Petroleum politics

Petroleum politics have been an increasingly important aspect of diplomacy since the rise of the petroleum industry in the Middle East in the early 20th century. As competition continues for a vital resource, the strategic calculations of major and minor countries alike place prominent emphasis on the pumping, refining, transport, sale and use of petroleum products. However, international climate policy and unconventional oil and gas developments may change the balance of power between petroleum exporting and importing countries with major negative implications expected for the exporting states.[1]

From around 2015 and onwards, there was growing discussion about whether the geopolitics of oil and gas would be replaced by new geopolitical patterns related to access to renewable energy sources such as sun and wind and critical materials for renewable energy technologies.[1][2][3]

Quota agreements

The Achnacarry Agreement or "As-Is Agreement" was an early attempt to restrict petroleum production, signed in Scotland on 17 September 1928.[4] The discovery of the East Texas Oil Field in the 1930s led to a boom in production that caused prices to fall, leading the Railroad Commission of Texas to control production. The Commission retained de facto control of the market until the rise of OPEC in the 1970s.

The Anglo-American Petroleum Agreement of 1944 tried to extend these restrictions internationally but was opposed by the industry in the United States and so Franklin Roosevelt withdrew from the deal.

Venezuela was the first country to move towards the establishment of OPEC by approaching Iran, Gabon, Libya, Kuwait and Saudi Arabia in 1949, but OPEC was not set up until 1960, when the United States forced import quotas on Venezuelan and Persian Gulf oil in order to support the Canadian and Mexican oil industries. OPEC first wielded its power with the 1973 oil embargo against the United States and Western Europe.

Oil and international conflict

The term "petro-aggression" has been used to describe the tendency of oil-rich states to instigate international conflicts.[5] There are many examples including: Iraq's invasion of Iran and Kuwait; Libya's repeated incursions into Chad in the 1970s and 1980s; Iran's long-standing suspicion of Western powers. Some scholars have also suggested that oil-rich states are frequently the targets of "resource wars."

Peak oil

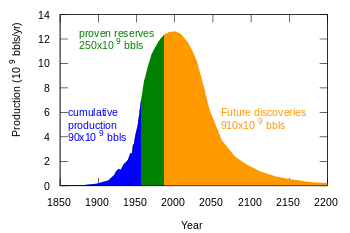

In 1956, a Shell geophysicist named M. King Hubbert accurately predicted that U.S. oil production would peak in 1970.[6]

In June 2006, former U.S. president Bill Clinton said in a speech,[7]

"We may be at a point of peak oil production. You may see $100 a barrel oil in the next two or three years, but what still is driving this globalization is the idea that is you cannot possibly get rich, stay rich and get richer if you don’t release more greenhouse gases into the atmosphere. That was true in the industrial era; it is simply factually not true. What is true is that the old energy economy is well organized, financed and connected politically."

In a 1999 speech, Dick Cheney, the US Vice President and former CEO of Halliburton (one of the world's largest energy services corporations), said,

"By some estimates there will be an average of two per cent annual growth in global oil demand over the years ahead along with conservatively a three per cent natural decline in production from existing reserves. That means by 2010 we will need on the order of an additional fifty million barrels a day. So where is the oil going to come from?....While many regions of the world offer great oil opportunities, the Middle East with two thirds of the world's oil and the lowest cost, is still where the prize ultimately lies, even though companies are anxious for greater access there, progress continues to be slow."[8]

Cheney went on to argue that the oil industry should become more active in politics:

"Oil is the only large industry whose leverage has not been all that effective in the political arena. Textiles, electronics, agriculture all seem often to be more influential. Our constituency is not only oilmen from Louisiana and Texas, but software writers in Massachusetts and specialty steel producers in Pennsylvania. I am struck that this industry is so strong technically and financially yet not as politically successful or influential as are often smaller industries. We need to earn credibility to have our views heard."

Pipeline diplomacy in the Caspian Sea area

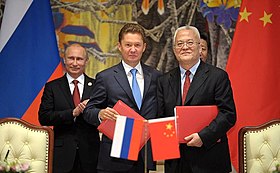

The Baku–Tbilisi–Ceyhan pipeline was built to transport crude oil and the Baku-Tbilisi-Erzurum pipeline was built to transport natural gas from the western side (Azerbaijani sector) of the Caspian Sea to the Mediterranean Sea bypassing Russian pipelines and thus Russian control. Following the construction of the pipelines, the United States and the European Union proposed extending them by means of the proposed Trans-Caspian Oil Pipeline and the Trans-Caspian Gas Pipeline under the Caspian Sea to oil and gas fields on the eastern side (Kazakhstan and Turkmenistan sectors) of the Caspian Sea. In 2007, Russia signed agreements with Turkmenistan and Kazakhstan to connect their oil and gas fields to the Russian pipeline system effectively killing the undersea route.

China has completed the Kazakhstan–China oil pipeline from the Kazakhstan oil fields to the Chinese Alashankou-Dushanzi Crude Oil Pipeline in China. China is also working on the Kazakhstan-China gas pipeline from the Kazakhstan gas fields to the Chinese West-East Gas Pipeline in China.

Politics of oil nationalization

Several countries have nationalised foreign-run oil businesses, often failing to compensate investors. Enrique Mosconi, the director of the Argentine state owned oil company Yacimientos Petrolíferos Fiscales (YPF, which was the first state owned oil company in the world, preceding the French Compagnie française des pétroles (CFP, French Company of Petroleums), created in 1924 by the conservative Raymond Poincaré), advocated oil nationalization in the late 1920s among Latin American countries. The latter was achieved in Mexico during Lázaro Cárdenas's rule, with the Expropiación petrolera.

Similarly Venezuela nationalized its oil industry in 1976.

Politics of alternative fuels

Vinod Khosla (a well known investor in IT firms and alternative energy) has argued[9] that the political interests of environmental advocates, agricultural businesses, energy security advocates (such as ex-CIA director James Woolsey) and automakers, are all aligned for the increased production of ethanol. He pointed out that from 2003 to 2006, ethanol fuel in Brazil replaced 40% of its gasoline consumption while flex fuel vehicles went from 3% of car sales to 70%. Brazilian ethanol, which is produced using sugarcane, reduces greenhouse gases by 60-80% (20% for corn-produced ethanol). Khosla also said that ethanol was about 10% cheaper per given distance. There are currently ethanol subsidies in the United States but they are all blender's credits, meaning the oil refineries receive the subsidies rather than the farmers. There are indirect subsidies due to subsidising farmers to produce corn. Vinod says after one of his presentations in Davos, a senior Saudi oil official came up to him and threatened: "If biofuels start to take off, we will drop the price of oil."[10] Since then, Vinod has come up with a new recommendation that oil should be taxed if it drops below $40.00/barrel in order to counter price manipulation.

Ex-CIA director James Woolsey and U.S. Senator Richard Lugar are also vocal proponents of ethanol.[11]

In 2005, Sweden announced plans to end its dependence on fossil fuels by the year 2020.[12]

From around 2015 onwards, there was increasing discussion about whether the geopolitics of oil and gas would be replaced by the geopolitics of renewable energy resources and critical materials for renewable energy technologies.[3][2]

Geopolitics of oil money

Multibillion-dollar inflows and outflows of petroleum money have worldwide macroeconomic consequences, and major oil exporters can gain substantial influence from their petrodollar recycling activities.

The GeGaLo index of geopolitical gains and losses assesses how the geopolitical position of 156 countries may change if the world fully transitions to renewable energy resources. Former fossil fuels exporters are expected to lose power, while the positions of former fossil fuel importers and countries rich in renewable energy resources is expected to strengthen.[13]

Key oil producing countries

Canada

As development in the Alberta oil sands, deep sea drilling in the North Atlantic and the prospects of arctic oil continue to grow Canada increasingly grows as a global oil exporter. There are currently three major pipelines under proposal that would ship oil to the pacific, atlantic and gulf ports. These projects have stirred internal controversy, receiving fierce opposition from First Nations groups and environmentalists.

Iran

Discovery of oil in 1908 at Masjed Soleiman in Iran initiated the quest for oil in the Middle East. The Anglo-Iranian Oil Company (AIOC) was founded in 1909. In 1951, Iran nationalized its oil fields initiating the Abadan Crisis. The United States of America and Great Britain thus punished Iran by arranging coup against its democratically elected prime minister, Mosaddeq, and brought the former Shah's son, a dictator, to power. In 1953 the US and GB arranged the arrest of the Prime Minister Mosaddeq. Iran exports oil to China and Russia. See also: Iranian Oil Subsidies

Iraq

Iraq holds the world's second-largest proven oil reserves, with increasing exploration expected to enlarge them beyond 200 billion barrels (3.2×1010 m3) of "high-grade crude, extraordinarily cheap to produce."[14] Organizations such as the Global Policy Forum (GPF) have asserted that Iraq's oil is "the central feature of the political landscape" there, and that as a result of the 2003 invasion,"'friendly' companies expect to gain most of the lucrative oil deals that will be worth hundreds of billions of dollars in profits in the coming decades." According to GPF, U.S. influence over the 2005 Constitution of Iraq has made sure it "contains language that guarantees a major role for foreign companies."[14][15]

Mexico

Mexico has a largely oil-based economy, being the seventh largest producer of petroleum. Though Mexico has gradually explored different types of electricity, oil is still crucial, recently generating 10% of revenue.[16]

Before 1938, all petroleum companies in Mexico were foreign based, often from the United States or Europe. The petroleum industry was nationalized in the late 1930s to early 1940s by then-president Lázaro Cárdenas, creating PEMEX. Mexico's oil industry still remains heavily nationalized. Though oil production has fallen in recent years, Mexico still remains in seventh place.[17]

Nigeria

Petroleum in Nigeria was discovered in 1955 at Oloibiri in the Niger Delta.[18]

High oil prices were the driving force behind Nigeria’s economic growth. This has made the Nigerian economy to become the largest in Africa surpassing both Egypt and South Africa, also making it the 24th largest in the world. The Nigerian economy is heavily dependent on the oil sector, which accounts for 98% percent of export earnings and 83% of federal government revenues as well as generating 14% of its GDP.

Nigeria's proven oil reserves are estimated by the United States Energy Information Administration at between 16 and 22 billion barrels (2.5*10^9 and 3.5*10^9 m^3). But other sources claim there could be as much as 35.3 billion barrels (5.61*10^9 m^3). Its reserves make Nigeria the tenth most petroleum rich nation and by far the most affluent in Africa. Nigeria produces an average of about 2.28 million barrels (350,000 m^3) per day.[19]

Russia

High-priced oil allowed the Soviet Union to subsidize the struggling economies of the Soviet bloc for a time, and the loss of petrodollar income during the 1980s oil glut contributed to the bloc's collapse in 1989.[20]

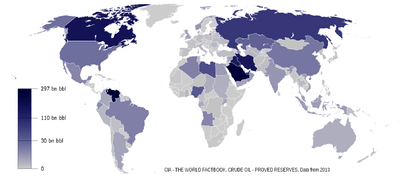

Saudi Arabia

In 1973, Saudi Arabia and other Arab nations imposed an oil embargo against the United States, United Kingdom, Japan and other Western nations which supported Israel in the Yom Kippur War of October 1973.[21] The embargo caused an oil crisis with many short- and long-term effects on global politics and the global economy.[22]

Saudi Arabia is an oil-based economy with strong government controls over major economic activities. It possesses both the world's largest known oil reserves, which are 25% of the world's proven reserves, and produces the largest amount of the world's oil. As of 2005, Ghawar field accounts for about half of Saudi Arabia's total oil production capacity.[23]

Saudi Arabia ranks as the largest exporter of petroleum, and plays a leading role in OPEC, its decisions to raise or cut production almost immediately impact world oil prices.[24] It is perhaps the best example of a contemporary energy superpower, in terms of having power and influence on the global stage (due to its energy reserves and production of not just oil, but natural gas as well). Saudi Arabia is often referred to as the world's only "oil superpower".[25]

It has been suggested that the Iran–Saudi Arabia proxy conflict was a powerful influence in the Saudi decision to launch the price war in 2014,[26][27] as was Cold War rivalry between the United States and Russia.[28] Larry Elliott argued that "with the help of its Saudi ally, Washington is trying to drive down the oil price by flooding an already weak market with crude. As the Russians and the Iranians are heavily dependent on oil exports, the assumption is that they will become easier to deal with."[29] Vice President of Russia's largest oil company, Rosneft, accused Saudi Arabia of conspiring against Russia.[30]

United States

.jpg)

In 1998, about 40% of the energy consumed by the United States came from oil.[31] The United States is responsible for 25% of the world's oil consumption, while having only 3% of the world's proven oil reserves and less than 5% of the world's population.[32] In January 1980, President Jimmy Carter explicitly declared: "An attempt by any outside force to gain control of the Persian Gulf region will be regarded as an assault on the vital interests of the United States."[33]

United Kingdom

British Foreign Secretary Boris Johnson described Nord Stream 2 gas pipeline from Russia to Germany as "divisive" and a "threat" that left Europe dependent on a "malign Russia" for its energy supplies.[34]

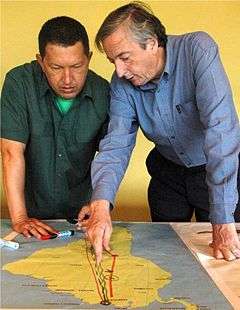

Venezuela

According to the Oil and Gas Journal (OGJ), Venezuela has 77.2 billion barrels (1.227×1010 m3) of proven conventional oil reserves, the largest of any country in the Western Hemisphere. In addition it has non-conventional oil deposits similar in size to Canada's - at 1,200 billion barrels (1.9×1011 m3) approximately equal to the world's reserves of conventional oil. About 267 billion barrels (4.24×1010 m3) of this may be producible at current prices using current technology.[35] Venezuela's Orinoco tar sands are less viscous than Canada's Athabasca oil sands – meaning they can be produced by more conventional means, but are buried deeper – meaning they cannot be extracted by surface mining. In an attempt to have these extra heavy oil reserves recognized by the international community, Venezuela has moved to add them to its conventional reserves to give nearly 350 billion barrels (5.6×1010 m3) of total oil reserves. This would give it the largest oil reserves in the world, even ahead of Saudi Arabia.

Venezuela nationalized its oil industry in 1975–1976, creating Petróleos de Venezuela S.A. (PdVSA), the country's state-run oil and natural gas company. Along with being Venezuela's largest employer, PdVSA accounts for about one-third of the country's GDP, 50 percent of the government's revenue and 80 percent of Venezuela's exports earnings. In recent years, under the influence of President Chavez, the Venezuelan government has reduced PdVSA's previous autonomy and amended the rules regulating the country's hydrocarbons sector.[36]

In the 1990s, Venezuela opened its upstream oil sector to private investment. This collection of policies, called apertura, facilitated the creation of 32 operating service agreements (OSA) with 22 separate foreign oil companies, including international oil majors like Chevron, BP, Total, and Repsol-YPF. Hugo Chávez, the President of Venezuela sharply diverged from previous administrations' economic policies. PDVSA is now used as a cash-cow and as an employer-of-last-resort;[37] foreign oil businesses were nationalised and the government refused to pay compensation.[38]

Estimates of Venezuelan oil production vary. Venezuela claims its oil production is over 3 million barrels per day (480,000 m3/d), but oil industry analysts and the U.S. Energy Information Administration believe it to be much lower. In addition to other reporting irregularities, much of its production is extra-heavy oil, which may or may not be included with conventional oil in the various production estimates. The U.S. Energy Information Agency estimated Venezuela's oil production in December 2006 was only 2.5 million barrels per day (400,000 m3/d), a 24% decline from its peak of 3.3 million in 1997.[39]

Recently, Venezuela has pushed the creation of regional oil initiatives for the Caribbean (Petrocaribe), the Andean region (Petroandino), and South America (Petrosur), and Latin America (Petroamerica). The initiatives include assistance for oil developments, investments in refining capacity, and preferential oil pricing. The most developed of these three is the Petrocaribe initiative, with 13 nations signing a preliminary agreement in 2005. Under Petrocaribe, Venezuela will offer crude oil and petroleum products to Caribbean nations under preferential terms and prices, with Jamaica as the first nation to sign on in August 2005.

See also

References

- Indra Overland (2015) Future Petroleum Geopolitics: Consequences of Climate Policy and Unconventional Oil and Gas, in Jinyue Yan (ed.) Handbook of Clean Energy Systems, Chichester: Wiley, pp. 3517–3544. https://www.researchgate.net/publication/281774890 Archived 2018-02-05 at the Wayback Machine

- "The Geopolitics of Renewable Energy". ResearchGate. Retrieved 2019-06-26.

- Overland, Indra (2019-03-01). "The geopolitics of renewable energy: Debunking four emerging myths". Energy Research & Social Science. 49: 36–40. doi:10.1016/j.erss.2018.10.018. ISSN 2214-6296.

- Bamberg, J.H. (1994). "The History of the British Petroleum Company, Volume 2: The Anglo-Iranian Years, 1928-1954". Cambridge University Press: 528–34. Archived from the original on 2011-10-20. Cite journal requires

|journal=(help) Text of the 18 August 1928 draft of the Achnacarry Agreement. - Colgan, Jeff. "Petro-Aggression: When Oil Causes War". Cambridge University Press. Retrieved Feb 23, 2013.

- Vidal, John (21 April 2005). "The end of oil is closer than you think". The Guardian. London. Retrieved 22 May 2010.

- Clinton, Bill (March 28, 2006). "Speech at the London Business School". Energy Bulletin. Archived from the original on December 3, 2008. Retrieved 2008-11-23.

- "Institute of Petroleum - Dick Cheney's Autumn lunch speech". Archived from the original on 14 April 2000. Retrieved 27 April 2016.

- Khosla, Vinod (29 March 2006). Biofuels: Think Outside The Barrel (Video podcast). Google. Archived from the original on 8 March 2016. Retrieved 30 December 2016.

- "A healthier addiction". The Economist. 23 March 2006. Archived from the original on 18 June 2006. Retrieved 26 June 2006.

- Lugar, Richard G.; Woolsey, R. James (January–February 1999). "The New Petroleum". Foreign Affairs. 78 (1): 88–102. doi:10.2307/20020241. JSTOR 20020241. Archived from the original on 31 January 2007.

- "Sweden first to break dependence on oil! New programme presented". Archived from the original on 25 November 2005. Retrieved 27 April 2016.

- Overland, Indra; Bazilian, Morgan; Ilimbek Uulu, Talgat; Vakulchuk, Roman; Westphal, Kirsten (2019). "The GeGaLo index: Geopolitical gains and losses after energy transition". Energy Strategy Reviews. 26: 100406. doi:10.1016/j.esr.2019.100406.

- "Oil in Iraq". Global Policy Forum. Archived from the original on 21 October 2016. Retrieved 30 December 2016.

- Muttitt, Greg (November 2005). "Crude Designs". Global Policy Forum. Archived from the original on 20 May 2016. Retrieved 30 December 2016.

- "Mexico". U.S. Energy Information Administration. Archived from the original on 30 December 2016. Retrieved 30 December 2016.

- "Oil - production - Country Comparison". Archived from the original on 13 May 2016. Retrieved 27 April 2016.

- "Extraction of Crude Petroleum in Nigeria - Overview". MBendi.com. Archived from the original on 10 April 2008. Retrieved 27 April 2016.

- "Nigeria's Crude Oil Falls To 1.999mbpd From 2.081m". Valuechain Online. Retrieved 2020-06-10.

- McMaken, Ryan (November 7, 2014). "The Economics Behind the Fall of the Berlin Wall". Mises Institute. Archived from the original on March 6, 2016. Retrieved January 12, 2016.

High oil prices in the 1970s propped up the regime so well, that had it not been for Soviet oil sales, it's quite possible the regime would have collapsed a decade earlier.

- "The Arab Oil Threat". The New York Times. November 23, 1973. Archived from the original on July 22, 2019. Retrieved July 27, 2019.

- "The price of oil – in context". CBC News. April 18, 2006. Archived from the original on June 9, 2007.

- "Saudi Arabia". U.S. Energy Information Administration (EIA). Archived from the original on 29 December 2016. Retrieved 30 December 2016.

- "The World Factbook". Archived from the original on 28 May 2010. Retrieved 27 April 2016.

- "Saudi vows to keep oil flowing". CNN. 30 May 2004. Archived from the original on 3 March 2016. Retrieved 30 December 2016.

- "Why is Saudi Arabia using oil as a weapon?". BBC News. 3 December 2014.

- "Why Would the Saudis Deliberately Crash the Oil Markets?". Foreign Policy. 18 December 2014.

- "Here's How President Obama Is Using the 'Oil Weapon'—Against Iran, Russia, and ISIS". Mother Jones. 10 October 2014.

- "Stakes are high as US plays the oil card against Iran and Russia". The Guardian. 9 November 2014.

- "Saudi Arabia's Oil Price 'Manipulation' Could Sink The Russian Economy". Business Insider. 13 October 2014.

- "United States Energy and World Energy Production and Consumption Statistics". USGS. Archived from the original on 11 January 2001.

- "Reduce Fossil Fuels". NRDC. Archived from the original on 19 March 2016. Retrieved 27 April 2016.

- Carter, Jimmy (23 January 1980). "Third State of the Union Address". Jimmy Carter Presidential Library. Archived from the original on 7 August 2008. Retrieved 11 December 2016.

- "Boris Johnson joins US in criticising Russia to Germany gas pipeline". The Guardian. 22 May 2018. Archived from the original on 26 July 2019. Retrieved 27 July 2019.

- Bauquis, Pierre-René (1998). "What Future for Extra Heavy Oil and Bitumen: The Orinoco Case". World Energy Council. Archived from the original on 4 February 2007.

- "Venezuela". U.S. Energy Information Administration (EIA). Archived from the original on 31 December 2016. Retrieved 30 December 2016.

- "Brazil's oil boom: Filling up the future". The Economist. 5 November 2011. Archived from the original on 5 January 2012. Retrieved 6 January 2012.

- "Politics this week". The Economist. 7 January 2012. Archived from the original on 6 January 2012. Retrieved 6 January 2012.

- "International Petroleum Monthly". U.S. Energy Information Administration. May 2007. Archived from the original on 18 June 2007.

External links

- Oil, Politics & Bribes The connection between VECO oil services company and Alaskan lawmakers