Romania and the euro

Romania’s current national currency is the leu. However, being bound by its EU accession agreement, Romania has to replace the leu with the euro, as soon as Romania will fulfil all of the four nominal euro convergence criteria as states in the Treaty of Functioning the European Union in article 140.[1] At the moment, the only currency on the market is leu, euro is not yet used in shops. The Romanian leu is not part of the European Exchange Rate Mechanism (ERM II), although the Romanian authorities are working to prepare the changeover to the euro. In order to achieve the change of the currency, Romania is required to undergo at least two years of sustainable stability within the limits of the convergence criteria. The current Romanian Government in addition established a self-imposed criterion to reach a certain level of real convergence, as a steering anchor to decide the appropriate target year for ERM II membership and euro adoption. As of March 2018, the scheduled date for euro adoption in Romania is 2024, according to the National Plan to Changeover to the Euro.[2]

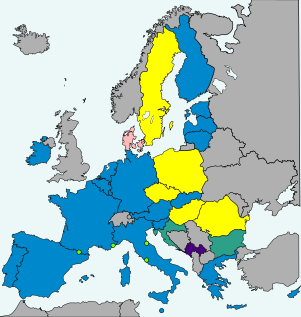

- European Union (EU) member states

-

5 not in ERM II, but obliged to join the eurozone on meeting convergence criteria (Czech Republic, Hungary, Poland, Romania, and Sweden).

- Non-EU member states

History

First changes in the Romanian currency

Romania is an open economy with free capital flows since September 2006 and with a total foreign trade exceeding 75% of GDP (Isărescu 2007).

Romania’s financial market is yet in progress, and the experts note the existence of a tendency towards the increase of the efficiency of stock exchange transactions.[3] Consequently, the inflows of portfolio investments are likely to increase. They could become another resource covering the current account deficit. As to the remittances of the Romanian people working abroad, it can be estimated that they shall keep up to high levels, in the short term. Nevertheless, the country’s accession to the EU also gives rise to a new resource capable of covering the deficit, namely the transfers from structural and cohesion funds to Romania, as a cohesion country, which shall be achieved starting from 2008.[4]

The first step required in the preparation of the changeover of the leu into euro took place at the same time with the depreciation of the national currency. Thus, in 2005 the new Romanian leu was printed with the same physical dimensions as the euro, in order to fit the ATMs system.[5]

One year later, the Romanian Government announced that the new plan to join the ERM II (a prerequisite for euro adoption) will take place only after 2012. Although, important impediments such as price instability and high interest rates, were at stake. The president of the European Central Bank said in June 2007, that "Romania has a lot of homework to do ... over a number of years" before joining ERM II. The Romanian government announced in December 2009, that they officially planned to join the eurozone by 1 January 2015.

In 2011, the Romanian government announced it would strive to comply with the first four convergence criteria by 2013, but the economy will need further reforms to successfully change to euro.

The delays in adhering to the ERM II

The governor of the National Bank of Romania (NBR) confirmed in 2012, that Romania would not meet its previous target of joining the Euro Zone in 2015. He addressed the benefits for Romania to not be a part of the Euro Area during the European debt-crisis, but that the country in the years ahead would strive to comply with all the convergence criteria. Concerns about its workforce productivity were also been cited for the delay.

In 2013, Romania submitted their annual Convergence Programme to the European Commission, which for the first time did not specify a target date for euro adoption. Then Prime Minister Victor Ponta stated that "Eurozone entry remains a fundamental objective for Romania but we can't enter poorly prepared", and that 2020 was a more realistic target.

At the same time, the NBR submitted draft amendments for the Romanian Constitution to the European Central Bank (ECB) for review. The amendments would make the NBR's statue an organic law to ensure "institutional and functional stability", and would allow for the "transfer of NBR tasks to the ECB and the introduction of the euro as legal tender" using organic law.

In 2014, Romania's Convergence Report set a target date of 1 January 2019 for euro adoption. According to the Erste Group Bank, Romania will not be able to meet this ambitious target by 2019, not in regards of complying with the four nominal convergence criteria values, but in regards of reaching some appropriate levels of real convergence (i.e. raising the GDP per capita from 50% to a level above 60% of the EU average) ahead of the euro adoption.

The Romanian Central Bank governor, Mugur Isărescu, admitted the target was challenging, but obtainable if the political parties passed a legal roadmap for the required reforms to be implemented. This roadmap should lead to Romania entering into the ERM II only on 1 January 2017 - so that the euro could be adopted after two years of ERM II membership on 1 January 2019.

However, in 2015, Isărescu argued once again for a delay in the changeover to euro. Ahead of ERM II entry Romania needs to conduct monetary adjustments in form of finalizing the process of bringing minimum reserve requirement ratios in line with Eurozone levels (a process envisaged to last between 1 and 1 1⁄2 years) and to complete major economic policy adjustments:

- removing the sources of repressed inflation (i.e. completion of the energy market deregulation);

- removing sources of quasi-fiscal deficits (by restructuring loss-making state-owned enterprises);

- removing other sources of future budgetary pressures (i.e. the unavoidable expenditures to modernise road infrastructure).

Romania's Prime Minister Victor Ponta said in June 2015 that he was open to the idea of holding a referendum on euro adoption.[6] However, the decisive trio, the President, BNR Governor, and Finance Minister did not considered this option.

The Romanian target for "real convergence" ahead of euro adoption, is for its GDP per capita (in purchasing power standards) to be above 60% of the same average figure for the entire European Union, and according to the latest outlook, this relative figure was now forecast to reach 65% in 2018 and 71% in 2020, after having risen at the same pace from 29% in 2002 to 54% in 2014.

Finally, the Romanian government also expressed its commitment to join all pillars of the Banking Union, as soon as possible. However, in September 2015 Romania's central bank governor Mugur Isarescu said that the 2019 target was no longer realistic. The new target date was initially the year 2022, as Teodor Meleșcanu, the foreign minister of Romania declared on 28 August 2017 that, as they "meet all formal requirements", Romania "could join the currency union even tomorrow". However, he thought Romania "will adopt the euro in five years, in 2022". In March 2018, members of the Social Democratic Party (PSD) voted at an extraordinary congress to back a 2024 target date to adopt the euro currency.

Current perspectives

There is no pressure on Romania to adhere to ERM in a certain year, followed by the adoption of the euro two years later. The EU Member States can bring into play the derogation clause from entering into ERM and hold on to their monetary policies as a buffer against external shocks. The EU Commission neither the European Council have ever urged Romania - a euro candidate country - to join the Eurozone, and it is not very probable that this will happen in the future – not least due to rising doubts in Brussels and the capitals of some current Eurozone members regarding the wisdom of further Eurozone enlargement. Thus Romania has enough time to establish the economic conditions under which the loss of monetary and fiscal sovereignty will be less painful.[7]

Monetary and exchange rate policies

In Romania, the main objective of the NBR is to ensure and maintain price stability, promoting at the same time the general economic policy of the Government. As states in Article 2 of Law 312/2004[8], the National Bank is responsible for defining and implementing the monetary policy strategy (Direct inflation targeting[9]) and the exchange rate policy.

Over the years, the NBR has supported the monetary policy, by progressively decreasing the policy rate. The first step achieved was between February 2009 and March 2012, when the NBR cut the policy rate by a cumulative 500 basis points, to 5.25%. Followed by rapid decreases in the annual inflation rate which made it possible for the NBR to resume the downward adjustment of the policy rate: between July 2013 and February 2014, the NBR cut the policy rate by a cumulative 175 basis points, to 3.5%.[10]

Romania has managed floating exchange rates and it is in line with using inflation targets as a nominal anchor for monetary policy and allowing for a flexible policy response to unpredictable shocks likely to affect the economy.[11] Reasons for not entering the euro area are complex, covering national problems, in particular the insufficient economic convergence over a lacking perceived attractiveness of euro membership, to an unresolved institutional reform agenda (Backé and Dvorsky 2018).[12]

Preparing the changeover to the euro[13]

Disclaimer of the monetary policy instrument. Monetary policy and exchange rate are passing in the responsibility of the European Central Bank. Thus, Romania remains without the ability to control a main monetary policy instrument (the monetary policy interest rate) and gives up to the exchange rate, another instrument that contributes to adjusting the economy, especially during the recession.

Convergence. In order to be able to suffer a smaller cost of the currency changeover, the structural, real and institutional convergence has to be as high as possible; the business cycles must be synchronized (periods of economic downturn and economic growth to be simultaneous in Romania, and in the euro area). So far, in general, Romania is a quarter-lagged room against the euro area economy. Hence, the effects of the ECB's monetary policy will have an asymmetrical effect. The decision to change to the euro currency is not appropriate to the phase of Romania’s economic cycle.

Control of macroeconomics balances. Romania must maintain the balance of macroeconomics: in the private sector (low debt rate), in the budgetary sector (a low budget deficit) and a stable balance in terms of the external sector.

An alternative instrument for interest rate and exchange rate. By renouncing to the famous two instruments, there is a need to find a tool that should be substituted: the literature usually recommends the flexibility of the labour market, the flexibility of wages and mobility of production factors.

It is an exercise of will and power. It is an ambitious objective that can bring Romania a solid, robust economy. Also, if Romania enters unprepared into the Monetary Union, the benefits will be smaller than the costs.

The Committee for Preparing the Changeover to the Euro

The Committee for Preparing the Changeover to the Euro at the National Bank of Romania (“Committee”) was originally established in 2011. The original scope of the Committee was to work as an advisory body to analyze the aspects related to euro adoption. Another objective of the Committee was to constitute a genuine platform for discussions, given that representatives of other public authorities were invited to attend its meetings.

The present objective of the Committee relays in a more in-depth and more comprehensive analysis within the NBR and a stronger relationship with the Board members and the heads of central bank departments in order to keep them informed about the aspects related to euro adoption. At the same time, the Committee keeps its initial role as a platform for discussion, due to the fact that it develops an inter-institutional dialogue with a view to raising awareness of the competent authorities about the fiscal and structural reforms for rendering the Romanian economy more flexible and taking the necessary steps for the changeover to the euro, on the other hand.[14]

The Committee’s main topics of discussion are[15]:

- the experience of other EU Member States in the preparation of the changeover to the euro;

- the stage of Romania's preparation for the adoption of the euro;

- new mechanisms and concepts developed at European Union level in the field of economic governance and the strengthening of the Economic and Monetary Union;

- documents of the European Commission, the European Central Bank and the Government of Romania regarding the convergence to the euro area of the derogating Member States.

The National Commission for the foundation of the National Plan for the adoption of the euro

In 2018, the Government established through a Government Emergency Ordinance (GEO) a new body to help achieve the right amount of convergence before changing to the euro. Thus, the National Commission for the foundation of the National Plan for the adoption of the euro (the National Commission) was established in 2018.[16] During the functioning of this National Commission, the Committee’s activity will be suspended, according to the provisions in the GEO.

The National Commission tasks which have a direct impact on criteria of legal convergence are:

a) elaboration of the National Plan for the transition to the euro and of the timetable of the actions necessary for the adoption of the euro;

b) periodic evaluation of the stage of meeting the convergence criteria;

c) evaluation of the current legislative framework and preparation of new legislative projects for the introduction of the euro;

d) preparing the national statistical system for updating the data series;

e) monitoring the preparation of the national systems for the changeover to the euro, the modification/compatibility of the payment system and the national accounting;

f) identification of the necessary actions and entities involved in organizing information campaigns for the general public on the adoption of the euro, developing and updating dedicated sites and setting up info-help points for citizens and companies. The National Commission will ensure that the public is informed clearly, objectively, in a timely and accurate manner about the adoption of the euro;

g) establishing and monitoring the specific elements, respectively the parallel circulation of the national currency and the euro, as well as the display of prices in national currency and in euro;

h) drawing up periodic working reports and sending them to the institutions involved.

| Convergence criteria | ||||||||

|---|---|---|---|---|---|---|---|---|

| Assessment month | Country | HICP inflation rate[17][nb 1] | Excessive deficit procedure[18] | Exchange rate | Long-term interest rate[19][nb 2] | Compatibility of legislation | ||

| Budget deficit to GDP[20] | Debt-to-GDP ratio[21] | ERM II member[22] | Change in rate[23][24][nb 3] | |||||

| 2012 ECB Report[nb 4] | Reference values | Max. 3.1%[nb 5] (as of 31 Mar 2012) |

None open (as of 31 March 2012) | Min. 2 years (as of 31 Mar 2012) |

Max. ±15%[nb 6] (for 2011) |

Max. 5.80%[nb 7] (as of 31 Mar 2012) |

Yes[25][26] (as of 31 Mar 2012) | |

| Max. 3.0% (Fiscal year 2011)[27] |

Max. 60% (Fiscal year 2011)[27] | |||||||

| 4.6% | Open | No | -0.6% | 7.25% | No | |||

| 5.2% | 33.3% | |||||||

| 2013 ECB Report[nb 8] | Reference values | Max. 2.7%[nb 9] (as of 30 Apr 2013) |

None open (as of 30 Apr 2013) | Min. 2 years (as of 30 Apr 2013) |

Max. ±15%[nb 6] (for 2012) |

Max. 5.5%[nb 9] (as of 30 Apr 2013) |

Yes[28][29] (as of 30 Apr 2013) | |

| Max. 3.0% (Fiscal year 2012)[30] |

Max. 60% (Fiscal year 2012)[30] | |||||||

| 4.1% | Open (Closed in June 2013) | No | -5.2% | 6.36% | Unknown | |||

| 2.9% | 37.8% | |||||||

| 2014 ECB Report[nb 10] | Reference values | Max. 1.7%[nb 11] (as of 30 Apr 2014) |

None open (as of 30 Apr 2014) | Min. 2 years (as of 30 Apr 2014) |

Max. ±15%[nb 6] (for 2013) |

Max. 6.2%[nb 12] (as of 30 Apr 2014) |

Yes[31][32] (as of 30 Apr 2014) | |

| Max. 3.0% (Fiscal year 2013)[33] |

Max. 60% (Fiscal year 2013)[33] | |||||||

| 2.1% | None | No | 0.9% | 5.26% | No | |||

| 2.3% | 38.4% | |||||||

| 2016 ECB Report[nb 13] | Reference values | Max. 0.7%[nb 14] (as of 30 Apr 2016) |

None open (as of 18 May 2016) | Min. 2 years (as of 18 May 2016) |

Max. ±15%[nb 6] (for 2015) |

Max. 4.0%[nb 15] (as of 30 Apr 2016) |

Yes[34][35] (as of 18 May 2016) | |

| Max. 3.0% (Fiscal year 2015)[36] |

Max. 60% (Fiscal year 2015)[36] | |||||||

| -1.3% | None | No | 0.0% | 3.6% | No | |||

| 0.7% | 38.4% | |||||||

| 2018 ECB Report[nb 16] | Reference values | Max. 1.9%[nb 17] (as of 31 Mar 2018) |

None open (as of 3 May 2018) | Min. 2 years (as of 3 May 2018) |

Max. ±15%[nb 6] (for 2017) |

Max. 3.2%[nb 18] (as of 31 Mar 2018) |

Yes[37][38] (as of 20 March 2018) | |

| Max. 3.0% (Fiscal year 2017)[39] |

Max. 60% (Fiscal year 2017)[39] | |||||||

| 1.9% | None | No | -1.7% | 4.1% | No | |||

| 2.9% | 35.0% | |||||||

| 2020 ECB Report[nb 19] | Reference values | Max. 1.8%[nb 20] (as of 31 Mar 2020) |

None open (as of 7 May 2020) | Min. 2 years (as of 7 May 2020) |

Max. ±15%[nb 6] (for 2019) |

Max. 2.9%[nb 21] (as of 31 Mar 2020) |

Yes[40][41] (as of 24 March 2020) | |

| Max. 3.0% (Fiscal year 2019)[42] |

Max. 60% (Fiscal year 2019)[42] | |||||||

| 3.7% | Open | No | -2.0% | 4.4% | No | |||

| 4.3% | 35.2% | |||||||

- Notes

- The rate of increase of the 12-month average HICP over the prior 12-month average must be no more than 1.5% larger than the unweighted arithmetic average of the similar HICP inflation rates in the 3 EU member states with the lowest HICP inflation. If any of these 3 states have a HICP rate significantly below the similarly averaged HICP rate for the eurozone (which according to ECB practice means more than 2% below), and if this low HICP rate has been primarily caused by exceptional circumstances (i.e. severe wage cuts or a strong recession), then such a state is not included in the calculation of the reference value and is replaced by the EU state with the fourth lowest HICP rate.

- The arithmetic average of the annual yield of 10-year government bonds as of the end of the past 12 months must be no more than 2.0% larger than the unweighted arithmetic average of the bond yields in the 3 EU member states with the lowest HICP inflation. If any of these states have bond yields which are significantly larger than the similarly averaged yield for the eurozone (which according to previous ECB reports means more than 2% above) and at the same time does not have complete funding access to financial markets (which is the case for as long as a government receives bailout funds), then such a state is not be included in the calculation of the reference value.

- The change in the annual average exchange rate against the euro.

- Reference values from the ECB convergence report of May 2012.[25]

- Sweden, Ireland and Slovenia were the reference states.[25]

- The maximum allowed change in rate is ± 2.25% for Denmark.

- Sweden and Slovenia were the reference states, with Ireland excluded as an outlier.[25]

- Reference values from the ECB convergence report of June 2013.[28]

- Sweden, Latvia and Ireland were the reference states.[28]

- Reference values from the ECB convergence report of June 2014.[31]

- Latvia, Portugal and Ireland were the reference states, with Greece, Bulgaria and Cyprus excluded as outliers.[31]

- Latvia, Ireland and Portugal were the reference states.[31]

- Reference values from the ECB convergence report of June 2016.[34]

- Bulgaria, Slovenia and Spain were the reference states, with Cyprus and Romania excluded as outliers.[34]

- Slovenia, Spain and Bulgaria were the reference states.[34]

- Reference values from the ECB convergence report of May 2018.[37]

- Cyprus, Ireland and Finland were the reference states.[37]

- Cyprus, Ireland and Finland were the reference states.[37]

- Reference values from the ECB convergence report of June 2020.[40]

- Portugal, Cyprus, and Italy were the reference states.[40]

- Portugal, Cyprus, and Italy were the reference states.[40]

Public opinion

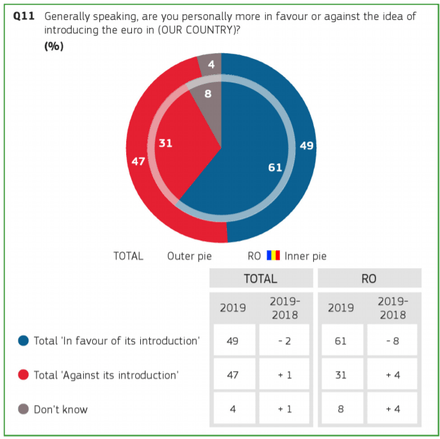

Public support for the euro in Romania[46]

The latest Flash Eurobarometer[47] shows that a majority of Romanian respondents supports the introduction of the euro on the national market. With a decrease of 8 percentage points, 61% of Romanians are in favour of euro adoption.

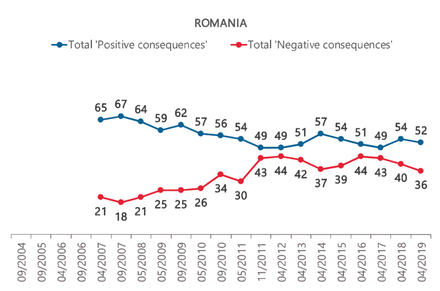

When referring to the positive impact of the changeover from the national currency to the euro, 52% of the Romanian respondents think that the common currency had a positive impact on the Eurozone Member States that already use it.

Notes

- Kosovo is the subject of a territorial dispute between the Republic of Kosovo and the Republic of Serbia. The Republic of Kosovo unilaterally declared independence on 17 February 2008, but Serbia continues to claim it as part of its own sovereign territory. The two governments began to normalise relations in 2013, as part of the 2013 Brussels Agreement. Kosovo is currently recognized as an independent state by 97 out of the 193 United Nations member states. In total, 112 UN member states recognized Kosovo at some point, of which 15 later withdrew their recognition.

References

- "CONSOLIDATED VERSION OF THE TREATY ON THE FUNCTIONING OF THE EUROPEAN UNION".

- "PLANUL NAŢIONAL DE ADOPTARE A MONEDEI EURO" (PDF).

- "NBR 2007c".

- Bal, A (2008). "Is the Current Account Deficit a Problem for Romania?". Transit Stud Rev. 15: 499–510. doi:10.1007/s11300-008-0024-3.

- "Coins and banknotes in circulation in Romania".

- "Euromoney Conference".

- Gabrisch, H.; Kämpfe, M. (2013). "The new EU countries and euro adoption". Intereconomics. 48: 180–186. doi:10.1007/s10272-013-0460-0. hdl:10419/113698.

- "Lege nr. 312 din 28.iun.2004, Monitorul Oficial, Partea I 582 30.iun.2004".

- "Direct Inflation Targeting".

- "Romania: Recent Macroeconomic & Banking System Developments, Mugur Isărescu, NBR Governor, 02.05.2014".

- "Exchange Rate Regime of the Leu".

- Blesse, Sebastian; Havlik, Annika; Heinemann, Friedrich (2019). "Searching for a Euro reform consensus: The perspective from Central and Eastern Europe". ZEW-Gutachten und Forschungsberichte, ZEW - Leibniz-Zentrum für Europäische Wirtschaftsforschung, Mannheim. hdl:10419/201191.

- George Stefan. "Unde suntem cu adoptarea monedei euro".

- "The Committee of Preparing the Changeover".

- "Cadrul juridic si institutional al aderarii la moneda euro. Starea de drept si de fapt in Romania".

- "Ordonanţă de urgenţă nr. 24/2018" (PDF).

- "HICP (2005=100): Monthly data (12-month average rate of annual change)". Eurostat. 16 August 2012. Retrieved 6 September 2012.

- "The corrective arm/ Excessive Deficit Procedure". European Commission. Retrieved 2018-06-02.

- "Long-term interest rate statistics for EU Member States (monthly data for the average of the past year)". Eurostat. Retrieved 18 December 2012.

- "Government deficit/surplus data". Eurostat. 22 April 2013. Retrieved 22 April 2013.

- "General government gross debt (EDP concept), consolidated - annual data". Eurostat. Retrieved 2018-06-02.

- "ERM II – the EU's Exchange Rate Mechanism". European Commission. Retrieved 2018-06-02.

- "Euro/ECU exchange rates - annual data (average)". Eurostat. Retrieved 5 July 2014.

- "Former euro area national currencies vs. euro/ECU - annual data (average)". Eurostat. Retrieved 5 July 2014.

- "Convergence Report May 2012" (PDF). European Central Bank. May 2012. Retrieved 2013-01-20.

- "Convergence Report - 2012" (PDF). European Commission. March 2012. Retrieved 2014-09-26.

- "European economic forecast - spring 2012" (PDF). European Commission. 1 May 2012. Retrieved 1 September 2012.

- "Convergence Report" (PDF). European Central Bank. June 2013. Retrieved 2013-06-17.

- "Convergence Report - 2013" (PDF). European Commission. March 2013. Retrieved 2014-09-26.

- "European economic forecast - spring 2013" (PDF). European Commission. February 2013. Retrieved 4 July 2014.

- "Convergence Report" (PDF). European Central Bank. June 2014. Retrieved 2014-07-05.

- "Convergence Report - 2014" (PDF). European Commission. April 2014. Retrieved 2014-09-26.

- "European economic forecast - spring 2014" (PDF). European Commission. March 2014. Retrieved 5 July 2014.

- "Convergence Report" (PDF). European Central Bank. June 2016. Retrieved 2016-06-07.

- "Convergence Report - June 2016" (PDF). European Commission. June 2016. Retrieved 2016-06-07.

- "European economic forecast - spring 2016" (PDF). European Commission. May 2016. Retrieved 7 June 2016.

- "Convergence Report 2018". European Central Bank. 2018-05-22. Retrieved 2018-06-02.

- "Convergence Report - May 2018". European Commission. May 2018. Retrieved 2018-06-02.

- "European economic forecast - spring 2018". European Commission. May 2018. Retrieved 2 June 2018.

- "Convergence Report 2020" (PDF). European Central Bank. 2020-06-01. Retrieved 2020-06-13.

- "Convergence Report - June 2020". European Commission. June 2020. Retrieved 2020-06-13.

- "European economic forecast - spring 2020". European Commission. 6 May 2020. Retrieved 13 June 2020.

- "Luxembourg Report prepared in accordance with Article 126(3) of the Treaty" (PDF). European Commission. 12 May 2010. Retrieved 18 November 2012.

- "EMI Annual Report 1994" (PDF). European Monetary Institute (EMI). April 1995. Retrieved 22 November 2012.

- "Progress towards convergence - November 1995 (report prepared in accordance with article 7 of the EMI statute)" (PDF). European Monetary Institute (EMI). November 1995. Retrieved 22 November 2012.

- http://ec.europa.eu/commfrontoffice/publicopinion/index.cfm/Survey/index#p=1&instruments=STANDARD&yearFrom=1999&yearTo=2017. Missing or empty

|title=(help) - https://ec.europa.eu/commfrontoffice/publicopinion/index.cfm/survey/getsurveydetail/instruments/flash/surveyky/2242. Missing or empty

|title=(help)