Royal Bank of Scotland

The Royal Bank of Scotland (Scottish Gaelic: Banca Rìoghail na h-Alba,[1] commonly abbreviated as RBS), is one of the retail banking subsidiaries of NatWest Group, together with NatWest and Ulster Bank. The Royal Bank of Scotland has around 700 branches, mainly in Scotland, though there are branches in many larger towns and cities throughout England and Wales. The bank is completely separate from the fellow Edinburgh-based bank, the Bank of Scotland, which pre-dates the Royal Bank by 32 years. The Royal Bank of Scotland was established in 1724 to provide a bank with strong Hanoverian and Whig ties.[2]

| |

| |

| Subsidiary | |

| ISIN | GB00B7T77214 |

| Industry | Finance and insurance |

| Founded | 31 May 1727 |

| Headquarters | Edinburgh, Scotland, UK |

Key people |

|

| Products |

|

Number of employees | 71,200 |

| Parent | NatWest Holdings |

| Website | www |

| Footnotes / references 1 Wholly owned subsidiary of NatWest Group. 2 NatWest Group total. | |

Following ring-fencing of the Group's core domestic business, the bank became a direct subsidiary of NatWest Holdings in 2019. NatWest Markets comprises the Group's investment banking arm. To give it legal form, the former RBS entity was renamed NatWest Markets in 2018; at the same time Adam and Company (which held a separate PRA banking licence) was renamed The Royal Bank of Scotland, with Adam and Company continuing as an RBS private banking brand in Scotland, along the same lines as the Messrs. Drummond and Child & Co. businesses in England.[3]

History

Foundation

The bank traces its origin to the Society of the Subscribed Equivalent Debt, which was set up by investors in the failed Company of Scotland to protect the compensation they received as part of the arrangements of the 1707 Acts of Union. The "Equivalent Society" became the "Equivalent Company" in 1724, and the new company wished to move into banking. The British government received the request favourably as the "Old Bank", the Bank of Scotland, was suspected of having Jacobite sympathies. Accordingly, the "New Bank" was chartered in 1727 as the Royal Bank of Scotland, with Archibald Campbell, Lord Ilay, appointed its first governor.

On 31 May 1728, the Royal Bank of Scotland invented the overdraft, which was later considered an innovation in modern banking.[5] It allowed William Hogg, a merchant in the High Street of Edinburgh, access to £1,000 (£136,244 in today's value)[6] credit.

Competition with the Bank of Scotland

Competition between the Old and New Banks was fierce and centred on the issue of banknotes. The policy of the Royal Bank was to either drive the Bank of Scotland out of business or take it over on favourable terms.

The Royal Bank built up large holdings of the Bank of Scotland's notes, which it acquired in exchange for its own notes, then suddenly presented to the Bank of Scotland for payment. To pay these notes, the Bank of Scotland was forced to call in its loans and, in March 1728, to suspend payments. The suspension relieved the immediate pressure on the Bank of Scotland at the cost of substantial damage to its reputation and gave the Royal Bank a clear space to expand its own business - although the Royal Bank's increased note issue also made it more vulnerable to the same tactics.

Despite talk of a merger with the Bank of Scotland, the Royal Bank did not possess the wherewithal to complete the deal. By September 1728, the Bank of Scotland was able to start redeeming its notes again, with interest, and in March 1729, it resumed lending. To prevent similar attacks in the future, the Bank of Scotland put an "option clause" on its notes, giving it the right to make the notes interest-bearing while delaying payment for six months; the Royal Bank followed suit. Both banks eventually decided that the policy they had followed was mutually self-destructive and a truce was arranged, but it still took until 1751 before the two banks agreed to accept each other's notes.

Scottish expansion

The bank opened its first branch office outside Edinburgh in 1783 when it opened one in Glasgow, in part of a draper's shop in the High Street.[7] Further branches were opened in Dundee, Rothesay, Dalkeith, Greenock, Port Glasgow, and Leith in the first part of the nineteenth century.

In 1821, the bank moved from its original head office in Edinburgh's Old Town to Dundas House, on St. Andrew Square in the New Town. The building as seen along George Street forms the eastern end of the central vista in New Town. It was designed for Sir Lawrence Dundas by Sir William Chambers as a Palladian mansion, completed in 1774. An axial banking hall (Telling Room) behind the building, designed by John Dick Peddie, was added in 1857; it features a domed roof, painted blue internally, with gold star-shaped coffers.[4] The banking hall continues in use as a branch of the bank, and Dundas House remains the registered head office of the bank to this day.

The rest of the nineteenth century saw the bank pursue mergers with other Scottish banks, chiefly as a response to failing institutions. The assets and liabilities of the Western Bank were acquired following its collapse in 1857; the Dundee Banking Company was acquired in 1864. By 1910, the Royal Bank of Scotland had 158 branches and around 900 staff.

By 1969, economic conditions were becoming more difficult for the banking sector. In response, the Royal Bank of Scotland merged with National Commercial Bank of Scotland.[8] The merger resulted in a new holding company, the National and Commercial Banking Group, with 662 branches in Scotland, which all transferred to the Royal Bank name. The holding company was renamed The Royal Bank of Scotland Group in 1979[9] and became NatWest Group in July 2020.[10]

Expansion into England

The expansion of the British Empire in the latter half of the nineteenth century saw the emergence of London as the largest financial centre in the world, attracting Scottish banks to expand southward into England. The first London branch of the Royal Bank of Scotland opened in 1874. However, English banks moved to prevent further expansion by Scottish banks into England; and, after a government committee was set up to examine the matter, the Scottish banks chose to drop their expansion plans. An agreement was reached, under which English banks would not open branches in Scotland and Scottish banks would not open branches in England outside London. This agreement remained in place until the 1960s, although various cross-border acquisitions were permitted.

The Royal Bank's English expansion plans were resurrected after World War I, when it acquired various small English banks, including London-based Drummonds Bank (in 1924), which continued as a branch of the Royal Bank of Scotland; Williams Deacon's Bank, based in northwestern England (in 1930); and Glyn, Mills & Co. (in 1939); the English and Welsh branches were reorganised as Williams & Glyn's Bank in 1969, before adopting to the Royal Bank name in 1985.

Takeover bids

During the late 1970s and early 1980s, the Royal Bank was the subject of three separate takeover approaches. In 1979, Lloyds Bank, which had previously built up a 16.4% stake in the Royal Bank, made a takeover approach for the remaining shares it did not own. The offer was rejected by the board of directors on the basis that it was detrimental to the bank's operations. However, when the Standard Chartered Bank proposed a merger with the Royal Bank in 1980, the board responded favourably. Standard Chartered Bank was headquartered in London, although most of its operations were in the Far East, and the Royal Bank saw advantages in creating a truly international banking group. Approval was received from the Bank of England, and the two banks agreed to a merger plan that would have seen the Standard Chartered acquire the Royal Bank and keep the UK operations based in Edinburgh. However, the bid was scuppered by the Hongkong and Shanghai Banking Corporation (HSBC) which tabled a rival offer. The bid by HSBC was not backed by the Bank of England and was subsequently rejected by the Royal Bank's board. However, the British government referred both bids to the Monopolies and Mergers Commission; both were subsequently rejected as being against the public interest.[11]

The Bank did obtain an international partnership with Banco Santander Central Hispano of Spain, each bank taking a 5% stake in the other. However, this arrangement ended in 2005, when Banco Santander Central Hispano acquired UK bank Abbey National – and both banks sold their respective shareholdings.[12]

International expansion

The first international office of the bank was opened in New York in 1960. Subsequent international banks were opened in Chicago, Los Angeles, Houston, and Hong Kong. In 1988 the bank acquired Citizens Financial Group, a bank based in Rhode Island, United States. Since then, Citizens has acquired several other American banks and in 2004 acquired Charter One Bank.[13]

From 1988 to 2015 it owned Citizens Financial Group, a bank in the United States, and from 2005 to 2009 RBS Group was the second-largest shareholder in the Bank of China, itself the world's fifth-largest bank by market capitalisation in February 2008.[14]

Recent history

On 20 January 2011, Royal Bank of Scotland were fined £28.58 million for anti-competitive practices that were enacted with Barclays in relation to the pricing of loan products for large professional services firms.[15] Also in 2011, Royal Bank of Scotland prevented Basic Account holders from using the ATMs of most rival banks (although they could still use those of NatWest, Tesco, Morrisons and the Post Office).[16]

In June 2012, computer problems prevented customers accessing accounts.[17]

Royal Bank of Scotland released a statement on 12 June 2013 that announced a transition in which CEO Stephen Hester would stand down in December 2013 for the financial institution "to return to private ownership by the end of 2014". For his part in the procession of the transition, Hester received 12 months' pay and benefits worth £1.6 million, as well as the potential for £4 million in shares. The Royal Bank of Scotland stated that, as of the announcement, the search for Hester's successor would commence.[18]

Hester was replaced as CEO by New Zealander Ross McEwan, formerly the head of the bank's retail arm, on 1 October 2013.[19] McEwan, who was 56 years old at the start of his tenure, will receive no bonus for his work in 2013 or at the end of 2014, and his pension will be replaced by an annual cash sum equivalent to 35 percent of his salary as CEO.[20]

In November 2013, Royal Bank of Scotland announced it was in talks to sell a shipping loan in ’Eagle Bulk Shipping Inc.’ worth $800 million.[21] It was also announced in that month that the bank was in talks to sell its equity derivatives business to a buyer rumoured to be BNP Paribas.[22]

In September 2014, Royal Bank of Scotland announced that they would move their headquarters to London in the event of a Yes vote in the Scottish referendum.[23] Whilst this move wouldn't affect day to day banking services in Scotland, there would be several major ramifications; the key issue being that the Scottish version of Royal Bank of Scotland would become a subsidiary to the London-based holding company. Therefore, tax would be paid chiefly through the London-based company, thus depriving Scotland of significant revenues. This would break a near 300-year period in which the Royal Bank of Scotland has been headquartered in Edinburgh.

In March 2015, Royal Bank of Scotland agreed to sell its internationally managed private banking and wealth management business to Switzerland's Union Bancaire Privée UBP SA. The sale includes client relationships managed under Coutts and Adam & Co. brands in Switzerland, Monaco, the UAE, Qatar, Singapore and Hong Kong. The terms of the sale were not announced. The operations being sold has CHF 32-billion of client assets under management. Royal Bank of Scotland will continue to offer private banking and wealth management in the British Isles, as well as to international clients with a strong connection to the UK.[24]

On March 20, 2017, the British paper The Guardian reported that hundreds of banks had helped launder KGB-related funds out of Russia, as uncovered by an investigation named Global Laundromat. The Royal Bank of Scotland was listed among the 17 banks in the UK that were "facing questions over what they knew about the international scheme and why they did not turn away suspicious money transfers," as the bank "handled $113.1 million" in Laundromat cash. Other banks facing scrutiny under the investigation included HSBC, NatWest, Lloyds, Barclays and Coutts. Coutts, owned by RBS, had "accepted $32.8m worth of payments via its office in Zurich, Switzerland." NatWest, also owned by RBS, was named for allowing through $1.1 million in related funds.[25]

In early 2018, The Royal Bank of Scotland Group accounted its plans for restructuring to comply with new UK-wide rules on ring-fencing retail banking operations from investment banking operations. As part of this restructuring, all retail banking assets of the existing Royal Bank of Scotland plc will be transferred to Adam and Company which will assume the Royal Bank of Scotland name in the process. Adam and Company will continue as an RBS private banking brand in Scotland, along the same lines as the Messrs. Drummond and Child & Co. businesses in England.[3]

As part of the restructuring and brand management, it was decided that NatWest would become RBS Group's primary customer-facing brand in England and Wales. As a result, up to 275 Royal Bank of Scotland branded branches in England and Wales will be closed as they are located close to NatWest branded branches which customers will be able to use for counter services instead.[26][27]

On 14 February 2020, it was announced that the holding company of Royal Bank of Scotland (Royal Bank of Scotland Group plc) would be renamed NatWest Group plc later that year, taking the brand under which the majority of its business is delivered. The change took place on 22 July 2020.[28][29][30]

Proposed Williams & Glyn divestment

As a consequence of the British Government taking an 81% shareholding in the RBS Group following the 2007–08 financial crisis, the group was required by a European Commission ruling to sell a portion of its business, as the commission regarded the shareholding as state aid.

Royal Bank of Scotland unveiled plans in 2009 to resurrect the dormant Williams and Glyn's brand name in preparation for the divestment of its Royal Bank of Scotland-branded retail banking business in England and its NatWest branches in Scotland.[31]

On 27 September 2013, the Royal Bank of Scotland Group confirmed it had agreed to sell 308 Royal Bank of Scotland branches in England and Wales and 6 NatWest branches in Scotland to the Corsair consortium. The branches were due to be divested from the group in 2016 as a standalone business operating under the Williams & Glyn name,[32] although, in August 2016, RBS cancelled the spin-off plan, stating that the new bank could not survive independently. It revealed it would instead seek to sell the division to another bank.[33]

In February 2017, HM Treasury suggested that the bank should abandon the plan to sell the division, and instead focus on initiatives to boost competition within business banking in the United Kingdom. The plan would be subject to approval by the European Commission.[34] A final agreement, known as the "Alternative Remedies Package", was reached with the European Commission in September 2017, allowing RBS Group to retain the Williams & Glyn assets and bringing the sale process to a close.

In May 2018, it was announced that 162 RBS branches in England or Wales that were to have become Williams & Glyn will be closed, resulting in almost 800 job losses, with customers able to use nearby NatWest branches for counter services instead.[35] The closure of a further 54 branches was announced in September 2018 with an expected loss of 258 jobs.[36]

Banknotes

Up until the middle of the 19th century, privately owned banks in Great Britain and Ireland were permitted to issue their own banknotes, and money issued by provincial Scottish,[37] English, Welsh and Irish banking companies circulated freely as a means of payment.[38] While the Bank of England eventually gained a monopoly for issuing banknotes in England and Wales, Scottish banks retained the right to issue their own banknotes and continue to do so to this day. The Royal Bank of Scotland, along with Clydesdale Bank and Bank of Scotland, still prints its own banknotes

Notes issued by Scottish banks circulate widely and may be used as a means of payment throughout Scotland and the rest of the United Kingdom; although they do not have the status of legal tender they are accepted as promissory notes. No paper money is legal tender in Scotland, even that issued by the Bank of England (which is legal tender in England and Wales).

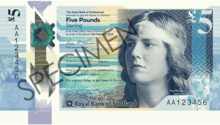

The “Fabric of Nature” series (2016)

As of early 2019 the RBS is in the process of replacing the “Ilay” series, which still provides the £1, £20, £50, and £100 denominations, with the new “Fabric of Nature” series of polymer banknotes. The first polymer notes, the £5, came into circulation on 27 October 2016.[39] The £5 note features Nan Shepherd on the obverse accompanied by a quote from her book 'The Living Mountain', and the Cairngorms in the background. The reverse shows a pair of mackerel, with an excerpt from the poem ‘The Choice’ by Sorley MacLean.[40]

The second polymer note to be introduced was the £10 note, which entered circulation in 2017. It shows Mary Somerville on the obverse, with a quote from her work 'The Connection of the Physical Sciences', and Burntisland beach in the background. The reverse displays two otters and an excerpt from the poem ‘Moorings’ by Norman MacCaig.[40]

The "Ilay" series (1987)

.jpg)

Prior to the current polymer series, the Royal Bank "Ilay" series of banknotes were in circulation, so-called because each denomination featured a picture of Lord Ilay (1682–1761), the first governor of the bank. The image was based on a portrait of Lord Ilay painted in 1744 by the Edinburgh artist Allan Ramsay. The "Ilay" series was introduced in 1987, and while some remain in circulation, they have been replaced by the new polymer notes which were issued from 2016.[41]

The front of the notes also included an engraving of the facade of Dundas House, the mansion of Sir Laurence Dundas in St. Andrew Square, Edinburgh, which was built by Sir William Chambers in 1774 and later became the bank's headquarters; the bank's coat of arms; and the 1969 arrows logo and branding. The background graphic on both sides of the notes was a radial star design which was based on the ornate ceiling of the banking hall in the old headquarters building, designed by John Dick Peddie in 1857.[42][43]

On the back of the notes were images of Scottish castles, with a different castle for each denomination:[42]

- 1 pound note featuring Edinburgh Castle

- 5 pound note featuring Culzean Castle

- 10 pound note featuring Glamis Castle

- 20 pound note featuring Brodick Castle

- 50 pound note featuring Inverness Castle (introduced in 2005)

- 100 pound note featuring Balmoral Castle

The £5 and £10 notes have now been replaced by their “Fabric of Nature” series equivalents.[44]

Commemorative banknotes

Occasionally the Royal Bank of Scotland issues special commemorative banknotes to mark particular occasions or to celebrate famous people. The Royal Bank was the first British bank to print commemorative banknotes in 1992 and followed with several subsequent special issues. These notes are much sought-after by collectors and they rarely remain long in circulation. Examples to date have included:[45][46]

- a £1 note to mark the meeting of the Council of the European Union in Holyrood Palace during the UK's Presidency of the Council of the European Union (1992)

- a £1 note to mark the 100th Anniversary of the death of Robert Louis Stevenson (1994)

- a £1 note to mark the 150th Anniversary of the birth of Alexander Graham Bell (1997)

- a £20 note for the 100th birthday of Queen Elizabeth The Queen Mother (2000)

- a £5 note honouring veteran golfer Jack Nicklaus in his last competitive Open Championship at St Andrews (2005).

- a £1 note to mark the opening of the Scottish Parliament, depicting the General Assembly Hall of the Church of Scotland, the temporary home of the parliament, and a diagram of the floorplan of the new parliament building, designed by Enric Miralles (1999)

- a £50 note to mark the opening of the Royal Bank of Scotland's new headquarters in Gogarburn (2005)

- a £10 note to commemorate the Diamond Jubilee of Elizabeth II. On the reverse of the commemorative note are four intaglio portraits of Elizabeth II, showing her at different stages of her life (2012)[47]

- a £5 note to commemorate the Ryder Cup. It is printed by Giesecke & Devrient on the "Hybrid" substrate.[48]

Services

The Royal Bank of Scotland provides a full range of banking and insurance services to personal, business, and commercial customers. As well as traditional branches, phone, and internet banking, Royal Bank of Scotland has operated "mobile branches" since 1946 using converted vans to serve rural areas. There are currently 19 mobile branches.[49][50]

The bank is authorised by the Prudential Regulation Authority and regulated by both the Financial Conduct Authority and the Prudential Regulation Authority.[51] It participates fully in the Faster Payments Service, an initiative to speed up certain payments, launched in 2008.[52]

In 2006, The Royal Bank of Scotland Group undertook the first trial of PayPass contactless debit and credit cards in Europe.[53] The bank is introducing Visa Debit cards with the technology for current accounts, which can be used to pay for purchases up to £30 by tapping an enabled card on the retailer's terminal.[54] In an effort to enhance security, Royal Bank of Scotland and NatWest introduced hand-held devices in 2007 for use with a card to authorise online banking transactions.[55]

Royal Bank of Scotland is a member of the Cheque and Credit Clearing Company Limited, Bankers' Automated Clearing Services Limited, the Clearing House Automated Payment System Limited and the LINK Interchange Network Limited. It is a member of the Financial Ombudsman Service, UK Payments Administration and of the British Bankers' Association; it subscribes to the Lending Code. The bank is covered by the Financial Services Compensation Scheme with Adam and Company, The One account, Child & Co., Drummonds Bank and Holts under one licence.[51]

Branding

The Royal Bank of Scotland Group uses branding developed for the Bank on its merger with the National Commercial Bank of Scotland in 1969.[56] The Group's logo takes the form of an abstract symbol of four inward-pointing arrows known as the "Daisy Wheel" and is based on an arrangement of 36 piles of coins in a 6 by 6 square,[56] representing the accumulation and concentration of wealth by the Group.[56] The Daisy Wheel logo was later adopted by Royal Bank of Scotland Group subsidiaries Ulster Bank in Ireland, Citizens Financial Group in the United States and, until it was sold in 2010, payment processing company Worldpay.

From 2003, the bank began to move away from referring to both the Group brand and its retail banking brand as "The Royal Bank of Scotland", instead of using the "RBS" initialism. This was intended to support the positioning of the bank as a Global financial services player as opposed to its roots as a national bank, however, "The Royal Bank of Scotland" continued to be used alongside the RBS initialism, with both appearing on bank signage. An example of the current branding can be found in the Six Nations Championship in rugby union, which it sponsors as the RBS 6 Nations or NatWest Six Nations.

In Spring 2014 the full bank name returned to print and television advertising in the form of a new logo with the omission of "The". In August 2016, Ross McEwan confirmed that the bank would use the full name for its business in Scotland in lieu of the RBS acronym, to distance the bank from its previous global expansion plans.[57]

Royal Bank of Scotland sponsored the Williams F1 team from 2005 until the end of 2010.[58] They also were the title sponsor for the Canadian Grand Prix from 2005 until the end of 2008. They have supported tennis player Andy Murray since he was aged 13.[58]

Controversies

The bonus payments paid to Royal Bank of Scotland staff subsequent to the 2008 United Kingdom bank rescue package caused controversy.[59] Staff bonuses were nearly £1 billion in 2010, even though Royal Bank of Scotland reported losses of £1.1 billion for 2010. More than 100 senior bank executives were paid in excess of £1 million each in bonuses.[60] Consequently, former CEO Fred Goodwin was stripped of his knighthood in mid-January, and newly appointed CEO Stephen Hester renounced his £1 million bonus after complaints over the bank's performance.[61]

82 percent of Royal Bank of Scotland's shares are now owned by the UK government, which bought Royal Bank of Scotland stock for £42 billion, representing 50 pence per share. In 2011, the shares were worth 19 pence, representing a taxpayer book loss of £26 billion. Historically, the Royal Bank of Scotland stock price went from a high of over 6,900 pence in early 2007 (taking into account a 3 for 1 reverse stock split that took place later that year) to around 120 pence February 2009 and up to 187 pence by December 2011.[62] In 2012 RBS shares were consolidated on a 1 for 10 basis. The Stock has not recovered from the financial shock of early 2009 and is currently at 316 pence (30 October 2015.) This equated to a price of just 31.6 pence per pre-consolidation share.

Fossil fuel financing

High street Royal Bank of Scotland branches were targeted by protests, after the bank was challenged over its financing of oil and coal mining by charities such as Platform London, People and Planet and Friends of the Earth. In 2007, Royal Bank of Scotland was promoting itself as "The Oil & Gas Bank", although the website www.oilandgasbank.com was later taken down.[63] A Platform London report criticised the bank's lending to oil and gas companies, estimating that the carbon emissions embedded within Royal Bank of Scotland' project finance reached 36.9 million tonnes in 2005, comparable to Scotland's carbon emissions.[64]

Royal Bank of Scotland provides the financial means for companies to build coal-fired power stations and dig new coal mines at sites throughout the world. Royal Bank of Scotland helped to provide an estimated £8 billion from 2006 to 2008 to the energy corporation E.ON and other coal-utilizing companies.[65] In 2012, 2.8% of Royal Bank of Scotland' total lending was provided to the power, oil and gas sectors combined. According to Royal Bank of Scotland' own figures, half of its deals to the energy sector were to wind power projects; although, this only included project finance and not general commercial loans.[66]

Branch closures

In 2010 Royal Bank of Scotland promised not to close bank branches where they were the last in town. In 2014 Royal Bank of Scotland changed direction, and closed 44 branches that are the last in town, as branch transactions had fallen by 30% over the last four years.[67]

Royal Bank of Scotland will close 259 more branches across Britain in its latest round of cuts as customers shift to online banking.[68]

Allegations of asset-stripping small business customers

In October 2016 BBC Newsnight and Buzzfeed published reports from a leaked internal document which showed that RBS had "Systematically Crushed British Businesses"[69] with fines, interest rate hikes and loan withdrawals, often acquiring equity or property at firesale prices, turning a sizeable profit.[70] RBS executives had previously assured Parliament that their Global Restructuring Group (GRG) was not a profit centre.[71] Controversy regarding the GRG was rekindled by the leader of the Liberal Democrats, Vince Cable, and others in January 2018.[72] In February 2018, the Financial Conduct Authority released a "Section 166" report from Promontory Financial Services to Nicky Morgan, Chair of the Treasury Select Committee, detailing widespread abuse of SMEs within GRG. This was despite protracted resistance by the FCA to releasing the report.[73]

See also

- List of investors in Bernard L. Madoff Securities

References

- Token and symbolic use of the Scottish Gaelic name occurs on some Royal Bank of Scotland buildings and customer stationery such as cheque books. Gaelic is not used on the Royal Bank of Scotland website, for contracts or on their banknotes.

- Lenman, Bruce (1992). Integration and Englightenment Scotland 1746–1832. ISBN 9780748603855.

- Treanor, Jill RBS to strengthen NatWest brand The Guardian, 30 September 2016

- "Dundas Mansion, Edinburgh, RBS branch, headquarters, Scotland". Retrieved 21 May 2009.

- "The history of payments in the UK". BBC News. 16 February 2009. Retrieved 13 December 2013.

- UK Retail Price Index inflation figures are based on data from Clark, Gregory (2017). "The Annual RPI and Average Earnings for Britain, 1209 to Present (New Series)". MeasuringWorth. Retrieved 2 February 2020.

- Glasguensis (1862). "Banking in Glasgow during the Olden Times". LSE Selected Pamphlets: 23. JSTOR 60220353.

- "National Commercial Bank of Scotland Ltd, Edinburgh, 1959–69". RBS Heritage Online. The Royal Bank of Scotland Group plc. Retrieved 16 April 2010.

- "The Royal Bank of Scotland plc, Edinburgh, 1727-date". RBS Heritage Online. The Royal Bank of Scotland Group plc. Retrieved 16 April 2010.

- https://www.theguardian.com/business/2020/jul/22/royal-bank-of-scotland-changes-name-to-natwest

- "The Hongkong and Shanghai Banking Corporation, Standard Chartered Bank Limited and The Royal Bank of Scotland Group Limited". Competition Commission. 2 September 2004. Archived from the original on 19 May 2011. Retrieved 18 April 2011.

- William Kay (6 September 2004). "HBOS fury as EU backs Santander's Abbey bid". The Independent. London.

- "Citizens Financial Acquires Charter One". The New York Times. 5 May 2004. Retrieved 9 April 2017.

- "World's largest banks". Financialranks.com. 5 February 2008. Retrieved 18 April 2011.

- "Royal Bank of Scotland fined £28m for price fixing with Barclays", Banking Times, 20 January 2011, archived from the original on 24 January 2011, retrieved 20 January 2011

- "Royal Bank of Scotland cuts some customers' ATM access". BBC. 17 August 2011. Retrieved 13 June 2013.

- Treanor, Jill (26 June 2012). "RBS glitch needs full investigation, says Mervyn King". The Guardian. Retrieved 26 June 2012.

- Robert Peston (12 June 2013). "Royal Bank of Scotland CEO Stephen Hester to stand down". BBC. Retrieved 13 June 2013.

- Scuffham, Matt (1 October 2013). "Royal Bank of Scotland's new CEO takes reins with break-up decision looming". The Baltimore Sun. Reuters. Archived from the original on 4 October 2013.

- "New Royal Bank of Scotland chief Ross McEwan to receive no bonus this year or next". BBC News. 2 August 2013. Retrieved 1 October 2013.

- "Royal Bank of Scotland in talks to sell $800 million shipping loan". Reuters. 11 November 2013.

- Matt Scuffham and Lionel Laurent (18 November 2013). "Royal Bank of Scotland in talks to sell equity derivatives business". Reuters.

- "BBC News – Scottish independence: Royal Bank of Scotland confirms London HQ move if Scotland votes 'Yes'". BBC News.

- "Royal Bank of Scotland sells overseas private banking and wealth management units". 27 March 2015.

- British banks handled vast sums of laundered Russian money in ‘’The Guardian’’ by Luke Harding, Nick Hopkins and Caelainn Barr on Monday, March 20, 2017

- "RBS is to close branches across England and Wales to reduce costs". Mail Online. 27 April 2018. Retrieved 13 January 2019.

- "Subscribe to read". Financial Times. Retrieved 13 January 2019.

- Makortoff, Kalyeena RBS will change name to NatWest as Alison Rose begins overhaul The Guardian, 14 February 2020

- RBS Group to change its name to NatWest BBC News, 14 February 2020

- Partridge, Joanna Royal Bank of Scotland changes name to NatWest The Guardian, 22 July 2020

- Dey, Iain (13 September 2009). "Royal Bank of Scotland to relaunch historic Williams & Glyn's brand after 24-year absence". London: The Times. Retrieved 29 September 2009.

- "Return of Williams & Glyn's moves closer". The Royal Bank of Scotland Group. 27 September 2013. Retrieved 29 September 2013.

- "RBS cancels Williams & Glyn project and loses another £2bn". The Telegraph. 5 August 2016. Retrieved 5 August 2016.

- "RBS plans: Williams & Glyn sale should be dropped, UK says". BBC News. 17 February 2017. Retrieved 17 February 2017.

- ews/business-43964273 "RBS to cut 162 branches and 792 jobs" Check

|url=value (help). BBC News. 1 May 2018. Retrieved 2 May 2018. - Read, Simon (5 September 2018). "RBS to shut 54 more bank branches". Retrieved 13 January 2019 – via www.bbc.co.uk.

- "Bank of Scotland 'family tree'". HBOS History. Archived from the original on 15 September 2007. Retrieved 8 October 2007.

- "British Provincial Banknotes". pp. 1–6. Retrieved 8 October 2007.

- "First RBS plastic banknotes enter circulation". BBC News. 27 October 2016. Retrieved 3 November 2016.

- "New RBS bank notes to feature Nan Shepherd and Mary Somerville". The Scotsman. 25 April 2016. Retrieved 25 April 2016.

- "Archibald Campbell [Mac Cailein Mòr], 3rd Duke of Argyll, 1682 – 1761. Statesman". National Galleries of Scotland – Scottish National Portrait Gallery. 2008. Retrieved 27 April 2013.

- "Our Banknotes – The Ilay Series". The Royal Bank of Scotland Group. 2008. Archived from the original on 26 January 2013. Retrieved 27 April 2013.

- "Dundas Mansion, Edinburgh". Edinburgh Architecture. Retrieved 14 October 2008.

- "Royal Bank of Scotland current banknotes". scotbanks.org.uk. Committee of Scottish Clearing Banks. Retrieved 19 April 2019.

- "Royal Bank Commemorative Notes". Rampant Scotland. Retrieved 14 October 2008.

- "Scottish Parliament Commemorative Bank Note". Rampant Scotland. Retrieved 15 October 2008.

- "Scotland new 10-pound commemorative note confirmed".

- "BBC News – Ryder Cup bank-note design unveiled". BBC News.

- "Mobile Branch". rbs.co.uk.

- "Mobile bank at Appin". Flickr – Photo Sharing!.

- "Website terms & conditions and FSCS". The Royal Bank of Scotland. 2015. Retrieved 4 November 2015.

- "Faster payments – how long?". Moneybox. BBC News. 24 May 2008. Retrieved 4 November 2015.

- Royal Bank of Scotland Group and Mastercard Join Forces for London Roll-out of Contactless Debit and Credit Cards Archived 12 February 2008 at the Wayback Machine MasterCard Europe, Press Release 6, 4 May 2007

- "Your contactless debit card". The Royal Bank of Scotland. 2015. Retrieved 4 November 2015.

- "Bank issues net security device". BBC News. 2 October 2007. Retrieved 4 November 2015.

- "Our History". Archived from the original on 15 March 2008. Retrieved 8 April 2008.

- Fraser, Douglas (12 August 2016). "Royal Bank of Scotland to disappear for customers outside Scotland". BBC News. Retrieved 20 August 2016.

- Bose, Mihir (25 February 2009). "RBS cutbacks to hit British sport". BBC News.

- "New outrage over billion-pound bonus plans at Barclays and Royal Bank of Scotland". Guardian Newspaper. 14 February 2010.

- "Royal Bank of Scotland bankers get £950 million in bonuses despite £1.1bn loss". Guardian Newspaper. 21 February 2011.

- "Frankfurt Business Media". Archived from the original on 4 September 2012. Retrieved 17 September 2012.

- "Royal Bank of Scotland Stock Price". Yahoo Finance. 1 December 2011.

- "Dirty Money: Corporate Greenwash & Royal Bank of Scotland coal finance" (PDF). Platform. March 2011. Retrieved 13 February 2014.

- "The Oil & Gas Bank" (PDF). Platform. March 2007. Retrieved 13 December 2013.

- Terry Macalister (11 August 2008). "Climate change: High street banks face consumer boycott over investment in coal projects". Guardian. UK. Retrieved 18 April 2011.

- "Energy sector lending". Royal Bank of Scotland. Royal Bank of Scotland. 2013. Archived from the original on 12 December 2013. Retrieved 13 December 2013.

- "BBC News – Royal Bank of Scotland to close 44 branches across UK". BBC News.

- Spezzati, Stefania (1 December 2017). "RBS to Shut 259 More Branches Amid Shift to Digital Banking". Bloomberg. Retrieved 12 December 2017.

- "Buzzfeed – The Dash For Cash: Leaked Files Reveal RBS Systematically Crushed British Businesses For Profit". Buzzfeed.

- "BBC News – RBS squeezed struggling businesses to boost profits, leak reveals". BBC News.

- "The Week – RBS bosses set to be hauled before MPs again". The Week.

- "Vince Cable 'disgusted' with FCA over RBS mistreatment of small firms". Guardian.

- "Subscribe to read". Financial Times. Retrieved 13 January 2019.

External links

| Wikimedia Commons has media related to Royal Bank of Scotland. |

- Official website

- Royal Bank of Scotland companies grouped at OpenCorporates

- Historical banknotes of the Royal Bank of Scotland (in English and German)