Bank of Valletta

Bank of Valletta plc (BOV) is a Maltese bank and financial services company headquartered in Santa Venera. It is the oldest established financial services provider in Malta and one of the largest. As of 2014, the bank had 44 branches, 6 regional business centres, a head office, and a wealth management arm located around the Maltese Islands.[2] It has representative offices in the United Kingdom, Australia, Belgium and Italy.

| |

| Public limited company | |

| Traded as | MSE: BOV |

| Industry | Banking Financial services |

| Predecessor | National Bank of Malta |

| Founded | 1974 |

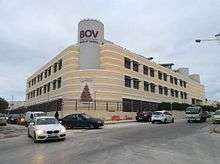

| Headquarters | BOV Centre, Triq il-Kanun, Santa Venera SVR 9030, Malta |

Area served | Maltese Islands |

Key people | Alfred Lupi (Interim Chairman) Rick Hunkin (Chief Executive Officer) |

| Products | Retail banking Commercial banking |

| €89.20 mln (2019)[1] | |

| Total assets | €10.6 bln (2019)[1] |

Number of employees | 1,843 (2017) |

| Subsidiaries | BOV Asset Management/BOV Fund Services |

| Website | www |

History

With the advent of British rule in Malta, a group of English and Maltese merchants established Anglo-Maltese Bank, which commenced operations on 23 June 1809.[3] Banco di Malta was established on 1 May 1812. Anglo-Maltese Bank and Banco di Malta began early on to issue their own promissory banknotes (payable at sight) at first in Scudi denominations and subsequently in Sterling. The third bank to be set up in Malta was B. Tagliaferro e Figli, which too was founded in 1812. The fourth bank established in Malta was Josef Scicluna et Fils, set up in 1830. These four banks would eventually merge, in stages, to form the National Bank of Malta. This was done in order to have strength in numbers at a time when there was a fear that the government was after the private banks .[4]

Anglo-Maltese Bank and Banco di Malta merged in January 1946 under the name National Bank of Malta.

In 1949 Sciclunas Bank affiliated to the newly established bank. Twenty years after that, i.e., in 1969, National Bank of Malta merged with Tagliaferro Bank through an exchange of shares.[5] In 1973,[6] following a run on the National Bank of Malta and its subsidiary Tagliaferro Bank, the Maltese government after Parliament passed the 'National and Tagliaferro Banks (Temporary Provision) Act 1973'.[7] The run on the bank is widely considered to have been orchestrated by the then government in an attempt to take control of the banking sector in Malta. On 22 March 1974 the Prime Minister Dom Mintoff announced the setting up of the Bank of Valletta. The new Bank took over the assets and liabilities of the National Bank of Malta, and commenced operations on 25 March 1974. The banking reform was described as a "hijack" by Adrain Busietta, as it created a number of controversies for those who had assets.[8][9][10] The National Bank's liabilities were artificially inflated by 151% by the government in an attempt to make it appear as insolvent.[11]

The Government, injected Lm3.3 million (equivalent to €7.7 million) into the new Bank in return for a 60 percent share of the capital. The Malta Development Corporation took up the remaining 40 percent, and in time sold 20 percent to the Banco di Sicilia and 10 percent to the Maltese public. In 1986, the Bank inaugurated its first overseas representative office.

In 1990, the Maltese government reduced its stake in Bank to 51 percent by issuing and offering 4.9 million shares to the public. That same year Bank of Valletta launched its fully owned investment bank - the subsidiary Valletta Investment Bank.

In 1992, Bank of Valletta International started operating. This wholly owned international banking subsidiary of the Bank of Valletta Group was Malta's first Offshore Bank. That same year Bank of Valletta became the first bank to be listed on the Malta Stock Exchange.

In 1995 Bank of Valletta and Insight Investment Management Limited established the Valletta Fund Management.

In September 2000, BOV set up its stockbroking arm, BOV Stockbrokers Limited ("BOVSL"). In time, Bank of Valleta amalgamated Bank of Valletta International Limited, Valletta Investment Bank Limited, Card Services Limited, and BOVSL.

Bank of Valletta continued to evolve its internationalisation through the opening of other representative offices in the Euro-Mediterranean region, though it closed the representative offices in Cairo and Tunis in 2011. With Malta's accession into the European Union, Bank of Valletta has become an active member of the European Savings Banks Group.

On 9 January 2014 a Maltese court found that the shareholders of the National Bank of Malta had suffered human rights abuses when the government of Malta had in 1975 forced them to sign away their shares for zero compensation.[12] On 6 February 2014 a Maltese court again found that shareholders of the National Bank of Malta had their rights violated when their assets were taken by the Government of Malta.[13] The government of Malta appealed these decisions, both the Constitutional Court of Malta has now confirmed the judgements of the previous courts. Shareholders will be able to negotiate a compensation package that is likely to involve Bank of Valletta shares.[14]

Shareholding

In 1992, the Bank became the first public company to be listed on the Malta Stock Exchange. Presently, 25% of the Bank's equity is held by the Government of Malta, UniCredit S.p.A. holds 10.20% and the remaining 64.80% is in the hands of the general public.

The BOV Group Today

The BOV Group has always been a pioneer in the local financial services sector. Today, Bank of Valletta is the leading financial services provider in Malta, playing a pivotal role in the local economy and having the largest balance sheet.

The Group offers a broad portfolio of financial services both for personal and non-personal customers, including Retail Banking, Wealth Management and Investment Services, Capital Market Services, Fund Administration, Bancassurance and Card Services. The Bank performs regular reviews of its business model and of its customers, taking corrective actions where needed to re-align its business model and customer relationships to its Risk Appetite.

Bank of Valletta p.l.c. operates the largest retail network on the island, with thirty six branches, one satellite branch and four agencies around Malta and Gozo. Furthermore, the Bank has a number of dedicated touchpoints – Investment Centres and Business Centres offering specialised services. Finally, the BOV Premium Banking Centre hosts the Wealth Management arm and Corporate Centre, offering a superior customer experience to the Bank's top customers.

The Bank's continued investment in technology and digital banking channels is aimed to improve the customer experience and provide round the clock accessibility to banking services. The extensive contactless Cards portfolio offers flexible payment solutions to the Bank's customers online, locally and when abroad.

Through its Corporate Social Responsibility programme, Bank of Valletta p.l.c. invests a significant portion of its profits back into society. The benefits of its extensive investment in Sports, Arts and Culture, Education, Philanthropy and the Environment are felt by various people and organisations and will continue to be reaped by future generations.

Bank of Valletta Group

Bank of Valletta p.l.c. is the parent company of the Group,

which comprises:

Fully Owned Subsidiaries

• BOV Asset Management Limited

• BOV Fund Services Limited

Associated Companies

• MAPFRE Middlesea p.l.c.

• MAPFRE MSV Life p.l.c.

References

- "BOV announces results for 2019". Bank of Valletta. 18 March 2020. Retrieved 3 April 2020.

- "BoV up, inaugurates new centre". timesofmalta.com. 12 February 2006.

- McGill, Thomas (1839). A hand book, or guide, for strangers visiting Malta. L. Tonna. p. 65.

- Rudolf, Uwe Jens; Berg, Warren G. (2010). Historical Dictionary of Malta. Scarecrow Press. pp. 35–37. ISBN 9780810873902.

- Banking and Finance in the Mediterranean: A Historical Perspective, edited by Mr John A Consiglio, Mr Juan Carlos Martinez Oliva, Professor Gabriel Tortella

- https://www.timesofmalta.com/articles/view/20081104/books/achievement-tragedy-and-failure.231867

- "Prince Grand Master: Adrian Busietta". Sovereign Hospitaller Order of Saint John of Jerusalem Knights of Malta. Archived from the original on 17 March 2014.

- Busietta, Adrian (2012). Adrian Busietta – The Biography. Best Print. ISBN 978-99957-0-120-8.

- "Adrian Busietta's autobiography". Times of Malta. 15 January 2012. Archived from the original on 13 April 2017.

- "An Autobiography of Adrian Busietta". The Malta Independent. 4 December 2011. Archived from the original on 14 April 2017.

- https://www.maltatoday.com.mt/news/national/55956/national_bank_shareholders_claiming_325_million_in_compensation#.XGGA8lwzZPY

- "National Bank case: Court finds shareholders' human rights were breached". Times of Malta. Retrieved 12 June 2015.

- "Mintoff's forcible take-over violated National Bank shareholders' rights". MaltaToday.com.mt. Retrieved 12 June 2015.

- "Government loses National Bank appeal, shareholders set to negotiate compensation". Times of Malta. Retrieved 12 June 2015.

Further reading

- Consiglio, John A. (2006) A history of banking in Malta, 1506-2005. (Valletta: Progress Press).

- Frendo, Henry (2002) "Ports, Ships and Money: The Origins of Corporate Banking in Malta". Journal of Mediterranean Studies 12 (2), 327–350.