Cobb–Douglas production function

In economics and econometrics, the Cobb–Douglas production function is a particular functional form of the production function, widely used to represent the technological relationship between the amounts of two or more inputs (particularly physical capital and labor) and the amount of output that can be produced by those inputs. The Cobb–Douglas form was developed and tested against statistical evidence by Charles Cobb and Paul Douglas during 1927–1947.[1]

Formulation

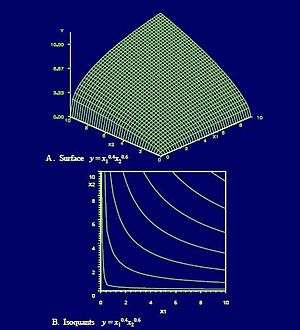

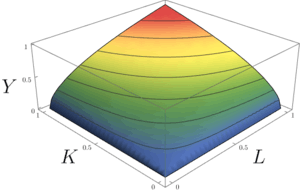

In its most standard form for production of a single good with two factors, the function is

where:

- Y = total production (the real value of all goods produced in a year or 365.25 days)

- L = labor input (the total number of person-hours worked in a year or 365.25 days)

- K = capital input (a measure of all machinery, equipment, and buildings; the value of capital input divided by the price of capital)

- A = total factor productivity

- α and β are the output elasticities of capital and labor, respectively. These values are constants determined by available technology.

Output elasticity measures the responsiveness of output to a change in levels of either labor or capital used in production, ceteris paribus. For example, if α = 0.45, a 1% increase in capital usage would lead to approximately a 0.45% increase in output.

Sometimes the term has a more restricted meaning, requiring that the function display constant returns to scale, meaning that doubling the usage of capital K and labor L will also double output Y. This holds if

- α + β = 1,

If

- α + β < 1,

returns to scale are decreasing, and if

- α + β > 1,

returns to scale are increasing. Assuming perfect competition and α + β = 1, α and β can be shown to be capital's and labor's shares of output.

In its generalized form, the Cobb–Douglas function models more than two goods. The Cobb–Douglas function may be written as:[2]

where:

- A is an efficiency parameter

- L is the total number of goods

- x1, ..., xL are the (non-negative) quantities of good consumed, produced, etc.

- is an elasticity parameter for good i

History

Paul Douglas explained that his first formulation of the Cobb–Douglas production function was developed in 1927; when seeking a functional form to relate estimates he had calculated for workers and capital, he spoke with mathematician and colleague Charles Cobb, who suggested a function of the form Y = ALβK1−β, previously used by Knut Wicksell, Philip Wicksteed, and Léon Walras, although Douglas only acknowledges Wicksteed and Walras for their contributions.[3]. Estimating this using least squares, he obtained a result for the exponent of labour of 0.75—which was subsequently confirmed by the National Bureau of Economic Research to be 0.741. Later work in the 1940s prompted them to allow for the exponents on K and L to vary, resulting in estimates that subsequently proved to be very close to improved measure of productivity developed at that time.[4]

A major criticism at the time was that estimates of the production function, although seemingly accurate, were based on such sparse data that it was hard to give them much credibility. Douglas remarked "I must admit I was discouraged by this criticism and thought of giving up the effort, but there was something which told me I should hold on."[4] The breakthrough came in using US census data, which was cross-sectional and provided a large number of observations. Douglas presented the results of these findings, along with those for other countries, at his 1947 address as president of the American Economic Association. Shortly afterwards, Douglas went into politics and was stricken by ill health—resulting in little further development on his side. However, two decades later, his production function was widely used, being adopted by economists such as Paul Samuelson and Robert Solow.[4] The Cobb–Douglas production function is especially notable for being the first time an aggregate or economy-wide production function had been developed, estimated, and then presented to the profession for analysis; it marked a landmark change in how economists approached macroeconomics from a microeconomics perspective.[5]

Criticisms

The function has been criticised for its lack of foundation. Cobb and Douglas were influenced by statistical evidence that appeared to show that labor and capital shares of total output were constant over time in developed countries; they explained this by statistical fitting least-squares regression of their production function. There is now doubt over whether constancy over time exists.

The Cobb–Douglas production function was not developed on the basis of any knowledge of engineering, technology, or management of the production process. This rationale may be true given the definition of the Capital term. Labor hours and Capital need a better definition. If capital is defined as a building, labor is already included in the development of that building. A building is composed of commodities, labor and risks and general conditions.

It was instead developed because it had attractive mathematical characteristics, such as diminishing marginal returns to either factor of production and the property that the optimal expenditure shares on any given input of a firm operating a Cobb–Douglas technology are constant. Initially, there were no utility foundations for it. In the modern era, some economists try to build models up from individual agents acting, rather than imposing a functional form on an entire economy. The Cobb–Douglas production function, if properly defined, can be applied at a micro-economic level, up to a macro- economic level.

However, many modern authors have developed models which give microeconomically based Cobb–Douglas production functions, including many New Keynesian models.[6] It is nevertheless a mathematical mistake to assume that just because the Cobb–Douglas function applies at the microeconomic level, it also always applies at the macroeconomic level. Similarly, it is not necessarily the case that a macro Cobb–Douglas applies at the disaggregated level. An early microfoundation of the aggregate Cobb–Douglas technology based on linear activities is derived in Houthakker (1955).[7]

A 2019 quantitative survey of 3186 estimates of the shape of the production function reported in 121 studies published in peer-reviewed journals finds that the empirical literature as a whole rejects the Cobb–Douglas specification and that the elasticity of substitution between capital and labor is on average close to 0.3 instead of 1, which would be necessary for the Cobb–Douglas production function.[8]

Cobb–Douglas utilities

The Cobb–Douglas function is often used as a utility function.[9][2] In this context the consumer is assumed to have finite wealth, and utility maximization takes the form:

where is the total wealth of the consumer and are the prices of the goods. The utility may be maximized as follows. First, take the logarithm of the utility

Let λ = λ1 + ... + λL. Since the function is strictly monotone for x > 0, it follows that represents the same preferences. Setting it can be shown that

The optimal solution is then:

An interpretation of this solution is that the consumer uses a fraction of his wealth in purchasing good j.

The indirect utility function can be calculated by substituting the demand into the utility function. Ignoring a certain multiplicative constant which depends only on the s, we get:

which is a special case of the Gorman polar form. The expenditure function is the inverse of the indirect utility function:[10]:112

Various representations of the production function

The Cobb–Douglas function form can be estimated as a linear relationship using the following expression:

where

The model can also be written as

As noted, the common Cobb–Douglas function used in macroeconomic modeling is

where K is capital and L is labor. When the model exponents sum to one, the production function is first-order homogeneous, which implies constant returns to scale—that is, if all inputs are scaled by a common factor greater than zero, output will be scaled by the same factor.

Relationship to the CES production function

The constant elasticity of substitution (CES) production function (in the two-factor case) is

in which the limiting case γ = 0 corresponds to a Cobb–Douglas function, with constant returns to scale.[11]

To see this, the log of the CES function,

can be taken to the limit by applying l'Hôpital's rule:

Therefore, .

Translog production function

The translog production function is an approximation of the CES function by a second-order Taylor polynomial about , i.e. the Cobb–Douglas case.[12][13] The name translog stands for 'transcendental logarithmic'. It is often used in econometrics for the fact that it is linear in the parameters, which means ordinary least squares could be used if inputs could be assumed exogenous.

In the two-factor case above the translog production function is

where , , , , and are defined appropriately. In the three factor case, the translog production function is:

where = total factor productivity, = labor, = capital, = materials and supplies, and = output.

See also

- Leontief production function

- Production–possibility frontier

- Production theory

References

- Cobb, C. W.; Douglas, P. H. (1928). "A Theory of Production" (PDF). American Economic Review. 18 (Supplement): 139–165. JSTOR 1811556. Retrieved 26 September 2016.CS1 maint: ref=harv (link)

- Brown, Murray (2016-05-18). The New Palgrave Dictionary of Economics. Springer. ISBN 9781349588022.

- Brown, Murray (2017). "Cobb–Douglas Functions". The New Palgrave Dictionary of Economics. Palgrave Macmillan UK. pp. 1–4. doi:10.1057/978-1-349-95121-5_480-2. ISBN 978-1-349-95121-5.

- Douglas, Paul H. (October 1976). "The Cobb-Douglas Production Function Once Again: Its History, Its Testing, and Some New Empirical Values". Journal of Political Economy. 84 (5): 903–916. doi:10.1086/260489.

- Filipe, Jesus; Adams, F. Gerard (2005). "The Estimation of the Cobb-Douglas Function: A Retrospective View". Eastern Economic Journal. 31 (3): 427–445. JSTOR 40326423.

- Walsh, Carl (2003). Monetary Theory and Policy (2nd ed.). Cambridge: MIT Press.

- Houthakker, H.S. (1955), "The Pareto Distribution and the Cobb–Douglas Production Function in Activity Analysis", The Review of Economic Studies, 23 (1): 27–31, doi:10.2307/2296148, JSTOR 2296148

- Gechet, S.; Havranek, T.; Irsova, Z.; Kolcunova, D. (2019). "Death to the Cobb-Douglas Production Function? A Quantitative Survey of the Capital-Labor Substitution Elasticity". EconStor Preprints. Retrieved 17 September 2019.CS1 maint: ref=harv (link)

- Brenes, Adrián (2011). Cobb-Douglas Utility Function.

- Varian, Hal (1992). Microeconomic Analysis (Third ed.). New York: Norton. ISBN 0-393-95735-7.

- Silberberg, Eugene; Suen, Wing (2001). "Elasticity of Substitution". The Structure of Economics: A Mathematical Analysis (Third ed.). Boston: Irwin McGraw-Hill. pp. 238–250 [pp. 246–7]. ISBN 0-07-234352-4.

- Berndt, Ernst R.; Christensen, Laurits R. (1973). "The Translog Function and the Substitution of Equipment, Structures, and Labor in U.S. manufacturing 1929–68". Journal of Econometrics. 1 (1): 81–113. doi:10.1016/0304-4076(73)90007-9.

- Wynn, R. F.; Holden, K. (1974). An Introduction to Applied Econometric Analysis. New York: Halsted Press. pp. 62–65. ISBN 0-333-16711-2.

Further reading

- Renshaw, Geoff (2005). Maths for Economics. New York: Oxford University Press. pp. 516–526. ISBN 0-19-926746-4.

External links

| Wikimedia Commons has media related to Cobb–Douglas production functions. |