U.S. Dollar Index

The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies,[1] often referred to as a basket of U.S. trade partners' currencies.[2] The Index goes up when the U.S. dollar gains "strength" (value) when compared to other currencies.[3]

The index is designed, maintained, and published by ICE (Intercontinental Exchange, Inc.), with the name "U.S. Dollar Index" a registered trademark.[4][5]

It is a weighted geometric mean of the dollar's value relative to following select currencies:

- Euro (EUR), 57.6% weight

- Japanese yen (JPY) 13.6% weight

- Pound sterling (GBP), 11.9% weight

- Canadian dollar (CAD), 9.1% weight

- Swedish krona (SEK), 4.2% weight

- Swiss franc (CHF) 3.6% weight

History

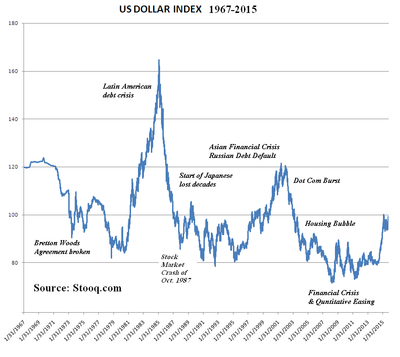

USDX started in March 1973, soon after the dismantling of the Bretton Woods system. At its start, the value of the U.S. Dollar Index was 100.000. It has since traded as high as 164.7200 in February 1985, and as low as 70.698 on March 16, 2008.

The make up of the "basket" has been altered only once, when several European currencies were subsumed by the euro at the start of 1999. Some commentators have said that the make up of the "basket" is overdue for revision as China, Mexico, South Korea and Brazil are major trading partners presently which are not part of the index whereas Sweden and Switzerland are continuing as part of the index.

| Year (last business day) | DXY Close | Factors Driving Dollar's Value[6] |

|---|---|---|

| 1967 | 121.79 | Gold standard kept dollar at $35/oz. |

| 1968 | 121.96 | |

| 1969 | 121.74 | Dollar hit 123.82 on 9/30. |

| 1970 | 120.64 | Recession. |

| 1971 | 111.21 | Wage-price controls. |

| 1972 | 110.14 | Stagflation. |

| 1973 | 102.39 | Gold standard ended. Index created in March. |

| 1974 | 97.29 | Watergate. |

| 1975 | 103.51 | Recession ended. |

| 1976 | 104.56 | Fed lowered rate. |

| 1977 | 96.44 | |

| 1978 | 86.50 | Fed raised rate to 20 percent to stop inflation. |

| 1979 | 85.82 | |

| 1980 | 90.39 | Recession. |

| 1981 | 104.69 | Reagan tax cut. |

| 1982 | 117.91 | Recession ended. |

| 1983 | 131.79 | Tax hike. Increased defense. |

| 1984 | 151.47 | |

| 1985 | 123.55 | Record of 163.83 on March 5. |

| 1986 | 104.24 | Tax cut. |

| 1987 | 85.66 | Black Monday. |

| 1988 | 92.29 | Fed raised rates. |

| 1989 | 93.93 | S&L Crisis. |

| 1990 | 83.89 | Recession. |

| 1991 | 84.69 | Recession. |

| 1992 | 93.87 | NAFTA approved. |

| 1993 | 97.63 | Balanced Budget Act. |

| 1994 | 88.69 | |

| 1995 | 84.83 | Fed raised rate. |

| 1996 | 87.86 | Welfare reform. |

| 1997 | 99.57 | LTCM crisis. |

| 1998 | 93.95 | Glass-Steagall repealed. |

| 1999 | 101.42 | Y2K scare. |

| 2000 | 109.13 | Tech bubble burst. |

| 2001 | 117.21 | Dollar rose to 118.54 on 12/24 after 9/11 attacks. |

| 2002 | 102.26 | Euro launched as a hard currency at $.90. |

| 2003 | 87.38 | Iraq War. JGTRRA. |

| 2004 | 81.00 | |

| 2005 | 90.96 | War on Terror doubled debt. It weakened the dollar. |

| 2006 | 83.43 | |

| 2007 | 76.70 | Euro rose to $1.47. |

| 2008 | 82.15 | Record low of 71.30 on 3/17. |

| 2009 | 77.92 | ECB lowered rates. |

| 2010 | 78.96 | QE2. |

| 2011 | 80.21 | Operation Twist. Debt crisis. |

| 2012 - 2013 | 79.77 | QE3 and QE4. Fiscal cliff. |

| 2013 | 80.04 | Taper tantrum. Government shutdown. Debt crisis. |

| 2014 | 90.28 | Ukraine crisis. Greek debt crisis. |

| 2015 | 98.69 | Fed raised rates. |

| 2016 | 102.21 | |

| 2017 | 92.12 | EU strengthened. |

| 2018 | 96.17 | Dow falls. |

| 2020 | 93.27 | COVID-19 outbreak. Massive quarantines slowdown the global economy. |

Quotes

ICE provides live feeds for Dow Futures that appear on Bloomberg.com, CNN Money, DollarIndex.org. USDX is updated whenever U.S. Dollar markets are open, which is from Sunday evening New York City local time (early Monday morning Asia time) for 24 hours a day to late Friday afternoon New York City local time.

Calculation

The U.S. Dollar Index is calculated with this formula: USDX = 50.14348112 × EURUSD-0.576 × USDJPY0.136 × GBPUSD-0.119 × USDCAD0.091 × USDSEK0.042 × USDCHF0.036 [7]

Trading

The Index can be traded as a futures contract on the ICE exchange. It is also available indirectly in exchange-traded funds (ETFs), options, CFDs and mutual funds.

See also

- Trade Weighted US dollar Index

- Special drawing rights

- Dow Jones FXCM Dollar Index

- Wall Street Journal Dollar Index[8]

References

- "U.S. Dollar Index - USDX". Investopedia. Retrieved March 23, 2013.

- "US Dollar Index Hits 12-Year High As ECB Unveils €1 Trillion Stimulus". FXTimes. Retrieved March 23, 2015.

- "US Dollar Index". FXStreet. Retrieved March 23, 2013.

- "U.S. Dollar Futures". Retrieved July 22, 2017.

The U.S. Dollar Index, together with all rights, title and interest in and related to the U.S. Dollar Index, including all content included therein (including, without limitation, it’s formulation, components, values, weightings and methods of calculation), and all related intellectual property and property rights, is the exclusive property of ICE Futures U.S., Inc.

- United States Patent and Trademark Office. "Trademark Search, Serial Number 74350026". Retrieved July 22, 2017.

- US Dollar Index®, What It Is, and Its History

- "U.S. Dollar Index® Contracts" (PDF). 2018. p. 2. Retrieved October 15, 2018.

- "Wall Street Journal Dollar Index". Dow Jones & Co. Retrieved July 24, 2013.