Mississippi Company

The Mississippi Company (French: Compagnie du Mississippi; founded 1684, named the Company of the West from 1717, and the Company of the Indies from 1719[1]) was a corporation holding a business monopoly in French colonies in North America and the West Indies. When land development and speculation in the region became frenzied and detached from economic reality, the Mississippi bubble became one of the earliest examples of an economic bubble.

| Public | |

| Industry | International trade |

| Founded | 1684 |

| Defunct | 1721 |

| Headquarters | France |

History

Banque Royale

In May 1716, the Scottish economist John Law, who had been appointed Controller General of Finances of France under the Duke of Orleans, created the Banque Générale Privée ("General Private Bank"). It was the first financial institution to develop the use of paper money.[2][3][4] It was a private bank, but three quarters of the capital consisted of government bills and government-accepted notes. In August 1717, Law bought the Mississippi Company to help the French colony in Louisiana. In the same year Law conceived a joint-stock trading company called the Compagnie d'Occident (The Mississippi Company, or, literally, "Company of [the] West"). Law was named the Chief Director of this new company, which was granted a trade monopoly of the West Indies and North America by the French government.[5]

The bank became the Banque Royale (Royal Bank) in 1718, meaning the notes were guaranteed by the king, Louis XV of France. The company absorbed the Compagnie des Indes Orientales ("Company of the East Indies"), the Compagnie de Chine ("Company of China"), and other rival trading companies and became the Compagnie Perpetuelle des Indes on 23 May 1719 with a monopoly of French commerce on all the seas. Simultaneously, the bank began issuing more notes than it could represent in coinage; this led to a currency devaluation, which was eventually followed by a bank run when the value of the new paper currency was halved.[6]

Mississippi Bubble

Louis XIV's long reign and wars had nearly bankrupted the French monarchy. Rather than reduce spending, the Regency of Louis XV of France endorsed the monetary theories of Scottish financier John Law. In 1716, Law was given a charter for the Banque Royale under which the national debt was assigned to the bank in return for extraordinary privileges. The key to the Banque Royale agreement was that the national debt would be paid from revenues derived from opening the Mississippi Valley. The Bank was tied to other ventures of Law—the Company of the West and the Companies of the Indies. All were known as the Mississippi Company. The Mississippi Company had a monopoly on trade and mineral wealth. The Company boomed on paper. Law was given the title Duc d'Arkansas. Bernard de la Harpe and his party left New Orleans in 1719 to explore the Red River. In 1721, he explored the Arkansas River. At the Yazoo settlements in Mississippi he was joined by Jean Benjamin who became the scientist for the expedition.

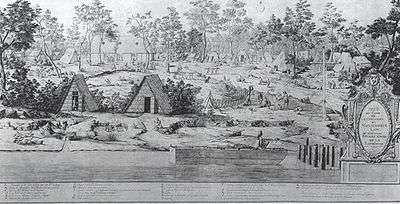

In 1718, there were only 700 Europeans in Louisiana. The Mississippi Company arranged ships to move 800 more, who landed in Louisiana in 1718, doubling the European population. Law encouraged some German-speaking peoples, including Alsatians and Swiss, to emigrate. They give their name to the regions of the Côte des Allemands and the Lac des Allemands in Louisiana.

Prisoners were set free in Paris from September 1719 onwards, under the condition that they marry prostitutes and go with them to Louisiana. The newly married couples were chained together and taken to the port of embarkation. In May 1720, after complaints from the Mississippi Company and the concessioners about this class of French immigrants, the French government prohibited such deportations. However, there was a third shipment of prisoners in 1721.[7]

Law exaggerated the wealth of Louisiana with an effective marketing scheme, which led to wild speculation on the shares of the company in 1719. The scheme promised success for the Mississippi Company by combining investor fervor and the wealth of its Louisiana prospects into a sustainable, joint-stock, trading company. The popularity of company shares were such that they sparked a need for more paper bank notes, and when shares generated profits the investors were paid out in paper bank notes.[8] In 1720, the bank and company were merged and Law was appointed by Philippe II, Duke of Orleans, then Regent for Louis XV, to be Comptroller General of Finances[9] to attract capital. Law's pioneering note-issuing bank thrived until the French government was forced to admit that the number of paper notes being issued by the Banque Royale exceeded the value of the amount of metal coinage it held.[10]

The "bubble" burst at the end of 1720,[11] when opponents of the financier attempted to convert their notes into specie en masse, forcing the bank to stop payment on its paper notes.[12] By the end of 1720 Philippe d'Orléans had dismissed Law from his positions. Law then fled France for Brussels, eventually moving on to Venice, where he lived off his gambling. He was buried in the church San Moisè in Venice.[6]

See also

- Richard Cantillon – banker who made an early profit from the company

- List of trading companies

- European chartered companies founded around the 17th century (in French)

References

- "The French Period". Jewell's Crescent City Illustrated. Cultural Center of the Inter-American Development Bank. Archived from the original on 9 October 2012. Retrieved 1 July 2013.

- Nevin, Seamus (2013). "Richard cantillon – The Father of Economics". History Ireland. 21 (2): 20–23. JSTOR 41827152.

- Backhosue, Roger. Economists and the economy: the evolution of economic ideas, Transaction Publishers, 1994, ISBN 978-1-56000-715-9, p. 118

- http://libertystreeteconomics.newyorkfed.org/2014/01/crisis-chronicles-the-mississippi-bubble-of-1720-and-the-european-debt-crisis.html NY Federal Reserve: Mississippi Bubble of 1720

- Bammer, Stuart. Anglo-American Securities Regulation: Cultural and Political Roots, 1690–1860, Cambridge University Press, 2002, ISBN 978-0-521-52113-0, p. 42

- Sheeran, Paul and Spain, Amber. The international political economy of investment bubbles, Ashgate Publishing, Ltd., 2004, ISBN 978-0-7546-1997-0, p. 95

- Cat Island: The History of a Mississippi Gulf Coast Barrier Island, by John Cuevas

- Beattie, Andrew. "What burst the Mississippi Bubble?" on Investopedia.com (June 17, 2009)

- Mckay, Charles. Extraordinary Popular Delusions and the Madness of Crowds. New York: Noonday Press, 1932, p.25. First edition published 1841, second edition 1852

- "Mississippi Company".

-

Moen, Jon (October 2001). "John Law and the Mississippi Bubble: 1718–1720". Mississippi History Now. Archived from the original on 1 March 2016. Retrieved 2 February 2011.

Law devalued shares in the company in several stages during 1720, and the value of bank notes was reduced to 50 percent of their face value. By September 1720 the price of shares in the company had fallen to 2,000 livres and to 1,000 by December. The fall in the price of stock allowed Law's enemies to take control of the company by confiscating the shares of investors who could not prove they had actually paid for their shares with real assets rather than credit. This reduced investor shares, or shares outstanding, by two-thirds. By September 1721 share prices had dropped to 500 livres, where they had been at the beginning.

- Davies, Roy and Davies, Glyn. "A Comparative Chronology of Money: Monetary History from Ancient Times to the Present Day: 1700–1749" (1996 and 1999)

Further reading

- Gleeson, Janet (2001). Millionaire: The Philanderer, Gambler, and Duelist Who Invented Modern Finance. New York: Simon & Schuster. ISBN 978-0684872957.

External links

| Wikisource has the text of the 1920 Encyclopedia Americana article Mississippi Bubble. |

- "Learning from past investment manias" (AME Info FN).

- . New International Encyclopedia. 1905.