Panic of 1893

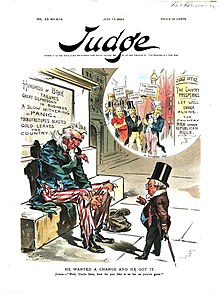

The Panic of 1893 was a serious economic depression in the United States that began in 1893 and ended in 1897.[1] It deeply affected every sector of the economy, and produced political upheaval that led to the realigning election of 1896 and the presidency of William McKinley.

Causes

One of the causes for the Panic of 1893 can be traced back to Argentina. Investment was encouraged by the Argentine agent bank, Baring Brothers. However, the 1890 wheat crop failure and a coup in Buenos Aires ended further investments. In addition, speculations also collapsed in South African and Australian properties. Because European investors were concerned that these problems might spread, they started a run on gold in the U.S. Treasury. Specie was considered more valuable than paper money; when people were uncertain about the future, they hoarded specie and rejected paper.[2][3]

During the Gilded Age of the 1870s and 1880s, the United States had experienced economic growth and expansion, but much of this expansion depended on high international commodity prices. To exacerbate the problems with international investments, wheat prices crashed in 1893.[2]

One of the first clear signs of trouble came on February 20, 1893,[4] twelve days before the inauguration of U.S. President Grover Cleveland, with the appointment of receivers for the Philadelphia and Reading Railroad, which had greatly overextended itself.[5] Upon taking office, Cleveland dealt directly with the Treasury crisis[6] and successfully convinced Congress to repeal the Sherman Silver Purchase Act, which he felt was mainly responsible for the economic crisis.[7]

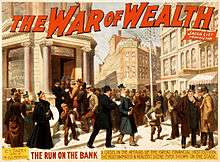

As concern for the state of the economy deepened, people rushed to withdraw their money from banks, and caused bank runs. The credit crunch rippled through the economy. A financial panic in London combined with a drop in continental European trade caused foreign investors to sell American stocks to obtain American funds backed by gold.[8]

Populists

The People's Party, also known as the 'Populists', was an agrarian-populist political party in the United States. From 1892 to 1896, it played a major role as a left-wing force in American politics. It drew support from angry farmers in the West and South. It was highly critical of capitalism, especially banks and railroads, and allied itself with the labor movement.

Established in 1891 as a result of the Populist movement, the People's Party reached its zenith in the 1892 presidential election, when its ticket, composed of James B. Weaver and James G. Field, won 8.5% of the popular vote and carried five states (Colorado, Idaho, Kansas, Nevada and North Dakota), and the 1894 House of Representatives elections, when it won nine seats. Built on a coalition of poor, white cotton farmers in the South (especially North Carolina, Alabama and Texas) and hard-pressed wheat farmers in the Plains States (especially Kansas and Nebraska), the Populists represented a radical crusading form of agrarianism and hostility to elites, cities, banks, railroads, and gold.

Silver

| Unemployment rates during the 1890s (rates are per 100 persons)[9] | ||

|---|---|---|

| Year | Lebergott | Romer |

| 1890 | 4.0 | 4.0 |

| 1891 | 5.4 | 4.8 |

| 1892 | 3.0 | 3.7 |

| 1893 | 11.7 | 8.1 |

| 1894 | 18.4 | 12.3 |

| 1895 | 13.7 | 11.1 |

| 1896 | 14.5 | 12.0 |

| 1897 | 14.5 | 12.4 |

| 1898 | 12.4 | 11.6 |

| 1899 | 6.5 | 8.7 |

| 1900 | 5.0 | 5.0 |

The Free Silver movement arose from a synergy of farming and mining interests. Farmers sought to invigorate the economy and thereby end deflation, which was forcing them to repay loans with increasingly valuable dollars. Mining interests sought the right to turn silver directly into money without a central minting institution. The Sherman Silver Purchase Act of 1890, while falling short of the Free Silver movement's goals, required the U.S. government to buy millions of ounces of silver above what was required by the 1878 Bland–Allison Act (driving up the price of silver and pleasing silver miners). People attempted to redeem silver notes for gold. Ultimately, the statutory limit for the minimum amount of gold in federal reserves was reached and U.S. notes could no longer be successfully redeemed for gold.[8] Investments during the time of the panic were heavily financed through bond issues with high interest payments. Rumors regarding the National Cordage Company (NCC)'s financial distress (NCC was the most actively traded stock at the time) caused its lenders to call in their loans immediately, and the company went into bankruptcy receivership as a result. The company, a rope manufacturer, had tried to corner the market for imported hemp. As demand for silver and silver notes fell, the price and value of silver dropped. Holders worried about a loss of face value of bonds, and many became worthless.[10]

A series of bank failures followed, and the Northern Pacific Railway, the Union Pacific Railroad and the Atchison, Topeka & Santa Fe Railroad failed. This was followed by the bankruptcy of many other companies; in total over 15,000 companies and 500 banks, many of them in the West, failed. According to high estimates, about 17%–19% of the workforce was unemployed at the panic's peak. The huge spike in unemployment, combined with the loss of life savings kept in failed banks, meant that a once-secure middle-class could not meet their mortgage obligations. Many walked away from recently built homes as a result.[11]

Effects

As a result of the panic, stock prices declined. Five hundred banks closed, 15,000 businesses failed, and numerous farms ceased operation. The unemployment rate hit 25% in Pennsylvania, 35% in New York, and 43% in Michigan. Soup kitchens were opened to help feed the destitute. Facing starvation, people chopped wood, broke rocks, and sewed by hand with needle and thread in exchange for food. In some cases, women resorted to prostitution to feed their families. To help the people of Detroit, Mayor Hazen S. Pingree launched his "Potato Patch Plan", which were community gardens for farming.[12]

President Grover Cleveland was blamed for the depression. Gold reserves stored in the U.S. Treasury fell to a dangerously low level. This forced President Cleveland to borrow $65 million in gold from Wall Street banker J.P. Morgan and the Rothschild banking family of England.[13] His party suffered enormous losses in the 1894 elections, largely being blamed for the downward spiral in the economy and the brutal crushing of the Pullman Strike. After their defeat in 1896, the Democrats did not regain control of any branch of the Federal Government until 1910.

Shipping

The Panic of 1893 affected many aspects of the shipping industry, both by rail and by sea. It arrested the acquisition of ships and rolling stock, and pushed down shipping rates.

Fluctuations in railroad investment after the Panic of 1893

The bad omen of investors switching from potentially volatile stocks to more stable bonds in 1894 was mirrored in railroads by slower acquisition of rolling stock. Railroad expansion rose again in 1895, but was arrested in 1897 by another economic trough.[14]

Receivership

In 1893, the total railroad mileage in the U.S. was 176,803.6 miles. In 1894 and 1895, railroads only expanded 4,196.4 miles, although 100,000 miles of rail was added from 1878 to 1896.[15] In 1893, the year following the panic, one fourth of all rail mileage went into receivership.[16] The U.S. Census placed this value at close to $1.8 billion (not adjusted for inflation), the largest amount recorded between 1876 and 1910. This was over $1 billion (also not adjusted for inflation) more than the next largest amount, in 1884.[17]

Pullman Strike

In 1894, the U.S. Army intervened during a strike in Chicago to prevent property damage.[18] The strike was instigated at the Pullman Company in Chicago after it refused to either lower rent in the company town or raise wages for its workers due to increased economic pressure from the Panic of 1893.[19] Since the Pullman Company was a railroad car company, this only increased the difficulty of acquiring rolling stock.

American merchant tonnage

The maritime industry of the United States did not escape the effects of the Panic of 1893. The total gross registered merchant marine tonnage employed in "foreign and coastwise trade and in the fisheries", as measured by the U.S. Census between 1888 and 1893, grew at a rate of about 2.74%. In 1894, however, U.S. gross tonnage decreased by 2.9%, and again in 1895 by 1.03%.[20]

Rates

In 1894, the rate for a bushel of wheat by rail dropped from 14.7¢ in 1893 to 12.88¢. This rate continued to decrease, reaching a terminal rate in 1901 of 9.92¢ and never reached 12 cents between 1898 and 1910.[17]

Between 1893 and 1894, average shipping rates by lake or canal per wheat bushel decreased by almost 2 cents, from 6.33¢ to 4.44¢. Rates on the transatlantic crossing from New York City to Liverpool also decreased, from 2 and 3/8 to 1 and 15/16, but this reflected a trend downward since 1891.[17]

See also

- Black Friday (1869) – also referred to as the "Gold Panic of 1869"

- Denver Depression of 1893

- Basic City, Virginia

- Panic of 1896

- Pullman Strike

- Second-term curse

- The Driver, 1922 novel set during the panic

References

- Timberlake, Jr., Richard H. (1997). "Panic of 1893". In Glasner, David; Cooley, Thomas F. (eds.). Business Cycles and Depressions: an Encyclopedia. New York: Garland Publishing. pp. 516–18. ISBN 0-8240-0944-4.CS1 maint: multiple names: authors list (link)

- Nelson, Scott Reynolds. 2012. A Nation of Deadbeats. New York: Alfred Knopf, p. 189.

- "The Depression of 1893". eh.net. Retrieved 2019-09-27.

- "IN RE RICE". Findlaw.

- James L. Holton, The Reading Railroad: History of a Coal Age Empire, Vol. I: The Nineteenth Century, pp. 323–325, citing Vincent Corasso, The Morgans.

- "Grover Cleveland Archived 2010-09-18 at the Wayback Machine," whitehouse.gov

- "Grover Cleveland Archived 2010-10-09 at the Wayback Machine," American President: A Reference Resource, millercenter.org

- Whitten, David O. "EH.Net Encyclopedia: Depression of 1893". eh.net. Archived from the original on 2009-04-27. Retrieved 2009-04-20.

- Romer, Christina (1986). "Spurious Volatility in Historical Unemployment Data". Journal of Political Economy. 94 (1): 1–37. doi:10.1086/261361.

- Northrup, Cynthia Clark (2003). The American Economy: Essays and primary source documents. ABC-CLIO. p. 195. ISBN 9781576078662.

- Hoffman, Charles. The Depression of the Nineties: An Economic History. Westport, CT: Greenwood Publishing, 1970. p. 109.

- Parshall, Gerald. "The Great Panic Of '93." U.S. News & World Report 113.17 (1992): 70. Academic Search Complete. Web. 26 Feb. 2013.

- Faulkner, Harold U. (1959). Politics Reform and Expansion: 1890–1900. pp. 143–44, 155–57.

- Hoffmann, Charles (1956). "The Depression of the Nineties". The Journal of Economic History. 16 (2): 137–164. doi:10.1017/S0022050700058629. JSTOR 2114113.

- "Annual report of the Interstate Commerce Commission. 1896". hdl:2027/uc1.$b796977. Cite journal requires

|journal=(help) - Leonard, W. N. (1949). "The Decline of Railroad Consolidation". The Journal of Economic History. 9 (1): 1–24. doi:10.1017/S0022050700090306. JSTOR 2113718.

- "Internal Communication and Transportation" (PDF). United States Census Bureau. 30 Mar 2015.

- Rondinone, Troy (2009). "Guarding the Switch: Cultivating Nationalism during the Pullman Strike". The Journal of the Gilded Age and Progressive Era. 8 (1): 83–109. doi:10.1017/S1537781400001018. JSTOR 40542737.

- Bigott, Joseph C. (2001-08-15). From Cottage to Bungalow: Houses and the Working Class in Metropolitan Chicago, 1869-1929. University of Chicago Press. p. 93. ISBN 9780226048758.

- "Merchant Marine and Shipping" (PDF). United States Census Bureau. 30 Mar 2015.

Further reading

Contemporary sources

- American Annual Cyclopedia...1894 (1895) online

- Baum, Lyman Frank and W. W. Denslow. The Wonderful Wizard of Oz (1900); see Political interpretations of The Wonderful Wizard of Oz

- Brice, Lloyd Stephens, and James J. Wait. "The Railway Problem." North American Review 164 (March 1897): 327–48. online at MOA Cornell.

- Cleveland, Frederick A. "The Final Report of the Monetary Commission," Annals of the American Academy of Political and Social Science 13 (January 1899): 31–56 in JSTOR

- Closson, Carlos C. Jr. "The Unemployed in American Cities." Quarterly Journal of Economics, vol. 8, no. 2 (January 1894) 168–217 in JSTOR; vol. 8, no. 4 (July 1894): 443–477 in JSTOR

- Fisher, Willard. "‘Coin’ and His Critics." Quarterly Journal of Economics 10 (January 1896): 187–208 in JSTOR

- Harvey, William H. Coin’s Financial School (1894), 1963 (Introduction by Richard Hofstadter). online first edition

- Noyes, Alexander Dana. "The Banks and the Panic," Political Science Quarterly 9 (March 1894): 12–28 in JSTOR.

- Shaw, Albert. "Relief for the Unemployed in American Cities," Review of Reviews 9 (January and February 1894): 29–37, 179–91.

- Stevens, Albert Clark. "An Analysis of the Phenomena of the Panic in the United States in 1893," Quarterly Journal of Economics 8 (January 1894): 117–48 in JSTOR.

Secondary sources

- Barnes, James A. John G. Carlisle: Financial Statesman (1931).

- Barnes, James A. (1947). "Myths of the Bryan Campaign". Mississippi Valley Historical Review. The Mississippi Valley Historical Review, Vol. 34, No. 3. 34 (3): 383–394. doi:10.2307/1898096. JSTOR 1898096.

- Bent, Peter H. (2015), "The Stabilising Effects of the Dingley Tariff and the Recovery from the 1890s Depression in the United States", Crises in Economic and Social History: A Comparative Perspective, pp. 373–390.

- Bent, Peter H. (2015). "The Political Power of Economic Ideas: Protectionism in Turn of the Century America". Economic Thought. 4 (2): 68–79. .

- Destler, Chester McArthur. American Radicalism, 1865–1901 (1966).

- Dewey, Davis Rich. Financial History of the United States (1903). online.

- Dighe, Ranjit S. ed. The Historian's Wizard of Oz: Reading L. Frank Baum's Classic as a Political and Monetary Allegory (2002).

- Dorfman, Joseph Harry. The Economic Mind in American Civilization. (1949). vol 3.

- Faulkner, Harold Underwood. Politics, Reform, and Expansion, 1890–1900. (1959).

- Feder, Leah Hanna. Unemployment Relief in Periods of Depression ... 1857–1920 (1926).

- Friedman, Milton, and Anna Jacobson Schwartz. A Monetary History of the United States, 1867–1960 (1963).

- Harpine, William D. From the Front Porch to the Front Page: McKinley and Bryan in the 1896 Presidential Campaign (2006) excerpt and text search

- Hoffmann, Charles (1956). "The Depression of the Nineties". Journal of Economic History. 16 (2): 137–164. doi:10.1017/S0022050700058629. JSTOR 2114113.

- Hoffmann, Charles. The Depression of the Nineties: An Economic History (1970).

- Jensen, Richard. The Winning of the Midwest: 1888–1896 (1971).

- Josephson, Matthew. The Robber Barons New York: Harcourt Brace Jovanovich (1990).

- Kirkland, Edward Chase. Industry Comes of Age, 1860–1897 (1961).

- Lauck, William Jett. The Causes of the Panic of 1893 (1907). online

- Lindsey, Almont. The Pullman Strike 1942.

- Littlefield, Henry M. (1964). "The Wizard of Oz: Parable on Populism". American Quarterly. American Quarterly, Vol. 16, No. 1. 16 (1): 47–58. doi:10.2307/2710826. JSTOR 2710826.

- Nevins, Allan. Grover Cleveland: A Study in Courage. 1932, Pulitzer Prize.

- Ramsey, Bruce (2018). The Panic of 1893: The Untold Story of Washington State's First Depression. Caxton Press. ISBN 978-0870046216.

- Rezneck, Samuel S. (1953). "Unemployment, Unrest, and Relief in the United States during the Depression of 1893–97". Journal of Political Economy. The Journal of Political Economy, Vol. 61, No. 4. 61 (4): 324–345. doi:10.1086/257393. JSTOR 1826883.

- Ritter, Gretchen. Goldbugs and Greenbacks: The Anti-Monopoly Tradition and the Politics of Finance in America (1997)

- Ritter, Gretchen (1997). "Silver slippers and a golden cap: L. Frank Baum's The Wonderful Wizard of Oz and historical memory in American politics". Journal of American Studies. 31 (2): 171–203. doi:10.1017/S0021875897005628.

- Rockoff, Hugh (1990). "The 'Wizard of Oz' as a Monetary Allegory". Journal of Political Economy. The Journal of Political Economy, Vol. 98, No. 4. 98 (4): 739–760. doi:10.1086/261704. JSTOR 2937766.

- Romer, Christina (1986). "Spurious Volatility in Historical Unemployment Data". Journal of Political Economy. 94 (1): 1–37. doi:10.1086/261361.

- Schwantes, Carlos A. Coxey’s Army: An American Odyssey (1985).

- Shannon, Fred Albert. The Farmer’s Last Frontier: Agriculture, 1860–1897 (1945).

- Steeples, Douglas, and David O. Whitten. Democracy in Desperation: The Depression of 1893 (1998).

- Strouse, Jean. Morgan: American Financier (1999).

- White; Gerald T. The United States and the Problem of Recovery after 1893 (1982).

- Whitten, David. EH.NET article on the Depression of 1893

- Wicker, Elmus. Banking panics of the gilded age (Cambridge University Press, 2006) contents

External links

- Causes of the Business Depression by Henry George; appeared in Once a Week, a New York periodical, March 6, 1894