Banknotes of the pound sterling

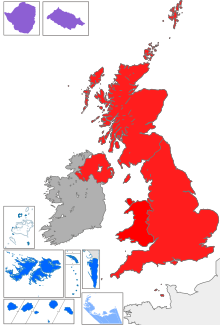

Sterling banknotes are the banknotes in circulation in the United Kingdom and its related territories, denominated in pounds sterling (symbol: £; ISO 4217 currency code GBP [Great Britain pound]).

| |||||||||||||

| ISO 4217 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Code | GBP (Great Britain pound) | ||||||||||||

| Denominations | |||||||||||||

| |||||||||||||

| Issuance | |||||||||||||

| Central Bank | Bank of England | ||||||||||||

| |||||||||||||

| Printer | De La Rue | ||||||||||||

| Demographics | |||||||||||||

| United Kingdom, Jersey, Guernsey Isle of Man | |||||||||||||

| British Antarctic Territory, South Georgia and the South Sandwich Islands St Helena, Ascension and Tristan da Cunha (Tristan da Cunha only) Gibraltar. | |||||||||||||

Sterling banknotes are official currency in the United Kingdom, Jersey, Guernsey, the Isle of Man, British Antarctic Territory, South Georgia and the South Sandwich Islands, and Tristan da Cunha in St Helena, Ascension and Tristan da Cunha. One pound is equivalent to 100 pence. Three British Overseas Territories also have currencies called pounds which are at par with the pound sterling.

The Bank of England has a monopoly of banknote issuance in England and Wales but, for historic reasons, three banks in Scotland and four banks in Northern Ireland are permitted to issue their own currency – but the law requires that the issuing banks hold a sum of Bank of England banknotes (or gold) equivalent to the total value of notes issued.[3] Versions of the pound sterling issued by Crown dependencies and other areas are regulated only by local governments and not the Bank of England.

History

Until the middle of the 19th century, privately owned banks in Great Britain and Ireland were free to issue their own banknotes. Paper currency issued by a wide range of provincial and town banking companies in England,[4][5][6] Wales,[7] Scotland[8] and Ireland[9] circulated freely as a means of payment.

As gold shortages affected the supply of money, note-issuing powers of the banks were gradually restricted by various Acts of Parliament,[10] until the Bank Charter Act 1844 gave exclusive note-issuing powers to the central Bank of England. Under the Act, no new banks could start issuing notes; and note-issuing banks gradually vanished through mergers and closures. The last private English banknotes were issued in 1921 by Fox, Fowler and Company, a Somerset bank.[10]

However, some of the monopoly provisions of the Bank Charter Act only applied to England and Wales.[11] The Bank Notes (Scotland) Act was passed the following year, and to this day, three retail banks retain the right to issue their own sterling banknotes in Scotland, and four in Northern Ireland.[12][13] Notes issued in excess of the value of notes outstanding in 1844 (1845 in Scotland) must be backed up by an equivalent value of Bank of England notes.[14]

Following the partition of Ireland, the Irish Free State created an Irish pound in 1928; the new currency was pegged to sterling until 1979. The issue of banknotes for the Irish pound fell under the authority of the Currency Commission of the Republic of Ireland, which set about replacing the private banknotes with a single Consolidated Banknote Issue in 1928.[15] In 1928 a Westminster Act of Parliament reduced the fiduciary limit for Irish banknotes circulating in Northern Ireland to take account of the reduced size of the territory concerned.

Elizabeth II was not the first British monarch to have her face on UK banknotes. George II, George III and George IV appeared on early Royal Bank of Scotland notes and George V appeared on 10 shilling and 1 pound notes issued by the British Treasury between 1914 and 1928. However, prior to the issue of its Series C banknotes in 1960, Bank of England banknotes generally did not depict the monarch. Today, notes issued by Scottish and Northern Irish banks do not depict the monarch.

The monarch is depicted on banknotes issued by the Crown dependencies and on some of those issued by overseas territories.

| Year | Event | Extent | Impact |

|---|---|---|---|

| 1694 | Bank of England Act 1694 | England & Wales | Incorporation of the Bank of England[10] |

| 1695 | An Act creating the Governor and Company of the Bank of Scotland | Scotland | Creation of the Bank of Scotland, principally as a trading bank[16] |

| 1696 | First banknotes issued by the Bank of Scotland | Scotland | The first notes in pounds sterling issued[17] |

| 1707 | Acts of Union 1707 |

England & Wales |

English and Scottish parliaments merged into the Parliament of Great Britain |

|

1708 1709 |

Bank of England Act 1708 Bank of England Act 1709 |

England & Wales | Prohibition of companies or partnerships of more than six people to set up banks and issue notes, preventing smaller banks from printing their own money[10] |

| 1727 | Chartering of the Royal Bank of Scotland | Scotland | Broke the monopoly of the Bank of Scotland, initiated the banking war when the Royal Bank attempted to drive the Bank of Scotland out of business by stockpiling and then presenting its notes for payment. |

| 1765 | Bank Notes (Scotland) Act 1765 | Scotland | Prohibited deferred conversion of notes into coin and the issue of notes for values under £1 by banks in Scotland.[18] |

| 1800 | Act of Union 1800 | Great Britain & Ireland | British and Irish parliaments merged into the Parliament of Great Britain and Ireland |

| 1826 | Country Bankers Act 1826 | England & Wales | Allowed joint stock banks with more than six partners which were at least 65 miles away from London to print their own money. Bank of England allowed to open branches in major English provincial cities, enabling wider distribution of its notes.[10] |

| 1826 |

Bank Notes Act 1826; |

Great Britain | Prohibition of circulation of notes under £5 in England. Attempts to apply this law in Scotland fail after a protest by Sir Walter Scott, and the Scottish £1 note is saved.[12] |

| 1833 | Bank Notes Act 1833 | England & Wales | Gave Bank of England notes official status as "legal tender" for all sums above £5 in England and Wales to guarantee public confidence in the notes even in the event of a gold shortage.[10] |

| 1844 | Bank Charter Act 1844 | UK | Took away the note-issuing rights of any new banks; existing note-issuing banks barred from expanding their issue. Began process of giving Bank of England monopoly over banknote issue in England and Wales.[10] |

| 1845 | Bank Notes (Scotland) Act 1845 | Scotland | Regulated issue of notes in Scotland; most Scottish banknotes had to be backed up by Bank of England money[12] |

| 1908 | Bank closure | Wales | The last private note issuer in Wales, the North and South Wales Bank, loses its note-issuing rights under the 1844 Act after it is acquired by Midland Bank. |

| 1914 | Currency and Bank Notes Act 1914 | UK | HM Treasury given temporary wartime powers to issue banknotes to the values of £1 and 10/- (ten shillings) in the UK (ended 1928) |

| 1921 | Bank closure | England | The last private note issuer in England, Fox, Fowler and Company of Somerset, loses its note-issuing rights under the 1844 Act after it is acquired by Lloyds Bank.[10] |

| 1928 | Irish pound established | Ireland | Following Partition of Ireland, Irish pound is established as a separate currency (but at parity with sterling until 1979); Northern Ireland remains within sterling |

| 1954 | Currency and Bank Notes Act 1954 | UK | Extended the Bank Notes Act 1833 to make Bank of England notes under £5 in value legal tender; act also applied to Scotland, making English 10/- and £1 legal tender for the first time. Bank of England withdrew low-denomination notes in 1969 and 1988, removing legal tender from Scotland. |

| 2008 | Banking Act 2009 | UK | As a consequence of the Financial Crisis of 2007–12, this Bill altered the rules governing the issue of private banknotes in Scotland and Northern Ireland, and requires commercial issuing banks to hold backing assets to protect the value of their notes in the event of commercial failure of the bank. |

Everyday use and acceptance

The wide variety of sterling notes in circulation means that acceptance of different pound sterling banknotes varies. Their acceptance may depend on the experience and understanding of individual retailers, and it is important to understand the idea of "legal tender", which is often misunderstood (see section below). The assumption that all sterling notes are legitimate and of equal value, and are accepted by merchants anywhere, has become a tourism headache in some parts of the UK. In summary, the various banknotes are used as follows:

- Bank of England banknotes

- Most sterling notes are issued by the Bank of England. These are legal tender in England and Wales, and are always accepted by traders throughout the UK.[19] Bank of England notes are generally accepted in the Overseas Territories which are at parity with sterling. In Gibraltar, there are examples of pairs of automatic cash dispensers placed together, one stocked with Bank of England notes, and the other with local ones.

- Scottish banknotes

- These are the recognised currency in Scotland, although they are not legal tender. They are always accepted by traders in Scotland, and are usually accepted in other parts of the United Kingdom. However, some outside Scotland are unfamiliar with the notes and they are sometimes refused.[20][21] Institutions such as clearing banks, building societies and the Post Office will readily accept Scottish bank notes. Branches of the Scottish note-issuing banks situated in England dispense Bank of England notes and are not permitted to dispense their own notes from those branches.[22] Modern Scottish banknotes are denominated in pounds sterling, and have exactly the same value as Bank of England notes; they should not be confused with the former Pound Scots, a separate currency which was abolished in 1707.

- Northern Irish banknotes

- Banknotes issued by Northern Irish banks have the same legal status as Scottish banknotes in that they are promissory notes issued in pounds sterling and may be used for cash transactions anywhere in the United Kingdom. However, they are rarely seen outside of Northern Ireland. In England and Wales, although they might be accepted by any shop, they are often not accepted without explanation.[23] Like Scottish notes, clearing banks and building societies will accept them. Northern Irish pound sterling banknotes should not be confused with the Irish pound (or Punt), the former currency of the Republic of Ireland, which was replaced by the euro in 2002.

- Banknotes of the Crown dependencies

- The Bailiwicks of Jersey and Guernsey, and the Isle of Man, are possessions of the Crown but are outside the UK; they are in currency union with the United Kingdom and issue pound sterling banknotes in local designs (Jersey and Guernsey pounds are freely interchangeable within the Channel Islands). In the United Kingdom, they are intermittently accepted by merchants. However, they are accepted by banks and post offices and the holder can exchange these notes for other sterling banknotes. They also issue their own coinage.

- British Overseas Territories

- There are fourteen British Overseas Territories, many of which issue their own currencies which are distinct under ISO 4217: Gibraltar, the Falkland Islands, and St Helena, Ascension Island and Tristan da Cunha have their own pounds which are at par with Sterling. These notes cannot be used in the UK or outside the territories of origin. Falkland Island pounds are also valid in South Georgia and the South Sandwich Islands and the British Antarctic Territory. Saint Helena pounds, however, cannot be used in the constituent territory of Tristan da Cunha, where the UK Pound Sterling is the only official currency.

Question of legal tender

Legal tender is a narrow technical concept for the settlement of debt, and it has little practical meaning for many everyday transactions such as buying goods in shops. But it does apply, for example, to the settlement of a restaurant bill, where the food has been eaten prior to demand for payment and so a debt exists. Essentially, any two parties can agree to any item of value as a medium for exchange when making a purchase (in that sense, all money is ultimately an extended form of barter). If a debt exists that is legally enforceable and the debtor party offers to pay with some item that is not "legal tender", the creditor may refuse such payment and declare that the debtor is in default of payment; if the debtor offers payment in legal tender, the creditor is required to accept it or else the creditor is in breach of contract. Thus, if in England party A owes party B 1,000 pounds sterling and offers to pay in Northern Irish banknotes, party B may refuse and sue party A for non-payment; if party A provides Bank of England notes, party B must acknowledge the debt as legally paid even if party B would prefer some other form of payment.

Banknotes do not have to be classed as legal tender to be acceptable for trade; millions of retail transactions are carried out each day in the UK using debit cards and credit cards, none of which is a payment using legal tender. Equally, traders may offer to accept payment in foreign currency, such as Euro, Yen or US Dollars. Acceptability as a means of payment is essentially a matter for agreement between the parties involved.[19][24]

Millions of pounds' worth of sterling banknotes in circulation are not legal tender, but that does not mean that they are illegal or of lesser value; their status is of "legal currency" (that is to say that their issue is approved by the parliament of the UK) and they are backed up by Bank of England securities.[25]

Bank of England notes are the only banknotes that are legal tender in England and Wales. Scottish and Northern Irish banknotes are not legal tender anywhere, and Jersey, Guernsey and Manx banknotes are only legal tender in their respective jurisdictions. Although these banknotes are not legal tender in the UK, this does not mean that they are illegal under English law, and creditors and traders may accept them if they so choose. Traders may, on the other hand, choose not to accept banknotes as payment, as contract law across the United Kingdom allows parties not to engage in a transaction at the point of payment if they choose not to.[20]

In Scotland and Northern Ireland, no banknotes, not even those issued in those countries, are legal tender.[12] They have a similar legal standing to cheques or debit cards, in that their acceptability as a means of payment is essentially a matter for agreement between the parties involved, although Scots law requires any reasonable offer for settlement of a debt to be accepted.

Until 31 December 1984, the Bank of England issued one pound notes, and these notes did have legal tender status in Scotland and Northern Ireland while they existed. The Currency and Bank Notes Act 1954 defined Bank of England notes of less than £5 in value as legal tender in Scotland.[26] Since the English £1 note was removed from circulation in 1988, this leaves a legal curiosity in Scots law whereby there is no paper legal tender in Scotland. The UK Treasury has proposed extending legal tender status to Scottish banknotes. The proposal has been opposed by Scottish nationalists who claim it would reduce the independence of the Scottish banking sector.[27]

Most of the notes issued by the note-issuing banks in Scotland and Northern Ireland have to be backed by Bank of England notes held by the issuing bank. The combined size of these banknote issues is well over a billion pounds. To make it possible for the note-issuing banks to hold equivalent values in Bank of England notes, the Bank of England issues special notes with denominations of one million pounds ("Giants") and one hundred million pounds ("Titans") for internal use by the other banks.

Bank notes are no longer redeemable in gold, and the Bank of England will only redeem sterling banknotes for more sterling banknotes or coins. The contemporary sterling is a fiat currency which is backed only by securities; in essence IOUs from the Treasury that represent future income from the taxation of the population. Some economists term this "currency by trust", as sterling relies on the faith of the user rather than any physical specie.

Issuing banks and authorities

The following table lays out the various banks or authorities which are authorised to print pound sterling banknotes, organised by territory:

| United Kingdom | ||

|---|---|---|

| England and Wales | Scotland | Northern Ireland |

| ||

| Crown dependencies | ||

| The Isle of Man | Bailiwick of Jersey | Bailiwick of Guernsey |

|

||

| British overseas territories | ||

| Gibraltar | Saint Helena | Falkland Islands |

| ||

| = notes issued by a government or treasury | |

| = notes issued by a central bank | |

| = notes issued by a retail bank |

England and Wales

Bank of England notes

In 1921, the Bank of England gained a legal monopoly on the issue of banknotes in England and Wales, a process that started with the Bank Charter Act of 1844 when the rights of other banks to issue notes was restricted.

The bank issued its first banknotes in 1694, although before 1745 they were written for irregular amounts, rather than predefined multiples of a pound. It tended to be times of war, which put inflationary pressure on the British economy, that led to greater note issue. In 1759, during the Seven Years' War, when the lowest-value note issued by the Bank was £20, a £10 note was issued for the first time. In 1793, during the war with revolutionary France, the Bank issued the first £5 note. Four years later, £1 and £2 notes appeared, although not on a permanent basis. Notes did not become entirely machine-printed and payable to the bearer until 1855.

At the start of the First World War, the government issued £1 and 10-shilling Treasury notes to supplant the sovereign and half-sovereign gold coins. The first coloured banknotes were issued in 1928, and were also the first notes to be printed on both sides. The Second World War saw a reversal in the trend of warfare creating more notes: to combat forgery, higher denomination notes (some as high as £1,000) were removed from circulation.

There are no Welsh banknotes in circulation; Bank of England notes are used throughout Wales. The last Welsh banknotes were withdrawn in 1908 upon the closure of the last Welsh bank, the North and South Wales Bank.[29] An attempt was made in 1969 by a Welsh banker to revive Welsh banknotes, but the venture was short-lived and the notes did not enter general circulation, surviving today only as a collectors' curiosity.[30]

All Bank of England notes issued since Series C in 1960 depict Queen Elizabeth II on the obverse side, in full view facing left; her image also appears as a hidden watermark, facing right; recent issues have the anti-photocopier security EURion constellation around.

Historical figures

| Image | Value | Size (mm) | Reverse portrait | Issued | Withdrawn | Time in circulation | |

|---|---|---|---|---|---|---|---|

| Series D | |||||||

| 10/- | 121 × 62[31] | Sir Walter Raleigh[32] by Unknown | Never issued | ||||

| 50p | |||||||

| £1 | 135 × 67[33] | Sir Isaac Newton by Sir Godfrey Kneller | 9 February 1978 | 11 March 1988 | 10 years, 1 month and 2 days | ||

| £5 | 145 × 78[33] | Duke of Wellington by Sir Thomas Lawrence | 11 November 1971 | 29 November 1991 | 20 years, 2 weeks and 4 days | ||

| £10 | 151 × 85[33] | Florence Nightingale by Unknown | 20 February 1975 | 20 May 1994 | 19 years and 3 months | ||

| £20 | 160 × 90[33] | William Shakespeare by William Kent & Peter Scheemakers | 9 July 1970 | 19 March 1993 | 22 years, 8 months, 1 week and 3 days | ||

| £50 | 169 × 95[33] | Sir Christopher Wren by Sir Godfrey Kneller | 20 March 1981 | 20 September 1996 | 16 years and 6 months | ||

| Series E | |||||||

| £5 | 135 × 70[34] | George Stephenson by Charles Turner | 7 June 1990 | 21 November 2003 | 13 years, 5 months, 1 week and 6 days | ||

| £10 | 142 × 75[35] | Charles Dickens by John Watkins | 29 April 1992 | 31 July 2003 | 11 years, 3 months and 2 days | ||

| £20 | 149 × 80[36] | Michael Faraday by Henry Dixon | 5 June 1991 | 28 February 2001 | 9 years, 8 months, 3 weeks and 2 days | ||

| £50 | 156 × 85[37] | Sir John Houblon by Robert Grave | 20 April 1994 | 30 April 2014 | 20 years, 1 week and 3 days | ||

| Series E (Variant) | |||||||

| £5 | 135 × 70[34] | Elizabeth Fry by Charles Robert Leslie | 21 May 2002 | 5 May 2017 | 14 years, 11 months and 2 weeks | ||

| £10 | 142 × 75[35] | Charles Darwin by Julia Margaret Cameron | 7 November 2000 | 1 March 2018 | 17 years, 3 months, 3 weeks and 1 day | ||

| £20 | 149 × 80[36] | Sir Edward Elgar by Unknown | 22 June 1999 | 30 June 2010 | 11 years, 1 week and 1 day | ||

| Series F | |||||||

| £20 | 149 × 80[36] | Adam Smith by James Tassie | 13 March 2007 | In use | 13 years, 5 months and 4 days | ||

| £50 | 156 × 85[37] | Matthew Boulton & James Watt by William Ridley and Sir Thomas Lawrence | 2 November 2011 | In use | 8 years, 9 months, 2 weeks and 1 day | ||

| Series G | |||||||

| £5 | 125 × 65[38] | Sir Winston Churchill by Yousuf Karsh | 13 September 2016 | In use[39] | 3 years, 11 months and 4 days | ||

| £10 | 132 × 69[38] | Jane Austen by James Andrews | 14 September 2017 | In use[40] | 2 years, 11 months and 3 days | ||

| £20 | 139 × 73[38] | J. M. W. Turner by J.M.W. Turner | 20 February 2020 | In use[41] | [42]5 months and 4 weeks | ||

| £50 | 146 × 77 (predicted) | Alan Turing by Elliott & Fry | in 2021[43] | To be released | |||

| High Value | |||||||

| £1,000,000 | 210 × 148[44] | None | c. 1990 | uncirculated | |||

| £100,000,000 | 297 × 210[44] | 2004 | |||||

In the mid 1960s, shortly after the introduction of Series C, the Bank of England proposed to introduce a new banknote series featuring people from British history. In addition to enhancing the appearance of banknotes, the complexity of the new designs was intended to make counterfeiting harder. The task of designing the new Series D notes was given to the Bank's new in-house designer, Harry Eccleston, who not only designed the notes themselves, but also created three individual portraits of the Queen.[lower-roman 1] It was initially envisaged that all of the denominations of notes then in circulation would be issued under Series D. To that end, a Series D 10 shilling note was designed, featuring Sir Walter Raleigh, which would become the 50 pence note upon decimalisation, and intended to be the first of the new series to be issued. However, inflation meant that the lifespan of such a note would be too short—estimates by the Decimal Currency Board suggested that a 10 shilling note would last approximately five months;[46] therefore, it was decided that it would be more economical to have a coin instead: the fifty pence coin was introduced in 1969.[32][47] Instead, the £20 note was the first Series D note to enter circulation in 1970, with William Shakespeare on the reverse.[48]

The Series D £1 note, featuring Sir Isaac Newton, was discontinued in 1984, having been replaced by a pound coin the year before, and was officially withdrawn from circulation in 1988. Nonetheless, all banknotes, regardless of when they were withdrawn from circulation, may be presented at the Bank of England where they will be exchanged for current banknotes. Other banks may also decide to exchange old banknotes, but they are under no obligation to do so.

When Series E was introduced in 1990, a new portrait of the Queen was commissioned based on photographs by Don Ford, one of the Bank of England's photographers. In this portrait, intended for all of the Series E banknotes, the Queen is shown wearing the Girls of Great Britain and Ireland Tiara, Queen Alexandra's cluster earrings and Queen Victoria's Golden Jubilee necklace.[49]

In the E revision series the £50 note was never issued; £100 notes were last used by the Bank of England in 1945 and in the F series the £5 and £10 notes were never issued either.

The Bank of England has a set of criteria for choosing characters for banknotes – initially, it looks at who has previously featured, to allow for a reflection of the diversity of society. It does not accept fictional characters, or anyone still living (with the exception of the reigning monarch), but instead aims for individuals that are both widely admired, and are considered to have made an important contribution to UK society and culture. The final criteria is that the individual has an easily recognisable portrait available for use.[50] This does not need to be a painting, as, up to August 2020, there have been two sculptures and a photograph used.

Current circulation

As of August 2020, the Bank of England issues five banknote denominations from two distinct series. The two larger denominations are from Series F (£20 first issued in 2007, £50 first issued in 2011). The £5 and £10 and £20 notes are from Series G (first issued in 2016, 2017 and 2020).

The notes currently in circulation are as follows. The obverse of these banknotes all feature a portrait of Queen Elizabeth II.

| Series | Image | Value | Dimensions (millimetres) | Material | Main colour | Reverse figure | Issue date | Notes | ||

|---|---|---|---|---|---|---|---|---|---|---|

| Obverse | Reverse | |||||||||

| G | £5 | 125 × 65 | Polymer | Turquoise/blue | 1941 portrait of Winston Churchill by Yousuf Karsh, the Elizabeth Tower, and the maze at Blenheim Palace, the quote "I have nothing to offer but blood, toil, tears and sweat." from a 1940 speech by Churchill, and the Nobel Prize medal. | 13 September 2016[51] | This is the Bank of England's first banknote to be printed in polymer. | |||

| G | £10 | 132 × 69 | Polymer | Orange | Portrait of author Jane Austen (c. 1810) by James Andrews, based on a portrait by her sister, Cassandra, the quote "I declare after all there is no enjoyment like reading!" from Pride and Prejudice, an illustration of Elizabeth Bennet and a view of Godmersham Park in Kent.[52][53] | 14 September 2017[54] | The previous note featuring Charles Darwin was withdrawn from circulation on 1 March 2018.[55] | |||

| F | £20 | 149 × 80 | Paper | Purple | Economist Adam Smith with an illustration showing his theory of "the division of labour in pin manufacturing". | 13 March 2007[56] | New polymer £20 note, featuring J. M. W. Turner, issued on 20 February 2020.[57][58] | |||

| G | 139 × 73 | Polymer | Self-portrait of artist J. M. W. Turner (c.1799), a version of Turner's The Fighting Temeraire, the quote "Light is therefore colour" from an 1818 lecture by Turner, and a copy of Turner's signature as made on his will. | 20 February 2020[59] | ||||||

| F | £50 | 156 × 85 | Paper | Red | Steam engine industrialists Matthew Boulton and James Watt with steam engine and Boulton's Soho factory. | 2 November 2011[60] | The Bank of England has announced that a new polymer £50 note, featuring Alan Turing, is to be issued "by the end of 2021".[61] | |||

The launch of the new Series F banknotes was announced on 29 October 2006 by the Governor of the Bank of England. The first of these new notes, a £20 note, features the Scottish economist, Adam Smith, the first Scot to appear on an English note (the first non-Englishman, Anglo-Irish Field Marshal Arthur Wellesley, Duke of Wellington appeared on the Series D £5 in 1971).[62] Smith also features on £50 notes issued by the Clydesdale Bank. Previous issues of Bank of England £20 notes were known to have suffered from a higher incidence of counterfeiting (276,000 out of 290,000 cases detected in 2007) than any other denomination.[63] The note, which also includes enhanced security features, entered circulation on 13 March 2007.[64]

The next new Series F banknote, the £50 note, entered circulation on 2 November 2011. It is the first Bank of England banknote to feature two Britons on the reverse: James Watt (another Scotsman) and Matthew Boulton.[65]

The first note of Series G, the polymer £5 note, entered circulation on 13 September 2016;[66],the £10 note on 14 September 2017;[52][67] the £20 note on 20 February 2020.[41] and the £50 in 2021.[68]

Polymer notes

In April 2013, the Bank of England announced that its next planned new note issue, intended to be the £5 note in 2016, would feature former British Prime Minister Winston Churchill.[69] The selection of Churchill to replace Elizabeth Fry raised some debate about the representation of women on British banknotes, with critics raising concerns that Bank of England notes would portray exclusively male figures, other than Elizabeth II who appears on every sterling banknote and coin.[70] In July 2013 it was announced that the Series F £10 note design would bear a portrait of 19th century author Jane Austen.[71] In 2015, the Bank announced that they were accepting suggestions from the public for a figure from the visual arts to appear on the £20 note to replace Adam Smith, with the new note to be introduced in 2020.[72] In April 2016, it was announced that J. M. W. Turner had been selected to appear on the new £20 note.[42]

In September 2013 the Bank of England opened a period of public consultation about the introduction of polymer, or plastic, banknotes, which would be introduced into circulation from 2016 if the proposals were supported.[73][74][75] The polymer notes will be "around 15% smaller" than the notes being replaced.[76] Following the consultation, in December 2013, the Bank confirmed that plastic or polymer notes would be brought into circulation in 2016 with the introduction of the £5 note featuring Sir Winston Churchill.[77][78] A spokesman for LINK, the company that operates many of the cash machines in the United Kingdom, said there would need to be significant investment as machines would need to be altered to fit the polymer £5 banknotes, which would be smaller than the previous ones.[79] The Jane Austen polymer £10 note went into circulation in September 2017.[52][80] The £20 shows J.M.W. Turner (from a self-portrait), the quote "Light is therefore colour" from an 1818 lecture by Turner, and a view of The Fighting Temeraire.[81]

In March 2018, the Treasury began a consultation looking at the potential withdrawal of the £50 note, as well as the one and two pence coins, on the basis that they are used significantly less than other denominations, with an additional rationale over the £50 note being the perception in the UK of its use in money laundering, tax evasion and other financial crime, despite the demand for it overseas.[82] The Series F version was introduced in 2011, while its predecessor was in circulation for twenty years, so there was some consideration to withdrawing the £50 note entirely as a way of combatting tax evasion, and the fact that cash transactions using such a high value note are becoming increasingly rare.[83][84] However, in October 2018 the Bank of England announced plans to introduce a Series G polymer £50 note, following the review by the government.[85] The new £50 note is planned for introduction once the Series G £20 note featuring JMW Turner is released.[86] In July 2019, it was announced that the new note would feature computer pioneer Alan Turing, from a photograph taken by the Elliott & Fry photographic studio in 1951, a table of formulae from Turing's 1936 work On Computable Numbers, with an application to the Entscheidungsproblem, an image of the Automatic Computing Engine Pilot machine, technical drawings of the British bombe machine, the quote "This is only a foretaste of what is to come, and only the shadow of what is going to be" from an interview Turing gave to The Times on 11 June 1949, and a ticker tape showing Turing's date of birth in binary code.[87]

High-value notes

Not since 1945 has there been bigger notes than £50 issued for general circulation by the Bank of England, although banks in Scotland and Northern Ireland still use £100 notes. However, the Bank of England does produce higher-value notes that are used to maintain parity with Scottish and Northern Irish notes. Banknotes issued by Scottish and Northern Irish banks have to be backed pound for pound by Bank of England notes (other than a small amount representing the currency in circulation in 1845), and special £1 million and £100 million notes are used for this purpose. Their design is based on the old Series A notes.[44][88]

Scotland and Northern Ireland

While provincial banks in England and Wales lost the right to issue paper currency altogether, the practice of private banknote issue has continued in Scotland and Northern Ireland. The right of Scottish banks to issue notes is popularly attributed to the author Sir Walter Scott, who in 1826 waged a campaign to retain Scottish banknotes under the pseudonym Malachi Malagrowther. Scott feared that the limitation on private banknotes proposed with the Bankers (Scotland) Act 1826 would have adverse economic consequences if enacted in Scotland because gold and silver were scarce and Scottish commerce relied on small notes as the principal medium of circulating money. His action eventually halted the abolition of private banknotes in Scotland.[89]

Scottish and Northern Irish banknotes are unusual, firstly because they are issued by retail banks, not central banks, and secondly, as they are technically not legal tender anywhere in the UK – not even in Scotland or Northern Ireland – as they are in fact promissory notes.[19][90]

Seven retail banks have the authority of HM Treasury to issue sterling banknotes as currency.[91][92] Despite this, the notes can be refused at the discretion of recipients in England and Wales, and are often not accepted by banks and exchange bureaus outside of the United Kingdom. This is particularly true in the case of the Royal Bank of Scotland 's £1 note, which is the only £1 note to remain in circulation within the UK.[93]

In 2000, the European Central Bank indicated that, should the United Kingdom join the Euro, Scottish banks (and, by extension, Northern Irish banks) would have to cease banknote issue.[94] During the Financial crisis of 2007–2008, the future of private banknotes in the United Kingdom was uncertain.

After the financial crisis of 2007–08, a number of banks were rescued from collapse by the United Kingdom government. The Banking Act 2009 was passed to improve protection for holders of banknotes issued by the authorised banks, so that the notes would have the same level of guaranteed value to that of Bank of England notes.[95][96] Critics of the 2009 Act expressed concerns that it would restrict the issue of banknotes by commercial banks in Scotland and Northern Ireland by removing many of the provisions of the earlier Acts quoted above.[97] Under the original proposals, banks would have been forced to lodge sterling funds with the Bank of England to cover private note issue for a full week, rather than over a weekend, thereby losing four days' interest and making banknote production financially unviable. Following negotiations among the UK Treasury, the Bank of England and the Scottish banks, it was agreed that the funds would earn interest, allowing them to continue to issue their own notes.[98]

During the public debate leading up to the 2014 Scottish independence referendum, the question of Scotland's future currency was discussed. Whilst the SNP advocated a currency union between an independent Scotland and the remaining United Kingdom,[99] HM Treasury issued a statement in April 2013 stating that the present relationship with the Bank of England could be changed after independence, with the result that Scottish banks might lose the ability to issue banknotes backed by Bank of England funds.[100][101][102]

Scotland

Until 1701 Scotland issued its own pound, the Pound Scots. The issuing of retail-bank banknotes in Scotland is subject to the Bank Charter Act 1844, Banknotes (Scotland) Act 1845, the Currency and Bank Notes Act 1928, and the Coinage Act 1971. Pursuant to some of these statutes, the Commissioners for Revenue and Customs publishes an account of "the Amount of Notes authorised by Law to be issued by the several Banks of Issue in Scotland, and the Average Amount of Notes in Circulation, and of Bank of England Notes and Coin held" in the London Gazette. See for example Gazette Issue 58254 published 21 February 2007 at page 2544.[3]

Bank of Scotland notes

All Bank of Scotland notes bear a portrait of Sir Walter Scott on the front in commemoration of his 1826 Malachi Malagrowther campaign for Scottish banks to retain the right to issue their own notes.[103] Bank of Scotland's 2007 redesign of their banknotes are known as the Bridges of Scotland series. These notes were introduced on 17 September 2007, and show Scotland's most famous bridges on the reverse side. The Bridges of Scotland series is currently being refreshed with the issue of new polymer notes with designs that follow the same basic theme of "bridges". The previous Tercentenary series notes are being withdrawn from circulation and replaced with the 2007 series (or polymer series as these are issued), but remain legal currency. Following the announcement that HBOS (Bank of Scotland's parent company) would be taken over by Lloyds TSB in September 2008, it was confirmed that the new banking company would continue to print bank notes under the Bank of Scotland name.[104] According to the Bank Notes (Scotland) Act 1845, the bank could have lost its note-issuing rights, but by retaining headquarters within Scotland, banknote issue will continue.[105]

| Image | Denomination | Obverse | Reverse |

|---|---|---|---|

| Tercentenary Series (1995) | |||

| £5 | Sir Walter Scott | vignette of oil and energy | |

| £10 | vignette of distilling and brewing | ||

| £20 | vignette of education and research | ||

| £50 | vignette of arts and culture | ||

| £100 | vignette of leisure and tourism | ||

| Bridges of Scotland Series (2007) | |||

| £5 | Sir Walter Scott | the Brig o' Doon | |

| £10 | the Glenfinnan Viaduct | ||

| £20 | the Forth Bridge | ||

| £50 | the Falkirk Wheel | ||

| £100 | the Kessock Bridge | ||

| Polymer Series (2016 onwards) | |||

| £5 | Sir Walter Scott | the Brig o' Doon | |

| £10 | the Glenfinnan Viaduct | ||

| £20 | the Forth Bridge | ||

Royal Bank of Scotland notes

As of August 2017, the Royal Bank of Scotland is in the process of adopting a new series of banknotes. These will be made of polymer. Two (the £5 and £10 notes) have already been released, whilst a new £20 note is being designed. The £5 note shows Nan Shepherd on the obverse accompanied by a quote from her book 'The Living Mountain', and the Cairngorms in the background. The reverse displays two mackerel, with an excerpt from the poem An Roghainn (The Choice) by Scottish Gaelic poet Sorley MacLean.[106] The obverse of the £10 note shows Mary Somerville, with a quote from her work 'The Connection of the Physical Sciences', and Burntisland beach in the background. The reverse displays two otters and an excerpt from the poem 'Moorings' by Norman MacCaig.[107] The obverse of the £20 note, to be introduced in 2020, will show Catherine Cranston.[108]

The previous series of Royal Bank of Scotland notes, originally issued in 1987, remains in circulation, although it is now in the process of being replaced by polymer notes. On the front of each note is a picture of Lord Ilay (1682–1761), the first governor of the bank, based on a portrait painted in 1744 by the Edinburgh artist Allan Ramsay.[109] The front of the notes also feature an engraving of the bank's former headquarters in St. Andrew Square, Edinburgh. The background graphic on both sides of the notes is a radial star design which is based on the ornate ceiling of the banking hall in the old headquarters building.[110] On the back of the notes are images of Scottish castles, with a different castle for each denomination.

Occasionally the Royal Bank of Scotland issues commemorative banknotes. Examples include the £1 note issued to mark the 150th Anniversary of the birth of Alexander Graham Bell in 1997, the £20 note for the 100th birthday of Queen Elizabeth The Queen Mother in 2000, the £5 note honouring veteran golfer Jack Nicklaus in his last competitive Open Championship at St Andrews in 2005, and the £10 note issued in commemoration of HM Queen Elizabeth II's Diamond Jubilee in 2012. These notes are much sought-after by collectors and they rarely remain long in circulation.

| Image | Denomination | Obverse | Reverse |

|---|---|---|---|

| Ilay Series (1987) | |||

| £1 | Lord Ilay | Edinburgh Castle | |

| £5 | Culzean Castle | ||

| £10 | Glamis Castle | ||

| £20 | Brodick Castle | ||

| £50 | Inverness Castle (introduced 2005) | ||

| £100 | Balmoral Castle | ||

| Fabric of Nature series (2016 onwards) | |||

| £5 | Nan Shepherd | mackerel | |

| £10 | Mary Somerville | otter | |

| £20 | Catherine Cranston | red squirrel | |

Clydesdale Bank notes

Clydesdale Bank has three series of banknotes in circulation at present. The most recent set of notes, the Polymer Series started coming into circulation in March 2015, when the Clydesdale Bank became the first bank in Great Britain to issue polymer banknotes. The £5 commemorative notes, issued to mark the 125th anniversary of the construction of the Forth Bridge, contain several new security features including a reflective graphic printed over a transparent "window" in the banknote.[111][112] Further notes in the polymer series will be introduced over time, replacing the previous paper notes.

The polymer notes continue the theme of the World Heritage Series of paper banknotes, introduced in autumn 2009. The new notes each depict a different notable Scot on the front and on the reverse bear an illustration of one of Scotland's UNESCO World Heritage Sites.[113]

Banknotes of the earlier Famous Scots Series portray notable Scottish historical people along with items and locations associated with them.[114]

The Clydesdale Bank also occasionally issues special edition banknotes, such as a £10 note celebrating the bank's sponsorship of the Scotland team at the 2006 Commonwealth Games

| Image | Denomination | Obverse | Reverse |

|---|---|---|---|

| Famous Scots Series | |||

| £5 | Robert Burns | A field mouse from Burns' poem To a Mouse | |

| £10 | Mary Slessor | A map of Calabar, Nigeria, and African missionary scenes | |

| £20 | King Robert the Bruce | The Bruce on horseback with the Monymusk Reliquary against a background of Stirling Castle | |

| £50 | Adam Smith | Industrial tools against a background of sailing ships | |

| £100 | Lord Kelvin | University of Glasgow | |

| World Heritage Series (2009) | |||

| £5 | Sir Alexander Fleming | St Kilda | |

| £10 | Robert Burns | Edinburgh Old and New Towns | |

| £20 | King Robert the Bruce | New Lanark | |

| £50 | Elsie Inglis | Antonine Wall | |

| £100 | Charles Rennie Mackintosh | Neolithic Orkney | |

| World Heritage (Polymer) Series (2015 onwards) | |||

| £5 | Sir William Arrol | Forth Bridge | |

| £10 | Robert Burns | Edinburgh Old and New Towns | |

| £20 | Robert the Bruce | St Kilda | |

Northern Ireland

In Northern Ireland, four retail banks exercise their right to issue pound sterling notes: Bank of Ireland, First Trust Bank, Danske Bank (formerly Northern Bank) and Ulster Bank.[115] Northern Bank and Ulster Bank are the only two banks that have issued special commemorative notes so far.

Bank of Ireland notes

Like other banks in Northern Ireland, Bank of Ireland retains its note-issuing rights from before the partition of Ireland; while Bank of Ireland is headquartered in Dublin, it issues sterling notes within the United Kingdom. In spite of its name, Bank of Ireland is not, and never has been, a central bank; it is a retail bank. Its sterling notes should not be confused with banknotes of the former Irish pound which were in use in the Republic of Ireland before the adoption of the euro in 2001.

Banknotes issued by Bank of Ireland are of a uniform design, with denominations of £5, £10 £20, £50 and £100 each differentiated by colour. The notes all feature an illustration of a seated woman, Hibernia, and the heraldic shields of the Counties of Northern Ireland.[116] Until April 2008, all Bank of Ireland notes featured an illustration of Queen's University of Belfast on the reverse side. A new series of £5, £10 and £20 notes issued in April 2008 depicts the Old Bushmills Distillery and these new notes will gradually replace the previous series as older notes are withdrawn from circulation.[117][118] In 2019 the Bank of Ireland released new Polymer banknotes with the same design as their paper counterparts but the same size as the Bank of England equivalents.

First Trust Bank

First Trust Bank issues notes in denominations of £10, £20, £50 and £100. The notes bear portraits of generic Northern Irish people on the front with varied illustrations on the reverse.[119] Until 1993 the bank issued notes under its former trading name, Allied Irish Banks.

| Denomination | Obverse | Reverse |

|---|---|---|

| £10 | Generic young man | The ship Girona |

| £20 | Generic old woman | The chimney at Lacada Point, Giant's Causeway |

| £50 | Generic old man | A 1588 commemorative medal and cherubs |

| £100 | Old man and woman together | Spanish Armada |

In February 2019, First Trust announced it would stop issuing its own banknotes, with the final withdrawal on 30 June 2020.[120] Any notes still in circulation remain legal currency until 30 June 2022, after which they can be exchanged for other sterling notes at branches of the bank.[121]

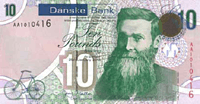

Danske Bank

In 2012 Northern Bank adopted the name of its Copenhagen-based parent company Danske Bank Group and rebranded its retail banking operation.[122][123] In June 2013 the bank issued a new series of £10 and £20 notes bearing the new brand name; at the same time it also announced that it would cease production of £50 and £100 notes. Older notes bearing the Northern Bank name will continue in circulation for some time as they are gradually withdrawn, and remain acceptable forms of payment.[124][125] In spite of the Danish name on the new notes, banknotes issued by Danske Bank are sterling notes and should not be confused with banknotes of the Danish krone issued by the Danmarks Nationalbank, Denmark's central bank.

Danske Bank does not issue £5 notes, but a special commemorative £5 note was issued by the Northern Bank to mark the Year 2000; it was a polymer banknote, printed on synthetic polymer instead of paper. It is the only one of the bank's pre-2004 notes still in circulation; all others were recalled following the £26.5 million pound robbery at its Belfast headquarters in 2004.

| Denomination | Obverse | Reverse |

|---|---|---|

| £5 | "Alpha" (α) motif, solar system, stars | Stars, globe, electronic circuitry & the Space Shuttle |

| £10 | J. B. Dunlop | Dome and pediment of Belfast City Hall |

| £20 | Harry Ferguson | |

| £50 | Sir S.C. Davidson | |

| £100 | James Martin |

As of 2019, Danske Bank only issues the £10 and £20 denominations.

Ulster Bank

Ulster Bank notes all feature a vignette of three Northern Ireland views: the Mourne Mountains, the Queen Elizabeth Bridge and the Giant's Causeway. Notes issued from 1 January 2007 feature the Royal Bank of Scotland "daisy wheel" logo.

In November 2006 Ulster Bank issued its first commemorative banknote – an issue of one million £5 notes commemorating the first anniversary of the death of Northern Irish footballer George Best.

In June 2018, Ulster Bank announced the introduction of a new series of polymer banknote designs, the first in the United Kingdom to have a vertical orientation. The new series was designed around the theme "Living in Nature", highlighting Northern Ireland's botanical, zoological and geographical features. The first announced were the five-pound note, featuring images of Strangford Lough, the Brent goose and the fuchsia, was designed using the theme of "migration", while the ten-pound note, which carries the theme of "growth", features Lough Erne, the Irish hare and the Guelder-rose.[126] In August 2019, the design of the new twenty-pound note was revealed, with the idea of Northern Ireland as 'dwelling place', and images including Lough Neagh, the European eel and the Hawthorn flower.[127]

Channel Islands

The Channel Islands are grouped for administrative purposes into the Bailiwicks of Jersey and Guernsey. The islands are not part of the United Kingdom but are dependencies of the British Crown and in currency union with the UK. Both Jersey and Guernsey issue their own banknotes. These notes circulate freely between the two territories, so Jersey notes are commonly used in Guernsey, and vice versa. Private banknotes are no longer in circulation in the Channel Islands. These pounds are sterling pounds but the word "sterling" is omitted as with the English notes. These notes are legal tender in their jurisdictions but are not legal tender in the UK.[128]

The Government of Alderney (a part of the Bailiwick of Guernsey) is also licensed to issue its own currency, the Alderney pound, but only mints special commemorative sterling coins and does not issue banknotes.[129]

Jersey Pound

The current series of notes entered circulation on 29 April 2010.[130] The obverse of the notes includes a portrait of Queen Elizabeth II based on a photograph by Mark Lawrence, alongside a view of an important Jersey landmark, with text in English. The reverse of each note includes an image of one of Jersey's numerous historic coastal defence towers, built in the late 18th century, as well as a further image of cultural or landscape importance, images of the twelve parish crests, and with denomination worded in French and Jèrriais. The watermark is a Jersey cow, and further security features include a see-through map of Jersey, and on the £10, £20 and £50 a patch hologram showing a varying image of the coat of arms of Jersey and the Island of Jersey on a background pattern of La Corbière lighthouse.[131] On 1 June 2012, a £100 note was issued to commemorate the Diamond Jubilee of Queen Elizabeth II.[132]

| Denomination | Colour | Obverse design | Reverse design |

|---|---|---|---|

| £1 | Green | Queen Elizabeth II; Liberation Sculpture in Saint Helier | Le Hocq Tower; La Hougue Bie |

| £5 | Sky blue | Queen Elizabeth II; Le Rât Cottage | Archirondel Tower; Les Augrès Manor |

| £10 | Burnt Sienna | Queen Elizabeth II; Hermitage of Saint Helier | Seymour Tower; Lalique sculpture in the Glass Church |

| £20 | Violet | Queen Elizabeth II; States Building | La Rocco Tower; States Chamber |

| £50 | Red | Queen Elizabeth II; Mont Orgueil | Tower, Ouaisné; La Marmotière, Les Écréhous |

| £100 | Purple | Queen Elizabeth II; map of Jersey and Cotentin peninsula | Royal mace of Jersey; Flag of Jersey |

The previous series, gradually being withdrawn from circulation in 2010, depicted Queen Elizabeth II on the front and various landmarks of Jersey or incidents in Jersey history on the reverse.

States of Guernsey notes

The Guernsey Pound is legal tender in Guernsey, but also circulates freely in Jersey. These pounds are sterling pounds but the word "sterling" is omitted on banknotes, as on the English ones. These notes can also be exchanged in banks and in bureaux de change although it has been reported that British banks no longer accept £1 Guernsey banknotes because they no longer have the facility for handling £1 UK banknotes. In addition to coins, the following banknotes are used:

- £1 note, green, Daniel De Lisle Brock, Bailiff of Guernsey (1762–1842) and Royal Court, St Peter Port (1840) on front and the Market, St Peter Port on back

- £5 note, pink, Queen Elizabeth II and the Town Church, St Peter Port on front, and Fort Grey and Hanois Lighthouse (1862) on the back

- £10 note, blue/orange, Queen Elizabeth II and Elizabeth College, St Peter Port on the front and Saumarez Park, Les Niaux Watermill, Le Trepied Dolmen on the back

- £20 note, pink, Queen Elizabeth II and St James Concert Hall, St Peter Port on the front and Vale Castle and St Sampson's Church on the back

- £50 note, light brown, Queen Elizabeth II and the Royal Court House on the front and St Andrew's Church and La Gran'mère on the back

Isle of Man

The Isle of Man Government issues its own banknotes and coinage, which are legal tender in the Isle of Man. Manx pounds are a local issue of the pound sterling, but the word "sterling" does not appear on the banknotes. These notes can be exchanged in banks and in bureaux de change in the United Kingdom.

The front of all Manx banknotes features images of Queen Elizabeth II (not wearing a crown: she is only "Lord" on the island) and the Triskeles (three legs emblem). Each denomination features a different scene of the Island on its reverse side:

- £1 – Tynwald Hill

- £5 – Castle Rushen

- £10 – Peel Castle

- £20 – the Laxey Wheel

- £50 – Douglas Bay

British overseas territories

Three British overseas territories use their own separate currencies called pounds which are at par with the pound sterling. The governments of these territories print their own banknotes which in general may only be used within their territory of origin. Bank of England notes usually circulate alongside the local note issues and are accepted as legal currency.

Gibraltar

In Gibraltar, banknotes are issued by the Government of Gibraltar. The pound was made sole legal tender in 1898 and Gibraltar has issued its own banknotes since 1934.[133] The notes bear an image of the British monarch on the obverse and the wording "pounds sterling", meaning that more retailers in the UK will accept them.

Falkland Islands

The Falkland Islands pound is the currency of the Falkland Islands. Banknotes are issued by the Falkland Islands Government. The illustrations on all notes are the same, featuring the British monarch, wildlife and local scenes; denominations are distinguished by the size and colour of the notes.

St Helena, Ascension and Tristan da Cunha

St Helena, Ascension and Tristan da Cunha's constituent territories of Saint Helena and Ascension Island use the Saint Helena pound. Banknotes in these areas are issued by the Saint Helena Government and bear the image of the British monarch.

Counterfeiting

According to the central banks, the ratio of counterfeited bank notes is about 10 in one million of real bank notes for the Swiss franc, 50 in one million for the Euro, 100 in one million for United States dollar and 300 in one million for Pound sterling.[134]

See also

- Bradbury Wilkinson and Company, printer of banknotes, postage stamps and share certificates

- Coins of the pound sterling

- List of British banknotes and coins

- Pound Scots and Scottish coinage, currency of Scotland before the union with England

- List of people on banknotes

- List of British currencies

- Polymer banknote

Commonwealth

States within the Commonwealth of Nations issue their own banknotes which are separate currencies:

References

Notes

- The first saw the Queen in Garter robe and cap, and was intended for the 10 shilling note; the second had the Garter cap replaced by the George IV State Diadem, and also featured Queen Alexandra's cluster earrings, and was used for the one pound and five pound notes; the third had the Garter robe replaced by Robe of State, and featured the State Diadem, Queen Alexandra's earrings and Queen Victoria's Golden Jubilee necklace, and was for the ten, twenty and fifty pound notes.[45]

Citations

- "Security by Design" (PDF). Bank of England. 2007. Retrieved 27 March 2008.

- Bowlby, Chris. "Britain's £1m and £100m banknotes". BBC News. Retrieved 22 May 2014.

- "No. 58254". The London Gazette. 21 February 2007. p. 2544.

- "One Guinea Banknote, Birmingham Bank". Birmingham Museums & Art Gallery. Archived from the original on 18 October 2007. Retrieved 8 October 2007.

- Malcolm Lobley FCIB (November 1998). "the Swaledale and Wensleydale Banking Company". P-Wood.com. Archived from the original on 13 August 2009. Retrieved 8 October 2007.

- "British Provincial Banknotes". pp. 1–6. Archived from the original on 19 November 2007. Retrieved 8 October 2007.

- "Welsh bank notes". Wales History. BBC Cymru/Wales. Retrieved 27 April 2013.

- "Bank of Scotland (1695- )". Lloyds Banking Group. Retrieved 8 October 2007.

- Kelly, John (2003). "The Irish Pound: From Origins to EMU" (PDF). Central Bank of Ireland Quarterly Bulletin (Spring 2003): 91. Retrieved 27 April 2013.

- "A brief history of banknotes". Bank of England. Archived from the original on 11 October 2007. Retrieved 8 October 2007.

- "Bank Charter Act 1844, Section XI, "Restriction against Issue of Bank Notes"".

- Committee of Scottish Clearing Bankers. "Banknote History – Legal tender". Archived from the original on 16 October 2007. Retrieved 8 October 2007.

- "Bank Notes (Scotland) Act 1845". UK Statute Law Database.

- "Other British Notes". Bank of England. Archived from the original on 15 October 2007. Retrieved 8 October 2007.

- "Bank of Ireland Company History". Funding Universe. Archived from the original on 18 October 2007. Retrieved 8 October 2007.

- "The Governor and Company of the Bank of Scotland Business Information, Profile and History". jrank.org. Archived from the original on 12 November 2007. Retrieved 14 October 2007.

- Saville, Richard (1996). Bank of Scotland: A History, 1695–1995. Edinburgh: Edinburgh University Press. pp. 20–24. ISBN 0-7486-0757-9.

- "Banknote History: Early Scottish banknotes". cscb. Committee of Scottish Bankers. Retrieved 6 February 2018.

- Bank of England- Frequently Asked Questions. "Are Scottish & Northern Irish notes legal tender?". Archived from the original on 12 October 2007. Retrieved 14 October 2007.

- "Law 'hinders' Scottish bank notes". BBC News. 23 January 2008. Retrieved 15 October 2008.

- "7 in 10 Scots have money rejected in England". The Scotsman. 31 January 2014. Retrieved 1 February 2014.

- "Our Banknotes". RBS.com. 2018. Retrieved 4 August 2018.

- matthew McCreary (30 July 2007). "Store U-turn on Ulster notes after Nolan raises a rumpus". Belfast Telegraph. Retrieved 16 October 2008.

- "Scottish money 'needs protection'". BBC News. 27 December 2007. Retrieved 15 October 2008.

- Committee of Scottish Clearing Bankers. "Legal Tender". Archived from the original on 20 May 2007. Retrieved 14 October 2007.

- Silicon Glen. "Scotland Guide – Currency and legal tender". Archived from the original on 7 October 2007. Retrieved 8 October 2007.

- Hamish Macdonell (22 September 2005). "Activists fight 'threat' to Scottish banknotes". The Scotsman. Edinburgh. Retrieved 28 February 2011.

- Morris, Richard (February 2004). "Your Story: The Bank of England Printing Works". BBC. Retrieved 1 June 2008.

- Dr A.H. Stamp (1 June 2006). "The Man who printed his own Money" (JPEG). Country Quest Magazine. KatesPaperMoney.co.uk. Retrieved 8 October 2007.

- The Chief Treasury of Wales and the Black Sheep Company pjsymes.com.au. Retrieved on 7 March 2014

- Duggleby, Vincent (2011). English Paper Money. Pam West. p. 218. ISBN 9780954345730.

- Homren, Wayne (30 May 2010). "BANKNOTE DESIGNER HARRY ECCLESTON, 1923–2010". The E-Sylum. Numismatic Bibliomania Society. Retrieved 2 March 2015.

- "Withdrawn Banknotes Reference Guide".

- "£5 note design features (Bank of England)".

- "£10 note design features (Bank of England)".

- "£20 note design features (Bank of England)".

- "£50 note design features (Bank of England)".

- "Getting Your Business Ready". Archived from the original on 29 November 2017. Retrieved 9 March 2016.

- "Sir Winston Churchill to feature on new banknote". BBC News. 26 April 2013.

- Peachey, Kevin (14 September 2017). "Jane Austen polymer £10 note enters circulation". BBC News. Retrieved 14 September 2017.

- Peachey, Kevin (11 October 2019). "£20 note: New design for Britain's most-forged banknote". BBC News. Retrieved 11 October 2019.

- "New £20 note design and personality unveiled by Bank of England". BBC News. 22 April 2016. ||

- "Alan Turing to be the face of new £50 note". Retrieved 15 July 2019.

- "Britain's £1m and £100m banknotes". BBC News. 26 January 2013.

- Symes, Peter (2004). "Portrait 14". The Portraits of Queen Elizabeth II. Retrieved 26 May 2016.

- "1969: New 50-pence coin sparks confusion". BBC On This Day. BBC News. Retrieved 26 May 2016.

- The seven sides of a UK 50p Coin

- Callaway, Jonathan. "Historical figures on Bank of England banknotes". Pam West British Notes. Retrieved 23 March 2015.

- Symes, Peter (2004). "Portrait 20". The Portraits of Queen Elizabeth II. Retrieved 6 August 2018.

- "Choosing banknote characters". Bank of England. 14 May 2018. Retrieved 13 October 2018.

- Peachey, Kevin (26 April 2013). "Sir Winston Churchill to feature on new banknote". BBC News. Retrieved 19 August 2014.

- "The new £10 note is here". Bank of England. 14 September 2007. Archived from the original on 14 September 2017. Retrieved 14 September 2007.

- "The New £10 Note". Bank of England. Archived from the original on 8 September 2017. Retrieved 14 September 2007.

- "New Adam Smith £20 note launched". BBC News. 13 March 2007. Archived from the original on 15 March 2007. Retrieved 13 March 2007.

- "Polymer £20 note". Bank of England. Retrieved 20 February 2020.

- "New £50 banknote in circulation". BBC News. 2 November 2011.

- "Alan Turing to be the face of new £50 note". Bank of England. 15 July 2015.

- In life the "Iron Duke" disclaimed any Irish connection beyond his place of birth, observing that birth in a stable does not make a man a horse.

- Counterfeit Bank of England banknotes, Bank of England. Retrieved 16 June 2008.

- "New Adam Smith £20 note launched". BBC. 13 March 2007. Archived from the original on 15 March 2007. Retrieved 13 March 2007.

- "Steam giants on new £50 banknote". BBC News. 30 May 2009. Retrieved 28 February 2011.

- Milligan, Brian (13 September 2016). "New £5 note: Consumers face wait for plastic fiver". BBC News. Retrieved 31 January 2017.

- "New £5 note: Bank to keep note despite animal fat content". BBC News. 15 February 2017. Retrieved 23 February 2017.

- "Think science and celebrate Alan Turing". Bank of England. 15 July 2019. Retrieved 15 July 2019.

- "Sir Winston Churchill: the historical figure on the next banknote". Bank of England. 26 April 2013. Retrieved 26 April 2013.

- "Winston Churchill to be new face of five pound note". Channel4. 27 April 2012. Retrieved 27 April 2012.

- "Jane Austen to be face of the Bank of England £10 note". BBC News. 24 July 2013. Retrieved 24 July 2013.

- "The next £20 note". Bank of England. Archived from the original on 10 September 2015. Retrieved 27 August 2015.

- Understanding polymer notes Bank of England

- Plastic banknotes ready for 2016, says Bank of England BBC News

- Bank Of England Could Introduce Polymer Banknotes, Replacing Paper Huffington Post

- Moving to Polymer Banknotes Bank of England

- Bank of England switches to plastic pound notes with Churchill fiver Guardian

- Peachy, Kevin. "Sir Winston Churchill to feature on new banknote". BBC News. Retrieved 22 May 2014.

- Plastic banknotes: the implications for security, dealers and magicians Guardian

- BBC. "Jane Austen to be face of the Bank of England £10 note". BBC News. Retrieved 22 May 2014.

- Morley, Katie (22 April 2016). "JMW Turner unveiled as new face of £20 notes". The Telegraph. Retrieved 25 September 2017.

- Cowburn, Ashley (13 March 2018). "Copper coins and £50 notes could be scrapped, Treasury documents reveal". The Independent. Retrieved 16 March 2018.

- Yorke, Harry (2 June 2016). "The £50 note may be taken out of circulation after Bank of England says there are 'no plans' to introduce new plastic notes". Daily Telegraph. Retrieved 28 April 2017.

- Stott, Michael (15 December 2016). "An unloved banknote: is the £50 in danger?". Financial Times. Retrieved 28 April 2017.

- "The £50 note is changing and here's why". BBC News. 13 October 2018. Retrieved 13 October 2018.

- "Britain to introduce new, more secure 50-pound notes". Miami Herald. 13 October 2018. Archived from the original on 13 October 2018. Retrieved 13 October 2018.

- "New face of the Bank of England's £50 note is revealed". BBC News. 15 July 2019. Retrieved 15 July 2019.

- "The Bank of England's Role in Regulating the Issue of Scottish and Northern Ireland Banknotes". Bank of England.

- "Letters of Malachi Malagrowther". The Walter Scott Digital Archive. Edinburgh University Library. Retrieved 27 April 2013.

- "Legal Tender Guidelines". Royal Mint. Archived from the original on 17 December 2008. Retrieved 8 November 2008.

- "The Bank of England's Role in Regulating the Issuance of Scottish and Northern Ireland Banknotes". Retrieved 27 April 2015.

- "Banknote History". Scottish Clearing Banks. Archived from the original on 30 October 2007. Retrieved 26 October 2007.

- "Current Banknotes". Scottish Clearing Banks. Archived from the original on 30 October 2007. Retrieved 26 October 2007.

- "ECB opposes notes issue". BBC News. 25 February 2000. Retrieved 15 October 2008.

- "Banking Bill". Publications.parliament.uk. 7 October 2008. Retrieved 9 April 2010.

- "Scottish and Northern Ireland Banknotes – Overview". Bank of England. Retrieved 29 November 2013.

- "Salmond voices bank notes fears". BBC News. 4 February 2008. Retrieved 15 October 2008.

- "Scotland's own banknotes saved". The Scotsman. 11 June 2008. Retrieved 15 October 2008.

- "Scottish independence: Osborne says currency plans 'dive into uncharted waters'". BBC News. 23 April 2013. Retrieved 27 April 2013.

- Gardham, Magnus (21 April 2013). "www.heraldscotland.com/politics/referendum-news/scottish-banknotes-at-risk.20872840". The Herald. Retrieved 29 November 2013.

- Carrell, Severin (2 April 2013). "Scottish banknotes: the Treasury's symbolic hostage in the independence debate". The Guardian. London. Retrieved 27 April 2013.

- "More detail needed on key issue of currency". The Herald. 22 April 2013. Retrieved 27 April 2013.

- "Malachi Malagrowther and the Scottish banknote". BBC. 22 April 2017. Retrieved 25 August 2017.

- McIntosh, Lindsay; MacDonell, Hamish (19 September 2008). "Takeover 'may tip economy of Scotland into turmoil'". The Scotsman. Edinburgh. Archived from the original on 21 September 2008. Retrieved 20 September 2008.

- MacLeod, Angus (18 September 2008). "Salmond rallies bank chiefs to rescue Scottish jobs". The Times. London. Retrieved 20 September 2008.

- "New RBS bank notes to feature Nan Shepherd and Mary Somerville". The Scotsman. 25 April 2016. Retrieved 25 April 2016.

- "RBS to issue polymer £10 banknote in October". BBC. 11 August 2017. Retrieved 11 August 2017.

- "New RBS bank notes to feature Nan Shepherd and Mary Somerville". The Scotsman. 25 April 2016. Retrieved 25 April 2016.

- "Archibald Campbell [Mac Cailein Mòr], 3rd Duke of Argyll, 1682 – 1761. Statesman". National Galleries of Scotland – Scottish National Portrait Gallery. 2008. Retrieved 27 April 2013.

- "Our Banknotes – The Ilay Series". The Royal Bank of Scotland Group. 2008. Archived from the original on 26 January 2013. Retrieved 27 April 2013.

- "Clydesdale Bank brings in plastic £5 notes". BBC News. 23 March 2015. Retrieved 23 March 2015.

- "Plastic £5 notes released by Clydesdale Bank in first for Scotland". STV. 23 March 2015. Retrieved 23 March 2015.

- "Clydesdale launches Homecoming bank notes – Herald Scotland". The Herald. 14 January 2009. Archived from the original on 14 February 2009. Retrieved 9 April 2010.

- "Current Banknotes : Clydesdale Bank". Committee of Scottish Bankers. Retrieved 27 April 2013.

- "Current Banknotes". The Association of Commercial Banknote Issuers. Archived from the original on 13 September 2017. Retrieved 27 April 2013.

- "Bank Notes". Bank of Ireland Group.

- "Bank of Ireland to feature Old Bushmills Distillery on new Northern Ireland note issue". Bank of Ireland. 11 February 2008. Retrieved 30 October 2008.

- "Bank raises glass to famous drink". BBC News. 23 April 2008. Retrieved 30 October 2008.

- "First Trust Bank banknotes security features". First Trust Bank. Retrieved 27 April 2013.

- O'Neill, Julian (13 February 2019). "First Trust Bank to stop printing notes". BBC News. BBC. Retrieved 20 February 2020.

- "First Trust Bank to cease issuing its own banknotes". First Trust Bank. Retrieved 1 June 2019.

- "Northern Bank officially rebrands as 'Danske Bank'". BBC News. 15 November 2012. Retrieved 4 May 2013.

- Poole, Amanda (11 May 2012). "Northern Bank to be rebranded by owners Danske Bank". Belfast Telegraph. Retrieved 4 May 2013.

- "Danske Bank puts new bank-notes into circulation". BBC News. 24 June 2013. Retrieved 27 November 2013.

- "Danske Bank Launch New Bank Notes". Belfast City Centre Management. 24 June 2013. Archived from the original on 3 December 2013. Retrieved 29 November 2013.

- "Ulster Bank reveals new note designs". RBS. 6 June 2018. Retrieved 27 February 2020.

- "Ulster Bank introduces new £20 note designs". RBS. 21 August 2019. Retrieved 27 February 2020.

- The Question of Legal Tender

- "States of Alderney Alderney Coins". Alderney Government. Archived from the original on 24 December 2008. Retrieved 6 November 2008.

- "New Jersey banknotes begin circulation". BBC. 29 April 2010. Retrieved 28 February 2011.

- "On Demand" (PDF). States of Jersey-Treasury and Resources. Retrieved 28 February 2011.

- Jersey to issue 100-pound commemorative note in 2012 BanknoteNews.com, Retrieved 15 August 2011.

- Government of Gibraltar (June 1934). "Currency Notes Act" (PDF). Archived (PDF) from the original on 29 October 2008. Retrieved 5 November 2008.

- (in French) Michel Beuret, "Les mystères de la fausse monnaie", Allez savoir !, no. 50, May 2011.

External links

| Wikimedia Commons has media related to Banknotes of the United Kingdom. |

.jpg)