Modern Monetary Theory

Modern Monetary Theory or Modern Money Theory (MMT) is a macroeconomic theory considered by some as heterodox[1][2][3][4][5][6] that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of the financial assets needed to pay taxes and satisfy savings requirements.[7][8]

MMT is an alternative to mainstream macroeconomic theory. It has been criticized by well known economists but is claimed by its proponents to be more effective in describing the global economy in the years following the Great Recession.[9][10]

MMT argues that governments create new money by using fiscal policy. According to advocates, the primary risk once the economy reaches full employment is inflation, which can be addressed by gathering taxes to reduce purchasing power.[11] MMT is debated, with active dialogues[12] about its theoretical usefulness, the clear useful real-world practical applications and implications, together with the varying effectiveness of its targeted use and varying challenges of its policy prescriptions.

Principles

MMT's main tenets are that a government that issues its own fiat money:

- Can pay for goods, services, and financial assets without a need to collect money in the form of taxes or debt issuance in advance of such purchases;

- Cannot be forced to default on debt denominated in its own currency;

- Is only limited in its money creation and purchases by inflation, which accelerates once the real resources (labour, capital and natural resources) of the economy are utilized at full employment;

- Can control demand-pull inflation[13] by taxation which remove excess money from circulation (although the political will to do so may not always exist);

- Does not compete with the private sector for scarce savings by issuing bonds.

These tenets challenge the mainstream economics view that government spending is funded by taxes and debt issuance.[14][15][12] The first four MMT tenets do not conflict with mainstream economics understanding of how money creation and inflation works. For example, as former Fed Chair Alan Greenspan said, "The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default."[16] However, MMT economists disagree with mainstream economics about the fifth tenet, on the impact of government deficits on interest rates.[17][18][19][20][21]

History

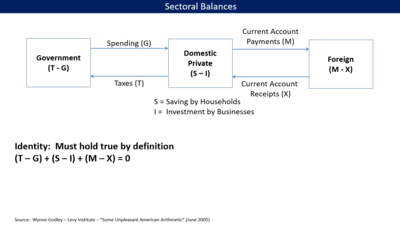

MMT synthesizes ideas from the State Theory of Money of Georg Friedrich Knapp (also known as Chartalism) and Credit Theory of Money of Alfred Mitchell-Innes, the functional finance proposals of Abba Lerner, Hyman Minsky's views on the banking system[22] and Wynne Godley's Sectoral balances approach.[19]

Knapp, writing in 1905, argued that "money is a creature of law" rather than a commodity.[23] Knapp contrasted his state theory of money with the Gold Standard view of "metallism", where the value of a unit of currency depends on the quantity of precious metal it contains or for which it may be exchanged. He argued that the state can create pure paper money and make it exchangeable by recognizing it as legal tender, with the criterion for the money of a state being "that which is accepted at the public pay offices".[23]

The prevailing view of money was that it had evolved from systems of barter to become a medium of exchange because it represented a durable commodity which had some use value,[24] but proponents of MMT such as Randall Wray and Mathew Forstater argue that more general statements appearing to support a chartalist view of tax-driven paper money appear in the earlier writings of many classical economists,[25] including Adam Smith, Jean-Baptiste Say, J.S. Mill, Karl Marx, and William Stanley Jevons.[26]

Alfred Mitchell-Innes, writing in 1914, argued that money exists not as a medium of exchange but as a standard of deferred payment, with government money being debt the government may reclaim through taxation.[27] Innes argued:

Whenever a tax is imposed, each taxpayer becomes responsible for the redemption of a small part of the debt which the government has contracted by its issues of money, whether coins, certificates, notes, drafts on the treasury, or by whatever name this money is called. He has to acquire his portion of the debt from some holder of a coin or certificate or other form of government money, and present it to the Treasury in liquidation of his legal debt. He has to redeem or cancel that portion of the debt...The redemption of government debt by taxation is the basic law of coinage and of any issue of government 'money' in whatever form.

— Alfred Mitchell-Innes, The Credit Theory of Money, The Banking Law Journal

Knapp and "chartalism" are referenced by John Maynard Keynes in the opening pages of his 1930 Treatise on Money[28] and appear to have influenced Keynesian ideas on the role of the state in the economy.[25]

By 1947, when Abba Lerner wrote his article Money as a Creature of the State, economists had largely abandoned the idea that the value of money was closely linked to gold.[29] Lerner argued that responsibility for avoiding inflation and depressions lay with the state because of its ability to create or tax away money.[29]

Economists Warren Mosler, L. Randall Wray, Stephanie Kelton,[30] Bill Mitchell and Pavlina R. Tcherneva are largely responsible for reviving the idea of chartalism as an explanation of money creation; Wray refers to this revived formulation as Neo-Chartalism.[31]

Bill Mitchell, Professor of Economics and Director of the Centre of Full Employment and Equity or CofFEE, at the University of Newcastle, New South Wales, coined the term Modern Monetary Theory.[32]

Pavlina R. Tcherneva has developed the first mathematical framework for MMT[33] and has largely focused on developing the idea of the Job Guarantee.

Scott Fullwiler has added detailed technical analysis of the banking and monetary systems.[34]

Rodger Malcolm Mitchell's book Free Money[35] (1996) describes in layman's terms the essence of chartalism.

Some contemporary proponents, such as Wray, place MMT within post-Keynesian economics, while MMT has been proposed as an alternative or complementary theory to monetary circuit theory, both being forms of endogenous money, i.e. money created within the economy, as by government deficit spending or bank lending, rather than from outside, as by gold. In the complementary view, MMT explains the "vertical" (government-to-private and vice versa) interactions, while circuit theory is a model of the "horizontal" (private-to-private) interactions.[36][37]

Hyman Minsky seemed to favor a chartalist approach to understanding money creation in his Stabilizing an Unstable Economy,[22] while Basil Moore, in his book Horizontalists and Verticalists,[38] lists the differences between bank money and state money.

In February 2019, the first academic textbook based on the theory was published.[12]

Theoretical approach

In sovereign financial systems, banks can create money but these "horizontal" transactions do not increase net financial assets as assets are offset by liabilities. According to MMT adherents, "The balance sheet of the government does not include any domestic monetary instrument on its asset side; it owns no money. All monetary instruments issued by the government are on its liability side and are created and destroyed with spending and taxing/bond offerings, respectively."[8] In MMT, "vertical money" enters circulation through government spending. Taxation and its legal tender enable power to discharge debt and establish the fiat money as currency, giving it value by creating demand for it in the form of a private tax obligation that must be met. In addition, fines, fees and licenses create demand for the currency. This can be a currency issued by the domestic government, or a foreign currency.[39][40] An ongoing tax obligation, in concert with private confidence and acceptance of the currency, maintains its value. Because the government can issue its own currency at will, MMT maintains that the level of taxation relative to government spending (the government's deficit spending or budget surplus) is in reality a policy tool that regulates inflation and unemployment, and not a means of funding the government's activities by itself. The approach of MMT typically reverses theories of governmental austerity. The policy implications of the two are likewise typically opposed.

Vertical transactions

MMT labels any transactions between the government, or public sector, and the non-government, or private sector, as a "vertical transaction". The government sector is considered to include the treasury and the central bank. The non-government sector includes domestic and foreign private individuals and firms (including the private banking system) and foreign buyers and sellers of the currency.[42]

Interaction between government and the banking sector

MMT is based on an account of the "operational realities" of interactions between the government and its central bank, and the commercial banking sector, with proponents like Scott Fullwiler arguing that understanding reserve accounting is critical to understanding monetary policy options.[43]

A sovereign government typically has an operating account with the country's central bank. From this account, the government can spend and also receive taxes and other inflows.[36] Each commercial bank also has an account with the central bank, by means of which it manages its reserves (that is, money for clearing and settling interbank transactions).[44]

When the government spends money, the treasury debits its operating account at the central bank, and deposits this money into private bank accounts (and hence into the commercial banking system). This money adds to the total deposits in the commercial bank sector. Taxation works exactly in reverse; private bank accounts are debited, and hence deposits in the commercial banking sector fall. In the United States, a portion of tax receipts are deposited in the treasury operating account, and a portion in commercial banks' designated Treasury Tax and Loan accounts.[17][45]

Government bonds and interest rate maintenance

Virtually all central banks set an interest rate target, and conduct open market operations to ensure base interest rates remain at that target level. According to MMT, the issuing of government bonds is best understood as an operation to offset government spending rather than a requirement to finance it.[43]

In most countries, commercial banks' reserve accounts with the central bank must have a positive balance at the end of every day; in some countries, the amount is specifically set as a proportion of the liabilities a bank has (i.e. its customer deposits). This is known as a reserve requirement. At the end of every day, a commercial bank will have to examine the status of their reserve accounts. Those that are in deficit have the option of borrowing the required funds from the central bank, where they may be charged a lending rate (sometimes known as a discount rate) on the amount they borrow. On the other hand, the banks that have excess reserves can simply leave them with the central bank and earn a support rate from the central bank. Some countries, such as Japan, have a support rate of zero.[46]

Banks with more reserves than they need will be willing to lend to banks with a reserve shortage on the interbank lending market. The surplus banks will want to earn a higher rate than the support rate that the central bank pays on reserves; whereas the deficit banks will want to pay a lower interest rate than the discount rate the central bank charges for borrowing. Thus they will lend to each other until each bank has reached their reserve requirement. In a balanced system, where there are just enough total reserves for all the banks to meet requirements, the short-term interbank lending rate will be in between the support rate and the discount rate.[46]

Under an MMT framework where government spending injects new reserves into the commercial banking system, and taxes withdraw them from the banking system,[17] government activity would have an instant effect on interbank lending. If on a particular day, the government spends more than it taxes, reserves have been added to the banking system (see vertical transactions). This will typically lead to a system-wide surplus of reserves, with competition between banks seeking to lend their excess reserves forcing the short-term interest rate down to the support rate (or alternately, to zero if a support rate is not in place). At this point banks will simply keep their reserve surplus with their central bank and earn the support rate.[47]

The alternate case is where the government receives more taxes on a particular day than it spends. In this case, there may be a system-wide deficit of reserves. As a result, surplus funds will be in demand on the interbank market, and thus the short-term interest rate will rise towards the discount rate. Thus, if the central bank wants to maintain a target interest rate somewhere between the support rate and the discount rate, it must manage the liquidity in the system to ensure that the correct amount of reserves is on hand in the banking system.[17]

Central banks manage this by buying and selling government bonds on the open market. On a day where there are excess reserves in the banking system, the central bank sells bonds and therefore removes reserves from the banking system, as private individuals pay for the bonds. On a day where there are not enough reserves in the system, the central bank buys government bonds from the private sector, and therefore adds reserves to the banking system.

It is important to note that the central bank buys bonds by simply creating money – it is not financed in any way.[48] It is a net injection of reserves into the banking system. If a central bank is to maintain a target interest rate, then it must necessarily buy and sell government bonds on the open market in order to maintain the correct amount of reserves in the system.[49]

Horizontal transactions

MMT economists describe any transactions within the private sector as "horizontal" transactions, including the expansion of the broad money supply through the extension of credit by banks.

MMT economists regard the concept of the money multiplier, where a bank is completely constrained in lending through the deposits it holds and its capital requirement, as misleading.[50][51] Rather than being a practical limitation on lending, the cost of borrowing funds from the interbank market (or the central bank) represents a profitability consideration when the private bank lends in excess of its reserve and/or capital requirements (see interaction between government and the banking sector). Effects on employment are used as evidence that a currency monopolist is overly restricting the supply of the financial assets needed to pay taxes and satisfy savings desires.[7][8]

According to MMT, bank credit should be regarded as a "leverage" of the monetary base and should not be regarded as increasing the net financial assets held by an economy: only the government or central bank is able to issue high-powered money with no corresponding liability.[52] Stephanie Kelton argues that bank money is generally accepted in settlement of debt and taxes because of state guarantees, but that state-issued high-powered money sits atop a "hierarchy of money".[53]

Foreign sector

Imports and exports

MMT proponents such as Warren Mosler argue that trade deficits need not be unsustainable and are beneficial to the standard of living in the short run.[54] Imports are an economic benefit to the importing nation because they provide the nation with real goods it can consume, that it otherwise would not have had. Exports, on the other hand, are an economic cost to the exporting nation because it is losing real goods that it could have consumed.[55] Currency transferred to foreign ownership, however, represents a future claim over goods of that nation.

Cheap imports may also cause the failure of local firms providing similar goods at higher prices, and hence unemployment but MMT commentators label that consideration as a subjective value-based one, rather than an economic-based one: it is up to a nation to decide whether it values the benefit of cheaper imports more than it values employment in a particular industry.[55] Similarly a nation overly dependent on imports may face a supply shock if the exchange rate drops significantly, though central banks can and do trade on the FX markets to avoid sharp shocks to the exchange rate.[56]

Foreign sector and government

MMT argues that as long as there is a demand for the issuer's currency, whether the bond holder is foreign or not, governments can never be insolvent when the debt obligations are in their own currency; this is because the government is not constrained in creating its own fiat currency (although the bond holder may affect the exchange rate by converting to local currency).[57]

MMT does agree with mainstream economics, that debt denominated in a foreign currency certainly is a fiscal risk to governments, since the indebted government cannot create foreign currency. In this case the only way the government can sustainably repay its foreign debt is to ensure that its currency is continually in high demand by foreigners over the period that it wishes to repay the debt – an exchange rate collapse would potentially multiply the debt many times over asymptotically, making it impossible to repay. In that case, the government can default, or attempt to shift to an export-led strategy or raise interest rates to attract foreign investment in the currency. Either one has a negative effect on the economy.[58]

Policy implications

Economist Stephanie Kelton explained several policy claims made by MMT in March 2019:

- Under MMT, fiscal policy (i.e., government taxing and spending decisions) is the primary means of achieving full employment, establishing the budget deficit at the level necessary to reach that goal. In mainstream economics, monetary policy (i.e., central bank adjustment of interest rates and its balance sheet) is the primary mechanism, assuming there is some interest rate low enough to achieve full employment. Kelton claims that cutting interest rates is ineffective in a slump, because businesses expecting weak profits and few customers will not invest even at very low interest rates.

- Government interest expenses are proportional to interest rates, so raising rates is a form of stimulus (it increases the budget deficit and injects money into the private sector, other things equal), while cutting rates is a form of austerity.

- Achieving full employment can be administered via a federally funded job guarantee, which acts as an automatic stabilizer. When private sector jobs are plentiful, the government spending on guaranteed jobs is lower, and vice versa.

- Under MMT, expansionary fiscal policy (i.e., money creation to fund purchases) can increase bank reserves, which can lower interest rates. In mainstream economics, expansionary fiscal policy (i.e., debt issuance and spending) can result in higher interest rates, crowding out economic activity.[14][15]

Economist John T. Harvey explained several of the premises of MMT and their policy implications in March 2019:

- The private sector treats labor as a cost to be minimized, so it cannot be expected to achieve full employment without government creating jobs as well, such as through a job guarantee.

- The public sector's deficit is the private sector's surplus and vice-versa, by accounting identity, a reason why private sector debt increased during the Clinton-era budget surpluses.

- Idle resources (mainly labor) can be activated by money creation. Not acting to do so is immoral.

- Demand can be insensitive to interest rate changes, so a key mainstream assumption, that lower interest rates lead to higher demand, is questionable.

- When the economy is below full employment, there is a "free lunch" in creating money to fund government expenditure to achieve full employment. Unemployment is a burden; full employment is not.

- Creating money alone does not cause inflation; spending it when the economy is at or above full employment can.[59]

MMT claims that the word "borrowing" is a misnomer when it comes to a sovereign government's fiscal operations, because what the government is doing is accepting back its own IOUs, and nobody can borrow back their own debt instruments.[60] Sovereign government goes into debt by issuing its own liabilities that are financial wealth to the private sector. "Private debt is debt, but government debt is financial wealth to the private sector."[61]

In this theory, sovereign government is not financially constrained in its ability to spend; it is argued that the government can afford to buy anything that is for sale in currency that it issues (there may be political constraints, like a debt ceiling law). The only constraint is that excessive spending by any sector of the economy (whether households, firms, or public) could cause inflationary pressures.

MMT economists advocate a government-funded job guarantee scheme to eliminate involuntary unemployment. Proponents argue that this can be consistent with price stability as it targets unemployment directly rather than attempting to increase private sector job creation indirectly through a much larger economic stimulus, and maintains a "buffer stock" of labor that can readily switch to the private sector when jobs become available. A job guarantee program could also be considered an automatic stabilizer to the economy, expanding when private sector activity cools down and shrinking in size when private sector activity heats up.[62]

Comparison of MMT with mainstream Keynesian economics

MMT can be compared and contrasted with mainstream Keynesian economics in a variety of ways:[12][14][15]

| Topic | Mainstream Keynesian | MMT |

|---|---|---|

| Funding government spending | Advocates taxation and issuing bonds (debt) as preferred methods for funding government spending. | Emphasizes that government funds its spending by crediting bank accounts. |

| Purpose of taxation | To pay down debt creation from the central banks loaned to the Government at interest, which is spent into the economy and needing to be paid back by the taxpayer. | Primarily to drive demand for the currency. Secondary uses of taxation include addressing inflation, addressing income inequality, and discouraging bad behaviour.[63] |

| Achieving full employment | Main strategy uses monetary policy; Fed has "dual mandate" of maximum employment and stable prices, but these goals are not always compatible. For example, much higher interest rates used to reduce inflation also caused high unemployment in the early 1980s.[64] | Main strategy uses fiscal policy; running a budget deficit large enough to achieve full employment through a job guarantee. |

| Inflation control | Driven by monetary policy; Fed sets interest rates consistent with a stable price level, sometimes setting a target inflation rate.[64] | Driven by fiscal policy; government increases taxes to remove money from private sector. A job guarantee also provides a NAIBER, which acts as an inflation control mechanism. |

| Setting interest rates | Managed by Fed to achieve "dual mandate" of maximum employment and stable prices.[64] | Emphasizes that an interest rate target is not a potent policy.[14] The government may choose to maintain a zero interest-rate policy by not issuing public debt at all.[65] |

| Budget deficit impact on interest rates | At full employment, higher budget deficit can crowd-out investment. | Deficit spending can drive down interest rates, encouraging investment and thus "crowding-in" economic activity.[66] |

| Automatic stabilizers | Primary stabilizers are unemployment insurance and food stamps, which increase budget deficits in a downturn. | In addition to the other stabilizers, a job guarantee would increase deficits in a downturn.[62] |

Reception

James K. Galbraith supports MMT and wrote the foreword for Mosler's book Seven Deadly Innocent Frauds of Economic Policy in 2010.[67]

Steven Hail of the University of Adelaide is another well known MMT economist.[68][69]

Criticisms

A 2019 survey of leading economists by the University of Chicago Booth's Initiative on Global Markets showed a unanimous rejection of assertions that the survey attributes to modern monetary theory: "Countries that borrow in their own currency should not worry about government deficits because they can always create money to finance their debt" and "Countries that borrow in their own currency can finance as much real government spending as they want by creating money".[70][71] Directly responding to the survey, MMT economist William K. Black said "MMT scholars do not make or support either claim."[72] Multiple MMT academics regard the attribution of these claims as a smear.[73]

The post-Keynesian economist Thomas Palley argues that MMT is largely a restatement of elementary Keynesian economics, but prone to "over-simplistic analysis" and understating the risks of its policy implications.[74] Palley denies the MMT claim that standard Keynesian analysis does not fully capture the accounting identities and financial restraints on a government that can issue its own money. He argues that these insights are well captured by standard Keynesian stock-flow consistent IS-LM models, and have been well understood by Keynesian economists for decades. He also criticizes MMT for "assum[ing] away the problem of fiscal–monetary conflict"[75] – that is, that the governmental body that creates the spending budget (e.g. Congress) may refuse to cooperate with the governmental body that controls the money supply (e.g. the Federal Reserve). In Palley's view the policies proposed by MMT proponents would cause serious financial instability in an open economy with flexible exchange rates, while using fixed exchange rates would restore hard financial constraints on the government and "undermines MMT’s main claim about sovereign money freeing governments from standard market disciplines and financial constraints". He also argues that MMT lacks a plausible theory of inflation, particularly in the context of full employment in the employer of last resort policy first proposed by Hyman Minsky and advocated by Bill Mitchell and other MMT theorists; of a lack of appreciation of the financial instability that could be caused by permanently zero interest rates; and of overstating the importance of government created money. Palley concludes that MMT provides no new insights about monetary theory, while making unsubstantiated claims about macroeconomic policy, and that MMT has only received attention recently due to it being a "policy polemic for depressed times."[75]

Marc Lavoie argues that whilst the neochartalist argument is "essentially correct", many of its counter-intuitive claims depend on a "confusing" and "fictitious" consolidation of government and central banking operations[21] – again what Palley calls "the problem of fiscal–monetary conflict."[75]

New Keynesian economist and Nobel laureate Paul Krugman argues that MMT goes too far in its support for government budget deficits and ignores the inflationary implications of maintaining budget deficits when the economy is growing.[76] Krugman described MMT devotees as engaging in "calvinball" – a game from the comic strip Calvin and Hobbes in which the players change the rules at whim.[30] Austrian School economist Robert P. Murphy states that MMT is "dead wrong" and that "the MMT worldview doesn't live up to its promises."[77] He observes that MMT's claim that cutting government deficits erodes private saving is true "only for the portion of private saving that is not invested" and argues that the national accounting identities used to explain this aspect of MMT could equally be used to support arguments that government deficits "crowd out" private sector investment.[77]

The chartalist view of money itself, and the MMT emphasis on the importance of taxes in driving money, is also a source of criticism.[21] Economist Eladio Febrero argues that modern money draws its value from its ability to cancel (private) bank debt, particularly as legal tender, rather than to pay government taxes.[78]

References

- Chohan, Usman W. (6 April 2020). "Modern Monetary Theory (MMT): A General Introduction". CASS Working Papers on Economics & National Affairs. Social Science Research Network. EC017UC (2020). Retrieved 27 July 2020.

- Edwards, Sebastian (2019). "Modern monetary theory: Cautionary tales from Latin America". Cato Journal. 39 (3): 529. Retrieved 27 July 2020.

- Kosaka, Norihiko (6 August 2019). "The Heterodox Modern Monetary Theory and Its Challenges for Japan". nippon.com. Retrieved 27 July 2020.

- Krugman, Paul (12 February 2019). "Opinion | How Much Does Heterodoxy Help Progressives? (Wonkish)". The New York Times. Retrieved 27 July 2020.

- Raposo, Ines Goncalves. "On Modern Monetary Theory". Bruegel.org. Bruegel. Retrieved 27 July 2020.

- "Heterodox Views of Money and Modern Monetary Theory (MMT)" (PDF).

- Warren Mosler, ME/MMT: The Currency as a Public Monopoly

- Éric Tymoigne and L. Randall Wray, "Modern Money Theory 101: A Reply to Critics," Levy Economics Institute of Bard College, Working Paper No. 778 (November 2013).

- Goldmark, Alex (26 September 2018). "Episode 866: Modern Monetary Theory". NPR. Washington DC. Retrieved 26 September 2019.

- Cohen, Patricia (5 April 2019). "Modern Monetary Theory Finds an Embrace in an Unexpected Place: Wall Street". The New York Times. New York. Retrieved 5 April 2019.

- Wray, L. Randall (2015). Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems. Houndmills, Basingstoke, Hampshire New York, NY: Palgrave Macmillan. pp. 137–141, 199–206. ISBN 978-1-137-53990-8.

- Bloomberg-Coy, Dmitrieva & Boesler-A Beginner's Guide to MMT-21 March 2019

- Fullwiler, Scott; Grey, Rohan; Tankus, Nathan (1 March 2019). "An MMT response on what causes inflation". FT Alphaville. The Financial Times Ltd. Retrieved 27 April 2019.

- Bloomberg-Stephanie Kelton-Paul Krugman Asked Me About Modern Monetary Theory-1 March 2019

- Bloomberg-Stephanie Kelton-The Clock Runs Down on Mainstream Keynesianism-4 March 2019

- No Chance of Default, US Can Print Money: Greenspan CNBC-No Chance of Default, US Can Print Money: Greenspan-7 August 2011

- Bell, Stephanie, (2000), "Do Taxes and Bonds Finance Government Spending?", Journal of Economic Issues, 34, issue 3, pp. 603–620

- Sharpe, Timothy P. (2013) "A Modern Money Perspective on Financial Crowding Out", Review of Political Economy, 25:4, 586-606

- Fullwiler, Scott; Kelton, Stephanie; Wray, L. Randall (January 2012), "Modern Money Theory : A Response to Critics", Working Paper Series: Modern Monetary Theory - A Debate (PDF), Amherst, MA: Political Economy Research Institute, pp. 17–26, retrieved 7 May 2015

- Fullwiler, Scott T. (2016) "The Debt Ratio and Sustainable Macroeconomic Policy", World Economic Review 7:12-42

- Marc Lavoie. "The monetary and fiscal nexus of neo-chartalism" (PDF).

- Minsky, Hyman: Stabilizing an Unstable Economy, McGraw-Hill, 2008, ISBN 978-0-07-159299-4

- Knapp, George Friedrich (1905), Staatilche Theorie des Geldes, Verlag von Duncker & Humblot

- Marx, Karl. "1: Commodities". Capital. I. Archived from the original on 23 September 2015. Retrieved 18 May 2009.

The utility of a thing makes it a use value.

- Wray, L. Randall (2000), The Neo-Chartalist Approach to Money, UMKC Center for Full Employment and Price Stability

- Forstater, Mathew (2004), Tax-Driven Money: Additional Evidence from the History of Thought, Economic History, and Economic Policy (PDF)

- Mitchell-Innes, Alfred (1914). "The Credit Theory of Money". The Banking Law Journal. 31.

- Keynes, John Maynard: A Treatise on Money, 1930, pp. 4, 6

- Lerner, Abba P. (May 1947). "Money as a Creature of the State". The American Economic Review. 37 (2).

- "Is modern monetary theory nutty or essential?". The Economist. 12 March 2019. ISSN 0013-0613. Retrieved 12 March 2019.

- The Economist, 31 December 2011, "Marginal revolutionaries" neo-chartalism, sometimes called "Modern Monetary Theory"

- Matthews, Dylan (18 February 2012). "Modern Monetary Theory is an unconventional take on economic strategy". The Washington Post. Washington DC. Retrieved 18 February 2019.

- Tcherneva, Pavlina R. "Monopoly Money: The State as a Price Setter" (PDF). www.modernmoneynetwork.org. Retrieved 27 March 2017.

- "Author Page for Scott T. Fullwiler :: SSRN". Papers.ssrn.com. Retrieved 28 July 2016.

- Mitchell, Rodger Malcolm: Free Money – Plan for Prosperity, PGM International, Inc., paperback 2005, ISBN 978-0-9658323-1-1

- "Deficit Spending 101 – Part 3" Bill Mitchell, 2 March 2009

- "In the spirit of debate...my reply" Bill Mitchell, 28 September 2009

- Moore, Basil J.: Horizontalists and Verticalists: The Macroeconomics of Credit Money, Cambridge University Press, 1988, ISBN 978-0-521-35079-2

- Mosler, Warren. "Soft Currency Economics", January 1994

- Tcherneva Pavlina R. "Chartalism and the tax-driven approach to money", in A Handbook of Alternative Monetary Economics, edited by Philip Arestis & Malcolm C. Sawyer, Elgar Publishing (2007), ISBN 978-1-84376-915-6

- CBO-An Update to the Economic Outlook: 2018 to 2028-Retrieved November 12, 2018

- Mitchell, William; Wray, L. Randall; Watts, Martin: Macroeconomics, Red Globe Press, 2019, ISBN 978-1137610669. pp.84-87

- Scott T. Fullwiler, "Modern Monetary Theory—A Primer on the Operational Realities of the Monetary System," Wartburg College; Bard College - The Levy Economics Institute (30 August 2010).

- Meulendyke, A.M. (1998) U.S. Monetary Policy and Financial Markets. New York: Federal Reserve Bank of New York.

- "Treasury and Tax and Loan Program". Federal Reserve Bank of New York. April 2007. Retrieved 16 June 2016.

- "Unconventional monetary policies: an appraisal" by Claudio Borio and Piti Disyatat, Bank for International Settlements, November 2009

- Fullwiler, Scott T. (2005) "Paying Interest on Reserve Balances: It’s More Significant Than You Think" (Working Paper No. 38), Wartburg College and the UMKC Center for Full Employment and Price Stability

- Bell, Stephanie (1999), "Functional Finance: What, Why, and How?" (Working Paper No. 287), UMKC Center for Full Employment and Price Stability

- Fullwiler, Scott T. (2007) "Interest Rates and Fiscal Sustainability", Journal of Economic Issues, 41:4, 1003-1042

- Wray, L Randall: Money and Credit in Capitalist Economies: The Endogenous Money Approach, Edward Elgar Publishing, 1990 ISBN 1-85278-356-7 pp.149,179

- Lavoie, Marc: Introduction to Post-Keynesian Economics, Palgrave MacMillan, 2006 ISBN 9780230626300 pp.60-73

- "Money multiplier and other myths" Bill Mitchell, 21 April 2009

- Kelton, Stephanie (Bell) (2001), "The Role of the State and the Hierarchy of Money" (PDF), Cambridge Journal of Economics (25): 149–163

- Mosler, Warren (2010). Seven Deadly Innocent Frauds (PDF). Valance. pp. 60–62. ISBN 978-0-692-00959-8.

- "Do current account deficits matter?" Bill Mitchell, 22 June 2010

- Foreign Exchange Transactions and Holdings of Official Reserve Assets, Reserve Bank of Australia

- "Modern monetary theory and inflation – Part 1" Bill Mitchell, 7 July 2010

- "There is no financial crisis so deep that cannot be dealt with by public spending – still!" Bill Mitchell, 11 October 2010

- Forbes-John T. Harvey-MMT: Sense or Nonsense?-5 March 2019

- "Q:Why does government issue bonds? Randall Wray: Sovereign government really can't borrow, because what it is doing is accepting back its own IOUs. If you have given your IOU to your neighbour because you borrowed some sugar, could you borrow it back? No, you can't borrow back your own IOUs". Youtube.com. Retrieved 28 July 2016.

- Yeva Nersisyan & L. Randall Wray, "Does Excessive Sovereign Debt Really Hurt Growth? A Critique of This Time Is Different, by Reinhart and Rogoff," Levy Economics Institute (June 2010), p. 15.

- L. Randal Wray, "Job Guarantee," New Economic Perspectives (23 August 2009).

- Wray, L. Randall. "WHAT ARE TAXES FOR? THE MMT APPROACH".

- "FRB Richmond-Aaron Steelman-The Federal Reserves Dual Mandate: The Evolution of an Idea"-December 2011

- Mitchell, William (3 September 2015). "There is no need to issue public debt".

- Bloomberg-Stephanie Kelton-Modern Monetary Theory Is Not a Recipe for Doom-21 February 2019

- Mosler, Warren: Seven Deadly Innocent Frauds of Economic Policy, Valance Co., 2010, ISBN 978-0-692-00959-8; also available in .DOC

- "Steven Hail's presentation on modern money and the "budget emergency"". 31 August 2014.

- Wood, Patrick (20 November 2018). "The case for offering every Australian a government-funded job". ABC News. Retrieved 14 May 2019.

University of Adelaide economics lecturer Steven Hail is an expert in MMT and regularly speaks on the topic.

- "Modern Monetary Theory". www.igmchicago.org. 2019. Retrieved 15 March 2019.

- Bryan, Bob (14 March 2019). "A new survey shows that zero top US economists agreed with the basic principles of an economic theory supported by Alexandria Ocasio-Cortez". Business Insider. Retrieved 15 March 2019.

- "The Day Orthodox Economists Lost Their Minds and Integrity". 2019. Retrieved 19 March 2019.

- "Fake surveys and Groupthink in the economics profession". 19 March 2019. Retrieved 19 March 2019.

- Thomas Palley, Money, fiscal policy, and interest rates: A critique of Modern Monetary Theory (PDF)

- Thomas Palley (February 2014). "Modern money theory (MMT): the emperor still has no clothes" (PDF).

- Paul Krugman (25 March 2011). "Deficits and the Printing Press (Somewhat Wonkish)". The New York Times. Archived from the original on 26 March 2011. Retrieved 17 July 2011.

- Robert P. Murphy (9 May 2011). "The Upside-Down World of MMT". Ludwig von Mises Institute. Retrieved 17 July 2011.

- Eladio Febrero (27 March 2008), "Three difficulties with Neo-Chartalism" (PDF), Jornadas de Economía Crítica, 11

Further reading

| Library resources about Modern Monetary Theory |

- Mitchell, Bill (February 2019), Macroeconomics, Macmillan Publishers, ISBN 9781137610676

- Innes, A. Mitchell (1913), "What is Money?", The Banking Law Journal, archived from the original on 22 October 2016, retrieved 28 January 2009

- Lerner, Abba P. (1947), "Money as a Creature of the State", American Economic Review

- Wray, L. Randall (2000), The Neo-Chartalist Approach to Money, UMKC Center for Full Employment and Price Stability

- Wray, L. Randall (2001), The Endogenous Money Approach, UMKC Center for Full Employment and Price Stability

- Febrero, Eladio (2009), "Three difficulties with neo-chartalism" (PDF), Journal of Post Keynesian Economics, 31 (3): 523–541, CiteSeerX 10.1.1.564.8770, doi:10.2753/PKE0160-3477310308

- Mitchell, Bill (2009), The fundamental principles of modern monetary economicsin "It’s Hard Being a Bear (Part Six)? Good Alternative Theory?" (PDF). Introduction to modern (as of 2009) Chartalism.

- Wray, L. Randall (December 2010), Money, Levy Economics Institute of Bard College

- Mosler, Warren (March 2014), ME/MMT: The Currency as a Public Monopoly (PDF), University of Bergamo

- Wray, L. Randall (2015). Modern Money Theory : A Primer on Macroeconomics for Sovereign Monetary Systems. Houndmills, Basingstoke, Hampshire New York, NY: Palgrave Macmillan. pp. 137–141, 199–206. ISBN 978-1-137-53990-8.

- Mitchell, Bill (February 2019), Macroeconomics, Macmillan Publishers, ISBN 9781137610676

- Kelton, Stephanie (2020), The Deficit Myth, John Murray, ISBN 978-1-529-35252-8

External links

- Modern Monetary Theory: A Debate (Brett Fiebiger critiques and Scott Fullwiler, Stephanie Kelton, L. Randall Wray respond; Political Economy Research Institute, Amherst, MA)

- Knut Wicksell and origins of modern monetary theory-Lars Pålsson Syll

- Modern Money Network