Bó (bank)

Bó was a banking brand that operated in the United Kingdom between November 2019 and May 2020. Bó operated as a trading division of National Westminster Bank, part of the Royal Bank of Scotland Group, later renamed NatWest Group.[1]

_logo.png) | |

| Trading division | |

| Industry | Banking |

| Founded | 27 November 2019 |

| Defunct | 1 May 2020 |

| Services | Retail banking |

| Parent | National Westminster Bank |

| Website | wearebo |

History

In March 2018, it was revealed that the then Royal Bank of Scotland Group were planning to establish a digital banking brand to rival services offered by newly established and tech-focused challenger banks.[2] The name of the new banking brand, Bó, was announced in September 2018.[3] Following a period of beta testing by RBS Group employees, Bó was launched to the public on 27 November 2019.[4] The development of Bó was estimated as costing £100 million.[5]

In February 2020, Bó was forced to re-issue up to 6,000 debit cards as these were no longer compliant with European customer authentication regulations.[6] The chief executive officer of Bó, Mark Bailie, announced that he would be leaving the bank later in 2020.[7]

On 1 May 2020, it was announced that Bó would close,[8] and its 11,413 customers were given 60 days to withdraw their money. Staff working for Bó would be transferred to NatWest's Mettle business banking division.[9][10]

Branding

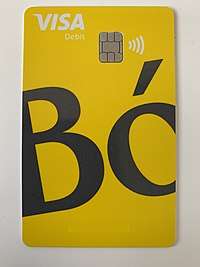

The Bó brand was developed by Accenture Interactive.[11] The name Bó was described as having no meaning in the English language but it has been reported that the word means "cow" in Irish and "to live" in Danish.[12][13] Bó used the marketing slogan "Do Money Better". The Bó brand used yellow as its focus colour and its circular logo was said to represent the Sun. Debit cards were yellow in colour and in the portrait orientation on the front side, showing only the bank name and customer name. The card number, sort code and account number, expiration dates and CVC codes are printed on the reverse side.[14]

Services

Bó offered a current account and that was accessed through a debit card and mobile banking app. The app allowed customers to save money to a linked non-interest paying savings account and offered tools to help customers better manage their money. It allowed payments in and out using the faster payments system. The account did not support direct debits or standing orders and customers were not able to pay in cash or cheques.[15] Bó did not offer overdraft facilities or the ability to open joint accounts.[16]

References

- https://www.thisismoney.co.uk/money/saving/article-7706273/What-Bo-NatWest-launches-new-youth-focused-digital-bank.html

- https://www.computerweekly.com/news/252437250/RBS-said-to-be-setting-up-its-own-digital-bank

- https://www.telegraph.co.uk/business/2018/09/27/rbs-prepares-launch-standalone-digital-bank/

- https://www.cityam.com/rbs-launches-digital-bank-bo-in-bid-to-rival-fintechs/

- https://www.telegraph.co.uk/technology/2020/02/06/rbss-attempt-take-monzo-bo-failing/

- https://www.thisismoney.co.uk/money/saving/article-7971111/RBSs-digital-bank-Bo-tells-customers-shred-cards.html

- https://business.financialpost.com/pmn/business-pmn/digital-bank-bo-underwhelms-investors-as-rbs-revamp-looms

- "We are closing Bo". National Westminster Bank. 1 May 2020. Retrieved 9 May 2020.

- Afifi-Sabet, Keumars (1 May 2020). "RBS challenger brand Bó shuts down after just six months". IT PRO. Retrieved 9 May 2020.

- "RBS bids farewell to app-only offshoot Bó". Finextra Research. 1 May 2020. Retrieved 9 May 2020.

- https://www.marketingweek.com/launch-rbs-mobile-banking-brand-bo/

- https://www.finder.com/uk/bo-review

- https://wearebo.co.uk/blog/whats-in-a-name

- https://wearebo.co.uk/blog/get-to-know-your-spending-habits

- https://wearebo.co.uk/faq/

- https://www.finder.com/uk/bo-review