Federal Reserve Bank of New York

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is located at 33 Liberty Street, New York, New York. It is responsible for the Second District of the Federal Reserve System, which encompasses New York State, the 12 northern counties of New Jersey, Fairfield County in Connecticut, Puerto Rico, and the U.S. Virgin Islands. Working within the Federal Reserve System, the Federal Reserve Bank of New York implements monetary policy, supervises and regulates financial institutions[1] and helps maintain the nation's payment systems.[2]

| |||

| Headquarters | Federal Reserve Bank of New York Building New York, New York, US | ||

|---|---|---|---|

| Coordinates | 40.708767°N 74.008756°W | ||

| Established | May 18, 1914 | ||

| President | John C. Williams | ||

| Central bank of | Second District

| ||

| Website | www | ||

| The Federal Reserve Bank of New York is one of twelve regional banks that make up the Federal Reserve System | |||

Among the other regional banks, the New York Fed and its president are considered first among equals.[3] Its current president is John C. Williams. It is by far the largest (by assets), most active (by volume) and most influential of the 12 regional Federal Reserve Banks.

History

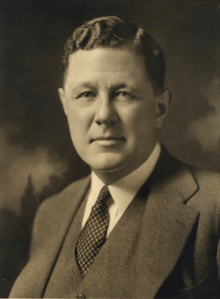

Establishment and early leadership under Benjamin Strong

The Federal Reserve Bank of New York opened for business on November 16, 1914, under the leadership of Benjamin Strong Jr., who had previously been president of the Bankers Trust Company. He led the Bank until his death in 1928. Strong became the executive officer (then called the "governor"—today, the term would be "president"). As the leader of the Federal Reserve's largest and most powerful district bank, Strong became a dominant force in U.S. monetary and banking affairs. One biographer has termed him the "de facto leader of the entire Federal Reserve System".[4] This was not only because of Strong's abilities, but also because the central board's powers were ambiguous and, for the most part, limited to supervisory and regulatory functions under the 1913 Federal Reserve Act because many Americans were antagonistic to centralized control.

When the United States entered World War I, Strong was a major force behind the campaigns to fund the war effort via bonds owned primarily by U.S. citizens. This enabled the United States to avoid many of the post-war financial problems of the European belligerents. Strong gradually recognized the importance of open market operation, or purchases and sales of government securities, as a means of managing the quantity of money in the U.S. economy and thus affecting interest rates. This was particularly important at the time because gold had flooded into the United States during and after World War I. Thus, its gold-backed currency was well-protected, but prices had been pushed up substantially by the currency expansion due to the gold standard-imposed expansion of currency. In 1922, Strong unofficially scrapped the gold standard and instead began aggressively pursuing open market operations as a means of stabilizing domestic prices and thus internal economic stability. Thus, he began the Federal Reserve's practice of buying and selling government securities as monetary policy. John Maynard Keynes, a prominent British economist who had previously not questioned the gold standard, used Strong's activities as an example of how a central bank could manage a nation's economy without the gold standard in his book "A Tract on Monetary Reform" (1923). To quote one authority:

It was Strong more than anyone else who invented the modern central banker. When we watch ... [central bankers of today] describe how they are seeking to strike the right balance between economic growth and price stability, it is the ghost of Benjamin Strong who hovers above him. It all sounds quite prosaically obvious now, but in 1922 it was a radical departure from more than two hundred years of central banking history.[5]

Strong's policy of maintaining price levels during the 1920s through open market operation and his willingness to maintain the liquidity of banks during panics have been praised by monetarists and harshly criticized by Austrian economists.[6]

With the European economic turmoil of the 1920s, Strong's influence became worldwide. He was a strong supporter of European efforts to return to the gold standard and economic stability. Strong's new monetary policies not only stabilized U.S. prices, they encouraged both U.S. and world trade by helping to stabilize European currencies and finances. However, with virtually no inflation, interest rates were low and the U.S. economy and corporate profits surged, fueling the stock market increases of the late 1920s. This worried him, but he also felt he had no choice because the low interest rates were helping Europeans (particularly Great Britain) in their effort to return to the gold standard.

Economic historian Charles P. Kindleberger states that Strong was one of the few U.S. policymakers interested in the troubled financial affairs of Europe in the 1920s, and that had he not died in 1928, just a year before the Great Depression, he might have been able to maintain stability in the international financial system.[7]

A public competition for the design of the building was held and the architectural firm of York and Sawyer submitted the winning design. The bank moved to the new Federal Reserve Bank of New York Building in 1924.[8] The Federal Reserve Bank of New York maintains a vault that lies 80 feet (24 m) below street level and 50 feet (15 m) below sea level,[9] resting on Manhattan bedrock. By 1927, the vault contained 10% of the world's official gold reserves.[8]

Terrorism attempt

On October 17, 2012, Quazi Mohammad Rezwanul Ahsan Nafis, 21, was arrested while attempting to detonate what he believed to be an 800-pound bomb. A joint FBI/NYPD operation flagged the suspect on the Internet and set up the sting with fake explosives. In 2013, Nafis pleaded guilty and was sentenced to 30 years in federal prison.[10]

Responsibilities

The Federal Reserve Bank of New York publishes a monthly recession probability prediction derived from the yield curve and based on the work by Arturo Estrella & Tobias Adrian.

Their models show that, when the difference between short-term interest rates (using three-month T-bills) and long-term interest rates (using ten-year Treasury bonds) at the end of a Federal Reserve tightening cycle is negative or less than 93 basis points positive, a rise in unemployment usually occurs.[11]

Largest regional Federal Reserve Bank

Since the founding of the Federal Reserve banking system, the Federal Reserve Bank of New York in Manhattan's Financial District has been the place where monetary policy in the United States is implemented, although policy is decided in Washington, D.C. by the Federal Reserve Board of Governors. The Federal Reserve Bank of New York is the largest in terms of assets of the twelve regional banks. Operating in the financial capital of the U.S., the Federal Reserve Bank of New York is responsible for conducting open market operations, the buying and selling of outstanding U.S. Treasury securities. The Trading Desk is the office at the Federal Reserve Bank of New York that manages the FOMC Directive to sell or buy bonds.[12] Note that the responsibility for issuing new U.S. Treasury securities lies with the Bureau of the Public Debt. In 2003, Fedwire, the Federal Reserve's system for transferring balances between it and other banks, transferred $1.8 trillion a day in funds, of which about $1.1 trillion originated in the Second District. It transferred an additional $1.3 trillion a day in securities, of which $1.2 trillion originated in the Second District. The Federal Reserve Bank of New York is also responsible for carrying out exchange rate policy by buying and selling dollars at the discretion of the United States Treasury Department. The Federal Reserve Bank of New York is the only regional bank with a permanent vote on the Federal Open Market Committee and its president is traditionally selected as the Committee's vice chairman.

Currently, it is reputedly the largest gold repository in the world (though this cannot be confirmed as Swiss banks do not report their gold stocks) and holds approximately 7,000 tonnes (7,700 short tons) of gold bullion ($415 billion as of October 2011), more than Fort Knox. Nearly 98% of the gold at the Federal Reserve Bank of New York is owned by the central banks of foreign nations.[13] The rest is owned by the United States and international organizations such as the IMF. The Federal Reserve Bank does not own the gold but serves as guardian of the precious metal, which it stores at no charge to the owners, but charging a $1.75 fee (in 2008) per bar to move the gold.[14]

Branch

The Federal Reserve Bank of New York Buffalo Branch was formerly the sole branch of the Federal Reserve Bank of New York. It was formally disbanded on October 31, 2008.

Criticisms

In 2009, the Federal Reserve Bank of New York commissioned a probe into its own practices. David Beim, finance professor at Columbia Business School submitted a report in 2009, released by the Financial Crisis Inquiry Commission in 2011, saying "that a number of people he interviewed at the reserve bank believe that supervisors paid excessive deference to banks and, as a result, they were less aggressive in finding issues or in following up on them in a forceful way".[15]

In 2012, Carmen Segarra, then Federal Reserve Bank of New York bank examiner, told her superiors that Goldman Sachs had no policy governing conflicts of interest. She was "fired in May 2012 after refusing to change her findings on the conflict-of-interest policy and sued the New York Fed October 2013".

In April 2014 the U.S. District court in Manhattan dismissed the case, "ruling that Segarra failed to make a legally sufficient claim under the whistle-blower protections of the Federal Deposit Insurance Act".[15]

In September 2014, Segarra's secretly recorded conversations were aired by This American Life and the Federal Reserve Bank of New York was accused of political corruption by being a "captured agency", i.e., subject to regulatory capture, of the banks which it supervises.[16][17]

Board of Directors

The following people serve on the board of directors as of April 2020.[18] Terms expire on December 31 of their final year on the board.[18]

| Name | Title | Term Expires |

|---|---|---|

| James P. Gorman | Chairman and Chief Executive Officer Morgan Stanley New York, New York |

2021 |

| Gerald Lipkin | President and Chief Executive Officer Peapack-Gladstone Bank Bedminster, New Jersey |

2022 |

| Paul P. Mello | President and Chief Executive Officer Solvay Bank Solvay, New York |

2020 |

| Name | Title | Term Expires |

|---|---|---|

| Adena T. Friedman | President and Chief Executive Officer Nasdaq New York, New York |

2022 |

| Glenn H. Hutchins | Co-Founder Silver Lake New York, New York |

2021 |

| Charles Phillips | Chairman Infor New York, New York |

2020 |

| Name | Title | Term Expires |

|---|---|---|

| Vincent Alvarez | President, New York City Central Labor Council AFL-CIO New York, New York |

2021 |

| Denise Scott

(Chair) |

Executive Vice President Local Initiatives Support Corporation New York, New York |

2022 |

| Rosa M. Gil

(Deputy Chair) |

Founder, President & Chief Executive Officer Comunilife, Inc. New York, New York |

2020 |

Presidents

- 3. Sproul (1941-1956)

- 4. Hayes (1956–1975)

- 6. Solomon (1980–1985)

- 8. McDonough (1993–2003)

In popular culture

In the first Godfather movie, the "meeting of the Dons" scene uses the Federal Reserve building exterior, even though the interior of another New York building (the Penn Central railway boardroom) was also used for filming.

In the 1974 film The Taking of Pelham One Two Three hijackers take over a subway train car and demand $1 million for release of the car and 19 passengers, and the city must deliver it to the train car within one hour or the hijackers will start executing passengers at the rate of one per minute until it's delivered. The money for the ransom, to be provided in bundles of used $50 and $100 bills, is frantically assembled by workers at the Federal Reserve Bank of New York while a police cruiser waits at the front entrance for it to be assembled for delivery.

The Federal Reserve Bank of New York plays a prominent role in the 1995 film Die Hard with a Vengeance, starring Bruce Willis and Jeremy Irons. The Federal Reserve Bank is the setting for a major heist of the gold by Jeremy Irons' character, Simon Gruber. The vault is penetrated under the pretense of construction work and the gold bullion transported via dump trucks to a location outside the city.

The New York Fed publishes a series of educational comic books about its activities. Included are such titles as Once upon a Dime, The Story of Money, Too Much, Too Little, A Penny Saved . . ., and The Story of Foreign Trade and Exchange.[19]

See also

- Economy of New York City

- Federal Reserve Act

- Federal Reserve System

- Federal Reserve Districts

- Federal Reserve Branches

- Federal Reserve Bank of New York Buffalo Branch

- Official gold reserves

- Structure of the Federal Reserve System

- East Rutherford Operations Center (regional office for cash handling and processing of the Federal Reserve Bank of New York)

References

Notes

- Matt Taibbi (July 13, 2009). "The Great American Bubble Machine". Rolling Stone. p. 6. Archived from the original on April 6, 2010. Retrieved September 9, 2012.

- "About the Fed." New York Federal Reserve Web page. Footnote upgraded/confirmed 2010-03-30.

- Spitzer, Eliot (May 6, 2009). "The New York Fed is the most powerful financial institution you've never heard of. Look who's running it". Slate Magazine.

- Lester Vernon Chandler, Benjamin Strong: Central Banker (1958)

- Liaquat Ahamed, Lords of Finance: The Bankers Who Broke the World (2009), p. 171

- Rothbard, Murray, America's Great Depression (2000), page xxxiii

- Kindleberger, Charles, The World in Depression, 1929–1939,(1986)

- "History". New York Federal Reserve Web page. Retrieved 2010-03-30.

- "The Key to the Gold Vault" (PDF). The Federal Reserve Bank of New York. Archived from the original (PDF) on August 21, 2010. Retrieved September 18, 2010.

- Secret, Mosi (August 9, 2013). "30-Year Prison Sentence in Plot to Bomb U.S. Bank". The New York Times.

- Arturo Estrella & Tobias Adrian, FRB of New York Staff Report No. 397, 2009

- "Open Market Operations - FEDERAL RESERVE BANK of NEW YORK". www.newyorkfed.org.

- Mightiest Bank. Aired on Monday, 14 November 2011, 7:00pm - 8:00pm EST on Planet Green. 51 minutes. (See also Inside the World’s Mightiest Bank: The Federal Reserve. Tug Yourgrau and Pip Gilmour. Princeton, NJ: Films for the Humanities & Sciences. 2000. Originally produced for the Discovery Channel by Powderhouse Productions. Retrieved 14 November 2011)

- "Welcome to the World's Largest Gold Vault". ABC News.

- Matthew Boesler and Kathleen Hunter (September 27, 2014). "Warren Calls for Hearings on New York Fed Allegations". Bloomberg News. Retrieved October 9, 2014.

- "The Secret Recordings of Carmen Segarra". This American Life. September 26, 2014.

- Bernstein, Jake (September 26, 2014). "Inside the New York Fed: Secret Recordings and a Culture Clash". ProPublica.org. ProPublica.

- "Federal Reserve Bank of New York - Directors". Federal Reserve. April 2020.

- "Internet Archive Search: creator%3A%22Federal Reserve Bank of New York%22". archive.org. Retrieved July 20, 2019.

Further reading

- Alessi, Lucia, et al. "Central bank macroeconomic forecasting during the global financial crisis: the European Central Bank and Federal Reserve Bank of New York experiences." Journal of Business & Economic Statistics (2014) 32#4 pp: 483-500.

- Chandler, Lester Vernon. Benjamin Strong: Central Banker (Brookings Institution, 1958)

- Clark, Lawrence Edmund. Central Banking Under the Federal Reserve System: With Special Consideration of the Federal Reserve Bank of New York (Macmillan, 1935)

- Greider, William. Secrets of the temple: How the Federal Reserve runs the country (Simon and Schuster, 1989)

- Meltzer, Allan H. A History of the Federal Reserve (2 vol, University of Chicago Press, 2010)

External links

- Official website

- "World's Greatest Treasure Cave" Popular Mechanics, January 1930, pp. 34–38

- "How Uncle Sam Guards His Millions", March 1931, Popular Mechanics article showing the upgrades for gold storage at the New York Federal Reserve Bank

- Historical resources by and about the Federal Reserve Bank of New York including annual reports back to 1915

.jpg)