İşbank

İşbank is a commercial bank in Turkey. It was the largest private bank in the country by the size of assets and equity, as well as by the number of branches and employees as of 30 June 2019.[5] It was the first bank founded by the Turkish Republic.[6] İşbank was ranked 96th in a survey of "The World's Biggest 1000 Banks”.[7] It was ranked and 447 on the Forbes Global 2000 list for 2015.[8] It had a gross profit for 2015 of TRY 3.023 billion[9] and US$6.8 billion in Tier I Capital, as defined by Basel's Bank for International Settlements.

| |

| Anonim Şirket | |

| Traded as | BİST: ISATR BİST: ISBTR BİST: ISCTR LSE: TIBD |

| ISIN | TRAISATR91N6 |

| Industry | Finance and insurance |

| Founded | 1924 |

| Founder | Mustafa Kemal Atatürk |

| Headquarters | |

Number of locations | 1,271 branches (1,249 domestic; 22 abroad) (2019)[1] |

Area served | Turkey and parts of Europe |

Key people | Füsun Tümsavaş (Chairwoman) Adnan Bali (CEO) |

| Products | Financial services, credit cards, consumer banking, corporate banking, investment banking, mortgage loans, private banking |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 24,053 (2019)[1] |

| Subsidiaries | 106 subsidiaries,[4] including List

|

| Website | www.IsBank.com |

| Footnotes / references "Turkey's Bank" | |

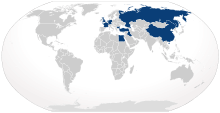

The bank operates 1,354 branches domestically, giving it one of the largest branch networks in Turkey. İşbank's international network comprises 16 branches in the Turkish Republic of Northern Cyprus, two branches in each of Iraq, Kosovo and the United Kingdom,[10] and one branch each in Bahrain, Cairo and Shanghai. İşbank's German banking subsidiary (İşbank GmbH) has 13 branches in Germany and one branch each in the Netherlands, France, Switzerland and Bulgaria. İşbank's Russian banking subsidiary (JSC İşbank) has 11 branches in Russia. There is also a subsidiary in Georgia (JSC İşbank Georgia) with branches in Tbilisi and Batumi.

History

Following the culmination of World War I in 1918 and the subsequent dissolution of the Ottoman Empire in 1922, Turkey was declared a republic and Mustafa Kemal Atatürk was elected by parliament as the first president of Turkey. Atatürk was quick to realise that the government needed a national bank to rebuild Turkey's economy following the debacle of the war. Türkiye İş Bankası, the first truly national bank in the Turkish Republic was founded on 26 August 1924 at the First Economy Congress in İzmir.

Atatürk appointed Celâl Bayar, his close aide and then the Minister of Exchange Construction and Settlement as the president of the newly formed bank. İşbank began operations with two branches and 37 staff under the leadership of Celâl Bayar, its first general manager. The bank was established with a capital of 1 TL Million of which 250'000 TL was covered by Atatürk, and the rest by private investors.[11] In 1927 the capital was raised by 2 Million TL so it could be merged with the National Credit Bank as equal partners.[12]

Contributions to banking in Turkey

- The use of cheques for daily transactions.

- Initiating electronic banking in the country.

- Introduction of the ATM.

- Overseas branches in Europe and Turkish Republic of Northern Cyprus.

- Saving accounts.

- Mutual funds.

- Introduction of child's coin bank.

- Operation of an in-house securities division.

- Interactive banking service since July 1996

- Deployment of Netmatik machines, to enable online banking among clients without access to a computer.

- Introduction of mobile banking on WAP enabled GSM phones.

- Bankamatik(+) which allows the money to be put directly to the account of the client.

- Introduction of Maximum Cash Point which allows clients to draw cash from POS machine where there is no ATM available.

Financial operations

In May 1998, 12.3% of the Bank's total shares previously held by the Turkish Treasury have been sold to national and international investors in a public offering. The states Pension Fund has brokered the offering of stock options to employees and retired staff in the company which has reached 41.5%. As of February 2019 41.5% of Isbank shares are held by Isbank's own Pension Fund, 28.1% are represented by Republican People's Party (CHP) and 30.4% are free float.[13] In February 2019 the Turkish President Recep Tayyip Erdoğan announced that he advocated of transferring the shares held be the CHP to the treasury.[13]

The shares are listed on the Istanbul and London Stock Exchanges. As of February 2019, İş Bank's market value was 26.04 Billion Lira.[13]

References

- İşbank Annual Report 2019, p. 2.

- İşbank Annual Report 2019, p. 125.

- İşbank Annual Report 2019, p. 5.

- İşBank Annual Report 2015, p. 4.

- The Banks Association of Turkey

- "History of Turkiye Is Bankasi A.S. – FundingUniverse".

- İşBank Annual Report 2015, p. 3.

- Forbes Global 2000 2015.

- İşbank Annual Report 2015, p. 5.

- "London".

- Landau, Jacob M. (1984). Atatürk and the Modernization of Turkey. Boulder: Westview Press. p. 158. ISBN 0865319863.

- Jacob M. Landau, (1984) p. 159

- "Turkey's Erdogan to move CHP's Isbank stake to Treasury". Reuters. 2019-02-05. Retrieved 2020-03-18.

Sources

- Annual Report 2019 (PDF), İşbank, 2019

- Isbank on the Forbes Global 2000 List, 2015, retrieved 17 June 2016