Economy of Nigeria

The economy of Nigeria is a middle-income, mixed economy and emerging market, with expanding manufacturing, financial, service, communications, technology and entertainment sectors.[24] It is ranked as the 27th-largest economy in the world in terms of nominal GDP, and the 24th-largest in terms of purchasing power parity.[25] Nigeria has the largest economy in Africa; its re-emergent manufacturing sector became the largest on the continent in 2013, and it produces a large proportion of goods and services for the West African subcontinent.[26] In addition, the debt-to-GDP ratio is 16.075 percent as of 2019.[27]

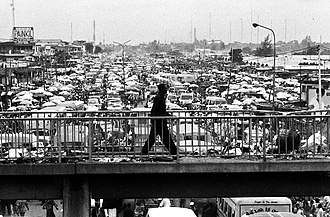

Lagos, the financial centre of Nigeria | |

| Currency | Nigerian naira (NGN, ₦) |

|---|---|

| 1 April – 31 March[1] | |

Trade organisations | AU, AfCFTA (signed), WTO, ECOWAS |

Country group |

|

| Statistics | |

| Population | |

| GDP | |

| GDP rank | |

GDP growth |

|

GDP per capita | |

GDP per capita rank | |

GDP by sector |

|

| 13.4% (2020 est.)[6] | |

Population below poverty line | 40% (2020)[9] |

Labour force |

|

Labour force by occupation |

|

| Unemployment | 23.1% (Q3 2018)[14] |

Main industries | cement, oil refining, construction and construction materials, food processing and food products, beverages and tobacco, textiles, apparel and footwear, pharmaceutical products, wood products, pulp paper products, chemicals, ceramic products, plastic and rubber products, electrical and electronic products, base metals: iron and steel, information technology, automobile manufacturing, and other manufacturing (2015)[15] |

| External | |

| Exports | |

Export goods | petroleum and petroleum products, chemicals, vehicles, aircraft parts, vessels, vegetable products, processed food, beverages, spirits and vinegar, cashew nuts, processed leather, cocoa, tobacco, aluminum alloys (2015)[19] |

Main export partners |

|

| Imports | |

Import goods | industry supplies, machinery, appliances, vehicles, aircraft parts, chemicals, base metals (2015)[19] |

Main import partners |

|

FDI stock | |

Gross external debt | |

| Public finances | |

| $5.2 billion; 1% of GDP (2014)[21] | |

| Revenues | $54.48 billion |

| Expenses | $31.61 billion (2012 est.) |

Foreign reserves | |

Nigerian GDP at purchasing power parity (PPP) has almost tripled from $170 billion in 2000 to $451 billion in 2012,[28] though estimates of the size of the informal sector (which is not included in official figures) put the actual numbers closer to $630 billion. Correspondingly, the GDP per capita doubled from $1400 per person in 2000 to an estimated $2,800 per person in 2012 (again, with the inclusion of the informal sector, it is estimated that GDP per capita hovers around $3,900 per person).[29] (Population increased from 120 million in 2000 to 160 million in 2010). These figures were to be revised upwards by as much as 80% when metrics were to be recalculated subsequent to the rebasing of its economy in April 2014.[30]

Although oil revenues contribute 2/3 of state revenues,[31] oil only contributes about 9% to the GDP. Nigeria produces only about 2.7% of the world's oil supply. Although the petroleum sector is important, as government revenues still heavily rely on this sector, it remains a small part of the country's overall economy.

The largely subsistence agricultural sector has not kept up with rapid population growth, and Nigeria, once a large net exporter of food, now imports some of its food products, though mechanization has led to a resurgence in manufacturing and exporting of food products, and the move towards food sufficiency.[32] In 2006, Nigeria came to an agreement with the Paris Club to buy back the bulk of its debts owed from them for a cash payment of roughly US$12 billion.[33]

According to a Citigroup report published in February 2011, Nigeria will have the highest average GDP growth in the world between 2010 and 2050.[34] Nigeria is one of two countries from Africa among 11 Global Growth Generators countries.[35]

Overview

In 2014, Nigeria changed its economic analysis to account for rapidly growing contributors to its GDP, such as telecommunications, banking, and its film industry.[36]

In 2005, Nigeria reached an agreement with the Paris Club of lending nations to eliminate all of its bilateral external debt.[37] Under the agreement, the lenders will forgive most of the debt, and Nigeria will pay off the remainder with a portion of its energy revenues.[38][39] Moreover, human capital is underdeveloped—Nigeria ranked 151 out of countries in the United Nations Development Index in 2004[40]—and non-energy-related infrastructure is inadequate.

[41] From 2003 to 2007, Nigeria attempted to implement an economic reform program called the National Economic Empowerment Development Strategy (NEEDS). The purpose of the NEEDS was to raise the country's standard of living through a variety of reforms, including macroeconomic stability, deregulation, liberalization, privatization, transparency, and accountability.[42]

The NEEDS addressed basic deficiencies, such as the lack of freshwater for household use and irrigation, unreliable power supplies, decaying infrastructure, impediments to private enterprise, and corruption.[43] NEEDS was intended to create 7 million new jobs, diversify the economy, boost non-energy exports, increase industrial capacity utilization, and improve agricultural productivity. A related initiative on the state level is the State Economic Empowerment Development Strategy (SEEDS).[44]

A longer-term economic development program is the United Nations (UN)- sponsored National Millennium Goals for Nigeria. Under the program, which covers the years from 2000 to 2015, Nigeria is committed to achieving a wide range of ambitious objectives involving poverty reduction, education, gender equality, health, the environment, and international development cooperation. In an update released in 2004, the UN found that Nigeria was making progress toward achieving several goals but was falling short on others.[45]

Specifically, Nigeria had advanced efforts to provide universal primary education, protect the environment.[46][47]

A prerequisite for achieving many of these worthwhile objectives is curtailing endemic corruption, which stymies development and taints Nigeria's business environment. President Olusegun Obasanjo's campaign against corruption, which includes the arrest of officials accused of misdeeds and recovering stolen funds, has won praise from the World Bank.[48] In September 2005, Nigeria, with the assistance of the World Bank, began to recover US$458 million of illicit funds that had been deposited in Swiss banks by the late military dictator Sani Abacha, who ruled Nigeria from 1993 to 1998. However, while broad-based progress has been slow, these efforts have begun to become evident in international surveys of corruption. Nigeria's ranking has consistently improved since 2001 ranking 147 out of 180 countries in Transparency International's 2007 Corruption Perceptions Index.[49]

The Nigerian economy suffers from an ongoing supply crisis in the power sector. Despite a rapidly growing economy, some of the world's largest deposits of coal, oil and gas and the country's status as Africa's largest oil producer, power supply difficulties are frequently experienced by residents.[50]

Two thirds of Nigerians expect living conditions to improve in the coming decades.[51]

Economic history

This is a chart of trend of gross domestic product of Nigeria at market prices estimated[52] by the International Monetary Fund with figures in USD billions. Figures before 2000 are backwards projections from the 2000–2012 numbers, based on historical growth rates, and should be replaced when data becomes available. The figure for 2014 is derived from a rebasing of economical activity earlier in the year.

| Year | Gross domestic product, (PPP, in billions) | US dollar exchange | Inflation index (2000=100) | Per capita income (as % of USA) |

|---|---|---|---|---|

| 1980 | *58 | 1 Naira | 1.30 | 7% |

| 1985 | *82 | 3 Naira | 3.20 | 5% |

| 1990 | *118 | 9 Naira | 8.10 | 2.5% |

| 1995 | *155 | 50 Naira | 56 | 3% |

| 2000 | 170 | 100 Naira | 100 | 3.5% |

| 2005 | 291 | 130 Naira | 207 | 4% |

| 2010 | 392 | 150 Naira | 108 | 5% |

| 2012 | 451 | 158 Naira | 121 | 7% |

| 2014 | 972 | 180 Naira | 10 | 11% |

| 2015 | 1,089 | 220 Naira | 10 | 10% |

| 2016 | 1,093 | 280 Naira | 17 | 10% |

| 2017 | 1,125 | 360 Naira | 5 (est) | 10% |

NOTES:

The US dollar exchange rate is an estimated average of the official rate throughout a year, and does not reflect the parallel market rate at which the general population accesses foreign exchange. This rate ranged from a high of 520 in March 2017 to a low of 350 in August 2017, due to a scarcity of forex (oil earnings had dropped by half), and to speculative activity as alleged by the Central Bank. All the while the official rate was pegged at 360.

Per capita income (as % of USA) is calculated using data from estimates in the PPP link above, and from census estimates, based on growth rates between census periods. For instance 2017 GDPs were 1,125 Billion (Nigeria) vs. 19,417 Billion (USA) and populations were estimated at 320 million vs 190 million. The ratio is therefore (1125/19417) / (190/320), which roughly comes to 0.0975. These are estimates and are intended to get a feel for the relative wealth and standard of living, as well as the market potential of its middle class.[53]

This is a chart of trend of the global ranking of the Nigerian economy, in comparison with other countries of the world, derived from the historical List of countries by GDP (PPP).

| Year | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 (est.) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Ranking | 52 | 47 | 38 | 37 | 34 | 31 | 31 | 30 | 23 | 20 | 21 | 22 | 23 |

This chart shows the variance in the parallel exchange rate at which the Dollar can be obtained with Naira in Lagos, with "Best" being cheaper for a Nigerian (i.e. stronger Naira).[54] [55]

| Year | 2015 | 2016 | 2017 |

|---|---|---|---|

| Best | 195 | 345 | 350 |

| Worst | 237 | 490 | 520 |

For purchasing power parity comparisons, the US dollar is exchanged at 1 USD to 314.27 Nigerian naira (as of 2017).[56]

Current GDP per capita of Nigeria expanded 132% in the sixties reaching a peak growth of 283% in the seventies. But this proved unsustainable and it consequently shrank by 66% in the 1980s.[57] In the 1990s, diversification initiatives finally took effect and decadal growth was restored to 10%. Although GDP on a PPP basis did not increase until the 2000s.[58]

In 2012, the GDP was composed of the following sectors: agriculture: 40%; services: 30%; manufacturing: 15%; oil: 14%.[59] By 2015, the GDP was composed of the following sectors: agriculture: 18%; services: 55%; manufacturing: 16%; oil: 8%[15]

In 2005 Nigeria's inflation rate was an estimated 15.6%. Nigeria's goal under the National Economic Empowerment Development Strategy (NEEDS) program is to reduce inflation to the single digits.[60] By 2015, Nigeria's inflation stood at 9%. In 2005, the federal government had expenditures of US$13.54 billion but revenues of only US$12.86 billion, resulting in a budget deficit of 5%. By 2012, expenditures stood at $31.61 billion, while revenues was $54.48 billion.[61]

Economic sectors

Agriculture

Nigeria ranks sixth worldwide and first in Africa in farm output. The sector accounts for about 18% of GDP and almost one-third of employment. Nigeria has 19 million head of cattle, the largest in Africa.[63] Though Nigeria is no longer a major exporter, due to local consumer boom, it is still a major producer of many agricultural products, including: cocoa, groundnuts (peanuts), rubber, and palm oil. Cocoa production, mostly from obsolete varieties and overage trees has increased from around 180,000 tons annually to 350,000 tons.[64]

Major agricultural products include cassava (tapioca), corn, cocoa, millet, palm oil, peanuts, rice, rubber, sorghum, and yams. In 2003, livestock production, in order of metric tonnage, featured eggs, milk, beef and veal, poultry, and pork, respectively. In the same year, the total fishing catch was 505.8 metric tons.[65] Roundwood removals totaled slightly less than 70 million cubic meters, and sawnwood production was estimated at 2 million cubic meters. The agricultural sector suffers from extremely low productivity, reflecting reliance on antiquated methods. Agriculture has failed to keep pace with Nigeria's rapid population growth, so that the country, which once exported food, now imports a significant amount of food to sustain itself.[66] However, efforts are being made towards making the country food sufficient again.

Oil

Nigeria's proven oil reserves are estimated to be 35 billion barrels (5.6×109 m3); natural gas reserves are well over 100 trillion cubic feet (2,800 km3). Nigeria is a member of the Organization of Petroleum Exporting Countries (OPEC). The types of crude oil exported by Nigeria are Bonny light oil, Forcados crude oil, Qua Ibo crude oil and Brass River crude oil.[67] Poor corporate relations with indigenous communities, vandalism of oil infrastructure, severe ecological damage, and personal security problems throughout the Niger Delta oil-producing region continue to plague Nigeria's oil sector.[68]

Efforts are underway to reverse these troubles. A new entity, the Niger Delta Development Commission (NDDC), has been created to help catalyze economic and social development in the region. The U.S. remains Nigeria's largest buyer of crude oil, accounting for 40% of the country's total oil exports; Nigeria provides about 10% of overall U.S. oil imports and ranks as the fifth-largest source for U.S. imported oil.[69]

The United Kingdom is Nigeria's largest trading partner followed by the United States. Although the trade balance overwhelmingly favors Nigeria, thanks to oil exports, a large portion of U.S. exports to Nigeria is believed to enter the country outside of the Nigerian government's official statistics, due to importers seeking to avoid Nigeria's tariffs. To counter smuggling and under-invoicing by importers, in May 2001, the Nigerian government instituted a full inspection program for all imports, and enforcement has been sustained.[70]

On the whole, Nigerian high tariffs and non-tariff barriers are gradually being reduced, but much progress remains to be made. The government also has been encouraging the expansion of foreign investment, although the country's investment climate remains daunting to all but the most determined.[71] The stock of U.S. investment is nearly $7 billion, mostly in the energy sector. Exxon Mobil and Chevron are the two largest U.S. corporations in offshore oil and gas production. Significant exports of liquefied natural gas started in late 1999 and are slated to expand as Nigeria seeks to eliminate gas flaring by 2008.

The pump price of P.M.S. as at 14 May 2020 stands at around ₦123.500 at fueling stations across Nigeria. An initial increase in the price of petrol (Premium Motor Spirit) from around ₦65 to ₦140 triggered by the removal of fuel subsidies on 1 January 2012, triggered a total strike and massive protests across the country. Then President Goodluck Ebele Jonathan later reached an agreement with the Nigerian Labour Congress and reduced the pump price to 97 naira. The pump price was further reduced by 10 to 87 naira in the run-up to the 2015 general elections. However, after the elections of Muhammadu Buhari, the fuel subsidies was removed again, and the pump price increased again, despite the fall in oil price.

Since the fall in oil prices in 2015 and 2016, the government exchange rate policy has limited devaluation of the naira due to inflation concerns by the President Muhammadu Buhari.[72][73]

Services

Nigeria ranks 27th worldwide and first in Africa in services' output.[74]

Since undergoing severe distress in the mid-1990s, Nigeria's banking sector has witnessed significant growth over the last few years as new banks enter the financial market.

Private sector-led economic growth remains stymied by the high cost of doing business in Nigeria, including the need to duplicate essential infrastructure, the lack of effective due process, and nontransparent economic decision making, especially in government contracting. While corrupt practices are endemic, they are generally less flagrant than during military rule, and there are signs of improvement. In 2013, The World Bank in 2013 stated that since 1999, the Nigerian Stock Exchange has enjoyed strong performance, although equity as a means to foster corporate growth is being more utilized by Nigeria's private sector.

Transport

Principal ports are at Lagos (Apapa and Tin Can Island), Port Harcourt (Onne), and Calabar.

Extensive road repairs and new construction activities are gradually being implemented as state governments, in particular, spend their portions of enhanced government revenue allocations.

Five of Nigeria's airports (Lagos, Kano, Port Harcourt, Enugu and Abuja) currently fly to international destinations. The Nigerian Airforce began a new airline called United Nigeria, with a Boeing 737-500 in 2013. There are several domestic private Nigerian carriers, and air service among Nigeria's cities is generally dependable.[75]

Tourism

Mining

The mining of minerals in Nigeria accounts for only 0.3% of its GDP, due to the influence of its vast oil resources. The domestic mining industry is underdeveloped, leading to Nigeria having to import minerals that it could produce domestically, such as salt or iron ore. Rights to ownership of mineral resources is held by the Federal government of Nigeria, which grants titles to organizations to explore, mine, and sell mineral resources. Organized mining began in 1903 when the Mineral Survey of the Northern Protectorates was created by the British colonial government. A year later, the Mineral Survey of the Southern Protectorates was founded. By the 1940s, Nigeria was a major producer of tin, columbite, and coal. The discovery of oil in 1956 hurt the mineral extraction industries, as government and industry both began to focus on this new resource. The Nigerian Civil War in the late 1960s led many expatriate mining experts to leave the country.[79]

Mining regulation is handled by the Ministry of Solid Minerals Development, which oversees the management of all mineral resources. Mining law is codified in the Federal Minerals and Mining Act of 1999. Historically, Nigeria's mining industry was monopolized by state-owned public corporations. This led to a decline in productivity in almost all mineral industries. The Obasanjo administration began a process of selling off government-owned corporations to private investors in 1999.[79]Energy

Nigeria's primary energy consumption was about 108 Mtoe in 2011.[80] Most of the energy comes from traditional biomass and waste, which account for 83% of total primary production. The rest is from fossil fuels (16%) and hydropower (1%).[80]

Nigeria has oil reserves of about 35 billion barrels (5.6×109 m3) and gas reserves of about 5 trillion cubic meters, ranking 10th and 9th in the world, respectively. Global production in 2009 reached 29 billion barrels (4.6×109 m3) of oil and 3 trillion cubic meters of natural gas.[81] Nigeria is a member of the Organisation of the Petroleum Exporting Countries.Data

Electricity – production: 18.89 billion kWh (2009)

Electricity – production by source:

fossil fuel:

61.69%

hydro:

38.31%

nuclear:

0%

other:

<.1% (1998)

Electricity - consumption: 17.66 billion kWh (2009)

Electricity - exports: 40 million kWh (2003)

Electricity - imports: 0 kWh (1998)

Oil - production: 2.35 million barrels per day (374×103 m3/d) (July 2006 est.)

Oil - consumption: 310,000 bbl/d (49,000 m3/d) (2003 est.)

Overseas remittances

A major source of foreign exchange earnings for Nigeria are remittances sent home by Nigerians living abroad.[82] In 2014, 17.5 million Nigerians lived in foreign countries, with the UK and the USA having more than 2 million Nigerians each.[82]

According to the International Organization for Migration, Nigeria witnessed a dramatic increase in remittances sent home from overseas Nigerians, going from USD $2.3 billion in 2004 to $17.9 billion in 2007, representing 6.7% of GDP. The United States accounts for the largest portion of official remittances, followed by the United Kingdom, Italy, Canada, Spain and France. On the African continent, Egypt, Equatorial Guinea, Chad, Libya and South Africa are important source countries of remittance flows to Nigeria, while China is the biggest remittance-sending country in Asia.[83]

Labour force

In 2015, Nigeria had a labour force of 74 million. In 2003, the unemployment rate was 10.8% overall; by 2015, unemployment stood at 6.4%.[84]

Since 1999, the Nigerian Labor Congress (NLC) a union umbrella organization, has called six general strikes to protest domestic fuel price increases. However, in March 2005 the government introduced legislation ending the NLC's monopoly over union organizing. In December 2005, the Nigerian Labour Congress (NLC) was lobbying for an increase in the minimum wage for federal workers. The existing minimum wage, which was introduced six years earlier but has not been adjusted since, has been whittled away by inflation to only US$42.80 per month.[85]

According to the International Organization for Migration, the number of immigrants residing in Nigeria has more than doubled in recent decades – from 477,135 in 1991 to 971,450 in 2005. The majority of immigrants in Nigeria (74%) are from neighbouring Economic Community of West African States (ECOWAS), and that this number has increased considerably over the last decade, from 63% in 2001 to 97% in 2005.[86]

The government has to pay a high interest rate on bonds in part because of the high fertility rate; there are many children and less savings.[87]

Human capital

The Human Development Index (HDI) shows in 2012 that Nigeria is ranked 156 with the value of 0.459 among 187 countries. As of 2015, Nigeria's HDI is ranked 152nd at 0.514. The comparative value for Sub-Saharan Africa is 0.475, 0.910 for the US,[88] and 0.694 for the world average.

The value for the education index is 0.457, compared to the average in the US of 0.939. The expected years of schooling in Nigeria is 9.0 (16.00 in the US), while the mean years of schooling for adults over 25 years is 5.2 years (12.4 years in the US). Additionally, Nigeria is also facing a relatively high inequality, worsening the problem regarding the formation of human capital.[89][90][91]

Government policy

Inflation

In the light of highly expansionary public sector fiscal policies in 2001, the government sought ways to head off higher inflation, leading to the implementation of stronger monetary policies by the Central Bank of Nigeria (CBN) and underspending of budgeted amounts. As a result of the CBN's efforts, the official exchange rate for the Naira had stabilized at about 112 Naira to the dollar. The combination of CBN's efforts to prop up the value of the Naira and excess liquidity resulting from government spending led the currency to be discounted by around 20% on the parallel (non-official) market.

A key condition of the Stand-by Arrangement has been closure of the gap between the official and parallel market exchange rates. The Inter Bank Foreign Exchange Market (IFEM) is closely tied to the official rate. Under IFEM, banks, oil companies, and the CBN can buy or sell their foreign exchange at government-influenced rates. Much of the informal economy, however, can only access foreign exchange through the parallel market. Companies can hold domiciliary accounts in private banks, and account holders have unfettered use of the funds.

Expanded government spending also has led to upward pressure on consumer prices. Inflation which had almost disappeared in April 2000 reached 14.5% by the end of the year and 18.7% in August 2001. In 2000, high oil prices resulted in government revenue of over $16 billion, about double the 1999 level. State and local governments demanded access to this "windfall" revenue, creating a tug-of-war between the federal government, which sought to control spending, and state governments desiring augmented budgets, preventing the government from making provision for periods of lower oil prices.

In 2016, the black market exchange rate of the Naira was about 60% above the official rate. The central bank releases about $200 million each week at the official exchange rate. However, some companies cite that budgets now include a 30% "premium" to be paid to central bank officials to get dollars.[72]

Gradual reform

The Obasanjo government supported "private-sector" led, "market oriented" economic growth and began extensive economic reform efforts. Although the government's anti-corruption campaign was left wanting, progress in injecting transparency and accountability into economic decision-making was notable. The dual exchange rate mechanism formally abolished in the 1999 budget remains in place in actuality.

During 2000 the government's privatization program showed signs of life and real promise with successful turnover to the private sector of state-owned banks, fuel distribution companies, and cement plants.[92] However, the privatization process has slowed somewhat as the government confronts key parastatals such as the state telephone company NITEL and Nigerian Airways. The successful auction of GSM telecommunications licenses in January 2001 has encouraged investment in this vital sector.

Although the government has been stymied so far in its desire to deregulate downstream petroleum prices, state refineries, almost paralyzed in 2000, are producing at much higher capacities. By August 2001, gasoline lines disappeared throughout much of the country. The government still intends to pursue deregulation despite significant internal opposition, particularly from the Nigeria Labour Congress. To meet market demand the government incurs large losses importing gasoline to sell at subsidized prices.

Foreign economic relations

Nigeria's foreign economic relations revolve around its role in supplying the world economy with oil and natural gas, even as the country seeks to diversify its exports, harmonize tariffs in line with a potential customs union sought by the Economic Community of West African States (ECOWAS), and encourage inflows of foreign portfolio and direct investment. In October 2005, Nigeria implemented the ECOWAS common external tariff, which reduced the number of tariff bands.[93]

Prior to this revision, tariffs constituted Nigeria's second largest source of revenue after oil exports. In 2005 Nigeria achieved a major breakthrough when it reached an agreement with the Paris Club to eliminate its bilateral debt through a combination of write-downs and buybacks.[94] Nigeria joined the Organization of the Petroleum Exporting Countries in July 1971 and the World Trade Organization in January 1995.

If the global transition to renewable energy is completed and international demand for Nigeria's petroleum resources ceases, Nigeria will be significantly weakened. It is ranked 149 out of 156 countries in the index of Geopolitical Gains and Losses after energy transition (GeGaLo).[95]

External trade

.png)

In 2017, Nigeria imported about US$34.2 billion of goods.[96] In 2017 the leading sources of imports were China (28%), the Belgium-Luxembourg (8.9%), the Netherlands (8.3%), South Korea (6.4%), the United States (6.0%) and the Republic of India (4.6%).[18] Principal imports were manufactured goods, machinery and transport equipment, chemicals, and food and live animals.

In 2017, Nigeria exported about US$46.68 billion of goods.[17] In 2017, the leading destinations for exports were India (18%), the United States (14%), Spain (9.7%), France (6.0%) and the Netherlands (4.9%).[18] In 2017 oil accounted for 83% of merchandise exports.[17] Natural rubber and cocoa are the country’s major agricultural exports.[8]

In 2005, Nigeria posted a US$26 billion trade surplus, corresponding to almost 20% of gross domestic product. In 2005, Nigeria achieved a positive current account balance of US$9.6 billion. The Nigerian currency is the naira (NGN). As of June 2006, the exchange rate was about US$1=NGN128.4. As of June 2019, it stands at US$1 =NGN357. In recent years, Nigeria has expanded its trade relations with other developing countries such as India. Nigeria is the largest African crude oil supplier to India – it annually exports 400,000 barrels per day (64,000 m3/d) to India valued at US$10 billion annually.[97]

India is the largest purchaser of Nigeria's oil which fulfills 20% to 25% of India's domestic oil demand. Indian oil companies are also involved in oil drilling operations in Nigeria and have plans to set up refineries there.[98]

The trade volume between Nigeria and the United Kingdom rose by 35% from USD6.3 billion in 2010 to USD8.5 billion in 2011.[99]

External debt

In 2012, Nigeria's external debt was an estimated $5.9 billion and N5.6 trillion domestic - putting total debt at $44 billion.[100]

In April 2006, Nigeria became the first African country to fully pay off its debt owed to the Paris Club.[101] This was structured as a debt write off of approximately $18 billion and a cash payment of approximately $12 billion.

Foreign investment

In 2012, Nigeria received a net inflow of US$85.73 billion of foreign direct investment (FDI), much of which came from Nigerians in the diaspora. Most FDI is directed toward the energy and banking sectors. Any public designed to encourage inflow of foreign capital is capable of generating employment opportunities within the domestic economy. The Nigerian Enterprises Promotion (NEP) Decree of 1972 (revised in 1977) was intended to reduce foreign investment in the Nigerian economy.

The stock market capitalisation of listed companies in Nigeria was valued at $97.75 billion on 15 February 2008 by the Nigerian Stock Exchange.

Swiss Banks to return Abacha Funds

The Swiss foreign ministry says it has done all it can to ensure that funds stolen by the late Nigerian dictator Sani Abacha were used properly in his homeland. The authorities were responding to allegations that $200 million (SFr240 million) of $700 million handed back by the Swiss Banks to Nigeria had been misappropriated.[102]

Data

Household income or consumption by percentage share:

lowest 10%:

2.6%

highest 10%:

35.8% (1996–97)

Industries: crude oil, coal, tin, columbite, palm oil, peanuts, cotton, rubber, wood, hides and skins, textiles, cement and other construction materials, food products, footwear, chemicals, fertilizer, printing, ceramics, steel, small commercial ship construction and repair[103]

Industrial production growth rate: 4.7% (2010 est.)

Agriculture – products: cocoa, peanuts, palm oil, maize, rice, sorghum, millet, cassava (tapioca), yams, rubber; cattle, sheep, goats, pigs; timber; fish

Exchange rates: Naira (NGN) per US$1 – 358 (2019), 157.3 (2012) 149.5 (2009), 120 (2006), 128 (2005), 132.89 (2004), 129.22 (2003), 120.58 (2002), 111.23 (2001)[104]

References

- "2020 Appropriation Act - Budget Office of the Federation - Federal Republic of Nigeria".

- "World Economic Outlook Database, April 2019". IMF.org. International Monetary Fund. Retrieved 29 September 2019.

- "World Bank Country and Lending Groups". World Bank. Retrieved 29 September 2019.

- "Population, total". World Bank. Retrieved 23 August 2019.

- "World Economic Outlook Database, October 2019". IMF.org. International Monetary Fund. Retrieved 26 December 2019.

- "World Economic Outlook Database, April 2020". IMF.org. International Monetary Fund. Retrieved 17 April 2020.

- "World Economic Outlook Update, June 2020". IMF.org. International Monetary Fund. Retrieved 10 August 2020.

- "The World Factbook". CIA.gov. Central Intelligence Agency. Retrieved 8 February 2019.

- "NBS puts Nigeria's poverty rate at 40%". Businessamlive. 4 May 2020. Retrieved 8 June 2020.

- "Poverty and Inequality Index". National Bureau of Statistics. Retrieved 8 June 2020.

- "Human Development Index (HDI)". hdr.undp.org. HDRO (Human Development Report Office) United Nations Development Programme. Retrieved 11 December 2019.

- "Labour Force and Unemployment Report". National Bureau of Statistics. Third Quarter 2018.

- "Labour Force Statistics, 2010". Nigerian Bureau of Statistics. 2010. Archived from the original on 24 April 2015. Retrieved 22 June 2015.

- "Nigeria's unemployment rate rises to 23.1% – NBS". Premium Times. 19 December 2018. Retrieved 14 February 2019.

- "Nigerian Gross Domestic Product Report Q2 2015". National Bureau of Statistics. Archived from the original on 15 September 2015. Retrieved 22 September 2015.

- "Doing Business in Nigeria 2012". Doing Business,org. Retrieved 31 January 2017.

- "Nigeria facts and figures". opec.org. OPEC. Retrieved 30 March 2019.

- "Nigeria". The Observatory of Economic Complexity. Retrieved 30 March 2019.

- "Foreign Trade Statistics". National Bureau of Statistics. 2015. Archived from the original on 15 September 2015. Retrieved 22 September 2015.

- "DEBT - EXTERNAL". CIA.gov. Central Intelligence Agency. Retrieved 28 December 2018.

- "Nigeria's budget deficit now 1% after rebasing". News 24. 27 May 2014. Retrieved 22 June 2015.

- "Sovereigns rating list". Standard & Poor's. Retrieved 26 May 2011.

- Rogers, Simon; Sedghi, Ami (15 April 2011). "How Fitch, Moody's and S&P rate each country's credit rating". The Guardian. London. Retrieved 31 May 2011.

- "Nigeria Economy". nigeria-consulate-frankfurt.de. Retrieved 28 May 2020.

- "Nigeria | Data". data.worldbank.org. Retrieved 25 May 2020.

- "Manufacturing Sector Report, 2015: Manufacturing in Africa" (PDF). KPMG. 2015. Archived from the original (PDF) on 27 September 2016. Retrieved 18 November 2016.

- "UPDATE Nigeria Government Debt: % of GDP". Retrieved 9 September 2019.

- "Page 13 - one_africa18". sunmediaonline.com. Retrieved 25 May 2020.

- "Investing in Nigeria". Dibida.com.ng. Retrieved 25 May 2020.

- Inc, IBP (3 March 2008). Nigeria Investment and Trade Laws and Regulations Handbook Volume 1 Strategic Information and Basic Laws. Lulu.com. ISBN 978-1-4330-7643-5.

- "Low oil price and currency controls hit Nigeria hard". Financial Times. Retrieved 2 June 2017.

- "Nigeria at a glance | FAO in Nigeria | Food and Agriculture Organization of the United Nations". fao.org. Retrieved 25 May 2020.

- "Resolving Nigeria's Debt Through a Discounted Buyback". Center For Global Development. Retrieved 11 June 2015.

- "The Economic Development of Nigeria from 1914 to 2014". CASADE. 20 January 2015. Retrieved 25 May 2020.

- "FORGET THE BRICs: Citi's Willem Buiter Presents The 11 "3G" Countries That Will Win The Future". Business Insider. 22 February 2011. Retrieved 31 May 2011.

- "Africa's new Number One". The Economist. Retrieved 9 April 2017.

- Odiadi, Anthony N. (21 January 2008). "Paris Club and the Nigerian Debt". Rochester, NY. SSRN 1082592. Cite journal requires

|journal=(help) - Adenikinju, Adeola (1 January 2003). "Efficiency of the Energy Sector and its Impact on the Competitiveness of the Nigerian Economy". Cite journal requires

|journal=(help) - "Nigerian Debt Relief". Center For Global Development. Retrieved 6 February 2020.

- "2014 Human Development Report". UNDP. Retrieved 25 May 2020.

- "Nigeria's Economic Reforms: Progress and Challenges". ResearchGate. Retrieved 25 May 2020.

- "BirdLife Data Zone". datazone.birdlife.org. Retrieved 25 May 2020.

- Library of Congress (2008). "Country profile:Nigeria" Check

|url=value (help). Library of Congress- Federal Research Division – via Library of Congress. - › pdc › NGA Final Programme Document - UNDP "UNDP; Government of the federal Republic of Nigeria project support document.(Niger Delta local development program)" Check

|url=value (help). 2007–2010. Retrieved 25 May 2020.CS1 maint: date format (link) - Okong, Christopher N., Ph; Essien, Ettah B., Ph; Onye, Kenneth U. (December 2013). The Economics of Youth Restiveness in the Niger Delta. Houston: Strategic Book Publishing. p. 1. ISBN 978-1-62516-540-4.CS1 maint: date and year (link)

- "Why innovation must be the new development strategy". Christensen Institute. 19 January 2017. Retrieved 22 January 2020.

- ""Nigeria's challenge – universal primary education" | YourCommonwealth". yourcommonwealth.org. Retrieved 22 January 2020.

- "EXCIF | Nigeria". Retrieved 25 May 2020.

- "Report corruption in Nigeria". Transparency.org. Retrieved 25 May 2020.

- editor (29 September 2019). "Finding Lasting Solution to Nigeria's Power Problem". THISDAYLIVE. Retrieved 25 May 2020.CS1 maint: extra text: authors list (link)

- The Economist, March 28th 2020, page 4.

- estimated

- "GDP per capita (current US$) - Nigeria | Data". data.worldbank.org. Retrieved 25 May 2020.

- "Your daily Naira exchange rate". abokifx.com. Retrieved 23 August 2017.

- "Daily Parallel Market Exchange Rate". nairametrics.com. Retrieved 23 August 2017.

- "XE: Convert USD/NGN. United States Dollar to Nigeria Naira". xe.com. Retrieved 2 June 2017.

- "Nigeria GDP 1960-2020". macrotrends.net. Retrieved 25 May 2020.

- "factfish Gross domestic product per capita, constant 2005 US $ for Nigeria". factfish.com. Retrieved 10 April 2018.

- "News 2012". Nigerian National Bureau of Statistics. Retrieved 26 March 2012.

- Bodedandyin #africa • 2 Years Ago (12 January 2018). "Africa Economy and Crypto-Currency; How Crypto-Currency Can Help To Boost Africa Economy". Steemit. Retrieved 30 May 2020.

- "Nigeria's 2012 t0 2014 Revenue and expenditure framwork". Nigeria Business News |Nigeria Financial News | Nigeria Economy News | Business News in Nigeria | Nigeria Stock Market News. 2 October 2012. Retrieved 25 May 2020.

- Olomola Ade S. (2007) "Strategies for Managing the Opportunities and Challenges of the Current Agricultural Commodity Booms in SSA" in Seminar Papers on Managing Commodity Booms in Sub-Saharan Africa: A Publication of the AERC Senior Policy Seminar IX. African Economic Research Consortium (AERC), Nairobi, Kenya

- "Nigeria to Increase Beef Consumption to 1.3 Million Tonnes By 2050 - Adesina". 16 May 2014. Retrieved 9 April 2017 – via AllAfrica.

- "Reviving the Cocoa Industry in Nigeria". Reviving the Cocoa Industry in Nigeria. Retrieved 25 May 2020.

- "Nigeria: ECONOMY". data.mongabay.com. Retrieved 24 May 2020.

- Iloani, Francis Arinze (15 August 2019). "Nigeria spent N40trn on food imports in 21yrs – Data". Daily Trust. Retrieved 25 May 2020.

- "Qua Iboe, Brass crude up by $5, trades at $21 per barrel". TheCable Petrobarometer. 23 April 2020. Retrieved 25 May 2020.

- Hinsch, Robin (18 October 2019). "Wahala: trouble in the Niger delta – photo essay". The Guardian. ISSN 0261-3077. Retrieved 25 May 2020.

- "International - U.S. Energy Information Administration (EIA)". eia.gov. Retrieved 25 May 2020.

- exports2nigeria.com http://www.exports2nigeria.com/faq. Retrieved 25 May 2020. Missing or empty

|title=(help) - "'Nigeria First' as new foreign policy thrust in a changing world". Businessday NG. 2 February 2020. Retrieved 25 May 2020.

- "Can you spare a dollar?". The Economist. ISSN 0013-0613. Retrieved 20 March 2016.

- Sotubo, 'Jola. "Buhari: Why President should devalue naira – Chuba Ezekwesili [VIDEO]". pulse.ng. Retrieved 20 March 2016.

- "Bloomberg - Are you a robot?". bloomberg.com. Retrieved 25 May 2020.

- "Nigeria's aviation sector in dire need of sustainable policies". Businessamlive. 23 July 2019. Retrieved 25 May 2020.

- Archibong, Maurice (18 March 2004). "Nigeria: Gold mine waiting to be tapped". The Sun Online. The Sun Publishing Ltd. Archived from the original on 26 April 2007. Retrieved 21 June 2007.

- "Nigeria". Wttc.org. World Travel and Tourism Council. Archived from the original on 7 February 2012. Retrieved 21 June 2007.

- "Nigeria starts taking tourism sector seriously". afrol.com. afrol News. Retrieved 21 June 2007.

- "Investment and Mining Opportunities" (PDF). Ministry of Solid Minerals Development. Retrieved 12 April 2008.

- "Nigeria: Overview". U.S. Energy Information Administration. Retrieved 8 April 2014.

- 2011 report on oil and gas companies, Promoting revenue Transparency Transparency International 2011 page reserves 114–115

- "Remittances from diaspora Nigerians as lubricant for the economy", Nigerian Tribune, 8 September 2014. Archived 17 March 2015 at the Wayback Machine

- Cuevas-Mohr, Hugo. "Nigerian Diaspora and Remittances: Transparency and Market Development - IMTC". Retrieved 25 May 2020.

- Onuba, Ifeanyi (15 May 2015). "Only 4.67 million Nigerians are unemployed —NBS". The Punch Newspaper. Archived from the original on 26 May 2015. Retrieved 17 May 2015.

- "The struggle for a minimum wage in Nigeria". africasacountry.com. Retrieved 25 May 2020.

- "Nigeria | OIM". iomdakar.org. Retrieved 25 May 2020.

- The Economist, March 28th 2020, page 5.

- "Archived copy". Archived from the original on 19 January 2013. Retrieved 23 January 2013.CS1 maint: archived copy as title (link)

- Elliott, Larry (21 January 2019). "World's 26 richest people own as much as poorest 50%, says Oxfam". The Guardian. ISSN 0261-3077. Retrieved 3 February 2020.

- "World Poverty Clock". worldpoverty.io. Retrieved 22 January 2020.

- "Human capital development as key to solving Nigeria's economic challenges". Businessday NG. 22 January 2020. Retrieved 25 May 2020.

- "Economy & Market: Impact of privatisation on Nigeria's economy". Businessday NG. 27 April 2020. Retrieved 26 May 2020.

- "Nigeria implements ECOWAS common external tariff - Africa - Angola Press - ANGOP". angop.ao. Retrieved 26 May 2020.

- "Debt Relief Development: 2005 Debt Relief Agreement Nigeria". ECDPM. Retrieved 26 May 2020.

- Overland, Indra; Bazilian, Morgan; Ilimbek Uulu, Talgat; Vakulchuk, Roman; Westphal, Kirsten (2019). "The GeGaLo index: Geopolitical gains and losses after energy transition". Energy Strategy Reviews. 26: 100406. doi:10.1016/j.esr.2019.100406.

- "OEC - Nigeria (NGA) Exports, Imports, and Trade Partners". oec.world. Retrieved 26 May 2020.

- "India largest importer of Nigeria's crude oil in 2017 – NNPC". 23 May 2018. Retrieved 26 May 2020.

- "India now Nigeria's biggest crude oil buyer". The Hindu. Chennai, India. 15 July 2013.

- Nigeria, UK Trade Hits U.S.$9 Billion in 2011, Africa: AllAfrica.com, 2012, retrieved 27 September 2012

- "Nigeria's Domestic, External Debts Now $44bn, Articles - THISDAY LIVE". Archived from the original on 13 June 2015. Retrieved 11 June 2015.

- "Nigeria settles Paris Club debt". 21 April 2006. Retrieved 26 May 2020.

- swissinfo.ch, S. W. I.; Corporation, a branch of the Swiss Broadcasting. "Swiss respond to Abacha funds allegation". SWI swissinfo.ch. Retrieved 26 May 2020.

- "Industry Sectors". nse.com.ng. Retrieved 26 May 2020.

- "Nigeria Foreign Exchange Rates". ceicdata.com. Retrieved 26 May 2020.

Sources

- Nigerian Federal government Recruitment careerwatch.ng 23 February 2020

Further reading

External links

- World Bank Summary Trade Statistics Nigeria

- Nigeria latest trade data on ITC Trade Map

- Tariffs applied by Nigeria as provided by ITC's Market Access Map, an online database of customs tariffs and market requirements