Johnson & Johnson

Johnson & Johnson is an American multinational corporation founded in 1886 that develops medical devices, pharmaceutical, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average and the company is ranked No. 37 on the 2018 Fortune 500 list of the largest United States corporations by total revenue. J&J is one of the world's most valuable companies.

J&J headquarters at One Johnson & Johnson Plaza in New Brunswick, New Jersey | |

| Public | |

| Traded as | NYSE: JNJ DJIA Component S&P 100 Component S&P 500 Component |

| ISIN | US4781601046 |

| Industry | Pharmaceutical Medical devices Consumer healthcare |

| Founded | January 1886 New Brunswick, New Jersey, United States |

| Founders | Robert Wood Johnson I James Wood Johnson Edward Mead Johnson |

| Headquarters | One Johnson & Johnson Plaza, , |

Area served | Worldwide |

Key people | Alex Gorsky (Chairman and CEO)[1] Paul Stoffels(Vice Chairman of the Executive Committee and Chief Scientific Officer)[2] Joaquin Duato(Vice Chairman of the Executive Committee)[3] |

| Products | See list of Johnson & Johnson products |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | |

| Subsidiaries | Janssen Pharmaceutica Janssen Biotech Crucell Cilag Tibotec Actelion MorphoSys Ethicon Inc. DePuy Synthes Synthes Acclarent Mentor Johnson & Johnson Vision McNeil Consumer Healthcare |

| Website | www |

Johnson & Johnson is headquartered in New Brunswick, New Jersey, the consumer division being located in Skillman, New Jersey. The corporation includes some 250 subsidiary companies with operations in 60 countries and products sold in over 175 countries. Johnson & Johnson had worldwide sales of $70.1 billion during calendar year 2015.[6] Johnson & Johnson's brands include numerous household names of medications and first aid supplies. Among its well-known consumer products are the Band-Aid Brand line of bandages, Tylenol medications, Johnson's Baby products, Neutrogena skin and beauty products, Clean & Clear facial wash and Acuvue contact lenses.

History

Johnson & Johnson operates over 250 companies in what is termed "the Johnson & Johnson family of companies".[7] The company operates in three broad divisions; Consumer Healthcare, Medical Devices and Pharmaceuticals.

| Johnson & Johnson Family of Companies | ||

|---|---|---|

| Consumer Healthcare[8] | Medical Devices[9] | Pharmaceuticals[10] |

| Baby Care Skin & Hair Care Wound Care and Topicals Oral Health Care Women's Health McNeil Consumer Healthcare Over-The-Counter Medicines Nutritionals | Biosense Webster Cerenovus DePuy Synthes Ethicon, Inc. Janssen Diagnostics BVBA Johnson & Johnson Vision Care, Inc. Mentor | Janssen Janssen R&D LLC Janssen Healthcare Innovation Janssen Pharmaceuticals Inc Janssen Diagnostics Janssen Therapeutics Janssen Scientific Affairs McNeil-PPC, Inc |

Foundation and early history

Inspired by antiseptic advocate Joseph Lister, Robert Wood Johnson joined his brothers, James Wood Johnson and Edward Mead Johnson, to create a line of ready-to-use surgical dressings in 1885. The company produced its earliest products in 1886. Those products initially featured a logo that resembled the signature of James Wood Johnson, very similar to the logo used today.[11]

Robert Wood Johnson served as the first president of the company. Upon his death in 1910, he was succeeded in the presidency by his brother James Wood Johnson until 1932, and then by his son, Robert Wood Johnson II.

Robert Wood Johnson's granddaughter, Mary Lea Johnson Richards, was the first baby to appear on a Johnson & Johnson baby powder label.[12][13]

1943–44: Credo and Going Public

In 1943, as the company was preparing for its initial public offering (IPO), Robert Wood Johnson wrote what would become called by the company "Our Credo," a defining document that has been used to guide the company's decisions over the years.[14] The company completed its IPO and became a public company in 1944.[15]

1959: McNeil Consumer Healthcare

McNeil Consumer Healthcare was founded on March 16, 1879, by Robert McNeil. In 1904, one of McNeil's sons, Robert Lincoln McNeil, became part of the company, and together they created McNeil Laboratories in 1933. The company focused on the direct marketing of prescription drugs to hospitals, pharmacists, and doctors. The development of acetaminophen began under the leadership of Robert L. McNeil, Jr., who later served as the firm's chairman. In 1959, Johnson & Johnson acquired McNeil Laboratories and a year later, the company was able to sell Tylenol for the first time without a prescription.[16]

In 1977, two subsidiary companies were created: McNeil Medicals Products and McNeil Consumer Products Company (also known as McNeil Consumer Healthcare). In 1993, McNeil Medicals Products merged with Ortho Pharmaceutical to form Ortho-McNeil Pharmaceutical. In 2001, McNeil Consumer Healthcare changed its name to McNeil Consumer & Specialty Medicals Products. The name was later changed to "McNeil Consumer Healthcare".[17]

1959: Cilag

In 1933, Swiss chemist Bernhard Joos, set up a small research laboratory in Schaffhausen, Switzerland. This led to the founding of Chemische Industrie-Labor AG (Chemical Industry Laboratory AG or Cilag) on 12 May 1936. In 1959, Cilag joined Johnson & Johnson. In the early 1990s, the marketing departments of Cilag and Janssen Pharmaceutica joined to form Janssen-Cilag. The non-marketing departments still operate under their original name.

1961: Janssen Pharmaceuticals

In 1933, Constant Janssen, the father of Paul Janssen, acquired the right to distribute the pharmaceutical products of Richter, a Hungarian pharmaceutical company, for Belgium, the Netherlands and Belgian Congo.[18] On 23 October 1934, he founded the N.V. Produkten Richter in Turnhout. After the Second World War, the name was changed to Eupharma, although the original company name Richter would remain until 1956.[19]

In 1956, Paul Janssen founded his own research laboratory within the Richter-Eurpharma company of his father. On 5 April 1956, the name of the company was changed to NV Laboratoria Pharmaceutica C. Janssen (named after Constant Janssen). On 2 May 1958, the research department in Beerse became a separate legal entity known as the N.V. Research Laboratorium C. Janssen. On 24 October 1961, the company was acquired by the American corporation Johnson & Johnson.[20][18]

On 10 February 1964, the name was changed to Janssen Pharmaceutica N.V.[19] In 1999, clinical research and non-clinical development became a global organization within Johnson & Johnson. In 2001, a portion of their research activities were transferred to the United States and reorganized under the Johnson & Johnson Pharmaceutical Research and Development organization. The research activities of the Janssen Research Foundation and the R.W. Johnson Pharmaceutical Research Institute were merged into the new global research organization. On 27 October 2004, the Paul Janssen Research Center was founded.

In August 2013, the company acquired Aragon Pharmaceuticals, Inc.[21] In November 2014, the company acquired Alios BioPharma, Inc. for $1.75 billion. As a result of the purchase, Alios was incorporated into the infectious diseases therapeutic area of Janssen Pharmaceuticals.[22]

1998: DePuy

DePuy was acquired by J&J in 1998, rolling it into the Johnson & Johnson Medical Devices group.

In September 2010, Johnson & Johnson announced it had completed the acquisition of Micrus Endovascular, manufacturer of minimally invasive devices for hemorrhagic and ischemic strokes. Micrus will operate under Codman Neurovascular, a business unit of Codman & Shurtleff, Inc.[23]

On June 14, 2012, Johnson and Johnson completed the acquisition of Synthes for $19.7 billion,[24] which was then integrated with the DePuy franchise to establish the DePuy Synthes Companies of Johnson & Johnson which includes: Codman & Shurteff, Inc., DePuy Mitek, Inc., DePuy Orthopaedics, Inc., and DePuy Spine, Inc. In February 2015, DePuy announced it would acquire Olive Medical Corporation.[25] In May 2016, DePuy Orthopaedics, Inc. acquired Biomedical Enterprises, Inc., an industry leader in small bone fixation.[26] Later in December of the same year, DePuy Synthes announced it would acquire Pulsar Vascular Inc., adding Pulsar to its Codman division.[27]

In January 2017, the company acquired Interventional Spine, Inc.[28] In April 2017, Irish subsidiary DePuy Ireland Unlimited Company announced it would acquire Neuravi, a company with a portfolio of products for hemorrhagic and ischemic strokes for an undisclosed sum, with Codman Neuro being behind the deal.[29][30] In June, DePuy Synthes Products, Inc. announced it would acquire Innovative Surgical Solutions, LLC (trading as Sentio, LLC) for an undisclosed sum, bolstering the company's technology for innovative nerve localisation in spinal surgery.[31]

1999: Janssen Biotech, Inc.

Janssen Biotech, Inc., formerly known as Centocor Biotech, Inc., is a biotechnology company that was founded in Philadelphia in 1979. In 1982, Centocor transitioned into a publicly traded company. In 1999, Centocor became a wholly owned subsidiary of Johnson & Johnson. Since the acquisition, Janssen Biotech increased its annual sales from $500 million to more than $2 billion. During the same period, research and development investment increased from $75 million to more than $300 million.

In 2008, Centocor, Inc. and Ortho Biotech Inc. merged to form Centocor Ortho Biotech Inc. In June 2009 Johnson & Johnson, through a new wholly owned subsidiary, Kite Merger Sub, Inc., announced it would purchase all outstanding shares of common stock of Cougar Biotechnology, Inc. for $43.00 in cash or around $970 million.[32][33] In the same year, Johnson & Johnson Nordic AB acquired Amic, developer of in vitro diagnostic, further strengthening the Ortho-Clinical Diagnostics division.[34]

In June 2010, Centocor Ortho Biotech acquired RespiVert, a privately held drug discovery company focused on developing small-molecule, inhaled therapies for the treatment of pulmonary diseases.[35] In June 2011, Centocor Ortho Biotech changed its name to Janssen Biotech, Inc.[36] as part of a global effort to unite the Janssen Pharmaceutical Companies around the world under a common identity. In December 2014, the company announced it would co-develop MacroGenics cancer drug candidate (MGD011) which targets both CD19 and CD3 proteins in treating B-cell malignant tumours. This could net MacroGenics up to $700 million.[37] In January 2015, the company announced it will utilise Isis Pharmaceuticals' RNA-targeting technology to discover and develop antisense drugs targeting autoimmune disorders of the gastrointestinal tract, with the partnership potentially generating up to $835 million for Isis.[38] In May 2018, Janssen announced it would acquire BeneVir Biopharm, Inc. for an undisclosed sum.[39]

In December 2019 XBiotech Inc. announced it would sell its novel antibody treatment (bermekimab) that neutralizes interleukin-1 alpha (IL-1⍺) to Janssen Biotech, Inc. for $750 million plus up to a further $600 million.[40][41]

Ethicon, Inc.

In 1915, George F. Merson opened a facility in Edinburgh for the manufacturing, packaging, and sterilizing of catgut, silk, and nylon sutures. Johnson & Johnson acquired Mr. Merson's company in 1947, and this was renamed Ethicon Suture Laboratories.[42] In 1953 this became Ethicon Inc.[43] In 1992, Ethicon was restructured, and Ethicon Endo-Surgery, Inc. became a separate corporation. During the 1990s, Ethicon diversified into new and advanced products and technologies and formed four different companies under the Ethicon umbrella, each of which specializes in different products.

In 2008, J&J announced it would acquire Mentor Corporation for $1 billion and merge its operations into Ethicon.[44] In the same year, Ethicon acquired Omrix Biopharmaceuticals, Inc. for $25 per share,[45] or $438 million in total.[46] In May 2012, Johnson & Johnson (China) Investment Ltd announced it would acquire surgery blood clotting developer, Guangzhou Bioseal Biotechnology Co., Ltd.[47] In March 2016, J&Js Ethicon business unit announced it would acquire NeuWave Medical, Inc.[48] In January 2017, J&J subsidiary Ethicon announced it would acquire Megadyne Medical Products, Inc., a medical device company that develops, manufactures and markets electrosurgical tools.[49] In February 2017, Ethicon acquired medical device manufacturer, Torax Medical for an undisclosed sum.[50] In June 2018, the business announced that Advanced Sterilization Products would be sold off to Fortive Corporation for around $2.8 billion.[51]

In February 2019, Johnson & Johnson announced that Ethicon had agreed to acquire surgical robotic company, Auris Health Inc, for $3.4 billion in cash[52] and over $2.3 billion in contingent payments based on performance.[53][54] In December of the same year, the company announced it would acquire the portion of Verb Surgical Inc, that it did not already own, from Verily, Alphabet's life sciences division.[55]

Ethicon Endo-Surgery, Inc.

Ethicon Endo-Surgery was part of Ethicon Inc. until 1992, when it became a separate corporate entity under the J&J umbrella. In 2008 Ethicon Endo-Surgery acquired tissue sealing system developer, SurgRx, Inc.[56] In September 2011 the business acquired SterilMed, Inc.[57]

2010 onwards

In October 2010, J&J acquired Crucell for $2.4 billion[58] and will operate as the centre for vaccines, within the wider Johnson & Johnson pharmaceuticals group.[59]

In November 2015, Biosense Webster, Inc. acquired Coherex, Medical Inc. expanding the companies range of treatment options for patients with atrial fibrillation.[60]

In July 2016, J&J announced its intention to acquire the privately held company, Vogue International LLC, boosting Johnson & Johnson Consumer Inc.[61] In September of the same year, J&J announced it would acquire Abbott Medical Optics from Abbott Laboratories for $4.325 billion, adding the new division into Johnson & Johnson Vision Care, Inc.[62]

In January 2017, J&J fought off competition from Sanofi to acquire Swiss drugmaker Actelion. Later in the month J&J announced a $30 billion deal, the largest ever pursued by the company,[63] to purchase the Swiss company Actelion and to spin off its research and development unit, into a separate legal entity.[64][65] In March, the company declared its tender offer for Swiss biotechnology company Actelion successful on Friday, reporting that Janssen Holding GmbH controlled 77.2 percent of the voting rights after the main offer period,[66] equating to 83,195,346 Actelion shares. In keeping with earlier agreements, the company announced its intention to delist Actelion, whilst spinning out its drug discovery operations and early-stage clinical development assets into a newly created Swiss-based biopharmaceutical company, Idorsia Ltd.[67] J&J will control 16% of Idorsia, with the ability to raise their stake to 32% through convertible notes.[68]

In July 2017, Johnson & Johnson Vision Care, Inc announced that its Abbott Medical Optics subsidiary would acquire TearScience, who recently received FDA approval for an office-based approach to imaging meibomian glands and treating meibomian gland dysfunction.[69] In September, the company acquired subscription-based contact lens startup Sightbox.[70]

In March 2018, the company announced that LifeScan, Inc. would be sold off to Platinum Equity for around $2.1 billion.[71] In September of the same year Johnson & Johnson Medical GmbH acquired Emerging Implant Technologies GmbH, manufacturer of 3D-printed titanium interbody implants for spinal fusion surgery.[72]

In 2019, Johnson & Johnson announced the release of photochromic contact lenses. The lenses adjust to sunlight and help eyes recover from bright light exposure faster. The lenses contain a photochromic additive that adapts visible light amounts filtered to the eyes and are the first to use such additives.[73]

Coronavirus (COVID-19) response

Johnson & Johnson committed over $1 billion toward the development of a not-for-profit COVID-19 vaccine in partnership with the Biomedical Advanced Research and Development Authority (BARDA) Office of the Assistant Secretary for Preparedness and Response (ASPR) at the U.S. Department of Health and Human Services (HHS).[74][75] In a Sky News interview, Dr. Paul Stoffels, M.D., Johnson & Johnson Chief Scientific Officer and Vice Chairman of the Executive Committee said, “In order to go fast, Johnson & Johnson - the people of Johnson & Johnson - are committed to do this and all together we say we're going to do this not for profit. That's the fastest and the best way to find all the collaborations in the world to make this happen so we commit to bring this at a not-for-profit level."[76]

Janssen Pharmaceuticals, in partnership with Beth Israel Deaconess Medical Center (BIDMC), is responsible for developing the vaccine candidate, based on the same technology used to make its Ebola vaccine. The vaccine candidate is expected to enter phase 1 human clinical study in September 2020.[74][77][78]

Demand for the product Tylenol surged two to four times normal levels in March 2020. In response, the company increased production globally. For example, the Tylenol plant in Puerto Rico ran 24 hours a day, seven days a week.[79]

In response to the shortage of ventilators, Ethicon, with Prisma Health, made and distributed the VESper Ventilator Expansion Splitter. Using 3D printing technology, the product is used to expand the capacity of one ventilator to support two patients.[80]

In June 2020, Johnson & Johnson and the National Institute of Allergy and Infectious Diseases (NIAID) confirmed its intention to start a clinical trials of J&J's vaccine in September 2020, with the possibility of Phase 1/2a human clinical trials starting at an accelerated pace in the second half of July.[81][82][83]

In July 2020, Johnson & Johnson pledged to deliver up to 300 million doses of its vaccine to the U.S., with 100 million upfront and an option for 200 million more. The deal, worth more than $1 billion, will be funded by the Biomedical Advanced Research and Development Authority (BARDA) and the U.S. Defense Department.[84][85]

On 5 August 2020, the US government agreed to pay more than $1 billion to Johnson and Johnson (medical device company) for the production of 100 million doses of COVID-19 vaccine. As part of the agreed-upon deal, the U.S. can order up to 200 million additional doses of SARS-CoV-2 vaccine.[86]

Structure

- Johnson & Johnson

- Johnson & Johnson Consumer Inc. (Consumer Healthcare Division)

- Baby Care

- Skin & Hair Care

- Dabao Cosmetics Co.

- Johnson & Johnson Consumer France SAS

- Groupe Vendome SA

- Wound Care and Topicals

- Oral Health Care

- Women's Health

- Over-The-Counter Medicines

- Pfizer Consumer Healthcare (Acq 2006)

- Wellness & Prevention

- LGE Performance Systems, Inc.

- HealthMedia, Inc.

- Nutritionals

- Vogue International LLC

- TriStrata Inc.

- NeoStrata Company, Inc.

- Zarbee's, Inc.

- Medical Devices Division

- Biosense Webster

- Coherex Medical, Inc.

- DePuy Synthes

- Codman & Shurteff, Inc.

- Micrus Endovascular

- Pulsar Vascular Inc.

- Neuravi

- DePuy Mitek, Inc.

- DePuy Orthopaedics, Inc.

- Biomedical Enterprises, Inc.

- DePuy Spine, Inc

- Interventional Spine, Inc.

- DePuy Synthes Products, Inc

- Sentio, LLC

- Olive Medical Corporation

- Advanced Sterilization Products (Divested 2018)

- Apsis SAS

- Gloster Europe

- Orthotaxy

- Apsis SAS

- Johnson & Johnson Medical GmbH

- Surgical Process Institute

- Emerging Implant Technologies GmbH

- Codman & Shurteff, Inc.

- Ethicon, Inc.

- Maple Merger Sub, Inc.

- Mentor

- Binder Merger Sub, Inc.

- Omrix Biopharmaceuticals, Inc.

- Acclarent

- NeuWave Medical, Inc

- Torax Medical

- Johnson & Johnson (China) Investment Ltd

- Guangzhou Bioseal Biotechnology Co., Ltd.

- Ethicon Endo-Surgery

- SurgRx, Inc.

- SterilMed, Inc.

- Megadyne Medical Products, Inc.

- Auris Health Inc

- Verb Surgical Inc

- Maple Merger Sub, Inc.

- Biosense Webster

- Janssen Diagnostics BVBA

- Johnson & Johnson Vision Care, Inc.

- Vistakon

- Abbott Medical Optics

- Sightbox

- Pharmaceuticals Division

- Janssen Pharmaceutica

- Cilag

- J B Chemicals & Pharmaceuticals Limited (OTC Division)

- Covagen

- Janssen-Cilag

- CorImmun GmbH

- Aragon Pharmaceuticals, Inc.

- Alios BioPharma, Inc.

- Novira Therapeutics, Inc.

- Actelion

- Cilag

- Janssen R&D LLC

- Janssen Healthcare Innovation

- Janssen Biotech, Inc.

- Ortho Biotech Inc.

- Ortho-Clinical Diagnostics, Inc.

- Johnson & Johnson Nordic AB

- Amic AB

- Johnson & Johnson Nordic AB

- Ortho-Clinical Diagnostics, Inc.

- Kite Merger Sub, Inc.

- Cougar Biotechnology, Inc.

- RespiVert

- BeneVir Biopharm, Inc.

- Ortho Biotech Inc.

- Janssen Therapeutics

- Janssen Diagnostics

- Janssen Scientific Affairs

- JJC Acquisition Company B.V.

- Ortho-McNeil-Janssen Pharmaceutical Services, Inc.

- Janssen-Ortho

- Ortho-McNeil

- McNeil Consumer Healthcare

- Janssen Pharmaceutica

- Johnson & Johnson Consumer Inc. (Consumer Healthcare Division)

Finance

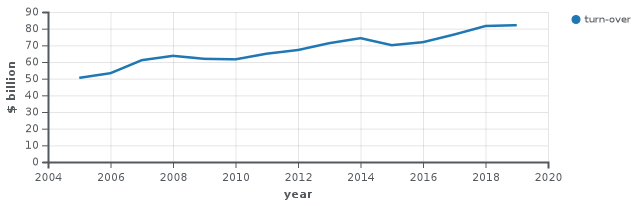

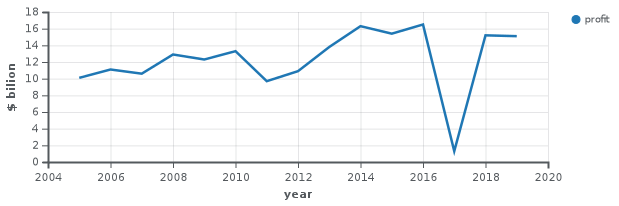

For the fiscal year 2018, Johnson & Johnson reported earnings of US$15.3 billion, with an annual revenue of US$81.6 billion, an increase of 6.7% over the previous fiscal cycle. Johnson & Johnson's shares traded at over $126 per share, and its market capitalization was valued at over US$367.5 billion in September 2018.[87]

| Year | Revenue in mil. US$ |

Net income in mil. US$ |

Employees[88] |

|---|---|---|---|

| 2005 | 50,514 | 10,060 | 115,600 |

| 2006 | 53,324 | 11,053 | 122,200 |

| 2007 | 61,095 | 10,576 | 119,200 |

| 2008 | 63,747 | 12,949 | 118,700 |

| 2009 | 61,897 | 12,266 | 115,500 |

| 2010 | 61,587 | 13,334 | 114,000 |

| 2011 | 65,030 | 9,672 | 117,900 |

| 2012 | 67,224 | 10,853 | 127,600 |

| 2013 | 71,312 | 13,831 | 128,100 |

| 2014 | 74,331 | 16,323 | 126,500 |

| 2015 | 70,074 | 15,409 | 127,100 |

| 2016 | 71,890 | 16,540 | 126,400 |

| 2017 | 76,450 | 1,300 | 155,000 |

| 2018 | 81,581 | 15,297 | 134,000 |

| 2019 | 82,059 | 15,119 | 132,200 |

Corporate governance

The current members of the board of directors of Johnson & Johnson for 2020 are: Alex Gorsky, Mary C. Beckerle, D. Scott Davis, Ian E. L. Davis, Jennifer A. Doudna, Mark B. McClellan, Anne M. Mulcahy, William D. Perez, Charles Prince, A. Eugene Washington, Marillyn A. Hewson, Hubert Joly, and Ronald A. Williams.[89] and Mark Weinberger.[90]

The current members of the Executive Committee of Johnson & Johnson are: Joseph Wolk (the company's chief financial officer),[63] Peter Fasolo, Ashley McEvoy, Thibaut Mongon, Paul Stoffels, and Michael Sneed, Jennifer Taubert, Michael Ullmann, and Kathy Wengel.[91]

On July 2, 2018, Johnson & Johnson's head of pharmaceuticals, Joaquin Duato, became the vice-chairman of the executive committee.[92]

Chairmen

- Robert Wood Johnson I (1887–1910)

- James Wood Johnson (1910–1932)

- Robert Wood Johnson II (1932–1963)

- Philip B. Hofmann (1963–1973)

- Richard B. Sellars (1973–1976)

- James E. Burke (1976–1989)

- Ralph S. Larsen (1989–2002)

- William C. Weldon (2002–2012)

- Alex Gorsky (2012–present)

Headquarters and the New Brunswick gentrification

The company has historically been located on the Delaware and Raritan Canal in New Brunswick. The company considered moving its headquarters out of New Brunswick in the 1960s but decided to stay in the town after city officials promised to revitalize downtown New Brunswick by demolishing old buildings and constructing new ones. While New Brunswick lost many historic structures, including the early home of Rutgers University, and most of its historic commercial waterfront to the redevelopment effort, the gentrification did attract people back to New Brunswick. Johnson & Johnson hired Henry N. Cobb from Pei Cobb Freed & Partners to design its new headquarters. Johnson and Johnson Plaza, in a park across the railroad tracks from the older portion of the headquarters, is one of tallest buildings in New Brunswick.

The stretch of Delaware and Raritan canal by the company's headquarters was replaced by a stretch of Route 18 in the late 1970s,[93] after a lengthy dispute.[94] In 2002, the company released its plan of setting up Asia-Pacific information technology headquarters in New South Wales within five years.[95]

Products

The company's business is divided into three major segments, Pharmaceuticals, Medical Devices, and Consumer Products. In 2015, these segments contributed 44.9%, 35.9%, and 19.2%, respectively, of the company's total revenues.[96]

Pharmaceuticals

The company's major franchises in the Pharmaceutical segment include Immunology, Neuroscience, Infectious Disease, and Oncology.

Immunology products include the anti-tumor necrosis factor antibodies Remicade (infliximab), and Simponi (golimumab) used for the treatment[97] of autoimmune diseases, including rheumatoid arthritis, Crohn's disease (Remicade only), ulcerative colitis, ankylosing spondylitis, and other disorders. In 2013, these two products accounted for 29% of Johnson and Johnson's pharmaceutical revenues, and 11.3% of the company's total revenues. A third immunology product, Stelara (ustekinumab), targets interleukin-12 and interleukin-23 and is used for the treatment of psoriasis.[98]

The company's CNS products include the ADHD drug Concerta (methylphenidate extended release), and the long-acting injectable antipsychotics Invega Sustenna (paliperidone palmitate) and Risperdal Consta (risperidone). Invega Sustenna and Risperdal Consta were the first widely utilized long-acting depot injections for the treatment of schizophrenia. Designed to address the issue of poor patient compliance with oral therapy, they are administered by intramuscular injection at intervals of 2 weeks and one month, respectively. Only minimal improvements in outcomes relative to the oral versions of these drugs were observed in the clinical trial setting, but some evidence suggests that the advantages of long-acting injections in clinical practice may be greater than is readily demonstrated in the environment of a clinical trial.[99][100][101]

Oncology products include Velcade (bortezomib), for the treatment of multiple myeloma and mantle cell lymphoma[102] and Zytiga (abiraterone), an androgen antagonist for the treatment of prostate cancer. In clinical trials, abiraterone treatment was associated with a 4.6 to 5.2 survival advantage when used either before or after chemotherapy with platinum-based drugs.[103] On December 31, 2012, the Food and Drug Administration approved Sirturo (bedaquiline), a Johnson & Johnson tuberculosis drug that is the first new medicine to fight the infection in more than forty years.[104]

Historically notable drugs include Incivio (telaprevir) for treating hepatitis C, whose sales declined from $2.4 billion in 2014 to $106 million in 2016 as competing curative drugs emerged.[105] HIV drugs include Edurant (rilpivirine), Intelence (etravirine) and Prezista (darunavir) but as of 2018, the most significant of these only accounted for around 2% of total revenue at $211 million.[106]

In March 2019 the FDA approved esketamine for the treatment of severe depression,[107] which is marketed as Spravato by Janssen Pharmaceuticals.[108]

Medical devices

Sectors in which the company is active[109] include:

- Aesthetics (Ethicon, Mentor)

- Arrhythmias (Biosense Webster)

- Bariatric Surgery for Obesity (Ethicon)

- Cardiovascular Disease (Biosense Webster, Inc.)

- Diabetes Care (LifeScan, Animas Corporation)

- Ear, Nose, and Throat Conditions (Acclarent)

- General Surgery (Ethicon, Codman Neuro)

- Hernia Surgery (Ethicon)

- Insulin Delivery Devices (Animas)

- Neurovascular Disease (Codman Neuro, DePuy Synthes)

- Orthopaedics (DePuy Synthes): Joint Reconstruction, Trauma, Spine, Sports Medicine, and Power Tools

- Self-Measured Blood Glucose Monitors (LifeScan)

- Surgical Instruments and Infection Prevention(Advanced Sterilization Products)

- Urologic Surgery (Ethicon)

- Vision Care (VISTAKON®)

Consumer health

Sectors in which the company is active[110] include:

- Baby Care

- Nutritionals

- Oral Health Care

- Over-the-Counter Medicines

- Skin & Hair Care

- Vision Care

- Wound Care & Topicals

Environmental record

Johnson & Johnson has set several positive goals to keep the company environmentally friendly and was ranked third among the United States's largest companies in Newsweek's "Green Rankings".[111] Some examples are the reduction in water use, waste, and energy use and an increased level of transparency.[112] Johnson & Johnson agreed to change its packaging of plastic bottles used in the manufacturing process, switching their packaging of liquids to non-polyvinyl chloride containers.[113] The corporation is working with the Climate Northwest Initiative and the EPA National Environmental Performance Track program.[114] As a member of the national Green Power Partnership, Johnson & Johnson operates the largest solar power generator in Pennsylvania at its site in Spring House, Pennsylvania.[115]

Recalls and litigation

1982 Chicago Tylenol murders

On September 29, 1982, a "Tylenol scare" began when the first of seven individuals died in Chicago metropolitan area, after ingesting Extra Strength Tylenol that had been deliberately laced with cyanide.[116] Within a week, the company pulled 31 million bottles of capsules back from retailers, making it one of the first major recalls in American history.[116] The incident led to reforms in the packaging of over-the-counter substances and to federal anti-tampering laws. The case remains unsolved and no suspects have been charged. Johnson & Johnson's quick response, including a nationwide recall, was widely praised by public relations experts and the media and was the gold standard for corporate crisis management.[117][118][119]

2010 children's product recall

On April 30, 2010, McNeil Consumer Healthcare, a subsidiary of Johnson and Johnson, voluntarily recalled 43 over-the-counter children's medicines, including Tylenol, Tylenol Plus, Motrin, Zyrtec and Benadryl. The recall was conducted after a routine inspection at a manufacturing facility in Fort Washington, Pennsylvania, United States revealed that some "products may not fully meet the required manufacturing specifications".[120][121] Affected products may contain a "higher concentration of active ingredients" or exhibit other manufacturing defects.[121] Products shipped to Canada, Dominican Republic, Mexico, Guam, Guatemala, Jamaica, Puerto Rico, Panama, Trinidad and Tobago, the United Arab Emirates, Kuwait and Fiji were included in the recall.[120] In a statement, Johnson & Johnson said "a comprehensive quality assessment across its manufacturing operations" was underway.[120][121] A dedicated website was established by the company listing affected products and other consumer information.[121]

2010 hip-replacement recall

On August 24, 2010, DePuy, a subsidiary of American giant Johnson & Johnson, recalled its ASR (articular surface replacement) hip prostheses from the market. DePuy said the recall was due to unpublished National Joint Registry data showing a 12% revision rate for resurfacing at five years and an ASR XL revision rate of 13%. All hip prostheses fail in some patients, but it is expected that the rate will be about 1% a year.[122] Pathologically, the failing prosthesis had several effects. Metal debris from wear of the implant led to a reaction that destroyed the soft tissues surrounding the joint, leaving some patients with long term disability. Ions of cobalt and chromium—the metals from which the implant was made—were also released into the blood and cerebral spinal fluid in some patients.[123]

In March 2013, a jury in Los Angeles ordered Johnson & Johnson to pay more than $8.3 million in damages to a Montana man in the first of more than 10,000 lawsuits pending against the company in connection with the now-recalled DePuy hip.[124]

Some lawyers and industry analysts have estimated that the suits ultimately will cost Johnson & Johnson billions of dollars to resolve.[124]

2010 Tylenol recall

In 2010 and 2011, Johnson & Johnson voluntarily recalled some over-the-counter products, including Tylenol, due to an odor caused by tribromoanisole.[125][126] In this case, 2,4,6-tribromophenol was used to treat wooden pallets on which product packaging materials were transported and stored.[125]

Shareholders lawsuit

In 2010 a group of shareholders sued the board for allegedly failing to take action to prevent serious failings and illegalities since the 1990s, including manufacturing problems, bribing officials, covering up adverse effects and misleading marketing for unapproved uses. The judge initially dismissed the case in September 2011, but allowed the plaintiffs opportunity to refile at a later time.[127] In 2012 Johnson and Johnson proposed a settlement with the shareholders, whereby the company would institute new oversight, quality and compliance procedures binding for five years.[128]

Illegal marketing of Risperdal

Juries in several US states have found J&J guilty of concealing the adverse effects of Janssen Pharmaceuticals' antipsychotic medication Risperdal, produced by its unit, in order to promote it to doctors and patients as better than cheaper generics, and of falsely marketing it for treating patients with dementia.[129] States that have awarded damages include Texas ($158 million), South Carolina ($327 million), Louisiana ($258 million), and most notably Arkansas ($1.2 billion).[130]

In 2010, the United States Department of Justice joined a whistleblowers suit accusing the company of illegally marketing Risperdal through Omnicare, the largest company supplying pharmaceuticals to nursing homes.[131][132] The allegations include that J&J were warned by the U.S. Food and Drug Administration (FDA) not to promote Risperdal as effective and safe for elderly patients, but they did so, and that they paid Omnicare to promote the drug to care home physicians.[133] The settlement was finalized on November 4, 2013, with J&J agreeing to pay a penalty of around $2.2 billion, "including criminal fines and forfeiture totaling $485 million and civil settlements with the federal government and states totaling $1.72 billion".[134]

Johnson & Johnson has also been subject to congressional investigations related to payments given to psychiatrists to promote its products and ghost write articles, notably Joseph Biederman and his pediatric bipolar disorder research unit.[135]

Foreign bribery

In 2011, J&J settled litigation brought by the US Securities and Exchange Commission under the Foreign Corrupt Practices Act and paid around $70M in disgorgement and fines.[136] J&J's employees had given kickbacks and bribes to doctors in Greece, Poland, and Romania to obtain business selling drugs and medical devices and had bribed officials in Iraq to win contracts under the Oil for Food program.[137] J&J fully cooperated with the investigation once the problems came to light.[138]

Consumer fraud settlements

In May 2017, J&J reached an agreement to pay $33 million to several states to settle consumer fraud allegations in some of the company's over-the-counter drugs.[139][140][141]

Use of the Red Cross symbol

Johnson & Johnson registered the Red Cross as a U.S. trademark for "medicinal and surgical plasters" in 1905 and has used the design since 1887.[142] The Geneva Conventions, which reserved the Red Cross emblem for specific uses, were first approved in 1864 and ratified by the United States in 1882. However, the emblem was not protected by U.S. law for the use of the American Red Cross and the U.S. military until after Johnson & Johnson had obtained its trademark. A clause in this law (now 18 U.S.C. 706) permits this pre-existing use of the Red Cross to continue.

A declaration made by the U.S. upon its ratification of the 1949 Geneva Conventions includes a reservation that pre-1905 U.S. domestic uses of the Red Cross, such as Johnson & Johnson's, would remain lawful as long as the cross is not used on "aircraft, vessels, vehicles, buildings or other structures, or upon the ground," i.e., uses which could be confused with its military uses.[143] This means that the U.S. did not agree to any interpretation of the 1949 Geneva Conventions that would overrule Johnson & Johnson's trademark. The American Red Cross continues to recognize the validity of Johnson & Johnson's trademark.[144]

In August 2007, Johnson & Johnson filed a lawsuit against the American Red Cross (ARC), demanding that the charity halt the use of the red cross symbol on products it sells to the public, though the company takes no issue with the charity's use of the mark for non-profit purposes.[145] In May 2008, the judge in the case dismissed most of Johnson & Johnson's claims, and a month later the two organizations announced a settlement had been reached in which both parties would continue to use the symbol.[146]

Boston Scientific lawsuits

Since 2003, Johnson & Johnson and Boston Scientific have both claimed that the other had infringed on their patents covering heart stent medical devices. The litigation was settled when Boston Scientific agreed to pay $716 million to Johnson & Johnson in September 2009 and an additional $1.73 billion in February 2010.[147] Their dispute was renewed in 2014, now on the grounds of a contract dispute.[148]

Patent-infringement case against Abbott

In 2007, Johnson & Johnson sued Abbott Laboratories over the development and sale of the arthritis drug Humira. Johnson & Johnson claimed that Abbott used technology patented by New York University and licensed exclusively to Johnson & Johnson's Centocor division to develop Humira. Johnson & Johnson won the court case, and in 2009 Abbott was ordered to pay Johnson & Johnson $1.17 billion in lost revenues and $504 million in royalties.[149] The judge also added $175.6 million in interest to bring the total to $1.84 billion.[150] This was the largest patent-infringement award in U.S. history[149] until the 2013 decision against Teva in favor of Takeda and Pfizer for over 2.1 billion dollars.[151] In 2010 Abbott appealed the verdict[150] and in 2011 won the appeal.[152]

Vaginal mesh implants

Tens of thousands of women worldwide have taken legal action against Johnson & Johnson after suffering serious complications following a vaginal mesh implant procedure.[153] In 2016 the U.S. states of California and Washington filed a lawsuit against the company, accusing it of deception.[153] More than 700 women began a class action against the company in the Federal Court of Australia in 2017, telling the court they "suffered irreparable, debilitating pain after the devices began to erode into surrounding tissue and organs, causing infections and complications". The class action alleged that Johnson & Johnson, which "aggressively marketed" the implants "failed to properly warn patients and surgeons of the risk, or test the devices adequately".[154] Emails between executives show the company was aware of the risks in 2005 but still went ahead and made the product available.[155]

In October 2019, the company and its subsidiary, Ethicon, Inc. reached a settlement with 41 states and the District of Columbia, with no admission of liability, in a suit alleging deceptive marketing of transvaginal surgical-mesh devices. The suit also alleges that the company failed to disclose risks associated with the product, which J&J pulled from the market in 2012. The amount settled in the suit was about US$117 million.[156]

Baby powder

In February 2016, J&J was ordered to pay $72 million in damages to the family of Jacqueline Fox, a 62-year-old woman who died of ovarian cancer in 2015: the company said it would appeal.[157]

By March 2017, over 1,000 U.S. women had sued J&J for covering up the possible cancer risk from its Baby Powder product; the company says that 70 percent of its Baby Powder is used by adults.[158]

In August 2017, a California jury ordered Johnson & Johnson to pay $417 million to a woman who claimed she developed ovarian cancer after using the company's talc-based products like Johnson's Baby Powder for feminine hygiene. The verdict included $70 million in compensatory damages and $347 million in punitive damages. J&J said they will appeal the verdict.[159]

In October 2017, the Missouri Eastern District appeals court on Tuesday threw out a $72 million jury verdict. The appeals court ruled 3-0 that Jacqueline Fox's lawsuit lacked jurisdiction in Missouri because of a U.S. Supreme Court decision that imposed limits on where injury lawsuit can be filed which ". . . establishing a lawsuit's jurisdiction requires a stronger connection between the forum state and a plaintiff's claims." Subsequently, this ruling would kill three other recent St. Louis jury verdicts of more than $200 million combined. Fox, 62, of Birmingham, Alabama, died in 2015, about four months before her trial was held in St. Louis Circuit Court. She was among 65 plaintiffs, of whom only two were from Missouri.[160]

In July 2018, a St. Louis jury awarded nearly US$4.7 billion in damages to 22 women and their families after they claimed asbestos in Johnson & Johnson talcum powder caused their ovarian cancer.[161] Conversely, in December 2019, a St. Louis jury ruled in favor of Johnson & Johnson in the case of a single plaintiff who had used the company's talc-containing baby powder for thirty years with a similar claim.[162] In 2019, the company's CEO, Alex Gorsky, declined to appear at a United States congressional hearing on the safety of J&J's Baby Powder and other talc-based cosmetics. J&J spokesman Ernie Knewitz said that the subcommittee had rejected the company's offers to send a talc testing expert or a J&J executive in charge of consumer products.[163]

In August 2018, J&J said that it removed several chemicals from baby powder products and re-engineered them to make consumers more confident that products were safer for children.[164]

In December 2018, with 11,700 people suing J&J over cancers allegedly caused by baby powder, the company was forced to release internal documents. The documents showed that the company had known about asbestos contamination since at least as early as 1971 and had spent decades finding ways to conceal the evidence from the public.[165] On December 19, the company lost its request to reverse a jury verdict that ruled in favor of the accusers, which required the company to pay $4.14 billion in punitive damages and $550 million in compensatory damages.[166] Though asbestos is a known carcinogen, the potential link between asbestos-free talc and cancer also alleged in these lawsuits is a subject of scientific controversy, as discussed on the Neurologica blog by Steven Novella. A large study performed in 2003 found that ovarian cancer risk increased from a baseline of 0.0121% to 0.0161% in people who reported regularly using talc in the genital area. Two more studies over the next twelve years, which also relied on self-reporting, had similar results. However, none of the three studies showed a relationship between how long someone used talc and how much their cancer risk increased, which is expected in experiments with carcinogens and other toxic substances (see dose-response relationship).[167]

In May 2020, in response to declining demand, J&J announced it would discontinue the sale of talc-based baby powder in the United States and Canada, but will continue to sell it in other markets. In a statement, the company said existing retail inventory of the talc-based powder will sell until it runs out, while the company's cornstarch-based baby powder will continue to sell in the United States and Canada.[168]

Opioid epidemic

By 2018, the company had become embroiled in the opioid epidemic in the United States and had become a target of lawsuits.[169][170] Over 500 opioid-related cases have been filed as of May 2018 against J&J and its competitors.[171] In Idaho, J&J is part of a lawsuit accusing the company for being partially to blame for opioid-related overdose deaths.[172] The first major trial began in Oklahoma in May 2019.[173] On August 26, 2019, the Oklahoma judge ordered J&J to pay $572 million for their part in the opioid crisis.[174] In October 2019, J&J reached a $20.4 million settlement with two Ohio counties grappling with the opioid epidemic.[175]

Northeastern Ohio Settlement

In October 2019, the company agreed to a settlement of US$20.4 million with two Ohio counties – Cuyahoga (Cleveland) and Summit (Akron). The settlement allows the company avoidance of a trial accusing J&J and many other pharmaceutical manufacturers of helping to spark the US opioid epidemic. The trial, scheduled for October 2019, was thought to be an indicator for thousands of opioid-related lawsuits against many drug manufacturers. The arrangement, which contains no admission of liability by the company, provides the counties US$10 million in cash, $5 million for legal expenses and $5.4 million in contributions to opioid-related non-profit organizations in the counties.[176]

See also

- Frederick Barnett Kilmer – Director of Scientific Laboratories from 1889 to 1934.

- Zodiac – Historic schooner built for the Johnson family heirs.

References

- "Alex Gorsky". Johnson & Johnson. Archived from the original on June 15, 2020. Retrieved July 10, 2020.

- "Paul Stoffels, M.D." Content Lab U.S. Retrieved July 9, 2020.

- "Joaquin Duato". Content Lab U.S. Retrieved July 9, 2020.

- "ANNUAL REPORT PURSUANT TO SECTION 13 OF THE SECURITIES EXCHANGE ACT OF 1934(Form 10-K)". February 18, 2020. Retrieved March 14, 2020.

- "Johnson & Johnson Profile". MarketWatch.com. Retrieved March 14, 2020.

- "Johnson & Johnson 2015 Annual Report" (PDF). www.jnj.com. February 24, 2016. Archived from the original (PDF) on April 18, 2016. Retrieved September 28, 2016.

- "Products". Content Lab - U.S.

- "Consumer Health Products". Content Lab - U.S.

- "Medical Devices". Content Lab - U.S.

- "Pharmaceutical Products". Content Lab - U.S.

- "A Sign of the Times: The Story Behind Johnson & Johnson's Iconic Logo - Johnson & Johnson". www.jnj.com. September 25, 2017.

- Horner, Shirley (February 15, 1987). "About Books". The New York Times. Retrieved May 7, 2010.

- "Crazier then You and Me". New York Magazine. February 23, 1987. p. 129.

- Todd, Susan (April 26, 2012). "Johnson & Johnson's new CEO emphasizes company credo at shareholder's meeting". NJ.com. Retrieved March 13, 2020.

- Carmichael, Taylor (December 31, 2019). "If You Invested $10,000 in Johnson & Johnson's IPO, This Is How Much Money You'd Have Now". fool.com. Retrieved March 13, 2020.

- Singer, Natasha (June 3, 2010). "Robert L. McNeil Jr., Chemist Who Introduced Tylenol, Dies at 94". The New York Times. Retrieved June 4, 2010.

- "FDA: Establishment Inspection Report, McNeil Consumer Healthcare".

- Watson, R. (2003). "Paul Janssen". BMJ : British Medical Journal. 327 (7426): 1290. doi:10.1136/bmj.327.7426.1290. PMC 286262.

- Ban, Thomas A. (August 2004). "Paul Adriaan Jan Janssen, 1926–2003". Neuropsychopharmacology. 29 (8): 1579–1580. doi:10.1038/sj.npp.1300423. ISSN 1740-634X.

- Saxon, Wolfgang (November 13, 2003). "Dr. Paul Janssen, 77, Dies; Founder of a Drug Company". The New York Times. ISSN 0362-4331. Retrieved February 11, 2020.

- "J&J Closes Aragon Pharmaceuticals Deal". San Diego Business Journal. Retrieved February 11, 2020.

- "Alios BioPharma From Startup To Big Pharma". www.lifescienceleader.com. Retrieved February 11, 2020.

- "Johnson & Johnson Completes Acquisition of Micrus Endovascular Corporation". BioSpace.

- "Johnson & Johnson Announces Completion of Synthes Acquisition | J&J Medical Devices". www.jnjmedicaldevices.com.

- "Depuy Synthes Companies Acquires Olive Medical Corporation | Johnson & Johnson". Content Lab - U.S.

- "DePuy Synthes Companies Announces Acquisition Of Biomedical Enterprises, Inc., A Leader In Small Bone Fixation | Johnson & Johnson". Content Lab - U.S.

- "Codman Neuro Announces Acquisition Of Pulsar Vascular Inc., Expanding Neurovascular Treatment For Patients With Complex Aneurysms | Johnson & Johnson". Content Lab - U.S.

- "Johnson & Johnson's DePuy Synthes Buys Technology From Interventional Spine for Undisclosed Sum". BioSpace.

- Ltd, Insider Media. "Johnson & Johnson moves for Irish medical firm".

- Coyle, Dominic. "Johnson & Johnson buys Irish stroke care firm in multimillion euro deal". The Irish Times.

- "DePuy Synthes Announces Acquisition of Sentio, LLC to Enable Innovation in Minimally Invasive Spine Surgery". www.jnj.com.

- "Johnson & Johnson (JOBS) to Acquire Cougar Biotechnology, Inc. for About $970 Million". BioSpace.

- "Johnson & Johnson Begins Tender Offer to Acquire Cougar Biotechnology, Inc". BioSpace.

- "Johnson & Johnson Nordic AB Acquires Amic Gains Access to In Vitro Diagnostic Technologies in Development for Use in Point-of-Care Settings". BioSpace.

- "Archived copy". Archived from the original on June 5, 2010. Retrieved June 1, 2010.CS1 maint: archived copy as title (link)

- www.bizjournals.com https://www.bizjournals.com/philadelphia/blog/john-george/2011/06/remicade-maker-centocor-ortho-biotech.html. Retrieved May 24, 2020. Missing or empty

|title=(help) - "Janssen Joins MacroGenics in Up-to-$700M Cancer Collaboration". GEN.

- "Janssen, Isis Pharma Ink Up-to-$835M Antisense Agreement". GEN.

- "Janssen to Acquire BeneVir Biopharm to Advance Immunotherapy Regimens". Content Lab - U.S.

- https://www.biospace.com/article/releases/xbiotech-announces-agreement-to-sell-true-human-antibody-bermekimab-targeting-il-1a-to-janssen/?s=79

- https://www.biospace.com/article/releases/janssen-to-acquire-investigational-bermekimab-from-xbiotech/?s=79

- "ETHICON History". www.ethiconproducts.co.uk. Archived from the original on January 10, 2016. Retrieved January 25, 2016.

- "A history of advancing surgery". www.ethicon.com. Ethicon U.S., LLC. Retrieved January 25, 2016.

- "Johnson & Johnson Announces Definitive Agreement to Acquire Mentor Corporation". Archived from the original on December 13, 2018. Retrieved February 3, 2019.

- "Johnson & Johnson Announces Receipt of Israeli Antitrust Approval for Acquisition of Omrix Biopharmaceuticals, Inc". BioSpace.

- "Johnson & Johnson (JOBS) Acquire Omrix Biopharmaceuticals, Inc. for $438 Million". BioSpace.

- "Johnson & Johnson Acquires Medical Device Maker in China". BioSpace.

- "Ethicon Announces Agreement To Acquire NeuWave Medical, Inc". FierceMedicalDevices. Archived from the original on March 11, 2016.

- "Ethicon Announces Acquisition of Megadyne Medical Products, Inc. | Johnson & Johnson". Content Lab - U.S.

- "Johnson & Johnson subsidiary buys Torax Medical". Star Tribune.

- "Johnson & Johnson Announces Binding Offer from Fortive Corporation to Acquire Advanced Sterilization Products (ASP)". Content Lab - U.S.

- "Johnson & Johnson to buy surgical robotics firm Auris for $3.4 billion". February 13, 2019 – via uk.reuters.com.

- "Johnson & Johnson Snaps up Surgical Robotics Company Auris Health for $3.4 Billion". BioSpace.

- "Johnson & Johnson Announces Agreement to Acquire Auris Health, Inc. | Johnson & Johnson". Content Lab - U.S.

- https://uk.reuters.com/article/uk-verb-surgical-m-a-johnson-johnson/jj-to-buy-remaining-stake-in-verb-surgical-to-strengthen-digital-surgery-portfolio-idUKKBN1YO1GR

- "Ethicon Endo-Surgery, Inc. Completes Acquisition of SurgRx, Inc". BioSpace.

- "Ethicon Endo-Surgery, Inc. to Acquire SterilMed". BioSpace.

- Eva von Schaper; Ellen Gibson (October 6, 2010). "J&J, Crucell Reach Agreement on $2.4 Billion Takeover". Bloomberg.com.

- "Johnson & Johnson Completes Tender Offer for Crucell N.V. and Declares Offer Unconditional". BioSpace.

- "Biosense Webster, Inc. Announces Acquisition of Coherex Medical, Inc. | Johnson & Johnson". Content Lab - U.S.

- "Johnson & Johnson Announces Completion of Acquisition of Vogue International LLC | Johnson & Johnson". Content Lab - U.S.

- "Johnson & Johnson Announces Agreement to Acquire Abbott Medical Optics | Johnson & Johnson". Content Lab - U.S.

- Johnson, Linda A. (January 24, 2018). "Johnson & Johnson Loses $10.7 B After Sweeping U.S. Tax Changes". Drug Discovery & Development Magazine. Associated Press. Retrieved January 24, 2018.

- "Johnson & Johnson to buy Actelion for $30 billion, spin off R&D unit". Reuters. January 26, 2017. Retrieved January 26, 2017.

- Roland, Denise; D. Rockoff, Jonathan (January 26, 2017), Johnson & Johnson to Acquire Actelion in $30 Billion Deal, Wall Street Journal, retrieved January 27, 2017

- "BRIEF-Johnson & Johnson says Janssen Holding to acquire all publicly held shares of Actelion for $280 per share". March 31, 2017 – via Reuters.

- "J&J declares Actelion tender offer a success, sees closing in second quarter". March 31, 2017 – via Reuters.

- "Johnson & Johnson (JNJ) Declares $30B Actelion Tender Successful; Controls 77.% of Voting Rights".

- "Johnson & Johnson Vision to acquire TearScience". www.healio.com.

- "Johnson & Johnson acquires subscription-based contact lens startup Sightbox". September 19, 2017.

- "Johnson & Johnson Announces Binding Offer from Platinum Equity to Acquire LifeScan, Inc". Content Lab - U.S.

- "Johnson & Johnson Medical GmbH Acquires Emerging Implant Technologies GmbH to Enhance Global Offering of Interbody Spine Implants". BioSpace.

- Research, National Center for Toxicological (March 18, 2019). "FDA clears first contact lens with light-adaptive technology". FDA. Retrieved August 2, 2019.

- Vecchione, Anthony (March 13, 2020). "J&J collaborates to accelerate COVID-19 vaccine development". NJBIZ. Retrieved April 22, 2020.

- "Prisma Health collaborates with Ethicon Inc. to make, distribute VESper Ventilator Expansion Splitter Device". WSPA 7News. April 6, 2020. Retrieved April 22, 2020.

- "Coronavirus: Johnson & Johnson vows to make 'not-for-profit' vaccine". Sky News. Retrieved April 22, 2020.

- Stankiewicz, Kevin (March 17, 2020). "J&J hopes to start human trials for coronavirus vaccine in November". CNBC. Retrieved April 22, 2020.

- Vecchione, Anthony (March 13, 2020). "J&J collaborates to accelerate COVID-19 vaccine development". NJBIZ. Retrieved April 22, 2020.

- "J&J's Tylenol production at maximum capacity as coronavirus boosts demand". Reuters. March 19, 2020. Retrieved April 22, 2020.

- "Prisma Health, Ethicon to Build Ventilator Split Device for Emergency Use". www.morningstar.com. Retrieved April 22, 2020.

- Coleman, Justine (June 10, 2020). "Final testing stage for potential coronavirus vaccine set to begin in July". TheHill. Retrieved June 11, 2020.

- "Moderna, AstraZeneca and J&J coronavirus shots rev up for NIH tests beginning in July: WSJ". FiercePharma. Retrieved June 11, 2020.

- "Johnson & Johnson to start human testing of COVID-19 vaccine next week". FiercePharma. Retrieved July 20, 2020.

- Division, News (August 5, 2020). "HHS, DOD Collaborate With Johnson & Johnson to Produce Millions of COVID-19 Investigational Vaccine Doses". HHS.gov. Retrieved August 6, 2020.

- "Johnson & Johnson Announces Agreement with U.S. Government for 100 Million Doses of Investigational COVID-19 Vaccine | Johnson & Johnson". Content Lab U.S. Retrieved August 6, 2020.

- "US to Pay Johnson and Johnson $1 Billion for COVID-19 Vaccine". Voice of America. Retrieved August 5, 2020.

- "Johnson & Johnson Revenue 2006–2018 | JNJ". www.macrotrends.net. Retrieved October 28, 2018.

- "Johnson & Johnson - Mitarbeiter bis 2017 | Statistik". Statista (in German). Retrieved December 9, 2018.

- "Our Leadership Team". Johnson & Johnson. Johnson & Johnson. Retrieved August 29, 2019.

- Leadership, Johnson & Johnson

- "Our Leadership Team". Johnson & Johnson.

- Palmer, Eric. "Johnson & Johnson shakeup leaves Joaquin Duato with largest portfolio". FiercePharma. Retrieved July 4, 2018.

- 2 Long-Disputed Projects to Begin, The New York Times, July 9, 1977

- Old Raritan Canal Lock Is Focus of a Classic Dispute, The New York Times, April 16, 1977.

- "JOHNSON & JOHNSON ASIA-PACIFIC INFORMATION TECHNOLOGY HEADQUARTERS". March 14, 2002. Archived from the original on May 30, 2013. Retrieved July 15, 2013.

- "Downloads" (PDF). files.shareholder.com.

- "www.accessdata.fda.gov" (PDF).

- "www.accessdata.fda.gov" (PDF).

- Kaplan G, Casoy J, Zummo J (2013). "Impact of long-acting injectable antipsychotics on medication adherence and clinical, functional, and economic outcomes of schizophrenia". Patient Prefer Adherence. 7: 1171–80. doi:10.2147/PPA.S53795. PMC 3833623. PMID 24265549.

- Kane JM, Kishimoto T, Correll CU (August 2013). "Assessing the comparative effectiveness of long-acting injectable vs. oral antipsychotic medications in the prevention of relapse provides a case study in comparative effectiveness research in psychiatry". J Clin Epidemiol. 66 (8 Suppl): S37–41. doi:10.1016/j.jclinepi.2013.01.012. PMC 3742035. PMID 23849151.

- Fusar-Poli P, Kempton MJ, Rosenheck RA (March 2013). "Efficacy and safety of second-generation long-acting injections in schizophrenia: a meta-analysis of randomized-controlled trials". Int Clin Psychopharmacol. 28 (2): 57–66. doi:10.1097/YIC.0b013e32835b091f. PMID 23165366.

- "www.accessdata.fda.gov" (PDF).

- "www.accessdata.fda.gov" (PDF).

- "FDA Approves 1st New Tuberculosis Drug in 40 Years". ABC News. Retrieved December 31, 2012.

- "J&J moves away from hep C due to rival drugmakers' cures". BioPharma Dive. Retrieved June 18, 2019.

- "Where does J&J's new drug fit in the crowded HIV market?". BioPharma Dive. Retrieved October 26, 2019.

- "www.fda.gov".

- "www.janssencarepath.com".

- "Healthcare products - Medical technologies". jnj.com. Retrieved March 13, 2015.

- "Healthcare products - consumer". jnj.com. Retrieved March 13, 2015.

- "Green Rankings". Archived from the original on October 10, 2009.

- "Johnson & Johnson Official Site". Archived from the original on May 2, 2008. Retrieved May 4, 2008.

- Environment New Service, December 8, 2004. Retrieved May 4, 2008

- "Coop America". March 27, 2008. Archived from the original on April 26, 2008. Retrieved May 4, 2008.

- "Department of Environmental Protection". Commonwealth of Pennsylvania.

- Judith Rehak (March 23, 2002). "Tylenol made a hero of Johnson & Johnson : The recall that started them all". The New York Times.

- Toyota, what's so hard about doing the right thing?, Los Angeles Times, February 11, 2010

- Jennifer Latson for Time Magazine Sept. 29, 2014 How Poisoned Tylenol Became a Crisis-Management Teaching Model

- Judith Rehak for The New York Times. March 23, 2002 Tylenol made a hero of Johnson & Johnson : The recall that started them all

- "US firm recalls children's drugs". Aljazeera. May 1, 2010. Retrieved May 3, 2010.

- Watts, Alex (May 2, 2010). "Warning As Baby Medicines Are Recalled". Sky News. Retrieved May 3, 2010.

- Deborah Cohen (May 14, 2011). "Out of joint: The story of the ASR".

- "FDA. Concerns about metal-on-metal hip implant systems. 2011". 2011.

- Meier, Barry (March 8, 2013). "J.&J. Loses First Case Over Faulty Hip Implant". New York Times. Retrieved September 4, 2013.

- Tylenol Recall Expands, WebMD Health News, January 18, 2010

- "McNeil Consumer Healthcare Announces Voluntary Recall Of One Product Lot Of TYLENOL® Extra Strength Caplets 225 Count Distributed In The U.S."

- "10-cv-2033, D. NJ., Sept. 29, 2011" (PDF).

- J&J, shareholders reach tentative deal in lawsuit By Linda A. Johnson, AP Business Writer / July 12, 2012

- Gregory Wallace (November 4, 2013). "Johnson & Johnson to pay $2 billion for false marketing". CNN Money. Retrieved November 6, 2013.

- J.&J. Fined $1.2 Billion in Drug Case NY Times, By KATIE THOMAS Published: April 11, 2012

- Hilzenrath, David S. (January 16, 2010). "Justice suit accuses Johnson & Johnson of paying kickbacks". The Washington Post. Retrieved January 17, 2010.

- Singer, Natasha (January 15, 2010). "Johnson & Johnson Accused of Drug Kickbacks". The New York Times. Retrieved January 17, 2010.

- J&J Said to Agree to $2.2 Billion Drug Marketing Accord Bloomberg News. By Margaret Cronin Fisk, Jef Feeley & David Voreacos – June 11, 2012

- Office of Public Affairs, Department of Justice (November 4, 2015). "Johnson & Johnson to Pay More Than $2.2 Billion to Resolve Criminal and Civil Investigations". United States Department of Justice. Retrieved June 16, 2015.

- Research Center Tied to Drug Company By Gardiner Harris, The New York Times, 2008

- "Johnson & Johnson". www.sec.gov. Retrieved July 5, 2017.

- "J&J settles U.S., UK bribery, kickback charges". Reuters. April 8, 2011. Retrieved July 5, 2017.

- "SEC Charges Johnson & Johnson With Foreign Bribery". SEC. April 7, 2011.

- "J&J Reaches $33 Million Settlement with States". DrugWatch. Retrieved July 5, 2017.

- Reuters (May 24, 2017). "Johnson & Johnson settles drug manufacturing probe by US states for $33 million". The Economic Times. Retrieved July 5, 2017.

- "UPDATE 1-J&J settles drug manufacturing probe by U.S. states for $33 mln". Business Insider. Retrieved July 5, 2017.

- "Trademark Status & Document Retrieval". uspto.gov.

- U.S. reservations to the 1949 Geneva Conventions (International Committee of the Red Cross website)

- American Red Cross Defends Use of Emblem and Mission Archived August 18, 2007, at the Wayback Machine (American Red Cross press release, August 10, 2007)

- "Red Cross Is Sued by J&J Over Signature Emblem" The Wall Street Journal August 9, 2007

- Saul, Stephanie (June 18, 2008). "Claim Over Red Cross Symbol Is Settled". The New York Times.

- Boston Scientific to Pay J&J $1.73B to Settle Stent Patent Disputes, The Wall Street Journal, February 2, 2010

- J&J seeks over $5 billion in damages from Boston Scientific at trial. Reuters, 19 November 2014

- Abbott Told to Pay Record $1.67 billion Award to J&J, Bloomberg News, June 29, 2009

- Abbott Challenges $1.67 billion Patent Loss to J&J Over Humira, Bloomberg News, November 2, 2010

- Pfizer, Takeda to Get $2.15 Billion Settlement, WSJ, 6 12 2013

- "abbott-wins-reversal-of-j-j-s-1-67-billion-patent-victory". Bloomberg.com. Archived from the original on May 6, 2011.

- "States file lawsuit against Johnson & Johnson over pelvic mesh implants". www.cbsnews.com.

- Knaus, Christopher (July 4, 2017). "Vaginal mesh risks downplayed by Johnson & Johnson, court told". the Guardian.

- Devlin, Hannah (November 27, 2018). "Pharma giant sold mesh implant despite pain warnings". The Guardian. ISSN 0261-3077. Retrieved November 25, 2019.

- Sebastian, Dave (October 17, 2019). "Johnson & Johnson to Pay $117 Million Over Surgical Device Marketing". Wall Street Journal. New York NY: Dow Jones and Company.

- "Johnson & Johnson hit with $72m damages in talc-cancer case". BBC News. February 24, 2016. Retrieved February 24, 2016.

- Johnson & Johnson Has a Baby Powder Problem Bloomberg, Retrieved April 20, 2017.

- "J&J ordered to pay $417 million in trial over talc cancer risks". August 21, 2017 – via Reuters.

- Currier, Joel. "Missouri appeals court tosses out $72 million Johnson & Johnson talcum powder verdict".

- Bever, Lindsey (July 13, 2018). "Johnson & Johnson ordered to pay $4.7 billion to women who say baby powder gave them cancer". Washington Post. Retrieved July 28, 2018.

- Salter, Jim (December 23, 2019). "St. Louis jury sides with Johnson & Johnson in talc case". The Seattle Times. Associated Press. Retrieved December 24, 2019.

- "Johnson & Johnson CEO refuses to attend US hearing on carcinogens". www.aljazeera.com. December 10, 2019. Retrieved December 11, 2019.

- "Johnson and Johnson removes chemicals to make products safer". Retrieved August 25, 2018.

- "Johnson & Johnson knew for decades that asbestos lurked in some of its baby powder". NBC News.

- Scipioni, Jade (December 19, 2018). "J&J loses its battle to overturn a $4.7B baby powder verdict". FOXBusiness. Retrieved December 19, 2018.

- Steven Novella. "The Johnson and Johnson Talc Cancer Case". Neurologica blog. Retrieved September 30, 2019.

- Albert, Victoria (May 19, 2020). "Johnson & Johnson to discontinue sales of talc-based baby powder in U.S., Canada". CBS News. Retrieved May 19, 2020.

- Gurman, Sadie; Mulvihill, Geoff (March 2, 2018). "DOJ to Support Lawsuits Against Companies Selling Opioids". Drug Discovery & Development. Advantage Business Media. Associated Press. Retrieved March 2, 2018.

- "Johnson & Johnson acted as opioid kingpin, Oklahoma attorney general says". CNN. March 12, 2019. Retrieved March 14, 2019.

- "Trump Insurance For Johnson & Johnson". Retrieved August 25, 2018.

- "11 Idaho counties take on Walmart, CVS, drug companies in opioid lawsuit". Retrieved August 25, 2018.

- Randazzo, Sara (May 27, 2019). "First Big Trial in Opioid Crisis Set to Kick Off in Oklahoma". Wall Street Journal. ISSN 0099-9660. Retrieved May 28, 2019.

- Howard, Jacqueline; Drash, Wayne (August 26, 2019). "Oklahoma wins case against drugmaker in historic opioid trial". CNN. Retrieved August 26, 2019.

- "Johnson & Johnson to Pay Ohio Counties $20.4M Opioid Settlement". www.usnews.com.

- Randazzo, Sara (October 1, 2019). "Johnson & Johnson Agrees to Settle Ohio Opioid Lawsuits for $20.4 Million". Wall Street Journal. New York NY: Dow Jones and Company.

External links

| Wikimedia Commons has media related to Johnson & Johnson. |

- Business data for Johnson & Johnson: