OPEC

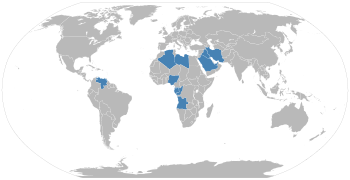

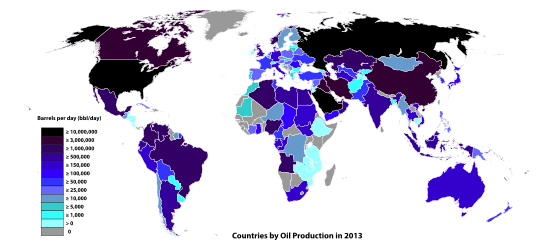

The Organization of the Petroleum Exporting Countries (OPEC, /ˈoʊpɛk/ OH-pek) is an intergovernmental organization of 13 nations. Founded on 14 September 1960 in Baghdad by the first five members (Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela), it has since 1965 been headquartered in Vienna, Austria. As of September 2018, the 13 member countries accounted for an estimated 44 percent of global oil production and 81.5 percent of the world's "proven" oil reserves, giving OPEC a major influence on global oil prices that were previously determined by the so-called "Seven Sisters" grouping of multinational oil companies. A larger group called OPEC+ was formed in late 2016, to have more control on global crude oil market.[5] Due to the COVID-19 pandemic the demand for OPEC oil has fallen to a 30-year low in second quarter of 2020.[6]

Organization of the Petroleum Exporting Countries (OPEC) | |

|---|---|

Flag | |

| |

| Headquarters | Vienna, Austria |

| Official language | English |

| Type | International cartel[1] |

| Membership | |

| Leaders | |

| Mohammed Barkindo | |

| Establishment | Baghdad, Iraq |

• Statute | September 1960 |

• In effect | January 1961 |

| Currency | Indexed as USD per barrel (US$/bbl) |

Website OPEC.org | |

The stated mission of the organization is to "coordinate and unify the petroleum policies of its member countries and ensure the stabilization of oil markets, in order to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers, and a fair return on capital for those investing in the petroleum industry."[7] The organization is also a significant provider of information about the international oil market. The current OPEC members are the following: Algeria, Angola, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, the Republic of the Congo, Saudi Arabia (the De facto leader), the United Arab Emirates and Venezuela. Former OPEC members are Ecuador, Indonesia and Qatar.[8]

The formation of OPEC marked a turning point toward national sovereignty over natural resources, and OPEC decisions have come to play a prominent role in the global oil market and international relations. The effect can be particularly strong when wars or civil disorders lead to extended interruptions in supply. In the 1970s, restrictions in oil production led to a dramatic rise in oil prices and in the revenue and wealth of OPEC, with long-lasting and far-reaching consequences for the global economy. In the 1980s, OPEC began setting production targets for its member nations; generally, when the targets are reduced, oil prices increase. This has occurred most recently from the organization's 2008, and 2016 decisions to trim oversupply.

Economists often cite OPEC as a textbook example of a cartel that cooperates to reduce market competition, but one whose consultations are protected by the doctrine of state immunity under international law. In December 2014, "OPEC and the oil men" ranked as #3 on Lloyd's list of "the top 100 most influential people in the shipping industry".[9] However, the influence of OPEC on international trade is periodically challenged by the expansion of non-OPEC energy sources, and by the recurring temptation for individual OPEC countries to exceed production targets and pursue conflicting self-interests.

In October 2019, Saudi Arabia invited Brazil to join OPEC.[10] The president of Petrobras, Roberto Castello Branco, in an interview in New York, said that being a member of OPEC is not an option currently considered by the Brazilian federal government.[11]

History and impact

Post-WWII situation

In 1949, Venezuela and Iran took the earliest steps in the direction of OPEC, by inviting Iraq, Kuwait and Saudi Arabia to improve communication among petroleum-exporting nations as the world recovered from World War II.[12] At the time, some of the world's largest oil fields were just entering production in the Middle East. The United States had established the Interstate Oil Compact Commission to join the Texas Railroad Commission in limiting overproduction. The US was simultaneously the world's largest producer and consumer of oil; and the world market was dominated by a group of multinational companies known as the "Seven Sisters", five of which were headquartered in the US following the breakup of John D. Rockefeller's original Standard Oil monopoly. Oil-exporting countries were eventually motivated to form OPEC as a counterweight to this concentration of political and economic power.[13]

1959–1960 anger from exporting countries

In February 1959, as new supplies were becoming available, the multinational oil companies (MOCs) unilaterally reduced their posted prices for Venezuelan and Middle Eastern crude oil by 10 percent. Weeks later, the Arab League's first Arab Petroleum Congress convened in Cairo, Egypt, where the influential journalist Wanda Jablonski introduced Saudi Arabia's Abdullah Tariki to Venezuela's observer Juan Pablo Pérez Alfonzo, representing the two then-largest oil-producing nations outside the United States and the Soviet Union. Both oil ministers were angered by the price cuts, and the two led their fellow delegates to establish the Maadi Pact or Gentlemen's Agreement, calling for an "Oil Consultation Commission" of exporting countries, to which MOCs should present price-change plans. Jablonski reported a marked hostility toward the West and a growing outcry against "absentee landlordism" of the MOCs, which at the time controlled all oil operations within the exporting countries and wielded enormous political influence. In August 1960, ignoring the warnings, and with the US favoring Canadian and Mexican oil for strategic reasons, the MOCs again unilaterally announced significant cuts in their posted prices for Middle Eastern crude oil.[12][13][14][15]

1960–1975 founding and expansion

(2009 building)

The following month, during 10–14 September 1960, the Baghdad Conference was held at the initiative of Tariki, Pérez Alfonzo, and Iraqi prime minister Abd al-Karim Qasim, whose country had skipped the 1959 congress.[16] Government representatives from Iran, Iraq, Kuwait, Saudi Arabia and Venezuela met in Baghdad to discuss ways to increase the price of crude oil produced by their countries, and ways to respond to unilateral actions by the MOCs. Despite strong US opposition: "Together with Arab and non-Arab producers, Saudi Arabia formed the Organization of Petroleum Export Countries (OPEC) to secure the best price available from the major oil corporations."[17] The Middle Eastern members originally called for OPEC headquarters to be in Baghdad or Beirut, but Venezuela argued for a neutral location, and so the organization chose Geneva, Switzerland. On 1 September 1965, OPEC moved to Vienna, Austria, after Switzerland declined to extend diplomatic privileges.[18]

During 1961–1975, the five founding nations were joined by Qatar (1961), Indonesia (1962–2008, rejoined 2014-2016), Libya (1962), United Arab Emirates (originally just the Emirate of Abu Dhabi, 1967), Algeria (1969), Nigeria (1971), Ecuador (1973–1992, 2007-2020), and Gabon (1975–1994, rejoined 2016).[2] By the early 1970s, OPEC's membership accounted for more than half of worldwide oil production. Indicating that OPEC is not averse to further expansion, Mohammed Barkindo, OPEC's Acting Secretary General in 2006, urged his African neighbors Angola and Sudan to join,[20] and Angola did in 2007, followed by Equatorial Guinea in 2017.[3] Since the 1980s, representatives from Egypt, Mexico, Norway, Oman, Russia, and other oil-exporting nations have attended many OPEC meetings as observers, as an informal mechanism for coordinating policies.[21]

In 1971, an accord was signed between major oil companies and members of OPEC doing business in the Mediterranean Sea region, called the Tripoli Agreement. The agreement, signed on 2 April 1971, raised oil prices and increased producing countries' profit shares.[22]

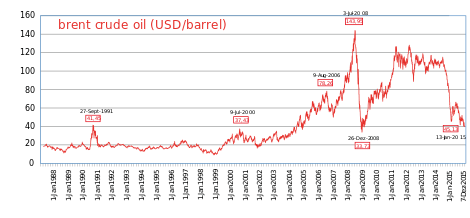

1973–1974 oil embargo

In October 1973, the Organization of Arab Petroleum Exporting Countries (OAPEC, consisting of the Arab majority of OPEC plus Egypt and Syria) declared significant production cuts and an oil embargo against the United States and other industrialized nations that supported Israel in the Yom Kippur War.[23][24] A previous embargo attempt was largely ineffective in response to the Six-Day War in 1967.[25] However, in 1973, the result was a sharp rise in oil prices and OPEC revenues, from US$3/bbl to US$12/bbl, and an emergency period of energy rationing, intensified by panic reactions, a declining trend in US oil production, currency devaluations,[24] and a lengthy UK coal-miners dispute. For a time, the UK imposed an emergency three-day workweek.[26] Seven European nations banned non-essential Sunday driving.[27] US gas stations limited the amount of gasoline that could be dispensed, closed on Sundays, and restricted the days when gasoline could be purchased, based on license plate numbers.[28][29] Even after the embargo ended in March 1974, following intense diplomatic activity, prices continued to rise. The world experienced a global economic recession, with unemployment and inflation surging simultaneously, steep declines in stock and bond prices, major shifts in trade balances and petrodollar flows, and a dramatic end to the post-WWII economic boom.[30][31]

The 1973–1974, oil embargo had lasting effects on the United States and other industrialized nations, which established the International Energy Agency in response, as well as national emergency stockpiles designed to withstand months of future supply disruptions. Oil conservation efforts included lower speed limits on highways, smaller and more energy-efficient cars and appliances, year-round daylight saving time, reduced usage of heating and air-conditioning, better insulation, increased support of mass transit, and greater emphasis on coal, natural gas, ethanol, nuclear and other alternative energy sources. These long-term efforts became effective enough that US oil consumption would rise only 11 percent during 1980–2014, while real GDP rose 150 percent. But in the 1970s, OPEC nations demonstrated convincingly that their oil could be used as both a political and economic weapon against other nations, at least in the short term.[24][32][33][34][35]

But the embargo also meant that a section of the Non-Aligned Movement saw power as a source of hope for their developing countries. The Algerian president Houari Boumédiène expressed this hope in a speech at the UN's 6th Special Session in April 1974:

The OPEC action is really the first illustration and at the same time the most concrete and most spectacular illustration of the importance of raw material prices for our countries, the vital need for the producing countries to operate the levers of price control, and lastly, the great possibilities of a union of raw material producing countries. This action should be viewed by the developing countries as an example and a source of hope.[36]

1975–1980 Special Fund, now OFID

OPEC's international aid activities date from well before the 1973–1974 oil price surge. For example, the Kuwait Fund for Arab Economic Development has operated since 1961.[37]

In the years after 1973, as an example of so-called "checkbook diplomacy", certain Arab nations have been among the world's largest providers of foreign aid,[38][39] and OPEC added to its goals the selling of oil for the socio-economic growth of poorer nations. The OPEC Special Fund was conceived in Algiers, Algeria, in March 1975, and was formally established the following January. "A Solemn Declaration 'reaffirmed the natural solidarity which unites OPEC countries with other developing countries in their struggle to overcome underdevelopment,' and called for measures to strengthen cooperation between these countries... [The OPEC Special Fund's] resources are additional to those already made available by OPEC states through a number of bilateral and multilateral channels."[40] The Fund became an official international development agency in May 1980 and was renamed the OPEC Fund for International Development (OFID),[41] with Permanent Observer status at the United Nations.[42]

1975 hostage siege

On 21 December 1975, Saudi Arabia's Ahmed Zaki Yamani, Iran's Jamshid Amuzegar, and the other OPEC oil ministers were taken hostage at their semi-annual conference in Vienna, Austria. The attack, which killed three non-ministers, was orchestrated by a six-person team led by Venezuelan militant "Carlos the Jackal", and which included Gabriele Kröcher-Tiedemann and Hans-Joachim Klein. The self-named "Arm of the Arab Revolution" group declared its goal to be the liberation of Palestine. Carlos planned to take over the conference by force and hold for ransom all eleven attending oil ministers, except for Yamani and Amuzegar who were to be executed.[43]

Carlos arranged bus and plane travel for his team and 42 of the original 63 hostages, with stops in Algiers and Tripoli, planning to fly eventually to Baghdad, where Yamani and Amuzegar were to be killed. All 30 non-Arab hostages were released in Algiers, excluding Amuzegar. Additional hostages were released at another stop in Tripoli before returning to Algiers. With only 10 hostages remaining, Carlos held a phone conversation with Algerian President Houari Boumédienne, who informed Carlos that the oil ministers' deaths would result in an attack on the plane. Boumédienne must also have offered Carlos asylum at this time and possibly financial compensation for failing to complete his assignment. Carlos expressed his regret at not being able to murder Yamani and Amuzegar, then he and his comrades left the plane. All the hostages and terrorists walked away from the situation, two days after it began.[43]

Some time after the attack, Carlos's accomplices revealed that the operation was commanded by Wadie Haddad, a founder of the Popular Front for the Liberation of Palestine. They also claimed that the idea and funding came from an Arab president, widely thought to be Muammar al-Gaddafi of Libya, itself an OPEC member. Fellow militants Bassam Abu Sharif and Klein claimed that Carlos received and kept a ransom between US$20 million and US$50 million from "an Arab president". Carlos claimed that Saudi Arabia paid ransom on behalf of Iran, but that the money was "diverted en route and lost by the Revolution".[43][44] He was finally captured in 1994 and is serving life sentences for at least 16 other murders.[45]

1979–1980 oil crisis and 1980s oil glut

In response to a wave of oil nationalizations and the high prices of the 1970s, industrial nations took steps to reduce their dependence on OPEC oil, especially after prices reached new peaks approaching US$40/bbl in 1979–1980[48][49] when the Iranian Revolution and Iran–Iraq War disrupted regional stability and oil supplies. Electric utilities worldwide switched from oil to coal, natural gas, or nuclear power;[50] national governments initiated multibillion-dollar research programs to develop alternatives to oil;[51][52] and commercial exploration developed major non-OPEC oilfields in Siberia, Alaska, the North Sea, and the Gulf of Mexico.[53] By 1986, daily worldwide demand for oil dropped by 5 million barrels, non-OPEC production rose by an even-larger amount,[54] and OPEC's market share sank from approximately 50 percent in 1979 to less than 30 percent in 1985. Illustrating the volatile multi-year timeframes of typical market cycles for natural resources, the result was a six-year decline in the price of oil, which culminated by plunging more than half in 1986 alone.[55] As one oil analyst summarized succinctly: "When the price of something as essential as oil spikes, humanity does two things: finds more of it and finds ways to use less of it."

To combat falling revenue from oil sales, in 1982 Saudi Arabia pressed OPEC for audited national production quotas in an attempt to limit output and boost prices. When other OPEC nations failed to comply, Saudi Arabia first slashed its own production from 10 million barrels daily in 1979–1981 to just one-third of that level in 1985. When even this proved ineffective, Saudi Arabia reversed course and flooded the market with cheap oil, causing prices to fall below US$10/bbl and higher-cost producers to become unprofitable.[54][56]:127–128,136–137 Faced with increasing economic hardship (which ultimately contributed to the collapse of the Soviet bloc in 1989),[57][58] the "free-riding" oil exporters that had previously failed to comply with OPEC agreements finally began to limit production to shore up prices, based on painstakingly negotiated national quotas that sought to balance oil-related and economic criteria since 1986.[54][59] (Within their sovereign-controlled territories, the national governments of OPEC members are able to impose production limits on both government-owned and private oil companies.)[60] Generally when OPEC production targets are reduced, oil prices increase.[61]

1990–2003 ample supply and modest disruptions

Leading up to his August 1990 Invasion of Kuwait, Iraqi President Saddam Hussein was pushing OPEC to end overproduction and to send oil prices higher, in order to help OPEC members financially and to accelerate rebuilding from the 1980–1988 Iran–Iraq War.[64] But these two Iraqi wars against fellow OPEC founders marked a low point in the cohesion of the organization, and oil prices subsided quickly after the short-term supply disruptions. The September 2001 Al Qaeda attacks on the US and the March 2003 US invasion of Iraq had even milder short-term impacts on oil prices, as Saudi Arabia and other exporters again cooperated to keep the world adequately supplied.[63]

In the 1990s, OPEC lost its two newest members, who had joined in the mid-1970s. Ecuador withdrew in December 1992, because it was unwilling to pay the annual US$2 million membership fee and felt that it needed to produce more oil than it was allowed under the OPEC quota,[65] although it rejoined in October 2007. Similar concerns prompted Gabon to suspend membership in January 1995;[66] it rejoined in July 2016.[2] Iraq has remained a member of OPEC since the organization's founding, but Iraqi production was not a part of OPEC quota agreements from 1998 to 2016, due to the country's daunting political difficulties.[67][68]

Lower demand triggered by the 1997–1998 Asian financial crisis saw the price of oil fall back to 1986 levels. After oil slumped to around US$10/bbl, joint diplomacy achieved a gradual slowing of oil production by OPEC, Mexico and Norway.[69] After prices slumped again in Nov. 2001, OPEC, Norway, Mexico, Russia, Oman and Angola agreed to cut production on 1 Jan. 2002 for 6 months. OPEC contributed 1.5 million barrels a day (mbpd) to the approximately 2 mbpd of cuts announced.[56]

In June 2003, the International Energy Agency (IEA) and OPEC held their first joint workshop on energy issues. They have continued to meet regularly since then, "to collectively better understand trends, analysis and viewpoints and advance market transparency and predictability."[70]

2003–2011 volatility

Widespread insurgency and sabotage occurred during the 2003–2008 height of the American occupation of Iraq, coinciding with rapidly increasing oil demand from China and commodity-hungry investors, recurring violence against the Nigerian oil industry, and dwindling spare capacity as a cushion against potential shortages. This combination of forces prompted a sharp rise in oil prices to levels far higher than those previously targeted by OPEC.[71][72][73] Price volatility reached an extreme in 2008, as WTI crude oil surged to a record US$147/bbl in July and then plunged back to US$32/bbl in December, during the worst global recession since World War II.[74] OPEC's annual oil export revenue also set a new record in 2008, estimated around US$1 trillion, and reached similar annual rates in 2011–2014 (along with extensive petrodollar recycling activity) before plunging again.[47] By the time of the 2011 Libyan Civil War and Arab Spring, OPEC started issuing explicit statements to counter "excessive speculation" in oil futures markets, blaming financial speculators for increasing volatility beyond market fundamentals.[75]

In May 2008, Indonesia announced that it would leave OPEC when its membership expired at the end of that year, having become a net importer of oil and being unable to meet its production quota.[76] A statement released by OPEC on 10 September 2008 confirmed Indonesia's withdrawal, noting that OPEC "regretfully accepted the wish of Indonesia to suspend its full membership in the organization, and recorded its hope that the country would be in a position to rejoin the organization in the not-too-distant future."[77]

2008 production dispute

The differing economic needs of OPEC member states often affect the internal debates behind OPEC production quotas. Poorer members have pushed for production cuts from fellow members, to increase the price of oil and thus their own revenues.[78] These proposals conflict with Saudi Arabia's stated long-term strategy of being a partner with the world's economic powers to ensure a steady flow of oil that would support economic expansion.[79] Part of the basis for this policy is the Saudi concern that overly expensive oil or unreliable supply will drive industrial nations to conserve energy and develop alternative fuels, curtailing the worldwide demand for oil and eventually leaving unneeded barrels in the ground.[80] To this point, Saudi Oil Minister Yamani famously remarked in 1973: "The Stone Age didn't end because we ran out of stones."[81]

On 10 September 2008, with oil prices still near US$100/bbl, a production dispute occurred when the Saudis reportedly walked out of a negotiating session where rival members voted to reduce OPEC output. Although Saudi delegates officially endorsed the new quotas, they stated anonymously that they would not observe them. The New York Times quoted one such delegate as saying: "Saudi Arabia will meet the market's demand. We will see what the market requires and we will not leave a customer without oil. The policy has not changed."[82] Over the next few months, oil prices plummeted into the $30s, and did not return to $100 until the Libyan Civil War in 2011.[83]

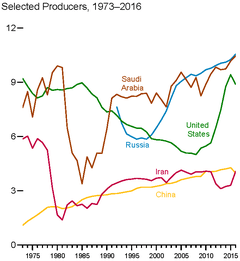

2014–2017 oil glut

(million barrels per day, 1973–2016)

During 2014–2015, OPEC members consistently exceeded their production ceiling, and China experienced a slowdown in economic growth. At the same time, US oil production nearly doubled from 2008 levels and approached the world-leading "swing producer" volumes of Saudi Arabia and Russia, due to the substantial long-term improvement and spread of shale "fracking" technology in response to the years of record oil prices. These developments led in turn to a plunge in US oil import requirements (moving closer to energy independence), a record volume of worldwide oil inventories, and a collapse in oil prices that continued into early 2016.[83][85][86]

In spite of global oversupply, on 27 November 2014 in Vienna, Saudi Oil Minister Ali Al-Naimi blocked appeals from poorer OPEC members for production cuts to support prices. Naimi argued that the oil market should be left to rebalance itself competitively at lower price levels, strategically rebuilding OPEC's long-term market share by ending the profitability of high-cost US shale oil production.[87] As he explained in an interview:[88]

Is it reasonable for a highly efficient producer to reduce output, while the producer of poor efficiency continues to produce? That is crooked logic. If I reduce, what happens to my market share? The price will go up and the Russians, the Brazilians, US shale oil producers will take my share... We want to tell the world that high-efficiency producing countries are the ones that deserve market share. That is the operative principle in all capitalist countries... One thing is for sure: Current prices [roughly US$60/bbl] do not support all producers.

A year later, when OPEC met in Vienna on 4 December 2015, the organization had exceeded its production ceiling for 18 consecutive months, US oil production had declined only slightly from its peak, world markets appeared to be oversupplied by at least 2 million barrels per day despite war-torn Libya pumping 1 million barrels below capacity, oil producers were making major adjustments to withstand prices as low as the $40s, Indonesia was rejoining the export organization, Iraqi production had surged after years of disorder, Iranian output was poised to rebound with the lifting of international sanctions, hundreds of world leaders at the Paris Climate Agreement were committing to limit carbon emissions from fossil fuels, and solar technologies were becoming steadily more competitive and prevalent. In light of all these market pressures, OPEC decided to set aside its ineffective production ceiling until the next ministerial conference in June 2016.[89][86][90][91][92][93] By 20 January 2016, the OPEC Reference Basket was down to US$22.48/bbl – less than one-fourth of its high from June 2014 ($110.48), less than one-sixth of its record from July 2008 ($140.73), and back below the April 2003 starting point ($23.27) of its historic run-up.[83]

As 2016 continued, the oil glut was partially trimmed with significant production offline in the US, Canada, Libya, Nigeria and China, and the basket price gradually rose back into the $40s. OPEC regained a modest percentage of market share, saw the cancellation of many competing drilling projects, maintained the status quo at its June conference, and endorsed "prices at levels that are suitable for both producers and consumers", although many producers were still experiencing serious economic difficulties.[94][95][96][97]

2017–2020 production cut and OPEC+

As OPEC members grew weary of a multi-year supply-contest with diminishing returns and shrinking financial reserves, the organization finally attempted its first production cut since 2008. Despite many political obstacles, a September 2016 decision to trim approximately 1 million barrels per day was codified by a new quota-agreement at the November 2016 OPEC conference. The agreement (which exempted disruption-ridden members Libya and Nigeria) covered the first half of 2017 – alongside promised reductions from Russia and ten other non-members, offset by expected increases in the US shale-sector, Libya, Nigeria, spare capacity, and surging late-2016 OPEC production before the cuts took effect. Indonesia announced another "temporary suspension" of its OPEC membership rather than accepting the organization's requested 5-percent production-cut. Prices fluctuated around US$50/bbl, and in May 2017 OPEC decided to extend the new quotas through March 2018, with the world waiting to see if and how the oil-inventory glut might be fully siphoned-off by then.[98][99][100][101][102][103][3] Longtime oil analyst Daniel Yergin "described the relationship between OPEC and shale as 'mutual coexistence', with both sides learning to live with prices that are lower than they would like."[104] These production cut deals with non-OPEC countries are generally referred to as OPEC+.[105][106]

In December 2017, Russia and OPEC agreed to extend the production cut of 1.8million barrels/day until the end of 2018.[107][108]

Qatar announced it would withdraw from OPEC effective 1 January 2019.[109] According to the New York Times, this constitutes a strategic response to the ongoing Qatar blockade by Saudi Arabia, United Arab Emirates, Bahrain, and Egypt.[110]

On 29 June 2019, Russia again agreed with Saudi Arabia to extend by six to nine months the original production cuts of 2018.[111]

In October 2019 Ecuador announced it would withdraw from OPEC on January 1, 2020 due to financial problems facing the country.[112]

In December 2019 OPEC and Russia agreed one of the deepest output cuts so far to prevent oversupply in a deal that will last for the first three months of 2020.[113]

2020 Saudi-Russian price war

In early March 2020, OPEC officials presented an ultimatum to Russia to cut production by 1.5% of world supply. Russia, which foresaw continuing cuts as American shale oil production increased, rejected the demand, ending the three-year partnership between OPEC and major non-OPEC providers.[114] Another factor was weakening global demand resulting from the COVID-19 pandemic.[115] This also resulted in 'OPEC plus' failing to extend the agreement cutting 2.1 million barrels per day that was set to expire at the end of March. Saudi Arabia, which has absorbed a disproportionate amount of the cuts to convince Russia to stay in the agreement, notified its buyers on 7 March that they would raise output and discount their oil in April. This prompted a Brent crude price crash of more than 30% before a slight recovery and widespread turmoil in financial markets.[114]

Several pundits saw this as a Saudi-Russian price war, or game of chicken which cause the "other side to blink first".[116][117][118][119] Saudi Arabia had in March 2020 $500 billion of foreign exchange reserves, while at that time Russia's reserves were $580 billion. The debt-to-GDP ratio of the Saudis was 25%, while the Russian ratio was 15%.[116] Another remarked that the Saudis can produce oil at as low a price as $3 per barrel, whereas Russia needs $30 per barrel to cover production costs.[119] Another analyst claims that "it’s about assaulting the Western economy, especially America’s."[118] In order to ward of from the oil exporters price war which can make shale oil production uneconomical, US may protect its crude oil market share by passing the NOPEC bill.[120]

On April 2020, OPEC and a group of other oil producers, including Russia, agreed to extend production cuts until the end of July. The cartel and its allies agreed to cut oil production in May and June by 9.7m barrels a day, equal to around 10% of global output, in an effort to prop up prices, which had previously fallen to record lows.[121]

Membership

Current member countries

As of January 2020, OPEC has 13 member countries: five in the Middle East (Western Asia), seven in Africa, and one in South America. According to the U.S. Energy Information Administration (EIA), OPEC's combined rate of oil production (including gas condensate) represented 44 percent of the world's total in 2016,[122] and OPEC accounted for 81.5 percent of the world's "proven" oil reserves.

Approval of a new member country requires agreement by three-quarters of OPEC's existing members, including all five of the founders.[123] In October 2015, Sudan formally submitted an application to join,[124] but it is not yet a member.

Qatar left OPEC on 1 January 2019, after joining the organization in 1961, to focus on natural gas production, of which it is the world's largest exporter in the form of liquified natural gas (LNG).[125][126]

Ecuador announced that it would leave OPEC on 1 January 2020.[127] Ecuador's Ministry of Energy and Non-Renewable Natural Resources released an official statement on 2 January 2020 which confirmed that Ecuador had left OPEC,[4] though it was still listed as a member state on OPEC's website as of 7 January.[2]

| Country | Region | Membership Years[2][3] | Population (2018 est.)[128][129] |

Area (km2)[130] |

Oil Production (bbl/day, 2016)[upper-alpha 1][122] |

Proven Reserves (bbl, 2016)[upper-alpha 1][131] |

|---|---|---|---|---|---|---|

| North Africa | 1969– | 42,228,408 | 2,381,740 | 1,348,361 | 12,200,000,000 | |

| Southern Africa | 2007– | 30,809,787 | 1,246,700 | 1,769,615 | 8,423,000,000 | |

| Central Africa | 2017– | 1,308,975 | 28,050 | ... | ... | |

| Central Africa | 1975–1995, 2016– | 2,119,275 | 267,667 | 210,820 | 2,000,000,000 | |

| Middle East | 1960[upper-alpha 2]– | 81,800,188 | 1,648,000 | 3,990,956 | 157,530,000,000 | |

| Middle East | 1960[upper-alpha 2]– | 38,433,600 | 437,072 | 4,451,516 | 143,069,000,000 | |

| Middle East | 1960[upper-alpha 2]– | 4,137,312 | 17,820 | 2,923,825 | 101,500,000,000 | |

| North Africa | 1962– | 6,678,559 | 1,759,540 | 384,686 | 48,363,000,000 | |

| West Africa | 1971– | 195,874,685 | 923,768 | 1,999,885 | 37,070,000,000 | |

| Central Africa | 2018[132]– | 5,125,821 | 342,000 | 260,000 | 1,600,000,000 | |

| Middle East | 1960[upper-alpha 2]– | 33,702,756 | 2,149,690 | 10,460,710 | 266,578,000,000 | |

| Middle East | 1967[upper-alpha 3]– | 9,630,959 | 83,600 | 3,106,077 | 97,800,000,000 | |

| South America | 1960[upper-alpha 2]– | 28,887,118 | 912,050 | 2,276,967 | 299,953,000,000 | |

| OPEC Total | 483,630,000 | 12,492,695 | 35,481,740 | 1,210,703,000,000 | ||

| World Total | 7,806,610,000 | 510,072,000 | 80,622,287[133] | 1,650,585,000,000 | ||

| OPEC Percent | 6.3% | 2.4% | 44% | 73% | ||

- One petroleum barrel (bbl) is approximately 42 U.S. gallons, or 159 liters, or 0.159 m3, varying slightly with temperature. To put the production numbers in context, a supertanker typically holds 2,000,000 barrels (320,000 m3),[134] and the world's current production rate would take approximately 56 years to exhaust the world's current proven reserves.

- The five founding members attended the first OPEC conference in September 1960.

- The UAE was founded in December 1971. Its OPEC membership originated with the Emirate of Abu Dhabi.

Lapsed members

| Country | Region | Membership Years[2] | Population (2018 est.)[128][129] |

Area (km2)[130] |

Oil Production (bbl/day, 2016)[122] |

Proven Reserves (bbl, 2016)[131] |

|---|---|---|---|---|---|---|

| South America | 1973–1992, 2007–2020[4] | 17,084,358 | 283,560 | 548,421 | 8,273,000,000 | |

| Southeast Asia | 1962–2008, Jan-Nov 2016 |

267,670,543 | 1,904,569 | 833,667 | 3,692,500,000 | |

| Middle East | 1961–2019[125] | 2,781,682 | 11,437 | 1,522,902 | 25,244,000,000 | |

For countries that export petroleum at relatively low volume, their limited negotiating power as OPEC members would not necessarily justify the burdens imposed by OPEC production quotas and membership costs. Ecuador withdrew from OPEC in December 1992, because it was unwilling to pay the annual US$2 million membership fee and felt that it needed to produce more oil than it was allowed under its OPEC quota at the time,[65] then rejoined in October 2007 before leaving again in January 2020.[4] Similar concerns prompted Gabon to suspend membership in January 1995;[66] it rejoined in July 2016. In May 2008, Indonesia announced that it would leave OPEC when its membership expired at the end of that year, having become a net importer of oil and being unable to meet its production quota.[76] It rejoined the organization in January 2016,[2] but announced another "temporary suspension" of its membership at year-end when OPEC requested a 5 percent production cut.[98]

Some commentators consider that the United States was a de facto member of OPEC during its formal occupation of Iraq, due to its leadership of the Coalition Provisional Authority in 2003–2004.[135][136] But this is not borne out by the minutes of OPEC meetings, as no US representative attended in an official capacity.[137][138]

OPEC+ members

In addition to the OPEC members, the following 10 additional oil exporting countries, led by Russia, are grouped as OPEC+ cartel from the year 2016 as they cooperate in fixing the global crude oil prices by agreeing to production quotas so that global production is below the global demand/consumption.[139][140] OPEC+ countries encourage unnecessary excess capital investment in the global oil sector instead of encouraging their cheaper oil production at lower capital investment.[141][142]

Observers

Since the 1980s, representatives from Egypt, Mexico, Norway, Oman, Russia, and other oil-exporting nations have attended many OPEC meetings as observers. This arrangement serves as an informal mechanism for coordinating policies.[21]

Vienna Group

A number of non-OPEC member countries also participate in the organisation's initiatives such as voluntary supply cuts in order to further bind policy objectives between OPEC and non-OPEC members.[5] This loose grouping of countries includes: Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, Sudan and South Sudan.[143]

Leadership and decision-making

The OPEC Conference is the supreme authority of the organization, and consists of delegations normally headed by the oil ministers of member countries. The chief executive of the organization is the OPEC Secretary General. The Conference ordinarily meets at the Vienna headquarters, at least twice a year and in additional extraordinary sessions when necessary. It generally operates on the principles of unanimity and "one member, one vote", with each country paying an equal membership fee into the annual budget.[123] However, since Saudi Arabia is by far the largest and most-profitable oil exporter in the world, with enough capacity to function as the traditional swing producer to balance the global market, it serves as "OPEC's de facto leader".[89]

International cartel

At various times, OPEC members have displayed apparent anti-competitive cartel behavior through the organization's agreements about oil production and price levels.[144] In fact, economists often cite OPEC as a textbook example of a cartel that cooperates to reduce market competition, as in this definition from OECD's Glossary of Industrial Organisation Economics and Competition Law:[1]

International commodity agreements covering products such as coffee, sugar, tin and more recently oil (OPEC: Organization of Petroleum Exporting Countries) are examples of international cartels which have publicly entailed agreements between different national governments.

OPEC members strongly prefer to describe their organization as a modest force for market stabilization, rather than a powerful anti-competitive cartel. In its defense, the organization was founded as a counterweight against the previous "Seven Sisters" cartel of multinational oil companies, and non-OPEC energy suppliers have maintained enough market share for a substantial degree of worldwide competition.[145] Moreover, because of an economic "prisoner's dilemma" that encourages each member nation individually to discount its price and exceed its production quota,[146] widespread cheating within OPEC often erodes its ability to influence global oil prices through collective action.[147][148]

OPEC has not been involved in any disputes related to the competition rules of the World Trade Organization, even though the objectives, actions, and principles of the two organizations diverge considerably.[149] A key US District Court decision held that OPEC consultations are protected as "governmental" acts of state by the Foreign Sovereign Immunities Act, and are therefore beyond the legal reach of US competition law governing "commercial" acts.[150][151] Despite popular sentiment against OPEC, legislative proposals to limit the organization's sovereign immunity, such as the NOPEC Act, have so far been unsuccessful.[152]

Conflicts

OPEC often has difficulty agreeing on policy decisions because its member countries differ widely in their oil export capacities, production costs, reserves, geological features, population, economic development, budgetary situations, and political circumstances.[88][82] Indeed, over the course of market cycles, oil reserves can themselves become a source of serious conflict, instability and imbalances, in what economists call the "natural resource curse".[153][154] A further complication is that religion-linked conflicts in the Middle East are recurring features of the geopolitical landscape for this oil-rich region.[155][156] Internationally important conflicts in OPEC's history have included the Six-Day War (1967), Yom Kippur War (1973), a hostage siege directed by Palestinian militants (1975), the Iranian Revolution (1979), Iran–Iraq War (1980–1988), Iraqi occupation of Kuwait (1990–1991), September 11 attacks by mostly Saudi hijackers (2001), American occupation of Iraq (2003–2011), Conflict in the Niger Delta (2004–present), Arab Spring (2010–2012), Libyan Crisis (2011–present), and international Embargo against Iran (2012–2016). Although events such as these can temporarily disrupt oil supplies and elevate prices, the frequent disputes and instabilities tend to limit OPEC's long-term cohesion and effectiveness.[157]

Market information

As one area in which OPEC members have been able to cooperate productively over the decades, the organization has significantly improved the quality and quantity of information available about the international oil market. This is especially helpful for a natural-resource industry whose smooth functioning requires months and years of careful planning.

Publications and research

In April 2001, OPEC collaborated with five other international organizations (APEC, Eurostat, IEA, OLADE, UNSD) to improve the availability and reliability of oil data. They launched the Joint Oil Data Exercise, which in 2005 was joined by IEF and renamed the Joint Organisations Data Initiative (JODI), covering more than 90 percent of the global oil market. GECF joined as an eighth partner in 2014, enabling JODI also to cover nearly 90 percent of the global market for natural gas.[158]

Since 2007, OPEC has published the "World Oil Outlook" (WOO) annually, in which it presents a comprehensive analysis of the global oil industry including medium- and long-term projections for supply and demand.[159] OPEC also produces an "Annual Statistical Bulletin" (ASB),[67] and publishes more-frequent updates in its "Monthly Oil Market Report" (MOMR)[160] and "OPEC Bulletin".[161]

Crude oil benchmarks

A "crude oil benchmark" is a standardized petroleum product that serves as a convenient reference price for buyers and sellers of crude oil, including standardized contracts in major futures markets since 1983. Benchmarks are used because oil prices differ (usually by a few dollars per barrel) based on variety, grade, delivery date and location, and other legal requirements.[162][163]

The OPEC Reference Basket of Crudes has been an important benchmark for oil prices since 2000. It is calculated as a weighted average of prices for petroleum blends from the OPEC member countries: Saharan Blend (Algeria), Girassol (Angola), Rabi Light (Gabon), Iran Heavy (Islamic Republic of Iran), Basra Light (Iraq), Kuwait Export (Kuwait), Es Sider (Libya), Bonny Light (Nigeria), Qatar Marine (Qatar), Arab Light (Saudi Arabia), Murban (UAE), and Merey (Venezuela).[164]

North Sea Brent Crude Oil is the leading benchmark for Atlantic basin crude oils, and is used to price approximately two-thirds of the world's traded crude oil. Other well-known benchmarks are West Texas Intermediate (WTI), Dubai Crude, Oman Crude, and Urals oil.[165]

Spare capacity

The US Energy Information Administration, the statistical arm of the US Department of Energy, defines spare capacity for crude oil market management "as the volume of production that can be brought on within 30 days and sustained for at least 90 days... OPEC spare capacity provides an indicator of the world oil market's ability to respond to potential crises that reduce oil supplies."[61]

In November 2014, the International Energy Agency (IEA) estimated that OPEC's "effective" spare capacity, adjusted for ongoing disruptions in countries like Libya and Nigeria, was 3.5 million barrels per day (560,000 m3/d) and that this number would increase to a peak in 2017 of 4.6 million barrels per day (730,000 m3/d).[166] By November 2015, the IEA changed its assessment "with OPEC's spare production buffer stretched thin, as Saudi Arabia – which holds the lion's share of excess capacity – and its [Persian] Gulf neighbours pump at near-record rates."[167]

See also

References

- "Glossary of Industrial Organization Economics and Competition Law" (PDF). OECD. 1993. p. 19. Archived (PDF) from the original on 4 March 2016. Retrieved 22 December 2015.

- "Member Countries". OPEC. Archived from the original on 7 January 2020. Retrieved 7 January 2020.

- "OPEC 172nd Meeting concludes". OPEC (Press release). 11 March 2019. Archived from the original on 27 May 2017. Retrieved 26 May 2017.

- "Comunicado Oficial" [Official Statement] (Press release) (in Spanish). Metropolitan District of Quito, Ecuador: Ministry of Energy and Non-Renewable Natural Resources. 2 January 2020. Archived from the original on 7 January 2020. Retrieved 6 January 2020.

- Cohen, Ariel. "OPEC Is Dead, Long Live OPEC+". Forbes. Archived from the original on 2 August 2019. Retrieved 2 August 2019.

- "Demand For OPEC Oil Falls To 30-Year Low". Retrieved 16 April 2020.

- "Our Mission". OPEC. Archived from the original on 11 February 2013. Retrieved 16 February 2013.

- "OPEC : Member Countries". www.opec.org. Retrieved 22 April 2020.

- "Top 100 Most Influential People in the Shipping Industry: 3. OPEC and the oil men". Lloyd's List. 12 December 2014. Archived from the original on 19 December 2014. Retrieved 19 December 2014.

- Lazarini, Jader (30 October 2019). "Exportador de petróleo, Brazil is invited to join OPEC, says Bolsonaro". Suno Notícias (in Portuguese). Retrieved 10 March 2020.

- "Joining Opep is not an option for Brazil, says Petrobras". InfoMoney (in Portuguese). 5 December 2019. Retrieved 10 March 2020.

- "General Information" (PDF). OPEC. May 2012. Archived (PDF) from the original on 13 April 2014. Retrieved 13 April 2014.

- Yergin, Daniel (1991). The Prize: The Epic Quest for Oil, Money, and Power. New York: Simon & Schuster. pp. 499–503. ISBN 978-0671502485.

- Painter, David S. (2012). "Oil and the American Century" (PDF). The Journal of American History. 99 (1): 24–39. doi:10.1093/jahist/jas073. Archived (PDF) from the original on 10 October 2014. Retrieved 4 May 2013.

- Vassiliou, M.S. (2009). Historical Dictionary of the Petroleum Industry. Scarecrow Press. p. 7. ISBN 978-0810862883.

- Styan, David (2006). France and Iraq: Oil, Arms and French Policy Making in the Middle East. I.B. Tauris. p. 74. ISBN 978-1845110451.

- Citino, Nathan J. (2002). From Arab Nationalism to OPEC: Eisenhower, King Sa'ud, and the Making of US-Saudi Relations. Bloomington: Indiana University Press. p. 4. ISBN 978-0-253-34095-5.

- Skeet, Ian (1988). OPEC: Twenty-Five Years of Prices and Politics. Cambridge: Cambridge University Press. p. 24. ISBN 9780521405720. Archived from the original on 17 June 2016. Retrieved 17 December 2015.

- "Angola, Sudan to ask for OPEC membership". Associated Press. 3 December 2006. Archived from the original on 4 June 2011. Retrieved 4 December 2006.

- "OPEC: Fifty Years Regulating Oil Market Roller Coaster". Inter Press Service. 14 September 2010. Archived from the original on 24 December 2015. Retrieved 23 December 2015.

- Marius Vassiliou (2009). Historical Dictionary of the Petroleum Industry. Lanham, MD: Scarecrow Press. ISBN 0-8108-5993-9.

- Kumins, Lawrence (1975). "Oil and the Economy". Energy Shock: 189.

- Maugeri, Leonardo (2006). The Age of Oil: The Mythology, History, and Future of the World's Most Controversial Resource. Greenwood Publishing Group. pp. 112–116. ISBN 978-0-275-99008-4. Archived from the original on 1 May 2016. Retrieved 20 June 2015.

- Foreign Relations of the United States, 1964–1968, Vol. XXXIV: Energy Diplomacy and Global Issues, Document 266. US Department of State. 1999. Archived from the original on 4 June 2016. Retrieved 28 April 2016.

- "British Economics and Trade Union politics 1973–1974". The National Archives (UK). January 2005. Archived from the original on 9 June 2007. Retrieved 29 December 2015.

- "Europe car ban becoming a real traffic stopper". Chicago Tribune. 26 November 1973. Archived from the original on 19 February 2016. Retrieved 6 January 2016.

- Frum, David (2000). How We Got Here: The '70s. Basic Books. pp. 313–318. ISBN 978-0-465-04195-4.

- "Gas Fever: Happiness Is a Full Tank". Time. 18 February 1974. Archived from the original on 22 September 2010. Retrieved 30 December 2015.

- Skidelsky, Robert (2009). Keynes: The Return of the Master. Allen Lane. pp. 116–126. ISBN 978-1-84614-258-1.

- Masouros, Pavlos E. (2013). Corporate Law and Economic Stagnation: How Shareholder Value and Short-Termism Contribute to the Decline of the Western Economies. Eleven International Publishing. pp. 60–62.

- "Energy Crisis (1970s)". The History Channel. 2010. Archived from the original on 24 June 2016. Retrieved 25 December 2015.

- Horton, Sarah (October 2000). "The 1973 Oil Crisis" (PDF). Pennsylvania Envirothon. Archived (PDF) from the original on 11 July 2012. Retrieved 16 February 2013.

- "Oil Shock: The role of OPEC". Socialism Today (51). October 2000. Archived from the original on 16 February 2015. Retrieved 30 November 2014.

- Aven, Petr; Nazarov, Vladimir; Lazaryan, Samvel (17 May 2016). "Twilight of the Petrostate". The National Interest. Archived from the original on 22 May 2016. Retrieved 2 June 2016.

- Tony Smith, Configurations of Power in North-South Relations since 1945. Industrial Organization 31:1 (Winter 1977) p. 4

- "Timeline". Kuwait Fund. Archived from the original on 24 December 2015. Retrieved 23 December 2015.

- Oweiss, Ibrahim M. (1990). "Economics of Petrodollars". In Esfandiari, Haleh; Udovitch, A.L. (eds.). The Economic Dimensions of Middle Eastern History. Darwin Press. pp. 179–199. Retrieved 19 October 2016.

- Hubbard, Ben (21 June 2015). "Cables Released by WikiLeaks Reveal Saudis' Checkbook Diplomacy". The New York Times. Archived from the original on 21 December 2016. Retrieved 19 October 2016.

- "About Us". OFID. Archived from the original on 3 January 2016. Retrieved 13 January 2016.

- "The Agreement Establishing the OPEC Fund for International Development" (PDF). OPEC. 27 May 1980. Archived from the original (PDF) on 24 April 2017. Retrieved 12 January 2016.

- "Intergovernmental Organizations". United Nations. Archived from the original on 6 August 2017. Retrieved 28 April 2017.

- Bellamy, Patrick. "Carlos the Jackal: Trail of Terror". truTV. Archived from the original on 7 January 2012.CS1 maint: unfit url (link)

- Follain, John (1998). Jackal: The Complete Story of the Legendary Terrorist, Carlos the Jackal. Arcade Publishing. p. 102. ISBN 978-1559704663. Archived from the original on 3 May 2016. Retrieved 13 January 2016.

- Anderson, Gary (28 March 2017). "'Carlos the Jackal' jailed over 1974 Paris grenade attack". Sky News. Archived from the original on 28 March 2017. Retrieved 22 April 2017.

- "OPEC Revenues Fact Sheet". US Energy Information Administration. 10 January 2006. Archived from the original on 7 January 2008.CS1 maint: unfit url (link)

- "OPEC Revenues Fact Sheet". US Energy Information Administration. 15 May 2017. Archived from the original on 22 December 2015. Retrieved 28 May 2017.

- Mouawad, Jad (3 March 2008). "Oil Prices Pass Record Set in '80s, but Then Recede". The New York Times. Archived from the original on 7 March 2017. Retrieved 11 February 2017.

- Denning, Liam (18 May 2016). "It's Saudi Arabia's World. Big Oil Just Lives In It". Bloomberg News. Archived from the original on 3 February 2017. Retrieved 10 March 2017.

- Toth, Ferenc L.; Rogner, Hans-Holger (January 2006). "Oil and nuclear power: Past, present, and future" (PDF). Energy Economics. 28 (1): 1–25. doi:10.1016/j.eneco.2005.03.004. Archived (PDF) from the original on 3 December 2007. Retrieved 30 December 2015.

- "Renewables in Global Energy Supply: An IEA Fact Sheet" (PDF). International Energy Agency. January 2007. Archived (PDF) from the original on 3 March 2016. Retrieved 30 December 2015.

- "Renewable Energy: World Invests $244 billion in 2012, Geographic Shift to Developing Countries" (Press release). United Nations Environment Programme. 12 June 2013. Archived from the original on 4 March 2016. Retrieved 30 December 2015.

- Bromley, Simon (2013). American Power and the Prospects for International Order. John Wiley & Sons. p. 95. ISBN 9780745658414. Archived from the original on 17 June 2016. Retrieved 30 December 2015.

- Robert, Paul (2004). The End of Oil: The Decline of the Petroleum Economy and the Rise of a New Energy Order. New York: Houghton Mifflin Company. pp. 103–104. ISBN 978-0-618-23977-1.

- Hershey Jr., Robert D. (30 December 1989). "Worrying Anew Over Oil Imports". The New York Times. Archived from the original on 12 June 2017. Retrieved 11 February 2017.

- Al-Naimi, Ali (2016). Out of the Desert. Great Britain: Portfolio Penguin. pp. 201–210, 239. ISBN 9780241279250.

- Gaidar, Yegor (April 2007). "The Soviet Collapse: Grain and Oil" (PDF). American Enterprise Institute. Archived (PDF) from the original on 4 March 2016. Retrieved 12 January 2016.

Oil production in Saudi Arabia increased fourfold, while oil prices collapsed by approximately the same amount in real terms. As a result, the Soviet Union lost approximately $20 billion per year, money without which the country simply could not survive.

- McMaken, Ryan (7 November 2014). "The Economics Behind the Fall of the Berlin Wall". Mises Institute. Archived from the original on 6 March 2016. Retrieved 12 January 2016.

High oil prices in the 1970s propped up the regime so well, that had it not been for Soviet oil sales, it's quite possible the regime would have collapsed a decade earlier.

- "Brief History". OPEC. Archived from the original on 28 February 2013. Retrieved 16 February 2013.

- "Libya orders oil cuts of 270K bpd". Associated Press. 30 December 2008. Archived from the original on 11 December 2015. Retrieved 8 December 2015.

Libya has asked oil companies to slash production by 270,000 barrels per day. Abu Dhabi National Oil Co. told customers in letters dated Dec. 25 that it was cutting ... 10 to 15 percent of all types of ADNOC crude in February. Ecuadorean President Rafael Correa said the South American nation would suspend crude production by Italy's Agip and reduce quotas for other companies to comply with new OPEC cuts.

- "Energy & Financial Markets: What Drives Crude Oil Prices?". US Energy Information Administration. 2014. Archived from the original on 13 December 2014. Retrieved 12 December 2014.

- "Report to Congress: United States Gulf Environmental Technical Assistance". US Environmental Protection Agency. 1991. p. 14. Archived from the original on 24 April 2016. Retrieved 11 April 2016.

- "Europe Brent Crude Oil Spot Price FOB (DOE)". Quandl. Retrieved 1 January 2016.

- Ibrahim, Youssef M. (18 July 1990). "Iraq Threatens Emirates and Kuwait on Oil Glut". The New York Times. Archived from the original on 30 June 2017. Retrieved 11 February 2017.

- "Ecuador Set to Leave OPEC". The New York Times. 18 September 1992. Archived from the original on 14 March 2016. Retrieved 8 April 2016.

- "Gabon Plans To Quit OPEC". The New York Times. 9 January 1995. Archived from the original on 14 March 2016. Retrieved 8 April 2016.

- "Annual Statistical Bulletin". OPEC. Archived from the original on 21 August 2018. Retrieved 31 December 2015.

- "Iraq heads for OPEC clash over quota". UPI. 5 February 2010. Archived from the original on 17 April 2016. Retrieved 6 April 2016.

Iraq, a founding member of OPEC, has not had a production quota since 1998, when it was pegged at 1.3 million bpd to allow Saddam Hussein's regime to sell oil for food during U.N. sanctions imposed in 1990... Despite the success of the 2009 auctions, problems remain – mounting violence in the run-up to March 7 parliamentary elections, uncertainty over their outcome, and, probably more importantly, the absence of a long-delayed oil law that will define revenue-sharing and regulation of the industry.

- Putting a Price on Energy (PDF). Energy Charter Secretariat. 2007. p. 90. ISBN 978-9059480469. Archived (PDF) from the original on 13 April 2016. Retrieved 1 January 2016.

- "Dialogue replaces OPEC–IEA Mistrust" (PDF). IEA Energy (7): 7. November 2014. Archived from the original (PDF) on 2 May 2016.

- Simmons, Greg (7 December 2005). "Dems Doubt Iraq Progress". Fox News. Archived from the original on 5 January 2016. Retrieved 14 January 2016.

- "Oil price 'may hit $200 a barrel'". BBC News. 7 May 2008. Archived from the original on 11 April 2009. Retrieved 2 January 2016.

- Masters, Michael W. (20 May 2008). "Testimony" (PDF). U.S. Senate Committee on Homeland Security and Governmental Affairs. Archived (PDF) from the original on 28 May 2008. Retrieved 2 January 2016.

- Tuttle, Robert; Galal, Ola (10 May 2010). "Oil Ministers See Demand Rising". Bloomberg News. Archived from the original on 6 February 2016. Retrieved 14 January 2016.

- "Opening address to the 159th Meeting of the OPEC Conference". OPEC (Press release). 8 June 2011. Archived from the original on 13 December 2014. Retrieved 12 December 2014.

- "Indonesia to withdraw from OPEC". BBC. 28 May 2008. Archived from the original on 3 December 2013. Retrieved 27 January 2014.

- "149th Meeting of the OPEC Conference". OPEC (Press release). 10 September 2008. Archived from the original on 22 December 2015. Retrieved 16 December 2015.

- Owen, Nick A.; Inderwildi, Oliver R.; King, David A. (August 2010). "The status of conventional world oil reserves: Hype or cause for concern?". Energy Policy. 38 (8): 4743–4749. doi:10.1016/j.enpol.2010.02.026.

- Al-Naimi, Ali (20 October 1999). "Saudi oil policy: stability with strength". Saudi Embassy. Archived from the original on 26 April 2009.CS1 maint: unfit url (link)

- Waldman, Peter (12 April 2015). "Saudi Arabia's Plan to Extend the Age of Oil". Bloomberg News. Archived from the original on 24 February 2017. Retrieved 10 March 2017.

- Frei, Matt (3 July 2008). "Washington diary: Oil addiction". BBC. Archived from the original on 31 October 2013. Retrieved 27 January 2014.

- "Saudis Vow to Ignore OPEC Decision to Cut Production". The New York Times. 11 September 2008. Archived from the original on 4 September 2017. Retrieved 11 February 2017.

- "OPEC Basket Daily Archives". OPEC. Archived from the original on 21 January 2016. Retrieved 21 January 2016.

- "Monthly Energy Review" (PDF). US Energy Information Administration. 25 May 2017. Figure 11.1a. Archived (PDF) from the original on 17 August 2017. Retrieved 28 May 2017.

- Krassnov, Clifford (3 November 2014). "US Oil Prices Fall Below $80 a Barrel". The New York Times. Archived from the original on 16 December 2014. Retrieved 13 December 2014.

- Smith, Grant; Rascouet, Angelina; Mahdi, Wael (4 December 2015). "OPEC Won't Cut Production to Stop Oil's Slump". Bloomberg News. Archived from the original on 28 March 2017. Retrieved 10 March 2017.

- "Inside OPEC room, Naimi declares price war on US shale oil". Reuters. 28 November 2014. Archived from the original on 11 February 2016. Retrieved 13 January 2016.

- "Interview With Saudi Oil Minister Ali Naimi". Middle East Economic Survey. 57 (51/52). 22 December 2014. Archived from the original on 21 December 2015.

- "OPEC discord fuels further oil price drop". The Financial Times. 7 December 2015.

- "Country Analysis Brief: Libya" (PDF). US Energy Information Administration. 19 November 2015. Archived (PDF) from the original on 23 December 2015. Retrieved 22 May 2016.

- "Despite Climate Concerns, OPEC Plans to Keep Pumping Oil While It Can". The New York Times. 5 December 2015. Archived from the original on 28 January 2017. Retrieved 11 February 2017.

- "OPEC ceiling falls in". Argus Media. 7 December 2015. Archived from the original on 8 December 2015. Retrieved 7 December 2015.

- Kalantari, Hashem; Sergie, Mohammed (2 January 2016). "Iran Says Post-Sanctions Crude Output Boost Won't Hurt Prices". Bloomberg News. Archived from the original on 15 January 2016. Retrieved 18 April 2016.

- "OPEC 169th Meeting concludes". OPEC (Press release). 2 June 2016. Archived from the original on 5 June 2016. Retrieved 2 June 2016.

- Halligan, Liam (4 June 2016). "OPEC is very much alive as Saudis learn to tread softly". The Telegraph. Archived from the original on 8 February 2017. Retrieved 4 April 2018.

- "OPEC Has Its Way as China Oil Output Cut by Most in 15 Years". Bloomberg News. 13 June 2016. Archived from the original on 18 January 2017. Retrieved 10 March 2017.

- "North America Rig Count". Baker Hughes. Archived from the original on 2 March 2017. Retrieved 21 February 2017.

- Jensen, Fergus; Asmarini, Wilda (1 December 2016). "Net oil importer Indonesia leaves producer club OPEC, again". Reuters. Archived from the original on 1 December 2016. Retrieved 1 December 2016.

- "OPEC Agrees to Cut Production in Drive to End Record Glut". Bloomberg News. 30 November 2016. Archived from the original on 1 December 2016. Retrieved 30 November 2016.

- "OPEC 171st Meeting concludes". OPEC (Press release). 30 November 2016. Archived from the original on 1 December 2016. Retrieved 30 November 2016.

- Blas, Javier (20 October 2016). "The World's Biggest Oil Kingdom Reverses Course". Bloomberg News. Archived from the original on 6 April 2017. Retrieved 10 March 2017.

- Hume, Neil (28 September 2016). "OPEC agrees on need for output cut". The Financial Times. Archived from the original on 28 September 2016. Retrieved 28 September 2016.

- "Russian Energy Minister Says Oil Cuts to Start in January". Bloomberg News. 11 December 2016. Archived from the original on 13 December 2016. Retrieved 12 December 2016.

- "OPEC Said to Break Bread With Shale in Rare Show of Detente". Bloomberg News. 7 March 2017. Archived from the original on 7 March 2017. Retrieved 8 March 2017.

- "Where OPEC+ Oil Production Stands Now - Bloomberg". Retrieved 19 March 2020.

- "OPEC Is Dead, Long Live OPEC+". Retrieved 19 March 2020.

- "Russia backs gradual, managed exit from oil cuts with OPEC". Reuters. 22 December 2017. Archived from the original on 26 December 2017. Retrieved 25 December 2017.

- "OPEC to extend production cuts throughout 2018". Archived from the original on 24 December 2018. Retrieved 23 December 2018.

- "Qatar to withdraw from OPEC in January 2019". Archived from the original on 3 December 2018.

- "Why is Qatar leaving OPEC?". Archived from the original on 16 December 2018.

- "Russia agrees with Saudi Arabia to extend OPEC+ oil output deal". Reuters. 29 June 2019. Archived from the original on 1 July 2019. Retrieved 1 July 2019.

- "Ecuador to leave OPEC in 2020 due to fiscal problems - ministry". Euronews. 1 October 2019. Archived from the original on 1 October 2019. Retrieved 1 October 2019.

- "OPEC, allies agree to deepen oil output cuts". Reuters. 5 December 2019. Archived from the original on 5 December 2019. Retrieved 5 December 2019.

- Reed, Stanley (9 March 2020). "How a Saudi-Russian Standoff Sent Oil Markets Into a Frenzy". The New York Times. Retrieved 9 March 2020.

- Mufson, Steven; Englund, Will. "Oil price war threatens widespread collateral damage". Washington Post. Retrieved 9 March 2020.

- Reguly, Eric (10 March 2020). "Who will win the Saudi-Russia game of chicken in the new oil war? Russia's chances look good". The Globe and Mail Inc.

- Rees, Tom (10 March 2020). "Russia and Saudi Arabia wait for the other side to blink first in the oil price war". Telegraph Media Group Limited. Daily Telegraph.

- Tertzakian, Peter (9 March 2020). "This crude war is about a lot more than oil prices and market share". Financial Post. Postmedia.

- Powell, Naomi (9 March 2020). "'Game of chicken': Saudis, Russians can wage an oil war for a long time — but at huge political cost". Financial Post. Postmedia.

- "Trump's Ultimate Weapon To End The Oil War". Retrieved 23 March 2020.

- "From The Economist Espresso: Minneapolis to disband its police force; New Zealand eliminates covid-19".

- "Production of Crude Oil including Lease Condensate 2016" (CVS download). US Energy Information Administration. Archived from the original on 27 April 2017. Retrieved 28 May 2017.

- "Statute" (PDF). OPEC. 2012. Archived (PDF) from the original on 21 October 2014. Retrieved 12 December 2014.

- "Sudan awaiting decision on its OPEC membership application: minister". Sudan Tribune. 22 October 2015. Archived from the original on 20 November 2015. Retrieved 19 November 2015.

- Alkhalisi, Zahraa (3 December 2018). "Qatar is pulling out of OPEC to focus on gas". cnn.com. Archived from the original on 3 December 2018. Retrieved 3 December 2018.

- "Qatar quit OPEC because of politics, not oil". The Economist. 6 December 2018. ISSN 0013-0613. Archived from the original on 26 January 2019. Retrieved 25 January 2019.

- Stephan, Kueffner (1 October 2019). "Ecuador to Leave OPEC in January Amid Efforts to Boost Income". bnnbloomberg.ca. Archived from the original on 6 October 2019. Retrieved 6 October 2019.

- ""World Population prospects – Population division"". population.un.org. United Nations Department of Economic and Social Affairs, Population Division. Retrieved 9 November 2019.

- ""Overall total population" – World Population Prospects: The 2019 Revision" (xslx). population.un.org (custom data acquired via website). United Nations Department of Economic and Social Affairs, Population Division. Retrieved 9 November 2019.

- "Field Listing: Area". The World Factbook. Central Intelligence Agency. Archived from the original on 31 January 2014. Retrieved 4 January 2009.

- "Crude Oil Proved Reserves 2016" (CVS download). U.S. Energy Information Administration. Archived from the original on 27 April 2017. Retrieved 28 May 2017.

- Editorial, Reuters. "Congo Republic becomes OPEC oil cartel's newest member". U.K. Archived from the original on 22 June 2018. Retrieved 22 June 2018.

- Excluding condensate oil production of nearly 20 million bbl/day

- Hayler, William B.; Keever, John M. (2003). American Merchant Seaman's Manual. Cornell Maritime Press. p. 14.3. ISBN 978-0-87033-549-5.

- Noah, Timothy (10 July 2007). "Go NOPEC". Slate. Archived from the original on 20 January 2012. Retrieved 21 August 2009.

- Noah, Timothy (18 September 2003). "Is Bremer a Price Fixer? Letting Iraq's oil minister attend an OPEC meeting may violate the Sherman Antitrust Act". Slate. Archived from the original on 4 March 2016. Retrieved 13 January 2016.

- "Iraq to Attend Next OPEC Ministerial Meeting". Arab News. 17 September 2003. Archived from the original on 20 June 2013. Retrieved 16 February 2013.

- "127th Meeting of the OPEC Conference". OPEC (Press release). 24 September 2003. Archived from the original on 4 October 2013. Retrieved 16 February 2013.

- "6 Things You Need to Know About OPEC+". Retrieved 23 March 2020.

- "Oil producers agree to cut production by a tenth". Retrieved 10 April 2020.

- "Is U.S. Energy Dominance Coming To An End?". Retrieved 8 April 2020.

- "Barrel Breakdown". Wall Street Journal. 15 April 2016. Retrieved 8 April 2020.

- "OPEC : OPEC makes history in Vienna". www.opec.org. Archived from the original on 2 August 2019. Retrieved 2 August 2019.

- Gülen, S. Gürcan (1996). "Is OPEC a Cartel? Evidence from Cointegration and Causality Tests" (PDF). The Energy Journal. 17 (2): 43–57. CiteSeerX 10.1.1.133.9886. doi:10.5547/issn0195-6574-ej-vol17-no2-3. Archived from the original on 16 September 2000.CS1 maint: unfit url (link)

- "The Global Energy Scene" (PDF). OPEC Bulletin. 43 (5): 24–41. June–July 2012. Archived (PDF) from the original on 9 September 2016. Retrieved 9 April 2016.

- Browning, Edgar K.; Zupan, Mark A. (2004). "The Prisoner's Dilemma and Cheating by Cartel Members". Microeconomics: Theory & Applications (8th ed.). Wiley. pp. 394–396. ISBN 978-0471678717. Archived from the original on 15 September 2016. Retrieved 5 September 2016.

- Colgan, Jeff (16 June 2014). "OPEC, the Phantom Menace". Washington Post. Archived from the original on 10 November 2016. Retrieved 9 November 2016.

- Van de Graaf, Thijs (2016). "Is OPEC dead? Oil exporters, the Paris agreement and the transition to a post-carbon world" (PDF). Energy Research & Social Science. 23: 182–188. doi:10.1016/j.erss.2016.10.005. hdl:1854/LU-8137111. Archived (PDF) from the original on 25 September 2019. Retrieved 25 September 2019.

- Farah, Paolo Davide; Cima, Elena (September 2013). "Energy Trade and the WTO: Implications for Renewable Energy and the OPEC Cartel". Journal of International Economic Law. 16 (3): 707–740. doi:10.1093/jiel/jgt024. SSRN 2330416.

- Weil, Dan (25 November 2007). "If OPEC Is a Cartel, Why Isn't It Illegal?". Newsmax. Archived from the original on 11 March 2014. Retrieved 27 January 2014.

- Joelson, Mark R.; Griffin, Joseph P. (1975). "The Legal Status of Nation-State Cartels Under United States Antitrust and Public International Law". The International Lawyer. 9 (4): 617–645. JSTOR 40704964.

- Learsy, Raymond J. (10 September 2012). "NOPEC ('No Oil Producing and Exporting Cartels Act'): A Presidential Issue and a Test of Political Integrity". Huffington Post. Archived from the original on 3 June 2017. Retrieved 6 April 2016.

Varied forms of a NOPEC bill have been introduced some 16 times since 1999, only to be vehemently resisted by the oil industry.

- Palley, Thomas I. (December 2003). "Lifting the Natural Resource Curse". Foreign Service Journal. Archived from the original on 20 May 2016. Retrieved 26 April 2016.

- Ross, Michael L. (May 2015). "What Have We Learned about the Resource Curse?" (PDF). Annual Review of Political Science. 18: 239–259. doi:10.1146/annurev-polisci-052213-040359.

- Kessler, Oren (13 February 2016). "The Middle East's Conflicts Are About Religion". The National Interest. Archived from the original on 26 March 2016. Retrieved 17 March 2016.

- Motadel, David (24 May 2015). "'Defending the Faith' in the Middle East". The New York Times. Archived from the original on 8 September 2015. Retrieved 17 March 2016.

- Mattar, Philip, ed. (2004). "Organization of Petroleum Exporting Countries (OPEC)". Encyclopedia of the Modern Middle East and North Africa. 3 (2nd ed.). Detroit: Gale / Macmillan Reference USA. ISBN 978-0028657691. Archived from the original on 9 April 2016. Retrieved 10 April 2016.

- "History of the Joint Organisations Data Initiative". JODI. Archived from the original on 12 October 2015. Retrieved 23 December 2015.

- "World Oil Outlook". OPEC. Archived from the original on 24 December 2015. Retrieved 31 December 2015.

- "Monthly Oil Market Report". OPEC. Archived from the original on 27 December 2015. Retrieved 31 December 2015.

- "OPEC Bulletin". OPEC. Archived from the original on 5 January 2016. Retrieved 31 December 2015.

- "Oil markets explained". BBC News. 18 October 2007. Archived from the original on 13 September 2018. Retrieved 6 April 2016.

- Razavi, Hossein (April 1989). The new era of petroleum trading: spot-oil, spot-related contracts, and futures markets (PDF). The World Bank. pp. 65–69. ISBN 978-0-8213-1199-8. Archived (PDF) from the original on 5 February 2017. Retrieved 4 February 2017.

- "OPEC Basket Price". OPEC. Archived from the original on 1 May 2019. Retrieved 6 January 2017.

- "Brent crude and other oil price benchmarks". Reuters. 5 April 2011. Archived from the original on 25 September 2017. Retrieved 4 April 2018.

- "'Effective' OPEC Spare Capacity: Reality-Based Data" (PDF). IEA Energy (7): 13. November 2014. Archived from the original (PDF) on 2 May 2016.

- "3 billion barrel cushion". Oil Market Report. 13 November 2015. Archived from the original on 22 December 2015. Retrieved 15 December 2015.

Further reading

- Evans, John (1986). OPEC, Its Member States and the World Energy Market. ISBN 978-0810321489.

- Fesharaki, Fereidun (1983). OPEC, the Gulf, and the World Petroleum Market: A Study in Government Policy and Downstream Operations. ISBN 9780367281939.

- Garavini, Giuliano. (2019). The Rise and Fall of OPEC in the Twentieth Century. Oxford University Press.

- Licklider, Roy (1988). "The Power of Oil: The Arab Oil Weapon and the Netherlands, the United Kingdom, Canada, Japan, and the United States" (PDF). International Studies Quarterly. 32 (2): 205–226. doi:10.2307/2600627. JSTOR 2600627.CS1 maint: ref=harv (link)

- Painter, David S (2014). "Oil and geopolitics: The oil crises of the 1970s and the cold war". Historical Social Research/Historische Sozialforschung. 186–208.

- Skeet, Ian (1988). OPEC: Twenty-five Years of Prices and Politics. Cambridge UP. ISBN 978-0521405720

- Yergin, Daniel (1991). The Prize: The Epic Quest for Oil, Money, and Power. ISBN 978-1439110126

External links

| Wikimedia Commons has media related to OPEC. |

.jpg)

.jpg)