Ore

Ore is natural rock or sediment that contains one or more valuable minerals, typically metals, that can be mined, treated and sold at a profit. Ore is extracted from the earth through mining and treated or refined, often via smelting, to extract the valuable metals or minerals.[1]

The grade of ore refers to the concentration of the desired material it contains. The value of the metals or minerals an ore contains must be weighed against the cost of extraction to determine whether it is of sufficiently high grade to be worth mining.[1]

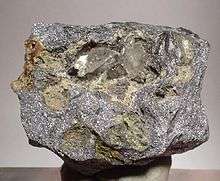

Metal ores are generally oxides, sulfides, silicates, native metals such as copper, or noble metals such as gold. Ores must be processed to extract the elements of interest from the waste rock. Ore bodies are formed by a variety of geological processes generally referred to as ore genesis.

Ore deposits

An ore deposit is an accumulation of ore. This is distinct from a mineral resource as defined by the mineral resource classification criteria. An ore deposit is one occurrence of a particular ore type. Most ore deposits are named according to their location (for example, the Witwatersrand, South Africa), or after a discoverer (e.g. the Kambalda nickel shoots are named after drillers), or after some whimsy, a historical figure, a prominent person, something from mythology (phoenix, kraken, serepentleopard, etc.) or the code name of the resource company which found it (e.g. MKD-5 was the in-house name for the Mount Keith nickel sulphide deposit).

Classification

Ore deposits are classified according to various criteria developed via the study of economic geology, or ore genesis. The classifications below are typical.

Hydrothermal epigenetic deposits

- Mesothermal lode gold deposits, typified by the Golden Mile, Kalgoorlie

- Archaean conglomerate hosted gold-uranium deposits, typified by Elliot Lake, Ontario, Canada and Witwatersrand, South Africa

- Carlin–type gold deposits, including;

- Epithermal stockwork vein deposits

Granite related hydrothermal

- IOCG or iron oxide copper gold deposits, typified by the supergiant Olympic Dam Cu-Au-U deposit

- Porphyry copper +/- gold +/- molybdenum +/- silver deposits

- Intrusive-related copper-gold +/- (tin-tungsten), typified by the Tombstone, Arizona deposits

- Hydromagmatic magnetite iron ore deposits and skarns

- Skarn ore deposits of copper, lead, zinc, tungsten, etcetera

Magmatic deposits

- Magmatic nickel-copper-iron-PGE deposits including

- Cumulate vanadiferous or platinum-bearing magnetite or chromite

- Cumulate hard-rock titanium (ilmenite) deposits

- Komatiite hosted Ni-Cu-PGE deposits

- Subvolcanic feeder subtype, typified by Noril'sk-Talnakh and the Thompson Belt, Canada

- Intrusive-related Ni-Cu-PGE, typified by Voisey's Bay, Canada and Jinchuan, China

- Lateritic nickel ore deposits, examples include Goro and Acoje, (Philippines) and Ravensthorpe, Western Australia.

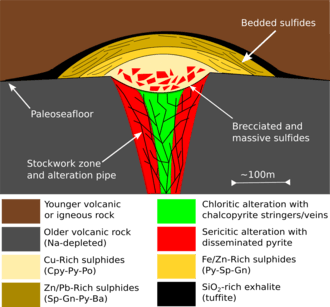

Volcanic-related deposits

- Volcanic hosted massive sulfide (VHMS) Cu-Pb-Zn including;

- Examples include Teutonic Bore and Golden Grove, Western Australia

- Besshi type

- Kuroko type

- Examples include Teutonic Bore and Golden Grove, Western Australia

Metamorphically reworked deposits

- Podiform serpentinite-hosted paramagmatic iron oxide-chromite deposits, typified by Savage River, Tasmania iron ore, Coobina chromite deposit

- Broken Hill Type Pb-Zn-Ag, considered to be a class of reworked SEDEX deposits

Carbonatite-alkaline igneous related

- Phosphorus-tantalite-vermiculite (Phalaborwa South Africa)

- Rare earth elements – Mount Weld, Australia and Bayan Obo, Mongolia

- Diatreme hosted diamond in kimberlite, lamproite or lamprophyre

Sedimentary deposits

- Banded iron formation iron ore deposits, including

- Channel-iron deposits or pisolite type iron ore

- Heavy mineral sands ore deposits and other sand dune hosted deposits

- Alluvial gold, diamond, tin, platinum or black sand deposits

- Alluvial oxide zinc deposit type: sole example Skorpion Zinc

Sedimentary hydrothermal deposits

- SEDEX

- Lead-zinc-silver, typified by Red Dog, McArthur River, Mount Isa, etc.

- Stratiform arkose-hosted and shale-hosted copper, typified by the Zambian copperbelt.

- Stratiform tungsten, typified by the Erzgebirge deposits, Czechoslovakia

- Exhalative spilite-chert hosted gold deposits

- Mississippi valley type (MVT) zinc-lead deposits

- Hematite iron ore deposits of altered banded iron formation

Astrobleme-related ores

- Sudbury Basin nickel and copper, Ontario, Canada

Extraction

The basic extraction of ore deposits follows these steps:

- Prospecting or exploration to find and then define the extent and value of ore where it is located ("ore body").

- Conduct resource estimation to mathematically estimate the size and grade of the deposit.

- Conduct a pre-feasibility study to determine the theoretical economics of the ore deposit. This identifies, early on, whether further investment in estimation and engineering studies is warranted and identifies key risks and areas for further work.

- Conduct a feasibility study to evaluate the financial viability, technical and financial risks and robustness of the project and make a decision as whether to develop or walk away from a proposed mine project. This includes mine planning to evaluate the economically recoverable portion of the deposit, the metallurgy and ore recoverability, marketability and payability of the ore concentrates, engineering, milling and infrastructure costs, finance and equity requirements and a cradle to grave analysis of the possible mine, from the initial excavation all the way through to reclamation.

- Development to create access to an ore body and building of mine plant and equipment.

- The operation of the mine in an active sense.

- Reclamation to make land where a mine had been suitable for future use.

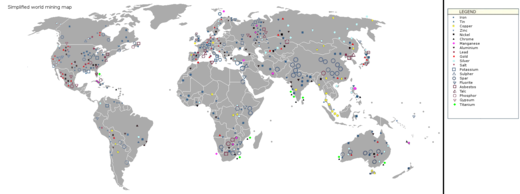

Trade

Ores (metals) are traded internationally and comprise a sizeable portion of international trade in raw materials both in value and volume. This is because the worldwide distribution of ores is unequal and dislocated from locations of peak demand and from smelting infrastructure.

Most base metals (copper, lead, zinc, nickel) are traded internationally on the London Metal Exchange, with smaller stockpiles and metals exchanges monitored by the COMEX and NYMEX exchanges in the United States and the Shanghai Futures Exchange in China.

Iron ore is traded between customer and producer, though various benchmark prices are set quarterly between the major mining conglomerates and the major consumers, and this sets the stage for smaller participants.

Other, lesser, commodities do not have international clearing houses and benchmark prices, with most prices negotiated between suppliers and customers one-on-one. This generally makes determining the price of ores of this nature opaque and difficult. Such metals include lithium, niobium-tantalum, bismuth, antimony and rare earths. Most of these commodities are also dominated by one or two major suppliers with >60% of the world's reserves. The London Metal Exchange aims to add uranium to its list of metals on warrant.

The World Bank reports that China was the top importer of ores and metals in 2005 followed by the US and Japan.[2]

Important ore minerals

- Acanthite (cooled polymorph of Argentite): Ag2S for production of silver

- Barite: BaSO4

- Bauxite Al(OH)3 and AlOOH, dried to Al2O3 for production of aluminium

- Beryl: Be3Al2(SiO3)6

- Bornite: Cu5FeS4

- Cassiterite: SnO2

- Chalcocite: Cu2S for production of copper

- Chalcopyrite: CuFeS2

- Chromite: (Fe, Mg)Cr2O4 for production of chromium

- Cinnabar: HgS for production of mercury

- Cobaltite: (Co, Fe)AsS

- Columbite-Tantalite or Coltan: (Fe, Mn)(Nb, Ta)2O6

- Galena: PbS

- Native gold: Au, typically associated with quartz or as placer deposits

- Hematite: Fe2O3

- Ilmenite: FeTiO3

- Magnetite: Fe3O4

- Malachite: Cu2CO3(OH)2

- Molybdenite: MoS2

- Pentlandite: (Fe, Ni)9S8

- Pyrolusite: MnO2

- Scheelite: CaWO4

- Sperrylite: PtAs2 for production of platinum

- Sphalerite: ZnS

- Uraninite (pitchblende): UO2 for production of metallic uranium

- Wolframite: (Fe, Mn)WO4

See also

References

- Hustrulid, William A.; Kuchta, Mark; Martin, Randall K. (2013). Open Pit Mine Planning and Design. Boca Raton, Florida: CRC Press. p. 1. ISBN 9781482221176. Retrieved 5 May 2020.

- "Background Paper - The Outlook for Metals Markets Prepared for G20 Deputies Meeting Sydney 2006" (PDF). The China Growth Story. WorldBank.org. Washington. September 2006. p. 4. Retrieved 2019-07-19.

External links

![]()