Payroll

A company's payroll is the list of employees of that company that are entitled to receive pay and the amounts that each should receive.[1] Along with the amounts that each employee should receive for time worked or tasks performed, payroll can also refer to a company's records of payments that were previously made to employees, including salaries and wages, bonuses, and withheld taxes,[2] or the company's department that calculates and pays out these amounts. One way that payroll can be handled is in-house. This means that a company handles all aspects of the payroll process on its own, including timesheets, calculating wages, producing pay checks, sending the ACH, or Automated Clearing House, for any direct deposits, and remitting any tax payments necessary. Payroll can also be outsourced to a full-service payroll processing company. When a company chooses to outsource their payroll, timesheets, wage calculations, creating pay checks, direct deposits, and tax payments can be handled all, or in part, by the payroll company.

Payroll plays a major role in the internal operations of a business for several reasons. From the perspective of accounting, payroll and payroll taxes are subject to laws and regulations. Payroll in the U.S. is subject to federal, state, and local regulations including employee exemptions, record keeping, and tax requirements.[3] Payroll also plays a large role from the human resources point of view. Payroll errors, such as late or incorrect paychecks, are a sensitive topic that can cause tension between employees and their employer. One requirement to maintaining high employee morale is that payroll must be paid accurately and in a timely manner because employees are very sensitive to any payroll errors.[4]

Frequency

Companies typically process payroll at regular intervals. This interval varies from company to company and will often differ within the company for different employees for larger companies. The four most common pay frequencies according to research conducted in February 2019 by the U.S. Department of Labor and the Bureau of Labor Statistics are weekly at 33.8%, biweekly at 42.2%, semimonthly at 18.6%, and monthly at 5.4%.[5] The other, much less common payroll frequencies, include daily, four-weekly, bimonthly, quarterly, semiannually, and annually.

Weekly payrolls have 52 40-hour pay periods per year and includes one 40 hour work week for overtime calculations. Biweekly payrolls consist of 26 80-hour pay periods per year and consist of two 40 hour work weeks for overtime calculations. Weekly and biweekly payrolls are the most common for nonexempt employees because they are the two that allow for the easiest and most transparent overtime calculations.[6]

Semimonthly payrolls have 24 pay periods per year with two pay dates per month. These pay dates are commonly paid on either the 1st and the 15th day of the month or the 15th and the last day of the month and consist of 86.67 hours per pay period. Monthly payrolls have 12 pay periods per year with a monthly pay date. Each monthly payroll consists of 173.33 hours. Both semimonthly and monthly payrolls are more common for exempt employees that are earning a set salary each payroll. This is because overtime can be confusing and difficult to follow as it may be earned in one week but then falls under a different pay period.[6]

Daily payroll is paid to the employee on a day-to-day basis. Four-weekly payrolls are paid once every four weeks, or 13 times per year. Bimonthly payrolls are paid once every two months, or six times per year. These three payroll options are very rarely used, but are used for regular payroll when used. Quarterly payrolls are paid once at the end of each quarter, or four times per year. Semiannually payrolls are paid twice per year and annual payrolls are paid once per year. These three payroll options are mostly used for pay such as bonuses or owner profit sharing or capital gain payrolls.

Components

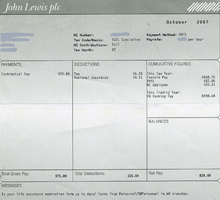

Each employee views their individual payroll on either a physical check stub or via an online portal. When viewing this stub, there are different components that are separate from one another yet all tie together to complete the transaction.

The first component is gross pay, or gross income. Gross pay is simply the total amount of compensation that an employee will receive before any deductions or reimbursements are made, including, but not limited to, regular wages, overtime pay, commissions, and bonuses.[7] The next part of a paycheck is any pretax deductions that may be applicable. These could include insurances, such has health, dental, or life insurance, deductions for certain retirement accounts, or deductions for FSA or HSA accounts. A paycheck also includes taxes. Taxes taken out of the paycheck are collected by the employer and then paid to either the federal, state, or local governments. After the taxes are taken out of payroll, additional adjustments are made in the form of deductions, reimbursements, and garnishments. After the payroll is adjusted for the different components, the final total that the employee takes home is known as the net pay, or net amount, of the check. Net pay is the amount that the employee gets to keep for themselves and spend however they see fit.

Gross pay

In payroll, the gross pay is "The big number" on an employee's paycheck. Gross pay, also known as gross income, is the total payment that an employee earns before any deductions or taxes are taken out.[7] For employees that are hourly, gross pay is calculated when the rate of hourly pay is multiplied by the total number of regular hours worked. If the employee has overtime hours, these are multiplied by the overtime rate of pay and the two amounts are added together.[8] Also included in gross pay is any other type of earnings that an employee may have. These may include holiday pay, vacation or sick pay, bonuses, and any miscellaneous pay that the employee may receive.

Gross pay for salaried employees is an amount that is set every payroll, unless there are bonuses or other pay involved. If a salaried employee has a salary of $40,000 per year, then their base gross pay will be $40,000 per year, plus any bonuses. For hourly employees, their gross pay can vary from one check to the next. An hourly employee's gross pay amount is their hourly rate times the number of hours they worked, plus any bonuses or miscellaneous pay they may receive.

Deductions and reimbursements

There are two types of payroll deductions that are taken out of gross pay. The first type are mandatory deductions. These deductions are simply the taxes taken out. The other type of deductions are then considered to be voluntary deductions.[9] There are a wide array of voluntary deductions that can be taken out of an employee's gross pay, some of which are taken out before taxes and some being taken out after taxes. Pre tax deductions are deductions that are taken out of an employee's gross pay amount before it is subject to tax. Since pre tax deductions are taken from an employee's gross pay before taxes are applied, it also reduces the amount of taxable income for that employee.

After tax deductions are just as they seem. They are deductions that are taken out after taxes have been taken out of an employee's payroll.[10] Unlike pre-taxed deductions, after tax deductions do not reduce the amount of taxable income for an employee. Like pretax deductions, there are numerous forms of after tax deductions that can be taken out of an employee's check each payroll.

Payroll taxes

Taxes are one of the most complicated and sensitive aspects of payroll. Various levels of government require employers to withhold various types of income and payroll taxes as well as require the employer to pay their portion of these taxes as well. In the United States, payroll taxes and income taxes are two separate taxes, yet they are both associated with payroll.[11] Payroll taxes are used to support Social Security and Medicare costs while income taxes are used for other government programs and expenses.[12] To differentiate the two when viewing the paystub, payroll taxes will be listed as FICA, social security, and Medi, or Medicare, and income taxes will be the Federal and State taxes that are withheld.

Payroll taxes in the United States

By law, employers must withhold payroll and income taxes from employees' checks and transfer them to several tax agencies. Employers are also responsible for paying the employer's share of payroll taxes along with depositing tax withheld from the employees' paychecks, preparing various reconciliation reports, accounting for the payroll expense through their financial reporting, and filing payroll tax returns. The exception to employer taxes is if the employee that is working is an independent contractor or freelancer.

Employee taxes

Payroll taxes that are taken out of an employee's check include Social Security, or FICA, and Medicare taxes. Employees pay 6.2% of their salary to Social Security up to $132,900. Wages earned after an employee has earned gross wages of $132,900 are no longer subject to Social Security taxes. Employees must also pay 1.45% of their earned wages towards Medicare. Wages earned in excess of $200,000 are subject to a 0.9% Additional Medicare Tax. This means that every dollar earned over $200,000 is subject to Medicare taxes that total 2.35%.[13]

Income taxes that employee wages are subject to include federal income tax withholding, state income tax withholding, and various local taxes. Federal income tax withholding is different for each employee based on filing status, allowances elected, and total wages earned, which is determined when an employee fills out the federal W-4 Form.[14] Federal income taxes are determined by the federal government and are governed by the Internal Revenue Service. State income tax withholding is determined by each state individually and vary in amounts. There are 7 states that have no income taxes and two others that tax only dividend and interest income, which do not involve payroll.[15] Depending on the location, sometimes there will also need to be local taxes included in the taxes taken out of each employee's pay check as well. Local income taxes are not nearly as common as federal and state income taxes and most people will not have any local income taxes that have to be paid.

Employer taxes

While income taxes are only paid by the employee, payroll taxes are paid not only by the employee, but also by their employer. Payroll taxes that employer's must pay are FICA, Medicare, FUTA, and SUTA. The employer portion of the Social Security tax that is paid is the same as the employee portion. Employers must pay a match that is an additional 6.2% of each employee's wages that caps at $132,900 worth of earned wages for each employee. For Medicare, employers must pay a match of 1.45% of all employee wages earned. Contrary to the employee portion, the employer does not pay to pay Additional Medicare Tax Withholding of 0.9% on wages earned above $200,000.[16]

Employers also have two payroll taxes they must pay that the employees do not have to pay. These two taxes are FUTA and SUTA. FUTA, or Federal Unemployment Tax Act, is a tax that is used to fund those employees who have lost their jobs through unemployment compensation.[17] Initially, FUTA is taxed at 6% of the first $7,000 earned by each employee. However, most employers receive a credit, or discount, or 5.4% which leaves the effective FUTA tax rate at 0.6% of the first $7,000 earned by each employee.[17]

Freelance taxes

The exceptions to the payroll and income taxes above are found in W-9 employees and freelancers. When an employer hires a freelancer, or W-9 employee, they are not responsible for remitting tax payments for that employee. Freelancers are responsible for paying their Federal and State Income Taxes and both portions of the FICA and Medicare Taxes (12.4% and 2.9% respectively) on all income if total income is over $400.[18] For freelancers or independent contractors that expect to owe at least $1,000 in taxes must pay their taxes quarterly based on the current year's Quarterly Tax Deadlines. In regard to FUTA and SUTA taxes, independent contractors do not pay either of these taxes.[19]

Wage garnishments

A wage garnishment is a court-ordered method of collecting overdue debts that requires employers to withhold money from employee wages and then send it directly to the creditor or to whomever it is that the employee owes money to.[20] Wage garnishments are post-tax deductions, meaning that these mandatory withholdings do not lower an employee's taxable income. Unpaid debts that may result in wage garnishments include credit card bill and medical bills, child support and alimony, federal student loans, and taxy levy's.[20] Each of these garnishments have different amounts that they can deduct from an employee's check, with child support being able to take up to 60% of disposable income.[21]

Net pay

Net pay is simply the total amount that an employee receives from their pay check after all required and voluntary deductions are taken out.[22] The formula for determining an employee's net pay would be: Net Pay = Gross Pay - Pretax Deductions - Taxes + Reimbursements - Garnishments - After Tax Deductions.

Outsourcing

Businesses may decide to outsource their payroll functions to an outsourcing service like a Payroll service bureau or a fully managed payroll service. These can normally reduce the costs involved in having payroll trained employees in-house as well as the costs of systems and software needed to process a payroll. Where this may reduce the cost for some companies many will foot a bigger bill to outsource their payroll if they have a special designed payroll program or payouts for their employees. In many countries, business payrolls are complicated in that taxes must be filed consistently and accurately to applicable regulatory agencies. For example, restaurant payrolls which typically include tip calculations, deductions, garnishments and other variables, can be difficult to manage especially for new or small business owners.

In the UK, payroll bureaus will deal with all HM Revenue & Customs inquiries and deal with employee's queries. Payroll bureaus also produce reports for the businesses' account department and payslips for the employees and can also make the payments to the employees if required. As of 6 April 2016, umbrella companies are no longer able to offset travel and subsistence expenses and if they do, they will be deemed liable to reimburse to HMRC any tax relief obtained. Furthermore, recruitment companies and clients may be potentially liable for the unpaid tax.[23]

Another reason many businesses outsource is because of the ever-increasing complexity of payroll legislation. Annual changes in tax codes, Pay as you earn (PAYE) and National Insurance bands as well as statutory payments and deductions having to go through the payroll often mean there is a lot to keep abreast of in order to maintain compliance with the current legislation.

On the other hand, businesses may also decide to utilize payroll software to supplement the efforts of a payroll accountant or office instead of hiring more payroll specialists and outsourcing a payroll company. Payroll software base its calculation on entered rate, approved data obtained from other integrated tools like the electronic Bundy clock, and other essential digital HR tools.

References

- "Definition of PAYROLL". www.merriam-webster.com. Retrieved 2019-11-04.

- Bragg, Steven M. (2003). Essentials of Payroll: Management and Accounting. John Wiley & Sons. ISBN 0471456144. Retrieved 4 November 2017.

- "Employee Payroll Laws". smallbusiness.chron.com. Retrieved 2019-11-05.

- Smith, Mac. "EMPLOYEES WILL JUMP SHIP BECAUSE OF A PAYROLL ERROR". 501(c) Services. Retrieved 2019-11-05.

- "Length of pay periods in the Current Employment Statistics survey". www.bls.gov. Retrieved 2019-11-10.

- "5 Considerations When Choosing a Payroll Frequency". HireLevel. 2015-02-24. Retrieved 2019-11-10.

- "Which of your friends needs to learn this term?". BusinessDictionary.com. Retrieved 2019-11-09.

- Murray, Jean. "How to Calculate Gross Pay for All of Your Employees". The Balance Small Business. Retrieved 2019-11-14.

- Heathfield, Susan M. "Everything You Need to Know About Payroll Deductions". The Balance Careers. Retrieved 2019-11-21.

- "What Are Pre-Tax and After-Tax Deductions?". finance.zacks.com. Retrieved 2019-11-21.

- "Income Tax vs Payroll Tax | Top 5 Differences (with infographics)". Wallstreet Mojo. 2018-06-16. Retrieved 2019-11-05.

- November 29, Catie Watson-Updated; 2018. "What Is the Difference Between Payroll Tax & Income Tax?". budgeting.thenest.com. Retrieved 2019-11-07.CS1 maint: numeric names: authors list (link)

- "Publication 15 (2019), (Circular E), Employer's Tax Guide | Internal Revenue Service". www.irs.gov. Retrieved 2019-11-10.

- Murray, Jean. "How to Use the New W-4 Form to Calculate Employee Withholding". The Balance Small Business. Retrieved 2019-11-10.

- "2019 State Individual Income Tax Rates and Brackets". Tax Foundation. 2019-03-20. Retrieved 2019-11-10.

- "Topic No. 751 Social Security and Medicare Withholding Rates | Internal Revenue Service". www.irs.gov. Retrieved 2019-11-11.

- Murray, Jean. "When and How to Pay and Report Federal Unemployment Taxes (FUTA)". The Balance Small Business. Retrieved 2019-11-11.

- "Freelance Taxes 101". daveramsey.com. Retrieved 2019-11-12.

- "What is FUTA?". Paychex. 2019-04-02. Retrieved 2019-11-12.

- Team, Content (2015-04-15). "Wage Garnishment - Definition, Examples, Processes". Legal Dictionary. Retrieved 2019-12-03.

- "Can Child Support Be the Majority of Your Paycheck?". info.legalzoom.com. Retrieved 2019-12-03.

- Heathfield, Susan M. "The Difference Between Gross Pay and Net Pay". The Balance Careers. Retrieved 2019-12-03.

- "All change for Umbrella Companies from April 2016". FCSA. The Freelancer & Contractor Services Association. Retrieved 4 November 2017.

External links

| Wikimedia Commons has media related to Payroll. |

| Look up payroll in Wiktionary, the free dictionary. |