President of the European Central Bank

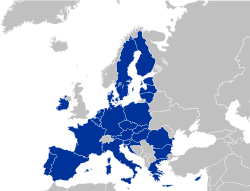

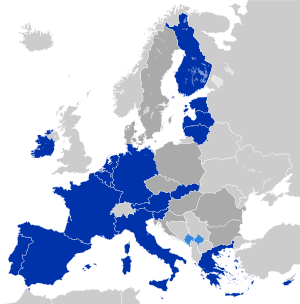

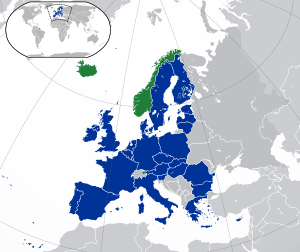

The President of the European Central Bank is the head of the European Central Bank (ECB), the main institution responsible for the management of the euro and monetary policy in the Eurozone of the European Union (EU).

| President of the European Central Bank | |

|---|---|

Emblem of the European Central Bank | |

| European Central Bank Institutions of the European Union | |

| Status | Head of an Institution Head of the Central Bank Chair of a Council |

| Member of | Eurogroup Executive Board (as Chair) Governing Council (as Chair) General Council (as Chair) |

| Reports to | |

| Residence | Seat of the European Central Bank |

| Seat | Frankfurt, Germany |

| Appointer | President of the European Commission - by majority approval of the European Council |

| Term length | Eight years (not renewable) |

| Constituting instrument | Treaties of the European Union |

| Precursor | President of the European Monetary Institute |

| Inaugural holder | Wim Duisenberg as first President of the European Central Bank (1 June 1998) |

| Formation | 1 June 1998 |

| Deputy | Vice President of the European Central Bank |

| Salary | €396,900 per annum (2017)[1] |

| Website | ecb.europa.eu |

The current head of the European Central Bank is Christine Lagarde, previously of the International Monetary Fund.

Role and appointment

The President heads the executive board, governing council and general council of the ECB. They also represent the bank abroad, for example at the G20. The officeholder is appointed by a qualified majority vote of the European Council, de facto by those who have adopted the euro, for an eight-year non-renewable term.[2]

History

Duisenberg

Wim Duisenberg was President of the European Monetary Institute (EMI) when it became the ECB, just prior to the launch of the Euro, on 1 June 1998. Duisenberg then became the first President of the ECB.

The French interpretation of the agreement made with the installation of Wim Duisenberg as ECB President was that Duisenberg would resign after just four years of his eight-year term, and would be replaced by the Frenchman Jean-Claude Trichet.[3] Duisenberg always strongly denied that such an agreement was made and stated in February 2002 that he would stay in office until his 68th birthday on 9 July 2003.

In the meanwhile Jean-Claude Trichet was not cleared of legal accusations before 1 June 2002, so he was not able to begin his term after Duisenberg's first four years. Even on 9 July 2003 Trichet was not cleared, and therefore Duisenberg remained in office until 1 November 2003. Duisenberg died on 31 July 2005.

Trichet

Jean-Claude Trichet became president in 2003 and served during the European sovereign debt crisis. Trichet's strengths lay in keeping consensus and visible calm in the ECB. During his tenure, Trichet has had to fend off criticism from French President Nicolas Sarkozy who demanded a more growth-orientated policy at the ECB. Germany supported Trichet in demanding the bank's independence be respected.[4]

However, he was also criticised from straying from his mandate during the crisis by buying the government bonds of eurozone member states. ECB board members Axel A. Weber and Jürgen Stark resigned in protest at this policy, even if it helped prevent states from defaulting. IMF economist Pau Rabanal argued that Trichet "maintained a relatively expansionary monetary policy," but even "sacrificed the ECB's inflation target for the sake of greater economic growth and jobs creation, and not the other way round." While straying from his mandate, he has however still kept interest rates under control and maintained greater price stability than the Deutsche Bundesbank did before the euro.[5][6]

As well as defending the ECB's independence and balancing its commitment to interest rates and economic stability, Trichet also fought Sarkozy for automatic sanctions in the EU fiscal reforms and against Angela Merkel against private sector involvement in bail outs so as not to scare the markets. He had however made some mistakes during the crisis, for example by: raising interest rates just after inflation topped out and just prior to the recession triggered by the Lehman Brothers collapse; also by its early timidity in buying eurozone state bonds.[5][6]

In his final appearance (his 35th) before the European Parliament, Trichet called for more political unity, including; significant new powers to be granted to the ECB, the establishment of an executive branch with a European Finance Ministry and greater oversight powers for the European Parliament. He also asserted that the ECB's role in maintaining price stability throughout the financial crisis and the oil price rises should not be overlooked.[7] He stated, in response to a question from a German newspaper attacking the ECB's credibility following its bond-buying;

...first, we were called to deliver price stability! ... We have delivered price stability over the first 12–13 years of the euro! Impeccably! I would like very much to hear some congratulations for this institution, which has delivered price stability in Germany over almost 13 years at approximately 1.55% - as the yearly average of inflation - we will recalculate the figure to the second decimal. This figure is better than any ever obtained in this country over a period of 13 years in the past 50 years. So, my first remark is this: we have a mandate and we deliver on our mandate! And we deliver in a way that is not only numerically convincing, but which is better than anything achieved in the past.

— Jean Claude Trichet at the European Parliament, 8 September 2011[8]

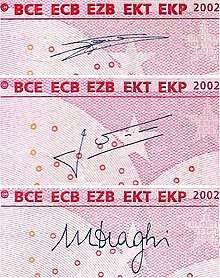

Draghi

Although Axel Weber was tipped as one of the possible successors,[9] he resigned from the ECB in protest at the bail out policies. Mario Draghi was chosen to become the next President of the ECB on 24 June 2011.[10] Draghi was president from 1 November 2011 until 31 October 2019 (succeeded by Christine Lagarde).

Pascal Canfin, Member of the European Parliament for France, asserted that Draghi had been involved in swaps for European governments, namely Greece, trying to disguise their countries' economic status. Draghi responded that the deals were "undertaken before my joining Goldman Sachs [and] I had nothing to do with" them, in the 2011 European Parliament nomination hearings.

In December 2011, Draghi oversaw a €489 billion ($640 billion), three-year loan program from the ECB to European banks. The program was around the same size as the US Troubled Asset Relief Program (2008) though still much smaller than the overall US response including the Federal Reserve's asset purchases and other actions of that time.

In February, 2012, a second, somewhat larger round of ECB loans to European banks was initiated under Draghi, called long term refinancing operation (LTRO). One commentator, Matthew Lynn, saw the ECB's injection of funds, along with Quantitative easing from the US Fed and the Asset Purchase Facility at the Bank of England, as feeding increases in oil prices in 2011 and 2012.[11]

In July 2012, in the midst of renewed fears about sovereigns in the eurozone, Draghi stated in a panel discussion that the ECB "...is ready to do whatever it takes to preserve the Euro. And believe me, it will be enough."[12] This statement led to a steady decline in bond yields (borrowing costs) for eurozone countries, in particular Spain, Italy and France. In light of slow political progress on solving the eurozone crisis, Draghi's statement has been seen as a key turning point in the fortunes of the Eurozone.[13][14]

List

| # | President (birth–death) |

State | Took office | Left office | |

|---|---|---|---|---|---|

| 1 |  |

Wim Duisenberg (1935–2005) |

1 June 1998 | 31 October 2003 | |

| Previously Minister of Finance, President of De Nederlandsche Bank and President of the European Monetary Institute. | |||||

| 2 |  |

Jean-Claude Trichet (1942–) |

1 November 2003 | 31 October 2011 | |

| Previously a member of the Group of Thirty and Governor of the Bank of France. | |||||

| 3 |  |

Mario Draghi (1947–) |

1 November 2011 | 31 October 2019 | |

| Previously a managing director of Goldman Sachs, executive director of the World Bank, Chairman of the Financial Stability Board and Governor of the Bank of Italy. | |||||

| 4 | _New_ECB_Chief_Lagarde_to_address_plenary_for_first_time_(49521491927)_(cropped).jpg) |

Christine Lagarde (1956–) |

1 November 2019 | ||

| Previously Minister of Economy, Finance and Industry of France and Managing Director of the International Monetary Fund. | |||||

Vice Presidents

Vice President Christian Noyer was only appointed for four years so that his resignation would coincide with the expected resignation of Duisenberg. His successors, starting with Lucas Papademos, are granted eight-year terms.

| # | Vice President (birth–death) |

State | Took office | Left office | |

|---|---|---|---|---|---|

| 1 | .jpg) |

Christian Noyer (1950–) |

1 June 1998 | 31 May 2002 | |

| Previously a civil servant, advisor and head of the treasury at the Ministry of Finance. | |||||

| 2 |  |

Lucas Papademos (1947–) |

1 June 2002 | 31 May 2010 | |

| Previously the senior economist at the Federal Reserve Bank of Boston chief economist and then Governor of the Bank of Greece. | |||||

| 3 |  |

Vítor Constâncio (1943–) |

1 June 2010 | 31 May 2018 | |

| Previously secretary-general of the Socialist Party and Governor of the Bank of Portugal. | |||||

| 4 | .jpg) |

Luis de Guindos (1960–) |

1 June 2018 | Incumbent Term expires 31 May 2026 | |

| Previously Minister of Economy and Competitiveness of the Government of Spain. | |||||

References

- Atalaia, Rita. "Constâncio ganhou 340 mil euros no último ano no BCE". ECO. Retrieved 22 February 2018.

- Protocol 4 of the consolidated European treaties

- "New ECB chief 'must be French'". BBC, Friday, 8 February 2002. Retrieved 9 April 2012.

- Murphy, Francois (23 September 2007). "Trichet brushes off French criticism of ECB". Reuters. Retrieved 26 June 2011.

- By Xavier Vidal-Folch (translated by Anton Baer) 6 October 2011 What it would have cost without Trichet, EL PAÍS, on Presseurop

- The euro crisis: Is anyone in charge?, The Economist 1 October 2011

- Martin Banks - 4 October 2011 ECB chief calls for 'significant' new powers for EU Archived 20 October 2011 at the Wayback Machine, the Parliament Magazine

- Introductory statement to the press conference (with Q&A), ECB

- Randow, Jana (9 February 2011). "Weber Throws ECB Race Open by Ruling Out Second Bundesbank Term". Bloomberg. Retrieved 26 June 2011.

- Baker, Luke (24 June 2011). "EU leaders appoint Mario Draghi as new ECB president | Reuters". Uk.reuters.com. Retrieved 26 June 2011.

- Lynn, Matthew (29 February 2012). "What central banks provide, oil markets take away". MarketWatch. Retrieved 29 February 2012.

- Mario Draghi (26 July 2012). ECB's Draghi to the euro's rescue? (Video). Euronews via YouTube. Retrieved 17 December 2012.

- Watts, William L. (26 July 2013). "Here's how things look a year after Mario Draghi pledged 'whatever it takes' to save the euro (blog)". MarketWatch. Retrieved 17 December 2013.

- Dixon, Hugo (30 July 2012). "Saving face and the Euro will be tough". The New York Times. Retrieved 23 August 2018.