Child benefit

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adults. A number of different countries operate different versions of the program. In the majority of countries, child benefit is means-tested and the amount of child benefit paid is usually dependent on the number of children one has.

Conditions for payment

A number of conditional cash transfer programs in Latin America and Africa link payment to the receivers' actions, such as enrolling children into schools, and health check-ups and vaccinations.[1] In the UK, in 2011 CentreForum proposed an additional child benefit dependent on parenting activities.[2]

Australia

In Australia, Child benefit payments are currently called Family Tax Benefit. Family Tax Benefit is income tested and is linked to the Australian Income tax system. It can be claimed as fortnightly payments or as an annual lump sum. It may be payable for dependant children from birth up to the age of 24. Children 16 years or older may alternatively be eligible for Youth Allowance. Parents of dependant children under the age of 16 may also be eligible for Income Support Payments including Parenting Payment and Newstart Allowance for Primary Carers of Children.

On 1 July 2000 the Australian government introduced major changes to the tax system including the introduction of a broad-based Goods and Service Tax (a VAT), substantial income tax cuts, as well as major changes to assistance for families.

These changes to family assistance simplified payments, by amalgamating a number of different forms of assistance, and also provided higher levels of assistance, with reductions in income test withdrawal rates. The new structure combined twelve of the pre-existing types of assistance into three new programs of assistance. The two most important of these are Family Tax Benefit Part A, which assists with the general costs of raising children, and Family Tax Benefit Part B, which is directed to single income and sole parent families. The third programme is Child Care Benefit.

The Family Tax Benefit Part A is paid for dependent children up to 20 years of age, and for dependent full-time students up to the age of 24 (who are not getting Youth Allowance or similar payments such as ABSTUDY and Veterans' Children Education Supplement). It is essentially a two-tier but integrated payment directed to most families with children, with a higher rate for lower income families, including both those in work and receiving income support.

The maximum rate is paid up to a family income of $28,200, and is then reduced by 30 cents for every extra dollar of income, until the minimum rate is reached. Part-payment at the minimum rate is available up to a family income of $73,000 (plus an additional $3,000 for each dependent child after the first). Payments are then reduced by 30 cents in every dollar over that amount until the payment reaches nil.

To receive some Family Tax Benefit Part A, the maximum income levels are $76,256 a year for a family with one dependent child under 18 and $77,355 a year for a family with one dependent 18- to 24-year-old. These thresholds are lifted by $6,257 for each additional dependent child under 18 and $7,356 for each additional dependent 18- to 24-year-old.

Families receiving Family Tax Benefit Part A may also be eligible for extra payments, such as Rent Assistance if renting privately, the Large Family Supplement for four or more children, and Multiple Birth Allowance for three or more children born during the same birth.

Family Tax Benefit Part B provides extra assistance to single income families including sole parents - particularly families with children under 5 years of age. In a couple, if the secondary earner's income is above $1,616 a year, payments are reduced by 30 cents for every extra dollar of income. Parents receive therefore some Family Tax Benefit Part B if the secondary earner's income is below $10,416 a year if the youngest child is under 5 years of age, or $7,786 a year if the youngest child is between 5 and 18 years of age. There is no income test on the primary earner's income, so in the case of sole parents the payment is universal.

The previous entry referred to Youth allowance and Parenting Payment. These are income support payments for young people and for parents who are not employed and looking after children respectively.[3]

Canada

The Canada child benefit (CCB) is a tax-free monthly payment made to eligible families to help them with the cost of raising children under 18 years of age.[4] Basic benefit for July 2019 to June 2020 is calculated as:[5]

- 6,639 CAD per year (553.25 CAD per month) for each eligible child under the age of 6.

- 5,602 CAD per year (466.83 CAD per month) for each eligible child aged 6 to 17.

This amount is reduced for families with adjusted family net income (AFNI) over $31,120, based on AFNI and the number of children.

Finland

Child benefit scheme was introduced to Finland in 1948 by law. Since the 1920s there was a child benefit allowance that covered state workers with children. In 1948 this benefit became universal following the example of other Nordic countries. Benefit is paid for children until they turn 17, and it is only paid for children that live in Finland. There is also a supplement for single parents. Benefit is paid through national Finnish Social Insurance institution (KELA). The Åland Islands have a different scheme.

| 1. child | 100,40 €/month |

| 2. child | 110,94 €/month |

| 3. child | 141,56 €/month |

| 4. child | 162,15 €/month |

| following children | 182,73 €/month |

| Single parents supplement for every child 46,79 euros. | |

Hungary

In Hungary there are several forms of family support. Every person who has a work permit and lives permanently in Hungary is eligible for almost all of them.

Family allowance

One of them is called family allowance (Hungarian: családi pótlék) which is corresponding to the social program in other countries under the name child benefit. Its amount depends on the number of children. For families with one child it is 12,200 HUF, for families with two children 13,300 HUF and for families with three or more children it is 16,000 HUF per child per month. For single parents (parents who are raising their children alone) the amount of family allowance is 1,500 HUF more in the first and second categories and 1,000 HUF more in the third category. Family allowance is paid until the age of 18 or to the completion of secondary education.[6] For children with disability the amount is 23,300 HUF and for disabled children of single parents it is 25,900 HUF.[7]

Number of children Monthly amount for one parent in double parent household Monthly amount for single parent household 1 child 12,200 HUF (40.67 €) 13,700 HUF (45.67 €) 2 children 13,300 HUF (44.33 €) 14,800 HUF (49.33 €) 3 or more children 16,000 HUF (53.33 €) 17,000 HUF (56.67 €)

If the child misses more than 50 school hours without permission, the family allowance will be suspended until the child re-fulfills his/her school attendance obligation properly. In the case of pre-school age children, family allowance will be suspended in case of an unjustified absence exceeding 20 days of education.[8]

According to some sources the government plans to raise the child benefit. However, there has been no official declaration on the issue.[6]

Family tax benefit

The other one is called family tax benefit (Hungarian: családi adókedvezmény) which is a tax reduction for families according to the number of children living in the household. Its amount can be maximal 10,000 HUF for parents with one child, 15,000 HUF for parents with two children and 33,000 HUF for parents with three or more children per month. There are no differences between single and double households or between families with one or two parents employed.[9]

Number of children Monthly maximal tax saving for one parent 1 child 10,000 HUF (33.33 €) 2 children 15,000 HUF (50 €) 3 or more children 33,000 HUF (110 €)

People get family allowance and family tax benefit at the same time, so it is also common to count them together as a kind of child benefit.

Ireland

Child Benefit (Sochar Leanaí) is payable to parents of children under 16 years of age, or under 18 years of age if they are in full-time education, Youthreach training or has a disability. The payment is paid by the Department of Social Protection. The monthly payments are as follows:[10]

| Number of children | Monthly rate |

|---|---|

| Per child | €140.00 |

Multiple births are a special case. In the event of twins, 150% of the monthly payment is paid for each child. Triplets, or more, are paid the double (200%) rate each; provided that all of them remain qualified (i.e. stay in further education until 19). In addition, a special 'once-off' grant of €635 is paid on all multiple births. Further 'once-off' grants of €635 are paid when the children are 4 and 12 years old respectively.[10]

Fraudulent claims of Child Benefit are treated very seriously, and can result in large fines or prison for up to 3 years.[11]

Japan

Luxembourg

Family allowance

The Luxembourg Government, through the Caisse pour l'avenir des enfants (Children's Future Fund), pays €265 per month per child. The allowance is universal and is not means-tested.[12]

When a child turns 6 years old, the amount increases to €285 per month.

When a child turns 12 years old, the amount increases to €315 per month.

The family allowance is paid until the child turns 18, unless they continue in education, in which case it is paid until the adult child ceases being enrolled at an educational institution or turns 25 years old, whichever comes first.

Supplement for disabled children

The family allowance amount is increased by €200 per month for children who suffer from a permanent disability causing them to lose at least 50% of their physical or mental capacity in comparison to an able-bodied child of the same age.[13]

Back-to-school allowance

In addition to the family allowance, a lump-sum back-to-school allowance is paid once a year in August for every child enrolled at a primary or secondary school or college.[12]

The allowance is €115 every August per child over 6 years old and under 12 years old.

The allowance is €235 every August per child over 12 years old until their schooling comes to an end.

New Zealand

New Zealand has a tax rebate system known as 'Working For Families', which are allocated to families based on income and the number of children. A report in 2012 by the children's commissioner Dr Russell Wills recommended New Zealand adopt a universal child benefit, which the Government rejected.[14]

South Korea

From September 2018, any Korean family with a child aged between 0-5 receives 100,000 won per month in cash transferred to the parent's bank account from the Korean government. A temporary exception existed for the top 10% richest families until December 2018, who were excluded from this benefit[15] but since January 2019, all Korean families regardless of income or wealth receive a child benefit of 100,000 won per month per child in cash.

From September 2019, child benefit payment of 100,000 won per month per child expanded to cover children under 7, two years more than the previous 0-5 year bracket.

Sweden

After World War I, many countries were left with dwindling populations. In an attempt to solve this problem, Sweden began a program called "family allowance". These were government funds given to families with children to encourage them to bear more children and increase the birthrate.

Today, the guardians of all children aged 15 or younger, are awarded child benefits of 1250 Swedish kronor per month.[17]

The couple Alva and Gunnar Myrdal have played a very influential role in the Swedish society. Alva received the Nobel Peace Prize in 1982 and Gunnar received the Nobel Prize in Economics in 1974.[18] Their book "Kris i befolkningsfrågan" (Crisis in the Population Development") was published in 1934. It painted a very dark picture of Sweden. The growth of the population would turn negative and Sweden be filled with mostly elderly people. This book had an important influence and in 1937 child allowance was introduced for poor mothers.

In 1948 child allowance was extended to all families and was then SEK 260 per year or SEK 22 per child and month. The price of milk was then SEK 0.30 per litre so the value of the monthly allowance was 72 litres of milk per month. – Quite a significant contribution. Using the consumer price index, in 2010 the value would have been SEK 383 per month and child.

In 2001 the child allowance increases as the number of children increases. The number of children born per mother has decreased as well as the death rates in Sweden as can be seen from the figure below. Regarding the 1948 decision one woman was interviewed by the Swedish Radio, Mrs. Persson. She had 13 children and one had died. The journalist asked her what she would do with the money. Three of her children went to school and they needed clothes. Perhaps she would save some of the child allowance in case the children would study further. She would not use the money on luxury such as bicycles. She did not plan to spend any money on herself. One of the heads of the child allowance system was born in 1948 and he believes that there was very little corruption in the system.

United Kingdom

The minimum wage was introduced in Great Britain in 1909 for certain low-wage industries and expanded to numerous industries, including farm labour, by 1920. However, by the 1920s, family allowance targeted at low-income families was an alternative method, suggested by reformers, to relieve poverty without distorting the labour market.[19][20] The trade unions and the Labour Party adopted this view. In 1945, family allowances were introduced; minimum wages faded from view. Talk resumed in the 1970s, but in the 1980s the Thatcher ministry made it clear it would not accept a national minimum wage. Finally, with the return of Labour to power, the National Minimum Wage Act 1998 set a minimum wage of £3.60 per hour, with lower rates for younger workers. It largely affected workers in high-turnover service industries such as fast-food restaurants, and people from ethnic minority backgrounds.[21]

The system was first implemented in August 1946 as "family allowances" under the Family Allowances Act 1945, at a rate of 5s (= £0.25) per week per child in a family, except for the eldest. This was raised from September 1952, by the Family Allowances and National Insurance Act 1952, to 8s (= £0.40), and from October 1956, by the Family Allowances Act and National Insurance Act 1956, to 8s for the second child with 10s (= £0.50) for the third and subsequent children.

By 1955, some 5,000,000 allowances were being paid, to about 3,250,000 families.[22]

It was modified in 1977, with the payments being termed "child benefit" and given for the eldest child as well as the younger ones; by 1979 it was worth £4 per child per week. In 1991, the system was further altered, with a higher payment now given for the first child than for their younger siblings. In October 2010, the Conservative-Liberal Democrat coalition government announced that Child Benefit would be withdrawn from households containing a higher-rate taxpayer from January 2013.[23] After some controversy, this was amended so that any household with at least one person with prescribed income over £50,000 would lose Child Benefit by a taper which removed it altogether when the income reached £60,000. This came into force on 7 January 2013.[24]

Today, child benefit is administered by Her Majesty's Revenue and Customs (HMRC). As of April 2015, this is £20.70 per week for the first child (including the eldest of a multiple birth) and £13.70 per week for each additional child.[25]

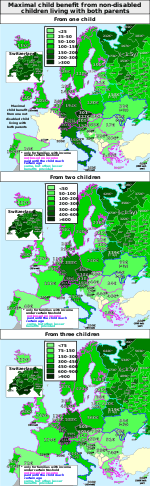

Comparison in Europe

[lower-roman 1] [lower-roman 2] [lower-roman 3] [lower-roman 4]

| 1 child | €77.05 | Each child age 0 - 3 | €145 | 1 child | €194[26] | ||

| 2 children | €219.63 | Each child age 3 - 7 | €131 | 2 children | €388 | ||

| 3 children | €432.50 | Each child age 7 - 18 | €103 | 3 children | €588 | ||

| Each additional child | €212.87 | Each additional child | €225 | ||||

| 1 child | €5.87 | 1 child | - | 1 child | €140 | ||

| 2 children | €18 | 2 children | €120.32 | 2 children | €280 | ||

| 3 children | €40 | 3 children | €274.47 | 3 children | €420 | ||

| 4 children | €48 | 4 children | €428.62 | Multiplier for twins | × 1.5 | ||

| Each additional child | €8.07 | 5 children | €582.77 | Multiplier for triplets and quadruplets | × 2 | ||

| Each additional child | €154.15 | ||||||

| 1 child (married parents) | €115.25 | Annual income of parents up to €11,422.98 | €250.48 | Each child aged under 6 | €265 | ||

| 2 or more children (married parents) | €137.17 | Annual income between €27,693.04 and €30,403.39 | €38.73 | Each child aged 6–11 | €285 | ||

| 1 child (single parent) | €191.92 | Annual income above €43,962.05 | No more payments | Each child aged 12 or over | €315 | ||

| 2 or more children (single parent) | €196.83 | ||||||

| Children under 6 years | €58.11 | Each child under 18 years | NOK 1054 (€105)[27] | First child aged under 3 | €105.40 | ||

| Children aged 6–11 | €70.57 | First child aged 3-9 | €112.70 | ||||

| Children aged 12–17 | €82.02 | First child aged 10-18 | €130.90 | ||||

| First child aged 19 or older | €152.70 | ||||||

| Second child | €12.80 | ||||||

| Each additional child | €25.50 | ||||||

| First child | €100 | 1 child | SEK 1,250 (€118) | First child under 16 | £82 (€105) | ||

| Second child | €110.50 | 2 children | SEK 2,650 (€249) | Other children under 16 | £54.20 (€70) | ||

| Third child | €131 | 3 children | SEK 4,480 (€421) | ||||

| Additional children | €151.50 | 4 children | SEK 6,740 (€634) | ||||

| 5 children | SEK 9,240 (€869) | ||||||

| 6 children | SEK 11,740 (€1104) | ||||||

| 1 child | CHF 260 (€215) | Children under 18 (not-disabled) | €24.25 | Child supplement per child (under 16) | CHF 200 to CHF 400 (€165 to €330) | ||

| Twins, or over 3 children | CHF 310 (€260) | Children under 18 (disabled) | €48.47 | Education supplement per child (aged 16 – 25) | CHF 250 to CHF 525 (€210 to €440) | ||

| Each child aged 10 or older | CHF 310 (€260) | Children under 18 (disability >75 %) | €381.19 | ||||

| Children under 18 (disability >65 %) | €260.79 | ||||||

| Children under 18 | PLN 500 (€120) | ||||||

- The following numbers cannot be compared directly because of different preconditions and taxation systems.

- The purpose of child benefits in Germany is to ensure that the subsistence level for a child is not taxed as required by the constitution. Therefore, child benefits are comparably high. When the taxes on the subsistence levels are deducted, an average of 50 euros per child remains, depending on the parent's income and taxation level. For low-level incomes, savings are highest; the level out around a taxable income of around 70,000 euros when there are 3 children.

- Belgium has supplements depending on the social status of a parent (retired, unemployed, invalid). Parents receive benefits until the child reaches the age of 25, as long as the child is enrolled in higher education.

- Amount depends on Canton and number of children.

See also

- Baby Bonus

- Human overpopulation

- Parental Leave

- Tax on childlessness

- Taxation in the United Kingdom

- UK labour law

- Cost of raising a child

- Elterngeld

- Child tax credit

Notes

References

- "Conditional Cash tr Ansfers" (PDF). The World Bank. Retrieved October 13, 2013.

- Chris Paterson. "Parenting matters: early years and social mobility" (PDF). www.centreforum.org. Archived from the original (PDF) on May 3, 2012. Retrieved October 13, 2013.

- "Centrelink website". www.humanservices.gov.au. Archived from the original on October 13, 2013. Retrieved October 13, 2013.

- "Canada child benefit - Overview". Canada Revenue Agency. Retrieved July 3, 2019.

- "Canada child benefit - How we calculate your CCB". Canada Revenue Agency. Retrieved July 3, 2019.

- napi.hu Zsolt Papp, Júlia Barabás - Drasztikus családi pótlék-emelés jön? (14 September 2016)

- officina.hu Családi pótlék 2017/2018 összege,...

- "csalad.hu Ministry of Human Resources of Hungary". Archived from the original on 2017-10-16. Retrieved 2017-10-15.

- officina.hu Családi adókedvezmény összege,...

- "Child Benefit". Citizens Information. Archived from the original on 10 May 2010. Retrieved 24 December 2016.

- "Child Benefit". Welfare.ie. Retrieved 2018-09-10.

- "Applying for family allowance". Retrieved 2018-10-30.

- "Applying for the supplementary allowance for disabled children". Retrieved 2018-10-30.

- "Report calls for universal child payment". 3 News NZ. December 11, 2012. Archived from the original on January 29, 2013. Retrieved December 10, 2012.

- http://mbn.mk.co.kr/pages/news/newsView.php?ref=newsstand&news_seq_no=3464547&pos=20002_7

- "Child allowance". Retrieved February 23, 2018.

- sv:Kris i befolkningsfrågan

- Jane Lewis, "The English Movement for Family Allowances, 1917-1945." Histoire sociale/Social History 11.22 (1978) pp 441-459.

- John Macnicol, Movement for Family Allowances, 1918-45: A Study in Social Policy Development (1980).

- Pat Thane, Cassell's Companion to Twentieth Century Britain (2002) pp 267-68.

- Whitaker's Almanack: for the year 1958, p. 1127. J. Whitaker & Sons, London, 1957

- "Spending Review, October 2010, United Kingdom HM Treasury, Oct 2010. Archived 2010-11-22 at the Wayback Machine

- "HMRC High Income Child Benefit charge

- "Tax and tax credit rates and thresholds for 2015-16". gov.uk. Retrieved 2018-09-10.

- http://www.finanztip.de/kindergeld/

- Barnbidrag - Försäkringskassen