M&T Bank

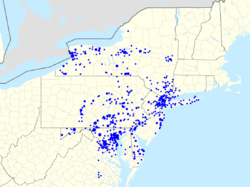

M&T Bank Corporation is an American bank holding company headquartered in Buffalo, New York.[1] It operates 780 branches in New York, New Jersey, Pennsylvania, Maryland, Delaware, Virginia, West Virginia, Washington, D.C., and Connecticut.[2] M&T is ranked 462nd on the Fortune 500.[1] Until May 1998, it was named First Empire State Corporation.[3]

| Public company | |

| Traded as | NYSE: MTB S&P 500 Index component |

| Industry | Financial services |

| Founded | August 29, 1856 |

| Headquarters | One M&T Plaza Buffalo, New York United States |

Key people | René F. Jones (Chairman and CEO) Kevin J. Pearson (Vice Chairman) Richard S. Gold (President and COO) |

| Products | Retail banking Commercial bank Investment Banking Investment Management Private banking |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 16,840 [1] (2019) |

| Subsidiaries | Wilmington Trust |

| Website | www |

| Footnotes / references [2] | |

M&T Bank has been profitable in every quarter since 1976.[4] Other than Northern Trust, M&T was the only bank in the S&P 500 Index not to lower its dividend during the financial crisis of 2007–2008.[5]

The bank owns the Buffalo Savings Bank building in downtown Buffalo. M&T Bank also sponsors M&T Bank Stadium, home of the Baltimore Ravens. M&T Bank is the official bank of the Buffalo Bills in Western New York and of their home Stadium New Era Field in Orchard Park, New York. Wilmington Trust is a subsidiary of M&T Bank Corporation, offering global corporate and institutional services, private banking, investment management, and fiduciary services.

History

M&T was founded in 1856 in Western New York state as "Manufacturers and Traders Trust Company". The company opened its first branch on August 29 of that year at 2 East Swan Street in Buffalo.[6]

In 1983, Robert G. Wilmers was named Chairman and CEO, a position he held until his death in December 2017.[6]

Between 1987 and 2009, M&T Bank acquired 20 financial institutions, as follows:[7]

- December 1987: East New York Savings of New York City

- January 1989: Monroe Savings Bank of Rochester, New York

- September 1990: Assets of Empire of America Savings Bank of Buffalo (along with KeyBank and others)

- May 1991: Assets of Goldome Bank of Buffalo (along with KeyBank and others)

- July 1992: Central Trust and Endicott Trust of Rochester, New York and Binghamton, New York.[8]

- December 1994: Hudson Valley branches of Chemical Bank; New York and Ithaca Bancorp of Ithaca, New York.

- July 1995: Hudson Valley branches of Chase Manhattan

- January 1997: Green Point Bank branches of Westchester, New York

- June 1999: First National Bank of Rochester

- April 1998: OnBank of Syracuse, New York[9]

- September 1999: 29 Chase Bank Branches in Buffalo, Jamestown, and Binghamton[10]

- October 2000: Keystone Financial of Central Pennsylvania[11]

- February 2001: Premier Nation Bancorp of Newburgh[12]

- April 2003: Allfirst Bank of Baltimore, a subsidiary of Allied Irish Banks of Ireland, in exchange for 26.7 million shares of M&T and $886 million in cash.[13][14] At the direction of Irish government financial regulators, AIB sold its 22% ownership interest in M&T in 2010.[15]

- July 2006: 21 Citibank branches in Buffalo and Rochester[16]

- December 2007: Partners Trust Financial Group, including 33 branches in upstate New York, for $555 million.[17]

- December 2007: 12 First Horizon National Corporation branches in the greater Washington D.C. and Baltimore markets.[18]

- May 2009: Provident Bank of Maryland in a stock transaction.[19]

- August 2009: The Federal Deposit Insurance Corporation (FDIC) seized Bradford Bank and sold all its deposits and most assets to M&T.[20] M&T and the FDIC agreed to share future losses on $338 million worth of Bradford's assets.[21]

In May 2011, M&T acquired Wilmington Trust for $351 million in stock.[22]

On August 27, 2012, M&T announced the acquisition of Hudson City Bancorp for $3.7 billion. The bank had $25 billion in deposits and $28 billion in loans and 135 brick-and-mortar branch locations including 97 in New Jersey.[23] The acquisition was delayed for 3 years due to a money laundering case involving an M&T branch and the acquisition closed on November 2, 2015.[24][25]

In 2008, M&T received a $600 million investment by the United States Treasury as a result of the Troubled Asset Relief Program (TARP) and M&T assumed another $482 million in TARP obligations from its acquisitions.[26] In 2011, the bank repaid $700 million of TARP funds.[26]

On December 16, 2017, Robert Wilmers died and non-Executive Chairman Robert T. Brady became acting Chairman and CEO.[27] On December 20, 2017, René F. Jones was appointed Chairman and Chief Executive Officer.

Legal issues

Money laundering

In June 2014, a U.S. District Judge ordered M&T Bank to forfeit $560,000 in drug proceeds that had been laundered through its Perry Hall, Maryland, branch. At least 8 times from 2011 to 2013, Deanna Bailey, a drug dealer, went to the branch and had head teller Sabrina Fitts convert cash amounts from $20,000 to $100,000 into larger bills.[28] Fitts accepted a 1% transaction fee in exchange for not filing a currency transaction report. This violated the Bank Secrecy Act of 1970 which requires all cash transactions of more than $10,000 to be reported to the Internal Revenue Service.[29]

The acquisition of Hudson City Bancorp was delayed for more than 3 years by the Federal Reserve Board, which was unconvinced that the bank's anti-laundering controls were strong enough.[30][31]

References

- "M&T Bank Corp". Fortune. Retrieved 2018-12-31.

- "M&T Bank Corporation 2017 Form 10-K Annual Report". U.S. Securities and Exchange Commission.

- Reynolds, Ben (March 3, 2017). "Buffett Stocks in Focus: M&T Bank". Yahoo! Finance.

- Engren, John (February 20, 2012). "M&T Bank's Bob Wilmers is Too Sharp to Fail". Institutional Investor.

- "Newsroom: History". M&T Bank. Archived from the original on 2018-08-15. Retrieved 2018-02-08.

- "Investor Relations: Acquisitions". M&T Bank.

- "M&T Buys Central Trust, Endicott Bank Fast-Growing Buffalo Bank Pays $111 Million for Two MidAtlantic Subsidiaries". The Buffalo News. February 23, 1992.

- Pinckney, Barbara (November 3, 1997). "M&T parent adopts bank with local branches". American City Business Journals.

- "M&T Bank To Acquire 29 Chase Branches". American City Business Journals. June 4, 1999.

- "M&T Bank to Acquire Keystone Financial". Los Angeles Times. Bloomberg News. May 18, 2000.

- "Company News: M & T Bank in Deal to Acquire Premier National Bancorp". The New York Times. Associated Press. July 11, 2000.

- "M&T Bank Corporation Consummates Acquisition of Allfirst Financial Inc" (Press release). PR Newswire. April 1, 2003.

- Patalon III, William (April 2, 2003). "Allfirst's sale to M&T Bank is completed". The Baltimore Sun.

- "Allied Irish Selling $2.2 Billion Stake in M&T". The New York Times. October 6, 2010.

- Appelbaum, Binyamin (December 20, 2008). "M&T Agrees to Buy Provident Bank". The Washington Post.

- "M&T Completes Partners Trust Acquisition" (Press release). PR Newswire. December 3, 2007. Archived from the original on April 2, 2015. Retrieved May 21, 2017.

- Adams, Thomas (September 25, 2007). "M&T buys First Horizon branches". American City Business Journals.

- "M&T Bank Corporation Completes Acquisition of Provident Bankshares Corporation" (Press release). PR Newswire. May 26, 2009.

- "Manufacturers and Traders Trust Company, Buffalo, New York, Assumes All of the Deposits of Bradford Bank, Baltimore, Maryland" (Press release). Federal Deposit Insurance Corporation. August 28, 2009.

- Haber, Gary; Sullivan, Joanna (August 31, 2009). "Feds seize Bradford Bank; M&T to buy assets". American City Business Journals.

- "M&T to acquire Delaware bank". American City Business Journals. November 1, 2010.

- "M&T Bank to Buy Hudson City Bancorp for $3.7 Billion". The New York Times. August 27, 2012.

- "M&T Bank Corporation Completes Acquisition of Hudson City Bancorp, Inc" (Press release). PR Newswire. November 2, 2015.

- Ensign, Rachel Louise (November 2, 2015). "M&T Bank Completes Acquisition of Hudson City After 3-Year Delay". The Wall Street Journal.

- Eavis, Peter (April 9, 2012). "Despite Good Health, Bank Holds Tight to TARP Funds". The New York Times.

- "M&T Bank Announces Passing of Chairman and Chief Executive Officer Robert G. Wilmers" (Press release). PR Newswire. December 17, 2017.

- "Baltimore Drug Dealer Sentenced In Money Laundering Scheme" (Press release). United States Attorney for the District of Maryland. February 24, 2014.

- Bodley, Michael (June 18, 2014). "M&T Bank ordered to forfeit $560,000 of laundered drug proceeds". The Baltimore Sun.

- Crittenden, Michael R. (June 18, 2013). "Fed Cites M&T for Anti-Money Laundering Problems". The Wall Street Journal.

- Kline, Allissa (June 18, 2014). "Drug money-laundering probe costs M&T $560K". American City Business Journals.