TED spread

The TED spread is the difference between the interest rates on interbank loans and on short-term U.S. government debt ("T-bills"). TED is an acronym formed from T-Bill and ED, the ticker symbol for the Eurodollar futures contract.

Initially, the TED spread was the difference between the interest rates for three-month U.S. Treasuries contracts and the three-month Eurodollars contract as represented by the London Interbank Offered Rate (LIBOR). However, since the Chicago Mercantile Exchange dropped T-bill futures after the 1987 crash,[1] the TED spread is now calculated as the difference between the three-month LIBOR and the three-month T-bill interest rate.

Formula and reading

The size of the spread is usually denominated in basis points (bps). For example, if the T-bill rate is 5.10% and ED trades at 5.50%, the TED spread is 40 bps. The TED spread fluctuates over time but generally has remained within the range of 10 and 50 bps (0.1% and 0.5%) except in times of financial crisis. A rising TED spread often presages a downturn in the U.S. stock market, as it indicates that liquidity is being withdrawn.

Indicator

The TED spread is an indicator of perceived credit risk in the general economy,[2] since T-bills are considered risk-free while LIBOR reflects the credit risk of lending to commercial banks. An increase in the TED spread is a sign that lenders believe the risk of default on interbank loans (also known as counterparty risk) is increasing. Interbank lenders, therefore, demand a higher rate of interest, or accept lower returns on safe investments such as T-bills. When the risk of bank defaults is considered to be decreasing, the TED spread decreases.[3] Boudt, Paulus, and Rosenthal show that a TED spread above 48 basis points is indicative of economic crisis.[4]

Historical levels

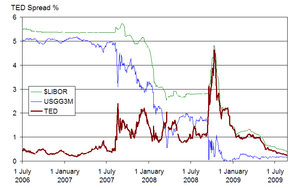

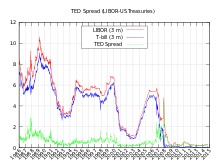

Highs

The long-term average of the TED spread has been 30 basis points with a maximum of 50 bps. During 2007, the subprime mortgage crisis ballooned the TED spread to a region of 150–200 bps. On September 17, 2008, the TED spread exceeded 300 bps, breaking the previous record set after the Black Monday crash of 1987.[5] Some higher readings for the spread were due to inability to obtain accurate LIBOR rates in the absence of a liquid unsecured lending market.[6] On October 10, 2008, the TED spread reached another new high of 457 basis points.

Lows

In October 2013, due to worries regarding a potential default on US debt, the 1-month TED went negative for the first time since it started being tracked.[7][8]

See also

- LIBOR-OIS spread

- Overnight indexed swap

- Treasury Bill

- Treasury security

References

- http://www.atimes.com/atimes/Global_Economy/LK25Dj01.html

- Bloomberg.com Financial Glossary

- Mission not accomplished not yet, anyway - Paul Krugman - Op-Ed Columnist - New York Times Blog

- Boudt, K.; Paulus, E.; Rosenthal, D.W.R. (2017). "Funding liquidity, market liquidity and TED spread: A two-regime model". Journal of Empirical Finance. 43: 143–158. doi:10.1016/j.jempfin.2017.06.002. hdl:10419/144456.

- Financial Times. (2008). Panic grips credit markets

- Bloomberg - Libor Jumps as Banks Seek Cash to Shore Up Finances

- Obama Says Real Boss in Default Showdown Means Bonds Call Shots, Bloomberg.com, 11 October 2013

- UBS Asset Management Taps Derivatives to Hedge U.S. Debt Risk, Bloomberg.com, 10 October 2013

External links

- Current TED Spread Quote from StockCharts.com

- Betting the Bank

- Understanding the TED spread from the Econbrowser blog