Plug-in electric vehicle

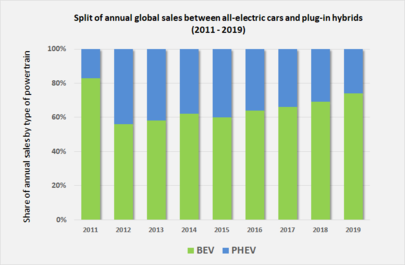

A plug-in electric vehicle (PEV) is any vehicle that can be recharged from an external source of electricity, such as wall sockets, and the electricity stored in the rechargeable battery packs drives or contributes to drive the wheels. PEV is a subset of electric vehicles that includes all-electric, or battery electric vehicles (BEVs), and plug-in hybrid vehicles (PHEVs).[1][2][3] In China, plug-in electric vehicles are classified as new energy vehicles (NEVs). Sales of the first mass-production plug-in cars by major carmakers began in late December 2010, with the introduction of the all-electric Nissan Leaf and the plug-in hybrid Chevrolet Volt.

(global sales as of May 2020)

Plug-in cars have several benefits compared to conventional internal combustion engine vehicles. All-electric vehicles have lower operating and maintenance costs, and produce little or no local air pollution. They reduce dependence on petroleum and may significantly reduce greenhouse gas emissions, depending on the electricity source. Plug-in hybrids capture most of these benefits when they are operating in all-electric mode.

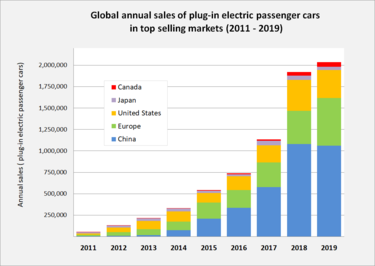

Cumulative global sales of highway legal plug-in electric passenger cars and light utility vehicles achieved the 1 million unit mark in September 2015,[4] and the 5 million milestone in December 2018.[5] By the end of 2019 the stock of light-duty plug-in vehicles totaled about 7.5 million units.[6] Despite the rapid growth experienced, the plug-in electric car segment by December 2018 represented just about 1 out of every 250 vehicles on the world's roads.[7]

As of March 2020, the Tesla Model 3 listed as the world's top selling highway-capable plug-in electric car in history, with global sales since inception of more than 500,000 units,[8] followed by the Nissan Leaf with 470,000 units sold through May 2020.[9] The Mitsubishi Outlander P-HEV is the world's all-time best selling plug-in hybid with global sales of 250,000 units by May 2020.[10]

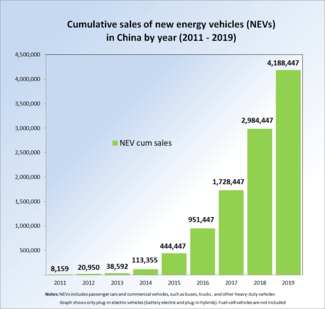

As of December 2019, China had the world's largest stock of highway legal plug-in electric passenger cars with 3.4 million units on the road, representing almost half (47%) of the world's stock of plug-in cars.[11] Europe ranked next with 1.7 million plug-in electric passenger cars in use, accounting for 25% of the global stock.[11] The U.S. stock totaled about 1.5 million plug-in cars at the end of 2019, 20% of the global stock.[11]

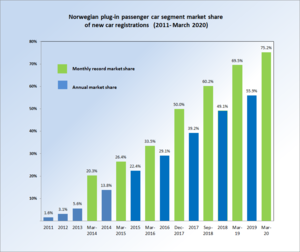

Norway leads Europe with almost 376,000 light-duty vehicles in use as of December 2019, and has the world's third largest plug-in country fleet.[12] In October 2018, Norway became the first country where 1 for every 10 passenger cars registered is a plug-in electric vehicle, and its plug-in car penetration rose to 13% in 2019.[11][13]

Terminology

Plug-in electric vehicle

A plug-in electric vehicle (PEV) is any motor vehicle with rechargeable battery packs that can be charged from the electric grid, and the electricity stored on board drives or contributes to drive the wheels for propulsion.[1][2] Plug-in electric vehicles are also sometimes referred to as grid-enabled vehicles (GEV)[2] and also as electrically chargeable vehicles (ECV).[14]

PEV is a subcategory of electric vehicles that includes battery electric vehicles (BEVs), plug-in hybrid vehicles, (PHEVs), and electric vehicle conversions of hybrid electric vehicles and conventional internal combustion engine vehicles.[1][2] Even though conventional hybrid electric vehicles (HEVs) have a battery that is continually recharged with power from the internal combustion engine and regenerative braking, they can not be recharged from an off-vehicle electric energy source, and therefore, they do not belong to the category of plug-in electric vehicles.[1][2]

"Plug-in electric drive vehicle" is the legal term used in U.S. federal legislation to designate the category of motor vehicles eligible for federal tax credits depending on battery size and their all-electric range.[15][16] In some European countries, particularly in France, "electrically chargeable vehicle" is the formal term used to designate the vehicles eligible for these incentives.[17] While the term "plug-in electric vehicle" most often refers to automobiles or "plug-in cars", there are several other types of plug-in electric vehicle, including electric motorcycles and scooters, neighborhood electric vehicles or microcars, city cars, vans, buses, electric trucks or lorries, and military vehicles.[18]

Battery electric vehicles

A battery electric vehicle (BEV) uses chemical energy stored in rechargeable battery packs as its only source for propulsion.[2][19] BEVs use electric motors and motor controllers instead of internal combustion engines (ICEs) for propulsion.[2]

A plug-in hybrid operates as an all-electric vehicle or BEV when operating in charge-depleting mode, but it switches to charge-sustaining mode after the battery has reached its minimum state of charge (SOC) threshold, exhausting the vehicle's all-electric range (AER).[20][21]

Plug-in hybrid electric vehicles

A plug-in hybrid electric vehicle (PHEV or PHV), also known as a plug-in hybrid, is a hybrid electric vehicle with rechargeable batteries that can be restored to full charge by connecting a plug to an external electric power source.[2][22] A plug-in hybrid shares the characteristics of both a conventional hybrid electric vehicle and an all-electric vehicle: it uses a gasoline engine and an electric motor for propulsion, but a PHEV has a larger battery pack that can be recharged, allowing operation in all-electric mode until the battery is depleted.[22][23][24]

Aftermarket conversions

An aftermarket electric vehicle conversion is the modification of a conventional internal combustion engine vehicle (ICEV) or hybrid electric vehicle (HEV) to electric propulsion, creating an all-electric or plug-in hybrid electric vehicle.[25][26][27]

There are several companies in the U.S. offering conversions. The most common conversions have been from hybrid electric cars to plug-in hybrid, but due to the different technology used in hybrids by each carmaker, the easiest conversions are for 2004–2009 Toyota Prius and for the Ford Escape/Mercury Mariner Hybrid.[25]

New energy vehicles

In China the term new energy vehicles (NEVs) refers to vehicles that are partially or fully powered by electricity, such as battery electric vehicles (BEVs), plug-in hybrids (PHEVs), and hydrogen fuel cell vehicles (FCEVs). The Chinese government began implementation of its NEV program in 2009 to foster the development and introduction of new energy vehicles.[28]

Advantages

PEVs have several advantages. These include reduced greenhouse gas emissions, improved air quality, noise reduction, and national security benefits. According to the Center for American Progress, PEVs are an important part of the group of technologies that will help the U.S. meet its goal under the Paris Agreement, which is a 26-28 percent reduction in greenhouse gas emissions by the year 2025.[29]

Lower operating and maintenance costs

Internal combustion engines are relatively inefficient at converting on-board fuel energy to propulsion as most of the energy is wasted as heat, and the rest while the engine is idling. Electric motors, on the other hand, are more efficient at converting stored energy into driving a vehicle. Electric drive vehicles do not consume energy while at rest or coasting, and modern plug-in cars can capture and reuse as much as one fifth of the energy normally lost during braking through regenerative braking.[30][31] Typically, conventional gasoline engines effectively use only 15% of the fuel energy content to move the vehicle or to power accessories, and diesel engines can reach on-board efficiencies of 20%, while electric drive vehicles typically have on-board efficiencies of around 80%.[30]

In the United States, as of early 2010 with a national average electricity rate of US$0.10 per kWh,[33] the cost per mile for a plug-in electric vehicle operating in all-electric mode is estimated between $0.02 to $0.04, while the cost per mile of a standard automobile varies between $0.08 to $0.20, considering a gasoline price of $3.00 per gallon.[30] As petroleum price is expected to increase in the future due to oil production decline and increases in global demand, the cost difference in favor of PEVs is expected to become even more advantageous.[30]

According to Consumer Reports, as of December 2011 the Nissan Leaf has a cost of 3.5 cents per mile and the Chevrolet Volt has a cost in electric mode of 3.8 cents per mile. The Volt cost per mile is higher because it is heavier than the Leaf. These estimates are based on the fuel economy and energy consumption measured on their tests and using a U.S. national average rate of 11 cents per kWh of electricity. When the Volt runs in range-extended mode using its premium gasoline-powered engine, the plug-in hybrid has a cost of 12.5 cents per mile. The out-of-pocket cost per mile of the three most fuel efficient gasoline-powered cars as tested by the magazine are the Toyota Prius, with a cost of 8.6 cents per miles, the Honda Civic Hybrid with 9.5 cents per mile, the Toyota Corolla with 11.9 cents per mile, and the Hyundai Elantra 13.1 cents per mile. The analysis also found that on trips up to 100 mi (160 km), the Volt is cheaper to drive than the Prius and the other three cars due to the Volt's 35 mi (56 km) driving range on electricity. The previous operating costs do not include maintenance, depreciation or other costs.[34]

All-electric and plug-in hybrid vehicles also have lower maintenance costs as compared to internal combustion vehicles, since electronic systems break down much less often than the mechanical systems in conventional vehicles, and the fewer mechanical systems onboard last longer due to the better use of the electric engine. PEVs do not require oil changes and other routine maintenance checks.[30][31]

The Edison Electric Institute (EEI) conducted an analysis that demonstrated that between January 1976 and February 2012 the real price for gasoline has been much more volatile than the real price of electricity in the United States. The analysis is based on a plug-in electric vehicle with an efficiency of 3.4 miles per kW-hr (like the Mitsubishi i MiEV) and a gasoline-powered vehicle with a fuel economy rated at 30 mpg‑US (7.8 L/100 km; 36 mpg‑imp) (like the 2012 Fiat 500). The EEI estimated that operating a plug-in would have had an equivalent cost of around US$1.50 a gallon in the late 1970s and early 1980s, and around US$1.00 a gallon since the late 1990s. In contrast, the price to operate an internal combustion engine vehicle has had many ample variations, costing more than US$3.50 per gallon during the 1979 energy crisis, then had a couple of lows with prices at less than US$1.50 during 1999 and 2001, only to climb and reach a maximum of more than US$4.00 before the beginning of the 2007–2009 financial crisis, by early 2012 has fluctuated around US$3.50. The analysis found that the cost of an equivalent electric-gallon of gasoline would have been not only cheaper to operate during the entire analysis period but also that equivalent electricity prices are more stable and have been declining in terms of equivalent dollars per gallon.[35][36]

Air pollution and greenhouse gas emissions

Electric cars, as well as plug-in hybrids operating in all-electric mode, emit no harmful tailpipe pollutants from the onboard source of power, such as particulates (soot), volatile organic compounds, hydrocarbons, carbon monoxide, ozone, lead, and various oxides of nitrogen. The clean air benefit is usually local because, depending on the source of the electricity used to recharge the batteries, air pollutant emissions are shifted to the location of the generation plants.[31] In a similar manner, plug-in electric vehicles operating in all-electric mode do not emit greenhouse gases from the onboard source of power, but from the point of view of a well-to-wheel assessment, the extent of the benefit also depends on the fuel and technology used for electricity generation. This fact has been referred to as the long tailpipe of plug-in electric vehicles. From the perspective of a full life cycle analysis, the electricity used to recharge the batteries must be generated from renewable or clean sources such as wind, solar, hydroelectric, or nuclear power for PEVs to have almost none or zero well-to-wheel emissions.[1][31] On the other hand, when PEVs are recharged from coal-fired plants, they usually produce slightly more greenhouse gas emissions than internal combustion engine vehicles and higher than hybrid electric vehicles.[31][37] In the case of plug-in hybrid electric vehicles operating in hybrid mode with assistance of the internal combustion engine, tailpipe and greenhouse emissions are lower in comparison to conventional cars because of their higher fuel economy.[1]

The magnitude of the potential advantage depends on the mix of generation sources and therefore varies by country and by region. For example, France can obtain significant emission benefits from electric and plug-in hybrids because most of its electricity is generated by nuclear power plants; similarly, most regions of Canada are primarily powered with hydroelectricity, nuclear, or natural gas which have no or very low emissions at the point of generation; and the state of California, where most energy comes from natural gas, hydroelectric and nuclear plants can also secure substantial emission benefits. The United Kingdom also has a significant potential to benefit from PEVs as natural gas plants dominate the generation mix. On the other hand, emission benefits in Germany, China, India, and the central regions of the United States are limited or non-existent because most electricity is generated from coal.[31][38] However these countries and regions might still obtain some air quality benefits by reducing local air pollution in urban areas. Cities with chronic air pollution problems, such as Los Angeles, México City, Santiago, Chile, São Paulo, Beijing, Bangkok and Kathmandu may also gain local clean air benefits by shifting the harmful emission to electric generation plants located outside the cities. Nevertheless, the location of the plants is not relevant when considering greenhouse gas emission because their effect is global.[31]

Carbon footprint during production

- Ricardo

A report published in June 2011, prepared by Ricardo in collaboration with experts from the UK's Low Carbon Vehicle Partnership, found that hybrid electric cars, plug-in hybrids and all-electric cars generate more carbon emissions during their production than current conventional vehicles, but still have a lower overall carbon footprint over the full life cycle. The higher carbon footprint during production of electric drive vehicles is due mainly to the production of batteries. As an example, 43 percent of production emissions for a mid-size electric car are generated from the battery production, while for standard mid-sized gasoline internal combustion engine vehicle, around 75% of the embedded carbon emissions during production comes from the steel used in the vehicle glider.[39] The following table summarizes key results of this study for four powertrain technologies:

| Comparison of full life cycle assessment (well-to-wheels) of carbon emissions and carbon footprint during production for four different powertrain technologies[39] | |||

|---|---|---|---|

| Type of vehicle (powertrain) | Estimated emissions in production (tonnes CO2e) | Estimated lifecycle emissions (tonnes CO2e) | Percentage of emissions during production |

| Standard gasoline vehicle | 5.6 | 24 | 23% |

| Hybrid electric vehicle | 6.5 | 21 | 31% |

| Plug-in hybrid electric vehicle | 6.7 | 19 | 35% |

| Battery electric vehicle | 8.8 | 19 | 46% |

| Notes: Estimates based upon a 2015 model vehicle assuming 150,000 km (93,000 mi) full life travel using 10% ethanol blend and 500g/kWh grid electricity. | |||

The Ricardo study also found that the lifecycle carbon emissions for mid-sized gasoline and diesel vehicles are almost identical, and that the greater fuel efficiency of the diesel engine is offset by higher production emissions.[39]

- Volkswagen

In 2014 Volkswagen published the results of life-cycle assessment of its electric vehicles certified by TÜV NORD, and independent inspection agency. The study found that CO

2 emissions during the use phase of its all-electric VW e-Golf are 99% lower than those of the Golf 1.2 TSI when powers come from exclusively hydroelectricity generated in Germany, Austria, and Switzerland. Accounting for the full lifecycle, the e-Golf reduces emissions by 61%, offsetting higher production emissions. When the actual EU-27 electricity mix is considered, the e-Golf emissions are still 26% lower than those of the conventional Golf 1.2 TSI. Similar results were found when comparing the e-Golf with the Golf 1.6 TDI. The analysis considered recycling of the three vehicles at the end of their lifetime.[40]

Well-to-wheel GHG emissions in the U.S.

- Environmental Protection Agency

The following table compares tailpipe and upstream CO

2 emissions estimated by the U.S. Environmental Protection Agency for all series production model year 2014 plug-in electric vehicles available in the U.S. market. Total emissions include the emissions associated with the production and distribution of electricity used to charge the vehicle, and for plug-in hybrid electric vehicles, it also includes emissions associated with tailpipe emissions produced from the internal combustion engine. These figures were published by the EPA in October 2014 in its annual report "Light-Duty Automotive Technology, Carbon Dioxide Emissions, and Fuel Economy Trends: 1975 Through 2014." All emissions are estimated considering average real world city and highway operation based on the EPA 5-cycle label methodology, using a weighted 55% city and 45% highway driving. For the first time, the 2014 Trends report presents an analysis of the impact of alternative fuel vehicles, with an emphasis in plug-in electric vehicles because as their market share is approaching 1%, the EPA concluded that PEVs began to have a measurable impact on the U.S. overall new vehicle fuel economy and CO

2 emissions.[41][42]

For purposes of an accurate estimation of emissions, the analysis took into consideration the differences in operation between plug-in hybrids. Some, like the Chevrolet Volt, can operate in all-electric mode without using gasoline, and others operate in a blended mode like the Toyota Prius PHV, which uses both energy stored in the battery and energy from the gasoline tank to propel the vehicle, but that can deliver substantial all-electric driving in blended mode. In addition, since the all-electric range of plug-in hybrids depends on the size of the battery pack, the analysis introduced a utility factor as a projection of the share of miles that will be driven using electricity by an average driver, for both, electric only and blended EV modes. Since all-electric cars do not produce tailpipe emissions, the utility factor applies only to plug-in hybrids. The following table shows the overall fuel economy expressed in terms of miles per gallon gasoline equivalent (mpg-e) and the utility factor for the ten MY2014 plug-in hybrids available in the U.S. market, and EPA's best estimate of the CO

2 tailpipe emissions produced by these PHEVs.[41]

In order to account for the upstream CO

2 emissions associated with the production and distribution of electricity, and since electricity production in the United States vary significantly from region to region, the EPA considered three scenarios/ranges with the low end scenario corresponding to the California powerplant emissions factor, the middle of the range represented by the national average powerplant emissions factor, and the upper end of the range corresponding to the powerplant emissions factor for the Rocky Mountains. The EPA estimates that the electricity GHG emission factors for various regions of the country vary from 346 g CO

2/kWh in California to 986 g CO

2/kWh in the Rockies, with a national average of 648 g CO

2/kWh.[41]

| Comparison of tailpipe and upstream CO 2 emissions(1) estimated by EPA for the MY 2014 plug-in electric vehicles available in the U.S. market[41] | ||||||

|---|---|---|---|---|---|---|

| Vehicle | Overall fuel economy (mpg-e) | Utility factor(2) (share EV miles) | Tailpipe CO 2 (g/mi) | Tailpipe + Total Upstream CO2 | ||

| Low (g/mi) | Avg (g/mi) | High (g/mi) | ||||

| BMW i3 | 124 | 1 | 0 | 93 | 175 | 266 |

| Chevrolet Spark EV | 119 | 1 | 0 | 97 | 181 | 276 |

| Honda Fit EV | 118 | 1 | 0 | 99 | 185 | 281 |

| Fiat 500e | 116 | 1 | 0 | 101 | 189 | 288 |

| Nissan Leaf | 114 | 1 | 0 | 104 | 194 | 296 |

| Mitsubishi i | 112 | 1 | 0 | 104 | 195 | 296 |

| Smart electric drive | 107 | 1 | 0 | 109 | 204 | 311 |

| Ford Focus Electric | 105 | 1 | 0 | 111 | 208 | 316 |

| Tesla Model S (60 kWh) | 95 | 1 | 0 | 122 | 229 | 348 |

| Tesla Model S (85 kWh) | 89 | 1 | 0 | 131 | 246 | 374 |

| BMW i3 REx(3) | 88 | 0.83 | 40 | 134 | 207 | 288 |

| Mercedes-Benz B-Class ED | 84 | 1 | 0 | 138 | 259 | 394 |

| Toyota RAV4 EV | 76 | 1 | 0 | 153 | 287 | 436 |

| BYD e6 | 63 | 1 | 0 | 187 | 350 | 532 |

| Chevrolet Volt | 62 | 0.66 | 81 | 180 | 249 | 326 |

| Toyota Prius Plug-in Hybrid | 58 | 0.29 | 133 | 195 | 221 | 249 |

| Honda Accord Plug-in Hybrid | 57 | 0.33 | 130 | 196 | 225 | 257 |

| Cadillac ELR | 54 | 0.65 | 91 | 206 | 286 | 377 |

| Ford C-Max Energi | 51 | 0.45 | 129 | 219 | 269 | 326 |

| Ford Fusion Energi | 51 | 0.45 | 129 | 219 | 269 | 326 |

| BMW i8 | 37 | 0.37 | 198 | 303 | 351 | 404 |

| Porsche Panamera S E-Hybrid | 31 | 0.39 | 206 | 328 | 389 | 457 |

| McLaren P1 | 17 | 0.43 | 463 | 617 | 650 | 687 |

| Average MY 2014 gasoline car | 24.2 | 0 | 367 | 400 | 400 | 400 |

| Notes: (1) Based on 45% highway and 55% city driving. (2) The utility factor represents, on average, the percentage of miles that will be driven using electricity (in electric only and blended modes) by an average driver. (3) The EPA classifies the i3 REx as a series plug-in hybrid[41][43][44] | ||||||

- Union of Concerned Scientists

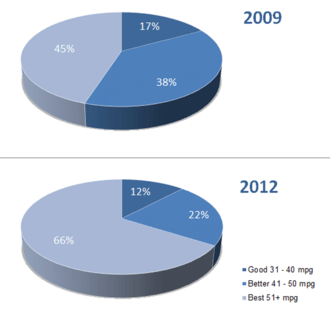

The Union of Concerned Scientists (UCS) published a study in 2012 that assessed average greenhouse gas emissions in the U.S. resulting from charging plug-in car batteries from the perspective of the full life-cycle (well-to-wheel analysis) and according to fuel and technology used to generate electric power by region. The study used the model year 2011 Nissan Leaf all-electric car to establish the analysis baseline, and electric-utility emissions are based on EPA's 2009 estimates. The UCS study expressed the results in terms of miles per gallon instead of the conventional unit of grams of greenhouse gases or carbon dioxide equivalent emissions per year in order to make the results more friendly for consumers. The study found that in areas where electricity is generated from natural gas, nuclear, hydroelectric or renewable sources, the potential of plug-in electric cars to reduce greenhouse emissions is significant. On the other hand, in regions where a high proportion of power is generated from coal, hybrid electric cars produce less CO

2 equivalent emissions than plug-in electric cars, and the best fuel efficient gasoline-powered subcompact car produces slightly less emissions than a PEV. In the worst-case scenario, the study estimated that for a region where all energy is generated from coal, a plug-in electric car would emit greenhouse gas emissions equivalent to a gasoline car rated at a combined city/highway driving fuel economy of 30 mpg‑US (7.8 L/100 km; 36 mpg‑imp). In contrast, in a region that is completely reliant on natural gas, the PEV would be equivalent to a gasoline-powered car rated at 50 mpg‑US (4.7 L/100 km; 60 mpg‑imp).[45][46]

The study concluded that for 45% of the U.S. population, a plug-in electric car will generate lower CO

2 equivalent emissions than a gasoline-powered car capable of combined 50 mpg‑US (4.7 L/100 km; 60 mpg‑imp), such as the Toyota Prius and the Prius c. The UCS also found that for 37% of the population, the electric car emissions will fall in the range of a gasoline-powered car rated at a combined fuel economy of 41 to 50 mpg‑US (5.7 to 4.7 L/100 km; 49 to 60 mpg‑imp), such as the Honda Civic Hybrid and the Lexus CT200h. Only 18% of the population lives in areas where the power-supply is more dependent on burning carbon, and the greenhouse gas emissions will be equivalent to a car rated at a combined fuel economy of 31 to 40 mpg‑US (7.6 to 5.9 L/100 km; 37 to 48 mpg‑imp), such as the Chevrolet Cruze and Ford Focus.[46][47][48] The study found that there are no regions in the U.S. where plug-in electric cars will have higher greenhouse gas emissions than the average new compact gasoline engine automobile, and the area with the dirtiest power supply produces CO

2 emissions equivalent to a gasoline-powered car rated at 33 mpg‑US (7.1 L/100 km).[45]

In September 2014 the UCS published an updated analysis of its 2012 report. The 2014 analysis found that 60% of Americans, up from 45% in 2009, live in regions where an all-electric car produces fewer CO

2 equivalent emissions per mile than the most efficient hybrid. The UCS study found several reasons for the improvement. First, electric utilities have adopted cleaner sources of electricity to their mix between the two analysis. The 2014 study used electric-utility emissions based on EPA's 2010 estimates, but since coal use nationwide is down by about 5% from 2010 to 2014, actual efficiency in 2014 is better than estimated in the UCS study. Second, electric vehicles have become more efficient, as the average 2013 all-electric vehicle used 0.33 kWh per mile, representing a 5% improvement over 2011 models. Also, some new models are cleaner than the average, such as the BMW i3, which is rated at 0.27 kWh by the EPA. An i3 charged with power from the Midwest grid would be as clean as a gasoline-powered car with about 50 mpg‑US (4.7 L/100 km), up from 39 mpg‑US (6.0 L/100 km) for the average electric car in the 2012 study. In states with a cleaner mix generation, the gains were larger. The average all-electric car in California went up to 95 mpg‑US (2.5 L/100 km) equivalent from 78 mpg‑US (3.0 L/100 km) in the 2012 study. States with the dirtier generation that rely heavily on coal still lag, such as Colorado, where the average BEV only achieves the same emissions as a 34 mpg‑US (6.9 L/100 km; 41 mpg‑imp) gasoline-powered car. The author of the 2014 analysis noted that the benefits are not distributed evenly across the U.S. because electric car adoptions are concentrated in the states with cleaner power.[49][50]

In November 2015 the Union of Concerned Scientists published a new report comparing two battery electric vehicles (BEVs) with similar gasoline vehicles by examining their global warming emissions over their full life-cycle, cradle-to-grave analysis. The two BEVs modeled, midsize and full-size, are based on the two most popular BEV models sold in the United States in 2015, the Nissan Leaf and the Tesla Model S. The study found that all-electric cars representative of those sold today, on average produce less than half the global warming emissions of comparable gasoline-powered vehicles, despite taking into account the higher emissions associated with BEV manufacturing. Considering the regions where the two most popular electric cars are being sold, excess manufacturing emissions are offset within 6 to 16 months of average driving. The study also concluded that driving an average EV results in lower global warming emissions than driving a gasoline car that gets 50 mpg‑US (4.7 L/100 km) in regions covering two-thirds of the U.S. population, up from 45% in 2009. Based on where EVs are being sold in the United States in 2015, the average EV produces global warming emissions equal to a gasoline vehicle with a 68 mpg‑US (3.5 L/100 km) fuel economy rating. The authors identified two main reasons for the fact that EV-related emissions have become even lower in many parts of the country since the first study was conducted in 2012. Electricity generation has been getting cleaner, as coal-fired generation has declined while lower-carbon alternatives have increased. In addition, electric cars are becoming more efficient. For example, the Nissan Leaf and the Chevrolet Volt, have undergone improvements to increase their efficiencies compared to the original models launched in 2010, and other even more efficient BEV models, such as the most lightweight and efficient BMW i3, have entered the market.[51][52]

- National Bureau of Economic Research

One criticism of the UCS study is that the analysis was made using average emissions rates across regions instead of the marginal generation at different times of the day. The former approach does not take into account the generation mix within interconnected electricity markets and shifting load profiles throughout the day.[53][54] An analysis by three economists affiliated with the National Bureau of Economic Research (NBER), published in November 2014, developed a methodology to estimate marginal emissions of electricity demand that vary by location and time of day across the United States. The marginal analysis, applied to plug-in electric vehicles, found that the emissions of charging PEVs vary by region and hours of the day. In some regions, such as the Western U.S. and Texas, CO

2 emissions per mile from driving PEVs are less than those from driving a hybrid car. However, in other regions, such as the Upper Midwest, charging during the recommended hours of midnight to 4 a.m. implies that PEVs generate more emissions per mile than the average car currently on the road. The results show a fundamental tension between electricity load management and environmental goals as the hours when electricity is the least expensive to produce tend to be the hours with the greatest emissions. This occurs because coal-fired units, which have higher emission rates, are most commonly used to meet base-level and off-peak electricity demand; while natural gas units, which have relatively low emissions rates, are often brought online to meet peak demand.[54]

Well-to-wheel GHG emissions in several countries

A study published in the UK in April 2013 assessed the carbon footprint of plug-in electric vehicles in 20 countries. As a baseline the analysis established that manufacturing emissions account for 70 g CO2/km for an electric car and 40 g CO2/km for a petrol car. The study found that in countries with the coal-intensive generation, PEVs are no different from conventional petrol-powered vehicles. Among these countries are China, Indonesia, Australia, South Africa, and India. A pure electric car in India generates emissions comparable to a 20 mpg‑US (12 L/100 km; 24 mpg‑imp) petrol car.[55][56]

The country ranking was led by Paraguay, where all electricity is produced from hydropower, and Iceland, where electricity production relies on renewable power, mainly hydro and geothermal power. Resulting carbon emissions from an electric car in both countries are 70 g CO2/km, which is equivalent to a 220 mpg‑US (1.1 L/100 km; 260 mpg‑imp) petrol car, and correspond to manufacturing emissions. Next in the ranking are other countries with low carbon electricity generation, including Sweden (mostly hydro and nuclear power ), Brazil (mainly hydropower) and France (predominantly nuclear power). Countries ranking in the middle include Japan, Germany, the UK and the United States.[55][56][57]

The following table shows the emissions intensity estimated in the study for those countries where electric vehicle are available, and the corresponding emissions equivalent in miles per US gallon of a petrol-powered car:

| Country comparison of full life cycle assessment of greenhouse gas emissions resulting from charging plug-in electric cars and emissions equivalent in terms of miles per US gallon of a petrol-powered car[55][57] | ||||

|---|---|---|---|---|

| Country | PEV well-to-wheels carbon dioxide equivalent emissions per electric car expressed in (CO2e/km) | Power source | PEV well-to-wheels emissions equivalent in terms of mpg US of petrol-powered car | Equivalent petrol car |

| 81 | Low carbon | 159 mpg‑US (1.48 L/100 km) | Hybrid multiples | |

| 93 | 123 mpg‑US (1.91 L/100 km) | |||

| 115 | Fossil light | 87 mpg‑US (2.7 L/100 km) | Beyond hybrid | |

| 146 | 61 mpg‑US (3.9 L/100 km) | |||

| 175 | Broad mix | 48 mpg‑US (4.9 L/100 km) | New hybrid | |

| 179 | 47 mpg‑US (5.0 L/100 km) | |||

| 189 | 44 mpg‑US (5.3 L/100 km) | |||

| 202 | Fossil heavy | 40 mpg‑US (5.9 L/100 km) | Efficient petrol | |

| 203 | 40 mpg‑US (5.9 L/100 km) | |||

| 258 | Coal-based | 30 mpg‑US (7.8 L/100 km) | Average petrol | |

| 292 | 26 mpg‑US (9.0 L/100 km) | |||

| 370 | 20 mpg‑US (12 L/100 km) | |||

| Note: Electric car manufacturing emissions account for 70 g CO2/km Source: Shades of Green: Electric Cars’ Carbon Emissions Around the Globe, Shrink That Footprint, February 2013.[57] | ||||

Less dependence on imported oil

For many net oil importing countries the 2000s energy crisis brought back concerns first raised during the 1973 oil crisis. For the United States, the other developed countries and emerging countries their dependence on foreign oil has revived concerns about their vulnerability to price shocks and supply disruption. Also, there have been concerns about the uncertainty surrounding peak oil production and the higher cost of extracting unconventional oil. A third issue that has been raised is the threat to national security because most proven oil reserves are concentrated in relatively few geographic locations, including some countries with strong resource nationalism, unstable governments or hostile to U.S. interests.[31][58][59] In addition, for many developing countries, and particularly for the poorest African countries, high oil prices have an adverse impact on the government budget and deteriorate their terms of trade thus jeopardizing their balance of payments, all leading to lower economic growth.[60][61]

Through the gradual replacement of internal combustion engine vehicles for electric cars and plug-in hybrids, electric drive vehicles can contribute significantly to lessen the dependence of the transport sector on imported oil as well as contributing to the development of a more resilient energy supply.[31][58][59][62]

Vehicle-to-grid

Plug-in electric vehicles offer users the opportunity to sell electricity stored in their batteries back to the power grid, thereby helping utilities to operate more efficiently in the management of their demand peaks.[63] A vehicle-to-grid (V2G) system would take advantage of the fact that most vehicles are parked an average of 95 percent of the time. During such idle times the electricity stored in the batteries could be transferred from the PEV to the power lines and back to the grid. In the U.S. this transfer back to the grid have an estimated value to the utilities of up to $4,000 per year per car.[64] In a V2G system it would also be expected that battery electric (BEVs) and plug-in hybrids (PHEVs) would have the capability to communicate automatically with the power grid to sell demand response services by either delivering electricity into the grid or by throttling their charging rate.[63][65][66]

Disadvantages

Cost of batteries and cost of ownership

- Cost of batteries

As of 2015, plug-in electric vehicles are significantly more expensive as compared to conventional internal combustion engine vehicles and hybrid electric vehicles due to the additional cost of their lithium-ion battery pack. According to a 2010 study by the National Research Council, the cost of a lithium-ion battery pack was about US$1,700/kWh of usable energy, and considering that a PHEV-10 requires about 2.0 kWh and a PHEV-40 about 8 kWh, the manufacturer cost of the battery pack for a PHEV-10 is around US$3,000 and it goes up to US$14,000 for a PHEV-40.[67][68] As of June 2012, and based on the three battery size options offered for the Tesla Model S, the New York Times estimated the cost of automotive battery packs between US$400 to US$500 per kilowatt-hour.[69] A 2013 study by the American Council for an Energy-Efficient Economy reported that battery costs came down from US$1,300 per kWh in 2007 to US$500 per kWh in 2012. The U.S. Department of Energy has set cost targets for its sponsored battery research of US$300 per kWh in 2015 and US$125 per kWh by 2022. Cost reductions through advances in battery technology and higher production volumes will allow plug-in electric vehicles to be more competitive with conventional internal combustion engine vehicles.[70]

According to a study published in February 2016 by Bloomberg New Energy Finance (BNEF), battery prices fell 65% since 2010, and 35% just in 2015, reaching US$350 per kWh. The study concludes that battery costs are on a trajectory to make electric vehicles without government subsidies as affordable as internal combustion engine cars in most countries by 2022. BNEF projects that by 2040, long-range electric cars will cost less than US$22,000 expressed in 2016 dollars. BNEF expects electric car battery costs to be well below US$120 per kWh by 2030, and to fall further thereafter as new chemistries become available.[71]

- Cost of ownership

A study published in 2011 by the Belfer Center, Harvard University, found that the gasoline costs savings of plug-in electric cars do not offset their higher purchase prices when comparing their lifetime net present value of purchase and operating costs for the U.S. market at 2010 prices, and assuming no government subidies. According to the study estimates, a PHEV-40 is US$5,377 more expensive than a conventional internal combustion engine, while a battery electric vehicles is US$4,819 more expensive.[72] These findings assumed a battery cost of US$600 per kWh, which means that the Chevrolet Volt battery pack cost around US$10,000 and the Nissan Leaf pack costs US$14,400. The study also assumed a gasoline price of US$3.75 per gallon (as of mid June 2011), that vehicles are driven 12,000 miles (19,000 km) per year, an average price of electricity of US$0.12 per kWh, that the plug-in hybrid is driven in all-electric mode 85% of the time, and that the owner of PEVs pay US$1,500 to install a Level II 220/240 volt charger at home.[73]

The study also includes hybrid electric vehicles in the comparison, and analyzed several scenarios to determine how the comparative net savings will change over the next 10 to 20 years, assuming that battery costs will decrease while gasoline prices increase, and also assuming higher fuel efficiency of conventional cars, among other scenarios. Under the future scenarios considered, the study found that BEVs will be significantly less expensive than conventional cars (US$1,155 to US$7,181 cheaper), while PHEVs, will be more expensive than BEVs in almost all comparison scenarios, and only less expensive than conventional cars in a scenario with very low battery costs and high gasoline prices. The reason for the different savings among PEVs is because BEVs are simpler to build and do not use liquid fuel, while PHEVs have more complicated powertrains and still have gasoline-powered engines. The following table summarizes the results of four of the seven scenarios analyzed by the study.[73]

| Comparison of net lifetime savings among conventional gasoline-powered cars, hybrids and plug-in electric cars for several scenarios (U.S. market at 2010 prices)[73] | ||||

|---|---|---|---|---|

| Description | Conventional ICE | Hybrid electric (HEV) | Plug-in hybrid (PHEV) | Battery electric (BEV) |

| Scenario: 2010 costs (battery US$600 per kWh, gasoline US$3.75 per gallon, and electricity US$0.12 per kWh) | ||||

| Purchase price | US$21,390 | US$22,930 | US$30,235 | US$33,565 |

| Total net present cost | US$32,861 | US$33,059 | US$38,239 | US$37,680 |

| Cost differential with conventional car | - | US$197 | US$5,377 | US$4,819 |

| Scenario: Future Costs – Lower battery cost and higher gasoline and electricity prices (battery US$300 per kWh, gasoline US$4.50 per gallon, and electricity US$0.15 per kWh) | ||||

| Total net present cost | US$34,152 | US$32,680 | US$34,601 | US$30,674 |

| Cost differential with conventional car | - | (US$1,472) | US$449 | (US$3,478) |

| Scenario: Future Costs – Low battery cost and higher gasoline and electricity prices (battery US$150 per kWh, gasoline US$4.50 per gallon, and electricity US$0.15 per kWh) | ||||

| Total net present cost | US$34,152 | US$32,080 | US$32,549 | US$26,971 |

| Cost differential with conventional car | - | (US$2,072) | (US$1,603) | (US$7,181) |

| Scenario: Higher fuel efficiency ICEs:50 miles per US gallon (4.7 L/100 km; 60 mpg‑imp) HEVs and PHEVs: 75 miles per US gallon (3.1 L/100 km; 90 mpg‑imp) (battery US$300 per kWh, gasoline US$4.50 per gallon, and electricity US$0.15 per kWh) | ||||

| Total net present cost | US$32,829 | US$31,366 | US$34,403 | US$30,674 |

| Cost differential with conventional car | - | (US$463) | US$2,574 | (US$1,155) |

| Note: Assumes vehicles are driven 12,000 miles (19,000 km) per year and plug-in hybrid is driven in all-electric mode 85% of the time. Does not take into account other differences in cost of ownership. | ||||

According to a study by the Electric Power Research Institute published in June 2013, the total cost of ownership of the 2013 Nissan Leaf SV is substantially lower than that of comparable conventional and hybrid vehicles. For comparison, the study constructed average hybrid and conventional vehicles and assumed an average US distance per trip distribution. The study took into account the manufacturer's suggested retail price, taxes, credits, destination charge, electric charging station, fuel cost, maintenance cost, and additional cost due to the use of a gasoline vehicle for trips beyond the range of the Leaf.[74]

| Electric Power Research Institute comparison of the Leaf versus average conventional and hybrid cars. | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Vehicle | Operating mode (powertrain) | Total ownership cost | |||||||

| US Average | California | ||||||||

| Nissan Leaf SV | All-electric | $37,288 | $35,596 | ||||||

| Chevrolet Volt | Plug-in hybrid | $44,176 | $40,800 | ||||||

| Average Conventional | Gasoline | $44,949 | $46,561 | ||||||

| Average Hybrid | Gasoline-electric hybrid | $44,325 | $45,416 | ||||||

| Notes: Costs are based on a gasoline price of $3.64 per gallon, an electricity rate of $0.12/kWh, and a vehicle lifetime of 150,000 miles. The average conventional car was constructed by averaging of Honda Civic EX, Chevrolet Cruze LTZ, Ford Focus Titanium, and Volkswagen Passat. The average hybrid car was constructed from Ford Fusion Hybrid, Honda Civic Hybrid, Toyota Camry Hybrid XLE, and Toyota Prius trim IV. | |||||||||

Availability of recharging infrastructure

Despite the widespread assumption that plug-in recharging will take place overnight at home, residents of cities, apartments, dormitories, and townhouses do not have garages or driveways with available power outlets, and they might be less likely to buy plug-in electric vehicles unless recharging infrastructure is developed.[75][76] Electrical outlets or charging stations near their places of residence, in commercial or public parking lots, streets and workplaces are required for these potential users to gain the full advantage of PHEVs, and in the case of EVs, to avoid the fear of the batteries running out energy before reaching their destination, commonly called range anxiety.[76][77] Even house dwellers might need to charge at the office or to take advantage of opportunity charging at shopping centers.[78] However, this infrastructure is not in place and it will require investments by both the private and public sectors.[77]

Several cities in California and Oregon, and particularly San Francisco and other cities in the San Francisco Bay Area and Silicon Valley, already have deployed public charging stations and have expansion plans to attend both plug-ins and all-electric cars.[77] Some local private firms such as Google and Adobe Systems have also deployed charging infrastructure. In Google's case, its Mountain View campus has 100 available charging stations for its share-use fleet of converted plug-ins available to its employees.[77][79] Solar panels are used to generate the electricity, and this pilot program is being monitored on a daily basis and performance results are published on the RechargeIT website.[79] As of December 2013, Estonia is the first and only country that had deployed an EV charging network with nationwide coverage, with 165 fast chargers available along highways at a minimum distance of between 40 to 60 km (25 to 37 mi), and a higher density in urban areas.[80][81][82]

The importance to build the infrastructure necessary to support electric vehicles is illustrated by the decision of Car2Go in San Diego, California, that due to insufficient charging infrastructure decided to replace all of its all-electric car fleet with gasoline-powered cars starting on 1 May 2016. When the carsharing service started in 2011, Car2Go expected 1,000 charging stations to be deployed around the city, but only 400 were in place by early 2016. As a result, an average of 20% of the carsharing fleet is unavailable at any given time because the cars are either being charged or because they don't have enough electricity in them to be driven. Also, many of the company's 40,000 San Diego members say they often worry their Car2Go will run out of charge before they finish their trip.[83]

Battery swapping

A different approach to resolve the problems of range anxiety and lack of recharging infrastructure for electric vehicles was developed by Better Place. Its business model considers that electric cars are built and sold separately from the battery pack. As customers are not allowed to purchase battery packs, they must lease them from Better Place which will deploy a network of battery swapping stations thus expanding EVs range and allowing long distance trips. Subscribed users pay a per-distance fee to cover battery pack leasing, charging and swap infrastructure, the cost of sustainable electricity, and other costs.[84][85] Better Place signed agreement for deployment in Australia, Denmark, Israel, Canada, California, and Hawaii.[86] The Renault Fluence Z.E. was the electric car built with switchable battery technology sold for the Better Place network.[87] The robotic battery-switching operation was completed in about five minutes.[88]

After implementing the first modern commercial deployment of the battery swapping model in Israel and Denmark, Better Place filed for bankruptcy in Israel in May 2013. The company's financial difficulties were caused by the high investment required to develop the charging and swapping infrastructure, about US$850 million in private capital, and a market penetration significantly lower than originally predicted by Shai Agassi. Less than 1,000 Fluence Z.E. cars were deployed in Israel and around 400 units in Denmark.[89][90]

Tesla Motors designed its Model S to allow fast battery swapping.[91] In June 2013, Tesla announced their goal to deploy a battery swapping station in each of its supercharging stations. At a demonstration event Tesla showed that a battery swap operation with the Model S takes just over 90 seconds, about half the time it takes to refill a gasoline-powered car used for comparison purposes during the event.[92][93] The first stations are planned to be deployed along Interstate 5 in California where, according to Tesla, a large number of Model S sedans make the San Francisco-Los Angeles trip regularly. These will be followed by the Washington, DC to Boston corridor.[92]

Other charging solutions

The REVA NXR exhibited in the 2009 Frankfurt Motor Show and the Nissan Leaf SV trim both have roof-mounted solar panels. These solar panels are designed to trickle charge the batteries when the car is moving or parked.[94][95][96] Another proposed technology is REVive, by Reva. When the REVA NXR's batteries are running low or are fully depleted, the driver is able to send an SMS to REVive and unlock a hidden reserve in the battery pack. Reva has not provided details on how the system will work.[97][98] The Fisker Karma uses solar panel in the roof to recharge the 12-volt lead-acid accessory battery.[99] The Nissan Leaf SL trim also has a small solar panel at the rear of the roof/spoiler that can trickle charge the auxiliary 12-volt lead-acid battery.[100]

Potential overload of the electrical grid

The existing electrical grid, and local transformers in particular, may not have enough capacity to handle the additional power load that might be required in certain areas with high plug-in electric car concentrations. As recharging a single electric-drive car could consume three times as much electricity as a typical home, overloading problems may arise when several vehicles in the same neighborhood recharge at the same time, or during the normal summer peak loads. To avoid such problems, utility executives recommend owners to charge their vehicles overnight when the grid load is lower or to use smarter electric meters that help control demand. When market penetration of plug-in electric vehicles begins to reach significant levels, utilities will have to invest in improvements for local electrical grids in order to handle the additional loads related to recharging to avoid blackouts due to grid overload. Also, some experts have suggested that by implementing variable time-of-day rates, utilities can provide an incentive for plug-in owners to recharge mostly overnight when rates are lower.[77][101][102]

General Motors is sponsoring the Pecan Street demonstration project in Austin, Texas. The project objective is to learn the charging patterns of plug-in electric car owners and to study how a residential fleet of electric vehicles might strain the electric grid if all owners try to charge them at the same, which is what the preliminary monitoring found when the plug-in cars return home in the evening. The Mueller neighborhood is the testing ground, and as of June 2013, the community has nearly 60 Chevrolet Volt owners alone. This cluster of Volts was achieved thanks to GM's commitment to match the federal government's $7,500 rebate incentive, which effectively halves the purchase price of the plug-hybrid electric cars.[103]

In the 5 years from 2014 to 2019, EVs increased in number and range, and doubled power draw and energy per session. Charging increased after midnight, and decreased in the peak hours of early evening.[104][105]

Risks associated with noise reduction

Electric cars and plug-in hybrids when operating in all-electric mode at low speeds produce less roadway noise as compared to vehicles propelled by an internal combustion engine, thereby reducing harmful noise health effects. However, blind people or the visually impaired consider the noise of combustion engines a helpful aid while crossing streets, hence plug-in electric cars and conventional hybrids could pose an unexpected hazard when operating at low speeds.[106][107] Several tests conducted in the U.S. have shown that this is a valid concern, as vehicles operating in electric mode can be particularly hard to hear below 20 mph (30 km/h) for all types of road users and not only the visually impaired.[108][109][110] At higher speeds the sound created by tire friction and the air displaced by the vehicle start to make sufficient audible noise.[107]

The Japanese Ministry of Land, Infrastructure, Transport and Tourism issued guidelines for hybrid and other near-silent vehicles in January 2010.[111] In the United States the Pedestrian Safety Enhancement Act of 2010 was approved by the U.S. Senate and the House of Representatives in December 2010.[112][113][114] After several delays, the National Highway Traffic Safety Administration (NHTSA) issued its ruling in February 2018. It requires hybrids and electric vehicles traveling at less than 18.6 mph (30 km/h) to emit warning sounds that pedestrians must be able to hear over background noises. The regulation requires full compliance in September 2020, but 50% of "quiet" vehicles must have the warning sounds by September 2019.[115]

In April 2014 the European Parliament approved legislation that requires the mandatory use of the AVAS for all new electric and hybrid electric vehicles and car manufacturers have to comply within 5 years.[116]

Risks of battery fire

Lithium-ion batteries may suffer thermal runaway and cell rupture if overheated or overcharged, and in extreme cases this can lead to combustion.[117] To reduce these risks, lithium-ion battery packs contain fail-safe circuitry that shuts down the battery when its voltage is outside the safe range.[118][119] When handled improperly, or if manufactured defectively, some rechargeable batteries can experience thermal runaway resulting in overheating. Especially prone to thermal runaway are lithium-ion batteries. Reports of exploding cellphones have been reported in newspapers. In 2006, batteries from Apple, HP, Toshiba, Lenovo, Dell and other notebook manufacturers were recalled because of fire and explosions.[120][121][122][123] Also, during the Boeing 787 Dreamliner's first year of service, at least four aircraft suffered from electrical system problems stemming from its lithium-ion batteries, resulting in the whole Dreamliner fleet being voluntarily grounded in January 2013.[124][125]

Several plug-in electric vehicle fire incidents have taken place since the introduction of mass-production plug-in electric vehicles in 2008. Most of them have been thermal runaway incidents related to the lithium-ion batteries and have involved the Zotye M300 EV, Chevrolet Volt, Fisker Karma, BYD e6, Dodge Ram 1500 Plug-in Hybrid, Toyota Prius Plug-in Hybrid, Mitsubishi i-MiEV and Outlander P-HEV. As of November 2013, four fires after a crash have been reported associated with the batteries of all-electric cars involving a BYD e6 and three Tesla Model S cars.

The first modern crash-related fire was reported in China in May 2012, after a high-speed car crashed into a BYD e6 taxi in Shenzhen.[126] The second reported incident occurred in the United States on October 1, 2013, when a Tesla Model S caught fire after the electric car hit metal debris on a highway in Kent, Washington state, and the debris punctured one of 16 modules within the battery pack.[127][128] A second reported fire occurred on October 18, 2013, in Merida, Mexico. In this case the vehicle was being driven at high speed through a roundabout and crashed through a wall and into a tree. On November 6, 2013, a Tesla Model S being driven on Interstate 24 near Murfreesboro, Tennessee caught fire after it struck a tow hitch on the roadway, causing damage beneath the vehicle.[129]

The U.S. National Highway Traffic Safety Administration (NHTSA) is conducting a study due in 2014 to establish whether lithium-ion batteries in plug-electric vehicles pose a potential fire hazard. The research is looking at whether the high-voltage batteries can cause fires when they are being charged and when the vehicles are involved in an accident.[130] Both General Motors and Nissan have published a guide for firefighters and first responders to properly handle a crashed plug-in electric-drive vehicle and safely disable its battery and other high voltage systems.[131][132]

Rare-earth metals availability and supply security

Common technology for plug-ins and electric cars is based on the lithium-ion battery and an electric motor which uses rare-earth elements. The demand for lithium, heavy metals, and other specific elements (such as neodymium, boron and cobalt) required for the batteries and powertrain is expected to grow significantly due to the future sales increase of plug-in electric vehicles in the mid and long term.[133][134] As of 2011, the Toyota Prius battery contains more than 20 lb (9.1 kg) of the rare-earth element lanthanum,[135] and its motor magnets use neodymium and dysprosium.[136] While only 0.25 oz (7 g) of lithium carbonate equivalent (LCE) are required in a smartphone and 1.1 oz (30 g) in a tablet computer, electric vehicles and stationary energy storage systems for homes, businesses or industry use much more lithium in their batteries. As of 2016 a hybrid electric passenger car might use 11 lb (5 kg) of LCE, while one of Tesla's high performance electric cars could use as much as 180 lb (80 kg).[137]

Some of the largest world reserves of lithium and other rare metals are located in countries with strong resource nationalism, unstable governments or hostility to U.S. interests, raising concerns about the risk of replacing dependence on foreign oil with a new dependence on hostile countries to supply strategic materials.[133][134][138][139]

- Lithium

The main deposits of lithium are found in China and throughout the Andes mountain chain in South America. In 2008 Chile was the leading lithium metal producer with almost 30%, followed by China, Argentina, and Australia.[134][141] In the United States lithium is recovered from brine pools in Nevada.[142][143]

Nearly half the world's known reserves are located in Bolivia,[134][138] and according to the US Geological Survey, Bolivia's Salar de Uyuni desert has 5.4 million tons of lithium.[138][142] Other important reserves are located in Chile, China, and Brazil.[134][142] Since 2006 the Bolivian government have nationalized oil and gas projects and is keeping a tight control over mining its lithium reserves. Already the Japanese and South Korean governments, as well as companies from these two countries and France, have offered technical assistance to develop Bolivia's lithium reserves and are seeking to gain access to the lithium resources through a mining and industrialization model suitable to Bolivian interests.[138][144][145]

According to a 2011 study conducted at Lawrence Berkeley National Laboratory and the University of California Berkeley, the currently estimated reserve base of lithium should not be a limiting factor for large-scale battery production for electric vehicles, as the study estimated that on the order of 1 billion 40 kWh Li-based batteries (about 10 kg of lithium per car)[146] could be built with current reserves, as estimated by the U.S. Geological Survey.[147] Another 2011 study by researchers from the University of Michigan and Ford Motor Company found that there are sufficient lithium resources to support global demand until 2100, including the lithium required for the potential widespread use of hybrid electric, plug-in hybrid electric and battery electric vehicles. The study estimated global lithium reserves at 39 million tons, and total demand for lithium during the 90-year period analyzed at 12–20 million tons, depending on the scenarios regarding economic growth and recycling rates.[148]

A 2016 study by Bloomberg New Energy Finance (BNEF) found that the availability of lithium and other finite materials used in the battery packs will not be a limiting factor for the adoption of electric vehicles. BNEF estimated that battery packs will require less than 1% of the known reserves of lithium, nickel, manganese, and copper through 2030, and 4% of the world's cobalt. After 2030, the study states that new battery chemistries will probably shift to other source materials, making packs lighter, smaller, and cheaper.[71]

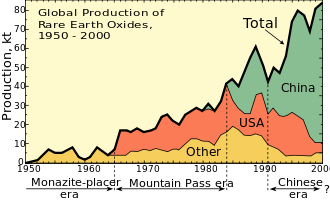

- Rare-earth elements

China has 48% of the world's reserves of rare-earth elements, the United States has 13%, and Russia, Australia, and Canada have significant deposits. Until the 1980s, the U.S. led the world in rare-earth production, but since the mid-1990s China has controlled the world market for these elements. The mines in Bayan Obo near Baotou, Inner Mongolia, are currently the largest source of rare-earth metals and are 80% of China's production. In 2010 China accounted for 97% of the global production of 17 rare-earth elements.[135] Since 2006 the Chinese government has been imposing export quotas reducing supply at a rate of 5% to 10% a year.[139][149][150]

Prices of several rare-earth elements increased sharply by mid-2010 as China imposed a 40% export reduction, citing environmental concerns as the reason for the export restrictions. These quotas have been interpreted as an attempt to control the supply of rare earths. However, the high prices have provided an incentive to begin or reactivate several rare-earth mining projects around the world, including the United States, Australia, Vietnam, and Kazakhstan.[149][150][151][152]

In September 2010, China temporarily blocked all exports of rare earths to Japan in the midst of a diplomatic dispute between the two countries. These minerals are used in hybrid cars and other products such as wind turbines and guided missiles, thereby augmenting the worries about the dependence on Chinese rare-earth elements and the need for geographic diversity of supply.[150][153] A December 2010 report published by the US DoE found that the American economy vulnerable to rare-earth shortages and estimates that it could take 15 years to overcome dependence on Chinese supplies.[154][155] China raised export taxes for some rare earths from 15 to 25%, and also extended taxes to exports of some rare-earth alloys that were not taxed before. The Chinese government also announced further reductions on its export quotas for the first months of 2011, which represent a 35% reduction in tonnage as compared to exports during the first half of 2010.[156]

On September 29, 2010, the U.S. House of Representatives approved the Rare Earths and Critical Materials Revitalization Act of 2010 (H.R.6160).[157][158] The approved legislation is aimed at restoring the U.S. as a leading producer of rare-earth elements, and would support activities in the U.S. Department of Energy (US DoE) to discover and develop rare-earth sites inside of the U.S. in an effort to reduce the auto industry's near-complete dependence on China for the minerals.[158][159] A similar bill, the Rare Earths Supply Technology and Resources Transformation Act of 2010 (S. 3521), is being discussed in the U.S. Senate.[158][160]

In order to avoid its dependence on rare-earth minerals, Toyota Motor Corporation announced in January 2011 that it is developing an alternative motor for future hybrid and electric cars that do not need rare-earth materials. Toyota engineers in Japan and the U.S. are developing an induction motor that is lighter and more efficient than the magnet-type motor used in the Prius, which uses two rare earths in its motor magnets. Other popular hybrids and plug-in electric cars in the market that use these rare-earth elements are the Nissan Leaf, the Chevrolet Volt and Honda Insight. For its second generation RAV4 EV due in 2012, Toyota is using an induction motor supplied by Tesla Motors that does not require rare-earth materials. The Tesla Roadster and the Tesla Model S use a similar motor.[136]

Car dealers reluctance to sell

With the exception of Tesla Motors, almost all new cars in the United States are sold through dealerships, so they play a crucial role in the sales of electric vehicles, and negative attitudes can hinder early adoption of plug-in electric vehicles.[161][162] Dealers decide which cars they want to stock, and a salesperson can have a big impact on how someone feels about a prospective purchase. Sales people have ample knowledge of internal combustion cars while they do not have time to learn about a technology that represents a fraction of overall sales.[161] As with any new technology, and in the particular case of advanced technology vehicles, retailers are central to ensuring that buyers, especially those switching to a new technology, have the information and support they need to gain the full benefits of adopting this new technology.[162]

There are several reasons for the reluctance of some dealers to sell plug-in electric vehicles. PEVs do not offer car dealers the same profits as a gasoline-powered cars. Plug-in electric vehicles take more time to sell because of the explaining required, which hurts overall sales and sales people commissions. Electric vehicles also may require less maintenance, resulting in loss of service revenue, and thus undermining the biggest source of dealer profits, their service departments. According to the National Automobile Dealers Association (NADS), dealers on average make three times as much profit from service as they do from new car sales. However, a NADS spokesman said there was not sufficient data to prove that electric cars would require less maintenance.[161] According to the New York Times, BMW and Nissan are among the companies whose dealers tend to be more enthusiastic and informed, but as of 2015, only about 10% of dealers were knowledgeable about the new technology.[161]

A study conducted at the Institute of Transportation Studies (ITS), at the University of California, Davis (UC Davis) published in 2014 found that many car dealers are less than enthusiastic about plug-in vehicles. ITS conducted 43 interviews with six automakers and 20 new car dealers selling plug-in vehicles in California's major metro markets. The study also analyzed national and state-level J.D. Power 2013 Sales Satisfaction Index (SSI) study data on customer satisfaction with new car dealerships and Tesla retail stores. The researchers found that buyers of plug-in electric vehicles were significantly less satisfied and rated the dealer purchase experience much lower than buyers of non-premium conventional cars, while Tesla Motors earned industry-high scores. According to the findings, plug-in buyers expect more from dealers than conventional buyers, including product knowledge and support that extends beyond traditional offerings.[162][163]

In 2014 Consumer Reports published results from a survey conducted with 19 secret shoppers that went to 85 dealerships in four states, making anonymous visits between December 2013 and March 2014. The secret shoppers asked a number of specific questions about cars to test the salespeople's knowledge about electric cars. The consumer magazine decided to conduct the survey after several consumers who wanted to buy a plug-in car reported to the organization that some dealerships were steering them toward gasoline-powered models. The survey found that not all sales people seemed enthusiastic about making PEV sales; a few outright discouraged it, and even one dealer was reluctant to even show a plug-in model despite having one in stock. And many sales people seemed not to have a good understanding of electric-car tax breaks and other incentives or of charging needs and costs. Consumer Reports also found that when it came to answering basic questions, sales people at Chevrolet, Ford, and Nissan dealerships tended to be better informed than those at Honda and Toyota. The survey found that most of the Toyota dealerships visited recommended against buying a Prius Plug-in and suggested buying a standard Prius hybrid instead. Overall, the secret shoppers reported that only 13 dealers “discouraged the sale of EV,” with seven of them being in New York. However, at 35 of the 85 dealerships visited, the secret shoppers said sales people recommended buying a gasoline-powered car instead.[164]

The ITS-Davis study also found that a small but influential minority of dealers have introduced new approaches to better meet the needs of plug-in customers. Examples include marketing carpool lane stickers, enrolling buyers in charging networks and preparing incentive paperwork for customers. Some dealers assign seasoned sales people as plug-in experts, many of whom drive plug-ins themselves to learn and be familiar with the technology and relate the car's benefits to potential buyers. The study concluded also that carmakers could do much more to support dealers selling PEVs.[162]

Government incentives and policies

Several national, provincial, and local governments around the world have introduced policies to support the mass market adoption of plug-in electric vehicles. A variety of policies have been established to provide direct financial support to consumers and manufacturers; non-monetary incentives; subsidies for the deployment of charging infrastructure; procurement of electric vehicle for government fleets; and long term regulations with specific targets.[11][165]

Financial incentives for consumers aim to make plug-in electric car purchase price competitive with conventional cars due to the still higher up front cost of electric vehicles. Among the financial incentives there are one-time purchase incentives such as tax credits, purchase grants, exemptions from import duties, and other fiscal incentives; exemptions from road, bridge and tunnel tolls, and from congestion pricing fees; and exemption of registration and annual use vehicle fees. Some countries, like France, also introduced a bonus-malus CO

2 based tax system that penalize fossil-fuel vehicle sales.[11][165][166]

As of 2020, monetary incentives for electrically chargeable vehicles are available, among others, in several European Union member states, China, the United States, the UK, Japan, Norway, some provinces in Canada, South Korea, India, Israel, Colombia, and Costa Rica.[11][167][168]

| Selected countries | Year |

|---|---|

| Norway (100% ZEV sales) | 2025 |

| Denmark | 2030 |

| Iceland | |

| Ireland | |

| Netherlands (100% ZEV sales) | |

| Sweden | |

| United Kingdom | 2040 |

| France | |

| Canada (100% ZEV sales) | |

| Singapore | |

| Sri Lanka (100% HEV or PEV stock) | |

| Germany (100% ZEV sales) | 2050 |

| U.S. (only 10 ZEV states) | |

| Japan (100% HEV/PHEV/ZEV sales) | |

| Costa Rica (100% ZEV sales) |

Among the non-monetary incentives there are several perks such allowing plug-in vehicles access to bus lanes and high-occupancy vehicle lanes, free parking and free charging.[165] In addition, in some countries or cities that restrict private car ownership (purchase quota system for new vehicles), or have implemented permanent driving restrictions (no-drive days), the schemes often exclude electric vehicles from the restrictions to promote their adoption.[166][170][167][171]

For example in Beijing, the license plate lottery scheme specifies a fixed number of vehicle purchase permits each year, but to promote the electrification of its fleet, the city government split the number of purchase permits into two lots, one for conventional vehicles, and another dedicated for all-electric vehicle applicants.[166] In the case of cities with driving alternate-days based on the license plate number, such as San José, Costa Rica, since 2012, São Paulo and Bogotá since 2014, and Mexico City since 2015, all-electric vehicles were excluded from the driving restrictions.[167][171][172][173]

Some government have also established long term regulatory signals with specific target timeframes such as ZEV mandates, national or regional CO

2 emissions regulations, stringent fuel economy standards, and the phase out of internal combustion engine vehicle sales.[11][165] For example, Norway set a national goal that all new car sales by 2025 should be zero emission vehicles (electric or hydrogen).[174][175]

Also, some cities are planning to establish zero-emission zones (ZEZ) restricting traffic access into an urban cordon area or city center where only zero-emission vehicles (ZEVs) are allowed access. In such areas, all internal combustion engine vehicles are banned.[176][177]

As of June 2020, Oxford is slated to be the first city to implement a ZEZ scheme, beginning with a small area scheduled to go into effect by mid 2021. The plan is to expand the clean air zone gradually into a much larger zone, until the ZEZ encompasses the majority of the city center by 2035.[178][179]

As of May 2020, other cities planning to gradually introduce ZEZ, or partial or total ban fossil fuel powered vehicles include, among others, Amsterdam (2030),[180] Athens (2025),[181] Barcelona (2030),[181] Brussels (2030/2035),[176] Copenhagen (2030),[181] London (2020/2025),[176] Los Angeles (2030),[181] Madrid (2025),[182] Mexico City (2025),[182] Milan (2030),[181] Oslo (2024/2030),[176] Paris (2024/2030),[176] Quito (2030),[181] Rio de Janeiro (2030),[181] Rome (2024/2030),[176] [183] Seattle (2030),[181] and Vancouver (2030).[181]

Production plug-in electric vehicles available

_cropped.jpg)

During the 1990s several highway-capable plug-in electric cars were produced in limited quantities, all were battery electric vehicles. PSA Peugeot Citroën launched several electric "Électrique" versions of its models starting in 1991. Other models were available through leasing mainly in California. Popular models included the General Motors EV1 and the Toyota RAV4 EV. Some of the latter were sold to the public and were still in use by the early 2010s.[184]

In the late 2000s began a new wave of mass production plug-in electric cars, motorcycles and light trucks. However, as of 2011, most electric vehicles in the world roads were low-speed, low-range neighborhood electric vehicles (NEVs) or electric quadricycles.[185] Sales of low-speed electric vehicles experienced considerable growth in China between 2012 and 2016, with an estimated NEV stock between 3 million to 4 million units, with most powered by lead-acid batteries.[186]

As of December 2019, according to the International Energy Agency, there were about 250 models of highway-capable plug-in electric passenger cars available for sale in the world, up from 70 in 2014.[11] There are also available several commercial models of electric light commercial vehicles, plug-in motorcycles, all-electric buses, and plug-in heavy-duty trucks.

The Renault–Nissan–Mitsubishi Alliance is the world's leading light-duty electric vehicle manufacturer. Since 2010, the Alliance's global all-electric vehicle sales totaled almost 725,000 units, including those manufactured by Mitsubishi Motors through December 2018, now part of the Alliance.[188] Its best selling all-electric Nissan Leaf was the world's top selling plug-in electric car in 2013 and 2014.[189] Tesla is the world's second largest plug-in electric passenger car manufacturer with global sales since 2012 of over 532,000 units as of December 2018.[190] Its Model S was the world's top selling plug-in car in 2015 and 2016,[189][191] and its Model 3 was the world's best selling plug-in electric car in 2018.[187]

Ranking next is BYD Auto with more than 529,000 plug-in passenger cars delivered in China through December 2018.[192][193][194][195] Its Qin plug-in hybrid is the company's top selling model with almost 137,000 units sold in China through December 2018.[189][196][195] As of December 2018, the BMW Group had sold more than 356,000 plug-in cars since inception of the BMW i3, accounting for global sales its BMW i cars, BMW iPerformance plug-in hybrid models, and MINI brand plug-ins.[197]

BYD Auto ended 2015 as the world's best selling manufacturer of highway legal light-duty plug-in electric vehicles, with 61,722 units sold, followed by Tesla, with 50,580 units.[198][199][200] BYD was again the world's top selling plug-in car manufacturer in 2016, with 101,183 units delivered, one more time followed again by Tesla with 76,243 units.[192][201] In 2017 BYD ranked for the third consecutive year as the global top plug-in car manufacturer with 113,669 units delivered. BAIC ranked second with 104,520 units.[194][196] The BAIC EC-Series all-electric city car ranked as the world's top selling plug-in car in 2017 with 78,079 units sold in China.[202]

After 10 years in the market, Tesla was the world's top selling plug-in passenger car manufacturer in 2018, both as a brand and by automotive group, with 245,240 units delivered and a market share of 12% of all plug-in cars sold globally in 2018.[187][203] BYD Auto ranked second with 227,152 plug-in passenger cars sold worldwide, representing a market share of 11%.[205]

Sales and main markets

The global stock of plug-in electric vehicles between 2005 and 2009 consisted exclusively of all-electric cars, totaling about 1,700 units in 2005, and almost 6,000 in 2009. The plug-in stock rose to about 12,500 units in 2010, of which, only 350 vehicles were plug-in hybrids.[207][208] By comparison, during the Golden Age of the electric car at the beginning of the 20th century, the EV stock peaked at approximately 30,000 vehicles.[206]

After the introduction of the first mass-production plug-in cars by major carmakers in late 2010, plug-in car global sales went from about 50,000 units in 2011, to 125,000 in 2012, almost 213,000 in 2013, and over 315,000 units in 2014.[209] By mid-September 2015, the global stock of highway legal plug-in electric passenger cars and utility vans reached the one million sales milestone,[4][210] almost twice as fast as hybrid electric vehicles (HEV).[4][210]

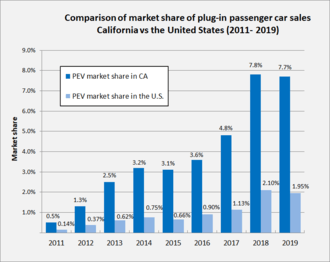

Light-duty plug-in electric vehicle sales in 2015 increased to more than 565,000 units in 2015, about 80% from 2014, driven mainly by China and Europe.[209] Both markets passed in 2015 the U.S. as the largest plug-in electric car markets in terms of total annual sales, with China ranking as the world's best-selling plug-in electric passenger car country market in 2015.[216][217] About 775,000 plug-in cars and vans were sold in 2016, and cumulative global sales passed the 2 million milestone by the end of 2016.[192] The global market share of the light-duty plug-in vehicle segment achieved a record 0.86% of total new car sales in 2016, up from 0.62% in 2015 and 0.38% in 2014.[218]