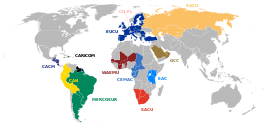

Customs union

A customs union is generally defined as a type of trade bloc which is composed of a free trade area with a common external tariff.[1]

| Part of a series on |

| World trade |

|---|

|

|

Economic integration

|

Customs unions are established through trade pacts where the participant countries set up common external trade policy (in some cases they use different import quotas). Common competition policy is also helpful to avoid competition deficiency.[2]

Purposes for establishing a customs union normally include increasing economic efficiency and establishing closer political and cultural ties between the member countries. It is the third stage of economic integration.

Every economic union, customs and monetary union and economic and monetary union includes a customs union.

WTO Definition

The General Agreement on Tariffs and Trade, part of the World Trade Organization framework defines a customs union in the following way:[1]

(a) A customs union shall be understood to mean the substitution of a single customs territory for two or more customs territories, so that

(i) duties and other restrictive regulations of commerce (except, where necessary, those permitted under Articles XI, XII, XIII, XIV, XV and XX) are eliminated with respect to substantially all the trade between the constituent territories of the union or at least with respect to substantially all the trade in products originating in such territories, and,

(ii) subject to the provisions of paragraph 9, substantially the same duties and other regulations of commerce are applied by each of the members of the union to the trade of territories not included in the union;

Historical background

The German Customs Union, which was established in 1834 and gradually developed and expanded, was a customs union organization that appeared earlier and played a role in promoting German economic development and political unification at that time. Before the establishment of the unified German Empire in the 1870s, there were checkpoints between and within the German states, which hindered the development of industry and commerce. In 1818, Prussia took the lead in abolishing the customs duties in the Mainland; it was followed by the establishment of the North German Customs Union in 1826; two years later, two customs unions were established in the states of China and South Germany.[3]

In 1834, 18 states joined together to form the German Customs Union with Prussia as the main leader; thereafter, this alliance was further expanded to all German-speaking regions and became the All-German Customs Union. The contents of the alliance convention include: abolishing internal tariffs, unifying external tariffs, raising import tax rates, and allocating tariff income to all states in the alliance in proportion. In addition, there are the French and Monaco Customs Union established in 1865.

The customs union established by Switzerland and the Principality of Liechtenstein in 1924; the customs union established by Belgium, the Netherlands, and Luxembourg in 1948; the customs union established by the countries of the European Economic Community in 1958; the European Free Trade Association once established in 1960; and the Economic Community of Central African States established in 1964. At that time, the European Free Trade Association was different from the European Economic Community Customs Union. Free trade within the former was limited to industrial products, and no uniform tariffs were imposed on countries outside the Union.[4][5]

Main feature

The main feature of the Customs Union is that the member countries have not only eliminated trade barriers and implemented free trade, but also established a common external tariff. In other words, in addition to agreeing to eliminate each other ’s trade barriers, members of the Customs Union also adopt common external tariff and trade policies.[6] GATT stipulates that if the customs union is not established immediately, but is gradually completed over a period of time, it should be completed within a reasonable period, which generally does not exceed 10 years.[7]

Protect measures

The exclusive protection measures of the Customs Union mainly include the following:[8]

- Reduce tariffs until the tariffs within the union are cancelled. In order to achieve this goal, the alliance often stipulates that the member countries must transition from their current external tariff rates to the unified tariff rates stipulated by the alliance in stages within a certain period of time, until finally canceling tariff.

- Formulate a unified foreign trade policy and foreign tariff rates. In terms of foreign affairs, allied members must increase or decrease their original foreign tariff rates within the prescribed time, and eventually establish a common external tariff rate; and gradually unify their foreign trade policies, such as foreign discrimination policies and import quantities.

- For goods imported from outside the alliance, common different tariffs are levied, such as preferential tax rates, agreed national tax rates, most-favored nation tax rates, ordinary preferential tax rates, and ordinary tax rates, according to the types of commodities and the provider countries.

- Formulate unified protective measures, such as import quotas, health and epidemic prevention standards, etc.[9]

Meaning

- It avoids the problem that the free trade zone needs to be supplemented by the principle of origin to maintain the normal flow of commodities. Here, instead of the principle of origin, a common 'foreign barrier' is built. In this sense, the customs union is more exclusive than the free trade zone.[10]

- It makes the 'national sovereignty' of the member countries to be transferred to the economic integration organization to a greater extent, so that once a country joins a customs union, it loses its right to autonomous tariffs. In reality, the more typical customs union is the European Economic Community established in 1958.

Economic Effects

The Customs Union started in Europe and is one of the organizational forms of economic integration. The customs union has two economic effects, static effects and dynamic effects.

- Static effect

There are trade creation effects and trade diversion effects. The trade creation effect refers to the benefits generated by products from domestic production with higher production costs to the production of customs union countries with lower costs. The trade diversion effect refers to the loss incurred when a product is imported from a non-member country with lower production costs to a member country with a higher cost. This is the price of joining the customs union. When the trade creation effect is greater than the transfer effect, the combined effect of joining the Customs Union on the member countries is net profit, which means an increase in the economic welfare level of the member countries; otherwise, it is a net loss and a decline in the economic welfare level.

The trade creation effect is usually regarded as a positive effect. This is because the domestic production cost of country A is higher than the production cost of country A ’s imports from country B. The Customs Union made Country A give up the domestic production of some commodities and change it to Country B to produce these commodities. From a worldwide perspective, this kind of production conversion improves the efficiency of resource allocation.[11]

- Dynamic effect

The customs union will not only bring static effects to member states, but also bring some dynamic effects to them. Sometimes, this dynamic effect is more important than its static effect, which has an important impact on the economic growth of member countries.[12]

- The first dynamic effect of the customs union is the large market effect (or economies of scale effect). After the establishment of the customs union, good conditions have been created for the mutual export of products between member countries. This expansion of the market has promoted the development of enterprise production, allowing producers to continuously expand production scale, reduce costs, enjoy the benefits of economies of scale, and can further enhance the externality of enterprises within the alliance, especially for non-member companies competitive power. Therefore, the large market effect created by the Customs Union has triggered the realization of economies of scale.

- The establishment of the Customs Union has promoted competition among enterprises among member countries. Before the member states formed a customs union, many sectors had formed domestic monopolies, and several enterprises had occupied the domestic market for a long time and obtained excessive monopoly profits. Therefore, it is not conducive to the resource allocation and technological progress of various countries. After the formation of the customs union, due to the mutual openness of the markets of various countries, enterprises of various countries face competition from similar enterprises in other member countries. As a result, in order to gain a favorable position in the competition, enterprises will inevitably increase research and development investment and continuously reduce production costs, thereby creating a strong competitive atmosphere within the alliance, improving economic efficiency, and promoting technological progress.[13]

- The establishment of a customs union helps to attract external investment. The establishment of a customs union implies the exclusion of products from non-members. In order to counteract such adverse effects, countries outside the alliance may transfer enterprises to some countries within the customs union to directly produce and sell locally in order to bypass uniform tariff and non-tariff barriers. This objectively generates capital inflows that accompany the transfer of production, attracting large amounts of foreign direct investment.

Lists of customs unions

Current

| Agreement | Date (in force) | Recent reference |

|---|---|---|

| 1988-05-25 | L/6737 | |

| 1991-01-01 | ||

| 2004-10-06 | WT/REG93/R/B/2 | |

| 2005-01-01[14] | ||

| 2005-01-01[15] | WT/COMTD/N/14 | |

| 1999-06-01[16] | ||

| 2010-07-01[17] | ||

| 1958 | ||

| ∟ | 1991-07-01 | WT/REG53/M/3 |

| ∟ | 2002-04-01 | |

| ∟ | 1996-01-01 | WT/REG22/M/4 |

| 2015-01-01[18][19][20] | ||

| 1994[21] | [22][23] | |

| 1991-11-29 | WT/COMTD/1/Add.17 | |

| Southern African Customs Union (SACU) | 1910[24] | WT/REG231/3 |

| 1924 | ||

| West African Economic and Monetary Union (WAEMU) | 1994-01-10 | WT/COMTD/N/11/Add.1 |

| 2019-03-13 | [25] |

Additionally, the autonomous and dependent territories such as some of the EU member state special territories are sometimes treated as separate customs territories from their mainland states or have varying arrangements of formal or de facto customs union, common market and currency union (or combinations thereof) with the mainland and in regards to third countries through the trade pacts signed by the mainland state.[26]

Proposed

- 2010

- 2011 Economic Community of Central African States (ECCAS)

- 2015

- 2021

Defunct

- Customs and Economic Union of Central Africa (UDEAC) – superseded by CEMAC

.svg.png)

- The former Zollverein of the Holy Roman Empire and the succeeding German confederations

.svg.png)

- Czechia and Slovakia from the dissolution of Czechoslovakia on 1st January 1993 until both countries' accession to the European Union on 1st May 2004.

Further reading

- The McGill University Faculty of Law runs a Regional Trade Agreements Database that contains the text of almost all preferential and regional trade agreements in the world. ptas.mcgill.ca

- Michael T. Florinsky. 1934. The Saar Struggle. New York: The Macmillan Company.

See also

- European Customs Information Portal (ECIP)

- List of international trade topics

- Trade creation

- Trade diversion

References

- GATT, Article 24, s. 8 (a)

- Winters, Alan L (1991). International Economics, Volume IV. Routledge. pp. 528 pages. ISBN 9780203028384.

- Flaherty, Jane (2018). "Tariff Wars and the Politics of Jacksonian America by William K. Bolt". Journal of Southern History. 84 (4): 981–982. doi:10.1353/soh.2018.0262. ISSN 2325-6893.

- "Discussion". Brookings Trade Forum. 2002 (1): 227–230. 2002. doi:10.1353/btf.2003.0003. ISSN 1534-0635.

- Chang, Ha-Joon (2013), The Industrial Policy Revolution II, Palgrave Macmillan UK, pp. 114–132, doi:10.1057/9781137335234_5, ISBN 978-1-137-37450-9 Missing or empty

|title=(help);|chapter=ignored (help) - "Free Trade". IGM Forum. March 13, 2012.

- Flaherty, Jane (2018). "Tariff Wars and the Politics of Jacksonian America by William K. Bolt". Journal of Southern History. 84 (4): 981–982. doi:10.1353/soh.2018.0262. ISSN 2325-6893.

- Simonova, Aleksandra (2019), From Russia with Code, Duke University Press, doi:10.1215/9781478003342-007, ISBN 978-1-4780-0334-2 Missing or empty

|title=(help);|chapter=ignored (help) - Diamond, Peter A.; Mirrlees, James A. (2002). "Optimal Taxation and The Le Chatelier Principle". SSRN Working Paper Series. doi:10.2139/ssrn.331300. hdl:1721.1/63998. ISSN 1556-5068.

- Krugman, Paul R. (2005). Microeconomics. Wells, Robin, 1959-. New York: Worth. ISBN 0-7167-5229-8. OCLC 58043929.

- Smirnov, Valery (29 March 2019). "Management Of Food Import Substitution In Russia". The European Proceedings of Social and Behavioural Sciences. Cognitive-Crcs: 805–811. doi:10.15405/epsbs.2019.03.02.92. Cite journal requires

|journal=(help) - Smirnov, Valery (29 March 2019). "Management Of Food Import Substitution In Russia". The European Proceedings of Social and Behavioural Sciences. Cognitive-Crcs: 805–811. doi:10.15405/epsbs.2019.03.02.92. Cite journal requires

|journal=(help) - Krugman, Paul; Wells, Robin (2017). Volkswirtschaftslehre. Schäffer-Poeschel. doi:10.34156/9783791039237. ISBN 978-3-7910-3923-7.

- Signed 1993-11-5, but entered into force in 1994-12-8.

- Signed 2000-7-7, but implemented in 2005.

- Signed 1994-05-16, but implemented in 1999.

- Customs Union of Eurasian Economic Community (EurAsEC) envisioned in its 1997-10-08 agreement, but not implemented. WT/REG71/8 Archived 5 March 2009 at the Wayback Machine

- Agreed on 2003-01-01, WT/COMTD/N/25 Archived 5 March 2009 at the Wayback Machine

- "GCC countries postpone customs union move".

- "GCC customs union fully operational". The Peninsula. 3 January 2015. Archived from the original on 18 January 2015. Retrieved 24 January 2016.

- Established following the Oslo Accords and the Paris protocol.

- Paris Protocol. B'Tselem, 19 September 2012

- Iqtisadi: The Israeli-Palestinian Economic Agreement and Current Consequences Archived 7 March 2016 at the Wayback Machine. Ephraim Lavie, Moshe Dayan Center–Tel Aviv University, January 2013

- latest revision is from 2004-07-15.

- "Market access arrangements for financial services between the UK and Gibraltar: a consultation". Gov.UK. 11 March 2020.

- EU Overseas countries and some other territories participate partially in the EU single market per part four of the Treaty Establishing the European Community; some EU Outermost Regions and other territories use the Euro of the currency union, others are part of the customs union; some participate in both unions and some in neither. Territories of the United States, Australian External Territories and Realm of New Zealand territories share the currency and mostly also the market of their respective mainland state, but are generally not part of its customs territory.

- "Leaders set to approve Arab customs union". Gulf Daily News. 18 January 2009.

- "Lebanon – FOREIGN RELATIONS".