Economic history of Portugal

The economic history of Portugal covers the development of the economy throughout the course of Portuguese history. It has its roots prior to nationality, when Roman occupation developed a thriving economy in Hispania, in the provinces of Lusitania and Gallaecia, as producers and exporters to the Roman Empire. This continued under the Visigoths and then Al-Andalus Moorish rule, until the Kingdom of Portugal was established in 1139.

Part of a series on the |

|---|

| History of Portugal |

.svg.png) |

|

|

| Timeline |

|

|

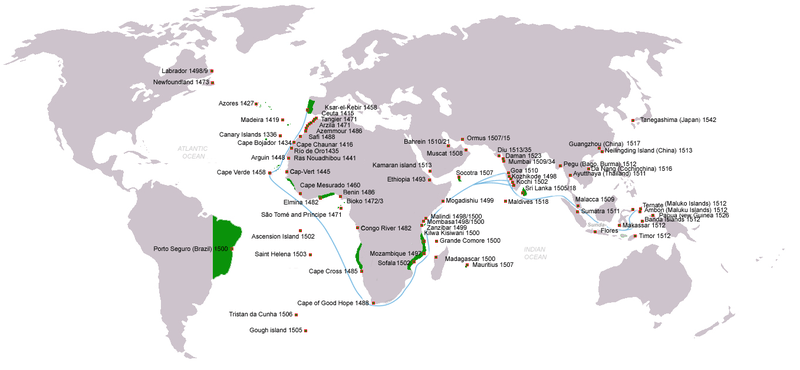

With the end of Portuguese reconquista and integration in the European Middle Age economy, the Portuguese were at the forefront of maritime exploration of the age of discovery, expanding to become the first global empire. Portugal then became the world's main economic power during the Renaissance, introducing most of Africa and the East to European society, and establishing a multi-continental trading system extending from Japan to Brazil.[1]

In 1822, Portugal lost its main colony, Brazil. The transition from absolutism to a parliamentary monarchy involved a devastating Civil War from 1828-34. The governments of the constitutional monarchy were not able to truly industrialise and modernise the country; by the dawn of the twentieth century, Portugal had a GDP per capita of 40% of the Western European average and an illiteracy rate of 74%.[2][3] Portuguese territorial claims in Africa were challenged during the Scramble for Africa. Political chaos and economic problems endured from the last years of the monarchy to the first Republic of 1910–1926, which led to the installing of a national dictatorship in 1926. While Finance Minister António de Oliveira Salazar managed to discipline the Portuguese public finances, it evolved into a single-party corporative regime in the early 1930s—the Estado Novo—whose first three decades were also marked by a relative stagnation and underdevelopment; as such, by 1960 the Portuguese GDP per capita was only 38% of the EC-12 average.[4]

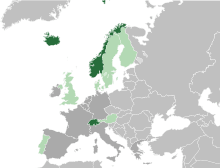

Starting in the early-1960s, Portugal entered in a period of robust economic growth and structural modernisation, owing to a liberalisation of the economy.[5] As an expression of such economic opening, in 1960 the country was one of the EFTA founding member states. Yearly growth rates sometimes with two digits, allowed the Portuguese GDP per capita to reach 56% of the EC-12 average by 1973.[4] This growth period eventually ended in the mid-1970s, for that contributing the 1973 oil crisis and the political turmoil following the 25 April 1974 coup which led to the transition to democracy. From 1974 to the late-1970s, over one million Portuguese citizens arrived from the former African overseas colonies, most as destitute refugees—the retornados.[6][7] After nearly a decade of economic troubles, during which Portugal received two IMF-monitored bailouts, in 1986 the country entered the European Economic Community (and left the EFTA). The European Union's structural and cohesion funds and the growth of many of Portugal's main exporting companies were leading forces in a new period of robust economic growth and socio-economic development which would last (though with a short crisis around 1992–94) to the early-2000s. In 1991, GDP per capita surpassed the 1973 level[4] and by 2000 it had achieved 70% of the EU-12 average, which nonetheless constituted an approach to the Western European standards of living without precedents in the centuries before.[8] Similarly, for several years Portuguese subsidiaries of large multinational companies ranked among the most productive in the world.[9][10][11] However, the economy has been stagnated since the early-2000s and was heavily hit by the effects of the Great Recession, which eventually led to an IMF/EU-monitored bailout from 2011-14.

The country adopted the euro in 1999. Despite being both a developed country and a high income country, Portugal's GDP per capita was of about 80% of the EU-27 average.[12] The Global Competitiveness Report of 2008–2009 ranked Portugal 43rd out of 134 countries and territories.[13] Research by the Economist Intelligence Unit's (EIU) Quality of Life survey in 2005[14] ranked Portugal 19th in the world. Portugal is home to a number of major companies with international reputation such as Grupo Portucel Soporcel, a major world player in the international paper market, Sonae Indústria, the largest producer of wood-based panels in the world, Corticeira Amorim, the world leader in cork production, and Conservas Ramirez, the oldest canned fish producer in continuous operation.

Pre-nationality

Before the arrival of Romans in Iberia, the peninsula had a rural-based subsistence economy with very limited trade, with the exception of large cities on the Mediterranean coast, which had contact with Greek and Phoenician traders. Pre-Celts and Celts were some of the first groups present in the territory, with the Celtic economy centered on cattle raising, agriculture, and metal working.

Roman province

The territory's mineral wealth made it an important strategic region during the early metal ages, and one of the first objectives of the Romans when invading the peninsula was to access the mines and other resources. After the Second Punic War, from 29 BC to 411 AD, Rome governed the Iberian peninsula, expanding and diversifying the economy, and extending trade with the Roman Empire. Indigenous peoples paid tribute to Rome through an intricate web of alliances and allegiances. The economy experienced a major production expansion, profiting from some of the best agricultural lands under Roman hegemony and fueled by roads, trade routes, and the minting of coins, which eased commercial transactions. Lusitania developed, driven by an intensive mining industry; fields explored included the Aljustrel mines (Vipasca), São Domingos, and Riotinto in the Iberian Pyrite Belt, which extended to Seville, and contained copper, silver, and gold. All mines belonged to the Roman Senate, and were operated by slaves.

Subsistence agriculture was replaced by large farming units (Roman villas) producing olive oil, cereals, and wine, and rearing livestock. This farming activity was located mainly in the region to the south of the Tagus River, the third largest grain-producing area in the Roman Empire.

There was also development in fishing activity, producing the valued garum or liquamen, a condiment obtained from the maceration of fish, preferably tuna and mackerel, exported throughout the entire empire. The largest producer of the entire Roman Empire was in Tróia Peninsula, near modern Setúbal, south of Lisbon. Remains of garum manufacturing plants show a sharp growth of the canning industry in Portugal, mainly on the coast of Algarve, but also in Póvoa de Varzim, Angeiras (Matosinhos), and the estuary of the Sado River, which made it one of the most important centers for canners in Hispania. At the same time, specialized industries also developed. The fish salting and canning in turn required the development of salt, shipbuilding, and ceramic industries, to facilitate the manufacture of amphorae and other containers that allowed the storage and transport of commodities such as oil, wine, cereals, and preserves.

Germanic rule

With the decline of the Roman Empire, circa 410–418, Suebi and Visigoths took over the power vacuum left by Roman administrators and established themselves as nobility, with some degree of centralized power at their capitals in Braga and Toledo. Although it suffered some decline, Roman law remained in the Visigothic Code, and infrastructure, such as roads, bridges, aqueducts, and irrigation systems, was maintained to varying degrees. While trade dwindled in most of the former Roman lands in Europe, it survived to some degree in Visigothic Hispania.

Al-Andalus

In 711, Moors occupied large parts of the Iberian Peninsula, establishing the Al-Andalus. They maintained much of the Roman legacy; they repaired and extended Roman infrastructure, using it for irrigation, while introducing new agricultural practices and novel crops, such as sugar cane, rice, citrus fruit, apricots, and cotton. Trade flourished with effective systems of contract relied upon by merchants, who would buy and sell on commission, with money lent to them by wealthy investors, or a joint investment of several merchants, who were often Muslim, Christian, and Jewish.

Little is directly known from the economic structures of the region due to the paucity of Arab sources. It is however possible to advance a few assertions. The constant warfare between Muslims and Christians and among Muslims certainly costed the region dearly and must have participated to the rampant problems of underpopulation experienced by the Gharb Al-Andalus. As a matter of example, several attempts to repopulate the regions north of Coimbra to guarantee a line of defense against the Christian kingdom failed. The economy was heavily influenced both by structural Islamic habits (creation of cities) and the direction chosen by the dominating Muslim ruler of the Maghrib and al-Andalus. For instance, the great interest paid by the Almohad dynasty to the Atlantic helped develop the military and civilian (trade, fishery) activities of the western Iberian ports such as Sevilla, Lisbon, etc. Despite a general impression of sustained development, specially during the 10th and 11th centuries when the area witnessed a noticeable demographic expansion, the Gharb al-Andalus also underwent some dramatic episodes such as the great famine of 740 which decimated the Berber colonists of the Douro region.[15]

Business partnerships would be made for many commercial ventures, and bonds of kinship enabled trade networks to form over huge distances. Muslims were involved in trade extending into Asia, and Muslim merchants traveled long distances for commercial activities.[16] After 800 years of warfare, the Catholic kingdoms gradually became more powerful and eventually expelled the Moors from the peninsula. In the case of the Kingdom of Portugal it happened in the 13th century; in the Algarve. The combined forces of Portugal, Aragon and Castile defeated the last Iberian Muslim strongholds in the 15th century.

Kingdom of Portugal

In 1139, the Kingdom of Portugal achieved independence from the Kingdom of León, having doubled its area through the Reconquista (the reconquest of former Christian lands to the Muslim rulers established in the Iberian Peninsula) under Afonso Henriques, first King of Portugal. His successor, Sancho I, accumulated the first national treasury, and supported new industries and the middle class of merchants. Moreover, he created several new towns, such as Guarda in 1199, and took great care in populating remote areas.

Middle ages

Starting in 1212, Afonso II of Portugal established the state's administration, designing the first set of Portuguese written laws. These were mainly concerned with private property, civil justice, and minting. He sent ambassadors to European kingdoms outside the Iberian Peninsula to begin commercial relations. The earliest references of commercial relations between Portugal and the County of Flanders document Portuguese attendance at Lille's fair in 1267.[17] In 1297, with the Reconquista completed, King Denis pursued policies on legislation and centralization of power, adopting Portuguese as the official language. He encouraged the discovery and exploitation of sulphur, silver, tin, and iron mines, and organized for the export of surplus production to other European countries. On 10 May 1293, King Denis instituted the Bolsa de Comércio, a commercial fund for the defense of Portuguese traders in foreign ports,[18] such as the County of Flanders, which were to pay certain sums according to tonnage, accrued to them when necessary. In 1308, he signed Portugal's first commercial agreement with England.[19] He distributed land, promoted agriculture, organized communities of farmers and took a personal interest in the development of exports, founding and regulating regular markets in a number of towns. In 1317, he made a pact with the Genoese merchant sailor Manuel Pessanha (Pesagno), appointing him Admiral and giving him trade privileges with his homeland, in return for twenty warships and crews. The intention was the defense of the country against pirates, and it laid the basis for the Portuguese Navy and the establishment of a Genoese merchant community in Portugal.[20]

Agriculture was Portugal's main activity, with produce mostly consumed internally. Wine and dried fruits from the Algarve (figs, grapes, and almonds) were sold in Flanders and England, salt from Setúbal and Aveiro was a profitable export to northern Europe, and leather and kermes, a scarlet dye, were also exported. Industry was minimal, and Portugal imported armor and munitions, fine clothes, and several manufactured products from Flanders and Italy. Since the 13th century, a monetary economy had been stimulated, but barter still dominated trade, and coinage was limited; foreign currency was also used until the beginning of the 15th century.[21]

In the second half of the 14th century, outbreaks of bubonic plague led to severe depopulation: the economy was extremely localized in a few towns, and migration from the country led to land being abandoned to agriculture and resulted in rises in rural unemployment. Only the sea offered alternatives, with most populations settling in fishing and trading coastal areas.[22]

Between 1325 and 1357, Afonso IV granted public funding to raise a proper commercial fleet and ordered the first maritime explorations, with the help of Genoese sailors under the command of admiral Manuel Pessanha. Forced to reduce their activities in the Black Sea, the Republic of Genoa had turned to the north African trade of wheat and olive oil (valued also as an energy source), and a search for gold, although they also visited the ports of Bruges (Flanders) and England. In 1341, the Canary Islands were officially discovered under the patronage of the Portuguese king, but in 1344 Castile disputed them, further propelling the development of the Portuguese navy.[23]

To promote settlement, the Sesmarias law was issued in 1375, expropriating vacant lands and leasing it to unemployed cultivators, without great effect: by the end of the century, Portugal faced food shortages, having to import wheat from north Africa. After the 1383–1385 Crisis—combining a succession crisis, war with Castile, and Lisbon plagued by famine and anarchy—a newly elected Aviz dynasty, with strong links to England, marked an eclipse of the conservative land-oriented aristocracy.

Expansion of the Portuguese empire (15th and 16th centuries)

In 1415, Ceuta was conquered by the Portuguese with the aim of controlling navigation of the African coast, expanding Christianity with the avail of the papacy, and providing the nobility with war. The king's son, Henry the Navigator, then became aware of the profitability of the Saharan trade routes. Governor of the rich 'Order of Christ' and holding valuable monopolies on resources in the Algarve, he sponsored voyages down the coast of Mauritania, gathering a group of merchants, shipowners, and stakeholders interested in the sea lanes. Later, his brother Prince Pedro granted him a "Royal Flush" of all profits from trading within the discovered areas. Soon the Atlantic islands of Madeira (1420) and Azores (1427) were reached and began to be settled, producing wheat for export to Portugal. By the beginning of the reign of King Duarte I in 1433, the Real became the currency unit in Portugal,[24] and remained so up to the 20th century.

In January 1430, Princess Isabella of Portugal married Philip III, Duke of Burgundy, Artur Côrte-Real, Count of Flanders. Around 2,000 Portuguese accompanied her, developing great activity in trade and finance in what was then the richest European court. With Portuguese support, Bruges shipyard was started, and in 1438 the Duke granted the Portuguese traders the opportunity to elect consuls with legal powers, thus giving full civil jurisdiction to the Portuguese community. In 1445, the Portuguese Feitoria of Bruges was built.

In 1443, Prince Pedro, Henry's brother, granted him the monopoly of navigation, war, and trade in the lands south of Cape Bojador. Later, this monopoly would be enforced by the Papal bulls Dum Diversas (1452) and Romanus Pontifex (1455), granting Portugal the trade monopoly for the newly discovered lands.[25]

When the Portuguese first sailed down the Atlantic, extending their influence on coastal Africa, they were interested in gold.[26] Trade in sub-Saharan Africa was controlled by Muslims, who controlled trans-Saharan trade routes for salt, kola, textiles, fish, and grain, and engaged in the Arab slave trade.[27]

To attract Muslim traders along the routes traveled in North Africa, the first factory trading post was built in 1445 on the island of Arguin, off the coast of Mauritania. Portuguese merchants accessed the interior via the Senegal and Gambia rivers, which bisected long-standing trans-Saharan routes. They brought in copperware, cloth, tools, wine, and horses, and later included arms and ammunition. In exchange, they received gold from the mines of Akan, Guinea pepper (a trade which lasted until Vasco da Gama reached India in 1498), and ivory. The expanding market opportunities in Europe and the Mediterranean resulted in increased trade across the Sahara.[28] There was a very small market for African slaves as domestic workers in Europe, and as workers on the sugar plantations of the Mediterranean and later Madeira. The Portuguese found they could make considerable amounts of gold by transporting slaves from one trading post to another, along the Atlantic coast of Africa: Muslim merchants had a high demand for slaves, which were used as porters on the trans-Saharan routes, and for sale in the Islamic Empire.

Atlantic Islands' sugar trade

Expansion of sugar cane agriculture in Madeira's captaincies started in 1455, using advisers from Sicily and (largely) the Genoese capital to produce the "sweet salt" rare in Europe. Already cultivated in Algarve, the accessibility of Madeira attracted Genoese and Flemish traders keen to bypass Venetian monopolies. Sugarcane production became a leading factor in the island's economy, and the establishment of plantations on Madeira, the Canary Islands, and the Cape Verde Islands increased the demand for labor. Rather than trading slaves back to Muslim merchants, there was an emerging market for agricultural workers on the plantations. By 1500, the Portuguese had transported approximately 81,000 slaves to these various markets,[29] and the proportion of imported slaves in Madeira reached 10% of the total population by the 16th century.[30] By 1480, Antwerp had some 70 ships engaged in the Madeira sugar trade, with refining and distribution concentrated in the city. By the 1490s, Madeira had overtaken Cyprus in the production of sugar,[31] and the success of sugar merchants such as Bartolomeo Marchionni would propel the investment in exploratory travel.

Guinean gold

In 1469, responding to meager returns from African explorations, King Afonso V granted monopoly of trade in part of the Gulf of Guinea to the merchant Fernão Gomes. For an annual rent of 200,000 reais, Gomes was to explore 100 leagues of the coast of Africa annually, for five years (later the agreement would be extended for another year).[32] He gained monopoly trading rights for a popular substitute of black pepper, then called "malagueta", the guinea pepper (Aframomum melegueta), for another yearly payment of 100,000 reais.[32] The Portuguese found Muslim merchants entrenched along the African coast as far as the Bight of Benin.[33] The slave coast, as the Bight of Benin was known, was reached by the Portuguese at the start of the 1470s. It was not until they reached the Kingdom of Kongo's coast in the 1480s that they exceeded Muslim trading territory.

Under Gomes' sponsorship, the equator was crossed and the islands of the Gulf of Guinea were reached, including São Tomé and Príncipe.

On the coast, Gomes found a thriving alluvial gold trade among the natives and visiting Arab and Berber traders at the port then named A Mina (meaning "the mine"), where he established a trading post. Trade between Elmina and Portugal grew over the next decade. The port became a major trading center for gold and slaves purchased from local African peoples along the slave rivers of Benin. Using his profits from African trade, Fernão Gomes assisted the Portuguese king in the conquests of Asilah, Alcácer Ceguer, and Tangier in Morocco.

Given the large profits, in 1482 the newly crowned king John II ordered a factory to be built in Elmina, to manage the local gold industry: Elmina Castle.[34] São Jorge da Mina Factory centralized trade, which was held again as a royal monopoly. The Company of Guinea was founded in Lisbon as a government institution that was to deal with trade and fix the prices of the goods.

15th-century Portuguese exploration of the African coast is commonly regarded as the harbinger of European colonialism, and marked the beginning of the Atlantic slave trade, Christian missionary evangelization, and the first globalization processes, which were to become a major element of European colonialism until the end of the 18th century. By the beginning of the colonial era there were forty forts operating along the coast. They acted mainly as trading posts and rarely saw military action, but the fortifications were important, as arms and ammunition were being stored prior to trade.[35]

Spice trade

The profitable eastern spice trade was cornered by the Portuguese in the 16th century. In 1498, Vasco da Gama's pioneering voyage reached India by sea, opening the first European direct trade in the Indian Ocean. Up to this point, spice imports to Europe had been brought overland through India and Arabia, based on mixed land and sea routes through the Persian Gulf, Red Sea, and caravans, and then across the Mediterranean by the Venetians for distribution in Western Europe, which had a virtual monopoly on these valuable commodities. By establishing these trade routes, Portugal undercut the Venetian trade with its abundance of middlemen.

The Republic of Venice had gained control over much of the trade routes between Europe and Asia. After traditional land routes to India had been closed by the Ottoman Turks, Portugal hoped to use the sea route pioneered by Gama to break the Venetian trading monopoly. Portugal aimed to control trade within the Indian Ocean and secure the sea routes linking Europe to Asia. This new sea route around the Cape of Good Hope was firmly secured for Portugal by the activities of Afonso de Albuquerque, who was appointed the Portuguese viceroy of India in 1508. Early Portuguese explorers established bases in Portuguese Mozambique and Zanzibar and oversaw the construction of forts and factories (trading posts) along the African coast, in the Indian subcontinent, and other places in Asia, which solidified the Portuguese hegemony.

At Lisbon the Casa da Índia (House of India) was the central organization that managed all Portuguese trade overseas under royal monopoly during the 15th and 16th centuries. Established around 1500, it was the successor of the House of Guinea, the House of Guinea and Mina, and the House of Mina (respectively, the Casa da Guiné, Casa de Guiné e Mina, and Casa da Mina in Portuguese). Casa da Índia maintained a royal monopoly on the trade in pepper, cloves, and cinnamon, and levied a 30 percent tax on the profits of other articles.

The export and distribution to Europe was made by the Portuguese factory in Antwerp. For about thirty years, from 1503 to 1535, the Portuguese cut into the Venetian spice trade in the eastern Mediterranean. By 1510, King Manuel I of Portugal was pocketing a million cruzados yearly from the spice trade alone, and this led François I of France to dub Manuel I "le roi épicier", meaning "the grocer king".

In 1506, about 65% of the state income was produced by taxes on overseas activity. Income started to decline mid-century because of the costs of maintaining a presence in Morocco and domestic waste. Also, Portugal did not develop a substantial domestic infrastructure to support this activity, but relied on foreigners for many services supporting their trading enterprises, and therefore a lot of money was consumed in this way. In 1549, the Portuguese trade center in Antwerp went bankrupt and was closed. As the throne became more overextended in the 1550s, it increasingly relied on foreign financing. By about 1560, the income of the Casa da Índia was not able to cover its expenses. The Portuguese monarchy had become, in Garrett Mattingly's words, the owner of "a bankrupt wholesale grocery business".

Triangular trade between China, Japan, and Europe

Goa had functioned from the start as the capital of Portuguese India, the central shipping base of a commercial net linking Lisbon, Malacca, and as far as China and the Maluku Islands (Ternate) since 1513.

The first official visit of Fernão Pires de Andrade to Guangzhou (1517–1518) was fairly successful, and the local Chinese authorities allowed the embassy led by Tomé Pires, brought by de Andrade's flotilla, to proceed to Beijing.

In 1542, Portuguese traders arrived in Japan. According to Fernão Mendes Pinto, who claimed to have been present in this first contact, they arrived at Tanegashima, where locals were impressed by firearms that would be immediately made by the Japanese on a large scale.[36] The arrival of the Portuguese in Japan in 1543 initiated the Nanban trade period, with the hosts adopting several technologies and cultural practices, such as the arquebus, European-style cuirasses, European ships, Christianity, decorative art, and language. In 1570, after an agreement between Jesuits and a local daimyō, the Portuguese were granted a Japanese port where they founded the city of Nagasaki,[37] thus creating a trading center which for many years was Japan's main gateway to the world.

Soon after, in 1557, Portuguese merchants established a colony on the island of Macau. Chinese authorities allowed the Portuguese to settle through an annual payment, creating a warehouse. After the Chinese banned direct trade by Chinese merchants with Japan, the Portuguese filled this commercial vacuum as intermediaries.[38] Engaging in the triangular trade between China, Japan, and Europe, the Portuguese bought Chinese silk and sold it to the Japanese in return for Japanese-mined silver; since silver was more highly valued in China, the Portuguese could then use their newly acquired metal to buy even larger stocks of Chinese silk.[38] However, by 1573, after the Spanish established a trading base in Manila, the Portuguese intermediary trade was trumped by the prime source of incoming silver to China from the Spanish Americas.[39][40]

Guarding its trade from European and Asian competitors, Portugal dominated not only the trade between Asia and Europe, but also much of the trade between different regions of Asia, such as India, Indonesia, China, and Japan. Jesuit missionaries, such as the Basque Francis Xavier, followed the Portuguese to spread Roman Catholicism to Asia, with mixed results.

Expansion in South America

During the 16th century, Portugal also started to colonize its newly discovered territory of Brazil. However, temporary trading posts were established earlier to collect Brazilwood, used as a dye, and with permanent settlements came the establishment of the sugar cane industry and its intensive labor. Several early settlements were founded, among them the colonial capital, Salvador, established in 1549 at the Bay of All Saints in the north, and the city of Rio de Janeiro in the south, in March 1567. The Portuguese colonists adopted an economy based on the production of agricultural goods that were exported to Europe. Sugar became by far the most important Brazilian colonial product until the early 18th century, when gold and other minerals assumed a higher importance.[41][42]

The first attempt to establish a Portuguese presence in Brazil was made by John III in 1533. His solution was simplistic; he divided the coastline into fifteen sections, each about 150 miles long, and granted these strips of land, on a hereditary basis, to fifteen courtiers, who become known as donatários. Each courtier was told that he and his heirs could found cities, grant land, and levy taxes over as much territory as they could colonize inland from their stretch of coastline. Only two of the donatários were to have any success in this venture. In the 1540s, John III was forced to change his policy. He placed Brazil under direct royal control (as in Spanish America) and appointed a governor general. The first governor general of Brazil arrived in 1549 and headquartered himself at Bahia (today known as Salvador). It remained the capital of Portuguese Brazil for more than two centuries, until replaced by Rio de Janeiro in 1763.

The economic strength of Portuguese Brazil derived at first from sugar plantations in the north, established as early as the 1530s by one of the two successful donatários. But from the late 17th century onward, Brazil benefited at last from the mineral wealth which underpinned Spanish America. Gold was found in 1693 in the southern inland region of Minas Gerais. The discovery set off the first great gold rush of the Americas, opening up the interior as prospectors swarmed westwards, and underpinning Brazil's economy for much of the 18th century. Diamonds were also discovered in large quantities in the same region in the 18th century.

Colonists gradually moved west into the interior. Accompanying the first governor general in 1549 were members of the newly founded order of Jesuits. In their mission to convert the Indians, they were often the first European presence in new regions far from the coast. They frequently clashed with adventurers also pressing inland (in great expeditions known as bandeiras) to find silver and gold or to capture Indians as slaves. These two groups, with their very different motives, brought a Portuguese presence far beyond the Tordesillas Line. By the late 17th century, the territory of Brazil encompassed the entire basin of the Amazon as far west as the Andes. At the same time, Portuguese colonists had moved south along the coast beyond Rio de Janeiro. The Portuguese Colony of Sacramento was established on the River Plate in 1680, provoking a century of Spanish-Portuguese border conflicts in what is now Uruguay. Meanwhile, the use of the Portuguese language gradually gave the central region of South America an identity and a culture distinct from that of its Spanish neighbours.

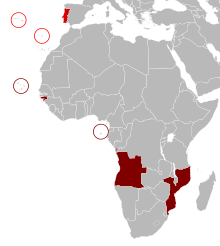

Expansion in sub-Saharan Africa

After initiating the European slave trade in Sub-Saharan Africa through its involvement in the African slave trade, Portugal played a decreasing role in it over the next few centuries. Although they were the first Europeans to establish trading settlements in Sub-Saharan Africa, they failed to press home their advantage. Nevertheless, they retained a clear presence in the three regions which received their particular attention during the original age of exploration. The closest of these, on the sea journey from Portugal, was Portuguese Guinea, known also, from its main economic activity, as the Slave Coast. The local African rulers in Guinea, who prospered greatly from the slave trade, had no interest in allowing the Europeans to move any further inland than the fortified coastal settlements where the trading took place. In the 15th century, Portugal's Company of Guinea was one of the first chartered commercial companies established by Europeans in other continents during the Age of Discovery. The Company's task was to deal with the spices and to fix the prices of the goods. The Portuguese presence in Guinea was largely limited to the port of Bissau. For a brief period in the 1790s, the British attempted to establish a rival foothold on an offshore island, at Bolama. By the 19th century, however, the Portuguese were sufficiently secure in Bissau to regard the neighbouring coastline as their own special territory.

Thousands of miles down the coast, in Angola, the Portuguese found it harder to consolidate their early advantage against encroachments by Dutch, British, and French rivals. Nevertheless, the fortified Portuguese towns of Luanda (established in 1587 with 400 Portuguese settlers) and Benguela (a fort from 1587, a town from 1617) remained almost continuously in their hands. As in Guinea, the slave trade became the basis of the local economy, with raids carried ever further inland by local natives to gain captives. More than a million men, women, and children were shipped from this region across the Atlantic. In this region, unlike Guinea, the trade remained largely in Portuguese hands. Nearly all the slaves who came from this area were destined for Brazil.

The deepest Portuguese penetration into the continent was from the east coast, up the Zambezi, with an early settlement as far inland as Tete. This was a region of powerful and rich African kingdoms. The eastern coastal area was also much visited by Arabs pressing south from Oman and Zanzibar. From the 16th to 19th centuries the Portuguese and their merchants were just one among many rival groups competing for the local trade in gold, ivory, and slaves.

Even if the Portuguese hold on these three African regions was tenuous, they clearly remained the main European presence in Sub-Saharan Africa. It was natural to assert their claim, therefore, in all three regions when the scramble for Africa began later. Prolonged military campaigns were required to retain and impose Portuguese control over the Africans in these territories in the late 19th century. The boundaries of Portuguese Guinea were agreed upon in two stages in 1886 with France, the colonial power in neighbouring Senegal and Guinea. No other nation presented a challenge for the vast and relatively unprofitable area of Angola. The most likely scene of conflict was Portuguese East Africa, where Portugal's hope of linking up with Angola clashed with Britain's plans for the Rhodesias. There was a diplomatic crisis in 1890, but the borders between British and Portuguese colonies were agreed upon by treaty in 1891.

Decline: 17th to 19th century

During the 15th and 16th centuries, with its global empire that included possessions in Africa, Asia, South America, and Oceania, Portugal remained one of the world's major economic, political, and cultural powers. English, Dutch, and French interests in and around Portugal's well-established overseas possessions and trading outposts tested Portuguese commercial and colonizing hegemony in Asia, Africa, and the New World. In the 17th century, the lengthy Portuguese Restoration War (1640–1668) between Portugal and Spain ended the sixty-year period of the Iberian Union (1580–1640). According to a 2016 study, Portugal's colonial trade "had a substantial and increasingly positive impact on [Portugal's] economic growth".[43] Despite its vast colonial possessions, Portugal's economy declined relative to other advanced European economies from the 17th century and onward, which the study attributes to the domestic conditions of the Portuguese economy.[43]

The 1755 Lisbon earthquake and, in the 19th century, armed conflicts with French and Spanish invading forces first in the War of the Oranges in 1801, and from 1807 in the Peninsular War, as well as the loss of its largest territorial possession abroad, Brazil, disrupted political stability and potential economic growth. The Scramble for Africa during the 19th century pressed the country to divert larger investments into the continent to secure its interests there.

By the late 19th century, the country's resources were exhausted by its overstretched empire, which was now facing unprecedented competition. Portugal had one of the highest illiteracy rates in Western Europe, a lack of industrialization, and underdeveloped transportation systems. The Industrial Revolution, which had spread out across several other European countries, creating more advanced and wealthier societies, was almost forgotten in Portugal. Under the rule of Carlos I, the penultimate King of Portugal, the country was twice declared bankrupt—on 14 June 1892, and 10 May 1902—causing socio-economic disturbances, socialist and republican antagonism, and press criticism of the monarchy. However, it was during this period that the predecessor of the Lisbon Stock Exchange was created in 1769 as the Assembleia dos Homens de Negócio in Praça do Comércio Square, in Lisbon's city center. In 1891, the Bolsa de Valores do Porto (Porto Stock Exchange) in Porto was founded. The Portuguese colonies in Africa started a period of great economic development fuelled by ambitious Chartered Companies and a new wave of colonization.

The Portuguese Republic

On 1 February 1908, King Carlos I was assassinated while travelling to Lisbon. Manuel II became the new king, but was eventually overthrown during the revolution on 5 October 1910, which abolished the monarchy and instated republicanism.

Along with new national symbols, a new currency was adopted. The "escudo" was introduced on 22 May 1911 to replace the real (Portuguese for "royal"), at the rate of 1,000 réis to 1 escudo. The escudo's value was initially set at 4$50 escudos = 1 pound sterling, but after 1914 its value fell, being fixed in 1928 at 108$25 to the pound. This was altered to 110$00 escudos to the pound in 1931.[44]

Portugal's First Republic (1910–26) became, in the words of historian Douglas L. Wheeler, "midwife to Europe's longest surviving authoritarian system". Under the sixteen-year parliamentary regime of the republic, with its forty-five governments, growing fiscal deficits, financed by money creation and foreign borrowing, climaxed in hyper-inflation , all made possible by the introduction of paper money after leaving the gold standard as did many other countries during the First World War,[45] and a moratorium on Portugal's external debt service. The cost of living around 1926 was thirty times higher than what it had been in 1914. Fiscal imprudence and accelerating inflation gave way to massive capital flight, crippling domestic investment. Burgeoning public sector employment during the First Republic was accompanied by a perverse shrinkage in the share of the industrial labor force in total employment. Although some headway was made toward increasing the level of literacy, 68.1 percent of Portugal's population was still classified as illiterate by the 1930 census.[4]

The economy under the Estado Novo regime

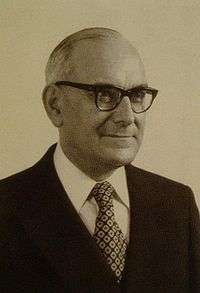

The First Republic was ended by a military coup in May 1926, but the newly installed government failed to fix the nation's precarious financial situation. Instead, President Óscar Fragoso Carmona invited António de Oliveira Salazar to head the Ministry of Finance, and the latter agreed to accept the position provided he would have veto power over all fiscal expenditures. At the time of his appointment in 1928, Salazar held the Chair of Economics at the Law School of the University of Coimbra and was considered by his peers to be Portugal's most distinguished authority on inflation. For forty years, first as minister of finance (1928–32) and then as prime minister (1932–68), Salazar's political and economic doctrines shaped the progress of the country.[4][46]

From the perspective of the financial chaos of the republican period, it was not surprising that Salazar considered the principles of a balanced budget and monetary stability as categorical imperatives. By restoring equilibrium, both in the fiscal budget and in the balance of international payments, Salazar succeeded in restoring Portugal's credit worthiness at home and abroad. Because Portugal's fiscal accounts from the 1930s until the early 1960s almost always had a surplus in the current account, the state had the wherewithal to finance public infrastructure projects without resorting either to inflationary financing or borrowing abroad.[4]

At the nadir of the Great Depression, Premier Salazar laid the foundations for his Estado Novo, the "New State". Neither capitalist nor communist, Portugal's economy was quasi-traditional. The corporative framework within which the Portuguese economy evolved combined two salient characteristics: extensive state regulation and predominantly private ownership of the means of production. Leading financiers and industrialists accepted extensive bureaucratic controls in return for assurances of minimal public ownership of economic enterprises and certain monopolistic (or restricted-competition) privileges.[4]

Within this framework, the state exercised extensive de facto authority regarding private investment decisions and the level of wages. A system of industrial licensing ('condicionamento' industrial), introduced by law in 1931, required prior authorization from the state for setting up or relocating an industrial plant. Investment in machinery and equipment, designed to increase the capacity of an existing firm, also required government approval. The political system was ostensibly corporatist, as political scientist Howard J. Wiarda makes clear: "In reality both labor and capital—and indeed the entire corporate institutional network—were subordinate to the central state apparatus."[4]

Under the old regime, Portugal's private sector was dominated by some forty prominent families. These industrial dynasties were allied by marriage with the large, traditional landowning families of the nobility, who held most of the arable land in the southern part of the country in large estates. Many of these dynasties had business interests in Portuguese Africa. Within this elite group, the top ten families owned all the important commercial banks, which in turn controlled a disproportionate share of the economy. Because bank officials were often members of the boards of directors of borrowing firms in whose stock the banks participated, the influence of the large banks extended to a host of commercial, industrial, and service enterprises. Portugal's shift toward a moderately outward-looking trade and financial strategy, initiated in the late 1950s, gained momentum during the early 1960s. Until that time the country remained very poor and largely underdeveloped; although the country had a disadvantaged starting position, three decades of the Estado Novo regime had done no better than slightly increasing the country's GDP per capita from 36 percent of EC-12 average in 1930[47] to 39 percent in 1960.[48] By the late 1950s, a growing number of industrialists, as well as government technocrats, favored greater Portuguese integration with the industrial countries to the north, as a badly needed stimulus to Portugal's economy. The influence of the Europe-oriented technocrats was rising within Salazar's cabinet. This was confirmed by the substantial increase in the foreign investment component in projected capital formation between the first (1953–58) and second (1959–64) economic development plans; the first plan called for a foreign investment component of less than 6 percent, but the latter envisioned a 25 percent contribution.[4]

A small economic miracle (1961–1974)

During the 1940s and 1950s, Portugal had experienced some economic growth due to increased raw material exports to the war-ravaged and recovering nations of Europe. Until the 1960s, however, the country remained very poor and largely underdeveloped due to its disadvantaged starting position and lack of effective policies to counter that situation. Salazar managed to discipline the Portuguese public finances, after the chaotic First Portuguese Republic of 1910–1926, but consistent economic growth and development remained scarce until well into the 1960s, when due to the influence of a new generation of technocrats with background in economics and technical-industrial know-how, the Portuguese economy started to take off with visible accomplishments in the people's quality of life and standard of living, as well as in terms of secondary and post-secondary education attainment. The newly influential Europe-oriented industrial and technical groups persuaded Salazar that Portugal should become a charter member of the European Free Trade Association (EFTA) when it was organized in 1959.[4]

The resulting European economic integration, consisting, among other factors, in relatively free markets that facilitated the bridging of labour shortages through migration from Portugal, as well as other southern European countries (such as Italy, Spain or Greece,) towards Central Europe (e.g. Germany) – so-called 'Gastarbeiter' – initiated and strengthened the impressive European economic growth that also affected Portugal. Moreover, capital shortages did not affect economies as negatively as earlier since capital could be moved across borders more easily.[49] In the following year, Portugal also became a member of the General Agreement on Tariffs and Trade (GATT), the International Monetary Fund, and the World Bank.[4]

In 1958, when the Portuguese government announced the 1959–64 Six-Year Plan for National Development, a decision had been reached to accelerate the country's rate of economic growth, a decision whose urgency grew with the outbreak of guerrilla warfare in Angola in 1961 and in Portugal's other African territories thereafter. Salazar and his policy advisers recognized that additional military expenditure needs, as well as increased transfers of official investment to the "overseas provinces", could only be met by a sharp rise in the country's productive capacity. Salazar's commitment to preserving Portugal's "multiracial, pluricontinental" state led him reluctantly to seek external credits beginning in 1962, an action from which the Portuguese treasury had abstained for several decades.[4]

Beyond military measures, the official Portuguese response to the "winds of change" in the African colonies was to integrate them administratively and economically more closely with the mainland. This was accomplished through population and capital transfers, trade liberalization, and the creation of a common currency, the so-called Escudo Area. The integration program established in 1961 provided for the removal of Portugal's duties on imports from its overseas territories by January 1964. The latter, on the other hand, were permitted to continue to levy duties on goods imported from Portugal but at a preferential rate, in most cases 50 percent of the normal duties levied by the territories on goods originating outside the Escudo Area. The effect of this two-tier tariff system was to give Portugal's exports preferential access to its colonial markets.[4] The economies of the overseas provinces, especially those of both the Overseas Province of Angola and Mozambique, boomed.

Despite the opposition to protectionist interests, the Portuguese government succeeded in bringing about some liberalization of the industrial licensing system, as well as in reducing trade barriers to conform with EFTA and GATT agreements. The last years of the Salazar era witnessed the creation of important privately organized ventures, including an integrated iron and steel mill, a modern ship repair and shipbuilding complex, vehicle assembly plants, oil refineries, petrochemical plants, pulp and paper mills, and electronic plants. As economist Valentim Xavier Pintado observed, "Behind the facade of an aged Salazar, Portugal knew deep and lasting changes during the 1960s."[4]

The liberalization of the Portuguese economy continued under Salazar's successor, Prime Minister Marcello José das Neves Caetano (1968–74), whose administration abolished industrial licensing requirements for firms in most sectors and in 1972 signed a free trade agreement with the newly enlarged EC. Under the agreement, which took effect at the beginning of 1973, Portugal was given until 1980 to abolish its restrictions on most community goods and until 1985 on certain sensitive products amounting to some 10 percent of the EC's total exports to Portugal. EFTA membership and a growing foreign investor presence contributed to Portugal's industrial modernization and export diversification between 1960 and 1973.[4]

Notwithstanding the concentration of the means of production in the hands of a small number of family-based financial-industrial groups, Portuguese business culture permitted a surprising upward mobility of university-educated individuals with middle-class backgrounds into professional management careers. Before the revolution, the largest, most technologically advanced (and most recently organized) firms offered the greatest opportunity for management careers based on merit rather than birth.[4]

By the early 1970s, Portugal's fast economic growth with increasing consumption and purchase of new automobiles set the priority for improvements in transportation. Brisa – Autoestradas de Portugal was founded in 1972, and the State granted the company a 30-year concession to design, build, manage, and maintain express motorways.

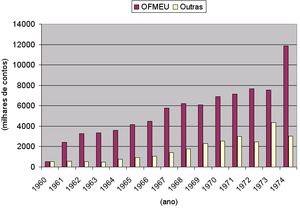

The counterinsurgency war effort

From 1961 to 1974, Portugal faced an independentist insurgency in its African overseas territories – the Portuguese Colonial War. The Portuguese national interests in Africa were put under threat by several separatist guerrilla organizations supported by most of the international community and the United Nations. By the early 1970s, while the counterinsurgency war was won in Angola, it was less than satisfactorily contained in Mozambique and dangerously stalemated in Portuguese Guinea from the Portuguese point of view, so the Portuguese Government decided to create sustainability policies in order to allow continuous sources of financing for the war effort in the long run. On 13 November 1972, a sovereign wealth fund (Fundo do Ultramar – The Overseas Fund) was enacted through the Decree Law Decreto-Lei n.º 448/ /72 and the Ministry of Defense ordinance Portaria 696/72, in order to finance the counterinsurgency effort in the Portuguese overseas territories.[50] In addition, new Decree Laws (Decree Law: Decretos-Leis n.os 353, de 13 de Julho de 1973, e 409, de 20 de Agosto) were enforced in order to cut down military expenses and increase the number of officers by incorporating irregular militia as if they were regular military academy officers.[51][51][52][53][54]

Retrospective analysis

In 1960, at the initiation of Salazar's more outward-looking economic policy due to the influence of a new generation of technocrats with background in economics and technical-industrial know-how, Portugal's per capita GDP was only 38 percent of the European Community (EC-12) average; by the end of the Salazar period, in 1968, it had risen to 48 percent, and by 1973, under the leadership of Marcelo Caetano, Portugal's per capita GDP had reached 56.4 percent of the EC-12 average.[4][4][55] On a long term analysis, after an extended period of economic divergence before 1914, and a period of chaos during the First Republic (1910–1926), the Portuguese economy recovered slightly until 1960, entering thereafter on a path of strong economic convergence until the Carnation Revolution in April 1974. Portuguese economic growth in the period 1960–1973 under the Estado Novo regime (and even with the effects of an expensive war effort in African territories against independence guerrilla groups from 1961 onwards) created an opportunity for real integration with the developed economies of Western Europe. Through emigration, trade, tourism, and foreign investment, individuals and firms changed their patterns of production and consumption, bringing about a structural transformation. Simultaneously, the increasing complexity of a growing economy brought new technical and organizational challenges, stimulating the formation of modern professional and management teams.[5][56] The economy of Portugal and its overseas territories on the eve of the Carnation Revolution (a military coup on 25 April 1974) was growing well above the European average. Average family purchasing power was rising together with new consumption patterns and trends and this was promoting both investment in new capital equipment and consumption expenditure for durable and nondurable consumer goods. The Estado Novo regime economic policy encouraged and created conditions for the formation of large and successful business conglomerates. Economically, the Estado Novo regime maintained a policy of corporatism that resulted in the placement of a big part of the Portuguese economy in the hands of a number of strong conglomerates, including those founded by the families of António Champalimaud (Banco Totta & Açores, Banco Pinto & Sotto Mayor, Secil, Cimpor), José Manuel de Mello (CUF – Companhia União Fabril), Américo Amorim (Corticeira Amorim) and the dos Santos family (Jerónimo Martins). Those Portuguese conglomerates had a business model with similarities to South Korean chaebols and Japanese keiretsus and zaibatsus. The Companhia União Fabril (CUF) was one of the largest and most diversified Portuguese conglomerates with its core businesses (cement, chemicals, petrochemicals, agrochemicals, textiles, beer, beverages, metallurgy, naval engineering, electrical engineering, insurance, banking, paper, tourism, mining, etc.) and corporate headquarters located in mainland Portugal, but also with branches, plants and several developing business projects all around the Portuguese Empire, specially in the Portuguese territories of Angola and Mozambique. Other medium-sized family companies specialized in textiles (for instance those located in the city of Covilhã and the northwest), ceramics, porcelain, glass and crystal (like those of Alcobaça, Caldas da Rainha and Marinha Grande), engineered wood (like SONAE near Porto), canned fish (like those of Algarve and the northwest), fishing, food and beverages (alcoholic beverages, from liqueurs like Licor Beirão and Ginjinha, to beer like Sagres, were produced across the entire country, but Port Wine was one of its most reputed and exported alcoholic beverages), tourism (well established in Estoril/Cascais/Sintra and growing as an international attraction in the Algarve since the 1960s) and in agriculture (like the ones scattered around the Alentejo – known as the breadbasket of Portugal) completed the panorama of the national economy by the early 1970s. In addition, rural areas' populations were committed to agrarianism that was of great importance for a majority of the total population, with many families living exclusively from agriculture or complementing their salaries with farming, husbandry and forestry yields.

Besides that, the overseas territories were also displaying impressive economic growth and development rates from the 1920s onwards. Even during the Portuguese Colonial War (1961–1974), a counterinsurgency war against independentist guerrilla and terrorism, the overseas territories of Angola and Mozambique (Portuguese Overseas Provinces at the time) had continuous economic growth rates and several sectors of its local economies were booming. They were internationally notable centres of production of oil, coffee, cotton, cashew, coconut, timber, minerals (like diamonds), metals (like iron and aluminium), banana, citrus, tea, sisal, beer (Cuca and Laurentina were successful beer brands produced locally), cement, fish and other sea products, beef and textiles. Tourism was also a fast-developing activity in Portuguese Africa both by the growing development of and demand for beach resorts and wildlife reserves.

Labour unions were not allowed and a minimum wage policy was not enforced. However, in a context of an expanding economy, bringing better living conditions for the Portuguese population in the 1960s, the outbreak of the colonial wars in Portuguese Africa set off significant social changes, among them the rapid incorporation of more and more women into the labour market. Marcelo Caetano moved on to foster economic growth and some social improvements, such as the awarding of a monthly pension to rural workers who had never had the chance to pay social security. The objectives of Caetano's pension reform were threefold: enhancing equity, reducing fiscal and actuarial imbalance, and achieving more efficiency for the economy as a whole, for example, by establishing contributions less distortive to labour markets or by allowing the savings generated by pension funds to increase the investments in the economy. In 1969, after the replacement of António de Oliveira Salazar by Marcelo Caetano, the Estado Novo-controlled nation got indeed a very slight taste of democracy and Caetano allowed the formation of the first democratic labour union movement since the 1920s.

Caetano's Portuguese Government began also a military reform that gave the opportunity to militia officers who completed a brief training program and had served in the overseas territories' defensive campaigns, of being commissioned at the same rank as military academy graduates in order to increase the number of officials employed against the African insurgencies, and at the same time cut down military costs to alleviate an already overburdened government budget. Thus, a group of disgusted captains started to instigate their peers to conspire against the new laws proposed by the regime.[57] The protest of Portuguese Armed Forces captains against a decree law: the Dec. Lei nº 353/73 of 1973.[53][58] would therefore lie behind a military coup on 25 April 1974 – the Carnation Revolution.

Revolutionary change, 1974

The anti-Estado Novo MFA-led Carnation Revolution, a military coup in Lisbon on 25 April 1974, initially had a negative impact on the Portuguese economy and social structure. Although the military-led coup returned democracy to Portugal, ending the unpopular Colonial War where thousands of Portuguese soldiers had been conscripted into military service, and replacing the authoritarian Estado Novo (New State) regime and its secret police which repressed elemental civil liberties and political freedoms, it also paved the way for the end of Portugal as an intercontinental empire and an intermediate emerging power. The coup was originally a mostly pro-democracy movement, intended to replace the previous regime with an Western-style liberal democracy and to develop and modernize the economy in order to achieve Western European standards of living, along with finding a solution for the African colonies to end the 13-year-long Colonial War. However, by late 1974 to early 1975, moderate factions (led by personalities such as António de Spínola and Mário Soares) lost power to Marxist-oriented and far-left ones (led by personalities such as Otelo Saraiva de Carvalho and Álvaro Cunhal). Communists gained increasing influence in the provisorial cabinets led by Vasco Gonçalves and after a failed coup carried by Spínola on 11 March 1975, the government launched the Processo Revolucionário em Curso (Ongoing Revolutionary Process) marked by nationalizations of hundreds of private companies (including virtually all mass media), politically-based firings (saneamentos políticos) and land expropriations. Power in the African colonies was handover to selected former independentist guerrilla movements, which acted as the spark for the appearance of civil wars or the introduction of single party regimes in the newly independent states. This decolonization also prompted a mass exodus of Portuguese citizens from Portugal's African territories (mostly from the then overseas territories of Angola and Mozambique), creating over a million Portuguese destitute refugees – the retornados.[6][7] Along with the arrival of the retornados, PREC was also marked by political violence and social chaos, exodus of industrialists, a brain drain of technical and managerial experts and sanctioned occupations of agricultural estates, factories and houses. Moderates eventually reconquered influence in the government after mid-1975: Prime Minister Vasco Gonçalves was sacked in September (replaced by moderate Pinheiro de Azevedo) and the radical factions eventually lost most of their influence after carrying a failed coup on 25 November 1975. The 1976 parliamentary and presidential elections allowed Mário Soares to become Prime Minister and General Ramalho Eanes (who played an essential role in defeating the 25 November 1975 coup attempt) to become President of Portugal.

The Portuguese economy had changed significantly prior to the 1974 revolution, in comparison with its position in 1961—total output (GDP at factor cost) had grown by 120 percent in real terms. The pre-revolutionary period was characterized by robust annual growth rates for GDP (6.9 percent), industrial production (9 percent), private consumption (6.5 percent), and gross fixed capital formation (7.8 percent).[4]

The post revolution period was, however, characterized by chaos and negative economic growth, as industries became nationalized and the effects of the decoupling of Portugal from its former overseas territories, especially Angola and Mozambique, were felt.

Additionally, the general European economic growth, including the Portuguese one, came to an end after the oil price shock of 1973. That shock consisted in a significant increase of energy prices as a result of occurring conflicts in the Middle East. The result was stagflation, a combination of economic growth stagnation and inflation.[59] Heavy industry came to an abrupt halt. All sectors of the economy, including manufacturing, mining, chemical, defence, finance, agriculture, and fishing, collapsed. Portugal quickly went from the country with the highest growth rate in Western Europe to the lowest, and experienced several years of negative growth. This was amplified by the mass emigration of skilled workers and entrepreneurs (among them were António Champalimaud and José Manuel de Mello) due to communism-inspired political intimidation in the context of the political turnoil that marked the country from mid-1974 to late 1975, along with economic stagnation.

Only in 1991, 16 years later, did the GDP as a percentage of EC-12 average climb to 54.9 percent (nearly comparable with that which had existed by the time of the Carnation Revolution in 1974), mainly as a result of participation in the European Economic Community since 1985. Post revolution Portugal was not able to achieve the same economic growth rates as it achieved during the last decade before 1975.[5][56][60]

Nationalization

The reorganization of the MFA coordinating committee in March 1975 brought into prominence a group of Marxist-oriented officers. In league with the General Confederation of Portuguese Workers-National Intersindical (Confederação Geral dos Trabalhadores Portugueses–Intersindical Nacional (CGTP–IN), the communist-dominated trade union confederation known as Intersindical prior to 1977, they sought a radical transformation of the nation's social system and political economy. This change of direction from a purely pro-democracy coup to a communist-oriented one became known as the Processo Revolucionário Em Curso (PREC). Abandoning its moderate-reformist posture, the MFA leadership set out on a course of sweeping nationalizations and land expropriations. During the balance of that year, the government nationalized all Portuguese-owned capital in the banking, insurance, petrochemical, fertilizer, tobacco, cement, and wood pulp sectors of the economy, as well as the Portuguese iron and steel company, major breweries, large shipping lines, most public transport, two of the three principal shipyards, core companies of the Companhia União Fabril (CUF) conglomerate, radio and TV networks (except that of the Roman Catholic Church), and important companies in the glass, mining, fishing, and agricultural sectors. Because of the key role of the domestic banks as holders of stock, the government indirectly acquired equity positions in hundreds of other firms. An Institute for State Participation was created to deal with the many disparate and often tiny enterprises in which the state had thus obtained a majority shareholding. Another 300 small to medium enterprises came under public management as the government "intervened" to rescue them from bankruptcy following their takeover by workers or abandonment by management.

Although foreign direct investment was statutorily exempted from nationalization, many foreign-controlled enterprises curtailed or ceased operation because of costly forced labor settlements or worker takeovers. The combination of revolutionary policies and a negative business climate brought about a sharp reversal in the trend of direct investment inflows from abroad.

After the coup, both the Lisbon and Porto stock exchanges were closed by the revolutionary National Salvation Junta; they would be reopened a couple of years later.[61]

A study by the economists Maria Belmira Martins and José Chaves Rosa showed that a total of 244 private enterprises were directly nationalized during the 16 months from 14 March 1975, to 29 July 1976. Nationalization was followed by the consolidation of the several private firms in each industry into state monopolies. As an example, Quimigal, the chemical and fertilizer entity, represented a merger of five firms. Four large companies were integrated to form the national oil company, Petróleos de Portugal (Petrogal). Portucel brought together five pulp and paper companies. The fourteen private electric power enterprises were joined into a single power generation and transmission monopoly, Electricidade de Portugal (EDP). With the nationalization and amalgamation of the three tobacco firms under Tabaqueira, the state gained complete control of this industry. The several breweries and beer distribution companies were integrated into two state firms, Central de Cervejas (Centralcer) and Unicer; and a single state enterprise, Rodoviária, was created by merging the 93 nationalized trucking and bus lines. The 47 cement plants, formerly controlled by the Champalimaud interests, were integrated into Cimentos de Portugal (Cimpor). The government also acquired a dominant position in the export-oriented shipbuilding and ship repair industry. Former private monopolies retained their company designations following nationalization. Included among these were the iron and steel company Siderurgia Nacional, the railway Caminhos de Ferro Portugueses (CP), and the national airline, Transportes Aéreos Portugueses (TAP).

Unlike other sectors, where existing private firms were typically consolidated into state monopolies, the commercial banking system and insurance industry were left with a degree of competition. By 1979, the number of domestic commercial banks was reduced from 15 to 9. Notwithstanding their public status, the remaining banks competed with each other and retained their individual identities and policies.

Before the revolution, private enterprise ownership dominated the Portuguese economy to a degree unmatched in other western European countries. Only a handful of wholly owned or majority owned state entities existed; these included the post office (CTT), two of three telecommunications companies (CTT and TLP), the armaments industry, and the ports, as well as the National Development Bank and Caixa Geral de Depósitos, the largest savings bank. The Portuguese government held minority interests in TAP, the national airline, in Siderurgia Nacional, the third telecommunications company Radio Marconi, and in oil refining and oil marketing firms. The railroads, two colonial banks (Banco de Angola and BNU), and the Bank of Portugal were majority privately owned but publicly administered. Finally, although privately owned, the tobacco companies were operated under government concessions.

Two years after the military coup, the enlarged public sector accounted for 47 percent of the country's gross fixed capital formation (GFCF), 30 percent of total value added (VA), and 24 percent of employment. These compared with 10 percent of GFCF, 9 percent of VA, and 13 percent of employment for the traditional public sector of 1973. Expansion of the public sector since the revolution was particularly apparent in heavy manufacturing, in public services including electricity, gas, transport, and communications, and in banking and insurance. Further, according to the Institute for State Participation, these figures did not include private enterprises under temporary state intervention, with minority state participation (less than 50 percent of the common stock), or worker-managed firms and agricultural collectives.

Land reform

In the agricultural sector, the collective farms set up in Alentejo after the 1974–75 expropriations due to the coup proved incapable of modernizing, and their efficiency declined. According to government estimates, about 900,000 hectares (2,200,000 acres) of agricultural land were occupied between April 1974 and December 1975 in the name of land reform (reforma agrária); around 32% of these were ruled illegal. In January 1976, the government pledged to restore the illegally occupied lands to their owners, and in 1977, it promulgated the Land Reform Review Law. Restoration began in 1978.

The brain drain

Compounding the problem of massive nationalizations was the brain drain of managerial and technical expertise away from public enterprises. The income-leveling measures of the MFA revolutionary regime, together with the "anti-fascist" purges in factories, offices, and large agricultural estates, induced an exodus of human capital, mainly to Brazil. This loss of managers, technicians, and businesspeople inspired a popular Lisbon saying: "Portugal used to send its legs to Brazil, but now we are sending our heads."

A detailed analysis of Portugal's loss of managerial resources is contained in Harry M. Makler's follow-up surveys of 306 enterprises, conducted in July 1976, and again in June 1977. His study makes clear that nationalization was greater in the modern, large, and technically advanced industries than in the traditional ones such as textiles, apparel, and construction. In small enterprises (50–99 employees), only 15 percent of the industrialists left as compared with 43 percent in the larger organizations. In the largest firms (1,000 or more employees), more than half left. Makler's calculations show that the higher the socioeconomic class of the person, the greater the likelihood that they had left the firm. He also notes that "the more upwardly mobile also were more likely to have quit than those who were downwardly socially mobile." Significantly, a much larger percentage of professional managers (52 percent) compared with owners of production such as founders (18%), heirs (21%), and owner-managers (32%) had left their enterprises.

The constitution of 1976 confirmed the large and interventionist role of the state in the economy. Its Marxist character, which lasted until the 1982 and 1989 revisions, was revealed in a number of its articles, which pointed to a "classless society" and the "socialization of the means of production" and proclaimed all nationalizations made after 25 April 1974, as "irreversible conquests of the working classes". The constitution also defined new power relationships between labor and management, with a strong bias in favor of labor. All regulations with reference to layoffs, including collective redundancy, were circumscribed by Article 53.

Role of the new public sector

After the revolution, the Portuguese economy experienced a rapid, and sometimes uncontrollable, expansion of public expenditures—both in the general government and in public enterprises. The lag in public sector receipts resulted in large public enterprise and government deficits. In 1982, the borrowing requirement of the consolidated public sector reached 24 percent of GDP, its peak level; it was reduced to 9 percent of GDP by 1990.

To rein in domestic demand growth, the Portuguese government was obliged to pursue International Monetary Fund (IMF)-monitored stabilization programs in 1977–78 and 1983–85. The large negative savings of the public sector (including the state-owned enterprises) became a structural feature of Portugal's political economy after the revolution. Other official impediments to rapid economic growth after 1974 included all-pervasive price regulation, as well as heavy-handed intervention in factor markets and the distribution of income.

In 1989, Prime Minister Aníbal Cavaco Silva succeeded in mobilizing the required two-thirds vote in the National Assembly to amend the constitution, thereby permitting the denationalization of the state-owned banks and other public enterprises. Privatization, economic deregulation, and tax reform became the salient concerns of public policy as Portugal prepared itself for the challenges and opportunities of membership in the EC's single market in the 1990s.

The non-financial public enterprises

Following the sweeping nationalizations of the mid-1970s, public enterprises became a major component of Portugal's consolidated public sector. Portugal's nationalized sector in 1980 included a core of fifty non-financial enterprises, which were entirely government owned. This so-called public non-financial enterprise group included the Institute of State Participation, a holding company with investments in some seventy subsidiary enterprises; a number of state-owned entities manufacturing or selling goods and services grouped with nationalized enterprises for national accounts purposes (arms, agriculture, and public infrastructure such as ports); and a large number of over 50 percent EPNF-owned subsidiaries operating under private law. Altogether, these public enterprises accounted for 25 percent of VA in GDP, 52 percent of GFCF, and 12 percent of Portugal's total employment. In terms of VA and GFCF, the relative scale of Portugal's public entities exceeded that of the other western European economies, including the EC member countries.

Although the nationalizations broke up the concentration of economic power that had been held by financial-industrial groups, the subsequent merger of several private firms into single publicly owned enterprises left domestic markets even more monopolized. Apart from special cases, as in iron and steel, where the economies of scale are optimal for very large firms, there was some question as to the desirability of establishing national monopolies. The elimination of competition following the official takeover of industries such as cement, chemicals, and trucking probably reduced managerial incentives for cost reduction and technical advance.

It was not surprising that numerous nationalized enterprises experienced severe operating and financial difficulties. State operations faced considerable uncertainty as to the goals of public enterprises, with negative implications for decision making, often at odds with market criteria. In many instances, managers of public firms were less able than their private-sector counterparts to resist strong wage demands from militant unions. Further, public firm managers were required for political expediency to maintain a redundant labor force and freeze prices or utility rates for long periods in the face of rising costs. Overstaffing was particularly flagrant at Petrogal, the national petroleum monopoly, and Estaleiros Navais de Setúbal (Setenave), the wholly state-owned shipbuilding and repairing enterprise. The failure of the public transportation firms to raise fares during a time of accelerating inflation resulted in substantial operating losses and obsolescence of the sector's capital stock.

As a group, the public enterprises performed poorly financially and relied excessively on debt financing from both domestic and foreign commercial banks. The operating and financial problems of the public enterprise sector were revealed in a study by the Bank of Portugal covering the years 1978–80. Based upon a survey of fifty-one enterprises, which represented 92 percent of the sector's VA, the analysis confirmed the debilitated financial condition of the public enterprises, as evidenced by their inadequate equity and liquidity ratios. The consolidated losses of the firms included in the survey increased from 18.3 to 40.3 million contos from 1978 to 1980, or 4.6 percent to 6.1 percent of net worth, respectively. Losses were concentrated in transportation and to a lesser extent transport equipment and materials (principally shipbuilding and ship repair). The budgetary burden of the public enterprises was substantial: enterprise transfers to the Portuguese government (mainly taxes) fell short of government receipts in the forms of subsidies and capital transfers. The largest nonfinancial state enterprises recorded (inflation-discounted) losses in the seven-year period from 1977 to 1983 equivalent to 11 percent on capital employed. Notwithstanding their substantial operating losses and weak capital structure, these large enterprises financed 86 percent of their capital investments from 1977 to 1983 through increased debt, of which two-thirds was foreign. The rapid buildup of Portugal's external debt from 1978 to 1985 was largely associated with the public enterprises.

General government

The share of general government expenditure (including capital outlays) in GDP rose from 23 percent in 1973 to 46 percent in 1990. On the revenue side, the upward trend was less pronounced: the share increased from nearly 23 percent in 1973 to 39.2 percent in 1990. From a modest surplus before the revolution in 1973, the government balance swung to a wide deficit of 12 percent of GDP in 1984, declining thereafter to around 5.4 percent of GDP in 1990. Significantly, both current expenditures and capital expenditures roughly doubled their shares of GDP between 1973 and 1990: government current outlays rose from 19.5 percent to 40.2 percent, capital outlays from 3.2 percent to 5.7 percent.

Apart from the growing investment effort, which included capital transfers to the public enterprises, government expenditure patterns since the revolution reflected rapid expansion in the number of civil servants and pressure to redistribute income, mainly through current transfers and subsidies, as well as burgeoning interest obligations. The category "current transfers" nearly tripled its share of GDP between 1973 and 1990, from under 5 percent to 13.4 percent, reflecting the explosive growth of the social security system, both with respect to the number of persons covered and the upgrading of benefits. Escalating interest payments on the public debt, from less than half a percent of GDP in 1973 to 8.2 percent of GDP in 1990, were the result of both a rise in the debt itself and higher real effective interest rates.