Bitcoin

Bitcoin (code: BTC, XBT[note 1]) is an Internet-based decentralized cryptocurrency and payment-network. It uses a cryptographic "blockchain" to verify transactions and to prevent users from spending counterfeit bitcoins. Bitcoin's notional independence from the control of governmental entities tends to appeal to libertarians, minarchists, anarcho-capitalists, laissez-faire capitalists, technophiles[2] and criminals. At the same time, Bitcoin also does not enjoy the security, protection and dispute resolution which those large state-apparatuses tend to provide, making it a volatile and often insecure asset.

| The dismal science Economics |

| Economic Systems |

|

$ Market Economy |

| Major Concepts |

| People |

|

v - t - e |

“”[Bitcoin is] the best penny stock and the worst currency in the world. … Bitcoin is a revolutionary technology built on reactionary economics. |

| —Matt O'Brien[1] |

A person known only by the apparent pseudonym of "Satoshi Nakamoto" started work on the Bitcoin concept in 2007 and first publicly proposed it in late 2008.[3][4] Satoshi's identity has been a continuing source of intrigue.[5][6]

Satoshi designed the currency system to employ lots of computers to process and record transactions. People mint Bitcoin money by "mining", in which users run software to do all the necessary work.[7] Every time someone successfully proves they performed this work, they receive bitcoins in return. This provides an incentive to keep the currency running, but also attracts a lot of prospectors and speculators looking for easy money, and scammers who consider them suitably exploitable suckers.[8]

The use case of the currency is purchasing illicit goods (e.g., drugs and stolen data on darknet markets

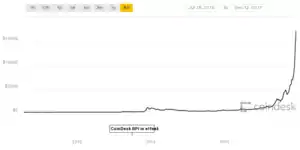

In 2014 Bitcoin began a sharp decline after a principal exchange, Mt. Gox

Economics

“”Years earlier, Bitcoin had promised that it would spread its benefits to all its users, but by 2014 large chunks of the Bitcoin economy were owned by a few people who had been wealthy enough before Bitcoin came along to invest in this new system. Most of the new coins being released each day were collected by a few large mining syndicates. If this was the new world, it didn't seem all that different from the old one—at least not yet. |

| —Nathaniel Popper[20] |

The notable bit about Bitcoin is that it is intended to be entirely decentralised. The blockchain, the cryptographically-authenticated public ledger of every Bitcoin transaction ever, is reconciled by agreement of over 50% of all miners—an attempt at a practical solution to the Byzantine Generals' Problem

There is no central bank backing Bitcoin; previous virtual currencies, such as E-Gold, Flooz, Beenz, Lindens, or WoW gold have always had an organization behind them. This lack of a monetary authority means that, were governments to try to do something about it, they would not have a central point of attack.[note 2] Bitcoin therefore presents a rare sandbox/universe-in-a-jar scenario for observing market interactions in a free banking

You can buy actual stuff with bitcoins! Mostly internet services, geek toys, phone sex,[22] illegal drugs[23] and, of course, pre-used Bitcoin mining hardware.[24] And actually useful things like beer and pizza.[25][26] To allow payment with a high-volatility currency like Bitcoin, it is common for merchants to price their goods in the local standard currency, but receive payment via Bitcoin converted at current market rates.[27] Even then receiving payments in Bitcoin can be a risk, as the price of Bitcoin may plummet faster and further than your profit margin, forcing you to choose between taking a loss, or hoarding Bitcoins hoping the price will rise.[28]

Bitcoin advocates often contrast Bitcoin with "fiat money".[note 3] Bitcoin is in fact another form of fiat money; has no intrinsic value (i.e., has no use-value), similar to the US dollar,[note 4] and could be a general currency if 300 million people similarly behaved as though it was one, i.e., would do work in exchange for it.[note 5] Its biggest problem as an exchange medium is that it is not widely accepted, and that trading is thus very thin indeed.

There is also the matter of built-in deflation: there is a strictly limited possible number of bitcoins, and the processing power to mine new ones goes up as more miners join.[29] Also, if your wallet file is deleted, your bitcoins are gone for good.

"Babbage" at The Economist took it seriously and found it quite interesting,[30] but has muted his praise over time.[31] Other economists have criticized the idea (to the point of calling it a scam), citing inherent design problems.[32][33][34][35][36] Paul Krugman initially refrained from poking fun at the concept, but considered it a reimplementation of the gold standard, with the economic problems that implies;[37] he's since judged it as effectively just another right-wing affinity fraud, in which big libertarians prey upon smaller ones.[38] Warren Buffett has called it a "mirage."[39] Joseph Stiglitz has stated Bitcoin is only good because of its lack of supervision as well as its capacity for tax evasion and general circumvention of rules, even stating that it is a financial bubble that provides thrills with the ups and downs on its value, and that it serves no useful social purpose; on these grounds, he calls for the outlawing of Bitcoin, noting that as soon as it would happen, its value would right away tumble down since outlawing it would kill demand.[40][41] About 25% of the European Central Bank's report on "Virtual Currency Schemes" is about Bitcoin,[42] and both the European Banking Authority and US Consumer Financial Protection Bureau have warned about major consumer protection issues.[43][44]

The trouble with re-implementing the gold standard in the 21st century is that financial attacks, just like cryptographic attacks, don't get less effective with time—if you apply attacks evolved in a hundred years of Red Queen's race against regulation, then remove the regulation, the subeconomy in question is utterly defenseless. As one quant on Hacker News outlined:[45]

Bitcoin takes the monetary system back essentially a hundred years. We know how to beat that system. In fact, we know how to nuke it for profit. Bitcoin is volatile, inherently deflationary and has no lender of last resort. Cornering and squeezing would work well - they use mass in a finite trading space. Modern predatory algos like bandsaw (testing markets by raising and suddenly dropping prices), sharktooth (electronically front-running orders), and band-burst (creating self-perpetuating volatile equilibria in a leverage-sensitive trading space, e.g. an inherently deflationary one), would rapidly wreak havoc. There is also a part of me that figures regulators will turn a blind eye to Bitcoin shenanigans.

And we can now see this in practice: the $1200/BTC peak in late 2013 was caused by the market manipulation known as "painting the tape";[46] Mt. Gox in particular appears to have suffered chronic tape-painting.[47] Note that the "free market" completely failed to deal with fraud in this environment: all other exchanges were tracking Mt. Gox's blatantly skewed prices.

In 2018, it was shown that the 2017 astronomical rise in price was also due to market manipulation (pump and dump), caused by a different cryptocurrency, "tether", whose company (also Tether) likely falsely claimed to have 1-to-1 US dollar reserves.[48]

The 51% attack

“”Instead of becoming a currency free of the controls of governments and banks, Bitcoin is now largely controlled by a small collection of interested parties who have heavily invested in securing the network. And ironically, greater acceptance of Bitcoin will likely come only with additional regulations. |

| —PC Gamer,

How Bitcoin and cryptocurrencies are hurting gamers[49] |

Bitcoin relies on distributed consensus: the blockchain is what a majority of mining capacity says it is. Since mining is the "core of the Bitcoin protocol," there is the possibility of what is termed a "51% attack," where miners could consolidate into a cartel to exceed 50% of the mining power (yes, a de facto monopoly) and so could unilaterally ratify the entire blockchain to do things like double-spending confirmed transactions and preventing any new transactions or just ones they don't like from happening while they're in control (though they cannot take other people's coins).[50][51] But this was considered unlikely because Bitcoin enthusiasts were highly distributed individualists. This type of attack was confirmed to have happened in 2019 for the cryptocurrency Ethereum Classic on two different exchanges, in the amounts of US$1.1 million and $200,000 on two different exchanges.[52]

This worked quite well early on. However, proof-of-work algorithms benefit from economies of scale,

Economically, it would be foolish for, e.g., GHash to just kick over the board because they could—cornering the market in an insubstantial good is only worth it while people trust the value of the insubstantial good—but the actual problem is that the group with 51% of all mining capacity will be able to "undermine the rules of the currency itself."[55] GHash quickly backed down to under 50% and claims it wants to fix the deeper problem,[56] but the economic incentives of "selfish mining" remain.

Cornell researchers have identified many more subtle attacks one can make even with less than 50%,[57] and it is worth noting that GHash had previously conducted a "49% attack" (a "Finney attack"[58]) — wherein a large miner double-spends coins, just not with certainty—against a gambling site.[59] They blamed this on a rogue employee, but this in itself shows that individuals can be motivated to trash a whole system for temporary personal gain. Again, real financial systems have government regulation for this specific threat.

Hardware

So who's doing the maths? The answer is the most powerful distributed computing project in the world.[note 6] While other distributed computing systems are investigating protein folding or sifting through radiotelescope data for signs of intelligent communication from the stars, Bitcoins are being generated by people running hashing algorithms to process transactions on a poorly-traded virtual currency.

But it's long past the point where you can do any decent amount of processing on a standard desktop system (or, as some less-than-ethical Bitcoiners have, sneaking processing code into JavaScript on web pages, or simply deploying a Trojan on someone's desktop box). Bitcoin miners quickly moved to the GPUs of video cards, then field-programmable gate arrays (FPGAs) specifically programmed for the algorithm, and now mining is done on ASIC chips specifically designed for Bitcoin mining based on said FPGAs. There are even companies selling Bitcoin mining rigs; their frequently-sketchy workmanship wouldn't endear them to IT pros or the FTC, but they're still better than some of the firetrap rigs that Bitcoiners have put together for themselves.[60]

The irony of all this is that once hardware and power costs are factored in, it's hard to make a profit from Bitcoin mining. Many more-savvy Bitcoiners filch their power from someone else and don't factor in the equipment cost at all; poor understanding of economics is a recurring theme in the Bitcoin community.

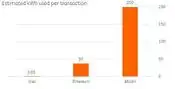

Energy usage

Bitcoin is also an environmental disaster, using on the order of 1 gigawatt (GW) (that's a billion watts) according to a 2013 and 2014 paper[62][63] Estimates would be about 7 GW by end of 2015 as the paper[62] shows approximately power use scales linearly with mining difficulty and mining difficulty in December 2015 is about 7 times the difficulty than when the paper is published (remember, mining each Bitcoin is more difficult than the previous one.) For comparison, the entire nation of Ireland runs about 3 GW average. The network cost per transaction (of any size) is around $20 of electricity.[64] (Thus, Bitcoin runs on libertarians externalising their costs to others.[note 7]) If only they'd based it on protein folding.[65] In 2018, it was estimated that cryptocurrency energy consumption has exceeded private usage within Iceland, and that Iceland may not be able to keep up with energy demand.[66] A 2018 analysis found that the energy cost of mining cryptocurrencies per unit value was comparable to or exceeded the cost of mining precious metals and rare earths: Bitcoin (17 megajoules), Ethereum (7 MJ), Litecoin (7 MJ) and Monero (14 MJ) vs. gold (5 MJ), platinum (7 MJ) and rare earth oxides (9 MJ).[67] Given that cryptocurrency mining energy costs increased exponentially within a 30-month period, and that the current costs are comparable to that of a small country, cryptocurrencies are actually contributing to global warming (with Bitcoin alone generating an estimated 22 megatons in CO2 emissions a year, comparable to a large city like Las Vegas, or a small country like Sri Lanka) for what is essentially no return value to society.[67][68][69][70]

Anonymity issues

Despite having a reputation for being used to pay for illegal goods and services anonymously, bitcoin is the most transparent currency in existence because it records everything in a blockchain. A blockchain is a gigantic database that records every transaction ever made for everyone to see — including your grandma;[71][15][16] paper money transactions do not suffer from this flaw. Individuals who wish to maintain anonymity must hide their IP with tools such as Tor and change their wallet's address every time a transaction is made (most clients do the latter automatically).[16]

Bitcoin Mixing

Bitcoin mixers

Advocates

The cryptography is robust, so many highly vocal internet libertarians think this is all that is needed, because they don't understand people, know very little about economics, and apparently nothing of how reliable financial computing infrastructures are built—real banks tend to use mainframes in highly redundant configurations, not AWS virtual servers without backups—and generally show terrifying naïveté and incompetence. This then bites them in the arse when they discover that running a Magic: The Gathering Online card exchange site is insufficient experience to securely run a currency exchange,[75] or discover they have no backups.[76] Many were sufficiently naïve as to fall for, not just a Ponzi scheme, but a Ponzi scheme that had already been tried in EVE Online's in-game currency.[77] There are also people who understand this level of computer science, but still keep their wallet.dat file in plain text on a Windows box, ready for reaping by malware and/or access via social engineering.[78][79][80][81][82] This is the sort of thing that gets bitcoins called "Dunning-Krugerrands."[83]

The decentralised nature attracts libertarian extremists (go read any Bitcoin forum for more wacko libertarianism than you ever thought possible). There are Bitcoin advocates who are not annoying Randroid fools, but the ones who are tend to drown out all the others. It is unsurprising, then, that some business writers have accused them of cultish behaviour;[55][84] some proponents are simply aghast that anyone might not consider it valuable for services rendered.[85]

One of the otherwise-saner advocates is Rick Falkvinge, founder of the Swedish Pirate Party, who has put all his savings into bitcoins.[86] Though, he also details its problems.[87] He is a big fan of Bitcoin not as a general currency, but as a pure medium of exchange, substituting for PayPal or credit cards and changing back into a more popular currency at each end—as the Visa/Mastercard/PayPal oligopoly's willingness to block recipients they, the American government or fundamentalists don't like, starts to become a practical problem.

Andrew Napolitano from Fox Business Network supports Bitcoin as well. In a move that may make many of his fans cry, Ron Paul does not.[88]

Banks and exchanges

There are multiple Bitcoin "banks," but most of this seems to revolve around doing things with bitcoins,[89] leading to accusations of cargo cult economics. And scams. There are lots of scammers in the Bitcoin community, who are punished by the harshest method imaginable: getting a "scammer" tag on the BitcoinTalk.org forum.

There is a Bitcoin exchange hack or collapse approximately every month; up to 2015, a third of exchanges had been hacked.[90] Leaving any money exposed on a Bitcoin exchange is a terrible idea.

One Bitcoin exchange, Bitcoin-Central (now called Paymium), has achieved bank status in France.[91] Their aim is to supply an alternative to PayPal, and their central bank backing on balances only applies to accounts in euros rather than in bitcoins. On the other hand, other players in the Bitcoin field have had to suspend operations because US banks view companies involved with Bitcoin as too high risk to do business with,[92] or have had to suspend US dollar withdrawals for undisclosed reasons.[93]

China

Despite Western-oriented services being portrayed as synonymous with the Bitcoin "brand" — Mt. Gox was still responsible for 90% of all Bitcoin transactions by the end of 2012,[94] so this isn't entirely unwarranted — Chinese exchanges actually overtook it in output before its collapse.[95] This presents another serious problem for the cryptocurrency moving forward: attempts by the US government to impose regulations post-Gox pale in comparison to recent pressure by Beijing to crack down on the Chinese market.[96] One incentive is off-the-books currency exchange: buy hardware and electricity in yuan, make it into bitcoins and sell the bitcoins for dollars.

The scheme

“”[This] Bitcoin crash is traumatic. I haven't seen this many libertarians cry since they found out Ayn Rand took Social Security for eight years. |

| —Drew Fairweather[97] |

In order to prop up the initial system, Bitcoin mining was designed to bribe early users with exponentially better rewards than latecomers could get for the same effort. In its current state - and as predicted as part of its core design curve - it is not feasible for a newcomer to Bitcoin to mine their own assets. The economies of scale are far too large and home PC equipment is obsolete. So, to join the network at all, new users must instead give ever-increasing amounts of wealth to previous bitcoiners who are sitting around doing nothing. This effectively makes Bitcoin a pump-and-dump scheme wherein these early adopters, who have more bitcoins than anyone else ever will and did little or no work and assumed no risk, hype it up so they can offload their bitcoins onto fools who think they'll strike it rich as speculators. At the same time those speculators, who are providing all of the capital (the amount of money Bitcoin is actually worth is limited to the amount of fiat currency placed in Bitcoin exchanges as that is the only way new value can enter the ecosystem) and taking all of the risk of a crash, are chasing far lower percentage returns than initial users would receive. This is another classic characteristic of both mania bubbles and the aforementioned pump-and-dump scheme. This means the system runs on opportunism, especially among people who like the idea of decentralized techno-money. This setup is defended as an acceptable trade-off and/or a fair reward for propping up the system.[98]

In the meantime, speculators and opportunists have remained Bitcoin's main users: according to one 2012 study, only 22% of existing bitcoins were in circulation at all, there were a total of 75 active users/businesses with any kind of volume, one (unidentified) user owned a quarter of all bitcoins in existence, and one large owner was trying to hide their wealth accumulation by moving it around in thousands of smaller transactions.[99] Meanwhile, businesses, from family stores to multimillion-dollar corporations, have jumped onto Bitcoin to seem forward-looking and get a cut of the Bitcoin action.[100] But go on, dive in and get rich.

More mundane problems

The real and overriding issue with Bitcoin is that it does practically nothing that isn't already possible, while also introducing flaws of its own:

- Security: The insecure nature of Bitcoin has turned out to be a major issue, with an estimated 17-25% (between 2.78 and 3.79 million Bitcoins valued at US$8500 each in November 2017) of all Bitcoins lost forever — this does not include Bitcoins merely lost to theft.[101] The wide range in estimates is due to the uncertainty of whether the original ("Satoshi") Bitcoins were lost.[101] The losses can occur "from a misdirected transaction or the loss of a private key through death or carelessness."[101] If the Satoshi coins were not lost, and they suddenly appear, it could deliver a big shock to the Bitcoin market.[101] Following the 2019 sudden death of the founder of Canada's biggest cryptocurrency exchange, QuadrigaCX, $190 million in other people's cryptocurrency holdings became inaccessible, possibly indefinitely.[102] In 2020, US$1 billion in bitcoin was seized by the US government from someone who had stolen it from Ross Ulbricht's Silk Road illicit drug operation in 2012-2013.[103]

- Thefts: As of 2017, it was estimated that 980,000 Bitcoins had been stolen (worth roughly US$15 billion as of December 6th 2017).[104] Stolen Bitcoins are rarely recoverable. In January 2018, about $400 million in NEM cryptocoins were stolen from the Japanese exchange Coincheck in a single event.[105] A relatively small amount of cryptocurrency was stolen in 2018: 215 Ethereum coins (about US$152,000); this was accomplished not by exploiting a security flaw in the cryptocurrency but by exploiting a security flaw in the internet, the Border Gateway Protocol.[106]

- Fiat coin: For the average person it's far more hassle than it's worth when the rest of the world takes traditional currencies (or "fiat" on Bitcoin communities, who use it as a snarl word[note 8]) and that there's nothing they can buy with Bitcoin that they can't buy with the money they already have. Responses to this range from wishful thinking that this will be irrelevant when Bitcoin takes over the world and then goes to the Moon, to assertions that people will choose Bitcoin despite its comparative lack of utility simply because they like the idea, to prognostications that when more small businesses start accepting Bitcoin — and why wouldn't they! — popularity will boom (It should be noted that this has been tried in Cleveland, with poor results[107]).

- Retail hassles: Much is made of Bitcoin's efficiency for buying things online—but there's almost nothing you can buy with Bitcoin that you can't buy with the money you already have, and a credit or debit card already lets you buy things online with minimal hassle and with fraud protection. Escrow is touted as a solution for this, but there are almost no working examples. When Butterfly Labs stiffed people on Bitcoin mining equipment, Bitcoiners who paid with filthy fiat via PayPal were able to raise chargebacks and get their money refunded, which many did gleefully;[108] those who paid with Bitcoin had no recourse other than the courts.

- Almost all online retailers who supposedly accept Bitcoin actually charge whatever the price of the product would be in conventional currency at the current exchange rate, then cash in the bitcoins as soon as is feasible. This raises questions about how stable Bitcoin's "economy" is when a lot of its participants wouldn't be involved if they couldn't get conventional money out of it.

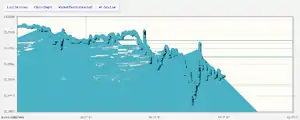

- Speed: Being a distributed computing project means that Bitcoin transactions are at the mercy of not only network latency (like credit or fund transfer transactions) but the time it takes for the transaction to be processed and stored around the network. The protocol design is for this to take approximately ten minutes (average; in practice it varies randomly between a minute and several hours)—barely usable for network orders, but problematic for point-of-sale use (The beer-selling example doesn't bother reconciling in real time, as the owner is treating the Bitcoin risk as a marketing expense). In 2015, transaction times over an hour are increasing in frequency.

- Scalability: Bitcoin is already failing to scale. It is limited to a worldwide total of 7 transactions per second, due to the design of the protocol,[109] and around 2.7 transactions per second in practice.[110] (Compare PayPal, which claims an average of 134 transactions per second as of 2014;[111] Visa, which ran approximately 15,000 transactions per second in 2013, with a capacity of 47,000 transactions per second;[112] even Western Union alone averages 29 transactions per second.[113]) The blockchain passed 150 gigabytes in February 2018.[114] This is large enough to be problematic for individuals to download, and its growth rate is increasing. A stress test by some Reddit /r/bitcoin posters sent confirmation times to eight hours with very little effort or expense.[115]

- Physical bitcoins: For those who prefer a non-virtual virtual currency, some companies came up with physical bitcoins. One of the more popular was the Casascius coin, which was forced to change into empty non-virtual virtual coins after the US Financial Crimes Enforcement Network classified the coins as a form of "money transmitting".[116] Fraud has been another concern with physical bitcoins.[116]

- Non-fixed supply: It is widely believed that there is a fixed supply of bitcoins — this is something that appeals to goldbugs since it makes Bitcoin a sort of virtual gold. In fact, the Bitcoin protocol could theoretically be changed by community consensus to include additional coins; many other changes to the protocol have already occurred, such as an updates to allow for new payment conditions. The regular addition to the maximum number of coins could be motivated by a desire to avoid the inevitable deflationary spiral, but it could also destroy confidence among hardcore goldbugs.[117]

- Transaction fees: It is often predicted that Bitcoin will overtake other online payment schemes ("In five years, if you try to use fiat currency they will laugh at you." — Silicon Valley investor Tim Draper[118]). Current design however limits the system to handling only a few transactions per second (theoretical maximum of 7 per second, with actual achieved speeds of 3 to 4 per second); this is a major drawback for practicality because it compares to Paypal (193 per second) and Visa (1667 per second).[119] Though Bitcoin transactions were once free, the fees for transactions is becoming an increasingly significant problem, with fees averaging $20/transaction, but rising as high as $400 based on demand, with the current trend towards increased fees.[117]

- Taxation: In the US, the Internal Revenue Service regards Bitcoin as property and not as currency, so every transaction is regarded as a profit or loss for tax purposes.[120] For investors in large brokerage firms, trading in property like real estate mutual funds is not a big deal because the brokerage firms (which aren't involved in virtual currency) take care of summarizing the the profits and losses for the investor, but for Bitcoin investors, who use intermediaries such as Coinbase, the investors are currently on their own.[120] Compounding this problem is that if one actually finds a retailer that accepts Bitcoin, then each purchase has tax implications because it requires transacting Bitcoin.[120] The IRS recently forced Coinbase to divulge the tax information of its customers, so don't plan to slip under the radar.[120]

Other distributed cryptocurrencies

A number of copycat cryptocurrencies ("altcoins") exist as a consequence of the Bitcoin experiment, only a few of which, such as Litecoin

Dogecoin

Dogecoin[124] gained some popularity on cuteness value and use for tipping on Reddit.[125] Unlike most altcoins, Dogecoin is slightly inflationary rather than deflationary.[126] Despite having similar get-rich hopes, Dogecoin fans are also notably less dickish than Bitcoin fans, though that's not hard to achieve.

Ethereum

Ethereum is the trendy altcoin in 2016, which offers a platform for smart contracts. (Imagine Bitcoin as a spreadsheet, Ethereum as a spreadsheet with macros.) In practice it's traded like any other cryptocurrency, with pumps[127] and dumps[128] and so forth, one of the most prominent Ethereum smart contract is an "honest Ponzi"[129] and another, "The DAO", lost $50 million to security bugs in the smart contract code.[130]

In addition, like many altcoins, Ethereum was substantially premined before a big launch sale[131] and its creator, Vitalik Buterin, is partially cashing out now it's been pumped; he describes this as "sound financial planning."[132]

Before Ethereum, Vitalik Buterin had proposed to solve an NP-complete problem in polynomial time by using a quantum computer. Of course, he didn't have a quantum computer, because nobody does. Instead, he was going to simulate it on a classical computer. Sadly for his Fields Medal hopes, he couldn't convince people to fund this enterprise.[133] The particular NP-complete problem he wanted to solve was not any of the zillions of long-known NP-complete problems it would have been useful to have a solution to — he wanted to use it to mine Bitcoins more efficiently. For some reason, even Bitcoin programmers make fun of his computer science skills.[134]

Reception

Many Bitcoin advocates really don't like altcoins:[135] most of the value proposition of Bitcoin is the strictly limited quantity available, and they perceive altcoins as undermining their HODLing,[note 10] instead suggesting the way to resolve Bitcoin's scaling problems without altcoins is with hypothetical add-ons such as sidechains.[137] (Though sidechain developers themselves are not so optimistic.[138]) They dismiss altcoins as scams (though they don't regard the substantially-premined Bitcoin as one). However, there is no way for them to stop altcoins from being created.

Scamcoins

To be fair, quite a lot of altcoins since the 2013 boom were blatant scams: make a coin, premine it, promise far-fetched features in BitcoinTalk's altcoin forum,[139] get it onto an exchange, sell it for Bitcoins. USBCoin, for example, netted 150 BTC this way.[140] DafuqCoin compromised exchanges because nobody checked the code before running it.[141][142] Bitconnect

BitcoinTalk dealt with these coins firmly: it limited advertisement signature image dimensions.

The moral of the story

In a gold rush, the money's in selling shovels. Cash up front, please.

(Unless you're Butterfly Labs, in which case the shovel-sellers are crooks too.[146])

Culture

As Bitcoin has grown in popularity, its advocates have discovered common interests with other groups. This has expanded from the early links between the Bitcoin movement and libertarian, anarchist, and minarchist groups. It is unsurprising that some Bitcoin enthusiasts hold conspiracy theories about fiat currency and the gold standard and Jewish conspiracies controlling world banking.[147] But Bitcoin culture goes well beyond that: there are subcultures like the "bitcoin carnivore", "bitcoin and meat maximalists", who embrace an extreme version of the paleo diet while trying to free themselves from the shackles of banking, big food, and carbohydrates, minting their own money and killing their own dinner.[148][149]

See also

- See the Wikipedia article on Bitcoin.

- Ponzi Scheme

- Bitcointistan

External links

- Bitcoin.org

- BitcoinTalk forum, glorious home of the revolution

- Buttcoin, criticism by vicious statists who hate freedom

- Bitcoin currency statistics and charts

- The Bitcoin Bubble and the Future of Currency, Felix Salmon (The ultimate primer on why Bitcoin, if not drastically retooled, will eventually fail — and how some of its features may be repurposed elsewhere.)

- Use your computer for something actually relevant.

- Advanced Bitcoin Simulator and Bitcoin Mining Profit Calculator: Gaiden, brilliant dark satires of Bitcoin, its community and its history.

- Dead Coins — autopsies of failed coin launches

- Coinpsy — another list of failed coin launches

- CoinMarketCap - Bitcoin and Cryptocurrencies market capitalization

- ExchangeRates.Pro - Bitcoin and Cryptocurrencies price comparison at the exchanges

Notes

- As per the ISO currency code standard, "BTC" is actually incorrect as a descriptor for Bitcoin. Currency codes are made up of an ISO country code (e.g. "GB" for the United Kingdom) and a third letter denoting the currency unit ("P", so "GBP" for the pound sterling). "BTC" therefore would imply a Bhutanese currency. "XBT" is unofficial, but is in line with the standard as non-currencies like gold and international currency units get an "X" prefix. Of course, as Bitcoiners are often both ignorant of how the world works and arrogant enough to think they can sweep the whole lot away, this often gets ignored and it's referred to as "BTC" anyway.

- You would be picturing the Randgasms right about now.

- Types of money include "commodity money", whose metallic forms are usually called specie. The canonical forms of commodity money are gold and silver, but other goods, from cigarettes to beaver pelts have been used as commodity money. There is also "representative money", scrips that can be redeemed for commodity money. Finally, there is "fiat money", which is called into being by declaring it to be money, usually but not necessarily by a government issuing it and binding itself to accept it in payment. The distinctive thing about commodity money is that it consists of things that have intrinsic value; whatever the value of the currency unit indicated by the coin, it also has "melt value" that can always be realized. Bitcoin is "fiat money" in that it consists of code that has been declared to be money. Unlike other fiat currencies, there is no entity that backs the currency by declaring its willingness to accept Bitcoin as payment for anything.

- One significant difference is that the US government usually asks people to pay taxes in US dollars.

- The real litmus test for a currency, of course, is whether you can buy sex with it. Bitcoin passes for phone sex, so let's end the Fed!

- Wikipedia's list of distributed computing projects

File:Wikipedia's W.svg listed Bitcoin at 312,000 teraflops equivalent as of November 2012; second place was Folding@home at 8,588 teraflops as of February 2012. Bitcoin actually uses integer calculations, so that number's fudged, but it's still the largest by a ridiculous margin. Actual participant numbers were much smaller: a few thousand for Bitcoin, a few hundred thousand for Folding@home. - Then comes the argument that in a libertarian world everyone would have generated their own power and those who want to make more money would "invest in infrastructures" and keep their tools of trade in working order.

- Note that in real economics, "fiat" simply means "money not backed by a commodity". Thus, Bitcoin is also fiat. The usage of "fiat" as a snarl word comes from goldbug screeds. Bitcoiners adopted this usage of the word without realising the term also applied to Bitcoins.

- The Shitcoin term has already been in use by Bitcoin detractors to describe Bitcoin, and by Bitcoin advocates to describe all non-Bitcoin cryptocurrencies. In October 2013 someone did the obvious and introduced a Shitcoin for real.

- HODLing was initially a typo for "HOLDing" that was later reverse-acronymmed to Hold On for Dear Life.[136]

References

- Bitcoin is teaching libertarians everything they don’t know about economics by Matt O'Brien (January 8, 2018) The Washington Post.

- What is Bitcoin and how does it work?, Mashable

- The Gospel according to St. Satoshi (the original Bitcoin paper)

- Re: Transactions and Scripts: DUP HASH160 … EQUALVERIFY CHECKSIG (2010-06-18 16:17:14 UTC) Satoshi Nakamoto Institute.

- The Rise and Fall of Bitcoin, Wired

- Alleged Bitcoin inventor says Newsweek story is dead wrong, Ars Technica

- 7 things you need to know about Bitcoin, PCWorld

- Meet the Suckers, it's like dot-com investing all over again! (5/6 are still in the game.)

- Silk Road Boss’ First Murder-for-Hire Was His Mentor’s Idea by Andy Greenberg (04.01.15 5:00 pm) Wired.

- Hitman Network Says It Accepts Bitcoins to Murder for Hire by Eli Lake (10.17.135:45 AM ET) The Daily Beast.

- What Is Ransomware? A Guide to the Global Cyberattack’s Scary Method by Kim Zetter (05.14.17 1:00 pm) Wired.

- McAfee Labs Report Sees New Ransomware Surge 165 Percent in First Quarter of 2015 (June 9, 2015) McAfee (archived from September 17, 2015).

- Kiell (11 December 2014). "A Carder’s First Experience". Retrieved 18 August 2015.

- Kujawa, Adam (24 January 2014). "FBI Takes Down Poorly Secured Carders". Retrieved 23 August 2015.

- Frequently Asked Questions: Is Bitcoin anonymous? Bitcoin.org

- Protect your privacy Bitcoin.org

- Bitcoin Exchange Mt. Gox Goes Offline Amid Allegations of $350 Million Hack, Wired (Later revised to half a billion USD.)

- What the Bitcoin theft might look like if it happened in the real world, Maclean's

- WizSec. The missing MtGox bitcoin. 19 April, 2015. Archived on 19 April, 2015 from The Missing MtGox Bitcoins.

- Nathaniel Popper, Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money

- The Byzantine General's Problem: Lamport, Shostak, and Pease for SRI International

- "Anything goes. Can roleplay." (Note that the service offered would, under the 2003 amendments to the Protection of Children Act 1978

File:Wikipedia's W.svg , constitute the production of filmed child pornography.) - Gawker.com: archive.is, web.archive.org The Underground Website Where You Can Buy Any Drug Imaginable] (Adrian Chen, Gawker, 2011-06-01); Silk Road has since been busted by the FBI and revived, and then busted again. (There are also lots of other marketplaces including

Black Market Reloaded and Sheep MarketplaceNever mind.) - Court extends Butterfly Labs asset freeze, Ars Technica

- Disruptions: Betting on a Coin With No Realm, The New York Times

- London's Bitcoin pub, Wired

- "Eliminate Bitcoin Volatility Risk with BitPay"

- Deep Web Drug Dealers Are Freaking Out About The Bitcoin Crash by Rob Price (Jan. 16, 2015, 3:48 PM) Business Insider.

- And down if miners leave.

- Bits and bob (Babbage, The Economist, 2011-06-13); print version

- Bitcoin bank heist (Babbage, The Economist, 2014-02-26)

- There Are Smart Kinds of Money and Dumb Kinds of Money, Brookings Institution

- Is Bitcoin a Real Currency? An economic appraisal, NBER

- The Bitcoin Question: Currency versus Trust-less Transfer Technology, OECD

- Heads or Tails? What the Future Holds for Bitcoin and ‘Altcoins’, University of Pennsylvania

- In Search of a Stable Electronic Currency, The New York Times

- Golden Cyberfetters, The New York Times

- The Long Cryptocon, The New York Times

- Buffett: ‘Stay Away’ From Bitcoin, VentureBeat (The author's belief that the currency should be rebranded as 'Bitgold' is particularly ironic because that was the name of one of its precursors

File:Wikipedia's W.svg .) - "Bitcoin ‘Ought to Be Outlawed,’ Nobel Prize Winner Stiglitz Says", Bloomberg.

- "Stiglitz Says Bitcoin 'Ought to Be Outlawed'", Bloomberg.

- Virtual Currency Schemes: October 2012, ECB

- Warning to consumers on virtual currencies, EBA

- CFPB warns consumers about bitcoin 'Wild West', The Hill

- Professional Traders Show Interest in Bitcoin, Hacker News

- Bitcoin's Vast Overvaluation Appears Caused by Price-fixing, Falkvinge

- Bots were responsible for bitcoin’s stratospheric ascent, anonymous report claims, GigaOM

- Bitcoin's astronomical rise last year was buoyed by market manipulation, researchers say by Hamza Shaban (June 14, 2018 at 10:25 AM) The Washington Post.

- How Bitcoin and cryptocurrencies are hurting gamers by Jarred Walton (July 05, 2017) PC Gamer.

- The Economics of Bitcoin Mining: Bitcoin in the Presence of Adversaries, Princeton University (They describe it more ominously as a "Goldfinger attack.")

- Weaknesses: Attacker has a lot of computing power Bitcoin Wiki.

- Once hailed as unhackable, blockchains are now getting hacked: More and more security holes are appearing in cryptocurrency and smart contract platforms, and some are fundamental to the way they were built. by Mike Orcutt (February 19, 2019) MIT Technology Review.

- Bitcoin Mining Software P2Pool Calls For Hardfork Upgrade In 24 Hours Before BIP66 Takes Effect by Lester Coleman (June 27, 2015 6:56 PM UTC) Crypto Coin News.

- Bitcoin Network Capacity Analysis – Part 3: Miner Incentives (Jun 09, 2015) TradeBlock.

- The Doomsday Cult of Bitcoin, New York Magazine

- Ghash.io: We Will Never Launch a 51% Attack Against Bitcoin, CoinDesk

- How a Mining Monopoly Can Attack Bitcoin, Hacking Distributed

- Bitcoin: What is a Finney attack? (2012) StackExchange.

- GHash.IO and double-spending against BetCoin Diceimg (RoadTrain, BitcoinTalk forums, 30 October 2013)

- The Bitcoin Mining Accidents blog has disappeared, but you may enjoy the most famous tale from it, of heatstroke-induced brain damage from an overheating Bitcoin rig. In 2014, a huge Bitcoin mine burned down in Bangkok, Thailand, showing that not just small-time idiots are susceptible to getting burned.

- Decarbonizing Bitcoin: Law and policy choices for reducing the energy consumption of Blockchain technologies and digital currencies, Jon Truby, Energy Research & Social Science

- Bitcoin power consumption is estimated at between 0.1 and 10 GW average over 2014; Ireland consumed around 3 GW average. O'Dwyer and Malone. "Bitcoin Mining and its Energy Footprint." Presented at ISSC 2014 / CIICT 2014, Limerick, June 26–27 2014.

- 982MWh per day in 2013: Bitcoin’s Environmental Problem, CleanTechnica

- $20 in October 2014; peak was $90/transaction in January 2014. (NASDAQ charges way less in comparison per transaction, indicated by the fact that your broker makes money with said commissions.)

- Someone did come up with CureCoin, which rewards both ASICs securing the blockchain and CPU/GPU protein folding. Note that protein folding doesn't have the same security properties hashes have.

- Cryptocurrency mining in Iceland is using so much energy, the electricity may run out by Rick Noack (February 13, 2018 at 12:24 PM) The Washington Post.

- Quantification of energy and carbon costs for mining cryptocurrencies by Max J. Krause & Thabet Tolaymat (2018) Nature Sustainability 1:711–718.

- Mining Bitcoin Can Be More of an Energy Drain Than Actual Mining by Brian Kahn (11/05/18 12:13pm) Gizmodo.

- Bitcoin Surges 15% Overnight Because Nobody Learned Their Lesson After the Last Crash by Matt Novak (April 2, 2019; 7:20am) Gizmodo.

- Bitcoin leaves a carbon footprint as large as Las Vegas, study finds

- Mixing service Bitcoin Wiki.

- Our Fees (2014) Bitcoin Mixing Service (August 11, 2014).

- Our Fees Coin Mixer (archived from August 11, 2014). Note: As of 2020, accessing the live site on some browsers brings upa security risk warning!

- Mixing service Bitcoin Wiki.

- Inside the Mega-Hack of Bitcoin: the Full Story (Jason Mick, DailyTech, 2011-06-19)

- "No database backups ... Everyone had root."

- Suspected multi-million dollar Bitcoin pyramid scheme shuts down, investors revolt, The Verge

- Bitcoin-stealing trojan spotted in the wild, VentureBeat

- Mac Bitcoin-stealing malware spreads via cracked versions of Angry Birds and other apps, Polygon

- Bitcoin’s skyrocketing value ushers in era of $1 million hacker heists, Ars Technica

- $1.2 million in Bitcoins hijacked in 'social engineering' attack, Engadget

- Bitcoin stolen via malware-infected pirated copy of Fallout 4, SiliconANGLE

- In mathematics we trust, MetaFilter

- The Bitcoin personality cult lives on, Financial Times

- The average Bitcoin evangelist. (Want to laugh for a few more minutes? Here's a full collection of insane Bitcoin comments from Reddit — yes, they're all real.)

- Why I'm Putting All My Savings Into Bitcoin, Falkvinge

- "Bitcoin's Four Hurdles," parts 1, 2, 3, and 4

- Ron Paul Slams Stability of US Dollar and Bitcoin in Pro-Gold Rant, The Raw Story

- Firm says online gambling accounts for almost half of all Bitcoin transactions, Ars Technica

- Risk of Bitcoin Hacks and Losses Is Very Real (August 29, 2016 4:56 AM EST) Reuters via Fortune.

- Virtual cash exchange becomes bank, BBC

- Bitspend ceases trading due to frozen accounts, CoinDesk

- Mt. Gox temporarily suspends USD withdrawals, CoinDesk

- Bitcoin trading volume since 2010 at Bitcoinity

- Timeline: a history of Bitcoin in China in 2013, Tech in Asia

- Bitcoin’s Uncertain Future in China, United States-China Economic and Security Review Commission

- "Look at the big picture!"

- FAQ – Economy on the "official" Bitcoin Wiki.

- A look at the Bitcoin network transaction history, TechnoLlama

- What Companies Accept Bitcoin?, NASDAQ

- Exclusive: Nearly 4 Million Bitcoins Lost Forever, New Study Says by Jeff John Roberts and Nicolas Rapp (November 25, 2017) Fortune.

- After founder's sudden death, cryptocurrency exchange can’t access $190 million in holdings by Taylor Telford (February 4, 2019 at 2:18 PM) The Washington Post.

- Justice Department Seizes $1 Billion of Bitcoin Tied to Silk Road Website: Agency says a hacker stole funds in 2012, 2013 from drug website, left untouched for years by Paul Vigna (Updated Nov. 5, 2020 6:23 pm ET) The Wall Street Journal.

- Hackers steal $64 million from cryptocurrency firm NiceHash by Jim Finkle & Jeremy Wagstaff (December 6, 2017 / 7:20 PM) Reuters.

- Coincheck Says It Lost Crypto Coins Valued at About $400 Million by Yuji Nakamura & Andrea Tan (January 26, 2018, 12:23 AM PST; Updated on January 26, 2018, 10:49 AM PST) Bloomberg.

- A $152,000 Cryptocurrency Theft Just Exploited A Huge 'Blind Spot' In Internet Security by Thomas Fox-Brewster (Apr 24, 2018, 02:10pm) Forbes.

- "Bitcoin Boulevard no longer booming", Marketplace

- Refunds!

- Scalability on the "official" Bitcoin Wiki.

- Re: Bitcoin 20MB Fork by solex (February 04, 2015, 10:17:57 PM) Bitcoin Forum.

- About Paypal (archived from Feburary 3, 2015). "PayPal customers made 1.06 billion transactions*** in Q4 2014": 1.06e9 / (60×60×24×365.25/4) = 134.

- [Stress Test Prepares VisaNet for the Most Wonderful Time of the Year (Oct 10, 2013) Visa

- Western Union 2013 Annual Report, page 2 (archive)

- Higher and higher.

- Stress Test Recap (45sbvad, /r/bitcoin, 30 May 2015); graph

- 10 Physical Bitcoins: the Good, the Bad and the Ugly by Nermin Hajdarbegovic (September 14, 2014 at 19:15 BST) CoinDesk.

- Five myths about bitcoin: No, the currency isn't beyond the reach of the law, and it won't replace cash. by Joseph Bonneau & Steven Goldfeder (December 15, 2017) The Washington Post.

- Tim Draper On Bitcoin: 'In 5 Years If You Use Fiat Currency, They Will Laugh At You' by John Koetsier (Nov 7, 2017 @ 10:10 AM) Forbes.

- Bitcoin and Ethereum vs Visa and PayPal – Transactions per second (April 22, 2017) Altcoin Today.

- 'It's going to be a nightmare': Some bitcoin investors are in for a rocky tax season by Brian Fung (January 11, 2018) The Washington Post.

- Although it has since moved to piggybacking off the Bitcoin blockchain, since one miner took over 70% of the Namecoin hashing power for much of 2014 and 2015.

- Because Cyprus.

- Coinye developers say they're abandoning project as Kanye West escalates legal battle, The Verge

- To the moon!

- Online Donors Send Jamaican Bobsled Team To Sochi, NPR

- Dogecoin to allow annual inflation of 5 billion coins each year, forever, Ars Technica

- Bitcoin rival Ethereum's price skyrockets by Jessica Sier (Feb 11, 2016 – 4.34pm) Fienancial Review.

- Is Ethereum a Bubble or is it Being Pumped – What Does the Data Say? Are bots generating fake ETH volumes, are investors fleeing bitcoin for Ethereum, is there a SPAM campaign to pump its by Avi Mizrahi (24/02/2016 | 16:57 GMT+2) Finance Magnates.

- Introducing SmartPonzi, a Ponzi scheme simulator ÐApp based on Ethereum self.ethereum by smartcontractor (c. October 2015) /r/ethereum Reddit (archived from 3 Mar 2016 10:11:15 UTC)

- Digital currency Ethereum is cratering because of a $50 million hack by Rob Price (Jun. 17, 2016, 10:34 AM 12,030) Business Insider.

- Code your own utopia: Meet Ethereum, bitcoin's most ambitious successor by Nathan Schneider (April 7, 2014 5:00AM ET) Aljazeera America.

- We Need to Think of Ways to Increase ETH Adoption by u/defenderofjustice (April 21, 2016) Reddit (archived from 23 Apr 2016 15:02:56 UTC).

- [Vitalik’s Quantum Quest (August 16, 2016) Bitcoin Error Log (archived from 15 Oct 2016 12:27:07 UTC).

- Can we not have egomaniacs, ex-cons, and scam artists leading efforts to fork? (c. 2017) Reddit.

- Call the whambulance

- For Bitcoin, HODLing Is The Best Strategy… With One Big Caveat by Matt Hougan (Apr 23, 2018, 06:00am) Forbes.

- "Sidechains Can Replace Altcoins and ‘Bitcoin 2.0' Platforms"

- Blockstream to Release First Open-Source Code for Sidechains by u/bubbasparse (c. 2016) Reddit.

- e.g. USBcoin

- USBcoin Confirmed As Scam, Removed From Bittrex, Fifth Scam Coin on Bittrex Exchange In Little Over A Month (Ian DeMartino, CoinTelegraph, 28 July 2014)

- Dafuq Coin, the first malware coin (Cryptocurrency Times, 4 May 2014) (archive)

- READ ME NOW! - dafuqcoin is a trojan - pool operators/exchanges beware (BitcoinTalk, 22 April 2014)

- Cryptocurrencies: Last Week Tonight with John Oliver by LastWeekTonight (Mar 11, 2018) YouTube.

- Update: After alleged scam, “Ponzicoin” refunds around $7,000 due to error

- Maina, Saruni. (January 26, 2018). Developer Shuts Down Fake Cryptocurrency PonziCoin after Things Go “Crazy Out of Hand”. Tech Weez. Retrieved: 7 July, 2019.

- FTC shuts down Butterfly Labs, the second-most hated company in Bitcoinland: The mining equipment company failed to deliver tens of thousands of computers, and delivered others so late they were obsolete by Adrianne Jeffries (Sep 23, 2014, 12:25pm EDT) The Verge.

- Anti-Semitism Drives Irrational Response To Cryptocurrency Warning, Jason Bloomberg, Forbes, March 17, 2018

- Inside the world of the Bitcoin carnivores, Motherboard, Vice, Sep 29, 2017

- They mock vegans and eat 4lbs of steak a day: meet 'carnivore dieters', The Guardian, May 11, 2018