Mining industry of South Africa

Mining in South Africa was once the main driving force[1] behind the history and development of Africa's most advanced and richest economy.[2] Large-scale and profitable mining started with the discovery of a diamond on the banks of the Orange River in 1867 by Erasmus Jacobs and the subsequent discovery and exploitation of the Kimberley pipes a few years later. Gold rushes to Pilgrim's Rest and Barberton were precursors to the biggest discovery of all, the Main Reef/Main Reef Leader on Gerhardus Oosthuizen's farm Langlaagte, Portion C, in 1886, the Witwatersrand Gold Rush and the subsequent rapid development of the gold field there, the biggest of them all.

Diamond and gold production are now well down from their peaks, though South Africa is still number 5 in gold[3] but remains a cornucopia of mineral riches. It is the world's largest producer[4] of chrome, manganese, platinum, vanadium and vermiculite. It is the second largest producer[4] of ilmenite, palladium, rutile and zirconium. It is also the world's third largest coal exporter.[5] South Africa is also a huge producer of iron ore; in 2012, it overtook India to become the world's third-biggest iron ore supplier to China, the world's largest consumers of iron ore.[6]

Due to a history of corruption and maladministration in the South African mining sector, ANC secretary-general Gwede Mantashe announced at the beginning of 2013 that mining companies misrepresenting their intentions could have their licences revoked.[7]

History

Diamond and gold discoveries played an important part in the growth of the early South African economy. A site northeast of Cape Town was discovered to have rich deposits of diamonds, and thousands of white and blacks rushed to the area of Kimberley in an attempt to profit from the discovery. The British later annexed the region of Griqualand West, an area which included the diamond fields. In 1868, the republic attempted to annex areas near newly discovered diamond fields, drawing protests from the nearby British colonial government. These annexations later led to the First Boer War of 1880-1881.[8]

Gold was discovered in the area known as Witwatersrand, triggering what would become the Witwatersrand Gold Rush of 1886. Like the diamond discoveries before, the gold rush caused thousands of foreign expatriates to flock to the region. This heightened political tensions in the area ultimately contributing to the Second Boer War in 1899. Ownership of the diamond and gold mines became concentrated in the hands of a few entrepreneurs, largely of European origin, known as the Randlords. South Africa's and the world's biggest diamond miner, De Beers, was funded by baron Nathaniel Mayer Rothschild in 1887, and Cecil Rhodes became the Founding Chairman of the board of directors in 1888. Cecil Rhodes' place was later taken by sir Ernest Oppenheimer, co-founder of the Anglo-American Corporation with J.P. Morgan.

The gold mining industry continued to grow throughout much of the early 20th century, significantly contributing to the tripling of the economic value of what was then known as the Union of South Africa. In particular, revenue from gold exports provided sufficient capital to purchase much-needed machinery and petroleum products to support an expanding manufacturing base.

As of 2007, the South African mining industry employs 493,000 workers. The industry represents 18% of South Africa's $588 billion USD Gross Domestic Product.[9][10]

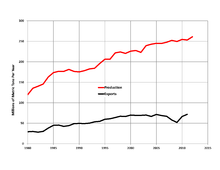

Coal

South Africa is the world's third largest coal exporter, and much of the country's coal is used for power production. (about 40%)[5] 77% of South Africa's energy needs are provided by coal.

Gold

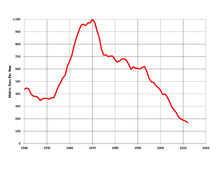

South Africa accounted for 15% of the world's gold production in 2002[11] and 12% in 2005, though the nation had produced as much as 30% of world output as recently as 1993. Despite declining production, South Africa's gold exports were valued at US$3.8 billion in 2005.[12] The US Geological Survey estimated in that as of 2002, South Africa held about 50% of the world's gold resources, and 38% of reserves.[11] In July 2018, Mineral Council of South Africa announced, 75% of mines in South Africa are now unprofitable due to decline in gold reserves.[13][14]

Among the nation's gold mines are two of the deepest mines in the world. The East Rand Mine, in Boksburg, extends to a depth of 3,585 metres (11,762 ft). A 4-metre (13 ft) shallower mine is located at TauTona in Carletonville, though plans are in place to begin work on an extension to the TauTona mine, bringing the total depth to over 3,900 metres (12,800 ft) and breaking the current record by 127 feet (39 m).[15] At these depths the temperature of the rocks is 140 °F (60 °C).[16]

The gold in the Witwatersrand Basin area was deposited in ancient river deltas, having been washed down from surrounding gold-rich greenstone belts to the north and west. Rhenium-osmium isotope studies indicates that the gold in those mineral deposits came from unusual three billion year old mantle sourced intrusions known as komatiites present in the edenvale belts.[17] The Vredefort Dome impact which lies within the basin and the nearby Bushveld Igneous Complex are both about a billion years younger than the interpreted age of the gold.[17]

Diamonds

Ever since the Kimberley diamond strike of 1868, South Africa has been a world leader in diamond production. The primary South African sources of diamonds, including seven large diamond mines around the country, are controlled by the De Beers Consolidated Mines Company. In 2003, De Beers operations accounted for 94% of the nation's total diamond output of 11,900,000 carats (2.38 t). This figure includes both gem stones and industrial diamonds.[18] Diamond production rose in 2005 to over 15,800,000 carats (3.16 t).[12]

Platinum and palladium

South Africa produces more platinum and similar metals than any other nation.[10] In 2005, 78% of the world's platinum was produced in South Africa, along with 39% of the world's palladium. Over 163,000 kilograms (5,200,000 ozt) of platinum was produced in 2010, generating export revenues of US$3.82 billion.[12] Palladium is produced in two ways: recovery and mining production.[19] Currently Russia and South Africa are the biggest palladium producers in the world.[20]

Chromium

Chromium is another leading product of South Africa's mining industry. The metal, used in stainless steel and for a variety of industrial applications, is mined at 10 sites around the country. South Africa's production of chromium accounted for 100% of the world's total production in 2005, and consisted of 7,490,000 metric tons (7,370,000 long tons; 8,260,000 short tons) of material.[12]

Uranium

South Africa has the second-largest reserves of uranium in the world.[21] The Nuclear Fuels Corporation of South Africa (NUFCOR) started processing uranium as a by-product of gold mining[22] in 1967.[23] Most of the uranium produced as a by-product of gold mining is concentrated in the golf fields of the Witwatersrand area. Uranium is more easily and readily available than gold in South Africa.[24]

There are a number of mining companies that process uranium from mines that they own. Anglo Gold Ashanti,[25] Sibayane Gold Ltd,[26] Harmony Gold Mining Co.,[27] First Uranium, and Peninsula Energy own or control most of the uranium-from-gold mining processing plants in South Africa.

Though uranium production in South Africa showed a decrease from 711t in 2000 to 579t in 2010, in 2011 930t were produced with a forecast of 2,000t by 2020.[28] In 2016, Tasman Pacific Minerals, owned by Peninsula Energy started plans to open the first uranium ore mine, Tasman RSA.[29]

Working conditions

Conditions on most South African mines are very similar to those elsewhere[30] except for the gold mines where the low geothermal gradient, i.e. the rate at which the temperature goes up with depth, is often as low as 9 °C per kilometre depth (compared with a world average of about 25 °C/km[31]), and this, combined with narrow and very continuous orebodies in hard and competent rocks, makes it possible to mine to depths unattainable elsewhere in the world.

Silica dust is an ever-present potential hazard so that all drilling dust and loose rock has to be wetted down at all times to prevent silicosis, a lethal disease that attacks the lungs. Unfortunately the narrowness of the inclined reefs/orebodies prevents mechanisation except in a very few cases and most work is very labour-intensive. Ventilation requirements to keep working conditions tolerable are huge and a survey of the South African gold mines indicated that the average quantity of ventilating air circulated was some 6 cubic metres per second (210 cu ft/s) per 1000 ton of rock mined per month.[32]

Another serious problem is that of heat. In the deeper mines refrigeration of the intake air is often necessary to keep conditions tolerable and this is now becoming necessary on some platinum mines which, although shallower, have a higher geothermal gradient.[33] Refrigeration is very energy hungry and it is currently a moot point whether ESKOM, the state power company, can supply the necessary power after its recent problems, which will cut power supplies to 90% of previous levels until at least 2012, when a new power station is ready.[34][35]

The South African mining industry is frequently criticized for its poor safety record and high number of fatalities but conditions are improving. Total fatalities were 533 in 1995 and had fallen to 199 in 2006.[36] The overall fatality rate in 2006 was 0.43 per 1,000 per annum but this hides some important differences. The gold mining rate was 0.71, platinum mining was 0.24 and other mining was 0.35. (For comparison, the rate in the Sixties was around 1.5—see any Chamber of Mines Annual of the period). The reason for the difference is quite clear; the gold mines are much deeper and conditions are both more difficult and dangerous than on the shallower platinum mines.

Falls of ground dominated the causes at 72, machinery, transportation and mining accidents caused 70 and the remainder were classed as general.[37] Of the falls of ground, approx. two thirds were on the deep gold mines, a reflection of the extreme pressure at depth and continual movement of the country rock. Amongst the machinery, mining and transportation fatalities were working on grizzlies without safety belts, working below loose rock in ore passes, getting crushed by that deadly combination of a loco and a ventilation door frame (the clearance between the two is only a few inches) and working on running conveyors, all direct contraventions of safety instructions. Drilling into misfires was also mentioned, a clear example of sloppy and unsafe mining.

It is difficult to see how falls of ground can be eliminated given their frequent unpredictability, which is increasing with depth, and the difficulties in providing continuous roof support as on longwall coal mines due to the violence of a face blast in the hard rock of the gold mines but clearly much can be done to improve training and to instill a sense of safe working practice in the miners, many of whom are relatively inexperienced.

Mine safety received considerable publicity in 2007, particularly after 3,200 workers were temporarily trapped underground at the Elandskraal mine after a compressed air pipe ruptured due to internal corrosion, broke loose and fell into the man-hoisting shaft. The workers were eventually rescued through the rock hoisting shaft after the blasting smoke had cleared. The incident caused South African President Thabo Mbeki to mandate full safety audits for all operating mines. This audit has caused additional facilities to shut down temporarily, including the nation's largest gold mine located at Driefontein.[38]

Rand Rebellion

The Rand Rebellion was a widespread strike amongst miners in the Witwatersrand area of the Transvaal Province in the former Union of South Africa.

2007 strike

In 2007 the South African National Union of Mineworkers, which represents the nation's mineworkers, engaged in a series of talks with the Chamber of Mines, an industry group. The meetings also saw the participation of the Commission for Conciliation, Mediation and Arbitration, a body with mediation authority over the dispute. On 27 November 2007, the National Union of Mineworkers announced that South African mineworkers would go on strike to protest at unsafe working conditions.[39] The strike took place on 4 December, and impacted over 240,000 workers at 60 sites across the country, including mines devoted to the production of gold, platinum, and coal.[40][41]

2012 Lonmin strike

The Lonmin strike was a strike in August 2012 in the Marikana area, close to Rustenburg, South Africa at a mine owned by Lonmin one of the world's largest primary producers of platinum group metals (PGMs). A series of violent confrontations occurred between platinum mine workers on strike and the South African Police Service on Thursday, 16 August 2012, and resulted in the deaths of 34 individuals (30 were miners and 4 protesters), as well as the injury of an additional 78 miners. Occurring in the post-apartheid era, it was the deadliest incident of violence between police and the civilian population in South Africa since the 1960 Sharpeville Massacre which prompted South African President Jacob Zuma to set up an investigation. Gordon Farlam was appointed as the chairperson of a committee. Under the probe, Cyril Ramaphosa testified for lobbying with the Lonmin and SAPS. Ramaphosa also accepted to the commission that massacre could have been avoided if proper precautionary actions had been taken.[42][43]

Jacob Zuma declared a 66-day-long week of mourning.[44]

In 2014, platinum industry workers went on a strike that lasted five months. It was the longest strike in the history of South African mining.[45]

In 2019, a high court in Johannesburg approved the historic compensation deal for the miners who contracted the fatal silicosis disease when they worked in the mines.[46]

Politics

There were few parties that advocate to nationalizing the industry, the most major one is Economic Freedom Fighters (EFF) that was founded on 2013, and by 2014 elections became the third-largest party in South Africa. The others are:

References

- "South African mining is in crisis". The Economist. Retrieved 21 October 2017.

- "Africa's new Number One". The Economist. Retrieved 4 January 2018.

- "U.S. Geological Survey, Mineral Commodity Summaries, January 2013" (PDF). USGS.gov. Retrieved 4 January 2018.

- "USGS Minerals Information: Mineral Commodity Summaries". minerals.USGS.gov. Retrieved 4 January 2018.

- "South Africa's coal future looks bright". Platts.com. Retrieved 4 January 2018.

- SA replaces India as China's No 3 iron-ore supplier, International: Mining Weekly, 2013

- Mining licences can be revoked – Mantashe, International: Mining Weekly, 2013

- Duxbury, Geo. (1981). David and Goliath: The First War of Independence, 1880-1881. South African National Museum of Military History. ISBN 0-620-05012-8.

- Charlotte Mathews (7 November 2007). "South Africa: Mining Investment Shows Recovery". Business Day (Johannesburg).

- "CIA World Factbook, South Africa". United States Central Intelligence Agency. Retrieved 28 November 2007.

- "United States Geological Survey, 2002 Mineral Industry Report" (PDF). Retrieved 27 November 2007.

- "United States Geological Survey, 2005 Minerals Yearbook: South Africa" (PDF). Retrieved 28 November 2007.

- "75% of South African gold mines unprofitable – mineral council". RT International. Retrieved 13 July 2018.

- "World running out of gold & there's no substitute, experts warn". RT International. Retrieved 13 July 2018.

- Naidoo, Brindaveni (15 December 2006). "TauTona to take 'deepest mine' accolade". Creamer Media's Mining Weekly Online. Archived from the original on 15 October 2007. Retrieved 2007-11-28.

- "Two miles underground". Princeton Weekly Bulletin. 13 December 1999. Archived from the original on 13 January 2016. Retrieved 2008-06-11.

- Kirk, Jason; Joakin Ruiz; John Chesley; Spencer Titley (December 2003). "The Origin of Gold in South Africa" (PDF). American Scientist. 91: 534–531.

- "United States Geological Survey, 2003 Mineral Study, South Africa" (PDF). (211 KiB)

- "NAP - Palladium - Market Overview". Napalladium.com. Retrieved 4 August 2016.

- "Palladium mine production worldwide by country 2010-2015". Statista.com. Retrieved 4 August 2016.

- "Archived copy". Archived from the original on 20 August 2016. Retrieved 4 August 2016.CS1 maint: archived copy as title (link)

- "Archived copy" (PDF). Archived from the original (PDF) on 2 February 2017. Retrieved 4 August 2016.CS1 maint: archived copy as title (link)

- "Nuclear Power in South Africa". World-nuclear.org. Retrieved 4 August 2016.

- Ackroyd, Bianca. "Uranium mining in the Karoo South Africa's new gold?". Enca.com. Retrieved 4 August 2016.

- "AngloGold still on top of uranium deposits". Financial Mail. Retrieved 4 August 2016.

- "Sibanye hoards uranium for deals". Business Day Live. Retrieved 4 August 2016.

- "New Uranium Mining Projects - South Africa". Wise-uranium.org. Retrieved 4 August 2016.

- Kotze, Chantelle. "Uranium-rich South Africa good environment for nuclear plants". Retrieved 4 August 2016.

- CrowleyKev, Kevin Crowley. "Uranium in South Africa's Karoo May Be 10 Times Estimate". Bloomberg.com. Retrieved 4 August 2016.

- "Mining Conditions in South Africa - Mining in Africa". Mining Africa. 8 January 2017. Retrieved 30 March 2017.

- "Geothermal Gradient vs. Tectonic Setting (not a very satisfactory reference but the best I could find) ". UBC.ca. Archived from the original on 16 November 2007. Retrieved 4 January 2018.

- Economics Dept The platinum supply equation - refrigeration key to ongoing supply levels Archived 3 June 2008 at the Wayback Machine

- "Archived copy". Archived from the original on 26 May 2008. Retrieved 30 June 2008.CS1 maint: archived copy as title (link)

- "Limited power for mines to 2012". News24.com. Retrieved 4 January 2018.

- "Department of Minerals and Energy, Accident Statistics ". DME.gov.za. Archived from the original on 5 July 2008. Retrieved 4 January 2018.

- "Gold Fields Says Africa's Biggest Gold Mine Halted". Bloomberg. Retrieved 28 November 2007.

- "First-ever industrywide strike to hit South Africa mines". CNN. Retrieved 28 November 2007.

- "Officials meet to decide planned S.Africa mine strike". Reuters. Archived from the original on 1 February 2013. Retrieved 27 November 2007.

- "South African miners to strike on Dec. 4". Reuters. Retrieved 28 November 2007.

- "Cyril Ramaphosa: The true betrayal". Dailymaverick.co.za. Retrieved 17 June 2017.

- "MARIKANA COMMISSION INQUIRY REPORT" (PDF). The Marikana Commission of Inquiry. October 2014. Archived from the original (PDF) on 12 September 2016.

- "President declares week of mourning after Lonmin bloodbath". SowetanLive.co.za. Retrieved 4 January 2018.

- Leander (24 October 2014). "2014 South African platinum strike: longest wage strike in South Africa". SAHistory.org.za. Retrieved 4 January 2018.

- Burke, Jason (26 July 2019). "Multimillion-dollar compensation deal for South African miners". The Guardian. ISSN 0261-3077. Retrieved 28 July 2019.