Cross elasticity of demand

In economics, the cross elasticity of demand or cross-price elasticity of demand measures the responsiveness of the quantity demanded for a good to a change in the price of another good, ceteris paribus. It is measured as the percentage change in quantity demanded for the first good that occurs in response to a percentage change in price of the second good. For example, if, in response to a 10% increase in the price of fuel, the demand for new cars that are fuel inefficient decreased by 20%, the cross elasticity of demand would be: . An increase in the price of fuel will decrease demand for cars that are not fuel efficient.

| Part of a series on |

| Economics |

|---|

|

|

|

By application |

|

Notable economists |

|

Lists |

|

Glossary |

|

A negative cross elasticity denotes two products that are complements, while a positive cross elasticity denotes two substitute products. For example, if products A and B are complements, an increase in the price of B leads to a decrease in the quantity demanded for A. Equivalently, if the price of product B decreases, the demand curve for product A shifts to the right reflecting an increase in A's demand, resulting in a negative value for the cross elasticity of demand. The exact opposite reasoning holds for substitutes.

Results for main types of goods

In the example above, the two goods, fuel and cars (consists of fuel consumption), are complements; that is, one is used with the other. In these cases the cross elasticity of demand will be negative, as shown by the decrease in demand for cars when the price for fuel will rise. In the case of perfect substitutes, the cross elasticity of demand is equal to positive infinity (at the point when both goods can be consumed). Where the two goods are independent, or, as described in consumer theory, if a good is independent in demand then the demand of that good is independent of the quantity consumed of all other goods available to the consumer, the cross elasticity of demand will be zero i.e. if the price of one good changes, there will be no change in demand for the other good.

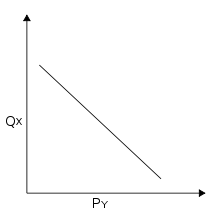

Two goods that complement each other show a negative cross elasticity of demand: as the price of good Y rises, the demand for good X falls |

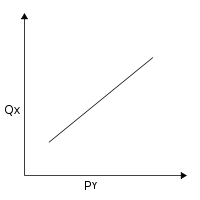

Two goods that are substitutes have a positive cross elasticity of demand: as the price of good Y rises, the demand for good X rises |

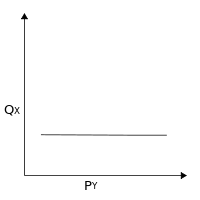

Two goods that are independent have a zero cross elasticity of demand: as the price of good Y rises, the demand for good X stays constant |

When goods are substitutable, the diversion ratio, which quantifies how much of the displaced demand for product j switches to product i, is measured by the ratio of the cross-elasticity to the own-elasticity multiplied by the ratio of product i's demand to product j's demand. In the discrete case, the diversion ratio is naturally interpreted as the fraction of product j demand which treats product i as a second choice,[1][2] measuring how much of the demand diverting from product j because of a price increase is diverted to product i can be written as the product of the ratio of the cross-elasticity to the own-elasticity and the ratio of the demand for product i to the demand for product j. In some cases, it has a natural interpretation as the proportion of people buying product j who would consider product i their "second choice".

Approximate estimates of the cross price elasticities of preference-independent bundles of goods (e.g. food and education, healthcare and clothing, etc.) can be calculated from the income elasticities of demand and market shares of individual bundles, using established models of demand based on a differential approach.[3]

Selected cross price elasticities of demand

Below are some examples of the cross-price elasticity of demand (XED) for various goods:[4]

| Good | Good with Price Change | XED |

|---|---|---|

| Butter | Margarine | +0.81 |

| Beef | Pork | +0.28 |

| Entertainment | Food | -0.72 |

See also

Notes

- Bordley, R., "Relating Elasticities to Changes in Demand", Journal of Business and Economic Statistics, Vol.3, No. 2, p.156-158 (1985), https://www.jstor.org/stable/1391869

- Capps, O. and Dharmasena, S., "Enhancing the Teaching of Product Substitutes/Complements: A Pedagogical Note on Diversion Ratios",Applied Economics Teaching Resources, Vol. 1, Issue 1, p.32-45, (2019), https://www.aaea.org/UserFiles/file/AETR_2019_001ProofFinal_v1.pdf

- Sabatelli L (2016) Relationship between the Uncompensated Price Elasticity and the Income Elasticity of Demand under Conditions of Additive Preferences. PLoS ONE11(3): e0151390. https://doi.org/10.1371/journal.pone.0151390

- Frank (2008) p.186.

References

- Frank, Robert (2008). Microeconomics and Behavior (7th ed.). McGraw-Hill. ISBN 978-0-07-126349-8.

External links

- Database for Commodity Elasticity at Food and Agricultural Policy Research Institute, University of Iowa