Taylor rule

The Taylor rule is one kind of targeting monetary policy used by central banks. The Taylor rule was proposed by the American economist John B. Taylor, economic adviser in the presidential administrations of Gerald Ford and George H. W. Bush[1], in 1992 as a central bank technique to stabilize economic activity by setting an interest rate.[2]

The rule is based on three main indicators: the federal funds rate, the price level and the changes in real income.[3] The Taylor rule prescribes economic activity regulation by choosing the federal funds rate based on the inflation gap between desired (targeted) inflation rate and actual inflation rate; and the output gap between the actual and natural level.

According to Taylor, a central bank implements a stabilizing monetary policy when it raises the nominal interest rate by more than an increase in inflation.[4] In other words, the Taylor rule prescribes a relatively high-interest rate in the situation when actual inflation is higher than targeted. The main advantage of a general targeting rule is that a central bank gains the discretion to apply all means to achieve the set target. The economic model based on backwards- and forward-looking assumptions is justified.[5]

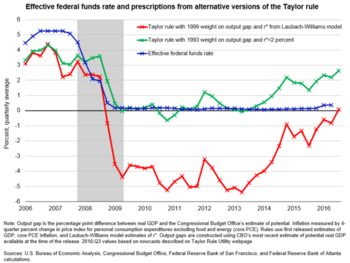

The monetary policy of the Federal Reserve has been changing throughout the 20th century. The period between 1960s - 1970s is defined by Taylor as a period of a poor monetary policy. The inflation rate was growing in the US while the interest rate was sat at the low level not allowing to restrain the rise of prices.[6] Since the mid-1970s monetary targets have been used in many countries to state targets for inflation.[7] However, since the 2000s the actual interest rate in advanced economies, especially in the US, was below the suggested by the Taylor rule.[8]

The Taylor rule is usually opposed to discretion policy. Due to the high technicality of the rule, the inaccuracy of predictable variable and limited number of factors incorporated into the model, the Taylor rule often faces criticism.

As an equation

According to Taylor's original version of the rule, the nominal interest rate should respond to divergences of actual inflation rates from target inflation rates and of actual Gross Domestic Product (GDP) from potential GDP:

In this equation, is the target short-term nominal interest rate (e.g. the federal funds rate in the US, the Bank of England base rate in the UK), is the rate of inflation as measured by the GDP deflator, is the desired rate of inflation, is the assumed equilibrium real interest rate, is the logarithm of real GDP, and is the logarithm of potential output, as determined by a linear trend.

In this equation, both and should be positive (as a rough rule of thumb, Taylor's 1993 paper proposed setting ).[9] That is, the rule "recommends" a relatively high interest rate (a "tight" monetary policy) when inflation is above its target or when output is above its full-employment level, in order to reduce inflationary pressure. It recommends a relatively low interest rate ("easy" monetary policy) in the opposite situation, to stimulate output. Sometimes monetary policy goals may conflict, as in the case of stagflation, when inflation is above its target while output is below full employment. In such a situation, a Taylor rule specifies the relative weights given to reducing inflation versus increasing output.

The Taylor principle

By specifying , the Taylor rule says that an increase in inflation by one percentage point should prompt the central bank to raise the nominal interest rate by more than one percentage point (specifically, by , the sum of the two coefficients on in the equation above). Since the real interest rate is (approximately) the nominal interest rate minus inflation, stipulating implies that when inflation rises, the real interest rate should be increased. The idea that the nominal interest rate should be raised "more than one-for-one" to cool the economy when inflation increases (that is increasing the real interest rate) has sometimes been called the Taylor principle.[10]

The historical perspective

The policy rule emerged in the era of the broad debate on the policy rules versus discretion. The discourse among economists and policymakers started at the beginning of the 19th century. The first forum for debate was launched in the 1920s by the House Committee on Banking and Currency. In the hearing on the Strong bill in 1923, the conflict in the views on the monetary policy clearly appeared. Congressman Governor Strong, supported by John R. Commons and Irving Fisher, was highly concerned about the practices uses by the Fed to control the price stability. In his opinion, Federal Reserve policy regarding the price level was unstable and could not guarantee long-term stability. After the death of the congressman, a political debate on changing the Fed’s policy was suspended. The Fed was highly influenced by the New York Bank.

Only after the Great Depression hit the country, the Fed policies started to be debated again. Irving Fisher compressed that “this depression was almost wholly preventable and that it would have been prevented if Governor Strong had lived, who was conducting open-market operations with a view of bringing about stability”.[11] Later on, such monetarists as Friedman and Schwartz, confirmed that the economic dichotomy and the high inflation could be bypassed if the Fed followed more precise the constant-money-rule.[12]

The recession in the US in the 1960s was accompanied by relatively high-interest rate. After Bretton Woods collapse the policy-makers were focused on keeping a low-interest rate, which had a negative impact on inventory process and resulted in the Great Inflation of 1970.

Since the mid-1970s monetary targets have been used in many countries to state targets for inflation. Many advanced economies, such as the US and the UK, their policy rates were broadly consistent with the Taylor rule in the period of the “Great Moderation” between the mid-1980s and early 2000s. The Great moderation period was characterized by the limited inflation and stability of prices. Thus, many central banks started to adjust their policies. The first mover was New Zealand, where the inflation target was introduced in 1984. The Reserve Bank of New Zealand was reformed to prioritize the price stability, besides, it gained more independence. After that, the Bank of Canada in 1991 and by 1994 the banks of Sweden, Finland, Australia, Spain, Israel and Chile were given the mandate to target inflation.[13]

However, since the 2000s the actual interest rate in advanced economies, especially in the US, was below the suggested by the Taylor rule. The deviation can be explained by the fact that the central banks were supposed to mitigate the outcomes of financial busts but should intervene only when there are inflation expectations. The economics shocks were accompanied by the fall of the interest rate.[14]

Alternative versions of the rule

While the Taylor principle has proved very influential, there is more debate about the other terms that should enter into the rule. According to some simple New Keynesian macroeconomic models, insofar as the central bank keeps inflation stable, the degree of fluctuation in output will be optimized (Blanchard and Gali call this property the 'divine coincidence'). In this case, the central bank does not need to take fluctuations in the output gap into account when setting interest rates (that is, it may optimally set .) On the other hand, other economists have proposed including additional terms in the Taylor rule to take into account financial conditions: for example, the interest rate might be raised when stock prices, housing prices, or interest rate spreads increase.

- Taylor Rule 1993 - the original definition by John Taylor with

- Taylor Rule 1999 - adapted and updated by John Taylor in a new research paper:

Alternative theories

Solvency rule: the alternative theory to the Taylor equation. The new perspective on the rule was presented by Emiliano Brancaccio after the financial crises of 2008. The central banker follows a 'rule' aimed to control the solvency conditions in the economic system.[15] The inflation target and output gap are neglected, while the interest rate is put under the conditionality to the solvency of workers and firms that represent financial stability. Opposite to stricter Taylor rule the solvency rule represents more a benchmark than a mechanistic formula.[16]

McCallum rule: The rule created by economist Bennett T. McCallum at the end of the 20th-century targets the nominal gross domestic products. In the idea of McCallum the Fed should stabilize the nominal GDP to achieve economic stability. Although the same monetary policy objectives can be reached by McCallum rule as by Taylor rule, the McCallum rule uses the precise financial data.[17] Thus, the McCallum rule can overcome the problem of the unobservable variables.

Empirical relevance

Although the Federal Reserve does not explicitly follow the Taylor rule, many analysts have argued that the rule provides a fairly accurate summary of US monetary policy under Paul Volcker and Alan Greenspan.[18][19]Similar observations have been made about central banks in other developed economies, both in countries like Canada and New Zealand that have officially adopted inflation targeting rules, and in others like Germany where the Bundesbank's policy did not officially target the inflation rate.[20][21] This observation has been cited by Clarida, Galí, and Gertler as a reason why inflation had remained under control and the economy had been relatively stable (the so-called 'Great Moderation') in most developed countries from the 1980s through the 2000s.[18] However, according to Taylor, the rule was not followed in part of the 2000s, possibly leading to the housing bubble.[22][23] Certain research has determined that some households form their expectations about the future path of interest rates, inflation, and unemployment in a way that is consistent with Taylor-type rules.[24]

Limitation of the Taylor rule

The Taylor rule is highly debated in the discourse of the rules vs. discretion. There are a few main limitations of the Taylor rule.

1) Technical reasons. For the economic models, the period of 4 months was widely used, however, the period is not accurate to track the real changes in price, and this period is too long for setting the fixed interest rate.[25] Besides, the formulate incorporates the unobservable parameters can be easily misevaluated.[26] For example, the output-gap could not be precisely estimated by any bank.

2) The inaccuracy of predictable variables, such as the inflation and output gap that depend on the different scenarios of economic development.

3) Difficulty to assess the state of the economy in real-time 4) The discretionary optimization that leads to stabilization bias and a lack of history dependence.[27]

5) The limited number of factors in the model. The model does not outlook the financial parameters. Thus, in the period of the financial boost the Taylor rule might tend to underestimate the interest rate, and opposite, during the financial busts overestimate.

6) Does not reflect the usability of other monetary policy instruments such as reserve funds adjustment, balance sheet policies.[28]

7) The relationship between the interest rate and aggregate demand is questioning by Kriesler and Lanoie, 2007.[29]

However, Taylor in his economic work highlighted that the rule should not be implicated mechanically: “…There will be episodes where monetary policy will need to be adjusted to deal with special factors.” On another hand, the Taylor rule is opposed to the discretion approach since it aimed to overcome the limitation of the purely discretionary approach.[30] Hence, although the Taylor rule gives the room for manoeuvre, it is encouraged to treat the Taylor rule as a policy rule that required the strict implementation of the policy based on the incoming economic parameters.

Criticisms

Athanasios Orphanides (2003) claims that the Taylor rule can misguide policy makers since they face real-time data. He shows that the Taylor rule matches the US funds rate less perfectly when accounting for these informational limitations and that an activist policy following the Taylor rule would have resulted in an inferior macroeconomic performance during the Great Inflation of the seventies.[31]

In 2015, financial manager Bill Gross said the Taylor rule "must now be discarded into the trash bin of history", in light of tepid GDP growth in the years after 2009.[32] Gross believed low interest rates were not the cure for decreased growth, but the source of the problem.

References

- Clement, Douglas, ed. (March 8, 2006). "Interview with John B. Taylor | Federal Reserve Bank of Minneapolis". www.minneapolisfed.org. Retrieved 2020-05-22.

- Judd, John P. and Bharat Trehan, Has the Fed Gotten Tougher on Inflation? (1995) FRBSF Weekly Letter, Number 95-13, March 31

- John B. Taylor, Discretion versus policy rules in practice (1993), Stanford University, y, Stanford, CA 94905

- Frederic S. Mishkin, Monetary Policy Strategy Lessons from the Crisis National Bureau of Economic Research Cambridge MA 02138 February 2011

- Lars E. O. Svensson, What Is Wrong with Taylor Rules? Using Judgment in Monetary Policy through Targeting Rules (June 2003), Journal of Economic Literature

- B. Taylor, John (January 2014). "Causes of the Financial Crisis and the Slow Recovery: A Ten-Year Perspective", Hoover Institution Economics Working Paper.

- Pier Francesco Asso, George A. Kahn, and Robert Leeson, The Taylor Rule and the Practice of Central Banking (February 2010), The Federal Reserve Bank of Kansas City

- Boris Hofmann, Taylor rules and monetary policy: a global “Great Deviation”? (September 2012)

- Athanasios Orphanides (2008). "Taylor rules," The New Palgrave Dictionary of Economics, 2nd Edition. v. 8, pp. 2000-2004, equation (7).Abstract.

- Davig, Troy; Leeper, Eric M. (2007). "Generalizing the Taylor Principle" (PDF). American Economic Review. 97 (3): 607–635. doi:10.1257/aer.97.3.607. JSTOR 30035014.

- Robert L. Hetzel, The Rules versus discretion debate over monetary policy in the 1920

- Frederic S. Mishkin, Monetary Policy Strategy Lessons from the Crisis National Bureau of Economic Research Cambridge MA 02138 February 2011

- Pier Francesco Asso, George A. Kahn, and Robert Leeson, The Taylor Rule and the Practice of Central Banking (February 2010), The Federal Reserve Bank of Kansas City

- Boris Hofmann, Taylor rules and monetary policy: a global “Great Deviation”? (September 2012)

- Emiliano Brancaccio, Giuseppe Fontana, The Global Economic Crisis. (2011), Routledge, Oxon OX14 4RN

- E. Brancaccio and G. Fontana, (2013). ‘Solvency rule’ versus ‘Taylor rule’: an alternative interpretation of the relation between monetary policy and the economic crisis, Cambridge Journal of Economics, 37, 1. See also Brancaccio, E., Moneta, A., Lopreite, M., Califano, A. (2020). Nonperforming Loans and Competing Rules of Monetary Policy: a Statistical Identification Approach. Structural Change and Economic Dynamics. Volume 53, pages 127-136

- Michael F. Gallmeyer Burton Hollifield Stanley E. Zin, Taylor Rules, McCallum Rules and the term structure of interest rates (April 2005), National Bureau Of Economic Research 1050 Massachusetts Avenue Cambridge, MA 02138

- Clarida, Richard; Galí, Jordi; Gertler, Mark (2000). "Monetary Policy Rules and Macroeconomic Stability: Theory and Some Evidence". Quarterly Journal of Economics. 115 (1): 147–180. CiteSeerX 10.1.1.111.7984. doi:10.1162/003355300554692. JSTOR 2586937.

- Lowenstein, Roger (2008-01-20). "The Education of Ben Bernanke". The New York Times.

- Bernanke, Ben; Mihov, Ilian (1997). "What Does the Bundesbank Target?" (PDF). European Economic Review. 41 (6): 1025–1053. doi:10.1016/S0014-2921(96)00056-6.

- Clarida, Richard; Gertler, Mark; Galí, Jordi (1998). "Monetary Policy Rules in Practice: Some International Evidence" (PDF). European Economic Review. 42 (6): 1033–1067. doi:10.1016/S0014-2921(98)00016-6.

- Taylor, John B. (2008). "The Financial Crisis and the Policy Responses: An Empirical Analysis of What Went Wrong" (PDF). Cite journal requires

|journal=(help) - Taylor, John B. (2009). Getting Off Track: How Government Actions and Interventions Caused, Prolonged, and Worsened the Financial Crisis. Hoover Institution Press. ISBN 978-0-8179-4971-6.

- Carvalho, Carlos; Nechio, Fernanda (2013). "Do People Understand Monetary Policy?". Federal Reserve Bank of San Francisco Working Paper 2012-01. SSRN 1984321.

- John B. Taylor, Discretion versus policy rules in practice (1993), Stanford University, y, Stanford, CA 94905)

- Boris Hofmann, Taylor rules and monetary policy: a global “Great Deviation”? (September 2012)

- Lars E. O. Svensson, What Is Wrong with Taylor Rules? Using Judgment in Monetary Policy through Targeting Rules (June 2003), Journal of Economic Literature

- Boris Hofmann, Taylor rules and monetary policy: a global “Great Deviation”? (September 2012)

- Emiliano Brancaccio and Giuseppe Fontana, ‘Solvency rule’ versus ‘Taylor rule’: an alternative interpretation of the relation between monetary policy and the economic crisis (August 2012 ), Cambridge Journal of Economics

- John B. Taylor, Discretion versus policy rules in practice (1993), Stanford University, y, Stanford, CA 94905

- Orphanides, A. (2003). "The Quest for Prosperity without Inflation". Journal of Monetary Economics. 50 (3): 633–663. CiteSeerX 10.1.1.196.7048. doi:10.1016/S0304-3932(03)00028-X.

- Bill Gross (July 30, 2015). "Gross: Low rates are the problem, not the solution". CNBC. Retrieved July 30, 2015.