Federal Reserve Bank of Chicago

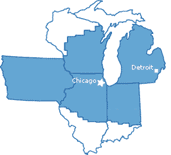

The Federal Reserve Bank of Chicago (informally the Chicago Fed) is one of twelve regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the nation's central bank. The Chicago Reserve Bank serves the Seventh Federal Reserve District, which encompasses the northern portions of Illinois and Indiana, southern Wisconsin, the Lower Peninsula of Michigan, and the state of Iowa. In addition to participation in the formulation of monetary policy, each Reserve Bank supervises member banks and bank holding companies, provides financial services to depository institutions and the U.S. government, and monitors economic conditions in its District.

| |||

| Headquarters | 230 S LaSalle Street Chicago, IL, USA | ||

|---|---|---|---|

| Established | May 18, 1914 | ||

| President | Charles L. Evans | ||

| Central bank of | |||

| Website | www.ChicagoFed.org | ||

| The Federal Reserve Bank of Chicago is one of 12 regional banks that make up the Federal Reserve System | |||

Responsibilities

As one of the Reserve Banks that make up the Federal Reserve System, the Chicago Fed is responsible for:

- Helping to formulate national monetary policy. The Chicago Fed's CEO, Charles L. Evans, helps formulate monetary policy by taking part and voting in meetings of the Federal Open Market Committee (FOMC).

- Providing financial services such as cash, check clearing and electronic payment processing. Each day the Federal Reserve System processes millions of payments in the form of both paper checks and electronic transfers. These payments services are offered to institutions in the Seventh District on a fee basis. Because of a nationwide reduction in the use of checking instruments, the Chicago Fed and most other Reserve Banks ceased processing paper checks on November 17, 2009 and electronic checks in 2010.[1] Items previously routed to this facility are now routed to the Federal Reserve Bank of Cleveland or to the Federal Reserve Bank of Atlanta.

- Supervising and regulating state-chartered banks that are members of the Federal Reserve System, bank holding companies, and financial holding companies. These organizations are located within the Seventh Federal Reserve District.

Leadership

Charles L. Evans is the president of the Chicago Fed. He took office on September 1, 2007 as the ninth president and chief executive officer of the Federal Reserve Bank of Chicago.[2]

Ellen Bromagen is first vice president and chief operating officer of the Chicago Fed.[3]

The Chicago Fed annually co-hosts in Chicago an international banking conference to examine cross-national banking and finance issues.[4]

Money Museum

The bank's Money Museum[5] is free and open to the public year-round from 8:30am to 5pm, Monday through Friday, except on Bank holidays.[6] All visitors must show a photo identification, walk through a metal detector and have their bags x-rayed before entering the Money Museum. No food or drink are allowed in the museum. A presentation lasting roughly 45 minutes is available at 1pm on Monday through Friday, or by appointment. The rest of the Money Museum is accessible at any time during open hours. The museum includes a free kiosk, which takes a guest's picture in front of a million dollars in $100 bills. A million dollars in $1 bills and a million dollars in $20 bills are on display. The museum has been known for giving out bags of shredded money as souvenirs.[7]

Branches

The Federal Reserve Bank of Chicago Detroit Branch is the only branch of the Federal Reserve Bank of Chicago.

Board of directors

The following people are on the board of directors as of 2016.[8] Class A directors are elected by member banks to represent member banks. Class B directors are elected by member banks to represent the public. Class C directors are appointed by the board of governors to represent the public.

| Director | Title | Director Class |

Term Expires |

|---|---|---|---|

| David W. Nelms | Chairman and CEO, Discover Financial Services, Chicago, Illinois | A | 2017 |

| Abram Tubbs | Chairman and chief executive officer, Ohnward Bank and Trust, Cascade, Iowa | A | 2017 |

| William M. Farrow III | President and CEO, Urban Partnership Bank, Chicago, Illinois | A | 2018 |

| Jorge Ramirez | President, Chicago Federation of Labor, Chicago, Illinois | B | 2016 |

| Nelda J. Connors | Chairwoman and CEO, Pine Grove Holdings, LLC, Chicago, Illinois | B | 2017 |

| Susan Collins | Weill Dean of Public Policy, Gerald R. Ford School of Public Policy, Univ. of Michigan, Ann Arbor, Michigan | B | 2018 |

| Greg Brown | Chairman and CEO, Motorola Solutions, Schaumburg, Illinois | C | 2018 |

| Anne Pramaggiore, chair | Chairman and CEO, Commonwealth Edison, Chicago, Illinois | C | 2019 |

| E. Scott Santi, Deputy Chair | Chairman and CEO, Illinois Tool Works Inc., Glenview, Illinois | C | 2018 |

| Director | Title | Term Expires |

|---|---|---|

| Joseph B. Anderson, Jr. | Majority Owner, chairman and chief executive officer, TAG Holdings LLC, Wixom, Michigan | 2019 |

| Sandy K. Baruah | President and chief executive officer, Detroit Regional Chamber, Detroit, MI | 2020 |

| Linda Hubbard | President and chief operating officer, Carhartt, Inc., Dearborn, Michigan | 2019 |

| Wright L. Lassiter III | President and chief executive officer, Henry Ford Health System, Detroit, Michigan | 2018 |

| Sandra E. Pierce | Senior Executive Vice President, Private Client Group and Regional Banking Director, Southfield, MI | 2017 |

| Rip Rapson | President and chief executive officer, The Kresge Foundation, Troy, Michigan | 2018 |

| Michael L. Seneski | Director of Mobility, Ford Motor Company, Dearborn, Michigan | 2017 |

See also

- Federal Reserve Act

- Federal Reserve System

- Federal Reserve Districts

- Federal Reserve Branches

- Federal Reserve Bank of Chicago Detroit Branch

- Structure of the Federal Reserve System

References

- "Check restructuring". The Federal Reserve. December 29, 2012. Archived from the original on July 13, 2010. Retrieved July 6, 2010.

- "Charles Evans". The Federal Reserve. July 27, 2016.

- "Ellen Bromagen". The Federal Reserve. July 27, 2016.

- "International Series". The Federal Reserve. July 27, 2016.

- "Money Museum". The Federal Reserve. December 29, 2012.

- "Bank Holidays". The Federal Reserve. December 29, 2012.

- "Bags of shredded money given as souvenirs to students". The Federal Reserve. July 27, 2016.

- "Directors of Federal Reserve Banks and Branches". The Federal Reserve. July 27, 2016.