Student loans in the United States

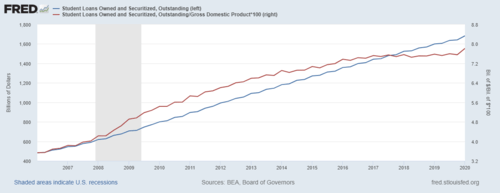

Student loans are a form of financial aid used to help students access higher education. Student loan debt in the United States has grown rapidly since 2006. The debt was ~$1.6 trillion in 2019 which was ~7.5% of 2019 GDP.[1] [2]:1

| Student loans in the U.S. |

| Regulatory framework |

|---|

| Higher Education Act of 1965 U.S. Dept. of Education · FAFSA Cost of attendance · Expected Family Contribution |

| Distribution channels |

| Federal Direct Student Loan Program Federal Family Education Loan Program |

| Loan products |

| Perkins · Stafford PLUS · Consolidation Loans Private student loans |

| Education in the United States |

|---|

|

|

|

Loans usually must be repaid, in contrast to other forms of financial aid such as scholarships, which never have to be repaid, and grants, which rarely have to be repaid. Research indicates the increased usage of student loans has been a significant factor in college cost increases.[3]

US leaders have acknowledged the rise in student loan debt as a crisis. Secretary of Education Betsy DeVos has noted that Federal Student Aid's portfolio "is nearly 10 percent of our nation's debt."[4] Approximately 45 million people have student loan debt.[5] In 2018, the average borrower owed $37,172 at the time of graduation, an increase of $20,000 from 2005.[6] Student loan debt is unevenly distributed, and race and social class are significant factors in the distribution of student loans. Approximately 30 percent of all college students do not incur debt.[7] The schools with the highest amount of student loan debt are University of Phoenix, Walden University, Nova Southeastern University, Capella University, and Strayer University.[8] Except for Nova Southeastern, they are all proprietary (profit-making) universities.

The default rate for borrowers who didn't complete their degree is three times as high as the rate for those who did. [2]:1 Student loan defaults are disproportionately concentrated in the for-profit college sector.[9] In 2018, the National Center for Education Statistics reported that the 12-year student loan default rate for for-profit colleges was 52 percent.[10] The 12-year student loan default rate for African Americans going to for-profit colleges was reported to be 65.7 percent.[11] A 2018 Brookings Institution study projected that "nearly 40 percent of students who took out loans in 2004 may default by 2023."[12]

History

In The Student Loan Mess: How Good Intentions Created a Trillion-Dollar Problem (2014), authors Joel and Eric Best identified four overlapping periods of crisis related to US student loans. The periods are (1) 1958–1972 with the first federal student loans and the creation of Sallie Mae, (2) Mid-1960s-1978 with high rates of default to the near impossibility of student loan discharge in bankruptcy, (3) Mid-1990s-present and "crushing debt", and (4) 2012-the present with widespread economic damage.[13]

In April 2019, the Trump administration commissioned private consultants to estimate the value of the U.S. government's student-loan portfolio, in order to possibly sell all or some of the debt to private investors.[14][15][16]

Overview

Compared to most nations, student loans play a significant role in U.S. higher education.[17] Nearly 20 million Americans attend college each year, of whom close to 12 million – or 60% – borrow annually to help cover costs.[6]

In Europe, higher education receives much more government funding, so student loans are much less common.[18] In parts of Asia and Latin America government funding for post-secondary education is lower – usually limited to a few flagship universities, like the Mexican UNAM – and there are no special programs under which students can easily and inexpensively borrow money.[18]

In the United States, much of college is funded by students and their families through loans, although public institutions are funded in part through state and local taxes, and both private and public institutions through Pell grants and, especially with older schools, gifts from donors and alumni, and investment earnings.[18][19] Some believe this substantially increases intergenerational correlations in income (having two generations of a family have similar earning ability), although other factors have been estimated to play a larger combined role.[20]

Historically, higher education in the US was perceived as a good investment for many individuals and for the public, even though differences in the returns of educational investment across schools were often overstated.[21][22][23]

Student loans come in several varieties in the United States, but are basically split into federal loans[24] and private student loans. The federal loans, for which the FAFSA is the application, are subdivided into subsidized (the government pays the interest while the student is studying at least half-time) and unsubsidized. Federal student loans are subsidized at the undergraduate level only. Subsidized loans generally defer payments and interest until some period (usually six months) after the student has graduated.[25] Some states have their own loan programs, as do some colleges.[26] In almost all cases, these student loans have better conditions – sometimes much better – than the heavily advertised and expensive private student loans.[27]

Student loans may be used for any college-related expenses, including tuition, room and board, books, computers, and transportation expenses.

The main types of student loans in the United States are the following:

- Federal student loans made to students directly (Stafford and Perkins loans).[28] These loans are made regardless of credit history (most students have no credit history); approval is automatic if the student meets program requirements. The student makes no payments while enrolled in at least half-time studies. If a student drops below half time or graduates, there is a six-month grace period. If the student re-enrolls in at least half-time status, the loans are deferred, but when they drop below half time again they no longer have access to a grace period and repayment must begin. All Perkins loans and some undergraduate Stafford loans receive subsidies from the federal government. Amounts of both subsidized and unsubsidized loans are limited.

- There are many deferments and a number of forbearances (cancellation of loan) one can get in the Direct Loan program.[29] For those who are disabled, there is also the possibility of 100% loan discharge (cancellation of loan).[30] Due to changes by the Higher Education Opportunity Act of 2008, it became easier to get one of these discharges after July 1, 2010.[31] There are loan forgiveness provisions for teachers in specific critical subjects or in a school with more than 30% of its students on reduced-price lunch (a common measure of poverty), and qualify for loan forgiveness of all their Stafford, Perkins, and Federal Family Education Loan Program loans totalling up to $77,500.[32] In addition, any person employed full-time (in any position) by any 501(c)(3) non-profit, or another qualifying public service organization, or serving in a full-time AmeriCorps or Peace Corps position,[33] qualifies for loan forgiveness (cancellation) after 120 qualifying payments. The 120 qualifying monthly payments do not need to be consecutive; they can be interrupted without penalty if there is a period of employment with a nonqualifying employer,.[34][35] However, loan forgivenesses or discharges are considered taxable income by the Internal Revenue Service under 26 U.S.C. 108(f).[36]

- Federal student loans made to parents (PLUS loans):[37] Much higher limit, but payments start immediately. Credit history is considered; approval is not automatic.

- Private student loans, made to students or parents: Higher limits and no payments until after graduation, although interest starts to accrue immediately and the deferred interest is added to the principal, so there is interest on the (deferred) interest (which Is not the case with subsidized student loans). Interest rates are higher than those of federal loans, which are set by the United States Congress. Private loans are, or should be, a last resort, when federal and other loan programs are exhausted. Any college financial aid officer will recommend you borrow the maximum under federal programs before turning to private loans.[38]

Social class differences in student loan debt

According to the Saint Louis Fed, "existing racial wealth disparities and soaring higher education costs may actually replicate racial wealth disparities across generations by driving racial disparities in student loan debt load and repayment."[39]

Race and gender differences in student loan debt

According to the New York Times "recent black graduates of four-year colleges owe, on average, $7,400 more than their white peers...Four years after graduation, they still owe an average of $53,000, almost twice as much as whites."[40]

According by an analysis by Demos, 12 years after entering college:

- White men paid off 44 percent of their student-loan balance

- White women paid off 28 percent

- Black men saw their balances grow 11 percent

- Black women saw their loan balances grow 13 percent[41]

Federal loans

Loans to students

Federal student loan debt statistics by loan program:

- Direct Loans ($1.1503 trillion, 34.2 million borrowers)

- FFEL Loans ($281.8 billion, 13.5 million borrowers)

- Perkins Loans ($7.1 billion, 2.3 million borrowers)

- Total ($1.4392 trillion, 42.9 million borrowers)

United States Government-backed student loans were first offered in 1958 under the National Defense Education Act (NDEA),[42] and were only available to select categories of students, such as those studying toward engineering, science, or education degrees. The student loan program, along with other parts of the Act, which subsidized college professor training, was established in response to the Soviet Union's launch of the Sputnik[43] satellite, and a widespread perception that the United States was falling behind in science and technology, in the middle of the Cold War. Student loans were extended more broadly in the 1960s under the Higher Education Act of 1965, with the goal of encouraging greater social mobility and equality of opportunity.[19][44]

Prior to 2010, Federal loans included 1) direct loans originated and funded directly by the United States Department of Education and 2) loans originated and funded by private investors and guaranteed by the federal government. Guaranteed loans were eliminated in 2010 through the Student Aid and Fiscal Responsibility Act and replaced with direct loans because of a belief that guaranteed loans benefited private student loan companies at taxpayers expense, but did not reduce costs for students.[19][44]

These loans are available to college and university students via funds disbursed directly to the school and are used to supplement personal and family resources, scholarships, grants, and work-study. They may be subsidized by the U.S. Government or unsubsidized, depending on financial need. The U.S. Department of Education published a booklet comparing federal loans with private loans. In this same document, the government describes what you may use the loan for:

You may use the money you receive only to pay for education expenses at the school that awarded your loan. Education expenses include school charges such as tuition, room and board, fees, books, supplies, equipment, dependent childcare expenses, transportation, and rental or purchase of a personal computer.

Both subsidized and unsubsidized loans are guaranteed by the U.S. Department of Education, either directly or through guarantee agencies. In 1967, the publicly-owned Bank of North Dakota made the first federally-insured student loan in the United States.[45][46] The loans that are provided are the Stafford and Perkins loans regulated by the U.S. Department of Education. Nearly all students are eligible to receive federal loans (regardless of credit score or other financial issues). Federal student loans are not priced according to any individualized measure of risk, nor are loan limits determined based on risk. Rather, pricing and loan limits are politically determined by Congress. Undergraduates typically receive lower interest rates, but graduate students typically can borrow more. This lack of risk-based pricing has been criticized by scholars as contributing to inefficiency in higher education.[19]

Both types offer a grace period of six months, which means that no payments are due until six months after graduation or after the borrower becomes a less-than-half-time student without graduating. Both types have a fairly modest annual limit. The dependent undergraduate limit effective for loans disbursed on or after July 1, 2008[47] is as follows (combined subsidized and unsubsidized limits): $5,500 per year for freshman undergraduate students, $6,500 for sophomore undergraduates, and $7,500 per year for junior and senior undergraduate students, as well as students enrolled in teacher certification or preparatory coursework for graduate programs. For independent undergraduates, the limits (combined subsidized and unsubsidized) effective for loans disbursed on or after July 1, 2008 are higher: $9,500 per year for freshman undergraduate students, $10,500 for sophomore undergraduates, and $12,500 per year for junior and senior undergraduate students, as well as students enrolled in teacher certification or preparatory coursework for graduate programs. Subsidized federal student loans are only offered to students with a demonstrated financial need. Financial need may vary from school to school. For these loans, the federal government makes interest payments while the student is in college. For example, those who borrow $10,000 during college owe $10,000 upon graduation.

Unsubsidized federal student loans are also guaranteed by the U.S. Government, but the government, while controlling (setting) the interest rate, does not pay interest for the student; rather, the interest accrues during college.[48] Nearly all students are eligible for these loans regardless of financial need (on need, see Expected Family Contribution).[49] Those who borrow $10,000 during college owe $10,000 plus interest upon graduation. For example, those who borrowed $10,000 and had $2,000 accrue in interest owe $12,000. Interest begins accruing on the $12,000, i.e., there is interest on the interest. The accrued interest is "capitalized" into the loan amount, and the borrower begins making payments on the accumulated total. Students can pay the interest while still in college, but few do so.

Federal student loans for graduate students have higher limits: $8,500 for subsidized Stafford and $12,500 (limits may differ for certain courses of study) for unsubsidized Stafford. Many students also take advantage of the Federal Perkins Loan. For graduate students the limit for Perkins is $6,000 per year.

Stafford loan aggregate limits

Students who borrow money for education through Stafford loans cannot exceed certain aggregate limits for subsidized and unsubsidized loans. For undergraduate dependent students, the maximum aggregate limit of subsidized and unsubsidized loans combined is $57,500, with subsidized loans limited to a maximum of $23,000 of the total loans.[50] Students who have borrowed the maximum amount in subsidized loans may (based on grade level—undergraduate, graduate/professional, etc.) take out a loan of less than or equal to the amount they would have been eligible for in subsidized loans. Once both the subsidized and unsubsidized aggregate limits have been met for both subsidized and unsubsidized loans, the student is unable to borrow additional Stafford loans until they pay back a portion of the borrowed funds. A student who has paid back some of these amounts regains eligibility up to the aggregate limits as before.

Graduate students have a lifetime aggregate loan limit of $138,500.

Loans to parents

Usually these are PLUS loans (formerly standing for "Parent Loan for Undergraduate Students"). Unlike loans made to students, parents can borrow much more, usually enough to cover the remainder of the costs student financial aid does not cover. Interest accrues during the time the student is in school. The interest rates for the PLUS loans as of 2017 are 7% for Stafford loans.[51] No payments are required until the student is no longer in school, although parents may start repayment ahead of time if they want, thus saving on interest.

The parents are responsible for repayment on these loans, not the student. Loans to parents are not a 'cosigner' loan with the student having equal accountability. The parents have signed the master promissory note to repay the loan and, if they do not repay the loan, their credit rating will suffer. Also, parents are advised to consider what their monthly payments will be after borrowing for four years at this rate (initial loan documents will give the repayment schedule as if only one year of loans was taken out). What sounds like a "manageable" debt load of (for example) $200 a month from freshman year loans can mushroom to a much more daunting $800 a month by the time four years have been funded through loans. Borrowing is not free, and the more borrowed, the more expensive it is. Additionally, PLUS loans consider credit history, making it more difficult for low income parents to qualify.

Under new legislation, graduate students are eligible to receive PLUS loans in their own names. These Graduate PLUS loans have the same interest rates and terms of Parent PLUS loans.

The current interest rate on these loans is 7%.[52]

Disbursement

Federal Direct Student Loans, also known as Direct Loans or FDLP loans, are funded from public capital originating with the United States Treasury. FDLP loans are distributed through a channel that begins with the U.S. Treasury Department and from there passes through the United States Department of Education, then to the college or university and then to the student.[53]

According to the United States Department of Education, more than 6,000 colleges, universities, and technical schools participate in the Federal Family Education Loan Program (FFELP), which represents about 80% of all schools. FFELP lending represents 75% of all federal student loan volume.[54]

In 2010, the Health Care Reform Act incorporated provisions on Education, which terminated the Federal Family Education Loan Appropriations after June 30, 2010. From that date on, all government-backed student loans have been issued through the Direct Loans program.

Debt levels

The maximum amount that any student can borrow is adjusted as federal policies change. Current loan limits are below the cost of most four year private institutions and most flagship public universities, and students therefore typically borrow higher cost private student loans to make up the difference. Scholars have advocated increasing federal debt limits to reduce the interest charges to student debtors.[44]

The maximum amount that any student can borrow is adjusted as federal policies change. A study published in the winter 1996 edition of the Journal of Student Financial Aid, “How Much Student Loan Debt Is Too Much?” suggested that the monthly student debt payment for the average undergraduate should not exceed 8% of total monthly income after graduation. Some financial aid advisers have referred to this as "the 8% rule." Circumstances vary for individuals, so the 8% level is an indicator, not a rule set in stone. A research report about the 8% level is available at the Iowa College Student Aid Commission.[55] Out of 100 students who ever attended a for-profit, 23 defaulted within 12 years of starting college in the 1996 cohort compared to 43 in the 2004 cohort (compared to an increase from just 8 to 11 students among entrants who never attended a for-profit).[56]

The Economist reported in June 2014 that United States student loan debt exceeded $1.2 trillion, with over 7 million debtors in default. Debt and default among black college students is at crisis levels, and even a bachelor's degree is no guarantee of security: black BA graduates default at five times the rate of white BA graduates (21 versus 4 percent), and are more likely to default than white dropouts.[56] Public universities increased their fees by a total of 27% over the five years ending in 2012, or 20% adjusted for inflation. Public university students paid an average of almost $8,400 annually for in-state tuition, with out-of-state students paying more than $19,000. For two decades ending in 2013, college costs have risen 1.6% more than inflation each year. Government funding per student fell 27% between 2007 and 2012. Student enrollments rose from 15.2 million in 1999 to 20.4 million in 2011, but fell 2% in 2012.[57][58]

Private loans

These are loans that are not guaranteed by a government agency and are made to students by banks or finance companies. Private loans cost more and have much less favorable terms than federal loans, and are generally only used when students have exhausted the borrowing limit under federal student loans. They are not eligible for Income Based Repayment plans, and frequently have less flexible payment terms, higher fees, and more penalties.[19][44][59]

Advocates of private student loans suggest that they combine the best elements of the different government loans into one: they generally offer higher loan limits than federal student loans, ensuring the student is not left with a budget gap. Unlike federal parent (PLUS) loans, they generally offer a grace period of six months (occasionally 12 months) with no payments due until after graduation; however, interest accrues and is added to the principal. Most experts unconnected to the private loan industry recommend private student loans only as an expensive last resort, because of the higher interest rates, multiple fees, and lack of the borrower and oversight protections which are built into the federal loans.[60][61]

Loan types

Private student loans generally come in two types: school-channel and direct-to-consumer.

School-channel loans offer borrowers lower interest rates but generally take longer to process. School-channel loans are "certified" by the school, which means the school signs off on the borrowing amount, and the funds are disbursed directly to the school. The "certification" means only that the school confirms the loan funds will be used for educational expenses only, and agrees to hold them and disburse them as needed. Certification does not mean that the school approves of, recommends, or has even examined the terms (conditions) of the loan.

Direct-to-consumer private loans are not certified by the school; schools don't interact with a direct-to-consumer private loan at all. The student simply supplies enrollment verification to the lender, and the loan proceeds are disbursed directly to the student. While direct-to-consumer loans generally carry higher interest rates than school-channel loans, they do allow families to get access to funds very quickly — in some cases, in a matter of days. Some argue that this convenience is offset by the risk of student over-borrowing and/or use of funds for inappropriate purposes, since there is no third-party certification that the amount of the loan is appropriate for the education needs of the student in question, or that it will be used only for education.[62]

Direct-to-consumer private loans was the fastest growing segment of education finance with the "percentage of undergraduates obtaining private loans from 2003–04 to 2007–08 rose from 5 percent to 14 percent" and were under legislative scrutiny due to the lack of school certification.[63][64] Loan providers range from large education finance companies to specialty companies that focus exclusively on this niche.[62][64] Lenders often push such loans by advertising: "no FAFSA required," or "Funds disbursed directly to you." But since the passing of Health Care and Education Reconciliation Act of 2010(HCERA), the death knell sounded for private sector lending under the Federal Family Education Loan Program (FFELP). Since July 1, 2010, no new student loans have been made under the FFELP; all subsidized and unsubsidized Stafford loans, PLUS loans, and Consolidation loans have been made solely under the Federal Direct Loan Program.[64]

Interest rates

Federal student loan interest rates are set by Congress, and fixed. Private student loans usually have substantially higher interest rates, and the rates fluctuate depending on the financial markets. Some private loans disguise the true cost of borrowing by requiring substantial up-front origination "fees", which enable deceptively lower interest rates to be offered. Interest rates also vary depending on the applicant's credit history.

Most private loan programs are tied to one or more financial indexes, such as the Wall Street Journal Prime rate or the BBA LIBOR rate, plus an overhead charge. Because private loans are based on the credit history of the applicant, the overhead charge varies. Students and families with excellent credit generally receive lower rates and smaller loan origination fees than those with poorer credit histories. Money paid toward interest is now tax deductible. However, lenders rarely give complete details of the terms of the private student loan until after the student submits an application, in part because this helps prevent comparisons based on cost. For example, many lenders only advertise the lowest interest rate they charge (for good credit borrowers). Borrowers with bad credit can expect interest rates that are as much as 6% higher, loan fees that are as much as 9% higher, and loan limits that are two-thirds lower than the advertised figures.[65]

Loan fees

Private loans often carry an origination fee, which can be substantial. Origination fees are a one-time charge based on the amount of the loan. They can be taken out of the total loan amount or added on top of the total loan amount, often at the borrower's preference. Some lenders offer low-interest, 0-fee loans.[66] Each percentage point on the front-end fee gets paid once, while each percentage point on the interest rate is calculated and paid throughout the life of the loan. Some have suggested that this makes the interest rate more critical than the origination fee. The amount that is borrowed from private lenders accumulates to about 15 billion borrowed from private loans.[67]

In fact, there is an easy solution to the fee-vs.-rate question: All lenders are legally required to provide you a statement of the "APR (Annual Percentage Rate)" for the loan before you sign a promissory note and commit to it. Unlike the "base" rate, this rate includes any fees charged and can be thought of as the "effective" interest rate including actual interest, fees, etc. When comparing loans, it may be easier to compare APR rather than "rate" to ensure an apples-to-apples comparison. APR is the best yardstick to compare loans that have the same repayment term; however, if the repayment terms are different, APR becomes a less-perfect comparison tool. With different term loans, consumers often look to "total financing costs" to understand their financing options.

Loan terms

In contrast with federal loans, whose terms are public and standardized, the terms for private loans vary from lender to lender. However, it is not easy to compare them, as some conditions may not be revealed until the student is presented with a contract (promissory note) to sign. A common suggestion is to shop around on all terms, not just respond to "rates as low as..." tactics that are sometimes little more than bait-and-switch. However, shopping around could damage your credit score.[68] Examples of other borrower terms and benefits that vary by lender are deferments (amount of time after leaving school before payments start) and forbearances (a period when payments are temporarily stopped due to financial or other hardship). These policies are solely based on the contract between lender and borrower and not set by Department of Education policies.

Cosigners

Private student loan programs generally issue loans based on the credit history of the applicant and any applicable cosigner, co-endorser or coborrower.[69] In contrast, federal loan programs deal primarily with need-based criteria, as defined by the EFC and the FAFSA. Students may find that their families have too much income or too many assets to qualify for federal aid, but lack sufficient assets and income to pay for school without assistance.[70] Most students will need a cosigner in order to obtain a private student loan.[71]

Many international students in the United States can obtain private loans (they are usually ineligible for federal loans) with a cosigner who is a United States citizen or permanent resident. However, some graduate programs (notably top MBA programs) have a tie-up with private loan providers and in those cases no cosigner is needed even for international students.[72]

After a student and the student's co-signer are approved for a student loan, a private student loan lender may offer a co-signer release option, which "releases" the original co-signer from any financial responsibility for the student loan. There are several student loan lenders who offer co-signer releases and other benefits.[73]

Repayment and Default

Key metrics

Key metrics in the student loan industry are student loan repayment rate,[74] and student loan default rate, such as the one-, three-,[75] five-,[9] and seven-year default rates.[76]

Repayment rate

The three year student loan repayment rate for each school that receives Title IV funding is available at the US Department of Education's College Scorecard.[76] This number may be a poor indicator of the overall student loan default rate, and some schools have learned to game the system by deferring loans beyond the three year window.[77]

Default rate

According to the Center for American Progress, the percentage of borrowers in default is 10 percent after three years and 16 percent after five years. However, the US Department of Education only publishes three year default rates.[9]

The default rate for borrowers who didn't complete their degree is three times as high as the rate for those who did. [2]:1

Standard repayment

When Federal student loans enter repayment, they are automatically enrolled in standard repayment.[78] Under it, a borrower has 10 years to repay the total amount of his or her loan. The loan servicer (whoever is sending the bill) determines the monthly bill by calculating a fixed monthly payment amount that will pay off the original loan amount plus all accrued interest after 120 equal payments (12 payments per year).

Payments pay off the interest building up each month, plus part of the original loan amount. Depending on the amount of the loan, the loan term may be shorter than 10 years. There is a $50 minimum monthly payment.

On July 25, 2018, US Secretary of Education Betsy DeVos issued an order declaring that the Borrower Defense Program, which was enacted by the US Department of Education in November 2016,[79] would be repealed and replaced with a stricter repayment policy effective July 1, 2019.[80] Under DeVos' policy, when a school closes for fraud before conferring degrees to its students, those students' loans are not forgiven automatically; rather, students must prove that they were financially harmed. There were bipartisan votes in the House and Senate in early 2020 to overturn DeVos' order, but President Trump vetoed the congressional legislation, siding with DeVos.[81]

Income-driven repayment plans

Income-based repayment

If a student's loan debt is high but their income is modest or zero, they may qualify for an income-driven repayment (IDR) plan. Most major types of federal student loans—except for PLUS loans for parents—are eligible for an IDR plan.[82] Income-driven plans allow borrowers to cap their monthly payments to 10%, 15%, or 20% of disposable income for up to 20 or 25 years, after which the remaining balance is forgiven.[83]

Currently, four specific IDRs are available:

1. Income-Based Repayment (IBR)

2. Pay As You Earn (PAYE)

3. Revised Pay As You Earn (REPAYE)

4. Income-Contingent Repayment (ICR)

Income share agreements

An income share agreement is an alternative to a traditional loan. During the term of an income share agreement the student agrees that after graduation the student will pay a percentage of their salary to the educational institution.[84] Purdue University is an example of a university that offers an income share agreement to its students.[85]

Defenses to repayment

Under some circumstances, student loan debt can be canceled. For example, if a student attended a school while it closed or if the student was enrolled by means of false claims, they may be able to file defense to repayment paperwork.[86]

Leaving the country to evade repayment

Debt evasion is the intentional act of trying to avoid attempts by creditors to collect or pursue one's debt. Some news accounts report that individuals are fleeing the US in order to stop repaying their student loans. While leaving the country does not discharge the loan or stop interest and penalties from accruing, it is generally more difficult to collect debts against debtors who reside in foreign nations.[87]

International addresses make it more difficult to find people, and collection companies would usually need to hire an international counsel or a third party collector to recoup the debt, cutting into their profits and reducing their incentive to go after a debtor. 'It increases our expenses to go overseas,' says Justin Berg of American Profit Recovery, a debt collection agency in Massachusetts. 'Our revenues are cut by more than half,' he says."

Some nations may enter into agreements with the US to facilitate the collection of student loans.[88]

After default, co-signers of student loans remain liable for repayment of the loan. Cosigners are often the parents of the borrowers.[89][90][91][92]

Student loans in bankruptcy proceedings

United States federal student loans and some private student loans can be discharged in bankruptcy only with a showing of "undue hardship." In contrast to credit card debt, which often can be discharged through bankruptcy proceedings,[93][94][95][96] this option is not generally available for educational loan debt.[97][98][99] Additionally, those seeking to discharge their student loan debt must initiate an adversary proceeding, a separate lawsuit within the bankruptcy case where they illustrate the required undue hardship.[100] Many borrowers cannot afford to retain an attorney or the additional litigation costs associated with an adversary proceeding, let alone a bankruptcy case. Further complicating matters, the undue hardship standard varies from jurisdiction to jurisdiction, but is generally difficult to meet, making student loans practically non-dischargeable through bankruptcy. In most circuits discharge depends on meeting three prongs in the Brunner test:[101]

As noted by the district court, there is very little appellate authority on the definition of "undue hardship" in the context of 11 U.S.C. § 523(a)(8)(B). Based on legislative history and the decisions of other district and bankruptcy courts, the district court adopted a standard for "undue hardship" requiring a three-part showing: (1) that the debtor cannot maintain, based on current income and expenses, a "minimal" standard of living for herself and her dependents if forced to repay the loans; (2) that additional circumstances exist indicating that this state of affairs is likely to persist for a significant portion of the repayment period of the student loans; and (3) that the debtor has made good faith efforts to repay the loans. For the reasons set forth in the district court's order, we adopt this analysis. The first part of this test has been applied frequently as the minimum necessary to establish "undue hardship." See, e.g., Bryant v. Pennsylvania Higher Educ. Assistance Agency (In re Bryant), 72 B.R. 913, 915 (Bankr.E.D.Pa.1987); North Dakota State Bd. of Higher Educ. v. Frech (In re Frech), 62 B.R. 235 (Bankr.D.Minn.1986); Marion v. Pennsylvania Higher Educ. Assistance Agency (In re Marion), 61 B.R. 815 (Bankr.W.D.Pa.1986). Requiring such a showing comports with common sense as well.[102]

While federal student loans can be discharged administratively for total and permanent disability, private student loans cannot be discharged outside of bankruptcy.[97][98][99]

One set of empirical data comes from Education Credit Management Corporation, which serviced loans for twenty-five lending agencies and the United States Department of Education; in 2008 it was reported that of 72,000 loans in bankruptcy proceedings, only 276 debtors attempted discharge, and by November 2009 of the 134 resolutions thus far, 29 resulted in total or partial discharge.[103]

A review of records in the United States Bankruptcy Court for the Western District of Washington found that 57% of the 115 adversary proceedings reviewed in a 5-year period resulted in partial discharge, through settlement or trial; however, the authors cautioned not to generalize the results of this small sample.[104] 86% involved at least one of the United States Department of Education or the Education Credit Management Corporation, a nonprofit which services loans where the student has declared bankruptcy.[104]

The rules for total and permanent disability discharge underwent major changes as a result of the Higher Education Opportunity Act of 2008. Loan holders are no longer required to be unable to earn any income, but instead the standard is "substantial gainful activity" (SGA) as a result of disability. The new regulations took effect July 1, 2010.[105] Under further changes that took effect July 1, 2013, if a borrower is determined to be disabled by the Social Security Administration, that determination will be accepted as proof of total and permanent disability if the SSA placed the individual on a five- to seven-year review cycle (the longest currently used by SSA).[106] Effective with discharges on or after January 1, 2018, debt discharged due to the death or total permanent disability of the borrower is no longer treated as taxable income.[107] This provision, part of the Tax Cuts and Jobs Act of 2017, will sunset on December 31, 2025 unless renewed by Congress.[108]

Criticism

In 1987, then-Secretary of Education William Bennett argued that “... increases in financial aid in recent years have enabled colleges and universities blithely to raise their tuitions, confident that Federal loan subsidies would help cushion the increase.”[109] This statement came to be known as the “Bennett Hypothesis.” In July 2015 (revised in March 2016), a Staff Report was published by the Federal Reserve Bank of New York, the conclusions of which indicate that institutions more exposed to increases in student loan program maximums tend to respond with disproportionate raises in tuition prices:

In this paper, we use a Bartik-like approach to identify the effect of increased loan supply on tuition following large policy changes in federal aid program maximums available to undergraduate students that occurred between 2008 and 2010. We construct institution-specific changes in program maximums as the interaction of an institution exposure to the maximums in each aid program (the fraction of qualifying students) and the legislated program maximums. We find that institutions that were most exposed to these maximums ahead of the policy changes experienced disproportionate tuition increases around these changes, with effects of changes in institution-specific program maximums of Pell Grant, subsidized loan, and unsubsidized loan of about 40, 60, and 15 cents on the dollar, respectively.[3]

The federal student loan program has been criticized for not adjusting interest rates according to the riskiness of factors that are under students' control, such as choice of academic major. Critics have contended that this lack of risk-based pricing contributes to inefficiency and misallocation of resources in higher education, and lower productivity in the labor market.[19] However, recent research indicates that while high levels of student loan debt, coupled with high default rates, present a number of challenges for individual student loan borrowers and for the federal government (which must cover the defaults through taxes), they do not necessarily place a substantial burden on society at large.[110]

After the passage of the bankruptcy reform bill of 2005, both federal and private student loans are not discharged during bankruptcy (prior to the passage of this bill, only federal student loans were unable to be discharged). This provided a credit risk free loan for the lender, averaging 7 percent a year.[111] In January 2013, the "Fairness for Struggling Students Act" was unveiled. This bill, if passed, would have allowed private student loans to be discharged in bankruptcy.[112] The bill was referred to the Senate Judiciary Committee where it died.[113]

Some critics of financial aid claim that, because schools are assured of receiving their fees no matter what happens to their students, they have felt free to raise their fees to very high levels, to accept students of inadequate academic ability, and to produce too many graduates in some fields of study. About one-third of students, whether or not they graduate or find jobs that match their credentials, are financially burdened for much of their lives by their debt obligations, instead of being economically productive citizens. When those former students default on their obligations, the burdens are shifted to taxpayers. Lastly, the proportion of graduates who come from poor backgrounds has actually declined since 1970.[114]

In 2007, then-Attorney General of New York State, Andrew Cuomo, led an investigation into lending practices and anti-competitive relationships between student lenders and universities. Specifically, many universities steered student borrowers to "preferred lenders" that charged higher interest rates. Some of these "preferred lenders" allegedly rewarded university financial aid staff with kick backs. This led to changes in lending policy at many major American universities. Many universities have also rebated millions of dollars in fees back to affected borrowers.[115][116]

The biggest lenders, Sallie Mae and Nelnet, are criticized by borrowers. They are frequently defendants in lawsuits, the most serious of which was filed in 2007. The False Claims Suit was filed on behalf of the federal government by former Department of Education researcher, Dr. Jon Oberg, against Sallie Mae, Nelnet, and other lenders. Oberg argued that the lenders overcharged the United States Government and defrauded taxpayers of over $22 million. In August 2010, Nelnet settled the lawsuit and paid $55 million.[117]

In an effort to improve the student loan market, startups like LendKey, SoFi (Social Finance, Inc.) and CommonBond were founded to offer student loans and refinance loans at lower rates than traditional repayment systems using an alumni-funded model.[118][119] According to a 2016 analysis by online student loan marketplace Credible, about 8 million borrowers could qualify to refinance their loans at a lower interest rate.[120]

In June 2010, the amount of student loan debt held by Americans exceeded the amount of credit card debt held by Americans.[121] At that time, student loan debt totaled at least $830 billion, of which approximately 80% was federal student loan debt and 20% was private student loan debt. By the fourth quarter of 2015, total outstanding student loans owned and securitized had risen to, and surpassed, $1.3 trillion.[122] This rising student debt is contributing to the expanding wealth gap.[123]

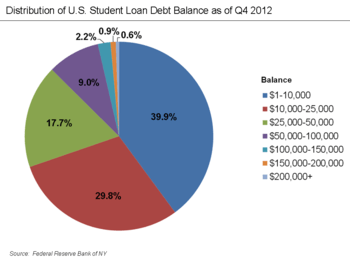

Every year, student debt continues to rise. Nearly two-thirds of undergraduates are in debt. By graduation, their student loan debt averages around $26,600. One percent of graduates leave college with $100,000 or more of student loan debt. In 2013, the federal debt had grown to $16.7 trillion. Six percent of that debt comes directly from student loans making student loans only second to mortgages in consumer debt. The Consumer Financial Protection Bureau reported that as of May 2013, federal student loan debt had reached $1 trillion bringing the total number for outstanding student loan debt to $1.2 trillion. However, this amount does not include what students take from savings accounts, borrow from parents, or charge to their credit cards in order to pay for their education. In actuality, the burden of student debt is much greater than these numbers indicate.[124] The Federal Reserve Bank of New York's February 2017 Quarterly Report on Household Debt and Credit reported that 11.2% of aggregate student loan debt was 90 or more days delinquent in the final quarter of 2016.[125]

One of the biggest reasons that students decide not to go to college is the cost. Many times students are forced to choose between going to college or going straight to the workforce because they are unable to keep up with the ever-rising tuition. In the 20 years between 1987 and 2007, tuition costs rose 326% Best and Keppo (2014). Even adjusting for inflation, a community college education cost 33% less than it does now National Center for Education Statistics (2018). Books and supplies are another tremendous expense with some books for basic required classes costing hundreds of dollars. Because of these costs, 58% of those students who choose to go to school will be forced to take out student loans to continue their education. Many student who are unable to get loans, or determine that the cost of going to school is not worth the debt without the means to pay it back like they would if they had completed school. Student loans are also very dangerous because there is no way to get out from under them unless they are paid in full or the borrower dies. Even bankruptcy does not wipe away student loan debt, and borrowers must continue to pay the loans off for years after they have left school. [126]

In April 2019, Brookings Institution fellow Adam Looney, a long-time analyst of student loans stated that:

"It is an outrage that the federal government offers loans to students at low-quality institutions even when we know those schools don’t boost their earnings and that those borrowers won’t be able to repay their loans. It is an outrage that we make parent PLUS loans to the poorest families when we know they almost surely will default and have their wages and social security benefits garnished and their tax refunds confiscated, as $2.8 billion was in 2017. It is an outrage that we saddled several million students with loans to enroll in untested online programs, that seem to have offered no labor market value. It is an outrage that our lending programs encourage schools like USC to charge $107,484 (and students to blithely enroll) for a master’s degree in social work (220 percent more than the equivalent course at UCLA) in a field where the median wage is $47,980. It’s no wonder many borrowers feel their student loans led to economic catastrophe."[127]

Activism

Organizations that advocate for student loan reform include the Debt Collective, the Strike Debt network, and Student Loan Justice.[128][129][130]

Reform proposals

According to Harvard Business School researchers, "when student debt is erased, a huge burden is lifted and people take big steps to improve their lives: They seek higher-paying careers in new states, improve their education, get their other finances in order, and make more substantial contributions to the economy." [131]

Democratic Senators Elizabeth Warren, Cory Booker, Kamala Harris, Kirsten Gillibrand and US Representative Tulsi Gabbard have endorsed Senator Bernie Sanders' College for All Act. The policy would eliminate undergraduate tuition and fees at public colleges and universities, lower student loan interest rates, and allow those with existing debt to refinance their student loans.[132]

Senator Brian Schatz (D-Hawaii) reintroduced the Debt Free College Act in 2019.[133] The co-sponsors are Senators Sherrod Brown, Kamala Harris, Cory Booker, Jeff Merkley, Richard Blumenthal, Kirsten Gillebrand, Richard Durbin, Tammy Baldwin, and Elizabeth Warren.[134]

Some conservative pundits have proposed that colleges limit student loans and share the liability on defaulted student loans.[135][136][137][138]

The New York Times published an editorial in 2011 in support of allowing private loans to again be discharged during bankruptcy.[139]

In June 2019, Bernie Sanders offered a new proposal that would cancel $1.6 trillion of student loan, undergraduate and graduate debt for around 45 million Americans. “This proposal completely eliminates student debt in this country and ends the absurdity of sentencing an entire generation, the millennial generation, to a lifetime of debt for the crime of doing the right thing -- and that is going out and getting a higher education,” Sanders said.[140]

On August 21, 2019, President Donald Trump ordered student loan forgiveness for permanently disabled veterans, which would save 25,000 veterans an average of $30,000 each.[141]

See also

References

- https://www.forbes.com/sites/ellenparis/2019/03/31/student-loan-debt-still-impacting-millennial-homebuyers/#4233ecac3e78

- Nadworny, Elissa (July 9, 2019). "These Are The People Struggling The Most To Pay Back Student Loans". NPR. Archived from the original on July 12, 2019. Retrieved July 12, 2019.

- David O. Lucca, Taylor Nadauld, and Karen Shen (July 2015). "Credit Supply and the Rise in College Tuition: Evidence from the Expansion in Federal Student Aid programs". Federal Reserve Bank of New York.CS1 maint: uses authors parameter (link)

- https://www.ed.gov/news/speeches/prepared-remarks-us-secretary-education-betsy-devos-federal-student-aids-training-conference

- "Student Debt Continues to Rise". Peter G. Peterson Foundation. July 18, 2018. Retrieved April 13, 2019.

- Hess, Abigail (July 13, 2017). "Here's how much it costs to go to college in the US compared to other countries". CNBC. Retrieved June 9, 2018.

- https://www.cnbc.com/2018/02/15/heres-how-much-the-average-student-loan-borrower-owes-when-they-graduate.html

- https://www.brookings.edu/wp-content/uploads/2016/07/ConferenceDraft_LooneyYannelis_StudentLoanDefaults.pdf

- Miller, Ben (August 25, 2018). "The Student Debt Problem Is Worse Than We Imagined". New York Times. Retrieved July 14, 2019.

- https://www.chicagotribune.com/business/ct-biz-for-profit-college-loan-default0-20171005-story.html

- https://www.bloomberg.com/news/articles/2017-10-11/black-americans-twice-as-likely-as-whites-to-default-on-student-debt

- Scott-Clayton, Judith (January 11, 2018). "The looming student loan default crisis is worse than we thought". Brookings. Brookings Institution. Retrieved July 14, 2019.

- Best, Joel; Best, Eric (May 2, 2014). The Student Loan Mess: How Good Intentions Created a Trillion-Dollar Problem. ISBN 978-0520276451.

- https://www.wsj.com/articles/trump-administration-hires-mckinsey-to-evaluate-student-loan-portfolio-11556728035

- https://www.politico.com/story/2019/05/02/devos-student-loans-1402546

- https://www.cnn.com/2019/05/01/politics/trump-administration-mckinsey-student-loan-debt/index.html

- Furman, Jason (July 19, 2016). "The Truth About Higher Education And Student Loans". Huffington Post. Retrieved June 4, 2018.

- Pan, Maoyuan; Dan Lou (2008). "A Comparative Analysis On Models of Higher Education Massification". Frontiers of Education in China. 3 (1): 64–78. doi:10.1007/s11516-008-0004-8.

- Michael Simkovic, Risk-Based Student Loans (2012)

- Mankiw, N. Gregory (August 2013). "Defending the One Percent". Journal of Economic Perspectives. 27 (3): 21–34. doi:10.1257/jep.27.3.21.

- OECD, Education at a Glance (2011)

- Stacy Berg Dale and Alan B. Krueger (2002). "Estimating the Payoff to Attending a More Selective College: An Application of Selection on Observables and Unobservables". The Quarterly Journal of Economics. 117 (4): 1491–1527. doi:10.1162/003355302320935089.CS1 maint: uses authors parameter (link)

- "Brian Leiter's Law School Reports". leiterlawschool.typepad.com. Retrieved November 15, 2015.

- "Student Loans | Consumer Information". www.consumer.ftc.gov. Retrieved November 11, 2015.

- "Subsidized and Unsubsidized Loans". Federal Student Aid. May 1, 2018. Retrieved June 9, 2018.

- Consumer Financial Protection Bureau. (2012) Private Student Loans. See also: Report Details Woes of Student Loan Debt. NYT.

- "Archived copy". Archived from the original on September 6, 2008. Retrieved March 22, 2015.CS1 maint: archived copy as title (link)

- "The Difference Between Stafford & Perkins Loans". Retrieved June 9, 2018.

- "Archived copy". Archived from the original on November 11, 2011. Retrieved September 6, 2009.CS1 maint: archived copy as title (link)

- "Archived copy". Archived from the original on September 10, 2009. Retrieved September 6, 2009.CS1 maint: archived copy as title (link)

- "Higher Education Opportunity Act - 2008". Ed.gov. Retrieved February 15, 2014.

- Wondering whether you can get your federal student loans forgiven or canceled for your service as a teacher?. FederalStudentAid.gov.

- "Public Service Loan Forgiveness | Federal Student Aid". Studentaid.ed.gov. Retrieved February 15, 2014.

- "Public Service Loan Forgiveness". Federal Student Aid. December 12, 2017. Retrieved January 17, 2018.

- Public Service Loan Forgiveness. FinAid.org. See also: H.R. 2669 (110th): College Cost Reduction and Access Act: Library of Congress Summary.

- U.S.C.

- "PLUS Loans". Federal Student Aid. February 26, 2018. Retrieved June 9, 2018.

- "Federal Versus Private Loans". Federal Student Aid. May 10, 2017. Retrieved June 9, 2018.

- https://www.stlouisfed.org/publications/in-the-balance/2018/parents-wealth-helps-explain-racial-disparities-in-student-loan-debt

- https://www.nytimes.com/2019/05/20/us/student-debt-america.html

- https://www.marketwatch.com/story/12-years-after-starting-college-white-men-have-paid-off-44-of-their-student-loans-and-black-women-owe-13-more-2019-06-06

- "Federal Role in Education". www2.ed.gov. May 25, 2017. Retrieved June 9, 2018.

- "U.S. Senate: Sputnik Spurs Passage of the National Defense Education Act". www.senate.gov. Retrieved June 9, 2018.

- Jonathan Glater (2011). "The Other Big Test: Why Congress Should Allow College Students to Borrow More Through Federal Aid Programs". New York University Journal of Legislation and Public Policy. 14. doi:10.2139/ssrn.1871305.

- https://bismarckstate.edu/alumnifoundation/news/BSCalumwasfirstfederalloanrecipient/

- https://bismarcktribune.com/news/state-and-regional/bank-of-north-dakota-will-end-student-loan-program/article_5ddf0668-3c73-11df-8c35-001cc4c03286.html

- "Loans: Federal William D. Ford Direct Loans | Types of Financial Aid | Student Financial Services | Student Life | Iona College". www.iona.edu. Retrieved June 9, 2018.

- "Understanding Repayment". Federal Student Aid. May 3, 2018. Retrieved June 9, 2018.

- "Expected Family Contribution (EFC)". fafsa.ed.gov. Retrieved June 9, 2018.

- "IFAP - Dear Colleague Letter". Ifap.ed.gov. Archived from the original on March 20, 2009. Retrieved February 15, 2014.

- "Interest Rates and Fees". Federal Student Aid. August 3, 2017. Retrieved December 13, 2017.

- https://studentaid.ed.gov/sa/types/loans/plus#interest

- "Federal Student Loan Programs Data Book - Introduction". www2.ed.gov. Retrieved June 9, 2018.

- "Federal Family Education Loan (FFEL) Program". www2.ed.gov. April 9, 2014. Retrieved June 9, 2018.

- Greiner, K., How Much Student Loan Debt is too Much?, Journal of Student Financial Aid, v26, n1, p7-16, Winter, 1996. ERIC document EJ527952

- Judith Scott-Clayton (January 10, 2018). "The looming student loan default crisis is worse than we thought" (PDF). Retrieved August 28, 2018.

- The Economist-Creative destruction-June 28, 2014

- The Economist-The digital degree-June 28, 2014

- Philip G. Schrag & Charles W. Pruett, Coordinating Loan Repayment Assistance Programs with New Federal Legislation, 60 J. LEGAL EDUC. 583, 590-597 (2010)

- "New changes will do you good if you have student loans". USA Today. July 1, 2008. Retrieved May 24, 2010.

- "Private Loans Deepen a Crisis in Student Debt". The New York Times. June 10, 2007. Retrieved May 24, 2010.

- "Comparison of Federal and Private Student Loans". Discover. Retrieved May 22, 2014.

- Woo, Jennie, H., and (ED) National Center for Education Statistics. "The Expansion of Private Loans in Postsecondary Education. Stats in Brief. NCES 2012-184" National Center For Education Statistics (2011): ERIC. Web. May 21, 2014

- SANTO JR., G. F., & RALL, L. L. (2010). Private Student Loan Financing in an Era of Needs and Challenges. Journal of Structured Finance, 16(3), 106-115.

- "Loans | Private Student Loans". FinAid. Retrieved February 15, 2014.

- "Interest Rates and Origination Fees • Office of Student Financial Aid • Iowa State University". www.financialaid.iastate.edu. Retrieved June 9, 2018.

- Collinge, Alan Micheal (2009). Student Loan Scam: The Most Oppressive Debt in The U.S. History and How We Can Fight Back. Beacon Press.

- Lieber, Ron (July 26, 2008). "Danger Lurks When Shopping for Student Loans". The New York Times. Retrieved May 24, 2010.

- "Federal Versus Private Loans". Federal Student Aid. U.S. Department of EAducation. Retrieved August 27, 2019.

- Amandolare, Sarah (February 10, 2014). "The student loan crisis: How middle-class kids get hammered". Los Angeles Times. Retrieved August 27, 2019.

- Powell, Farran (August 29, 2016). "6 Must-Know Facts For Student Co-Signers". U.S. News & World Report. Retrieved August 27, 2019.

- Jain, Ayushman (2012). Money Matters: Financing your MBA at UCLA. The MBA Student Voice, UCLA Anderson. Blog. Retrieved on 5/23/14 from http://mbablogs.anderson.ucla.edu/mba_students/2012/07/money-matters-financing-your-mba-at-ucla.html

- "Make Lemonade Student Loan Reviews". Make Lemonade. Retrieved September 3, 2016.

- https://trends.collegeboard.org/student-aid/figures-tables/federal-student-loan-repayment-rate-completion-status

- https://www.americanprogress.org/issues/education-postsecondary/reports/2018/07/10/453199/getting-repayment-rates-right/

- https://robertkelchen.com/2017/09/28/examining-trends-in-student-loan-repayment-rates/

- https://www.chronicle.com/article/Student-Loan-Default-Rates-Are/228771

- "How Standard Repayment Works". American Student Assistance. Archived from the original on June 11, 2010. Retrieved June 8, 2010.

- "U.S. Department of Education Announces Final Regulations to Protect Students and Taxpayers from Predatory Institutions | U.S. Department of Education". U.S. Dept. of Education. October 28, 2016. Retrieved May 31, 2020.

- Kroll, Andy (July 25, 2018). "Betsy DeVos' New Proposal Aligns Her With For-Profit Colleges Over Debt-Saddled Students". Rolling Stone. Retrieved May 31, 2020.

- Friedman, Zack (May 29, 2020). "Trump Vetoes Student Loan Forgiveness Bill". Forbes. Retrieved May 31, 2020.

- "Income-Based Plan". Federal Student Aid, a department of the United States Department of Education. Retrieved September 9, 2012.

If your student loan debt is high but your income is modest, you may qualify for the Income-Based Repayment Plan (IBR). Most major types of federal student loans—except for PLUS loans for parents—are eligible for IBR.

- Andrew Martin (September 8, 2012). "Debt Collectors Cashing In on Student Loan Roundup". The New York Times. Retrieved September 9, 2012.

- "So You Want to Offer an Income-Share Agreement? Here's How 5 Colleges Are Doing It. - EdSurge News". EdSurge. February 15, 2019. Retrieved June 17, 2019.

- "Income Share Agreements - Division of Financial Aid - Purdue University". www.purdue.edu. Retrieved June 17, 2019.

- https://studentaid.ed.gov/sa/about/data-center/student/loan-forgiveness/borrower-defense-data

- "Students escape loan debt by living overseas - Oct. 24, 2008". money.cnn.com. Retrieved June 15, 2019.

- Cherastidtham, Ittima. "Collecting student loans from overseas debtors just a start". The Conversation. Retrieved June 16, 2019.

- "'I had to escape this debtors' prison': College grad flees U.S. to avoid student loan debt". The York Daily Record. Retrieved June 12, 2019.

- Nova, Annie (May 25, 2019). "These Americans fled the country to escape their giant student debt". CNBC. Retrieved June 12, 2019.

- Chu, Caroline (January 18, 2016). "Students Are Leaving The US to Avoid Student Loan Debt". College Candy. Retrieved June 12, 2019.

- "Can I avoid my student loan debt by moving to another country?". Policygenius Magazine. September 15, 2016. Retrieved June 12, 2019.

- "25 Rich Athletes Who Went Broke". Business Pundid. 2009.

- Feingold, Sarah (2006). "Radio documentary to focus on bankruptcy, Credit Abuse Resistance Education program". Daily Record.

- "BANKRUPT: Maxed Out In America (transcript)". American RadioWorks. 2011.

- "STATEMENT OF THE NATIONAL MULTI HOUSING COUNCIL/NATIONAL APARTMENT ASSOCIATION JOINT LEGISLATIVE PROGRAM, NATIONAL LEASED HOUSING ASSOCIATION, MANUFACTURED HOUSING INSTITUTE, AND THE INSTITUTE OF REAL ESTATE MANAGEMENT". THE COMMITTEE ON THE JUDICIARY U.S. HOUSE OF REPRESENTATIVES HEARING ON H.R. 975, THE BANKRUPTCY ABUSE PREVENTION AND CONSUMER PROTECTION ACT OF 2003. 2003. Archived from the original on September 28, 2011.

- "Student Loans & Bankruptcy". Student Loan Borrower Assistance. 2011.

- Larson, Aaron (December 16, 2017). "Student Loans in Bankruptcy". ExpertLaw.com. Retrieved March 21, 2018.

- "Student Loan Bankruptcy Options". Money-Zine.com. 2005–2011.

- "Filing an Adversary Proceeding (AP) Without an Attorney | Northern District of Florida". Flnb.uscourts.gov. Retrieved August 24, 2013.

- Ron Lieber (August 31, 2012). "Last Plea on School Loans: Proving a Hopeless Future". The New York Times. Retrieved September 1, 2012.

- Marie Brunner, Appellant, v. New York State Higher Education Services Corp., Appellee, 831 F.2d 395 (United States Court of Appeals, Second Circuit Argued Sept. 22, 1987. Decided Oct. 14, 1987) ("Whether not discharging Brunner's student loans would impose on her "undue hardship" under 11 U.S.C. § 523(a)(8)(B) requires a conclusion regarding the legal effect of the bankruptcy court's findings as to her circumstances.").

- Melear KB. (2011). The Devil's Undue: Student Loan Discharged in Bankruptcy. Published in West's Education Law Reporter.

- Pardo RI, Lacey MR. (2009). The Real Student-Loan Scandal: Undue Hardship Discharge Litigation. American Bankruptcy Law Journal. Preprint at SSRN.

- "Federal Perkins Loan Program, Federal Family Education Loan Program, and William D. Ford Federal Direct Loan Program (Docket ID: ED-2009-OPE-0004)". Regulations.gov. August 25, 2009.

- 77 FR 66088

- Campbell, Patrick; Frotman, Seth (February 7, 2018). "Help is here for people with severe disabilities struggling with student loans". CFPB. Consumer Financial Protection Bureau. Retrieved April 18, 2018.

- Sahadi, Jeanne (December 20, 2017). "Enjoy your tax cuts while they last". CNN Money. Retrieved April 18, 2018.

- Bennett, William J. "Our Greedy Colleges." Nytimes.com. The New York Times Company, February 18, 1987. Web. April 28, 2016.

- "Federal Reserve Bank of Kansas City, Student Loans: Overview and Issues, August 2012" (PDF). Retrieved February 15, 2014.

- Collinge, Alan. The student loan scam : the most oppressive debt in U.S. history, and how we can fight back. Boston, MA : Beacon Press, c2009. ISBN 978-0-8070-4229-8LCCN 2008-12230

- Kingkade, Tyler (January 24, 2013). "Fairness for Struggling Students Act Would Reform Private Student Loan Bankruptcy Rules". Huff Post College. Retrieved February 20, 2013.

- "S.114 - Fairness for Struggling Students Act of 2013". January 23, 2013. Retrieved March 2, 2015.

- Vedder, Richard; Denhart, Christopher; Hartge, Joseph (June 2014), Dollars, Cents, and Nonsense: The Harmful Effects of Federal Student Aid, Center for College Affordability and Productivity, archived from the original on July 10, 2014, retrieved November 23, 2014

- "Cuomo: School loan corruption widespread". U.S.A. Today. April 10, 2007. Retrieved April 8, 2008.

- Lederman, Doug (May 15, 2007). "The First Casualty". Inside Higher Education. Retrieved April 8, 2008.

- Field, Kelly (August 15, 2010). "Nelnet to Pay $55 Million to Resolve Whistle Blower Lawsuit". The Chronicle of Higher Education. Retrieved July 14, 2011.

- "P2P Lending & Education: CommonBond Launches With $3.5M, Joining SoFi In Quest To Solve The Student Debt Crisis". TechCrunch. December 1, 2012.

- "SoFi Tapping Alumni to Help With Student Loans". The New York Times. April 3, 2012.

- Lobosco, Katie. "8 million Americans could get a lower rate on their student loans", CNN Money, 15 November 2016. Retrieved on 10 March 2017.

- Kantrowitz, Mark. "Total College Debt Now Exceeds Total Credit Card Debt". fastweb. Retrieved August 1, 2014.

- "Student Loans Owned and Securitized, Outstanding." Research.stlouisfed.org. New York Federal Reserve, April 7, 2016. Web. April 19, 2016.

- Carolyn Thompson (March 27, 2014). $1 trillion student loan debt widens US wealth gap. Associated Press. Retrieved July 6, 2014.

- Denhart, Chris (August 7, 2013). "How The $1.2 Trillion College Debt Crisis Is Crippling Students, Parents And The Economy". Forbes.com. Retrieved March 21, 2018.

- Federal Reserve Bank of New York (February 2017). "Quarterly Report on Household Debt and Credit" (PDF). Retrieved March 23, 2017.

- Best, K., & Keppo, J. (2014). The credits that count: how credit growth and financial aid affect college tuition and fees. Education Economics, 22(6), 589–613. doi:10.1080/09645292.2012.687102

- https://www.brookings.edu/blog/up-front/2019/04/30/a-better-way-to-provide-relief-to-student-loan-borrowers/

- Peterous, Siona (December 21, 2018). "How Activists Are Moving the Dial on Student Loan Debt". inequality.org. Retrieved April 2, 2019.

- Nova, Annie (December 21, 2018). "For some, student loan debt is doubling, tripling, and even quadrupling". CNBC.

- Vasquez, Michael (March 9, 2019). "The Nightmarish End of the Dream Center's Higher-Ed Empire". The Chronicle of Higher Education. Retrieved April 2, 2019.

- https://hbswk.hbs.edu/item/forgiving-student-loan-debt-leads-to-better-jobs-stronger-consumers

- Gregorian, Dareh (March 30, 2019). "Growing student debt crisis: Candidates say cancel it, free college, refinance Share this — 2020 Election Growing student debt crisis: Candidates say cancel it, free college, refinance". NBC News. Retrieved April 2, 2019.

- Kreighbaum, Andrew. "Senator Pushes 'Debt-Free' as Solution for College Costs". Inside Higher Ed. Retrieved April 2, 2019.

- "S.672 - Debt-Free College Act of 2019". Congress.gov. Library of Congress. Retrieved April 2, 2019.

- Carlson, Tucker (March 19, 2019). "Tucker Carlson: Congress must address the student loan debt problem and stop colleges from scamming our kids Tucker Carlson". Fox News. Retrieved April 2, 2019.

- Morici, Peter (April 2, 2019). "Make Colleges Liable If Students Can't Get Jobs, Pay Debt Read Newsmax: A Market-Based Solution to Fixing College Admissions and Student Debt". NewsMax Finance. Retrieved April 2, 2019.

- Nilsen, Ella (March 28, 2019). "Trump's vision for higher education is limiting student loans and prioritizing for-profit colleges". Vox. Retrieved April 2, 2019.

- Kirk, Charlie (March 21, 2019). "Student loan debt: The government broke it, and must fix it". The Hill. Retrieved April 2, 2019.

- "Relief for Student Debtors". The New York Times. August 26, 2011.

- "Bernie Sanders unveils plan to cancel all $1.6 trillion of student loan debt". CNN. Retrieved June 24, 2019.

- "Trump Orders Student Loan Forgiveness for Disabled Veterans". The New York Times. Retrieved August 22, 2019.

Further reading

- Best, J. and Best, E. (2014) The Student Loan Mess: How Good Intentions Created a Trillion-Dollar Problem. Atkinson Family Foundation.

- Loonin, Deanne. Student loan law: Collections, intercepts, deferments, discharges, repayment plans, and trade school abuses. Boston: National Consumer Law Center, June 30, 2006. ISBN 978-1-60248-001-8

- Student loan program: A journey through the world of educational lending, collection, and litigation. Mechanicsburg, Pennsylvania Pennsylvania Bar Institute, c2003. vii, 300 p. : forms ; 28 cm. ASIN B000IB82QA

- Wear Simmons, Charlene. Student Loans for Higher Education. Sacramento, California: California Research Bureau, California State Library, 2008. 59 pages. ISBN 1-58703-233-3

External links

| Look up student loans in the united states in Wiktionary, the free dictionary. |

- "College, Inc.", PBS FRONTLINE documentary, May 4, 2010