TransferWise

TransferWise is a London-based online money transfer service founded in January 2011 by Estonians Kristo Käärmann and Taavet Hinrikus.[1][2][3]

Type of site | Private company |

|---|---|

| Available in | Multilingual |

| Founded | January 2010 [1][2][3] |

| Headquarters | London, United Kingdom |

| Area served | Global: Europe, United States, Canada, Asia-Pacific, Latin-America |

| Founder(s) | Taavet Hinrikus[1][2][3] Kristo Käärmann[1][2][3] |

| Key people | Taavet Hinrikus (Executive Chairman) Kristo Käärmann (CEO) |

| Services | Financial services |

| Revenue | £179 million (2019)[4] |

| Employees | 2000+ (2020) |

| URL | transferwise |

| Alexa rank | |

| Registration | Yes |

| Launched | 2011 |

| Current status | Active |

The company supports more than 750 currency routes across the world including GBP, USD, EUR, AUD and CAD, and provides multi-currency accounts.[1] In 2018, TransferWise's net profit reached $8 million[6] and its customer base reached 4 million with monthly transfer of around $4 billion.[7]

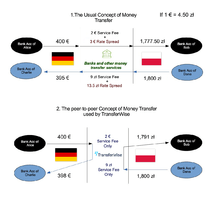

The concept was to match transfers with other people and then have a small commission while using the inter-bank mid exchange rate, unlike traditional currency transfers where there are buy and sell rates and the broker takes the difference between the two.

TransferWise is available in 12 languages: English, French, German, Hungarian, Italian, Japanese, Polish, Portuguese, Spanish, Romanian, Russian, and Turkish.

History

TransferWise was founded by Taavet Hinrikus, Skype's first employee,[8] and financial consultant Kristo Käärmann. As Estonians working between their native country and the UK, they had personal experience of the "pain of international money transfer"[9] due to bank charges on the amounts they needed to convert from euros to pounds and vice versa. In the words of Hinrikus, "I was losing five percent of the money each time I moved it. At the same time my co-founder Kristo Käärmann (also from Estonia) was starting to get paid in the UK and was losing a lot of money transferring cash back home to pay for a mortgage there".[10][11]

.jpg)

This inspired them to make a private arrangement, with Hinrikus – who was paid in euros – putting this currency directly into Käärmann's Estonian account so he could pay his mortgage without having to convert pounds to euros, while Käärmann reciprocated by putting pounds into Hinrikus' UK account.[12] This arrangement led them to start developing a crowdsourced currency exchange service to offer a cheaper alternative to established institutions.[13]

In February 2012, their approval from the UK financial regulator was finalised.[14] In April 2013, they stopped letting users purchase Bitcoin, citing pressure from banking providers.[15] In its first year, transactions through TransferWise amounted to €10 million.[16] In May 2017, the company announced its customers were sending over £1 billion every month using the service.[17]

In May 2016, TransferWise's claim "you save up to 90% against banks" was considered as misleading by the Advertising Standards Authority.[18] According to independent comparison site Monito.com, TransferWise was actually on average 83% cheaper than the big four UK banks on major currency "routes", but could be up to 90% cheaper in some occasions.[19] In April 2017, an internal memo from British bank Santander showed how much the bank was making from its charges on international money transfer and how much it could lose to new entrants, specifically TransferWise.[20]

In April 2017, TransferWise announced its decision to move its European headquarters from London to the European continent due to Brexit.[21] The same month, the company announced its APAC hub in Singapore[22] after becoming one of the first remittance companies to be allowed to offer online verification in Singapore.

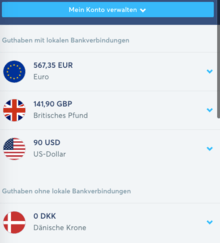

In May 2017, TransferWise launched a new service, the Borderless account. Initially, the account was for businesses and freelancers with an account and card for consumers planned for later in the year.[23] The Borderless account was available in Europe and the US at launch.[24] A multi-currencies Mastercard debit card was launched in January 2018 for customers located in the European Union, and support was later added for customers in the United States, with more countries expected to follow in 2019.

Also in May 2017, the company announced it had been operationally profitable since the beginning of the year.[25]

Two years later, in May 2019, the company had the secondary investment round of $292M and reached the total valuation of $3.5B, more than double the valuation TransferWise achieved in late 2017 at the time of its $280 million Series E round.[26]

Transfer process

TransferWise routes most payments not by transferring the sender's money directly to the recipient as it is in the case of SWIFT, but by matching the amounts with other TransferWise's users sending the other way around. TransferWise then uses these pools of funds to pay out transfers via local bank transfer.[27]

This process avoids currency conversion and transfers crossing borders.[28]

In 2012, the company's charges were €1—in 2015 raised to €2, £2, $3 etc. (depending on the currency sent)—or 0.5%, whichever is larger, in or of an equivalent amount in the customer's currency.[9]

In 2018, TransferWise revamped its fee structure to a percentage of the amount alongside a fixed fee (for example 0.35% + £0.80 when sending from GBP to EUR). In 2019, the fixed part was cancelled and the total fee became a decreasing percentage of the amount—for example £0.26 when sending £1 and £0.30 when sending £10 (both transfers with exchange to euros), the percentage dropping to a little below 0.4% (in the case of these currencies) with large amounts.

TransferWise's system has been compared to the hawala money transfer system.[29][30][31][32]

Borderless account

To set up the borderless account,[33] prior personal identity verification is needed. Once a user is approved for this account, they can hold multiple currencies concurrently, and decide when to make a transfer to best suit their financial needs. Personal local bank details can also be issued in a handful of currencies to receive payments from third parties, therefore avoiding the use of SWIFT transfers or having the sender register with TransferWise. This is similar to having a multi-currency brokerage account.

Issues with suspended accounts

Notable problems with the service are related to company's issue resolution process. Unlike most traditional banks, TransferWise reserves the right to suspend any account without explanation or prior notice. In that case, it can take up to 90 days to recover access to funds.[34] This practice has led to TranferWise having questionable international reputation. As an example, the Hungarian National Bank has issued a warning about the risks of using TransferWise.[35]

Available currencies

List of sending and receiving currencies supported by TransferWise (May 2020):

| Currency | Receiving | Sending | Local account number |

|---|---|---|---|

| West African CFA franc | |||

Investors

TransferWise received seed funding amounting to $1.3 million from a consortium including venture firms IA Ventures and Index Ventures, IJNR Ventures, NYPPE as well as individual investors such as PayPal co-founder Max Levchin, former Betfair CEO David Yu, and Wonga.com co-founder Errol Damelin.[36] TransferWise also received investment after being named one of Seedcamp 2011's winners.[37] In May 2013, it was announced that TransferWise had secured a $6 million investment round led by Peter Thiel's Valar Ventures.[38] TransferWise raised a further $25 million in June 2014, adding Richard Branson as an investor.[39] In January 2015, it was announced that TransferWise had raised a $58 million Series C round, led by investors Andreessen Horowitz.[40] In May 2016, TransferWise secured a funding of $26 million. This raised the company's valuation to $1.1 billion. As of May 2016, TransferWise has raised a total of $117 million in funding.[41] In November 2017, the company raised a $280 million Series E led by Old Mutual Global Investors and IVP, as well as Sapphire Ventures, Japanese Mitsui & Co, and World Innovation Lab.[42] The company's revenue reached $151 Million in September 2018.[43]

Media attention

Named as one of "East London's 20 hottest tech startups" by The Guardian,[44] TransferWise has also been picked as a Wired UK Start Up of the Week[45] as well as being listed as number 12 in Startups.co.uk's list of the top 100 UK start-ups of 2012.[46] TransferWise was also named by TechCrunch as one of five "start-ups to watch" at Seedcamp's 2012 US Demo Day.[47]

In May 2015, TransferWise was ranked No. 8 on CNBC's 2015 Disruptor 50 list.[48]

In August 2015, the company was named a World Economic Forum Tech Pioneer.[49]

References

- Bryant, Martin. "Money may make the world go round, but at what cost?". BBC. Retrieved 1 April 2015.

- "TransferWise Steps Toward Banking With Multicurrency Account". Bloomberg.com. 23 May 2017. Retrieved 31 May 2017.

- Bryant, Martin. "TransferWise valued at $1bn by top Silicon Valley venture capital fund". The Independent. Retrieved 1 April 2015.

- https://transferwise.com/gb/blog/annualreport2019. Missing or empty

|title=(help) - "transferwise.com Traffic Statistics". Alexa Internet. Retrieved 9 June 2018.

- Kauflin, Jeff. "Here's How TransferWise Has Nearly Quadrupled Revenue In Two Years, Reaching $151 Million". Forbes. Retrieved 25 December 2018.

- "TransferWise reports 75% revenue growth as customer base doubles to 4 million". VentureBeat. 10 September 2018. Retrieved 25 December 2018.

- Temperton, James (3 November 2016). "Has Skype lost its way? Taavet Hinrikus reveals what the company taught him". Wired UK. ISSN 1357-0978. Retrieved 2 April 2019.

- Ajilore, Joseph. "Skype's first employee: How Taavet Hinrikus left Skype and founded TransferWise". YHP. Retrieved 1 October 2012.

- Lytton-Dickie, Tom. "How TransferWise is making international money transfers transparent?". Hot Topics. Archived from the original on 25 February 2015. Retrieved 27 January 2015.

- Griffith, Gabriella. "Q&A: Taavet Hinrikus, co-founder of TransferWise which has landed $1.3 million funding". London Loves Business. Retrieved 1 October 2012.

- "TransferWise was born out of frustration". TransferWise. Retrieved 1 October 2012.

- "Can TransferWise transform money transfers". Mindful Money. Retrieved 1 October 2012.

- "Financial Services Authority approves TransferWise without limits". Retrieved 13 October 2014.

- "Bitcoin | TransferWise Support & FAQ - International Money Transfer". transferwise.com. Retrieved 31 May 2017.

- Bryant, Martin. "Peer-to-peer currency exchange service Transferwise handles $13.4m in its first year". Insider. Retrieved 1 October 2012.

- CNBC.com, Neil Ainger, Writer at (17 May 2017). "Fintech unicorn Transferwise achieves first profit". CNBC. Retrieved 31 May 2017.

- "ASA Ruling on TransferWise Ltd". 4 May 2016. Retrieved 21 November 2016.

- "TransferWise – Are they that cheap or is it just (inaccurate) advertising?". www.monito.com. Monito. 26 May 2016. Retrieved 21 November 2016.

- Collinson, Patrick (8 April 2017). "Revealed: the huge profits earned by big banks on overseas money transfers". The Guardian. ISSN 0261-3077. Retrieved 31 May 2017.

- Kelly, Jemima (12 April 2017). Brexit prompts Transferwise to move Europe headquarter from UK to continent. Reuters. Retrieved 30 April 2017

- Russell, Jon. "TransferWise moves into Asia Pacific with opening of regional HQ in Singapore | TechCrunch". Retrieved 31 May 2017.

- O'Hear, Steve. "TransferWise launches 'Borderless' account for businesses, sole traders and freelancers | TechCrunch". Retrieved 31 May 2017.

- Groenfeldt, Tom. "FinTechs Are Surpassing Banks On Cross-Border Payments". Forbes. Retrieved 31 May 2017.

- "TransferWise becomes profitable six years after being founded". BBC News. 17 May 2017. Retrieved 31 May 2017.

- "TransferWise now valued at $3.5B following a new $292M secondary round". TechCrunch. Retrieved 22 May 2019.

- Kauflin, Jeff. "Here's How TransferWise Has Nearly Quadrupled Revenue In Two Years, Reaching $151 Million". Forbes. Retrieved 27 November 2018.

- Price, Rob. "How TransferWise Works". Retrieved 24 February 2015.

- Price, Rob (27 January 2015). "London's $1 Billion Finance Startup TransferWise Is Just Like An Ancient Islamic Money Transfer System". Business Insider. Retrieved 19 October 2015.

- Marco della Cava (18 August 2014). "London's TransferWise aims to disrupt banking". USA Today. Retrieved 19 October 2015.

- Bennett Voyles (9 September 2015). "Online money transfers and the "Skype" of money". Forbes India. Retrieved 19 October 2015.

- Leander Bindewald (8 July 2015). "You need never use a bank again. Here's why". The Guardian. Retrieved 19 October 2015.

- Silver, Curtis (18 April 2018). "TransferWise Borderless Banking Bonks Blistering Bank Fees". Forbes. Retrieved 4 May 2019.

- "Why was my account deactivated?". Retrieved 4 August 2020.

- "Kockázatok merülhetnek fel egyes határon átnyúló elektronikus számla- és kártyaszolgáltatásoknál". www.mnb.hu. Retrieved 4 August 2020.

- Johnson, Bobbie. "Transferwise unveils Levchin, other superstar backers". Gigaoam. Retrieved 1 October 2012.

- "TransferWise". Seedcamp. Retrieved 1 October 2012.

- O'Hear, Steve. "P2P Currency Exchange TransferWise Raises $6M Led By Peter Thiel's Valar Ventures, With Participation From SV Angel, Others". TechCrunch. Retrieved 12 July 2013.

- O'Hear, Steve. "Now Backed By Sir Richard Branson, TransferWise Raises $25M For Cheaper Money Transfers". TechCrunch. Retrieved 9 June 2014.

- Price, Rob. "London Cash Startup TransferWise Is Now Worth $1 Billion". BusinessInsider. Retrieved 31 March 2015.

- O'Hear, Steve. "Money transfer company TransferWise raises further $26M at $1.1B valuation". TechCrunch. Retrieved 25 May 2016.

- "TransferWise Announces $280M Investment Round as Company Focuses on New Products and APAC Expansion". IVP. 2 November 2017.

- Kauflin, Jeff. "Here's How TransferWise Has Nearly Quadrupled Revenue In Two Years, Reaching $151 Million". Forbes. Retrieved 14 September 2018.

- Silver, James (8 July 2012). "East London's 20 hottest tech startups". The Guardian.

- "Startup of the Week: TransferWise". Wired. Retrieved 1 October 2012.

- "The 2012 Startups 100: revealed". Startups. Retrieved 1 October 2012.

- Taylor, Colleen. "5 Startups to Watch from Seedcamp's 2012 US Demo Day". TechCrunch. Retrieved 1 October 2012.

- "Meet the 2015 CNBC Disruptor 50 companies". CNBC. Retrieved 12 May 2015.

- Barber, Lynsey (5 August 2015). "Four UK firms named tech pioneers by WEF". Retrieved 13 November 2016.