1980s oil glut

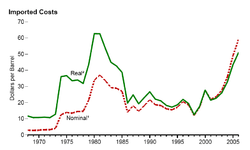

The 1980s oil glut was a serious surplus of crude oil caused by falling demand following the 1970s energy crisis. The world price of oil had peaked in 1980 at over US$35 per barrel (equivalent to $109 per barrel in 2019 dollars, when adjusted for inflation); it fell in 1986 from $27 to below $10 ($63 to $23 in 2019 dollars).[2][3] The glut began in the early 1980s as a result of slowed economic activity in industrial countries due to the crises of the 1970s, especially in 1973 and 1979, and the energy conservation spurred by high fuel prices.[4] The inflation-adjusted real 2004 dollar value of oil fell from an average of $78.2 in 1981 to an average of $26.8 per barrel in 1986.[5]

In June 1981, The New York Times proclaimed that an "oil glut" had arrived[6] and Time Magazine stated that "the world temporarily floats in a glut of oil".[7] However, The New York Times warned the next week that the word "glut" was misleading, and that temporary surpluses had brought down prices somewhat, but prices were still well above pre-energy crisis levels.[8] This sentiment was echoed in November 1981, when the CEO of Exxon Corp also characterized the glut as a temporary surplus, and that the word "glut" was an example of "our American penchant for exaggerated language". He wrote that the main cause of the glut was declining consumption. In the United States, Europe, and Japan, oil consumption had fallen 13% from 1979 to 1981, "in part, in reaction to the very large increases in oil prices by the Organization of Petroleum Exporting Countries and other oil exporters", continuing a trend begun during the 1973 price increases.[9]

After 1980, reduced demand and increased production produced a glut on the world market. The result was a six-year decline in the price of oil, which reduced the price by half in 1986 alone.[2]

Production

Non-OPEC

During the 1980s, reliance on Middle East production dwindled as commercial exploration developed major non-OPEC oilfields in Siberia, Alaska, the North Sea, and the Gulf of Mexico,[11] and the Soviet Union became the world's largest producer of oil.[12] Smaller non-OPEC producers including Brazil, Egypt, India, Malaysia, and Oman doubled their output between 1979 and 1985, to a total of 3 million barrels per day.[13]

USA

In April 1979, then-president Jimmy Carter signed an executive order which was to remove price controls from petroleum products by October 1981, so that prices would be wholly determined by the free market. Carter's successor, Ronald Reagan signed an executive order on 28 January 1981, which enacted this reform immediately,[14] allowing the free market to adjust oil prices in the US.[15] This ended the withdrawal of old oil from the market and artificial scarcity, encouraging increased oil production. The US Oil Windfall profits tax was lowered in August 1981 and removed in 1988, ending disincentives to US oil producers. Additionally, the Trans-Alaska Pipeline System began pumping oil in 1977. The Alaskan Prudhoe Bay Oil Field entered peak production, supplying 2 million bpd of crude oil in 1988, 25 percent of all U.S. oil production.[16]

North Sea

Phillips Petroleum discovered oil in the Chalk Group at Ekofisk, in Norwegian waters in the central North Sea.[17] Discoveries increased exponentially in the 1970s and 1980s, and new fields were developed throughout the continental shelf.[18]

OPEC

From 1980 to 1986, OPEC decreased oil production several times and nearly in half, in an attempt to maintain oil's high prices. However, it failed to hold on to its preeminent position, and by 1981, its production was surpassed by non-OPEC countries. OPEC had seen its share of the world market drop to less than a third in 1985, from about half during the 1970s.[2] In February 1982, the Boston Globe reported that OPEC's production, which had previously peaked in 1977, was at its lowest level since 1969. Non-OPEC nations were at that time supplying most of the West's imports.[19]

OPEC's membership began to have divided opinions over what actions to take. In September 1985, Saudi Arabia became fed up with de facto propping up prices by lowering its own production in the face of high output from elsewhere in OPEC.[20] In 1985, daily output was around 3.5 million bpd, down from around 10 million in 1981.[20] During this period, OPEC members were supposed to meet production quotas in order to maintain price stability; however, many countries inflated their reserves to achieve higher quotas, cheated, or outright refused to accord with the quotas.[20] In 1985, the Saudis tired of this behavior and decided to punish the undisciplined OPEC countries.[20] The Saudis abandoned their role as swing producer and began producing at full capacity, creating a "huge surplus that angered many of their colleagues in OPEC".[21] High-cost oil production facilities became less or even not profitable. Oil prices as a result fell to as low as $7 per barrel.[20]

Reduced demand

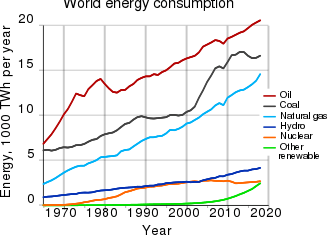

OPEC had relied on the price inelasticity of demand of oil to maintain high consumption, but underestimated the extent to which other sources of supply would become profitable as prices increased. Electricity generation from coal, nuclear power and natural gas;[22] home heating from natural gas; and ethanol blended gasoline all reduced the demand for oil.

USA

New passenger car fuel economy in the US rose from 17 miles per US gallon (14 L/100 km) in 1978 to more than 22 miles per US gallon (11 L/100 km) in 1982, an increase of more than 30 percent.[23]

The United States imported 28 percent of its oil in 1982 and 1983, down from 46.5 percent in 1977, due to lower consumption.[2]

Brazil

Impact

The 1986 oil price collapse benefited oil-consuming countries such as the United States, Japan, Europe, and developing nations, but represented a serious loss in revenue for oil-producing countries in northern Europe, the Soviet Union, and OPEC.

In 1981, before the brunt of the glut, Time Magazine wrote that in general, "A glut of crude causes tighter development budgets" in some oil-exporting nations.[7] Mexico had an economic and debt crisis in 1982.[26] The Venezuelan economy contracted and inflation levels (consumer price inflation) rose, remaining between 6 and 12% from 1982 to 1986.[27][28] Even Saudi Arabian economic power was significantly weakened.

Iraq had fought a long and costly war against Iran, and had particularly weak revenues. It was upset by Kuwait contributing to the glut [29] and allegedly pumping oil from the Rumaila field below their common border.[30] Iraq invaded Kuwait in 1990, planning to increase reserves and revenues and cancel the debt, resulting in the first Gulf War.[30]

The Soviet Union had become a major oil producer before the glut. The drop of oil prices contributed to the nation's final collapse.[31][32]

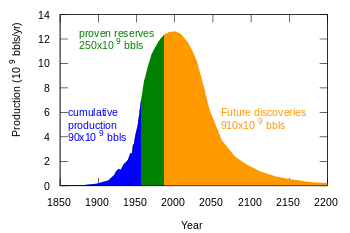

In the U.S., domestic exploration and the number of active drilling rigs were cut dramatically. In late 1985, there were nearly 2,300 rigs drilling wells in the USA; a year later, there were barely 1,000.[33] The number of petroleum producers in United States decreased from 11,370 in 1985 to 5,231 in 1989, according to data from the Independent Petroleum Association of America.[34] Oil producers held back on the search for new oilfields for fear of losing on their investments.[35] In May 2007, companies like ExxonMobil were not making nearly the investment in finding new oil that they did in 1981.[36]

Canada responded to high energy prices in the 1970s with the National Energy Program (NEP) in 1980. This program was in place until 1985.

See also

- 1980–89 world oil market chronology

- 2010s oil glut

- 2020 Russia–Saudi Arabia oil price war

References

- Annual Energy Review 2006, Energy Information Administration

- Hershey Jr., Robert D. (30 December 1989). "Worrying Anew Over Oil Imports". The New York Times. Retrieved 30 December 2015.

- Mouawad, Jad (8 March 2008). "Oil Prices Pass Record Set in '80s, but Then Recede". New York Times. Retrieved 20 April 2010.

- "Oil Glut, Price Cuts: How Long Will They Last?". U.S. News & World Report. 89 (7). 18 August 1980. p. 44.

- Oak Ridge National Lab data

- Hershey Jr., Robert D. (21 June 1981). "How the Oil Glut Is Changing Business". The New York Times. Retrieved 30 December 2015.

- Byron, Christopher (22 June 1981). "Problems for Oil Producers". Time. Retrieved 19 January 2008.

- Yergin, Daniel (28 June 1981). "The Energy Outlook; Lulled to Sleep by the Oil Glut Mirage". The New York Times.

- Garvin, C. C., Jr. (9 November 1981). "The Oil Glut in Perspective". Oil & Gas Journal. Annual API Issue: 151.

- EIA – International Energy Data and Analysis

- Bromley, Simon (2013). American Power and the Prospects for International Order. John Wiley & Sons. p. 95. ISBN 9780745658414.

- "World: Saudis Edge U.S. on Oil". Washington Post, 3 January 1980, p. D2.

- Gately, Dermot (1986). "Lessons from the 1986 Oil Price Collapsey" (PDF). Brookings Papers on Economic Activity (2): 239. Archived from the original (PDF) on 9 May 2016. Retrieved 19 January 2016.

- "Executive Order 12287 – Decontrol of Crude Oil and Refined Petroleum Products". 28 January 1981. Retrieved 27 January 2019.

- Weiner, Edward (1999). Urban Transportation Planning in the United States An Historical Overview. Greenwood Publishing Group. p. 112. ISBN 978-0-275-96329-3. Retrieved 7 June 2010.

By September 30, 1981, petroleum prices were to be determined by the free market. This process was accelerated by President Reagan through an Executive Order

- National Energy Technology Laboratory. "Fossil Energy – Alaska Oil History", Arctic Energy Office. Accessed 29 July 2009."Archived copy". Archived from the original on 25 April 2009. Retrieved 29 July 2009.CS1 maint: archived copy as title (link) CS1 maint: BOT: original-url status unknown (link)

- Ferrier, RW; Bamberg, JH (1982). The History of the British Petroleum Company. Cambridge University Press. pp. 201–3. ISBN 978-0-521-78515-0.

- Swartz, Kenneth I. (16 April 2015). "Setting the Standard". Vertical Magazine. Archived from the original on 18 April 2015. Retrieved 18 April 2015.

- Warsh, David (28 February 1982). "The economy: the Oil Glut deepens; OPEC's grip loosens; but a boom or a bomb could spur prices back up". Boston Globe.

- Yergin, Daniel (1991). The Prize: The Epic Quest for Oil, Money, and Power. Simon & Schuster. ISBN 0-671-50248-4.

- Koepp, Stephen (14 April 1986). "Cheap Oil!". Time. Retrieved 19 January 2008.

- Toth, Ferenc L.; Rogner, Hans-Holger (January 2006). "Oil and nuclear power: Past, present, and future" (PDF). Energy Economics. 28 (1): 3. Archived (PDF) from the original on 3 December 2007. Retrieved 4 January 2008.

- Portney, Paul R.; Parry, Ian W.H.; Gruenspecht, Howard K.; Harrington, Winston (November 2003). "The Economics of Fuel Economy Standards". Resources for the Future. Archived from the original on 1 December 2007. Retrieved 4 January 2008.

- "OPEC Revenues Fact Sheet". US Energy Information Administration. 10 January 2006. Archived from the original on 7 January 2008.

- "OPEC Revenues Fact Sheet". U.S. Energy Information Administration. 14 June 2016. Retrieved 25 August 2016.

- Ruiz, Ramón Eduardo (2010). Mexico: Why a Few are Rich and the People Poor. Berkeley, Los Angeles, London: University of California Press. p. 165. ISBN 978-0-520-26235-5.

- Heritage, Andrew (December 2002). Financial Times World Desk Reference. Dorling Kindersley. pp. 618–621. ISBN 9780789488053.

- "Venezuela Inflation rate (consumer prices)". Indexmundi. 2010. Retrieved 16 August 2010.

- Thornton, Ted (12 January 2007). "The Gulf Wars: Iraq Occupies Kuwait". Northfield Mount Hermon School. Archived from the original on 17 December 2007. Retrieved 14 January 2008.

- Rousseau, David L. (1998). "History of OPEC" (PDF). University of Pennsylvania. Archived from the original (PDF) on 27 February 2008. Retrieved 12 January 2008.

- Gaidar, Yegor (April 2007). "The Soviet Collapse: Grain and Oil" (PDF). American Enterprise Institute.

Oil production in Saudi Arabia increased fourfold, while oil prices collapsed by approximately the same amount in real terms. As a result, the Soviet Union lost approximately $20 billion per year, money without which the country simply could not survive.

- McMaken, Ryan (7 November 2014). "The Economics Behind the Fall of the Berlin Wall". Mises Institute.

High oil prices in the 1970s propped up the regime so well, that had it not been for Soviet oil sales, it's quite possible the regime would have collapsed a decade earlier.

- Gold, Russell (13 January 2015). "Back to the Future? Oil Replays 1980s Bust". Wall Street Journal. Retrieved 16 January 2016.

- Penty, Rebecca; Shauk, Zain (21 January 2015). "Crude Collapse Has Investors Braced for '80s-Like Oil Casualties". Bloomberg. Retrieved 16 January 2016.

- "Oil, Oil Everywhere". Forbes. 24 July 2006. Archived from the original on 8 January 2008. Retrieved 6 January 2008.

- Fox, Justin (31 May 2007). "No More Gushers for ExxonMobil". Time. Archived from the original on 13 January 2008. Retrieved 8 January 2008.

Further reading

- World Hydrocarbon Markets: Current Status, Projected Prospects, and Future Trends, (1983), By Miguel S. Wionczek, ISBN 0-08-029962-8

- The Oil Market in the 1980s: A Decade of Decline, (1992), by Siamack Shojai, Bernard S. Katz, Praeger/Greenwood, ISBN 0-275-93380-6