Asian Development Bank

The Asian Development Bank (ADB) is a regional development bank established on 19 December 1966,[4] which is headquartered in the Ortigas Center located in the city of Mandaluyong, Metro Manila, Philippines. The company also maintains 31 field offices around the world[5] to promote social and economic development in Asia. The bank admits the members of the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP, formerly the Economic Commission for Asia and the Far East or ECAFE) and non-regional developed countries.[6] From 31 members at its establishment, ADB now has 68 members.

| |

| Abbreviation | ADB |

|---|---|

| Motto | ADB is committed to achieving a prosperous, inclusive, resilient and sustainable Asia & the Pacific, while sustaining its efforts to eradicate extreme poverty. |

| Formation | 19 December 1966 |

| Type | Multilateral Development Bank |

| Legal status | Treaty |

| Purpose | Social and Economic Development |

| Headquarters | Ortigas Center Mandaluyong, Metro Manila, Philippines |

Region served | Asia-Pacific |

Membership | 68 countries |

President | Masatsugu Asakawa (from 17th January 2020)[1] |

Main organ | Board of Governors[2] |

Staff | 3,092[3] |

| Website | www |

The ADB was modeled closely on the World Bank, and has a similar weighted voting system where votes are distributed in proportion with members' capital subscriptions. ADB releases an annual report that summarizes its operations, budget and other materials for review by the public.[7] The ADB-Japan Scholarship Program (ADB-JSP) enrolls about 300 students annually in academic institutions located in 10 countries within the Region. Upon completion of their study programs, scholars are expected to contribute to the economic and social development of their home countries.[8] ADB is an official United Nations Observer.[9]

As of 31 December 2016, Japan holds the largest proportion of shares at 15.677%, closely followed by United States with 15.567% capital share. China holds 6.473%, India holds 6.359%, and Australia holds 5.812%.[10]

Organization

The highest policy-making body of the bank is the Board of Governors, composed of one representative from each member state. The Board of Governors, in turn, elect among themselves the twelve members of the Board of Directors and their deputies. Eight of the twelve members come from regional (Asia-Pacific) members while the others come from non-regional members.[11]

The Board of Governors also elect the bank's president, who is the chairperson of the Board of Directors and manages ADB. The president has a term of office lasting five years, and may be reelected. Traditionally, and because Japan is one of the largest shareholders of the bank, the president has always been Japanese.

The current president is Masatsugu Asakawa. He succeeded Takehiko Nakao on 17 January 2020,[12] who succeeded Haruhiko Kuroda in 2013.[13]

The headquarters of the bank is at 6 ADB Avenue, Mandaluyong, Metro Manila, Philippines,[14][15] and it has 31 field offices in Asia and the Pacific and representative offices in Washington, Frankfurt, Tokyo and Sydney. The bank employs about 3,000 people, representing 60 of its 67 members.[16]

List of presidents

| Name | Dates | Nationality |

|---|---|---|

| Takeshi Watanabe | 1966–1972 | |

| Shiro Inoue | 1972–1976 | |

| Taroichi Yoshida | 1976–1981 | |

| Masao Fujioka | 1981–1989 | |

| Kimimasa Tarumizu | 1989–1993 | |

| Mitsuo Sato | 1993–1999 | |

| Tadao Chino | 1999–2005 | |

| Haruhiko Kuroda | 2005–2013 | |

| Takehiko Nakao | 2013–2020 | |

| Masatsugu Asakawa (*) | 2020–present |

(*) As from 17 January 2020, Masatsugu Asakawa was president of ADB..[17]

History

1960s

As early as 1956, Japan Finance Minister Hisato Ichimada had suggested to United States Secretary of State John Foster Dulles that development projects in Southeast Asia could be supported by a new financial institution for the region. A year later, Japanese Prime Minister Nobusuke Kishi announced that Japan intended to sponsor the establishment of a regional development fund with resources largely from Japan and other industrial countries. But the US did not warm to the plan and the concept was shelved. See full account in "Banking on the Future of Asia and the Pacific: 50 Years of the Asian Development Bank," July 2017.

The idea came up again late in 1962 when Kaoru Ohashi, an economist from a research institute in Tokyo, visited Takeshi Watanabe, then a private financial consultant in Tokyo, and proposed a study group to form a development bank for the Asian region. The group met regularly in 1963, examining various scenarios for setting up a new institution and drew on Watanabe's experiences with the World Bank. However, the idea received a cool reception from the World Bank itself and the study group became discouraged.

In parallel, the concept was formally proposed at a trade conference organized by the Economic Commission for Asia and the Far East (ECAFE) in 1963 by a young Thai economist, Paul Sithi-Amnuai. (ESCAP, United Nations Publication March 2007, "The first parliament of Asia" pp. 65). Despite an initial mixed reaction, support for the establishment of a new bank soon grew.

An expert group was convened to study the idea, with Japan invited to contribute to the group. When Watanabe was recommended, the two streams proposing a new bank—from ECAFE and Japan—came together. Initially, the US was on the fence, not opposing the idea but not ready to commit financial support. But a new bank for Asia was soon seen to fit in with a broader program of assistance to Asia planned by U.S. President Lyndon B. Johnson in the wake of the escalating US military support for the government of South Vietnam.

As a key player in the concept, Japan hoped that the ADB offices would be in Tokyo. However, eight other cities had also expressed an interest—Bangkok, Colombo, Kabul, Kuala Lumpur, Manila, Phnom Penh, Singapore, and Tehran. To decide, the 18 prospective regional members of the new bank held three rounds of votes at a ministerial conference in Manila in November/December 1965. In the first round on 30 November, Tokyo failed to win a majority, so a second ballot was held the next day at noon. Although Japan was in the lead, it was still inconclusive, so a final vote was held after lunch. In the third poll, Tokyo gained eight votes to Manila's nine, with one abstention. Therefore, Manila was declared the host of the new development bank. The Japanese were mystified and deeply disappointed. Watanabe later wrote in his personal history of ADB: "I felt as if the child I had so carefully reared had been taken away to a distant country." (Asian Development Bank publication, "Towards a New Asia", 1977, p. 16)

As intensive work took place during 1966 to prepare for the opening of the new bank in Manila, high on the agenda was choice of president. Japanese Prime Minister Eisaku Satō asked Watanabe to be a candidate. Although he initially declined, pressure came from other countries and Watanabe agreed. In the absence of any other candidates, Watanabe was elected first President of the Asian Development Bank at its Inaugural Meeting on 24 November 1966.

By the end of 1972, Japan had contributed $173.7 million (22.6% of the total) to the ordinary capital resources and $122.6 million (59.6% of the total) to the special funds. In contrast, the United States contributed only $1.25 million to the special fund.[6]

After its creation in the 1960s, ADB focused much of its assistance on food production and rural development. At the time, Asia was one of the poorest regions in the world.[18]

Early loans went largely to Indonesia, Thailand, Malaysia, South Korea and the Philippines; these nations accounted for 78.48% of the total ADB loans between 1967 and 1972. Moreover, Japan received tangible benefits, 41.67% of the total procurements between 1967 and 1976. Japan tied its special funds contributions to its preferred sectors and regions and procurements of its goods and services, as reflected in its $100 million donation for the Agricultural Special Fund in April 1968.[6]

1970s–1980s

In the 1970s, ADB's assistance to developing countries in Asia expanded into education and health, and then to infrastructure and industry. The gradual emergence of Asian economies in the latter part of the decade spurred demand for better infrastructure to support economic growth. ADB focused on improving roads and providing electricity. When the world suffered its first oil price shock, ADB shifted more of its assistance to support energy projects, especially those promoting the development of domestic energy sources in member countries.[18]

Following considerable pressure from the Reagan Administration in the 1980s, ADB reluctantly began working with the private sector in an attempt to increase the impact of its development assistance to poor countries in Asia and the Pacific. In the wake of the second oil crisis, ADB expanded its assistance to energy projects. In 1982, ADB opened its first field office, in Bangladesh, and later in the decade it expanded its work with non-government organizations (NGOs).[18]

Japanese presidents Inoue Shiro (1972–76) and Yoshida Taroichi (1976–81) took the spotlight in the 1970s. Fujioka Masao, the fourth president (1981–90), adopted an assertive leadership style, launching an ambitious plan to expand the ADB into a high-impact development agency.

1990s

In the 1990s, ADB began promoting regional cooperation by helping the countries on the Mekong River to trade and work together. The decade also saw an expansion of ADB's membership with the addition of several Central Asian countries following the end of the Cold War.[18]

In mid-1997, ADB responded to the financial crisis that hit the region with projects designed to strengthen financial sectors and create social safety nets for the poor. During the crisis, ADB approved its largest single loan – a $4 billion emergency loan to the South Korea. In 1999, ADB adopted poverty reduction as its overarching goal.[18]

2000s

The early years of 2000s saw a dramatic expansion of private sector finance. While the institution had such operations since the 1980s (under pressure from the Reagan Administration) the early attempts were highly unsuccessful with low lending volumes, considerable losses and financial scandals associated with an entity named AFIC. However, beginning in 2002, the ADB undertook a dramatic expansion of private sector lending under a new team. Over the course of the next six years, the Private Sector Operations Department (PSOD) grew by a factor of 41 times the 2001 levels of new financings and earnings for the ADB. This culminated with the Board's formal recognition if these achievements in March 2008, when the Board of Directors formally adopted the Long Term Strategic Framework (LTSF). That document formally stated that assistance to private sector development was the lead priority of the ADB and that it should constitute 50% of the bank's lending by 2020.

In 2003, the severe acute respiratory syndrome (SARS) epidemic hit the region and ADB responded with programs to help the countries in the region work together to address infectious diseases, including avian influenza and HIV/AIDS. ADB also responded to a multitude of natural disasters in the region, committing more than $850 million for recovery in areas of India, Indonesia, Maldives, and Sri Lanka which were impacted by the December 2004 Asian tsunami. In addition, $1 billion in loans and grants was provided to the victims of the October 2005 earthquake in Pakistan.[18]

In 2009, ADB's Board of Governors agreed to triple ADB's capital base from $55 billion to $165 billion, giving it much-needed resources to respond to the global economic crisis. The 200% increase is the largest in ADB's history, and was the first since 1994.[18]

2010s

Asia moved beyond the economic crisis and by 2010 had emerged as a new engine of global economic growth though it remained home to two-thirds of the world's poor. In addition, the increasing prosperity of many people in the region created a widening income gap that left many people behind. ADB responded to this with loans and grants that encouraged economic growth.[18]

In early 2012, the ADB began to re-engage with Myanmar in response to reforms initiated by the government. In April 2014, ADB opened an office in Myanmar and resumed making loans and grants to the country.[18]

In 2017, ADB combined the lending operations of its Asian Development Fund (ADF) with its ordinary capital resources (OCR). The result was to expand the OCR balance sheet to permit increasing annual lending and grants to $20 billion by 2020 — 50% more than the previous level.[18]

Objectives and activities

Aim

The ADB defines itself as a social development organization that is dedicated to reducing poverty in Asia and the Pacific through inclusive economic growth, environmentally sustainable growth, and regional integration. This is carried out through investments – in the form of loans, grants and information sharing – in infrastructure, health care services, financial and public administration systems, helping nations prepare for the impact of climate change or better manage their natural resources, as well as other areas.

Focus areas

Eighty percent of ADB's lending is concentrated public sector lending in five operational areas.[21]

- Education – Most developing countries in Asia and the Pacific have earned high marks for a dramatic rise in primary education enrollment rates in the last three decades, but daunting challenges remain, threatening economic and social growth.[22]

- Environment, Climate Change, and Disaster Risk Management – Environmental sustainability is a prerequisite for economic growth and poverty reduction in Asia and the Pacific.[23]

- Finance Sector Development – The financial system is the lifeline of a country's economy. It creates prosperity that can be shared throughout society and benefit the poorest and most vulnerable people. Financial sector and capital market development, including microfinance, small and medium-sized enterprises, and regulatory reforms, is vital to decreasing poverty in Asia and the Pacific.This has been a key priority of the Private Sector Operations Department (PSOD) since 2002. One of the most active sub-sectors of finance is the PSOD's support for trade finance. Each year the PSOD finances billions of dollars in letters of credit across all of Asia and the rest of the world.[24]

- Infrastructure, including transport[25] and communications,[26] energy,[27] water supply and sanitation,[28] and urban development.[29]

- Regional Cooperation and Integration – Regional cooperation and integration (RCI) was introduced by President Kuroda when he joined the ADB in 2004. It was seen as a long-standing priority of the Japanese government as a process by which national economies become more regionally connected. It plays a critical role in accelerating economic growth, reducing poverty and economic disparity, raising productivity and employment, and strengthening institutions.[30]

- Private Sector Lending – This priority was introduced into the ADB's activities at the insistence of the Reagan Administration. However, that effort was never a true priority until the administration of President Tadeo Chino who in turn brought in a seasoned American banker – Robert Bestani. From then on, the Private Sector Operations Department (PSOD) grew at a very rapid pace, growing from the smallest financing unit of the ADB to the largest in terms of financing volume. As noted earlier, this culminated in the Long Term Strategic Framework (LTSF) which was adopted by the Board in March 2008.

Financings

The ADB offers "hard" loans on commercial terms primarily to middle income countries in Asia and "soft" loans with lower interest rates to poorer countries in the region. Based on a new policy, both types of loans will be sourced starting January 2017 from the bank's ordinary capital resources (OCR), which functions as its general operational fund.[31]

The ADB's Private Sector Department (PSOD) can and does offer a broader range of financings beyond commercial loans. They also have the capability to provide guarantees, equity and mezzanine finance (a combination of debt and equity).

In 2017, ADB lent $19.1 billion of which $3.2 billion went to private enterprises, as part of its "nonsovereign" operations. ADB's operations in 2017, including grants and cofinancing, totaled $28.9 billion.[32]

ADB obtains its funding by issuing bonds on the world's capital markets. It also relies on the contributions of member countries, retained earnings from lending operations, and the repayment of loans.[33]

| Country | 2018 | 2017 | 2016 | 2015 | ||||

|---|---|---|---|---|---|---|---|---|

| $ million | % | $ million | % | $ million | % | $ million | % | |

| 17,015 | 16.6 | 16,284 | 16.9 | 15,615 | 24.8 | 14,646 | 25.2 | |

| 16,115 | 15.7 | 14,720 | 15.2 | 13,331 | 21.2 | 12,916 | 22.2 | |

| 10,818 | 10.6 | 10,975 | 11.4 | 4,570 | 7.3 | 4,319 | 7.4 | |

| 10,356 | 10.1 | 9,393 | 9.7 | 8,700 | 13.8 | 8,214 | 14.1 | |

| 9,169 | 8.9 | 8,685 | 9.0 | - | - | - | - | |

| - | - | - | - | 5,935 | 9.4 | 5,525 | 9.5 | |

| Others | 38,998 | 38.1 | 36,519 | 37.8 | 14,831 | 23.5 | 12,486 | 21.6 |

| Total | 102,470 | 100.0 | 96,577 | 100.0 | 62,983 | 100.0 | 58,106 | 100.0 |

Private sector investments

ADB provides direct financial assistance, in the form of debt, equity and mezzanine finance to private sector companies, for projects that have clear social benefits beyond the financial rate of return. ADB's participation is usually limited but it leverages a large amount of funds from commercial sources to finance these projects by holding no more than 25% of any given transaction.[36]

Cofinancing

ADB partners with other development organizations on some projects to increase the amount of funding available. In 2014, $9.2 billion—or nearly half—of ADB's $22.9 billion in operations were financed by other organizations.[37] According to Jason Rush, Principal Communication Specialist, the Bank communicates with many other multilateral organizations.

Funds and resources

More than 50 financing partnership facilities, trust funds, and other funds – totalling several billion each year – are administered by ADB and put toward projects that promote social and economic development in Asia and the Pacific.[38] ADB has raised Rs 5 billion or around Rs 500 crores from its issuance of 5-year offshore Indian rupee (INR) linked bonds.

On 26 Feb 2020, ADB raises $118 million from rupee-linked bonds and supporting the development of India International Exchange in India, as it also contributes to an established yield curve which stretches from 2021 through 2030 with $1 billion of outstanding bonds.[39]

Access to information

ADB has an information disclosure policy that presumes all information that is produced by the institution should be disclosed to the public unless there is a specific reason to keep it confidential. The policy calls for accountability and transparency in operations and the timely response to requests for information and documents.[40] ADB does not disclose information that jeopardizes personal privacy, safety and security, certain financial and commercial information, as well as other exceptions.[41]

Notable projects and technical assistance

- Afghanistan: Hairatan to Mazar-e-Sharif Railway Project[42]

- Armenia: Water Supply and Sanitation Sector Project[43]

- Bhutan: Green Power Development Project[44]

- India: Rural Roads Sector II Investment Program[45]

- Indonesia: Vocational Education Strengthening Project[46]

- Laos: Northern and Central Regions Water Supply and Sanitation Sector Project[47]

- Mongolia: Food and Nutrition Social Welfare Program and Project[48]

- Solomon Islands: Pacific Private Sector Development Initiative[49]

Criticism

Since the ADB's early days, critics have charged that the two major donors, Japan and the United States, have had extensive influence over lending, policy and staffing decisions.[50]

Oxfam Australia has criticized the Asian Development Bank for insensitivity to local communities. "Operating at a global and international level, these banks can undermine people's human rights through projects that have detrimental outcomes for poor and marginalized communities."[51] The bank also received criticism from the United Nations Environmental Program, stating in a report that "much of the growth has bypassed more than 70 percent of its rural population, many of whom are directly dependent on natural resources for livelihoods and incomes."[52]

There had been criticism that ADB's large scale projects cause social and environmental damage due to lack of oversight. One of the most controversial ADB-related projects is Thailand's Mae Moh coal-fired power station. Environmental and human rights activists say ADB's environmental safeguards policy as well as policies for indigenous peoples and involuntary resettlement, while usually up to international standards on paper, are often ignored in practice, are too vague or weak to be effective, or are simply not enforced by bank officials.[53][54]

The bank has been criticized over its role and relevance in the food crisis. The ADB has been accused by civil society of ignoring warnings leading up the crisis and also contributing to it by pushing loan conditions that many say unfairly pressure governments to deregulate and privatize agriculture, leading to problems such as the rice supply shortage in Southeast Asia.[55]

Indeed, whereas the Private Sector Operations Department (PSOD) closed out that year with financings of $2.4 billion, the ADB has significantly dropped below that level in the years since and is clearly not on the path to achieving its stated goal of 50% of financings to the private sector by 2020. Critics also point out that the PSOD is the only Department that actually makes money for the ADB. Hence, with the vast majority of loans going to concessionary (sub-market) loans to the public sector, the ADB is facing considerable financial difficulty and continuous operating losses.

Largest countries and regions by subscribed capital and voting power

The following table are amounts for 20 largest countries by subscribed capital and voting power at the Asian Development Bank as of December 2014.[56]

| Rank | Country | Subscribed capital (% of total) | Voting power (% of total) |

|---|---|---|---|

| World | 100.000 | 100.000 | |

| 1 | 15.677 | 12.840 | |

| 2 | 15.567 | 12.752 | |

| 3 | 6.473 | 5.477 | |

| 4 | 6.359 | 5.386 | |

| 5 | 5.812 | 4.948 | |

| 6 | 5.254 | 4.502 | |

| 7 | 5.131 | 4.404 | |

| 8 | 5.060 | 4.347 | |

| 9 | 4.345 | 3.775 | |

| 10 | 2.735 | 2.487 | |

| 11 | 2.393 | 2.213 | |

| 12 | 2.338 | 2.169 | |

| 13 | 2.188 | 2.049 | |

| 14 | 2.051 | 1.940 | |

| 15 | 1.815 | 1.751 | |

| 16 | 1.543 | 1.533 | |

| 17 | 1.368 | 1.393 | |

| 18 | 1.094 | 1.174 | |

| 19 | 1.030 | 1.123 | |

| 20 | 1.026 | 1.119 |

Members

.png)

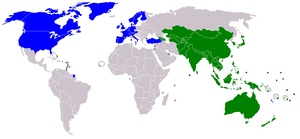

ADB has 68 members (as of 23 March 2019): 49 members from the Asian and Pacific Region, 19 members from Other Regions.[58] The year after a member's name indicates the year of membership. At the time a country ceases to be a member, the Bank shall arrange for the repurchase of such country's shares by the Bank as a part of the settlement of accounts with such country in accordance with the provisions of paragraphs 3 and 4 of Article 43.[59]

|

|

See also

- African Development Bank

- Asian Clearing Union

- Asian Development Bank Institute (ADBI)

- Asian Infrastructure Investment Bank (AIIB)

- Asia Cooperation Dialogue

- Asia Council

- Caribbean Development Bank

- Eurasian Development Bank

- International Monetary Fund

- South Asia Subregional Economic Cooperation

- World Bank

References

- "Masatsugu Asakawa Elected ADB President". 2 December 2019.

- About: Management, adb.org.

- "ADB Annual Report 2016". Asian Development Bank.

- "ADB History". adb.org. Retrieved 2015-11-26.

- "Departments and Offices". adb.org. Retrieved 2015-11-26.

- Ming, Wan (Winter 1995–1996). "Japan and the Asian Development Bank". Pacific Affairs. University of British Columbia. 68 (4): 509–528. doi:10.2307/2761274. JSTOR 2761274. Archived from the original on 2011-08-07.

- Anonymous. "ADB Annual Reports". Asian Development Bank. adb.org. Retrieved 2015-11-26.

- "Scholarship Program: List of Academic Institutions". Asian Development Bank. 12 October 2017.

- "Intergovernmental Organizations". www.un.org.

- "Shareholders" (PDF). Asian Development Bank. adb.org. Archived from the original (PDF) on 2017-08-03. Retrieved 2015-11-26.

- "Board of Directors". Asian Development Bank. adb.org. Retrieved 2015-11-26.

- Bank, Asian Development (2020-01-17). "New ADB President Masatsugu Asakawa Assumes Office". Asian Development Bank. Retrieved 2020-01-24.

- "New ADB President Takehiko Nakao Assumes Office". Asian Development Bank.

- "Contacts." (Archive) Asian Development Bank. Retrieved on April 21, 2015. "6 ADB Avenue, Mandaluyong City 1550, Philippines"

- "Contacts: How to Visit ADB." (Archive) Asian Development Bank. Retrieved on April 21, 2015.

- "Key Facts". Asian Development Bank. adb.org. Retrieved 2015-11-26.

- ADB, 'New ADB President Masatsugu Asakawa Assumes Office', News Release, 17 January 2020.

- "ADB History". Asian Development Bank. adb.org. Retrieved 2015-12-21.

- Devesh Kapur; John Prior Lewis; Richard Charles Webb (2010-12-01). The World Bank: Perspectives. Brookings Institution Press. pp. 304–. ISBN 0-8157-2014-9.

- Frank N. Magill (23 April 2014). Chron 20c Hist Bus Comer. Routledge. pp. 891–. ISBN 978-1-134-26462-9.

- "Core Operational Areas". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "Education". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "Environment, Climate Change, and Disaster Risk Management". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "Finance Sector Development". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "Sustainable Transport for All". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "Information and Communications Technology". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "Energy". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "Water for All". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "Urban Development". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "Regional Cooperation and Integration". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- Bank, Asian Development. "ADF-OCR Merger to Boost Support for Region's Poor". Asian Development Bank. adb.org. Retrieved 2015-11-27.

- Bank, Asian Development. "ADB news release". Asian Development Bank. adb.org. Retrieved 2018-01-12.

- "FAQs". Asian Development Bank. adb.org. Retrieved 2015-11-27.

- "Management's Discussion and Analysis and Annual Financial Statements" (PDF). Asian Development Bank. 31 December 2016.

- "2018 FINANCIAL REPORT" (PDF). Asian Development Bank. 31 December 2018.

- "Private Sector (Nonsovereign) Financing". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "Official Cofinancing". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "Funds". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "ADB raises $118 million from rupee-linked bonds". The Economic Times. 2020-02-26. Retrieved 2020-03-23.

- "Overview". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "Exceptions to Disclosure". Asian Development Bank. adb.org. Retrieved 2015-12-14.

- "Hairatan to Mazar-i-Sharif railway | Railways of Afghanistan". www.andrewgrantham.co.uk. Retrieved 2015-11-27.

- "Water Supply and Sanitation Sector Project – Additional Financing in Armenia: General Procurement Notice | Devex". www.devex.com. Retrieved 2015-11-27.

- "Proposed Green Power Development Project in Bhutan | Devex". www.devex.com. Retrieved 2015-11-27.

- "Government signs loan agreement with ADB for Rural Roads Sector II Investment Program–Project 4, Special Content – Association Releases – ConstructionBiz360,ConstructionBiz360". www.constructionbiz360.com. Archived from the original on 2015-12-08. Retrieved 2015-11-27.

- "ADB supports vocational education in Indonesia". Antara. 28 September 2012. Retrieved 2015-11-27.

- Murphy, B. J. "Oudomxay hosts belated opening ceremony for water treatment plant". Lao People's Democratic Republic. Retrieved 2015-11-27.

- "Food and Nutrition Social Welfare Programme and Project (Capacity Development Project – M&E)". Oxford Policy Management. Retrieved 2015-11-27.

- "Pacific banks go branchless to reach the unbanked | Scoop News". www.scoop.co.nz. Retrieved 2015-11-27.

- Kilby, Christopher (2002). "Donor Influence in MDBs: The Case of the Asian Development Bank" (PDF). The Review of International Organizations. 68 (4): 509–528. Retrieved 2010-09-16.

- "The Asian Development Bank and Food Security". Oxfam Australia.

- "Inter Press Service – News and Views from the Global South". Archived from the original on 2007-12-12.

- "Large-scale ADB projects draw criticism". The Japan Times.

- "RFI – NGO criticises ADB and questions its ability to reduce poverty". rfi.fr.

- "ADB to meet amid food crisis, growing poverty" Archived July 17, 2011, at the Wayback Machine

- "Members, Capital Stock, and Voting Power" (PDF). adb.org. December 2014.

- "A Graduation Policy for the Bank's DMCs". Asian Development Bank.

- "Members". Asian Development Bank.

- Agreement Establishing the Asian Development Bank. Asian Development Bank. Retrieved 2007-12-10.

- Joined as Kingdom of Laos, succeeded by Lao PDR in 1975

- "Asian Development Bank and Taipei,China: Fact Sheet". Asian Development Bank.

- Joined as Republic of China representing not only Taiwan Area, but also nominally Mainland China until 1986. However, its share of Bank capital was based on the size of Taiwan's capital, unlike the World Bank and IMF where the government in Taiwan had had a share. The representation was succeeded by China in 1986. However, the ROC was allowed to retain its membership, but under the name of Taipei,China (space deliberately omitted after the comma) — a name it protests. Uniquely, this allows both sides of the Taiwan Straits to be represented at the institution.

- Formerly South Vietnam until 1975

- Joined as "British Hong Kong", not "Hong Kong SAR"

- Founding member; joined as West Germany.

Further reading

- Huang, P.W. 1975. The Asian Development Bank: Diplomacy and Development in Asia. New York, NY: Vantage Press.

- Krishnamurti, R. 1977. ADB: The Seeding Days. Manila: Asian Development Bank.

- McCawley, Peter. 2017. Banking on the Future of Asia and the Pacific: 50 Years of the Asian Development Bank. Manila: Asian Development Bank, ISBN 978-92-9257-791-9 (print), ISBN 978-92-9257-792-6 (e-ISBN), ISBN 978-4-326-50451-0 (Japanese language edition).

- Watanabe, Takeshi. 1977 (reprinted 2010). Towards a New Asia. Manila: Asian Development Bank.

- Wihtol, Robert. 1988. The Asian Development Bank and Rural Development: Policy and Practice. Hampshire, UK: Macmillan Press.

- Wilson, Dick. 1997. A Bank for Half the World: The Story of the Asian Development Bank, 1966-1986. Manila: Asian Development Bank.

- Yasutomo, D.T. 1983. Japan and the Asian Development Bank. New York, NY: Praeger.

External links

| Wikimedia Commons has media related to Asian Development Bank. |

- Official website

- Bank Information Center

- ADB Institute

- "Inequality Worsens across Asia", Dollars & Sense magazine, November/December 2007. Article discussing recent reports from the ADB.

- "The right business environment" Youth unemployment in Asia. An interview with Jesus Felipe, advisor in the Economics and Research Department of ADB.