22 January 2019.

- "Knight Frank expands reach with opening of Saudi Arabian office". www.knightfrank.ae. Retrieved 22 January 2019.

- "Savills Dubai | Office". dubai.savills.ae. Retrieved 22 January 2019.

- "Saudi Vision 2030". vision2030.gov.sa. Retrieved 22 January 2019.

- "Real Estate Investment Traded Funds – REITs". Tadawul.

- House, Karen Elliott (2012). On Saudi Arabia: Its People, past, Religion, Fault Lines and Future. Knopf. p. 165.

- Aluwaisheg, Abdel Aziz (29 September 2014). "When privatization goes wrong". Arab News. Retrieved 29 September 2014.

- "Cabinet gives go-ahead for businesses to open 24/7 in Saudi Arabia". Arab News. 17 July 2019. Retrieved 18 July 2019.

- "New head of foreign trade thanks King for his trust". Saudigazette. 24 March 2019. Retrieved 9 July 2019.

- "Kingdom of Saudi Arabia - Member information". WTO. Retrieved 28 September 2012.

- "Membership of Key Economies in International Organisations". Kasinomics. Archived from the original on 16 January 2013. Retrieved 28 September 2012.

- "ICC – The world business organization". Iccwbo.org. 21 February 2011. Archived from the original on 21 February 2011. Retrieved 28 September 2012.

- "Members". ISO. Retrieved 28 September 2012.

- "WCO – Reports". Wcoomd.org. 3 May 2011. Archived from the original on 18 September 2012. Retrieved 28 September 2012.

- "The Cooperation Council For The Arab States of The Gulf – Secretariat General". Gcc-sg.org. Archived from the original on 23 November 2012. Retrieved 28 September 2012.

- Long, Culture and Customs, 2009: p. 206

- Cordesman, Anthony H. (2003). Saudi Arabia Enters the Twenty-First Century, Volume 1. Greenwood. p. 244. ISBN 9780275980917.

- Clark, Laura. "Longform's Picks of the Week [Will Saudi Arabia Ever Change?]". Foreign Policy. Retrieved 23 April 2019.

- Eakins, Hugh (10 January 2013). "Will Saudi Arabia Ever Change?". New York Review of Books.

Despite Saudi control of the largest petroleum reserves in the world, decades of rapid population growth have reduced per capita income to a fraction of that of smaller Persian gulf neighbors. Event the people of Bahrain, a country with little oil that has roiled with unrest since early 2011, are wealthier.

- World Population Prospects: The 2010 Revision

- House, Karen Elliott (2012). On Saudi Arabia: Its People, past, Religion, Fault Lines and Future. Knopf. p. 245.

In a country where a gallon of gasoline at roughly 53 cents is cheaper than bottled water and government energy subsidies are roughly $35 billion annually, Saudi energy consumption is rising at what one energy official calls an 'alarming rate.'

- Murphy, Caryle (7 February 2012). "Saudi Arabia's Youth and the Kingdom's Future". Woodrow Wilson International Center for Scholars' Environmental Change and Security Program. Retrieved 13 May 2014.

- "Saudi Arabia needs private sector growth to stem youth unemployment, business leaders say". December 03, 2013. Fox News. Associated Press. Retrieved 12 May 2014.

- "Out of the comfort zone". The Economist. 3 March 2012.

- Commins, David (2009). The Wahhabi Mission and Saudi Arabia. I.B.Tauris. p. 128.

Observers also note that in spite of generous budgets, Saudi education has been plagued by numerous problems: poorly trained teachers, low retention rates, lack of rigorous standards, weak scientific and technical instruction and excessive attention to religious subjects. Consequently, the kingdom has continued to depend on huge numbers of expatriates workers to fill technical and administrative positions.

- Roy, Delwin A. (1992). "Saudi Arabia education: Development policy". Middle Eastern Studies. xxviii (3): 481, 485, 495.

- Abir, Mordechai (1986). "Modern Education and the evolution of Saudi Arabia education". National and International Politics in the Middle East: Essays in Honour of Elie Kedouirie. Routledge. pp. 481, 485, 495.

- The Middle East and North Africa Salary Survey – May 2015, Bayt.com. Retrieved 29 June 2015

- House, Karen Elliott (2012). On Saudi Arabia: Its People, past, Religion, Fault Lines and Future. Knopf. pp. 162–64.

- Source: USPTO website accessed 17 May 2011

- Jr, Bernd Debusmann. "Saudi Arabia leads Arab world in patents". ArabianBusiness.com. Retrieved 10 March 2019.

- "KSA ranks 23rd in number of patents granted by the US Patent and Trademark Office". Arab News. 17 April 2018. Retrieved 10 March 2019.

- "Saudi Arabia Granted 664 Patents in 2017; Double of All Arab Countries Combined". www.businesswire.com. 16 April 2018. Retrieved 10 March 2019.

- House, Karen Elliott (2012). On Saudi Arabia: Its People, past, Religion, Fault Lines and Future. Knopf. p. 175.

- House, Karen Elliott (2012). On Saudi Arabia: Its People, past, Religion, Fault Lines and Future. Knopf. p. 167.

- "Saudi Arabia Accused Of Turning A Blind Eye To International Terrorism Financing By Global Watchdog". Forbes. Retrieved 25 September 2018.

- "Saudi Arabia has tenth lowest poverty rate worldwide, says World Bank". al-Arabiyya. Saudi Gazette. 3 November 2013. Retrieved 2 October 2014.

- Sullivan, Kevin (1 January 2013). "Saudi Arabia's riches conceal a growing problem of poverty". The Guardian. Washington Post. Retrieved 2 October 2014.

In a country with vast oil wealth and lavish royalty, an estimated quarter of Saudis live below the poverty line

- A 2003 survey by the Ministry of Social Affairs found 40% of all Saudi citizens live on less than 3000 Saudi riyals ($850) a month, (source:House, Karen Elliott (2012). On Saudi Arabia : Its People, past, Religion, Fault Lines and Future. Knopf. p. 159.), while 19% of Saudis live on less than 1800 SR (Saudi riyals) ($480) a month. (source: House, Karen Elliott (2012). On Saudi Arabia: Its People, past, Religion, Fault Lines and Future. Knopf. p. 179.

... according to a 2003 survey by the Ministry of Social Affairs.

) - Roy Gutman (4 December 2011). "Saudi dissidents turn to YouTube to air their frustrations". McClatchy Newspapers.

- "Mal3ob 3alena: Poverty in Saudi Arabia English Version". YouTube.

- "A foreign Saudi plot to expose foreign poverty in foreign Saudi". Lebanon Spring. 19 October 2011. Archived from the original on 3 January 2012.

- "Poverty Hides Amid Saudi Arabia's Oil Wealth". NPR.

- "Poverty exists in Saudi Arabia too | The Observers". France 24. 28 October 2008.

- Amelia Hill (23 October 2011). "Saudi film-makers enter second week of detention". The Guardian. London.

- "Nearly 50% citizens own houses in Saudi Arabia". Arab News. 26 January 2018. Retrieved 23 December 2018.

- Sloan, Alastair. "Saudi Arabia's housing predicament". Middle East Monitor. Archived from the original on 4 March 2016. Retrieved 11 June 2014.

- House, Karen Elliott (2012). On Saudi Arabia: Its People, Past, Religion, Fault Lines and Future. Knopf. p. 176.

- "New mortgages to boost home ownership in Saudi Arabia". Arab News. 8 August 2018. Retrieved 23 December 2018.

- House, Karen Elliott (2012). On Saudi Arabia : Its People, Past, Religion, Fault Lines and Future. Knopf. p. 106.

A second youth video, Monopoly, highlighted the near impossibility of owning a home in Saudi Arabia because a monopoly on landownership by royals and other wealthy Saudi has put the price of land out of reach of a majority of Saudis. It struck a responsive chord in the population.

- House, Karen Elliott (2012). On Saudi Arabia: Its People, Past, Religion, Fault Lines and Future. Knopf. p. 151.

In or around population centers, much of the open land is owned by various princes or a few wealthy families who are holding it for future development and profit.

- House, Karen Elliot (2012). On Saudi Arabia: Its People, Past, Religion, Fault Lines and Future. Alfred A. Knopf. p. 163. ISBN 978-0307473288. Retrieved 13 February 2015.

every five-year plan since the first one in 1970 has called for diversifying the economy beyond oil, but oil is still supreme

- "Manufacturing booms in Saudi Arabia | Saudi Arabia News". AMEinfo.com. Archived from the original on 24 September 2012. Retrieved 28 September 2012.

- "Rising Oil Prices Are Bad News for Saudi Arabia". Wall Street Journal. Retrieved 25 September 2018.

- "Saudi Arabia's Big Dreams and Easy Living Hit a Wall". The New York Times. Retrieved 16 May 2020.

- "Nomu - Parallel Market". Tadawul. 2020.

- "The Saudi Stock Exchange (Tadawul)". Tadawul. 2020.

- "Data – Finance". Web.worldbank.org. Archived from the original on 5 April 2010. Retrieved 28 September 2012.

- "Saudi Arabia most improved economy for business". Arab News. 28 May 2019. Retrieved 28 May 2019.

- "Saudi Arabia sees most improvement in ease of doing business: World Bank". Arab News. 24 October 2019. Retrieved 24 October 2019.

- "Doing Business 2020: Saudi Arabia Accelerated Business Climate Reforms, Joins Ranks of 10 Most Improved". World Bank. Retrieved 24 October 2019.

- "Doing Business 2020 report" (PDF). World Bank. Retrieved 24 October 2019.

- "Doing Business 2018" (PDF).

- "Doing Business 2013" (PDF).

- "Special Report: MEED 100 – The Middle East's top 100 listed companies in 2009 | Special Report". MEED. 1 March 2009. Archived from the original on 17 February 2012. Retrieved 28 September 2012.

- Saudi Arabia Company Formation Healy Consultants Retrieved 3 September 2013.

- "Saudi Arabia issued 5 new foreign investor licenses a day in Q2". Saudigazette. 11 September 2019. Retrieved 12 September 2019.

- The Report: Saudi Arabia 2009. Oxford Business Group. 2009. p. 130. ISBN 978-1-907065-08-8.

- "Our company. At a glance". Saudi Aramco.

The Saudi Arabian Oil Co. (Saudi Aramco) is the state-owned oil company of the Kingdom of Saudi Arabia.

- SteelGuru – News Archived 8 April 2010 at the Wayback Machine

- "Contact Us." Saudi Aramco. Retrieved on 5 November 2009. "Headquarters: Dhahran, Saudi Arabia Address: Saudi Aramco P.O. Box 5000 Dhahran 31311 Saudi Arabia"

- Saudi Aramco Annual Review 2010

- Forbes News for Shaybah Field

- "SABIC climbing up the growth ladder". Arabnews.com. Retrieved 28 September 2012.

- "Saudi electronic market reaches $3.5 billion". Projectsmiddleeast.com. 15 July 2011. Archived from the original on 15 July 2011. Retrieved 28 September 2012.

- "ICT Report – Mobility in Saudi Arabia" (PDF). CITC – Communications and Information Technology Commission. 9 March 2015. Archived from the original (PDF) on 25 March 2016.

- "Archived copy" (PDF). Archived from the original on 16 July 2011. Retrieved 6 April 2008.CS1 maint: archived copy as title (link) CS1 maint: BOT: original-url status unknown (link)

- Tripp, Harvey; North, Peter (2003). Culture Shock, Saudi Arabia. A Guide to Customs and Etiquette. Singapore; Portland, Oregon: Times Media Private Limited.

- Tripp, Harvey; North, Peter (2009). CultureShock! A Survival Guide to Customs and Etiquette. Saudi Arabia (3rd ed.). Marshall Cavendish.

Notes

- immigrants make up 38.3% of the total population, according to UN data (2019)[3]

Further reading

- Niblock, Tim (2007). The political economy of Saudi Arabia. Routledge. ISBN 0-415-42842-4.