Menu cost

In economics, a menu cost is the cost to a firm resulting from changing its prices. The name stems from the cost of restaurants literally printing new menus, but economists use it to refer to the costs of changing nominal prices in general. In this broader definition, menu costs might include updating computer systems, re-tagging items, and hiring consultants to develop new pricing strategies as well as the literal costs of printing menus. More generally, the menu cost can be thought of as resulting from costs of information, decision and implementation resulting in bounded rationality. Because of this expense, firms sometimes do not always change their prices with every change in supply and demand, leading to nominal rigidity. Generally, the effect on the firm of small shifts in price (by changes in supply and/or demand, or else because of slight adjustments in monetary policy) is relatively minor compared to the costs of notifying the public of this new information. Therefore, the firm would rather exist in slight disequilibrium than incur the menu costs.

History

The concept of a lump-sum cost (menu cost) to changing the price was originally introduced by Sheshinski and Weiss (1977) in their paper looking at the effect of inflation on the frequency of price-changes.[1] The idea of applying it as a general theory of Nominal Price Rigidity was simultaneously put forward by several New Keynesian economists in 1985–6. George Akerlof and Janet Yellen put forward the idea that due to bounded rationality firms will not want to change their price unless the benefit is more than a small amount.[2][3] This bounded rationality leads to inertia in nominal prices and wages which can lead to output fluctuating at constant nominal prices and wages. Gregory Mankiw took the menu-cost idea and focused on the welfare effects of changes in output resulting from sticky prices.[4] Michael Parkin also put forward the idea.[5] The menu cost idea was also extended to wages as well as prices by Olivier Blanchard and Nobuhiro Kiyotaki.[6]

The new Keynesian explanation of price stickiness relied on introducing imperfect competition with price (and wage) setting agents.[7] This started a shift in macroeconomics away from using the model of perfect competition with price taking agents to using imperfectly competitive equilibria with price and wage setting agents (mostly adopting monopolistic competition). Huw Dixon and Claus Hansen showed that even if menu costs applied to a small sector of the economy, this would influence the rest of the economy and lead to prices in the rest of the economy becoming less responsive to changes in demand.[8]

In 2007, Mikhail Golosov and Robert Lucas found that the size of the menu cost needed to match the micro-data of price adjustment inside an otherwise standard business cycle model is implausibly large to justify the menu-cost argument.[9] The reason is that such models lack "real rigidity".[10] This is a property that markups do not get squeezed by large adjustment in factor prices (such as wages) that could occur in response to the monetary shock. Modern New Keynesian models address this issue by assuming that the labor market is segmented, so that the expansion in employment by a given firm does not lead to lower profits for the other firms.[11]

Deeper analysis

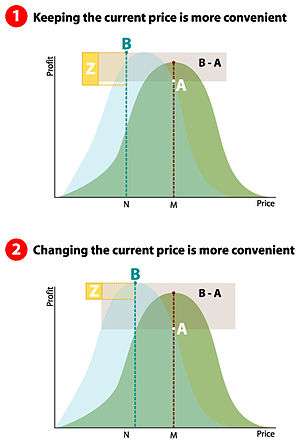

Consider a hypothetical firm in a hypothetical economy, with a concave graph describing the relationship between the price of its good and the firm's corresponding profit. As always, the profit maximizing point lies at the very top for the curve.

Now suppose that there exists a drop in aggregate output. While this causes real wages to fall (shifting the profit curve upward, allowing more profit for the same price), it also diminishes demand for the firm's product (shifting the curve down). Suppose the net effect is a downward shift (as it usually is).

The result is a maximum profit associated with a lower price (the max profit shifts to the left a bit, as a result of the profit curve moving). Suppose the old price (and thus the old maximizing profit price) was M and the new maximizing price is N. Also suppose the new maximum profit is B and new profit corresponding to the old price is A. Thus price M yields A in profit and price N yields B in profit.

Now suppose there is a menu cost, Z, in changing from price M to price N. Because the firm must pay Z to make this change, they will only pay it if Z < B-A. Thus tiny fluctuations in the economy leads to small differences in B and A so firms do not change their price, even if Z is small.

Note that if Z is zero, then prices will change all the time, allowing for firms to squeeze out every bit of profit from every change in the economy.

See also

- New Keynesian economics

- Bounded rationality

- Sticky (economics)

- Shoe leather cost

- Inflation

References

- Sheshinski, Eytan; Weiss, Yoram (1977). "Inflation and Costs of Price Adjustment". Review of Economic Studies. 44 (2): 287–303. doi:10.2307/2297067. JSTOR 2297067.

- Akerlof, George A.; Yellen, Janet L. (1985). "Can Small Deviations from Rationality Make Significant Differences to Economic Equilibria?". American Economic Review. 75 (4): 708–720. JSTOR 1821349.

- Akerlof, George A.; Yellen, Janet L. (1985). "A Near-rational Model of the Business Cycle, with Wage and Price Inertia". The Quarterly Journal of Economics. 100 (5): 823–838. doi:10.1093/qje/100.Supplement.823.

- Mankiw, N. Gregory (1985). "Small Menu Costs and Large Business Cycles: A Macroeconomic Model of Monopoly". The Quarterly Journal of Economics. 100 (2): 529–538. doi:10.2307/1885395. JSTOR 1885395.

- Parkin, Michael (1986). "The Output-Inflation Trade-off When Prices Are Costly to Change". Journal of Political Economy. 94 (1): 200–224. doi:10.1086/261369. JSTOR 1831966.

- Blanchard, O.; Kiyotaki, N. (1987). "Monopolistic Competition and the Effects of Aggregate Demand". American Economic Review. 77 (4): 647–666. JSTOR 1814537.

- Dixon, Huw (2001). "The Role of imperfect competition in new Keynesian economics" (PDF). Surfing Economics: Essays for the Inquiring Economist. New York: Palgrave. ISBN 0333760611.

- Dixon, Huw; Hansen, Claus (1999). "A Mixed Industrial Structure Magnifies the Importance of Menu Costs". European Economic Review. 43 (8): 1475–1499. doi:10.1016/S0014-2921(98)00029-4.

- Golosov, Mikhail; Lucas, Robert E., Jr. (2007). "Menu Costs and Phillips Curves". Journal of Political Economy. 115 (2): 171–199. CiteSeerX 10.1.1.498.5570. doi:10.1086/512625.

- Ball L. and Romer D (1990). Real Rigidities and the Non-neutrality of Money, Review of Economic Studies, volume 57, pages: 183-203

- Michael Woodford (2003), Interest and Prices: Foundations of a Theory of Monetary Policy. Princeton University Press, ISBN 0-691-01049-8.