Croatia and the euro

Croatia's currency, the kuna, has used the euro (and prior to that one of the euro's major predecessors, the German mark or Deutschmark) as its main reference since its creation in 1994, and a long-held policy of the Croatian National Bank has been to keep the kuna's exchange rate with the euro within a relatively stable range.

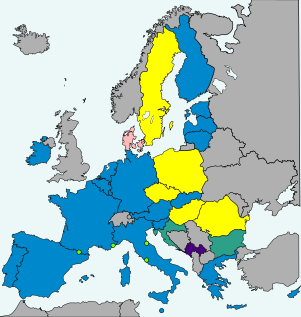

- European Union (EU) member states

-

5 not in ERM II, but obliged to join the eurozone on meeting convergence criteria (Czech Republic, Hungary, Poland, Romania, and Sweden).

- Non-EU member states

Croatia's EU membership obliges it to eventually join the eurozone. Prior to Croatian entry to the EU on 1 July 2013, Boris Vujčić, governor of the Croatian National Bank, stated that he would like the kuna to be replaced by the euro as soon as possible after accession.[2] This must be at least two years after Croatia joins the ERM2 (in addition to it meeting other criteria). Croatia joined the ERM II on 10 July 2020. The central rate of the kuna was set at 1 euro = 7.53450 kuna.[3]

Many small businesses in Croatia had debts denominated in euros before EU accession.[4] Croatians already use the euro for most savings and many informal transactions. Real estate, motor vehicle and accommodation prices are mostly quoted in euros.

Convergence status

In its first assessment under the convergence criteria in May 2014, the country satisfied the inflation and interest rate criteria, but did not satisfy the public finances, ERM membership and legislation compatibility criteria.[6] Subsequent convergence reports published in June 2016, May 2018 and June 2020 came to the same conclusions.

| Convergence criteria | ||||||||

|---|---|---|---|---|---|---|---|---|

| Assessment month | Country | HICP inflation rate[7][nb 1] | Excessive deficit procedure[8] | Exchange rate | Long-term interest rate[9][nb 2] | Compatibility of legislation | ||

| Budget deficit to GDP[10] | Debt-to-GDP ratio[11] | ERM II member[12] | Change in rate[13][14][nb 3] | |||||

| 2014 ECB Report[nb 4] | Reference values | Max. 1.7%[nb 5] (as of 30 Apr 2014) |

None open (as of 30 Apr 2014) | Min. 2 years (as of 30 Apr 2014) |

Max. ±15%[nb 6] (for 2013) |

Max. 6.2%[nb 7] (as of 30 Apr 2014) |

Yes[15][16] (as of 30 Apr 2014) | |

| Max. 3.0% (Fiscal year 2013)[17] |

Max. 60% (Fiscal year 2013)[17] | |||||||

| 1.1% | Open | No | -0.8% | 4.8% | No | |||

| 4.9% | 67.1% | |||||||

| 2016 ECB Report[nb 8] | Reference values | Max. 0.7%[nb 9] (as of 30 Apr 2016) |

None open (as of 18 May 2016) | Min. 2 years (as of 18 May 2016) |

Max. ±15%[nb 6] (for 2015) |

Max. 4.0%[nb 10] (as of 30 Apr 2016) |

Yes[18][19] (as of 18 May 2016) | |

| Max. 3.0% (Fiscal year 2015)[20] |

Max. 60% (Fiscal year 2015)[20] | |||||||

| -0.4% | Open | No | 0.3% | 3.7% | No | |||

| 3.2% | 86.7% | |||||||

| 2018 ECB Report[nb 11] | Reference values | Max. 1.9%[nb 12] (as of 31 Mar 2018) |

None open (as of 3 May 2018) | Min. 2 years (as of 3 May 2018) |

Max. ±15%[nb 6] (for 2017) |

Max. 3.2%[nb 13] (as of 31 Mar 2018) |

Yes[21][22] (as of 20 March 2018) | |

| Max. 3.0% (Fiscal year 2017)[23] |

Max. 60% (Fiscal year 2017)[23] | |||||||

| 1.3% | None | No | 0.9% | 2.6% | No | |||

| -0.8% (surplus) | 78.0% | |||||||

| 2020 ECB Report[nb 14] | Reference values | Max. 1.8%[nb 15] (as of 31 Mar 2020) |

None open (as of 7 May 2020) | Min. 2 years (as of 7 May 2020) |

Max. ±15%[nb 6] (for 2019) |

Max. 2.9%[nb 16] (as of 31 Mar 2020) |

Yes[24][25] (as of 24 March 2020) | |

| Max. 3.0% (Fiscal year 2019)[26] |

Max. 60% (Fiscal year 2019)[26] | |||||||

| 0.9% | None | No | 0.0% | 0.9% | No | |||

| -0.4% (surplus) | 73.2% | |||||||

- Notes

- The rate of increase of the 12-month average HICP over the prior 12-month average must be no more than 1.5% larger than the unweighted arithmetic average of the similar HICP inflation rates in the 3 EU member states with the lowest HICP inflation. If any of these 3 states have a HICP rate significantly below the similarly averaged HICP rate for the eurozone (which according to ECB practice means more than 2% below), and if this low HICP rate has been primarily caused by exceptional circumstances (i.e. severe wage cuts or a strong recession), then such a state is not included in the calculation of the reference value and is replaced by the EU state with the fourth lowest HICP rate.

- The arithmetic average of the annual yield of 10-year government bonds as of the end of the past 12 months must be no more than 2.0% larger than the unweighted arithmetic average of the bond yields in the 3 EU member states with the lowest HICP inflation. If any of these states have bond yields which are significantly larger than the similarly averaged yield for the eurozone (which according to previous ECB reports means more than 2% above) and at the same time does not have complete funding access to financial markets (which is the case for as long as a government receives bailout funds), then such a state is not be included in the calculation of the reference value.

- The change in the annual average exchange rate against the euro.

- Reference values from the ECB convergence report of June 2014.[15]

- Latvia, Portugal and Ireland were the reference states, with Greece, Bulgaria and Cyprus excluded as outliers.[15]

- The maximum allowed change in rate is ± 2.25% for Denmark.

- Latvia, Ireland and Portugal were the reference states.[15]

- Reference values from the ECB convergence report of June 2016.[18]

- Bulgaria, Slovenia and Spain were the reference states, with Cyprus and Romania excluded as outliers.[18]

- Slovenia, Spain and Bulgaria were the reference states.[18]

- Reference values from the ECB convergence report of May 2018.[21]

- Cyprus, Ireland and Finland were the reference states.[21]

- Cyprus, Ireland and Finland were the reference states.[21]

- Reference values from the ECB convergence report of June 2020.[24]

- Portugal, Cyprus, and Italy were the reference states.[24]

- Portugal, Cyprus, and Italy were the reference states.[24]

Target date for euro adoption

Croatia's EU membership obliges it to eventually join the eurozone. Prior to Croatian entry to the EU on 1 July 2013, Boris Vujčić, governor of the Croatian National Bank, stated that he would like the kuna to be replaced by the euro as soon as possible after accession.[2] This must be at least two years after Croatia joins the ERM2 (in addition to it meeting other criteria).

The Croatian National Bank had anticipated euro adoption within two or three years of EU entry.[30][31] However, the EU's response to the financial crises in eurozone delayed Croatia's adoption of the euro.[32] The country's own contracting economy also poses a major challenge to it meeting the convergence criteria.[33] While keen on euro adoption, one month before Croatia's EU entry governor Vujčić admitted "...we have no date [to join the single currency] in mind at the moment".[2] The European Central Bank was expecting Croatia to be approved for ERM II membership in 2016 at the earliest, with euro adoption in 2019.[34][35]

In April 2015, President Kolinda Grabar-Kitarović stated in a Bloomberg interview she was "confident that Croatia would introduce the euro by 2020", while Prime Minister Zoran Milanović said at the government session that "some occasional announcements when Croatia will introduce the euro shouldn't be taken seriously. We'll try to make it as soon as possible, but I distance myself from any dates and ask that you don't comment on it. When the country is ready, it will enter the euro area. The criteria are very clear."[36] In November 2017, Prime Minister Andrej Plenković said that Croatia is aiming to join ERM-2 by 2020 and to introduce the Euro by 2025.[37] Jean-Claude Juncker, President of the European Commission, stated in June 2019 that "Croatia is ready to join the ERM-2".[38]

A letter of intent of joining the ERM II mechanism was sent on 5 July 2019 to the ECB, signed by Minister of Finance Zdravko Marić, and the governor of the Croatian National Bank Boris Vujčić.[39][40] The letter marks the first formal step towards the adoption of the euro. Croatia committed to joining the Banking Union as part of its efforts to join ERM II. On 23 November 2019, European Commissioner Valdis Dombrovskis said that Croatia could join ERM II in the second half of 2020.[41]

Croatia joined the ERM2 on 10 July 2020. The central rate of the kuna was set at 1 euro = 7.53450 kuna.[42] The earliest date for euro adoption, which requires two years of ERM participation, is 10 July 2022.

Notes

- Kosovo is the subject of a territorial dispute between the Republic of Kosovo and the Republic of Serbia. The Republic of Kosovo unilaterally declared independence on 17 February 2008, but Serbia continues to claim it as part of its own sovereign territory. The two governments began to normalise relations in 2013, as part of the 2013 Brussels Agreement. Kosovo is currently recognized as an independent state by 97 out of the 193 United Nations member states. In total, 112 UN member states recognized Kosovo at some point, of which 15 later withdrew their recognition.

References

- "Bank Governor Determined For Croatia To Adopt Euro Currency ASAP". www.croatiaweek.com. Retrieved 7 September 2013.

- THOMSON, AINSLEY. "Croatia Aims for Speedy Adoption of Euro". Wall Street Journal. Retrieved 7 September 2013.

- https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.pr200710_1~88c0f764e7.en.html

- Joy, Oliver (21 January 2013). "Did Croatia get lucky on EU membership?". CNN.

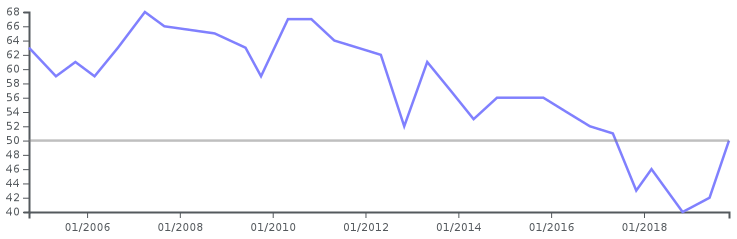

- "Public Opinion 1999–2020". European Commission. Retrieved 11 July 2020.

- "Convergence Report - 2014" (PDF). European Commission. April 2014. Retrieved 2014-09-26.

- "HICP (2005=100): Monthly data (12-month average rate of annual change)". Eurostat. 16 August 2012. Retrieved 6 September 2012.

- "The corrective arm/ Excessive Deficit Procedure". European Commission. Retrieved 2018-06-02.

- "Long-term interest rate statistics for EU Member States (monthly data for the average of the past year)". Eurostat. Retrieved 18 December 2012.

- "Government deficit/surplus data". Eurostat. 22 April 2013. Retrieved 22 April 2013.

- "General government gross debt (EDP concept), consolidated - annual data". Eurostat. Retrieved 2018-06-02.

- "ERM II – the EU's Exchange Rate Mechanism". European Commission. Retrieved 2018-06-02.

- "Euro/ECU exchange rates - annual data (average)". Eurostat. Retrieved 5 July 2014.

- "Former euro area national currencies vs. euro/ECU - annual data (average)". Eurostat. Retrieved 5 July 2014.

- "Convergence Report" (PDF). European Central Bank. June 2014. Retrieved 2014-07-05.

- "Convergence Report - 2014" (PDF). European Commission. April 2014. Retrieved 2014-09-26.

- "European economic forecast - spring 2014" (PDF). European Commission. March 2014. Retrieved 5 July 2014.

- "Convergence Report" (PDF). European Central Bank. June 2016. Retrieved 2016-06-07.

- "Convergence Report - June 2016" (PDF). European Commission. June 2016. Retrieved 2016-06-07.

- "European economic forecast - spring 2016" (PDF). European Commission. May 2016. Retrieved 7 June 2016.

- "Convergence Report 2018". European Central Bank. 2018-05-22. Retrieved 2018-06-02.

- "Convergence Report - May 2018". European Commission. May 2018. Retrieved 2018-06-02.

- "European economic forecast - spring 2018". European Commission. May 2018. Retrieved 2 June 2018.

- "Convergence Report 2020" (PDF). European Central Bank. 2020-06-01. Retrieved 2020-06-13.

- "Convergence Report - June 2020". European Commission. June 2020. Retrieved 2020-06-13.

- "European economic forecast - spring 2020". European Commission. 6 May 2020. Retrieved 13 June 2020.

- "Luxembourg Report prepared in accordance with Article 126(3) of the Treaty" (PDF). European Commission. 12 May 2010. Retrieved 18 November 2012.

- "EMI Annual Report 1994" (PDF). European Monetary Institute (EMI). April 1995. Retrieved 22 November 2012.

- "Progress towards convergence - November 1995 (report prepared in accordance with article 7 of the EMI statute)" (PDF). European Monetary Institute (EMI). November 1995. Retrieved 22 November 2012.

- "Vujčić: uvođenje eura dvije, tri godine nakon ulaska u EU". Poslovni dnevnik (in Croatian). HINA. 1 July 2006. Retrieved 2011-01-01.

statements made by Boris Vujčić, deputy governor of the Croatian National Bank (now governor (2013)), at the Dubrovnik economic conference, June 2006

- "Croatia ready to join EU in 2013 – official". reuters.com. 10 June 2011.

- "No Euro for Croatia before 2017". Croatian Times. 2010-05-31.

- "Approaching storm. Report on transformation" (PDF). www.pwc.pl. Retrieved 7 September 2013.

- "Konferencija HNB-a u Dubrovniku: Hrvatska može uvesti euro najranije 2019". www.banka.hr (in Croatian). Archived from the original on 2 February 2014. Retrieved 7 September 2013.

- "Croatia country report" (PDF). rbinternational.com. June 2013. Retrieved 7 September 2013.

- "Deficit to fall below 3 pct of GDP, public debt to stop rising by 2017". Government of the Republic of Croatia. 30 April 2015.

- Ilic, Igor (2017-10-30). "Croatia wants to adopt euro within 7-8 years: prime minister". Reuters. Retrieved 2017-10-31.

- "EU's Juncker backs Croatia joining open-border Schengen zone". Reuters. 2019-06-07. Retrieved 2019-06-09.

- "Statement on Croatia's path towards ERM II participation". Eurogroup. 2019-07-08. Retrieved 2019-07-14.

- "Republika Hrvatska uputila pismo namjere o ulasku u Europski tečajni mehanizam (ERM II)". Croatian National Bank (in Croatian). 2019-07-05. Retrieved 2019-07-05.

- "Croatia Could Enter ERM II in Second Half of 2020". Total Croatia news. 2019-11-23. Retrieved 2019-12-18.

- https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.pr200710_1~88c0f764e7.en.html