BEL 20

The BEL 20 is the benchmark stock market index of Euronext Brussels. In general, the index consists of a minimum of 10 and a maximum of 20 companies traded at the Brussels Stock Exchange. Since 20 June 2011, the BEL20 has contained 20 listings, with the exception a one month period in May-June 2018 when Ablynx stock was removed following the takeover by Sanofi [2], only to be replaced mid June by arGEN-X.

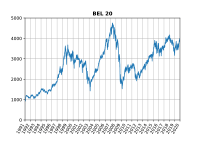

BEL 20 performance between 1991 and 2019 | |

| Foundation | 30 December 1990 |

|---|---|

| Operator | Euronext |

| Exchanges | Euronext Brussels |

| Constituents | 20 |

| Type | Large cap |

| Market cap | €287.5 billion (end 2018)[1] |

| Weighting method | Capitalization-weighted |

| Website | www.euronext.com |

Rules

The composition of the BEL 20 index is reviewed annually based on closing prices on the last Friday in February.[3] These changes are effective after the third Friday of March. In addition to meeting a set of criteria demanding a company be "representative of the Belgian equity market", at least 15% of its shares must be considered free float in order to qualify for the index.[3] In addition, a candidate for inclusion must possess a free float market capitalisation (in Euros) of at least 300000 times the price of the index on the last trading day of December.[3] The minimum requirement for an existing constituent to remain in the index is a market cap of 200000 times the index value.[3] At each annual review, the weights of companies in the index are capped at 15%,[3] but range freely with share price subsequently. The BEL20 is a capitalization-weighted index. Its record high is 4756,82 set on 23 May 2007.

Annual Returns

The following table shows the annual development of the BEL 20 Index, which was calculated back to 1990.[4]

| Year | Closing level | Change in Index in Points |

Change in Index in % |

|---|---|---|---|

| 1990 | 1,000.00 | ||

| 1991 | 1,029.72 | 29.72 | 2.97 |

| 1992 | 1,127.02 | 97.30 | 9.45 |

| 1993 | 1,473.10 | 346.08 | 30.71 |

| 1994 | 1,389.64 | −83.46 | −5.67 |

| 1995 | 1,559.63 | 169.99 | 12.23 |

| 1996 | 1,897.58 | 337.95 | 21.67 |

| 1997 | 2,419.34 | 521.76 | 27.50 |

| 1998 | 3,514.51 | 1,095.17 | 45.27 |

| 1999 | 3,340.43 | −174.08 | −4.95 |

| 2000 | 3,024.49 | −315.94 | −9.46 |

| 2001 | 2,782.01 | −242.48 | −8.02 |

| 2002 | 2,025.04 | −756.97 | −27.21 |

| 2003 | 2,244.18 | 219.14 | 10.82 |

| 2004 | 2,932.62 | 688.44 | 30.68 |

| 2005 | 3,549.25 | 616.63 | 21.03 |

| 2006 | 4,288.53 | 739.28 | 20.83 |

| 2007 | 4,127.47 | −161.06 | −3.76 |

| 2008 | 1,908.64 | −2,218.83 | −53.76 |

| 2009 | 2,511.62 | 602.98 | 31.59 |

| 2010 | 2,578.60 | 66.98 | 2.67 |

| 2011 | 2,083.42 | −495.18 | −19.20 |

| 2012 | 2,475.81 | 392.39 | 18.83 |

| 2013 | 2,923.82 | 448.01 | 18.10 |

| 2014 | 3,285.26 | 361.44 | 12.36 |

| 2015 | 3,700.30 | 415.04 | 12.63 |

| 2016 | 3,606.36 | −93.94 | −2.54 |

| 2017 | 3,977.88 | 371.52 | 10.30 |

| 2018 | 3,243.63 | −734.25 | −18.46 |

| 2019 | 3,955.83 | 712.20 | 21.96 |

Constituents

The following 20 stocks make up the BEL 20 as of 31 March 2020.

| Company | ICB Sector | Ticker symbol | Index weighting (%) | In index since |

|---|---|---|---|---|

| Ackermans & van Haaren | Financial Services | ACKB | 2.41 | March 2007 |

| Aedifica | Real Estate | AED | 2.16 | March 2020 |

| Ageas | Insurance | AGS | 6.30 | March 1991 |

| AB InBev | Food & Beverage | ABI | 13.67 | February 2002 |

| Aperam | Basic Resources | APAM | 0.90 | March 2017 |

| arGEN-X | Health Care | ARGX | 4.90 | June 2018 |

| Barco | Industrial Goods & Services | BAR | 1.37 | March 2019 |

| Cofinimmo | Real Estate | COFB | 2.72 | January 2003 |

| Colruyt | Retail | COLR | 2.54 | January 1993 |

| Galapagos | Health Care | GLPG | 7.08 | March 2016 |

| GBL | Financial Services | GBLB | 4.84 | March 1991 |

| ING Group | Banks | INGA | 11.63 | March 2016 |

| KBC | Banks | KBC | 9.77 | January 1993 |

| Proximus | Telecommunications | PROX | 2.95 | March 2004 |

| Sofina | Financial Services | SOF | 2.67 | March 2017 |

| Solvay | Chemicals | SOLB | 4.25 | March 1991 |

| Telenet Group | Media | TNET | 1.17 | March 2009 |

| UCB | Health Care | UCB | 9.30 | March 1991 |

| Umicore | Chemicals | UMI | 6.21 | March 1991 |

| WDP | Real Estate | WDP | 3.15 | March 2019 |

Former companies in the BEL20

| Company | ICB Sector | Ticker symbol | Period in BEL20 |

|---|---|---|---|

| Ablynx | pharmaceuticals | ABLX | March 2018 - June 2018 |

| Agfa-Gevaert | electronic equipment | AGFB | March 1991 - December 1994 June 1999 - March 2009[6] |

| Almanij | banks | No longer listed | March 1991 - March 2005[7] |

| BarcoNet | electronic equipment | November 2000 - November 2000 | |

| Befimmo-Sicafi | industrial and office REITs | BEFB | March 2009 - March 2016[8] |

| Bekaert | industrial goods and services | BEKB | January 1993 - June 1999 December 1999 - March 2018[9] |

| Bpost | Industrial Goods and Services | BPOST | March 2014 - March 2019 |

| CBR | Cement | No longer listed | March 1991 - December 1999 |

| CMB | Shipowners | No longer listed | January 1993 - January 1999 |

| CNP | Specialty finance | NAT | March 2006 - May 2011[10] |

| Cockerill-Sambre | Steel | No longer listed | December 1994 - December 1996 |

| Cobepa | Investment company | No longer listed | January 1999 - September 2000 |

| Cumerio | Copper | 2005 | |

| Delhaize Group | retail | AD | March 1991 - March 2017[11] |

| Delta Lloyd | Insurance | DL | March 2013 - March 2016[8] |

| Dexia | Banking | No longer listed | December 1997 - March 2012[12] |

| D'Ieteren | Consumer services | DIE | July 1998 - March 2006 March 2012 - March 2016[8] |

| Electrabel | Electricity | ELE | March 1991 - November 2005[13] |

| Elia | Utilities | ELI | March 2012 - March 2017[11] |

| Engie | Utilities | ENGI | November 2005 - March 2019 |

| Generale Bank | Banking | No longer listed | March 1991 - July 1998 |

| GIB Group | Supermarkets | No longer listed | March 1991 - November 2002 |

| IBA | Medical technology | No longer listed | November 1999 - March 2003 |

| Mobistar | Telecom | OBEL | November 2002 - March 2013 |

| Nyrstar | Metallurgy | NYR | March 2008 - March 2009 June 2011 - March 2013 |

| Omega Pharma | Pharmaceuticals | OME | March 2002 - December 2011[14] |

| Ontex Group | Personal and Household Goods | ONTEX | March 2016 - March 2020 |

| Petrofina | Oil | No longer listed | March 1991 - June 1999 |

| Real Software | Technology | No longer listed | June 1999 - February 2002 |

| Recticel | Polyurethane based products | REC | March 1991 - January 1993 |

| Royale Belge | Insurance | No longer listed | March 1991 - June 1998 |

| Société Générale de Belgique | Investment & Banking | No longer listed | March 1991 - July 1998 |

| Suez Environnement | Utility company | 2008 | |

| Telindus | ICT | No longer listed | September 2000 - March 2002 |

| Tessenderlo | Chemistry | TESB | March 1991 - January 1993 July 1998 - March 2004 |

| ThromboGenics | Biopharmaceuticals | THR | March 2013 - March 2014 |

| Tractebel | Energy | No longer listed | March 1991 - November 1999 |

References

- "BEL-20 Executive Factsheet 2018" (PDF). Euronext. Archived from the original on 9 November 2011. Retrieved 2018-11-15.

- "Frans bedrijf Sanofi neemt Ablynx over voor 3,9 miljard euro: "Voorzichtig tevreden, al blijven er heel wat vragen"" [French company Sanofi takes over Ablynx for 3,9 billion euro: "Cautiously happy, although many questions remain"]. demorgen.be. 29 January 2018. Retrieved 15 June 2018.

- "Rules for the BEL 20-Index" (PDF). Euronext. 1 October 2015. Retrieved 1 October 2015.

- "BEL 20 (^BFX) Historical Data - Yahoo Finance". finance.yahoo.com. Retrieved 21 January 2020.

- "BEL 20 Factsheet" (PDF). Euronext. Retrieved 15 April 2020.

- "Annual review of BEL20 index" (PDF). Euronext. 31 May 2011. Archived from the original (PDF) on 9 November 2011. Retrieved 22 June 2011.

- "BEL20: KBC-Almanij Merger" (PDF). Euronext. Archived from the original (PDF) on 20 March 2009. Retrieved 30 November 2007.

- "Galapagos, ING en Ontex komen in de Bel-20-index" [Galapagos, ING and Ontex enter the Bel-20-index]. de tijd (in Dutch). 4 March 2016. Retrieved 4 March 2016.

- "Bekaert verdwijnt uit Bel20" [Bekaert disappears from Bel20]. standaard.be (in Dutch). 7 March 2018. Retrieved 15 June 2018.

- "Index Announcement" (PDF). NYSE Euronext. 29 April 2011. Retrieved 8 May 2011.

- "Nieuwkomer Aperam samen met Sofina naar Bel20". beursduivel.be (in Dutch). 7 March 2017. Retrieved 7 March 2017.

- "Dexia valt uit Bel20". De Standaard (in Dutch). 2 January 2012. Retrieved 12 January 2013.

- "Suez replaces Electrabel in the BEL20 Index" (PDF). Euronext. Archived from the original (PDF) on 20 March 2009. Retrieved 4 December 2007.

- "Omega Pharma verdwijnt uit Bel20 na geslaagd bod Marc Coucke". Trends (in Dutch). 27 December 2011. Retrieved 12 January 2013.