Elasticity (economics)

In economics, elasticity is the measurement of the percentage change of one economic variable in response to a change in another.

| Part of a series on |

| Economics |

|---|

|

|

|

By application |

|

Notable economists |

|

Lists |

|

Glossary |

|

An elastic variable (with an absolute elasticity value greater than 1) is one which responds more than proportionally to changes in other variables. In contrast, an inelastic variable (with an absolute elasticity value less than 1) is one which changes less than proportionally in response to changes in other variables. A variable can have different values of its elasticity at different starting points: for example, the quantity of a good supplied by producers might be elastic at low prices but inelastic at higher prices, so that a rise from an initially low price might bring on a more-than-proportionate increase in quantity supplied while a rise from an initially high price might bring on a less-than-proportionate rise in quantity supplied.

Elasticity can be quantified as the ratio of the percentage change in one variable to the percentage change in another variable, when the latter variable has a causal influence on the former. A more precise definition is given in terms of differential calculus. It is a tool for measuring the responsiveness of one variable to changes in another, causative variable. Elasticity has the advantage of being a unitless ratio, independent of the type of quantities being varied. Frequently used elasticities include price elasticity of demand, price elasticity of supply, income elasticity of demand, elasticity of substitution between factors of production and elasticity of intertemporal substitution.

Elasticity is one of the most important concepts in neoclassical economic theory. It is useful in understanding the incidence of indirect taxation, marginal concepts as they relate to the theory of the firm, and distribution of wealth and different types of goods as they relate to the theory of consumer choice. Elasticity is also crucially important in any discussion of welfare distribution, in particular consumer surplus, producer surplus, or government surplus.

In empirical work an elasticity is the estimated coefficient in a linear regression equation where both the dependent variable and the independent variable are in natural logs. Elasticity is a popular tool among empiricists because it is independent of units and thus simplifies data analysis.

A major study of the price elasticity of supply and the price elasticity of demand for US products was undertaken by Joshua Levy and Trevor Pollock in the late 1960s.[1]

Definition

High elasticity indicates high responsiveness, sensitivity, of one variable to another. The x-elasticity of y measures the fractional response of y to a fraction change in x, which can be written as

- x-elasticity of y:

In economics, the common elasticities are the price-elasticity of quantity-demanded (elasticity of demand),the price-elasticity of quantity-supplied (elasticity of supply) and the price-of-a-different-good-elasticity of quantity-demanded (cross-price elasticity). They all have the same form:

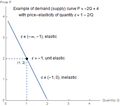

- P-elasticity of Q: if continuous, or if discrete.

| elastic | Q changes more than P | |

| unit elastic | Q changes like P | |

| inelastic | Q changes less than P |

Suppose price rises by 1%. If the elasticity of supply is 0.5, quantity rises by .5%; if it is 1, quantity rises by 1%; if it is 2, quantity rises by 2%.

Special cases:

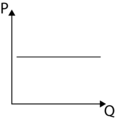

- perfectly elastic: ; quantity has an infinite response to even a small price change.

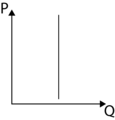

- perfectly inelastic: ; quantity does not respond at all to a price change.

Seller revenue (or, alternatively, consumer expenditure) is maximized when (unit elasticity) because at that point a change in price is exactly cancelled by the quantity response, leaving unchanged. To maximize revenue, a firm must:

- increase price if demand is inelastic:

- reduce price if demand is elastic:

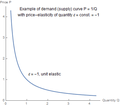

The elasticity of demand is different at different points of a demand curve, so for most demand functions, including linear demand, a firm following this advice will find some price at which and further price changes would reduce revenue. (This is not true for some theoretical demand functions: has an elasticity of -.5 for any value of , so revenue rises infinitely as price rises to infinity even though quantity approaches zero. See Isoelastic_function.)

perfect P-elasticity of Q: Q changes while P = constant

perfect P-elasticity of Q: Q changes while P = constant perfect P-inelasticity of Q: P changes while Q = constant

perfect P-inelasticity of Q: P changes while Q = constant Conventional demand curve (downwards linear slope), with its elasticity

Conventional demand curve (downwards linear slope), with its elasticity Example of demand curve with constant elasticity

Example of demand curve with constant elasticity Examples of supply curves, with different elasticity

Examples of supply curves, with different elasticity Examples of a non-linear supply curve with its elasticity

Examples of a non-linear supply curve with its elasticity

Specific elasticities

Elasticities of supply

- Price elasticity of supply

The price elasticity of supply measures how the amount of a good that a supplier wishes to supply changes in response to a change in price.[2] In a manner analogous to the price elasticity of demand, it captures the extent of horizontal movement along the supply curve relative to the extent of vertical movement. If the price elasticity of supply is zero the supply of a good supplied is "totally inelastic" and the quantity supplied is fixed.

- Elasticities of scale

Elasticity of scale or output elasticity measures the percentage change in output induced by a collective percent change in the usages of all inputs.[3] A production function or process is said to exhibit constant returns to scale if a percentage change in inputs results in an equal percentage in outputs (an elasticity equal to 1). It exhibits increasing returns to scale if a percentage change in inputs results in greater percentage change in output (an elasticity greater than 1). The definition of decreasing returns to scale is analogous.[4][5][6][7]

Elasticities of demand

- Price elasticity of demand

Price elasticity of demand is a measure used to show the responsiveness, or elasticity, of the quantity demanded of a good or service to a change in its price. More precisely, it gives the percentage change in quantity demanded in response to a one percent change in price (ceteris paribus, i.e. holding constant all the other determinants of demand, such as income).

- Cross-price elasticity of demand

Cross-price elasticity of demand is a measure of the responsiveness of the demand for one product to changes in the price of a different product. It is the ratio of percentage change in the former to the percentage change in the latter. If it is positive, the goods are called substitutes because a rise in the price of the other good causes consumers to substitute away from buying as much of the other good as before and into buying more of this good. If it is negative, the goods are called complements.

Income elasticity of demand

Income elasticity of demand is a measure used to show the responsiveness of the quantity demanded of a good or service to a change in the consumer income. It is measured as the ratio of the percentage change in quantity demanded to the percentage change in income. If a 10% increase in Mr. Smith's income causes him to buy 20% more bacon, Smith's income elasticity of demand for bacon is 20%/10% = 2.

Applications

The concept of elasticity has an extraordinarily wide range of applications in economics. In particular, an understanding of elasticity is fundamental in understanding the response of supply and demand in a market.

Some common uses of elasticity include:

- Effect of changing price on firm revenue. See Markup rule.

- Analysis of incidence of the tax burden and other government policies. See Tax incidence.

- Income elasticity of demand, used as an indicator of industry health, future consumption patterns and as a guide to firms' investment decisions. See Income elasticity of demand.

- Effect of international trade and terms of trade effects. See Marshall–Lerner condition and Singer–Prebisch thesis.

- Analysis of consumption and saving behavior. See Permanent income hypothesis.

- Analysis of advertising on consumer demand for particular goods. See Advertising elasticity of demand

Variants

In some cases the discrete (non-infinitesimal) arc elasticity is used instead. In other cases, such as modified duration in bond trading, a percentage change in output is divided by a unit (not percentage) change in input, yielding a semi-elasticity instead.

See also

References

- Taylor, Lester D.; Houthakker, H.S. (2010). Consumer demand in the United States : prices, income, and consumption behavior (Originally published by Harvard University Press, 2005)

|format=requires|url=(help) (3rd ed.). Springer. ISBN 978-1-4419-0510-9. - Perloff, J. (2008). p.36.

- Varian (1992). pp.16–17.

- Samuelson, W. & Marks, S. (2003). p.233.

- Hanoch, G. (1975). "The Elasticity of Scale and the Shape of Average Costs". American Economic Review. 65 (3): 492–497. JSTOR 1804855.

- Panzar, J. C.; Willig, R. D. (1977). "Economies of Scale in Multi-Output Production". Quarterly Journal of Economics. 91 (3): 481–493. JSTOR 1885979.

- Zelenyuk, V. (2013). "A scale elasticity measure for directional distance function and its dual: Theory and DEA estimation". European Journal of Operational Research. 228 (3): 592–600. doi:10.1016/j.ejor.2013.01.012.

Further reading

- Lovell, Michael C. (2004). Economics with Calculus. Hackensack: World Scientific. pp. 75–85. ISBN 981-238-857-5.

- Varian, Hal (1994). "Market Demand". Intermediate Microeconomics : A Modern Approach. New York: W.W. Norton. pp. 261–280. ISBN 0-393-96320-9.

External links

- Economics Basics: Elasticity from Investopedia.com. Accessed February 29, 2008.

- Revenue and Elasticity and Elasticity, Total Revenue, and the Linear Demand Curve by Fiona Maclachlan, Wolfram Demonstrations Project.