Poland and the euro

Poland does not use the euro as its currency. However, under the terms of their Treaty of Accession with the European Union, all new Member States "shall participate in the Economic and Monetary Union from the date of accession as a Member State with a derogation", which means that Poland is obliged to eventually replace its currency, the złoty, with the euro.

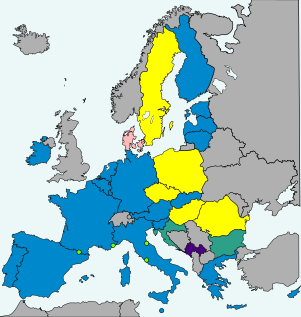

- European Union (EU) member states

-

5 not in ERM II, but obliged to join the eurozone on meeting convergence criteria (Czech Republic, Hungary, Poland, Romania, and Sweden).

- Non-EU member states

There is no target date for Polish euro adoption, and no fixed date for when the country will join ERM-II (the fifth euro convergence criterion). The country's former Deputy Prime Minister Janusz Piechociński has stated that Poland will not join the Euro until at least 2020.[1]

Euro adoption will require the approval of at least two-thirds of the Sejm to make a constitutional amendment changing the official currency from the złoty to the euro.[2] The ruling Law and Justice Party opposes euro adoption.[3][4] Former PM Donald Tusk has said that he may agree to a referendum on euro participation in order to gain their support for a constitutional amendment. Public opinion is against participation according to polls, with more than 70 percent believing that adoption of the euro would be bad for the Polish economy according to one poll from September 2012.[5]

There is not yet any official information on the design process for the Polish national sides of the euro coins.

Political preparations for euro adoption

Prior to 2004

Plans to join the eurozone began back in 2003 before the accession to the EU, when the contemporary premier Leszek Miller stated that Poland would join the eurozone between 2007 and 2009.[6] One of the leaders of Civic Platform party (PO) Jan Rokita was certain that the best way to converge to euro was through a unilateral euroization.[7] Nevertheless, euroization is against the rules of the EU and it cannot be adopted by any Member State without the approval of the Union. Lastly, the plan was not finalized and Poland suspended it.

2005–2007

During coalition of Law and Justice, Self-Defence of the Republic of Poland and League of Polish Families the euro was not a priority on Poland's agenda. In 2006 the premier Kazimierz Marcinkiewicz stated that the accession to euro area was possible only after 2009, as it would be possible that Polish deficit decreases to 3% of GDP until the end of 2007.[8] Till then the negotiations on Poland in the eurozone have been postponed.[8] Even more sceptical position held the premier Jarosław Kaczyński. In his opinion the euro was disadvantageous for Poland, and it would cause increase of prices, moreover, the stability of Polish złoty before the convergence would lose stability.[9]

2008–2012

The euro adoption process in Poland is regulated by the Strategic Framework for National Euro Changeover Plan (adopted by the Council of Ministers in 2010) and the National Euro Changeover Plan (approved in 2011 by the Committee for European Affairs). The plan comprises an economic impact assessment of the euro adoption, followed by a chapter on the measures needed to ensure Polish compliance with the "Maastricht convergence criteria", and finally a roadmap for the euro changeover process.

On 10 September 2008, speaking at the launch of an economic forum in a Polish resort of Krynica-Zdrój, Polish Prime Minister Donald Tusk announced the ruling government's objective to join the Eurozone in 2012, which was confirmed by the government on 28 October 2008.[10] However, Poland's then President Lech Kaczynski wanted euro adoption put to a referendum.[11][12] Finance Minister Dominik Radziwill said on 10 July 2009 that Poland could meet the fiscal criteria by 2012 and enter the Eurozone in 2014.[13] On 5 November 2009, speaking at the news conference, Polish Deputy Finance Minister Ludwik Kotecki said the government may announce a national strategy for euro adoption in mid-2010.[14] In an interview for Rzeczpospolita daily 22 October 2009 he also said Poland could adopt the euro in 2014 if the general government deficit is reduced in 2012.[15] Former President Lech Kaczyński said at a news conference that Poland was unable to join Eurozone before 2015, and even that date was still very optimistic. Also, Polish government officials had confirmed that Poland wouldn't join Eurozone in 2012.[16] On Friday, 11 December 2009, Polish Prime Minister Donald Tusk said Poland could join the eurozone in 2015.[17] Speaking during Finance Ministry-organized seminar on the euro-adoption process on 15 December 2009, Deputy Minister of Finance Ludwik Kotecki said the year 2015 is more likely than 2014, however he declined to specify the official target date.[18]

In the years following the 2008 Global Financial Crisis, economic statistics showed that the devaluation of its floating currency the złoty led Polish products to become more competitively priced to foreign buyers, and because of that Poland had a higher economic GDP growth in subsequent years than if the country had been a part of the eurozone. The Polish government advocated in 2012 that it would only be wise for Poland to join the eurozone once the euro crisis had ended, based on the argument that delaying their accession would minimise the risk for Poland to become one of the net financial creditors to other eurozone countries in financial difficulties.[19]

In December 2011, Polish foreign minister Radosław Sikorski said that Poland aimed to adopt the euro on 1 January 2016, but only if "the eurozone is reformed by then, and the entrance is beneficial to us."[20] The current Polish government plans to comply with all the Euro convergence criteria by 2015.[19] In autumn 2012 the Monetary Policy Council of the Polish National Bank published its official monetary guidelines for 2013, confirming earlier political statements that Poland should only join the ERM-II once the existing eurozone countries have overcome the current sovereign-debt crisis, to maximise the benefits of monetary integration and minimise associated costs.[21] The governor of the National Bank, Marek Belka, has stated that the euro won't be adopted before the end of his term in 2016.[19]

In late 2012, Tusk announced that he planned to launch a "national debate" on euro adoption the following spring, and in December 2012 Polish Finance Minister Jacek Rostowski said that his country should strive to adopt the euro as soon as possible. On 21 December 2012 it was announced by the Ministry of Finance that they planned to update the country's National Euro Changeover Plan in 2013, mainly due to the recent institutional changes in the eurozone which require additional considerations. One of the key details investigated as part of the work to update the plan is whether or not an amendment to Article 227 of the Constitution of the Republic of Poland[22] will need to be passed to change the currency from the Złoty to the euro and to enact changes to the central bank.[23][24] The opposition Law and Justice Party opposes euro adoption and the governing parties do not have enough seats in the Sejm to make the required constitutional amendment.[3][4] The Polish Finance Minister emphasised that the government's support for euro adoption remained unchanged as a strategic goal, and would not be changed in the updated plan.[25] At the same time, however, recent turbulences in the EU and in the world have caused the government to adopt a kind of additional criterion for euro adoption, namely the stabilization of the euro area.[26]

2013 – present

In January 2013, Polish President Bronislaw Komorowski stated that a decision on euro adoption should not be made until after parliamentary and presidential elections scheduled for 2015, but that in the meantime the country should try to comply with the convergence criteria.[3] In February 2013, Jaroslaw Kaczynski, leader of the Law and Justice Party stated that "I do not foresee any moment when the adoption of the euro would be advantageous for us" and called for a referendum on euro adoption.[27] Rostowski has stated that Poland won't set a target date for the switch since the country first needs to carry out reforms to prepare itself.[28] In March 2013, Tusk said for the first time that he would be open to considering a referendum on euro participation – decided by simple majority – provided that it was part of a package in which the parliament first approved the necessary constitutional amendment to adopt the euro subject to approval in a referendum.[29] In April 2013 Marek Belka, head of National Bank of Poland, said that Poland should demand to be permitted to adopt the euro without first joining the ERM-II due to concerns over currency speculation.[30] Following the 2014 Russian military intervention in Ukraine, Belka said that Poland needed to reevaluate its reluctance to join the eurozone.[31][32] In June 2014, a joint statement by the finance minister, central bank chief and president of Poland stated that Poland should begin a debate shortly after the 2015 parliamentary elections about when to adopt the euro,[33] leading to a roadmap decision that might even include identification of a target date.[34]

In October 2014, the Deputy Prime Minister Janusz Piechociński suggested that Poland should join the Eurozone in 2020 at the earliest.[35] The newly elect Prime Minister, Ewa Kopacz, having replaced Donald Tusk for the final year of the government's term, at the same time commented: "Before answering the question which target date should be set for the euro changeover, we must ask another: What is the situation of the eurozone and where are they going? If the eurozone will strengthen, then Poland should fulfil all the criteria for inclusion, which would in any case be good for the economy."[36] The PM hereby referred to the earlier political decision of first letting the National Coordination Committee for Euro Changeover complete its update of the changeover plan, which await a prior establishment of the banking union, before setting a target date for euro adoption.[nb 1] More recently, Krzysztof Szczerski, the foreign affairs advisor to Poland's new President Andrzej Duda, said in July 2015 that "Poles should decide in a referendum whether they want to embrace the euro".[38]

In the 2015 Polish parliamentary election, the winning party became the eurosceptic Law and Justice, which opposes euro adoption. On 13 April 2019 at a convention, Jarosław Kaczyński, the leader of Law and Justice Party (PiS) stated: "We will adopt the euro someday, because we are committed to do so and we are and will be in the European Union, but we will accept it when it is in our interest".[39] He came forth with a declaration, according to which the euro wouldn't be introduced until Poland's economy catches up with Western economies.[40] In his view Poland should accept the euro only when the national economy will reach 85% of GDP per capita of Germany.[41] Later on Jarosław Kaczyński and premier Mateusz Morawiecki maintain that convergence to euro at this point would be harmful for Poland.[40]

The process for introduction of the euro

While Donald Tusk held the post of the premier in Poland first steps have been taken towards a creation of the interinstitutional organizational structure for euro adoption.[42] On 13 January 2009 a new body of Government Plenipotentiary for Euro Adoption in the Republic of Poland was established.[43] The position of the first Government Plenipotentiary took Ludwik Kotecki.

Then, the next regulation from 3 November 2009 created new institutions:

- National Coordination Committee for Euro Changeover;

- Coordinating Council;

- Interinstitutional Working Committees for Preparation for the Introduction of the Euro by the Republic of Poland; and

- Task Groups.[44]

According to Regulation of the Council of Ministers from 28 December 2015, the position of Government Plenipotentiary for Euro Adoption in Poland has been suspended.[45]

Expected effects of the euro convergence

The adaptation of the euro in Poland is subject of economic analysis by experts in finance in Poland. In 2017 Polish Robert Schuman Foundation together with Konrad Adenauer Foundation in Poland prepared a report of three possible scenarios as results of Poland accessing the euro area.[46] According to the report, delaying the introduction of the euro goes against Poland.[46] Moreover, there are government reports draw up by Ministry of Finance in Poland in 2005,[47] and two reports by the National Bank of Poland in 2004[48] and 2009.[49] Both documents focus on expected short-term and long-term effects, including benefits as well as possible threats and costs. The NBP in the report from 2009 concluded that in the long-term Poland will gain extra 7,5% GDP as a member of the eurozone. In 2014 analysis, the NBP confirmed that the euro adaptation will have positive impact on the economic growth and the wealthiness of Polish citizens.[50]

Expected positive effects include:

- direct benefits

- reduction of exchange rate risk and costs of transactions – 80% of Polish trade is settled in the euro. Due to exchange rate risk many entrepreneurs uncertain of the profits and transaction costs do not engage into international operations;[51]

- lower business costs;

- improved quality in the estimation of profitability of investment projects;

- better transparency and comparability of prices in the international perspective;

- improved position of Poland as a trading partner;

- enhanced macroeconomic stability;

- limited risk of speculation of the currency;

- lower risk of a currency crisis;

- increase in the credibility of monetary policy;

- improvement in credit ranking;

- decline in interest rates;

- a decrease in the cost of raising capital for households, enterprises and public institutions;

- simpler credit availability and related to it increase in consumption;

- improvement of service interest;

- reduction of exchange rate risk and costs of transactions – 80% of Polish trade is settled in the euro. Due to exchange rate risk many entrepreneurs uncertain of the profits and transaction costs do not engage into international operations;[51]

- growth of trade

- increase investments – both in domestic investments and foreign direct investments (FDI)

- financial integration;

- growth of GDP and welfare.[49]

The reports note that part of the possible positive effects is contingent on an execution of changes, such as a reform of public finance or reduction of public debt.[49]

On the other side, the team of NBP analysts lists possible negative effects of the convergence to the euro:

- long-term costs

- loss of monetary policy independence – transfer to the EU level;

- loss of the possibility of using the exchange rate as a tool of adjustment policy;

- medium-term risks

- nonoptimal conversion rate;

- risk of deterioration of competitiveness;

- inflation differential within the monetary union;

- asset price inflation;

- Short-term risks and costs

- risks associated with convergence criteria – inter alia with an accession to the ESM II and a risk of the Mundell's trilemma ;[52]

- short-term price effects and the associated negative consequences of the euro illusion;

- price effects regarding the introduction of the euro into cash circulation;

Public opinion

Other surveys

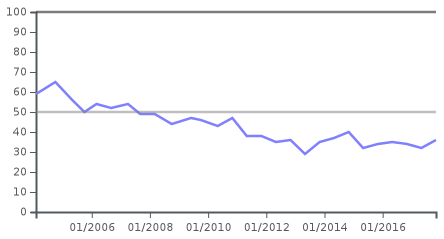

In 2010, the eurozone's debt crisis caused Poles' interest to cool, with two out of five Poles opposed to entry.[55] In March 2011, research by CBOS showed that 60% of Poles were against adopting the euro while 32% were supportive, a decrease from 41% in April 2010.[56] Surveys in the first half of 2012 indicated that 60% of Poles were opposed to adopting the common currency.[57] Public support for the euro continued to fall, reaching record lows in the CBOS polls from July 2012, where only 25% of those polled supported a switch to the euro.[58] However, polls conducted by TNS Polska throughout 2012–2015 have consistently shown support for eventually adopting the euro, though that support depends on the target date (as revealed by the detailed data in the table below).

The eurobarometer poll does not take adoption timing issues into concern, meaning that this result can not be directly compared to the above results of the TNS Polska surveys, as a percentage of those being surveyed might respond with a more negative bias (assuming the survey question is about if they favour adoption now" rather than favour "adoption either now or at a later point of time perceived as being more optimal for their country").

| Date | YES | NO | Undecided | Number of participants | Held by | Ref |

|---|---|---|---|---|---|---|

| 10–13 May 2012 | 51% (13% by the end of 2014) (38% after 2014) |

28% | 21% | 1000 | TNS Polska | [59] |

| 6–11 September 2013 | 49% (11% within 5yr) (18% in 6-10yr) (20% later than 10yr) |

40% | 11% | 1000 | TNS Polska | [60] |

| 6–11 December 2013 | 45% (12% within 5yr) (16% in 6-10yr) (17% later than 10yr) |

40% | 15% | 1000 | TNS Polska | [61] |

| 7–12 March 2014 | 44% (14% within 5yr) (14% in 6-10yr) (16% later than 10yr) |

42% | 14% | 1000 | TNS Polska | [62] |

| 6–11 June 2014 | 46% (14% within 5yr) (13% in 6-10yr) (19% later than 10yr) |

42% | 12% | ? | TNS Polska | [63] |

| 5–10 September 2014 | 45% (14% within 5yr) (14% in 6-10yr) (17% later than 10yr) |

42% | 13% | 1000 | TNS Polska | [64] |

| 5–10 December 2014 | 49% (16% within 5yr) (15% in 6-10yr) (18% later than 10yr) |

40% | 11% | 1000 | TNS Polska | [65] |

| 13–18 March 2015 | 44% (13% within 5yr) (12% in 6-10yr) (19% later than 10yr) |

41% | 15% | 1000 | TNS Polska | [66] |

| 12–17 June 2015 | 46% (15% within 5yr) (14% in 6-10yr) (17% later than 10yr) |

41% | 13% | 1015 | TNS Polska | [67] |

The adoption support found by the 2012–15 surveys in the above table, was detected while a majority of Poles in the same surveys said they expected the euro adoption would negatively impact the Polish economy. In example, 58% of the surveyed in May 2012 had this belief.[68] A later poll for the German Marshall Fund published in September 2012, even found 71% of Poles believed an immediate switch to the euro would be bad for the Polish economy.[5]

Convergence criteria

The Maastricht Treaty originally required that all members of the European Union join the euro once certain economic criteria are met. As of May 2018, Poland met 2 out of the 5 criteria.

Convergence Reports

Since 1989, the European Commission and ECB prepare Convergence Reports on countries that do not participate in the euro area. According to Article 140 TFEU, at least once every 2 years Reports must be issued on Member States that did not join the eurozone.[69]

Reports cover:

- legal compatibility;

- price stability;

- public finances;

- exchange rate stability;

- long-term interest rates; and

- additional factors.

The report of 2018 verify that Poland meets 2 out of 4 economic criteria related to price stability and public finances.[70] Poland does not meet 2 criteria of exchange rate stability and long-term interest rates. Moreover, Polish law is not completely compatible with the EU Treaties.[71] The NBP Act and the Constitution of the Republic of Poland are not fully compatible with the Article 131 of the TFEU,[72] which is related to lack of political approval in Poland. In order to fulfil legal compatibility Poland has to change three articles of the Constitution.[73] First article to be changed is Article 227(1), which improperly defines the main goal of the National Bank of Poland.[73] Secondly, Article 203(1) of the Constitution defines too broadly the competences of the Supreme Audit Office towards the National Bank. Finally, according to Article 198(1), President of the NBP carries responsibility before the State Tribunal, which is against requirements of the independence of the national central bank.[73]

| Convergence criteria | ||||||||

|---|---|---|---|---|---|---|---|---|

| Assessment month | Country | HICP inflation rate[74][nb 2] | Excessive deficit procedure[75] | Exchange rate | Long-term interest rate[76][nb 3] | Compatibility of legislation | ||

| Budget deficit to GDP[77] | Debt-to-GDP ratio[78] | ERM II member[79] | Change in rate[80][81][nb 4] | |||||

| 2012 ECB Report[nb 5] | Reference values | Max. 3.1%[nb 6] (as of 31 Mar 2012) |

None open (as of 31 March 2012) | Min. 2 years (as of 31 Mar 2012) |

Max. ±15%[nb 7] (for 2011) |

Max. 5.80%[nb 8] (as of 31 Mar 2012) |

Yes[82][83] (as of 31 Mar 2012) | |

| Max. 3.0% (Fiscal year 2011)[84] |

Max. 60% (Fiscal year 2011)[84] | |||||||

| 4.0% | Open | No | -3.2% | 5.77% | No | |||

| 5.1% | 56.3% | |||||||

| 2013 ECB Report[nb 9] | Reference values | Max. 2.7%[nb 10] (as of 30 Apr 2013) |

None open (as of 30 Apr 2013) | Min. 2 years (as of 30 Apr 2013) |

Max. ±15%[nb 7] (for 2012) |

Max. 5.5%[nb 10] (as of 30 Apr 2013) |

Yes[85][86] (as of 30 Apr 2013) | |

| Max. 3.0% (Fiscal year 2012)[87] |

Max. 60% (Fiscal year 2012)[87] | |||||||

| 2.7% | Open | No | -1.6% | 4.44% | Unknown | |||

| 3.9% | 55.6% | |||||||

| 2014 ECB Report[nb 11] | Reference values | Max. 1.7%[nb 12] (as of 30 Apr 2014) |

None open (as of 30 Apr 2014) | Min. 2 years (as of 30 Apr 2014) |

Max. ±15%[nb 7] (for 2013) |

Max. 6.2%[nb 13] (as of 30 Apr 2014) |

Yes[88][89] (as of 30 Apr 2014) | |

| Max. 3.0% (Fiscal year 2013)[90] |

Max. 60% (Fiscal year 2013)[90] | |||||||

| 0.6% | Open | No | -0.3% | 4.19% | No | |||

| 4.3% | 57.0% | |||||||

| 2016 ECB Report[nb 14] | Reference values | Max. 0.7%[nb 15] (as of 30 Apr 2016) |

None open (as of 18 May 2016) | Min. 2 years (as of 18 May 2016) |

Max. ±15%[nb 7] (for 2015) |

Max. 4.0%[nb 16] (as of 30 Apr 2016) |

Yes[91][92] (as of 18 May 2016) | |

| Max. 3.0% (Fiscal year 2015)[93] |

Max. 60% (Fiscal year 2015)[93] | |||||||

| -0.5% | None | No | 0.0% | 2.9% | No | |||

| 2.6% | 51.3% | |||||||

| 2018 ECB Report[nb 17] | Reference values | Max. 1.9%[nb 18] (as of 31 Mar 2018) |

None open (as of 3 May 2018) | Min. 2 years (as of 3 May 2018) |

Max. ±15%[nb 7] (for 2017) |

Max. 3.2%[nb 19] (as of 31 Mar 2018) |

Yes[94][95] (as of 20 March 2018) | |

| Max. 3.0% (Fiscal year 2017)[96] |

Max. 60% (Fiscal year 2017)[96] | |||||||

| 1.4% | None | No | 2.4% | 3.3% | No | |||

| 1.7% | 50.6% | |||||||

| 2020 ECB Report[nb 20] | Reference values | Max. 1.8%[nb 21] (as of 31 Mar 2020) |

None open (as of 7 May 2020) | Min. 2 years (as of 7 May 2020) |

Max. ±15%[nb 7] (for 2019) |

Max. 2.9%[nb 22] (as of 31 Mar 2020) |

Yes[97][98] (as of 24 March 2020) | |

| Max. 3.0% (Fiscal year 2019)[99] |

Max. 60% (Fiscal year 2019)[99] | |||||||

| 2.8% | None | No | -0.8% | 2.2% | No | |||

| 0.7% | 46.0% | |||||||

- Notes

- Cite from the 2014 Polish convergence report: Due to the significant reform agenda in the European Union and in the euro area, the current objective is to update the National Euro Changeover Plan with reference to the impact of those changes on Poland’s euro adoption strategy. The date of completion of the document is conditional on the adoption of binding solutions on the EU forum concerning the key institutional changes, in particular, those referring to the banking union. The outcome of these changes determines the area of the necessary institutional and legal adjustments as well as the national balance of costs and benefits arising from introduction of the common currency.[37]

- The rate of increase of the 12-month average HICP over the prior 12-month average must be no more than 1.5% larger than the unweighted arithmetic average of the similar HICP inflation rates in the 3 EU member states with the lowest HICP inflation. If any of these 3 states have a HICP rate significantly below the similarly averaged HICP rate for the eurozone (which according to ECB practice means more than 2% below), and if this low HICP rate has been primarily caused by exceptional circumstances (i.e. severe wage cuts or a strong recession), then such a state is not included in the calculation of the reference value and is replaced by the EU state with the fourth lowest HICP rate.

- The arithmetic average of the annual yield of 10-year government bonds as of the end of the past 12 months must be no more than 2.0% larger than the unweighted arithmetic average of the bond yields in the 3 EU member states with the lowest HICP inflation. If any of these states have bond yields which are significantly larger than the similarly averaged yield for the eurozone (which according to previous ECB reports means more than 2% above) and at the same time does not have complete funding access to financial markets (which is the case for as long as a government receives bailout funds), then such a state is not be included in the calculation of the reference value.

- The change in the annual average exchange rate against the euro.

- Reference values from the ECB convergence report of May 2012.[82]

- Sweden, Ireland and Slovenia were the reference states.[82]

- The maximum allowed change in rate is ± 2.25% for Denmark.

- Sweden and Slovenia were the reference states, with Ireland excluded as an outlier.[82]

- Reference values from the ECB convergence report of June 2013.[85]

- Sweden, Latvia and Ireland were the reference states.[85]

- Reference values from the ECB convergence report of June 2014.[88]

- Latvia, Portugal and Ireland were the reference states, with Greece, Bulgaria and Cyprus excluded as outliers.[88]

- Latvia, Ireland and Portugal were the reference states.[88]

- Reference values from the ECB convergence report of June 2016.[91]

- Bulgaria, Slovenia and Spain were the reference states, with Cyprus and Romania excluded as outliers.[91]

- Slovenia, Spain and Bulgaria were the reference states.[91]

- Reference values from the ECB convergence report of May 2018.[94]

- Cyprus, Ireland and Finland were the reference states.[94]

- Cyprus, Ireland and Finland were the reference states.[94]

- Reference values from the ECB convergence report of June 2020.[97]

- Portugal, Cyprus, and Italy were the reference states.[97]

- Portugal, Cyprus, and Italy were the reference states.[97]

Notes

- Kosovo is the subject of a territorial dispute between the Republic of Kosovo and the Republic of Serbia. The Republic of Kosovo unilaterally declared independence on 17 February 2008, but Serbia continues to claim it as part of its own sovereign territory. The two governments began to normalise relations in 2013, as part of the 2013 Brussels Agreement. Kosovo is currently recognized as an independent state by 97 out of the 193 United Nations member states. In total, 112 UN member states recognized Kosovo at some point, of which 15 later withdrew their recognition.

References

- http://biznes.interia.pl/wiadomosci/news/piechocinski-w-strefie-euro-znajdziemy-sie-najwczesniej-po,2051575,4199#iwa_item=5&iwa_img=0&iwa_hash=16484&iwa_block=facts_news_small&iwa_testab=a

- Odpowiedź na interpelację w sprawie wprowadzenia unijnej waluty bez zmiany konstytucji

- "Poland president says no euro entry decision before 2015 ballots". Reuters. 22 January 2013. Retrieved 9 February 2013.

- Puhl, Jan (6 February 2013). "Core or Periphery?: Poland's Battle Over Embracing the Euro". Der Spiegel. Retrieved 8 February 2013.

- "Wg raportu GMF Polacy coraz bardziej nie lubią USA, NATO, Obamy i Rosji". Wiadomości. 12 September 2012. Archived from the original on 17 October 2012. Retrieved 11 February 2013.

- Gazeta Wyborcza https://wyborcza.pl/1,75248,1515032.html?disableRedirects=true. Retrieved 25 March 2020. Missing or empty

|title=(help) - Zieliński, Michał (13 March 2005). "EuRokita". Wprost (in Polish). Retrieved 25 March 2020.

- Polska, Grupa Wirtualna (16 May 2006). "Euro się przybliża". money.pl (in Polish). Retrieved 25 March 2020.

- "Premier z niechęcią myśli o strefie euro". gazetapl (in Polish). Retrieved 25 March 2020.

- "Polish govt confirms euro plan despite hurdles". The Guardian. London. Retrieved 4 November 2008.

- "Poland may get referendum on euro". BBC. 28 October 2008. Retrieved 26 August 2015.

- "L. Kaczyński: najpierw referendum, potem euro". 31 October 2008. Retrieved 26 August 2015.

- "Poland may adopt euro before 2014-Deputy FinMin". Forbes. 10 July 2009. Archived from the original on 15 July 2009. Retrieved 31 July 2010.

- "Kotecki Says Poland Has No Plan to Suspend Debt Rules". Bloomberg L.P. 5 November 2009. Retrieved 12 November 2009.

- "Polish 2010 Gap Below 8% of GDP, Kotecki Tells Rzeczpospolita". Bloomberg L.P. 22 October 2009. Retrieved 12 November 2009.

- http://www.tvp.info/informacje/biznes/euro-nie-w-2012-roku

- "Polish PM says 2015 realistic date for euro entry". ForexPros. 11 December 2009. Retrieved 22 December 2009.

- "Poland delays adoption of the Euro until 2015". MercoPress. 16 December 2009. Retrieved 22 December 2009.

- Sobczyk, Marcin (5 June 2012). "Euro's Popularity Hits Record Low in Poland". The Wall Street Journal.

- Bloomberg Businessweek. 2 December 2011. Official: Poland to be ready for euro in 4 years Archived 15 August 2012 at the Wayback Machine

- "Monetary policy guidelines for 2013 (print nr.764)" (PDF). The Monetary Policy Council of the Polish National Bank (page 9) (in Polish). Sejm. 27 September 2012. Retrieved 28 October 2012.

- "Constitution of the Republic of Poland of 2nd April 1997, as published in Dziennik Ustaw (Journal of Laws) No. 78, item 483". Parliament of the Republic of Poland. Retrieved 25 September 2009.

- "Polish charter must change before ERM-2". fxstreet.com. Archived from the original on 23 April 2009. Retrieved 25 September 2008.

- "European Committee adopted the Strategic Framework NPWE". Ministry of Finance of Poland. 12 April 2010. Retrieved 21 February 2013.

- "Ministry of Finance in 2013, plans to update the National Euro Changeover Plan" (in Polish). Biznes.pl. 21 December 2012. Retrieved 21 February 2013.

- Kawecka-Wyrzykowska, E. (2013). Poland’s Public Finance Convergence with the Euro Area. Central European Business Review, vol. 2, no. 2, pp. 51–60. ISSN 1805-4862. Available online at: http://cebr.vse.cz/cebr/article/download/70/55

- "Polish opposition calls for single currency referendum". Polskie Radio. 19 February 2013. Retrieved 22 February 2013.

- Lovasz, Agnes (18 February 2013). "Poland's Euro Bid Requires Revamp Not Deadline: Rostowski". Bloomberg. Retrieved 22 February 2013.

- Cienski, Jan (26 March 2013). "Poland opens way to euro referendum". Financial Times. Retrieved 28 March 2013.

- "Belka suggests Poland should adopt euro without ERM II". Warsaw Business Journal. 8 April 2013. Archived from the original on 16 April 2013. Retrieved 27 April 2013.

- "Ukraine Crisis Means Poland Needs to Reconsider Euro, Belka Says". Bloomberg. 3 March 2014.

- "Marek Belka still wants the eurozone, but "not too fast". A few days ago he suggested – under the influence of news from the Crimea, that should speed up the process" (in Polish). 14 March 2014.

- "UPDATE 1-Polish officials display new appetite for adopting the euro". Reuters. 4 June 2014.

- "Polish President Wants Decision on Joining the Euro After 2015 Election". Newsweek. 20 October 2014.

- "Poland in the eurozone will find at the earliest after 2020 (Polska w strefie euro znajdziemy się najwcześniej po 2020 roku)" (in Polish). Interia Biznes. 10 October 2014.

- "Nová polská vláda chce větší vojenskou přítomnost USA a rychlý přechod k euru (The new Polish government wants greater US military presence and a quick transition to the euro)" (in Czech). Hospodářské Noviny iHNed. 1 October 2014.

- "Convergence programme: 2014 update" (PDF). Republic of Poland. April 2014.

- "Politics derail Poland's quest for the euro". Deutsche Welle. 26 August 2015.

- "Poland's Kaczynski says 'no' to the euro as part of election campaign". Reuters. 13 April 2019. Retrieved 25 March 2020.

- Bodalska, Barbara (23 April 2019). "W Polsce początek debaty o euro?". euractiv.pl (in Polish). Retrieved 25 March 2020.

- Wójcik, Łukasz (15 August 2017). "Czy Polska zdecyduje się kiedyś na europejską walutę". polityka.pl (in Polish). Retrieved 25 March 2020.

- "Kotecki wprowadzi Polskę do euro". Rzeczpospolita (in Polish). Retrieved 25 March 2020.

- "Rozporządzenie Rady Ministrów z dnia 13 stycznia 2009 r. w sprawie ustanowienia Pełnomocnika Rządu do Spraw Wprowadzenia Euro przez Rzeczpospolitą Polską". prawo.sejm.gov.pl. Retrieved 25 March 2020.

- "Rozporządzenie Rady Ministrów z dnia 3 listopada 2009 r. w sprawie powołania Narodowego Komitetu Koordynacyjnego do spraw Euro, Rady Koordynacyjnej oraz Międzyinstytucjonalnych Zespołów Roboczych do spraw Przygotowań do Wprowadzenia Euro przez Rzeczpospolitą Polską". isap.sejm.gov.pl. Retrieved 25 March 2020.

- "Rozporządzenie Rady Ministrów z dnia 28 grudnia 2015 r. w sprawie zniesienia Pełnomocnika Rządu do Spraw Wprowadzenia Euro przez Rzeczpospolitą Polską". prawo.sejm.gov.pl. Retrieved 25 March 2020.

- "co dalej z euro?". euroreg.uw.edu.pl. 2017. Retrieved 25 March 2020.

- "Integracja Polski ze Strefą Euro: uwarunkowania członkostwa i strategia zarządzania procesem". Ministerstwo Finansó. 2005.

- Borowski, Jakub (2004). Raport na temat korzyści i kosztów przystąpienia Polski do strefy euro (in Polish). Warszawa: Narodowy Bank Polski. OCLC 749415106.

- Narodowy Bank Polski. (2012). Raport na temat pełnego uczestnictwa Rzeczypospolitej Polskiej w trzecim etapie Unii Gospodarczej i Walutowej. Narodowy Bank Polski. OCLC 867949630.

- Narodowy Bank Polski. Ekonomiczne Wyzwania Integracji Polski ze Strefą Euro. NBP. OCLC 903343928.

- "Czy Polska powinna przystąpić do strefy euro? – Najwyższa Izba Kontroli". nik.gov.pl. Retrieved 25 March 2020.

- "Koszty mogą się pojawić jeszcze przed przyjęciem wspólnej waluty". Rzeczpospolita (in Polish). Retrieved 25 March 2020.

- "Strategic Guidelines for the National Euro Changeover Plan". mf-arch2.mf.gov.pl. Retrieved 25 March 2020.

- http://ec.europa.eu/commfrontoffice/publicopinion/index.cfm/Survey/index#p=1&instruments=STANDARD&yearFrom=1999&yearTo=2017

- "Czechs, Poles cooler to euro as they watch debt crisis". Reuters. 16 June 2010. Retrieved 18 June 2010.

- "CBOS za przyjęciem euro 32 proc. Polaków, przeciw 60 proc". bankier.pl. 28 March 2011. Retrieved 3 April 2011.

- "60 proc. Polaków nie chce euro" (in Polish). Wirtualna Polska. 14 February 2012. Retrieved 21 February 2012.

- "CBOS: Wprowadzenie euro popiera 25% badanych Polaków, aż 68% jest przeciw" (in Polish). 27 July 2012. Retrieved 26 August 2012.

- "As much as 58% of Poles are against the euro" (in Polish). Forbes.pl. 5 June 2012.

- "TNS Poland: 49 percent respondents in favor of the euro, 40 percent against (TNS Polska: 49 proc. badanych za przyjęciem euro, 40 proc. przeciw)" (in Polish). Onet.business. 27 September 2013.

- "TNS: 45 percent respondents in favor of the euro, 40 percent against (TNS OBOP: 45 proc. badanych za przyjęciem euro, 40 proc. przeciw)" (in Polish). Parkiet. 17 December 2013. Archived from the original on 7 November 2014. Retrieved 7 November 2014.

- "Poles do not want the euro. 63% of respondents fear the adoption of the euro (Polacy nie chcą euro. 63% badanych obawia się przyjęcia europejskiej waluty)" (in Polish). Wpolityce.pl. 25 March 2014.

- "TNS: 46 percent Poles for adoption of the euro; 42 percent against (TNS: 46 proc. Polaków za przyjęciem euro; 42 proc. przeciw)". Puls Biznesu (in Polish). 2 July 2014.

- "TNS Polska: Odsetek osób oceniających wejście do euro za błąd wzrósł do 51 proc" (in Polish). Obserwator Finansowy. 25 September 2014. Archived from the original on 7 November 2014.

- "TNS Poland: 49 percent for, 40 percent against the introduction of the euro in Poland (TNS Polska: 49 proc. za, 40 proc. przeciwko wprowadzeniu w Polsce euro)" (in Polish). Interia.pl. 21 December 2014.

- "Attitudes to adopt the euro without major changes, dominated by skeptics (Nastawienie do przyjęcia euro bez większych zmian, dominują sceptycy)" (in Polish). Bankier.pl. 25 March 2015.

- "Poles are increasingly skeptic against the euro (Polacy coraz sceptyczniejsi wobec euro" (in Polish). EurActiv. 24 June 2015. Archived from the original on 26 July 2015. Retrieved 24 August 2015.

- "As much as 58% of Poles are against the euro" (in Polish). Forbes.pl. 5 June 2012. Retrieved 21 February 2013.

- "Convergence Reports". European Commission – European Commission. Retrieved 25 March 2020.

- "Convergence Report 2018". European Commission – European Commission. Retrieved 25 March 2020.

- "Convergence Report 2018". European Commission – European Commission. Retrieved 25 March 2020.

- "1 – 2006 Convergence Report. COM(2006)762 –". European Commission. Retrieved 25 March 2020.

- Adamiec, Jolanta. (2013). Wprowadzenie euro w Polsce – za i przeciw. Wydawnictwo Sejmowe. ISBN 978-83-7666-259-6. OCLC 852971287.

- "HICP (2005=100): Monthly data (12-month average rate of annual change)". Eurostat. 16 August 2012. Retrieved 6 September 2012.

- "The corrective arm/ Excessive Deficit Procedure". European Commission. Retrieved 2 June 2018.

- "Long-term interest rate statistics for EU Member States (monthly data for the average of the past year)". Eurostat. Retrieved 18 December 2012.

- "Government deficit/surplus data". Eurostat. 22 April 2013. Retrieved 22 April 2013.

- "General government gross debt (EDP concept), consolidated - annual data". Eurostat. Retrieved 2 June 2018.

- "ERM II – the EU's Exchange Rate Mechanism". European Commission. Retrieved 2 June 2018.

- "Euro/ECU exchange rates - annual data (average)". Eurostat. Retrieved 5 July 2014.

- "Former euro area national currencies vs. euro/ECU - annual data (average)". Eurostat. Retrieved 5 July 2014.

- "Convergence Report May 2012" (PDF). European Central Bank. May 2012. Retrieved 20 January 2013.

- "Convergence Report - 2012" (PDF). European Commission. March 2012. Retrieved 26 September 2014.

- "European economic forecast - spring 2012" (PDF). European Commission. 1 May 2012. Retrieved 1 September 2012.

- "Convergence Report" (PDF). European Central Bank. June 2013. Retrieved 17 June 2013.

- "Convergence Report - 2013" (PDF). European Commission. March 2013. Retrieved 26 September 2014.

- "European economic forecast - spring 2013" (PDF). European Commission. February 2013. Retrieved 4 July 2014.

- "Convergence Report" (PDF). European Central Bank. June 2014. Retrieved 5 July 2014.

- "Convergence Report - 2014" (PDF). European Commission. April 2014. Retrieved 26 September 2014.

- "European economic forecast - spring 2014" (PDF). European Commission. March 2014. Retrieved 5 July 2014.

- "Convergence Report" (PDF). European Central Bank. June 2016. Retrieved 7 June 2016.

- "Convergence Report - June 2016" (PDF). European Commission. June 2016. Retrieved 7 June 2016.

- "European economic forecast - spring 2016" (PDF). European Commission. May 2016. Retrieved 7 June 2016.

- "Convergence Report 2018". European Central Bank. 22 May 2018. Retrieved 2 June 2018.

- "Convergence Report - May 2018". European Commission. May 2018. Retrieved 2 June 2018.

- "European economic forecast - spring 2018". European Commission. May 2018. Retrieved 2 June 2018.

- "Convergence Report 2020" (PDF). European Central Bank. 1 June 2020. Retrieved 13 June 2020.

- "Convergence Report - June 2020". European Commission. June 2020. Retrieved 13 June 2020.

- "European economic forecast - spring 2020". European Commission. 6 May 2020. Retrieved 13 June 2020.

- "Luxembourg Report prepared in accordance with Article 126(3) of the Treaty" (PDF). European Commission. 12 May 2010. Retrieved 18 November 2012.

- "EMI Annual Report 1994" (PDF). European Monetary Institute (EMI). April 1995. Retrieved 22 November 2012.

- "Progress towards convergence - November 1995 (report prepared in accordance with article 7 of the EMI statute)" (PDF). European Monetary Institute (EMI). November 1995. Retrieved 22 November 2012.