Minimum wage in the United States

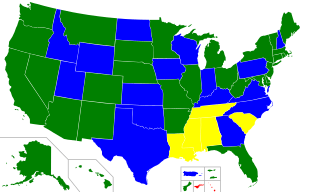

The minimum wage in the United States is set by U.S. labor law and a range of state and local laws.[2] Employers generally have to pay workers the highest minimum wage prescribed by federal, state, and local law. Since July 24, 2009, the federal minimum wage is $7.25 per hour.[3] As of January 2020, there were 29 states and D.C with a minimum wage higher than the federal minimum.[4] From 2018 to 2019, seven states increased their minimum wage levels through automatic adjustments, while increases in sixteen other states and D.C. occurred through referendum or legislative action.[5]

Higher Same Lower[lower-greek 1]

While the federal minimum wage is $7.25, most states[6]:1 and many cities have higher minimum wages resulting in almost 90% of U.S. minimum wage workers earning more than $7.25.[6] The effective nationwide minimum wage, the wage that the average minimum wage worker earns, is $11.80 as of May 2019. This is the highest it has been since at least 1994, the earliest year effective minimum wage data was available.[6]:1

The purchasing power of the federal minimum wage peaked in 1968 at $1.60 ($12.00 in 2019 dollars).[7][8][9] If the minimum wage in 1968 had kept up with labor's productivity growth, it would have reached $19.33 in 2017.[10] In 2019, the Congressional Budget Office released a report which estimated that raising the federal minimum wage to $15 an hour would benefit 17 million workers, but also cause 1.3 million people to lose their jobs.[11][12]

A 2016 Pew survey found that 52% of voters supported a $15 federal minimum wage with 89% of black, 71% of Latino, and 44% of white voters in favor.[13] In 2018, about 1.7 million Americans made at or below the federal minimum wage.[14] About 2% of white, Asian, and Latino workers earned the federal minimum wage or less. Amongst black workers, the percentage was about 3%.[14]

History

Minimum wage legislation emerged at the end of the nineteenth century from the desire to end sweated labor which had developed in the wake of industrialization.[17] Sweatshops employed large numbers of women and young workers, paying them what were considered nonliving wages that did not allow workers to afford the necessaries of life.[18] Besides substandard wages, sweating was also associated with long work hours and unsanitary and unsafe work conditions.[19] From the 1890s to the 1920s, during the Progressive Era, a time of social activists and political reform across the United States, progressive reformers, women's organizations, religious figures, academics, and politicians all played an important role in getting state minimum wage laws passed throughout the United States.[20]

The first successful attempts at using minimum wage laws to ameliorate the problem of nonliving wages occurred in the Australian state of Victoria in 1896.[21][22] Factory inspector reports and newspaper reporting on the conditions of sweated labor in Melbourne, Victoria led in 1895 to the formation of the National Anti-Sweating League which pushed the government aggressively to deal legislatively with the problem of substandard wages.[23] The government, following the recommendation of the Victorian Chief Secretary Alexander Peacock, established wage boards which were tasked with establishing minimum wages in the labor trades which suffered from unlivable wages. During the same time period, campaigns against sweated labor were occurring in the United States and England.[24]

Progressive Era

As in Australia, civic concern for sweated labor developed in the United States towards the end of the Gilded Age. In New York state in 1890, a group of female reformers who were worried about the harsh conditions of sweated labor in the country formed the Consumer's League of the City of New York. The consumer group sought to improve working conditions by boycotting products which were made under sweated conditions and did not conform to a code of "fair house" standards drawn up by them. Similar, consumer leagues formed throughout the United States, and in 1899, they united under the National Consumer League (NCL) parent organization.[25] Consumer advocacy, however, was extremely slow at changing conditions in the sweated industries. When NCL leaders in 1908 went to an international anti-sweatshop conference in Geneva, Switzerland and were introduced to Australian minimum wage legislation, which had successfully dealt with sweated labor, they came home believers and made minimum wage legislation part of their national platform.[26]

In 1910, in conjunction with advocacy work led by Florence Kelley of the National Consumer League, the Women's Trade Union League (WTLU) of Massachusetts under the leadership of Elizabeth Evans took up the cause of minimum wage legislation in Massachusetts. Over the next two years, a coalition of social reform groups and labor advocates in Boston pushed for minimum wage legislation in the state.[27] On June 4, 1912, Massachusetts passed the first minimum wage legislation in the United States, which established a state commission for recommending non-compulsory minimum wages for women and children.[28][29] The passage of the bill was significantly assisted by the Lawrence textile strike which had raged for ten weeks at the beginning of 1912. The strike brought national attention to the plight of the low wage textile workers, and pushed the state legislatures, who feared the magnitude of the strike, to enact progressive labor legislation.[30]

By 1923, fifteen U.S. states and the District of Columbia had passed minimum wage laws, with pressure being placed on state legislatures by the National Consumers League in a coalition with other women's voluntary associations and organized labor.[31][32] The United States Supreme Court of the Lochner era (1897–1937), however, consistently invalidated labor regulation laws. Advocates for state minimum wage laws hoped that they would be upheld under the precedent of Muller v. Oregon (1908), which upheld maximum working hours laws for women on the grounds that women required special protection that men did not.[32] The Supreme Court, however, did not extend this principle to minimum wage laws.[31]:518 The court ruled in Adkins v. Children's Hospital (1923) that the District of Columbia's minimum wage law was unconstitutional, because the law interfered with the ability of employers to freely negotiate wage contracts with employees. The court also noted that women did not require any more special protection by the law, following the passage in 1920 of the Nineteenth Amendment, which gave women the right to vote and equal legal status.[33]

New Deal

In 1933, the Roosevelt administration during the New Deal made the first attempt at establishing a national minimum wage regiment with the National Industrial Recovery Act, which set minimum wage and maximum hours on an industry and regional basis. The Supreme Court, however, in Schechter Poultry Corp. v. United States (1935) ruled the act unconstitutional, and the minimum wage regulations were abolished.[34] Two years later after President Roosevelt's overwhelming reelection in 1936 and discussion of judicial reform, the Supreme Court took up the issue of labor legislation again in West Coast Hotel Co. v. Parrish (1937) and upheld the constitutionality of minimum wage legislation enacted by Washington state and overturned the Adkins decision which marked the end of the Lochner era.[35] In 1938, the minimum wage was re-established pursuant to the Fair Labor Standards Act, this time at a uniform rate of $0.25 per hour (equivalent to $4.54 in 2019). The Supreme Court upheld the Fair Labor Standards Act in United States v. Darby Lumber Co. (1941), holding that Congress had the power under the Commerce Clause to regulate employment conditions.[36]

The 1938 minimum wage law only applied to "employees engaged in interstate commerce or in the production of goods for interstate commerce," but in amendments in 1961 and 1966, the federal minimum wage was extended (with slightly different rates) to employees in large retail and service enterprises, local transportation and construction, state and local government employees, as well as other smaller expansions; a grandfather clause in 1990 drew most employees into the purview of federal minimum wage policy, which now set the wage at $3.80.[37]

Legislation

.jpg)

The federal minimum wage in the United States was reset to its current rate of $7.25 per hour in July 2009.[37] Some U.S. territories (such as American Samoa) are exempt. Some types of labor are also exempt: Employers may pay tipped labor a minimum of $2.13 per hour, as long as the hour wage plus tip income equals at least the minimum wage. Persons under the age of 20 may be paid $4.25 an hour for the first 90 calendar days of employment (sometimes known as a youth, teen, or training wage) unless a higher state minimum exists.[38] The 2009 increase was the last of three steps of the Fair Minimum Wage Act of 2007, which was signed into law as a rider to the U.S. Troop Readiness, Veterans' Care, Katrina Recovery, and Iraq Accountability Appropriations Act, 2007, a bill that also contained almost $5 billion in tax cuts for small businesses.

Inflation indexing

Some politicians in the United States advocate linking the minimum wage to the consumer price index, thereby increasing the wage automatically each year based on increases to the consumer price index. Linking the minimum wage to the consumer price index avoids the erosion of the purchasing power of the minimum wage with time because of inflation. In 1998 Washington state became the first state to approve consumer price indexing for its minimum wage.[39] In 2003 San Francisco, California and Santa Fe, New Mexico were the first cities to approve consumer price indexing for their minimum wage.[40][41][42] Oregon and Florida were the next states to link their minimum wages to the consumer price index.[39] Later in 2006, voters in six states (Arizona, Colorado, Missouri, Montana, Nevada, and Ohio) approved statewide increases in the state minimum wage. The amounts of these increases ranged from $1 to $1.70 per hour, and all increases were designed to annually index to inflation.[43] As of 2018, the minimum wage is indexed to inflation in 17 states.[5]

Living wage protests

| City | Living wage |

|---|---|

| Cleveland | $14.84[46] |

| Houston | $15.04[47] |

| New Orleans | $15.28[48] |

| Atlanta | $15.57[49] |

| Tampa | $15.68[50] |

| United States | $16.14[51] |

| Philadelphia | $16.60[52] |

| Chicago | $17.11[53] |

| Boston | $18.61[54] |

| Los Angeles | $19.51[55] |

| New York City | $22.15[56] |

| San Francisco | $24.30[57] |

Since 2012, a growing protest and advocacy movement called "Fight for $15", initially growing out of fast food worker strikes, has advocated for an increase in the minimum wage to a living wage.[58] Since the start of these protests, a number of states and cities have increased their minimum wage. In 2014 Connecticut for instance passed legislation to raise the minimum wage from $8.70 to $10.10 per hour by 2017, making it one of about six states at the time to aim at or above $10.00 per hour.[59] In 2014 and 2015, several cities, including San Francisco, Seattle, Los Angeles, and Washington D.C. passed ordinances that gradually increase the minimum wage to $15.00 per hour.[60][61] In 2016 New York and California became the first states to pass legislation that would gradually raise the minimum wage to $15 per hour in each state,[62][63] followed by Massachusetts in 2018.[64]

In April 2014, the U.S. Senate debated the minimum wage on the federal level by way of the Minimum Wage Fairness Act. The bill would have amended the Fair Labor Standards Act of 1938 (FLSA) to increase the federal minimum wage for employees to $10.10 per hour over the course of a two-year period.[65] The bill was strongly supported by President Barack Obama and many of the Democratic Senators, but strongly opposed by Republicans in the Senate and House.[66][67][68] Later in 2014, voters in the Republican-controlled states of Alaska, Arkansas, Nebraska and South Dakota considered ballot initiatives to raise the minimum wage above the national rate of $7.25 per hour, which were successful in all four states. The results provided evidence that raising minimum wage has support across party lines.[69]

In April 2017, Senator Bernie Sanders and Senator Patty Murray, backed by 28 of the Senate's Democrats, introduced new federal legislation which would raise the minimum wage to $15 per hour by 2024 and index it to inflation.[70] The Raise the Wage Act of 2017, which was simultaneously introduced in the House of Representatives with 166 Democratic cosponsors, would raise the minimum wage to $9.25 per hour immediately, and then gradually increase it to $15 per hour by 2024, while simultaneously raising the minimum wage for tipped workers and phasing it out.[71] The legislation was introduced according to Senator Bernie Sanders to make sure that every worker has at least a modest and decent standard of living.[72]

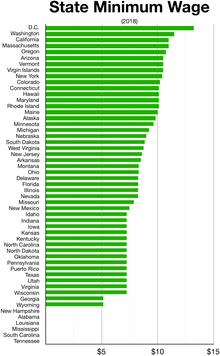

State laws

In the United States, different states are able to set their own minimum wages independent of the federal government. When the state and federal minimum wage differ the higher wage prevails. As of January 2018, there were 29 states with a minimum wage higher than the federal minimum.[4] Washington D.C. has the highest minimum wage at $14.00 per hour while California and Washington have the highest state minimum wage at $13.00 per hour, while Massachusetts follows at $12.75 per hour.[1] A number of states have also in recent years enacted state preemption laws, which restrict local community rights, and bar local governments from setting their own minimum wage amounts.[73] As of 2017, state preemption laws for local minimum wages have passed in 25 states.[74]

Legislation has passed recently in multiple states that significantly raises the minimum wage. California, Illinois, and Massachusetts are all set to raise their minimum wages to $15.00 per hour by January 1, 2023 for California and Massachusetts and by 2025 for Illinois.[75][76] Colorado raised its minimum wage from $9.30 per hour to $12 per hour by January 1, 2020, rising $0.90 per year.[77] New York has also passed legislation to increase its minimum wage to $15.00 per hour over time, with certain counties and larger companies set on faster schedules than others.[78] A number of other cities and states across the country are also debating and enacting legislation to increase the minimum wage for low wage workers to a livable wage.[79]

Local ordinances

Some government entities, such as counties and cities, observe minimum wages that are higher than the state as a whole. In 2003 San Francisco, California and Santa Fe, New Mexico were the first two cities to introduce local minimum wage ordinances.[42] Another device to increase wages locally are living wage ordinances, which generally apply only to businesses that are under contract to the local government itself. In 1994 Baltimore, Maryland was the first city in the United States to pass such a living wage ordinance. These targeted living wage ordinances for city contract workers have led in subsequent years to citywide local minimum wage laws which apply to all workers.[80]

In the current wave of minimum wage legislative action, Seattle, Washington was the first city to pass on June 2, 2014 a local ordinance to increase the minimum wage for all workers to $15.00 per hour,[81] which phases in over seven years.[82] This ordinance followed the referendum in SeaTac, Washington in November 2013, which raised on a more limited scale the local minimum wage to $15.00 for transportation and hospitality workers.[83][84] Numerous other cities have followed Seattle's example since. San Francisco became the first major city in the U.S. to reach a minimum wage of $15.00 per hour on July 1, 2018.[85] New York City's minimum wage will be $15.00 per hour by the end of 2018.[86] The minimum wage in Los Angeles and Washington, D.C., will be $15.00 per hour in 2020.[87][88] Similarly, the minimum wage in Minneapolis, Minnesota will be $15.00 per hour by 2022.[89] A growing number of other California cities have also enacted local minimum wage ordinances to increase the minimum wage to $15.00 per hour, including Berkeley, El Cerrito, Emeryville, Mountain View, Oakland, Richmond, and San Jose.[90]

Union exemptions

Some minimum wage ordinances have an exemption for unionized workers. For instance, the Los Angeles City Council approved a minimum salary in 2014 for hotel workers of $15.37 per hour which has such an exemption.[91] This led in some cases to longtime workers at unionized hotels such as the Sheraton Universal making $10.00 per hour, whereas non-union employees at a non-union Hilton less than 500 feet away making at least $15.37 as mandated by law for non-unionized employees.[92] Similar exemptions have been adopted in other cities. As of December 2014, unions were exempt from minimum wage ordinances in Chicago, Illinois, SeaTac, Washington, and Milwaukee County, Wisconsin, as well as the California cities of Los Angeles, San Francisco, Long Beach, San Jose, Richmond, and Oakland.[93] In 2016, the District of Columbia Council passed a minimum wage ordinance that included a union waiver, but Mayor Vincent Gray vetoed it. Later that year, the council approved an increase without the union waiver.[94]

Historical trend

The federal minimum wage was introduced in 1938 at the rate of $0.25 per hour (equivalent to $4.54 in 2019).[8] By 1950 the minimum wage had risen to $0.75 per hour.[96][8] The minimum wage had its highest purchasing power in 1968, when it was $1.60 per hour (equivalent to $11.76 in 2019).[96][97] The real value of the Federal minimum wage in 2016 dollars has decreased by one-third since 1968. The minimum wage would be $11 in 2016 if its real value had remained at the 1968 level.[98][99][100] From January 1981 to April 1990, the minimum wage was frozen at $3.35 per hour, then a record-setting minimum wage freeze. From September 1, 1997 through July 23, 2007, the federal minimum wage remained constant at $5.15 per hour, breaking the old record. In 2009 the minimum wage was adjusted to $7.25 where it has remained fixed for the past ten years.[8]

The purchasing power of the federal minimum wage has fluctuated. Since 1984, the purchasing power of the federal minimum wage has decreased. Measured in real terms (adjusted for inflation) using 1984 dollars, the real minimum wage was $3.35 in 1984, $2.33 in 1994, $1.84 in 2004, and $1.46 in 2014.[96] If the minimum wage had been raised to $10.10 in 2014, that would have equated to $4.40 in 1984 dollars.[101][102] This would have been equal to a 31% increase in purchasing power, despite the nominal value of the minimum wage increasing by 216% in the same time period.

Economic effects

— Henry Ford, 1926[103][104]

The economic effects of raising the minimum wage are unclear. Adjusting the minimum wage may affect current and future levels of employment, prices of goods and services, economic growth, income inequality, and poverty. The interconnection of price levels, central bank policy, wage agreements, and total aggregate demand creates a situation in which conclusions drawn from macroeconomic analysis are highly influenced by the underlying assumptions of the interpreter.[105]

Employment

In neoclassical economics, the law of demand states that—all else being equal—raising the price of any particular good or service reduces the quantity demanded.[106] Therefore, neoclassical economists argue that—all else being equal—raising the minimum wage will have adverse effects on employment. Conceptually, if an employer does not believe a worker generates value equal to or in excess of the minimum wage, they do not hire or retain that worker.[107]

Other economists of different schools of thought argue that a limited increase in the minimum wage does not affect or increases the number of jobs available. Economist David Cooper for instance estimates that a higher minimum wage would support the creation of at least 85,000 new jobs in the United States.[108] This divergence of thought began with empirical work on fast food workers in the 1990s which challenged the neoclassical model. In 1994, economists David Card and Alan Krueger studied employment trends among 410 restaurants in New Jersey and eastern Pennsylvania following New Jersey's minimum wage hike (from $4.25 to $5.05) in April 1992. They found "no indication that the rise in the minimum wage reduced employment."[109] In contrast, a 1995 analysis of the evidence by David Neumark found that the increase in New Jersey's minimum wage resulted in a 4.6% decrease in employment. Neumark's study relied on payroll records from a sample of large fast-food restaurant chains, whereas the Card-Krueger study relied on business surveys.[110]

A literature review conducted by David Neumark and William Wascher in 2007 (which surveyed 101 studies related to the employment effects of minimum wages) found that about two-thirds of peer-reviewed economic research showed a positive correlation between minimum wage hikes and increased unemployment—especially for young and unskilled workers. Neumark's review further found that, when looking at only the most credible research, 85% of studies showed a positive correlation between minimum wage hikes and increased unemployment.[111]

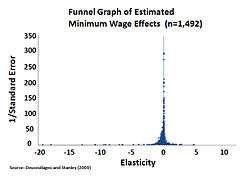

Statistical meta-analysis conducted by Tom Stanley in 2005 in contrast found that there is evidence of publication bias in minimum wage literature, and that correction of this bias shows no relationship between the minimum wage and unemployment.[112] In 2008 Hristos Doucouliagos and Tom Stanley conducted a similar meta-analysis of 64 U.S. studies on disemployment effects and concluded that Card and Krueger's initial claim of publication bias was correct. Moreover, they concluded, "Once this publication selection is corrected, little or no evidence of a negative association between minimum wages and employment remains."[113]

The Congressional Budget Office (CBO) in 2014 estimated the theoretical effects of a federal minimum wage increase under two scenarios: an increase to $9.00 and an increase to $10.10. According to the report, approximately 100,000 jobs would be lost under the $9.00 option, whereas 500,000 jobs would be lost under the $10.10 option (with a wide range of possible outcomes).[115] The Center for Economic and Policy Research (CEPR) in contrast in 2013 found in a review of multiple studies since 2000 that there was "little or no employment response to modest increases in the minimum wage."[116] CEPR found in a later study that job creation within the United States is faster within states that raised their minimum wage.[117] In 2014 the state with the highest minimum wage in the nation, Washington, exceeded the national average for job growth in the United States.[118] Washington had a job growth rate 0.3% faster than the national average job growth rate.[108]

The CBO in 2019 estimated the theoretical effects of a federal minimum wage increase under three scenarios: increases per hour to $10, $12 and $15 by 2025. Under the $15 scenario, in 2025 up to 27 million workers could see increases to their average weekly earnings while 3.7 million workers could lose employment. The latter statistic, in CBO's estimation would rise over time in any wage increase scenario as capital allocation replaces some workers. Wage increases would be heavily skewed (40%) towards those already earning above the minimum wage with more than 80% of benefits accruing to more educated workers living above the poverty line (Table 5). The number of persons in poverty would be reduced by 1.3 million (assuming no tax implications from increased income). The CBO notes that it does not consider the inflationary effects of these policies when estimating the change in poverty level as these estimates, while increasing inflation, are uncertain. Additionally, the CBO assumed that the weight of benefits would accrue to those below the poverty level based on historical wage increase levels. They noted that data on the minimum wage tends to assume the opposite (that benefits accrue to those above the poverty level), but that that data was not definitive enough to allow for estimation in their work. Some aspects of the CBO study are summarized in the table below.[119]

| Policy | $10 | $12 | $15 |

|---|---|---|---|

| Workers below new Minimum Wage that could see wage increase (millions) | 1.5 | 5 | 17 |

| Workers above new Minimum Wage that could see wage increase (millions) | 2 | 6 | 10 |

| Change in employment in an average week (millions) | -0.05 | -0.3 Median / 0 - -0.8 range | -1.3 Median / 0 - -3.7 range |

| Change in the number of people in poverty (millions) | -0.05 | -0.4 | -1.3 |

| Change in Real Annual Income: Families below poverty threshold (billions of 2018 dollars) | 0.4 | 2.3 | 7.7 |

| Change in Real Annual Income: Families between one and three times the poverty threshold (billions of 2018 dollars) | 0.3 | 2.3 | 14.2 |

| Change in Real Annual Income: Families between three and six times the poverty threshold (billions of 2018 dollars) | -0.05 | -0.3 | -2.1 |

| Change in Real Annual Income: Families with more than six times the poverty threshold (billions of 2018 dollars) | -0.6 | -5.1 | -28.4 |

| Change in Real Annual Income: All families (billions of 2018 dollars) | -0.1 | -0.8 | -8.7 |

A 2012 study led by Joseph Sabia estimated that the 2004-6 New York State minimum wage increase (from $5.15 to $6.75) resulted in a 20.2% to 21.8% reduction in employment for less-skilled, less-educated workers.[120] Similarly, a study led by Richard Burkhauser in 2000 concluded that minimum wage increases "significantly reduce the employment of the most vulnerable groups in the working-age population—young adults without a high school degree (aged 20-24), young black adults and teenagers (aged 16-24), and teenagers (aged 16-19)."[121]

The Economist wrote in December 2013 in sum that: "A minimum wage, providing it is not set too high, could thus boost pay with no ill effects on jobs...Some studies find no harm to employment from federal or state minimum wages, others see a small one, but none finds any serious damage...High minimum wages, however, particularly in rigid labour markets, do appear to hit employment. France has the rich world's highest wage floor, at more than 60% of the median for adults and a far bigger fraction of the typical wage for the young. This helps explain why France also has shockingly high rates of youth unemployment: 26% for 15- to 24-year-olds."[122]

A 2018 University of Washington study which investigated the effects of Seattle's minimum wage increases (from $9.50 to $11 in 2015 and then to $13 in 2016) found that while the second wage increase caused hourly wages to grow by 3%, it also caused employers to cut employee hours by 6%, yielding an average decrease of $74 earned per month per job in 2016.[123] In a follow-up study, the researchers found that workers already employed at the time of the wage increase and with above-median experience saw their earnings go up by an average of $8-$12 per week, (with one-quarter of the earnings gains attributed to experienced workers making up for lost hours in Seattle with work outside the city limits) while the earnings of less-experienced workers saw no significant change. Additionally, the study associated the minimum wage increase with an 8% reduction in employee turnover, and a significant reduction of new workers joining the workforce.[124][125]

Prices

Conceptually, raising the minimum wage increases the cost of labor, with all other things being equal. Thus, employers may accept some combination of lower profits, higher prices, or increased automation. If prices increase, consumers may demand a lesser quantity of the product, substitute other products, or switch to imported products, due to the effects of price elasticity of demand. Marginal producers (those who are barely profitable enough to survive) may be forced out of business if they cannot raise their prices sufficiently to offset the higher cost of labor. Federal Reserve Bank of Chicago research from 2007 has shown that restaurant prices rise in response to minimum wage increases.[126] However, there are studies that show that higher prices for products due to increased labor cost are usually only by about 0.4% of the original price.[108]

Effect on suicides

Researchers found in 2019 that, "Between 1990 and 2015, raising the minimum wage by $1 in each state might have saved more than 27,000 lives, according to a report published this week in the Journal of Epidemiology & Community Health. An increase of $2 in each state's minimum wage could have prevented more than 57,000 suicides." [127] The researchers stated, "The effect of a US$1 increase in the minimum wage ranged from a 3.4% decrease (95% CI 0.4 to 6.4) to a 5.9% decrease (95% CI 1.4 to 10.2) in the suicide rate among adults aged 18–64 years with a high school education or less. We detected significant effect modification by unemployment rate, with the largest effects of minimum wage on reducing suicides observed at higher unemployment levels."[128] They concluded, "Minimum wage increases appear to reduce the suicide rate among those with a high school education or less, and may reduce disparities between socioeconomic groups. Effects appear greatest during periods of high unemployment."[128]

Effects on crime

A 2016 White House report based on "back of envelope calculations and literature review" argued that higher hourly wages led to less crime.[129] The study by the Council of Economic Advisers calculated that "raising the minimum wage reduces crime by 3 to 5 percent." To get those numbers, the study assumed that "such a minimum wage increase would have no employment impacts, with an employment elasticity of 0.1 the benefits would be somewhat lower."[129]

In contrast in a 1987 journal article, Masanori Hashimoto noted that minimum wage hikes lead to increased levels of property crime in areas affected by the minimum wage after its increase.[130] According to the article, by decreasing employment in poor communities, total legal trade and production are curtailed. The report also argued that to compensate for the decrease in legal avenues for production and consumption, poor communities increasingly turn to illegal trade and activity.[130]

Economic growth

Whether growth (GDP, a measure of both income and production) increases or decreases depends significantly on whether the income shifted from owners to workers results in an overall higher level of spending. The tendency of a consumer to spend their next dollar is referred to as the marginal propensity to consume or MPC. The transfer of income from higher income owners (who tend to save more, meaning a lower MPC) to lower income workers (who tend to save less, with a higher MPC) can actually lead to an increase in total consumption and higher demand for goods, leading to increased employment.[115] Recent research has shown that higher wages lead to greater productivity.[131]

The CBO reported in February 2014 that income (GDP) overall would be marginally higher after raising the minimum wage, indicating a small net positive increase in growth. Raising the minimum wage to $10.10 and indexing it to inflation would result in a net $2 billion increase in income during the second half of 2016, while raising it to $9.00 and not indexing it would result in a net $1 billion increase in income.[115]

Additionally, a study by Overstreet in 2019 examined increases to the minimum wage in Arizona. Utilizing data spanning from 1976 to 2017, Overstreet found that a 1% increase in the minimum wage was significantly correlated with a 1.13% increase in per capita income in Arizona. This study could show that smaller increases in minimum wage may not distort labor market as significantly as larger increases experienced in other cities and states. Thus, the small increases experienced in Arizona may have actually led to a slight increase in economic growth.[132]

Income inequality

An increase in the minimum wage is a form of redistribution from higher-income persons (business owners or "capital") to lower income persons (workers or "labor") and therefore should reduce income inequality. The CBO estimated in February 2014 that raising the minimum wage under either scenario described above would improve income inequality. Families with income more than 6 times the poverty threshold would see their incomes fall (due in part to their business profits declining with higher employee costs), while families with incomes below that threshold would rise.[115] Writing in The Atlantic, journalist Derek Thompson summarized several studies which indicate that both state-level minimum wage increases and tighter labor markets caused wages to grow faster for lower income workers than higher income workers during the 2018-2019 time period.[134]

Poverty

Among hourly-paid workers in 2016, 701,000 earned the federal minimum wage and about 1.5 million earned wages below the minimum. Together, these 2.2 million workers represented 2.7% of all hourly-paid workers.[135]

The CBO estimated in February 2014 that raising the minimum wage would reduce the number of persons below the poverty income threshold by 900,000 under the $10.10 option versus 300,000 under the $9.00 option.[115] Similarly, Arindrajit Dube, professor of economics at University of Massachusetts Amherst, found in a 2017 study "robust evidence that higher minimum wages lead to increases in incomes among families at the bottom of the income distribution and that these wages reduce the poverty rate." According to the study "a 10 percent increase in the minimum wage reduces the nonelderly poverty rate by about 5 percent."[136][137]

In contrast, research conducted by David Neumark and colleagues in 2004 found that minimum wages are associated with reductions in the hours and employment of low-wage workers.[138] A separate study by the same researchers found that minimum wages tend to increase the proportion of families with incomes below or near the poverty line.[139] Similarly, a 2002 study led by Richard Vedder, professor of economics at Ohio University, concluded that "The empirical evidence is strong that minimum wages have had little or no effect on poverty in the U.S. Indeed, the evidence is stronger that minimum wages occasionally increase poverty…"[140]

According to some economists, minimum wage increases result in a variety of negative effects for lower-skilled workers including reduced employment, reduced hours, reduced benefits, and less safe working conditions.[141][111]

Federal budget deficit

The CBO reported in February 2014 that "[T]he net effect on the federal budget of raising the minimum wage would probably be a small decrease in budget deficits for several years but a small increase in budget deficits thereafter. It is unclear whether the effect for the coming decade as a whole would be a small increase or a small decrease in budget deficits." On the cost side, the report cited higher wages paid by the government to some of its employees along with higher costs for certain procured goods and services. This might be offset by fewer government benefits paid, as some workers with higher incomes would receive fewer government transfer payments. On the revenue side, some would pay higher taxes and others less.[115]

Commentary

Economists

| City | Effective minimum wage |

|---|---|

| Seattle | $8.51 |

| Denver | $7.57 |

| Houston | $7.26 |

| United States | $7.25 |

| San Francisco | $7.03 |

| Chicago | $7.01 |

| Boston | $6.59 |

| Washington, D.C. | $6.53 |

| Los Angeles | $6.38 |

| Philadelphia | $6.08 |

| New York City | $3.86 |

According to a survey conducted by economist Greg Mankiw, 79% of economists agreed that "a minimum wage increases unemployment among young and unskilled workers."[144]

A 2015 survey conducted by the University of New Hampshire Survey Center found that a majority of economists believes raising the minimum wage to $15 per hour would have negative effects on youth employment levels (83%), adult employment levels (52%), and the number of jobs available (76%). Additionally, 67% of economists surveyed believed that a $15 minimum wage would make it harder for small businesses with less than 50 employees to stay in business.[145]

A 2006 survey conducted by economist Robert Whaples of a sample of 210 Ph.D. economists randomly selected from the American Economic Association, found that, regarding the U.S. minimum wage:[146]

- 46.8% favored eliminating it

- 1.3% favored decreasing it

- 14.3% favored keeping it the same

- 5.2% favored increasing it by about 50 cents per hour

- 15.6% favored increasing it by about $1 per hour

- 16.9% favored increasing it by more than $1 per hour

In 2014, over 600 economists signed a letter in support of increasing the minimum wage to $10.10 with research suggesting that a minimum wage increase could have a small stimulative effect on the economy as low-wage workers spend their additional earnings, raising demand and job growth.[147][148][149][150] Also, seven recipients of the Nobel Prize in Economic Sciences were among 75 economists endorsing an increase in the minimum wage for U.S. workers and said "the weight" of economic research shows higher pay doesn't lead to fewer jobs.[151][152]

According to a February 2013 survey of the University of Chicago IGM Forum, which includes approximately 40 economists:

- 34% agreed with the statement that "Raising the federal minimum wage to $9 per hour would make it noticeably harder for low-skilled workers to find employment", with 32% disagreeing and 24% uncertain

- 42% agreed that "...raising the minimum wage to $9 per hour and indexing it to inflation...would be a desirable policy", with 11% disagreeing or strongly disagreeing and 32% uncertain.[153]

According to a fall 2000 survey conducted by Fuller and Geide-Stevenson, 73.5% (27.9% of which agreed with provisos) of American economists surveyed[How many?] agreed that minimum wage laws increase unemployment among unskilled and young workers, while 26.5% disagreed with the statement.[154]

Economist Paul Krugman advocated raising the minimum wage moderately in 2013, citing several reasons, including:

- The minimum wage was below its 1960s purchasing power, despite a near doubling of productivity;

- The great preponderance of the evidence indicates there is no negative impact on employment from moderate increases; and

- A high level of public support, specifically Democrats and Republican women.[155]

Major political parties

Democratic candidates, elected officials, and activists support an increase in the minimum wage.[157] In his 2013 State of the Union Address, President Barack Obama called for an increase in the federal minimum wage to $9 an hour; several months later, Democrats Tom Harkin and George Miller proposed legislation to increase the federal minimum wage to $10.10; and in 2015, congressional Democrats introduced a proposal to increase the federal minimum wage to $12 an hour.[158] These efforts did not succeed, but increases in city and state minimum wages prompted congressional Democrats to continue fighting for an increase on the federal level.[158] After much internal party debate,[159] the party's official platform adopted at the 2016 Democratic National Convention stated: "We should raise the federal minimum wage to $15 an hour over time and index it, give all Americans the ability to join a union regardless of where they work, and create new ways for workers to have power in the economy so every worker can earn at least $15 an hour."[160][161]

Most Republican elected officials oppose action to increase the minimum wage,[162][163] and have blocked Democratic efforts to increase the minimum wage.[164] Republican leadership such as Speakers of the House John Boehner[162] and Paul Ryan have opposed minimum wage increases.[165] Some Republicans oppose having a minimum wage altogether, while a few, conversely, have supported minimum wage increases or indexing the minimum wage to inflation.[162]

Polls

The Pew Center reported in January 2014 that 73% of Americans supported raising the minimum wage from $7.25 to $10. By party, 53% of Republicans and 90% of Democrats favored this action.[166] Pew found a racial difference for support of a higher minimum wage in 2017 with most blacks and Hispanics supporting a $15.00 federal minimum wage, and 54% of whites opposing it.[13]

A Lake Research Partners poll in February 2012 found the following:

- Strong support overall for raising the minimum wage, with 73% of likely voters supporting an increase to $10 and indexing it to inflation during 2014, including 58% who strongly support the action;

- Support crosses party lines, with support from 91% of Democrats, 74% of Independents, and 50% of Republicans; and

- A majority (56%) believe that raising the minimum wage will help the economy, 16% believe it won't make a difference, and only 21% felt it would hurt the economy.[167]

List by jurisdiction

This is a list of the minimum wages (per hour) in each state and territory of the United States, for jobs covered by federal minimum wage laws. If the job is not subject to the federal Fair Labor Standards Act, then state, city, or other local laws may determine the minimum wage.[168] A common exemption to the federal minimum wage is a company having revenue of less than $500,000 per year while not engaging in any interstate commerce.

Under the federal law, workers who receive a portion of their salary from tips, such as waitstaff, are required only to have their total compensation, including tips, meet the minimum wage. Therefore, often, their hourly wage, before tips, is less than the minimum wage.[169] Seven states, and Guam, do not allow for a tip credit.[170] Additional exemptions to the minimum wage include many seasonal employees, student employees, and certain disabled employees as specified by the FLSA.[171] However, paying workers with disabilities less than the minimum wage was outlawed in New Hampshire in 2015, in Maryland in 2016, and in Alaska in 2018.[172]

In addition, some counties and cities within states may implement a higher minimum wage than the rest of their state. Sometimes this higher wage applies only to businesses that contract with the local government, while in other cases the higher minimum applies to all work.

Federal

| Type | Min. wage ($/h) | Notes |

|---|---|---|

| Tipped | $2.13 | The Fair Labor Standards Act of 1938 has been requiring a minimum wage of $2.13 for tipped workers with the expectation that wages plus tips total no less than $7.25 per hour since September 1, 1991.[173] The employer must pay the difference if total income does not add up to $7.25 per hour.[174] |

| Non-tipped | $7.25 | Per the Fair Minimum Wage Act of 2007 (FMWA) since July 24, 2009.[175] |

| Youth (First 90 calendar days only) | $4.25 | The Fair Labor Standards Act has since August 20, 1996 allowed for persons under the age of 20 to be paid $4.25 for the first 90 calendar days of their employment.[176][177] |

State

As of October 2016, there have been 29 states with a minimum wage higher than the federal minimum. From 2014 to 2015, nine states increased their minimum wage levels through automatic adjustments, while increases in 11 other states occurred through referendum or legislative action.[97] Beginning in January 2019, Washington D.C has the highest minimum wages in the country, at $14.00 per hour.[178] New York City's minimum wage for companies with 11 or more employees became $15.00 per hour on December 31, 2018.[179] On the same day, NYC's hourly minimum wage for companies with 10 or fewer employees became $13.50.[179] The minimum wage in Illinois will reach $15 per hour by 2025 with increases beginning in 2020.[180]

| State | Min. wage ($/h)[1][181] |

Tipped ($/h)[182][lower-alpha 1] |

Youth/ training ($/h)[lower-alpha 2] |

Automatic indexed adjustment | Notes |

|---|---|---|---|---|---|

| Alabama | None[lower-alpha 3] | No | Local laws (including a local $10.10 minimum wage law passed by the City of Birmingham) were preempted in 2016 with the enactment of the Alabama Uniform Minimum Wage and Right-to-Work Act.[183][184] The NAACP and two African-American Birmingham workers sued, arguing that the state's adoption of the preemption legislation violated the U.S. Constitution and the Voting Rights Act on the grounds that its passage "was rooted in the state legislature's racial bias against Birmingham's black-majority city council and citizens."[185] In 2019, the U.S. Court of Appeals for the Eleventh Circuit held, in a closely divided 7–5 vote, that the plaintiffs lacked standing to pursue the case.[185] | ||

| Alaska | $10.19 | $10.19 | Yes | Minimum wage increased to $10.19 on January 1, 2020.[186] Voters passed a ballot initiative in 2014, which requires the minimum wage to be adjusted annually for inflation. | |

| Arizona | $12.00 | $9.00 | Yes | Voters passed Proposition 206 in 2016 scheduling a series of wage increases which completed on January 1, 2020 when Arizona's minimum wage became $12.00. Starting on January 1, 2021 the minimum wage will be tied to inflation.[187]

| |

| Arkansas | $10.00 | $2.63 | No | Voters passed Issue 5 in 2018 to schedule a series of wage increases. Effective January 1, 2020 the minimum wage increased to $10.00 and will increase to $11.00 in 2021.[189] | |

| California | $13.00[190] | $13.00 | Yes | Minimum wage increased to $13.00 for business with 26 employees or more; $12.00 for business with 25 employees or fewer, effective on January 1, 2020[191] and increases to $15.00 by 2022.[192] At least 27 California cities had a minimum wage higher than the state minimum on January 1, 2020:[193]

| |

| Colorado | $12.00 [200] | $8.98 | Yes | On January 1, 2020, the minimum wage increased to $12.00. On January 1, 2021, it will be adjusted in line with the Consumer Price Index (CPI).[201] The tipped wage is $3.02 less than the minimum wage.[202]

| |

| Connecticut | $11.00 | $6.59 | Yes | In 2019, the CT government passed a law raising the minimum wage to $11.00 on October 1, 2019, with future increases in later years scheduled as follows:

And finally, starting on January 1, 2024, the minimum wage will be indexed to the Employment Cost Index. [204]

| |

| Delaware | $9.25 | $2.23 | $8.75 | No | Minimum wage increased to $9.25 effective on October 1, 2019.[205] |

| Florida | $8.56 | $5.54 | Yes | Minimum wage is increased annually on September 30 (effective January 1 of the following calendar year) based upon a cost of living formula (the Consumer Price Index for Urban Wage Earners and Clerical Workers, not seasonally adjusted, for the South Region or a successor index as calculated by the United States Department of Labor, using the rate of inflation for the 12 months prior to September 1).[206] Florida's minimum wage increased to $8.56 and the tipped minimum wage to $5.54 on January 1, 2020.[207] | |

| Georgia | $5.15[208][209] | $2.13 | No | Only applicable to employers of 6 or more employees. The state law excludes from coverage any employment that is subject to the Federal Fair Labor Standards Act when the federal rate is greater than the state rate.[210] | |

| Hawaii | $10.10 | $9.35 | No | Minimum wage increased to $10.10 on January 1, 2018. Tipped employees earn 75 cents less than the current state minimum wage.[211] | |

| Idaho | $7.25[212] | $3.35 | No | ||

| Illinois | $10.00[213] | $6.00 | $8.00 | No | The current Illinois minimum wage is $10.00. As of January 1, 2020, if a worker under 18 works more than 650 hours for the employer during any calendar year, they must be paid the regular (over 18 wage). Tipped employees earn 60% of the minimum wage (employers may claim credit for tips, up to 40% of wage) and there is a training wage for tipped employees. Certain employees must be paid overtime, at time and one-half of the regular rate, after 40 hours of work in a workweek.[213] In February 2019, Governor J.B. Pritzker approved a statewide minimum wage rising to $15 by 2025.[214] Increases began on January 1, 2020 to $9.25 and rose to $10 on July 1, 2020. The rate will increase $1 each year until 2025 reaching $15.

|

| Indiana | $7.25[218] | $2.13 | No | ||

| Iowa | $7.25[219] | $4.35 | No | Most small retail and service establishments grossing less than $300,000 annually are not required to pay the minimum wage.[219] A tipped employee who makes $30.00 per month or more in tips, can be paid 60% of the minimum wage, i.e. as little as $4.35 per hour.[219] Increased minimum wage laws in Johnson and Linn counties were nullified by the legislature.[220] While unenforceable by law, Johnson county continues to ask businesses to pledge to honor the minimum wage of $10.25 since January 1, 2019. [221] Other places that have symbolic minimum wages include Linn at $10.25, Polk City at $10.75, and Wapello at $10.10. | |

| Kansas | $7.25[222] | $2.13 | No | Kansas had the lowest legislated, non-tipped worker minimum wage in the U.S., $2.65 per hour, until it was raised to $7.25, effective January 1, 2010.[223] | |

| Kentucky | $7.25[224] | $2.13 | No | Louisville: $8.10 from July 1, 2015 and increases to $9.00 by 2017.[225][226] However, the Kentucky Supreme Court ruled that localities do not have authority to increase the minimum wage.[227] | |

| Louisiana | None[lower-alpha 3] | No | |||

| Maine | $12.00 | $6.00 | Yes | The minimum wage increased to $12.00 and tipped minimum wage to $6.00 on January 1, 2020.[228][229] The tipped rate is half of the current state minimum wage.[230] | |

| Maryland | $11.00 | $3.63 | No | Minimum wage is $11.00 as of January 1, 2020.[231][232]

The minimum wage increases[233][234] as follows:

For employees working in Prince George's County, the minimum wage is $11.50 per hour, effective October 1, 2017.[231] For employees working in Montgomery County, the minimum wage is $13.00 per hour for businesses with 10 or fewer employees, $13.25 per hour for businesses with between 11 and 50 employees, and $14.00 per hour for businesses with 51 or more employees effective July 1, 2020.[235] County Council bill 12-16 was enacted on January 17, 2017 to adjust the minimum wage to $15 and base future adjustments on the Consumer Price Index, but was later vetoed by the County Executive.[236][237] | |

| Massachusetts | $12.75 | $4.95 | No | The minimum wage increased to $12.75 ($4.95 for tipped workers) on January 1, 2020. Massachusetts was the only state in the country that mandates time-and-a-half for retail workers working on Sunday. With state minimum wage at $12.75 an hour the effective minimum wage for a retail worker working on Sunday is $16.58 an hour.[238] As of 2017, Massachusetts has the largest gap between the hourly minimum wage for tipped workers ($4.35) and the general minimum wage ($12).[239]

The "Grand Bargain" passed in 2018 raises wages on the following schedule, and phases out time-and-a-half while prohibiting employers from requiring work on Sundays and holidays against employee wishes.[240][241]

| |

| Michigan | $9.65[242] | $3.67 | $4.25 (training) $8.20 (youth) | Yes | Public Act 368 of 2018 schedules possible minimum wage increases. There will be no increase in the minimum wage if the unemployment rate rises to or above 8.5% in the previous year.[243] Tipped workers must earn at least the standard Michigan minimum wage once tips are included in their wages.[244][245]

|

| Minnesota | $10.00[208] | $10.00 | $8.04 (for small employers; training; youth; and employees in J-1 status working for hotels, motels, lodging establishments, or resorts)[246] | Yes | Beginning January 1, 2018, all minimum wage rates will increase annually by the national implicit price deflator or 2.5%, whichever is lower.[247] For large employers when the employer's annual gross revenues are $500,000 or more, the Minnesota minimum wage became $10.00 on January 1, 2020. For small employers when the employer's annual gross revenues are less than $500,000, the minimum wage became $8.15 on January 1, 2020. Overtime applies after 48 hours per week.[248]

|

| Mississippi | None[lower-alpha 3] | No | |||

| Missouri | $9.45 | $4.73[250] | Yes | On November 6, 2018 Missouri passed Proposition B, which increased the minimum wage. Effective January 1, 2020, the minimum wage increased to $9.45; $10.30 January 1, 2021; $11.15 January 1, 2022; and $12.00 January 1, 2023. The minimum wage would afterwards be adjusted based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers.[251]

A state law passed July 5, 2017 prevents Missouri cities and local governments from setting a higher minimum wage.[252]

| |

| Montana | $8.65 | $8.65 | Yes | Minimum wage rate is automatically adjusted annually based on the U.S. Consumer Price Index, and increased to $8.65 on January 1, 2020. Income from tips cannot offset an employee's pay rate. The state minimum wage for business with less than $110,000 in annual sales is $4.00.[1]. | |

| Nebraska | $9.00[254] | $2.13 | No | Minimum wage increased to $9.00 January 1, 2016.[255] | |

| Nevada | $8.25 | $8.25 | Yes | The minimum wage has been $9.00 since July 1, 2020. Employers who offer health benefits can pay employees $8.00.[256]Assembly Bill 456, signed on June 12, 2019, raises the minimum wage in Nevada by 75 cents each year until it reaches $12 an hour. Employers who offer health benefits can continue to pay employees $1 per hour less at the Lower Tier rate.[257]

| |

| New Hampshire | $7.25[258] | $3.27 | No | ||

| New Jersey | $11.00

$10.30 (Agricultural)[259] |

$3.13[259] | Yes | Minimum wage increased to $11 on January 1, 2020. On January 17, 2019, Governor Phil Murphy and state legislative leaders passed an agreement to raise the minimum wage to $15 by 2024, with a bill to raise the minimum wage passed and signed by the Governor.[260] There are four separate pay rates: regular employers, seasonal & small employers (6 & fewer employees), agricultural employers, and tipped workers. The general wage increase is TBD after 2024, TBD after 2026 for seasonal wages, and will stop at $5.13 for tipped workers in 2022, and is TBD in 2025.[259]

| |

| New Mexico | $9.00 | $2.35 | No | Upcoming New Mexico minimum wage increases:[261]

| |

| New York | $11.80 | Varies | Yes | A 2016 law changed the minimum wage over the next six years. "Downstate" includes Nassau, Suffolk, and Westchester counties.[267]

Hospitality Industry varies. As of December 31, 2019 they are the following: [269][270]

| |

| North Carolina | $7.25[271] | $2.13 | No | The employer may take credit for tips earned by a tipped employee and may count them as wages up to the amount permitted in section 3(m) of the Fair Labor Standards Act.[271] | |

| North Dakota | $7.25[272] | $4.86 | No | Tipped minimum is 67% of the minimum wage.[182] | |

| Ohio | $8.70 | $4.35 | $7.25 under 16 years old | Yes | The rate is $7.25 for employers grossing $314,000 or less.[273]The rate is adjusted annually on January 1 based on the U.S. Consumer Price Index.[274] Ohio's minimum wage increased to $8.70 ($4.35 for tipped employees) on January 1, 2020.[275] |

| Oklahoma | $7.25[276] | $2.13 | No | Minimum wage for employers grossing under $100,000 and with fewer than 10 employees per location is $2.00.[277] (OK Statutes 40-197.5). | |

| Oregon | $11.50 (rural counties) $12.00(non-rural counties) $13.25 (Portland metro)[278] |

$11.50 (rural counties) $12.00 (non-rural counties) $13.25 (Portland metro) |

Yes | On March 2, 2016, Senate Bill 1532 was signed into law, increasing minimum wage depending on the county. Beginning July 1, 2019 the minimum wage increased to $11.25 for non-rural counties and to $11.00 for rural counties, thereafter increasing each year by fixed amounts until June 30, 2022 when the minimum wage will be $14.75 for the Portland metro area, $13.50 for other non-rural counties, and $12.50 for rural counties. Thereafter, the minimum wage will be adjusted each year based on the U.S. Consumer Price Index.[279] Non-rural counties are defined as Benton, Clackamas, Clatsop, Columbia, Deschutes, Hood River, Jackson, Josephine, Lane, Lincoln, Linn, Marion, Multnomah, Polk, Tillamook, Wasco, Washington, and Yamhill counties.[280] Rural counties are defined as Baker, Coos, Crook, Curry, Douglas, Gilliam, Grant, Harney, Jefferson, Klamath, Lake, Malheur, Morrow, Sherman, Umatilla, Union, Wallowa, Wheeler counties.[280] The Portland Metro rate ($1.25 over the non-rural rate) applies to employers located within the urban growth boundary (UGB) of the Portland metropolitan service district.[278] | |

| Pennsylvania | $7.25[281] | $2.83 | No | ||

| Rhode Island | $10.50 | $3.89[282] | No | Minimum wage is $10.50 as of January 1, 2019.[282] On October 1, 2020 the minimum wage will increase to $11.50. [283]

| |

| South Carolina | None[lower-alpha 3] | No | |||

| South Dakota | $9.30[285] | $4.65 | Yes | The minimum wage increased to $9.30 on January 1, 2020, and is indexed to inflation. [286] | |

| Tennessee | None[lower-alpha 3] | No | |||

| Texas | $7.25[287] | $2.13 | No | Applies to all workers in the state, excluding patients of the Texas Department of Mental Health and Mental Retardation who have diminished production capacity and who work on behalf of the Department; their salary is calculated at the minimum wage times a percentage of their diminished capacity. | |

| Utah | $7.25 | $2.13 | No | ||

| Vermont | $10.98 | $5.48[288] | Yes | Effective January 1, 2020, the minimum wage increased to $10.98 and the tipped minimum wage increased to $5.48.[289] Vermont's minimum wage will have the following increases:[290]

| |

| Virginia | $7.25[291] | $2.13 | No | In early 2019, a bill to raise the minimum wage to $13.00 in 2020 and then $15.00 in 2021 was voted down by the state senate 21–19. [292] | |

| Washington | $13.50[293] | $13.50[293] | $11.48[294] | Yes | The minimum wage increased to $13.50 in 2020. It will be increased annually by a voter-approved cost-of-living adjustment based on the federal Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).[295]

|

| West Virginia | $8.75[300] | $2.62 | No | Minimum wage increased to $8.75 on December 31, 2015.[301] The state minimum wage is applicable to employers of six or more employees at one location not involved in interstate commerce[1] and for tipped employees is 30% of the federal minimum wage.[182] | |

| Wisconsin | $7.25[302] | $2.33 | No | There is a special minimum wage for golf caddies: $5.90 per 9 holes and $10.50 per 18 holes. Another special minimum wage applies to camp counselors: $210 per week with board and lodging, $265 per week with board only, and $350 per week with no board or lodging provided.[303]

Governor Tony Evers has proposed legislation to increase the minimum wage for state employees to $15 by 2021, including employees at the University of Wisconsin-Madison.[304] | |

| Wyoming | $5.15[208] | $2.13 | No |

- Generally applies to employees who make over $30 in tips per month, unless otherwise noted.[182]

- Applies to persons under age 20, for the first 90 days of employment (per FMWA), unless otherwise noted.

- No state minimum wage law. Federal rates apply, although some small businesses exempt from FMWA may not be covered.

Federal district

| Federal district | Min. wage ($/h) |

Tipped ($/h) |

Youth/ training ($/h) |

Notes |

|---|---|---|---|---|

| District of Columbia | $15.00 | $5.00 | None | In accordance with a law signed on June 27, 2016,[305][306] the minimum wage increased to $14.00 per hour as of July 1, 2019; and $15.00 per hour as of July 1, 2020.[307] As of each successive July 1, the minimum wage will increase by the Consumer Price Index for All Urban Consumers in the Washington Metropolitan Statistical Area for the preceding twelve months.[307]

The minimum wage for tipped-employees increased to $4.45 per hour as of July 1, 2019; and $5.00 per hour as of July 1, 2020.[307] On June 19, 2018, Initiative 77 passed, increasing the tipped minimum wage to match the standard minimum wage by the year 2026. However, this was repealed by the D.C. Council before it could be enacted.[308] The minimum wage established by the federal government may be paid to newly hired individuals during their first 90 calendar days of employment, students employed by colleges and universities, and individuals under 18 years of age.[309] |

Territory

| Territory | Min. wage ($/h)[1] | Tipped

($/h)[182] |

Notes |

|---|---|---|---|

| American Samoa | $4.98–$6.39 | $2.13 | Varies by industry.[310] On September 30, 2010, President Obama signed legislation that delays scheduled wage increases for 2010 and 2011. On July 26, 2012, President Obama signed S. 2009 into law, postponing the minimum wage increase for 2012, 2013, and 2014. Annual wage increases of $0.40 recommenced on September 30, 2015 and will continue every three years until all rates have reached the federal minimum.[311] |

| Guam | $8.25 | $8.25 | |

| Northern Mariana Islands | $7.25 | $2.13 | Since September 30, 2016. Wages are to go up $0.50 annually until reaching the federal $7.25 rate by 2018.[312] Bill S. 256 to delay the planned increases to the full rate until 2018 passed in September 2013.[313] |

| Puerto Rico | $7.25 | $2.13 | Following the Fair Minimum Wage Act of 2007, Employers covered by the Federal Fair Labor Standards Act (FLSA) are subject to the federal minimum wage and all applicable regulations. Employers not covered by the FLSA will be subject to a minimum wage that is at least 70 percent of the federal minimum wage or the applicable mandatory decree rate, whichever is higher. The Secretary of Labor and Human Resources may authorize a rate based on a lower percentage for any employer who can show that implementation of the 70 percent rate would substantially curtail employment in that business. Puerto Rico also has minimum wage rates that vary according to the industry. These rates range from a minimum of $5.08 to $7.25 per hour. |

| U.S. Virgin Islands | $10.50[314] | $4.20 | The Virgin Islands' minimum wage increased to $9.50 on June 1, 2017 for all employees, with the exception of tourist service and restaurant employees (or those businesses with gross annual receipts of less than $150,000 set at $4.30). It further increased to $10.50 on June 1, 2018.[315] |

Large corporations

Some large employers in the traditionally low-paying retail sector have declared an internal minimum wage. As of 2020:

- Amazon.com - $15/hour[316]

- Bank of America - $17/hour[317]

- Ben & Jerry's - $16.92/hour[318]

- Charter Communications/Spectrum - $15/hour[319]

- Costco - $15/hour[320]

- Facebook - $15-20/hour depending on location[318]

- Huntington National Bank - $16/hour[318]

- JPMorgan Chase - $15-18/hour depending on location[317]

- Target - $13/hour [321] $15/hour starting July 5th, 2020[322]

- Walmart - $11/hour[323]

- Wells Fargo - $15/hour[324]

Low-paying occupations: 2006 and 2009

Jobs that a minimum wage is most likely to directly affect are those that pay close to the minimum.

According to the May 2006 National Occupational Employment and Wage Estimates, the four lowest-paid occupational sectors in May 2006 (when the federal minimum wage was $5.15 per hour) were the following:[325]

| Sector | Workers employed | Median wage | Mean wage | Mean annual |

|---|---|---|---|---|

| Food preparation and serving related occupations | 11,029,280 | $7.90 | $8.86 | $18,430 |

| Farming, fishing, and forestry occupations | 450,040 | $8.63 | $10.49 | $21,810 |

| Personal care and service occupations | 3,249,760 | $9.17 | $11.02 | $22,920 |

| Building and grounds cleaning and maintenance occupations | 4,396,250 | $9.75 | $10.86 | $22,580 |

Two years later, in May 2008, when the federal minimum wage was $5.85 per hour and was about to increase to $6.55 per hour in July, these same sectors were still the lowest-paying, but their situation (according to Bureau of Labor Statistics data)[326] was:

| Sector | Workers employed | Median wage | Mean wage | Mean annual |

|---|---|---|---|---|

| Food preparation and serving related occupations | 11,438,550 | $8.59 | $9.72 | $20,220 |

| Farming, fishing, and forestry occupations | 438,490 | $9.34 | $11.32 | $23,560 |

| Personal care and service occupations | 3,437,520 | $9.82 | $11.59 | $24,120 |

| Building and grounds cleaning and maintenance occupations | 4,429,870 | $10.52 | $11.72 | $24,370 |

In 2006, workers in the following 13 individual occupations received a median hourly wage of less than $8.00 per hour:[325]

| Occupation | Workers employed | Median wage | Mean wage | Mean annual |

|---|---|---|---|---|

| Gaming dealers | 82,960 | $7.08 | $8.18 | $17,010 |

| Waiters and waitresses | 2,312,930 | $3.14 | $4.27 | $11,190 |

| Combined food preparation and serving workers, including fast food | 2,461,890 | $7.24 | $7.66 | $15,930 |

| Dining room and cafeteria attendants and bartender helpers | 401,790 | $7.36 | $7.84 | $16,320 |

| Cooks, fast food | 612,020 | $7.41 | $7.67 | $15,960 |

| Dishwashers | 502,770 | $7.57 | $7.78 | $16,190 |

| Ushers, lobby attendants, and ticket takers | 101,530 | $7.64 | $8.41 | $17,500 |

| Counter attendants, cafeteria, food concession, and coffee shop | 524,410 | $7.76 | $8.15 | $16,950 |

| Hosts and hostesses, restaurant, lounge, and coffee shop | 340,390 | $7.78 | $8.10 | $16,860 |

| Shampooers | 15,580 | $7.78 | $8.20 | $17,050 |

| Amusement and recreation attendants | 235,670 | $7.83 | $8.43 | $17,530 |

| Bartenders | 485,120 | $7.86 | $8.91 | $18,540 |

| Farmworkers and laborers, crop, nursery, and greenhouse | 230,780 | $7.95 | $8.48 | $17,630 |

In 2008, two occupations paid a median wage less than $8.00 per hour:[326]

| Occupation | Workers employed | Median wage | Mean wage | Mean annual |

|---|---|---|---|---|

| Gaming dealers | 91,130 | $7.84 | $9.56 | $19,890 |

| Combined food preparation and serving workers, including fast food | 2,708,840 | $7.90 | $8.36 | $17,400 |

According to the May 2009 National Occupational Employment and Wage Estimates,[327] the lowest-paid occupational sectors in May 2009 (when the federal minimum wage was $7.25 per hour) were the following:

| Sector | Workers employed | Median wage | Mean wage | Mean annual |

|---|---|---|---|---|

| Gaming dealers | 86,900 | $8.19 | $9.76 | $20,290 |

| Combined food preparation and serving workers, including fast food | 2,695,740 | $8.28 | $8.71 | $18,120 |

| Waiters and waitresses | 2,302,070 | $8.50 | $9.80 | $20,380 |

| Dining room and cafeteria attendants and bartender helpers | 402,020 | $8.51 | $9.09 | $18,900 |

| Cooks, fast food | 539,520 | $8.52 | $8.76 | $18,230 |

See also

- Average worker's wage

- Fair Labor Standards Act

- History of labor law in the United States

- Income inequality in the United States

- List of minimum wages by country

- Living wage

- Maximum wage

- Minimum Wage Fixing Convention, 1970

- Minimum wage law

- Price/wage spiral

- United States labor law

- Wage slavery

- Wage theft

- Working poor

Notes

- The federal minimum wage applies to states with no set minimum wage and to most workers in states with lower minimum wages.

Further reading

- Price V. Fishback, Andrew Seltzer. 2020. "The Rise of American Minimum Wages, 1912-1968." NBER.

References

- "Minimum Wage Laws in the States". Wage and Hour Division (WHD). United States Department of Labor. Retrieved April 19, 2019. Scroll over states on that map to see exact minimum wage by state. See: table.

- Bradley, David H. (February 3, 2016). State Minimum Wages: An Overview (PDF). Washington, D.C.: Congressional Research Service. Retrieved January 31, 2018.

- United States Department of Labor, https://www.dol.gov/general/topic/wages/minimumwage. Retrieved November 20, 2017

- "State Minimum Wages, 2020 Minimum Wage by State". National Conference of State Legislatures. Retrieved March 12, 2020.

- {{cite web|url=https://www.epi.org/blog/low-wage-workers-saw-the-biggest-wage-growth-in-states-that-increased-minimum-wage-2018-2019/%7Ctitle=Low-wage workers saw the biggest wage growth in states that increased their minimum wage between 2018 and 2019|last=Gould|first=Elise |website=www.epi.org/|access-date=2020-03-12}

- Vanek-Smith, Stacey; Garcia, Cardiff (May 16, 2019). "The Real Minimum Wage". NPR. Retrieved January 9, 2020.

- Federal Reserve Bank of Minneapolis. "Consumer Price Index (estimate) 1800–". Retrieved January 1, 2020.

- "Minimum Wage". Wage and Hour Division (WHD). United States Department of Labor. Retrieved December 14, 2017.

- "Working for $7.25 an Hour: Exploring the Minimum Wage Debate". www.rand.org. Wenger, Jeffrey B. Retrieved December 14, 2017.

By 1968, the minimum wage had reached its peak purchasing power of $1.60 per hour ($11.08 in 2016 dollars).

CS1 maint: others (link) - "Low-wage workers will get paid more in 18 states in 2018 – but they could earn much more if the federal minimum wage had kept up with the economy". Business Insider. Retrieved December 21, 2017.

- Selyukh, Alina (July 8, 2019). "$15 Minimum Wage Would Boost 17 Million Workers, Cut 1.3 Million Jobs, CBO Says". NPR. Archived from the original on August 1, 2019. Retrieved October 4, 2019.

Raising the federal minimum wage to $15 an hour by 2025 would increase the pay of at least 17 million people, but also put 1.3 million Americans out of work, according to a study by the Congressional Budget Office released on Monday.

- See the section on Employment for more detailed findings from this study, including employment estimates on raising the wage to $10 or $12 per hour.

- DeSilver, Drew (January 4, 2017). "5 facts about the minimum wage". Pew Research Center.

Overall, 52% of people favored increasing the federal minimum to $15 an hour, but that idea was favored by just 21% of Trump supporters (versus 82% of Clinton backers). And while large majorities of blacks and Hispanics supported a $15 federal minimum wage, 54% of whites opposed it,

- "Characteristics of minimum wage workers, 2018". BLS Reports. United States Bureau of Labor Statistics. Retrieved April 13, 2019.

- Tritch, Teresa (March 7, 2014). "F.D.R. Makes the Case for the Minimum Wage". New York Times. Retrieved March 7, 2014.

- "Franklin Roosevelt's Statement on the National Industrial Recovery Act". Franklin D. Roosevelt Presidential Library and Museum Our Documents. June 16, 1933. Retrieved March 17, 2018.

- Broda, Rudolf; United States. Bureau of Labor Statistics (December 1928). Minimum Wage Legislation in Various Countries: Bulletin of the United States Bureau of Labor Statistics, No. 467. Bulletin of the United States Bureau of Labor Statistics. G.P.O. p. 8.

- Willis J., Nordlund (1997). The quest for a living wage : the history of the federal minimum wage program. Westport, Conn.: Greenwood Press. p. 2. ISBN 9780313264122. OCLC 33983425.

- Hammond, Matthew B. (1913). "The Minimum Wage in Great Britain and Australia". The Annals of the American Academy of Political and Social Science. 48: 26. JSTOR 1012009.

- Vivien., Hart (2001). Bound by Our Constitution : Women, Workers, and the Minimum Wage. Princeton: Princeton University Press. p. 67. ISBN 9781400821563. OCLC 700688619.

- Webb, Sidney (1912). "The Economic Theory of a Legal Minimum Wage". Journal of Political Economy. 20 (10): 973–998. doi:10.1086/252125. JSTOR 1820545.

- Starr, Gerald (1993). Minimum wage fixing : an international review of practices and problems (2nd impression (with corrections) ed.). Geneva: International Labour Office. p. 1. ISBN 9789221025115.

- Hammond, Matthew B. (1913). "The Minimum Wage in Great Britain and Australia". The Annals of the American Academy of Political and Social Science. 48: 27. JSTOR 1012009.

- Broda, Rudolf; United States. Bureau of Labor Statistics (December 1928). Minimum Wage Legislation in Various Countries: Bulletin of the United States Bureau of Labor Statistics, No. 467. Bulletin of the United States Bureau of Labor Statistics. G.P.O. p. 11.

- Jerold L., Waltman (2000). The politics of the minimum wage. Urbana: University of Illinois Press. p. 11. ISBN 9780252025457. OCLC 42072067.

- Vivien, Hart (2001). Bound by Our Constitution : Women, Workers, and the Minimum Wage. Princeton: Princeton University Press. p. 63. ISBN 9781400821563. OCLC 700688619.

- Vivien, Hart (2001). Bound by Our Constitution : Women, Workers, and the Minimum Wage. Princeton: Princeton University Press. p. 68. ISBN 9781400821563. OCLC 700688619.

- Kelley, Florence (1912). "Minimum-Wage Laws". Journal of Political Economy. 20 (10): 999–1010. doi:10.1086/252126. JSTOR 1820546.

- http://archives.lib.state.ma.us/actsResolves/1912/1912acts0706.pdf

- Vivien, Hart (2001). Bound by Our Constitution : Women, Workers, and the Minimum Wage. Princeton: Princeton University Press. pp. 70–71. ISBN 9781400821563. OCLC 700688619.

- William P. Quigley, "'A Fair Day's Pay For A Fair Day's Work': Time to Raise and Index the Minimum Wage", 27 St. Mary's L. J. 513, 516 (1996)

- Skocpol, Theda (1992). "Chapter 7: Safeguarding the "Mothers of the Race": Protective Legislation for Women Workers". Protecting soldiers and mothers: the political origins of social policy in the United States. Belknap Press of Harvard University Press. ISBN 9780674717657.

- Theda, Skocpol (1992). Protecting soldiers and mothers : the political origins of social policy in the United States. Cambridge, Mass.: Belknap Press of Harvard University Press. p. 423. ISBN 0674717651. OCLC 25409018.

- Levin-Waldman, Oren M. (December 1, 2015). The Minimum Wage: A Reference Handbook. ABC-CLIO. pp. 12–13. ISBN 9781440833953.

- Waltman, Jerold L. (2004). The Case for the Living Wage. Algora Publishing. pp. 184. ISBN 9780875863023.

- Text of U.S. v. Darby Lumber Co., 312 U.S. 100 (1941) is available from: Findlaw Justia

- "Minimum Wage". Wage and Hour Division (WHD). United States Department of Labor. Retrieved April 16, 2017.

- "Fact Sheet #32: Youth Minimum Wage – Fair Labor Standards Act" (PDF). Wage and Hour Division (WHD). United States Department of Labor. Retrieved September 25, 2013.

- "Indexing the minimum wage for inflation". Economic Policy Institute. Retrieved March 20, 2018.

- "San Francisco Historical Minimum Wage Rates | Office of Labor Standards Enforcement". sfgov.org. Retrieved March 19, 2018.

- "Minimum Wage Tracker". Economic Policy Institute. Retrieved March 19, 2018.

- "City Minimum Wage Laws: Recent Trends and Economic Evidence" (PDF). www.nelp.org. National Employment Law Project. April 2016. Retrieved April 13, 2019.

- "ACORN and Unions Increase Working Wages Across the Country". Common Dreams. November 11, 2006. Archived from the original on June 18, 2013.

- The living wage per hour for an individual is calculated for a family unit with two working adults and two children. Basic needs include food, childcare, medical care, housing, transportation, and other basic necessities.

- Glasmeier, Amy (2019). "Introduction to the living wage model". livingwage.mit.edu. Massachusetts Institute of Technology (MIT). Retrieved November 11, 2019.

- Glasmeier, Amy (2017). "Living Wage Calculation for Cleveland–Elyria, OH". livingwage.mit.edu. Massachusetts Institute of Technology (MIT). Retrieved November 11, 2019.

- Glasmeier, Amy (2017). "Living Wage Calculation for Houston–The Woodlands–Sugar Land, TX". livingwage.mit.edu. Massachusetts Institute of Technology (MIT). Retrieved November 11, 2019.

- Glasmeier, Amy (2017). "Living Wage Calculation for Orleans Parish, Louisiana". livingwage.mit.edu. Massachusetts Institute of Technology (MIT). Retrieved November 11, 2019.

- Glasmeier, Amy (2017). "Living Wage Calculation for Atlanta–Sandy Springs–Roswell, GA". livingwage.mit.edu. Massachusetts Institute of Technology (MIT). Retrieved November 11, 2019.

- Glasmeier, Amy (2017). "Living Wage Calculation for Tampa–St. Petersburg–Clearwater, FL". livingwage.mit.edu. Massachusetts Institute of Technology (MIT). Retrieved November 11, 2019.

- Glasmeier, Amy (2018). "Results from the 2018 Data Update". livingwage.mit.edu. Massachusetts Institute of Technology (MIT). Retrieved November 11, 2019.

- Glasmeier, Amy (2017). "Living Wage Calculation for Philadelphia County, Pennsylvania". livingwage.mit.edu. Massachusetts Institute of Technology (MIT). Retrieved November 11, 2019.

- Glasmeier, Amy (2017). "Living Wage Calculation for Chicago-Naperville-Elgin, IL". livingwage.mit.edu. Massachusetts Institute of Technology (MIT). Retrieved November 11, 2019.

- Glasmeier, Amy (2017). "Living Wage Calculation for Boston–Cambridge–Newton, MA". livingwage.mit.edu. Massachusetts Institute of Technology (MIT). Retrieved November 11, 2019.

- Glasmeier, Amy (2017). "Living Wage Calculation for Los Angeles County, California". livingwage.mit.edu. Massachusetts Institute of Technology (MIT). Retrieved November 11, 2019.

- Glasmeier, Amy (2017). "Living Wage Calculation for New York County, New York". livingwage.mit.edu. Massachusetts Institute of Technology (MIT). Retrieved November 11, 2019.

- Glasmeier, Amy (2017). "Living Wage Calculation for San Francisco County, California". livingwage.mit.edu. Massachusetts Institute of Technology (MIT). Retrieved November 11, 2019.

- Oakland, Jana Kasperkevic Ronnie Cohen in (April 14, 2016). "Fight for $15 protesters across US demand living wage in day of action". The Guardian. ISSN 0261-3077. Retrieved December 18, 2017.