Moneytree

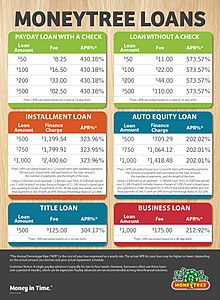

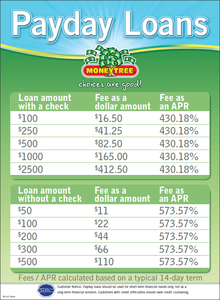

Moneytree, Inc. is a retail financial services provider headquartered in Tukwila, Washington, with branches in Washington, California, Colorado, Idaho, Nevada, and British Columbia. Moneytree offers payday loans, installment loans, prepaid debit cards, money orders, bill payment, Western Union transfers, auto equity and title loans. In 2013, Moneytree won "Best Place to Work in Colorado" in the small business category.[3]

| |

| Private | |

| Industry | Financial services |

| Founded | October 31, 1983 |

| Headquarters | Tukwila, Washington, United States |

Number of locations | 121 stores |

Area served | United States |

Key people | Dennis Bassford (CEO) |

| Services | Financing |

Number of employees | 980 (2013) |

| Website | www |

| Footnotes / references [1][2] | |

Origins

Moneytree first opened on October 31st, 1983 in Renton, Washington as a check cashing store. Over the years, the business expanded its product lines to what it offers today. Dennis Bassford, an Idaho native and Boise State University alum, has been the CEO and owner since the inception, along with his brother David and his wife Sara.

Regulation

As a retail financial provider, Moneytree is subject to laws as defined by the Consumer Financial Protection Bureau (CFPB) as well as applicable state and local laws.

Washington RCW 31.45

In 2009, Washington passed stringent reforms on payday lending in the state. The law, as defined in as RCW 31.45, regulates short-term high interest loans. Before the reforms were passed, the industry was worth $1.3 billion per year operating out of 603 locations across Washington state. After the reforms, those numbers had dropped to 173 locations generating $331 million by 2014.[4][5]

In response, Moneytree and its executives pledged more than $200,000 in political contributions in the 2010 election cycle with well over half coming directly from CEO and Owner Dennis Bassford, Vice President David Bassford, and his wife Sara.[6][7]

In 2013, Moneytree hired Sound View Strategies, a well-connected Democratic public-affairs firm, to work with lobbyists to create SB-5312, a bill that proposed raising the maximum amount a borrower can take out at one time to $1,500.[8][9] According to documents sourced by the Seattle Times, Sound View Strategies was retained for an $8,000-a-month “lobbyist’s fee" with a $15,000 “wrapping up fee” if the legislation was approved by March 5.[10] The bill made it through the Senate, but was unable to make it through the House before expiring at the April 19th deadline.[11]

In 2015, a bill sponsored by Rep. Larry Springer and Sen. Marko Liias -- both of whom had previously received donations from Moneytree[4] -- proposed installing a “small consumer installment loan” system that would allow lenders to offer 6-month to 12-month loans with effective interest rates up to 213 percent.[4] The bill, known as HB-1922, stalled in committee and never made it into law.[12][13]

Oregon Chapter 725A

In 2007, Oregon made Chapter 725 — Consumer Finance into law. These changes capped interest rates at 36% as well as placed other restrictions on businesses like Moneytree that operated within the state.[14] As a result, Moneytree withdrew from the Oregon market, and as of 2020, there are only seven licensed payday lenders in Oregon.[15]

Colorado Proposition 111

In 2018, Colorado voters passed Proposition 111 by a margin of 77% to 22%.[16] It stipulated that all loans must be repayable over an extended period of time (longer than two weeks) and capped their interest rates, effectively eliminating payday loans. As a result, Moneytree began offering installment loans which can be paid back over six months.

Nevada SB201

On February 18, 2019, the Nevada state legislature introduced SB201, a bill that codified provisions of the federal Military Lending Act and requires the Commissioner of Financial Institutions to "develop, implement and maintain a database storing certain information relating to deferred deposit loans, title loans and high-interest loans made to customers in this State." [17]

In introducing the bill, Sen. Yvanna Cancela cited a 2018 audit of the state’s Division of Financial Institutions which found nearly one in three high-interest lenders in the state of Nevada failed compliance reviews during the previous five years; it's unclear whether Moneytree accounted for any of these incidents.[18] The audit suggested to Sen. Cancela that a loan tracking database would have “significant value to the Division, its licensees, and Legislators.”

Lobbyists for retail financial providers, including Moneytree, claimed that the proposed law "unfairly targeted and that the measure could lead to more “underground” and non-regulated short-term loans." Despite this, the Nevada State Senate voted to approve the bill on April 19th, 2019.[19] The database solution was supposed to be in place by March of 2020, but the creation and provision of resources was delayed by the COVID-19 pandemic.[20]

Controversy

Criticism of the company and their practices are commonly based on the claim that Moneytree creates a "debt trap" that encourages irresponsible borrowing.[21][22] Bassford has stated that Moneytree's products are not predatory in nature, but instead that "for the most part, they are [a] responsible business" and "there are people who misuse all kinds of products in society."[23] The company also claims to promote financial literacy for customers, with Bassford saying he sponsors a group of students at the University of Washington who "deliver financial literacy in schools" though he could not recall any specific programs. Asked whether he works to improve financial education among potential clients, he said, "We're not conducting programs with our customers."[24]

In 2010, Moneytree was accused of "skirting" consumer laws which prohibit borrowers from taking out more than eight payday loans in a 12-month period. When pressed by the Kitsap Sun, Moneytree CEO Dennis Bassford responded by saying that Moneytree and Washington State Department of Financial Institutions “just interpret[ed] the statute differently.”[25]

In March of 2016, Moneytree fell victim to a CEO Email scam. A scammer impersonating Bassford send an email to the payroll department requesting names, home addresses, social security numbers, birthdates and W2 information of employees.[26] In a letter to employees detailing the breach, Bassford said the following:

"Unfortunately, this request was not recognized as a scam, and the information about current and former Team Members who worked in the US at Moneytree in 2015 or were hired in early 2016 was disclosed. The good news is that our servers and security systems were not breached, and our millions of customer records were not affected. The bad news is that our Team Members’ information has been compromised."[26]

In 2016, the Consumer Financial Protection Bureau fined Moneytree $505,000 for deceptive advertising and collections practices.[27] The fine consisted of a consumer refund of $255,000, and a civil penalty of $250,000.[28] The CFBP alleged that Moneytree broke the law twice: in 2014 and 2015, Moneytree sent out mailers that threatened to repossess the cars and trucks of 490 customers who were delinquent on loans. The next year, in March of 2015, Moneytree left a percent sign off of an advertisement for their check cashing services in what the CFBP called "misleading," though Moneytree insisted it was an isolated incident and purely accidental.[5]

Impact of COVID-19

In 2020, during the COVID-19 pandemic, Dennis Bassford stated in an interview that the company was facing dire straits. He told KUOW, Seattle's public radio affiliate, that business had decreased by 75% saying "We laid off 160 people this week. I laid off 35 people at the end of March. I’m closing over 20 stores."[29]

See also

References

- "BBB Business Review: Contact Information". BBB. Retrieved 8 February 2012.

- Myke, Folger (July 2009). "Treating Them Right". Seattle Business Magazine. Retrieved 8 February 2012.

- "Best Companies to Work for 2013"

- "The Payday Loan Rule Changes That Only Payday Lenders Want". The Stranger. 2016-12-21. Retrieved 2020-07-18.

- "Payday lender Moneytree hit with $500,000 in fines and refunds". The Seattle Times. 2016-12-21. Retrieved 2020-07-18.

- Corbit, Fred (2013-01-08). "Op-ed: Payday-lending law works in Washington state". The Seattle Times. Retrieved 2020-07-18.

- "Campaign Finance Records - CampaignMoney.com".

- "Washington State Legislature". apps.leg.wa.gov. Retrieved 2020-07-18.

- "Moneytree asks Washington state legislators for new payday-lending product". www.bizjournals.com. Retrieved 2020-07-18.

- "Moneytree leads push to loosen state's payday-lending law". The Seattle Times. 2015-03-03. Retrieved 2020-07-18.

- "Legislative bill favoring payday lender MoneyTree runs out of time in Olympia". www.bizjournals.com. Retrieved 2020-07-18.

- "Washington State Legislature". app.leg.wa.gov. Retrieved 2020-07-18.

- "Washington State Legislature". app.leg.wa.gov. Retrieved 2020-07-18.

- "Chapter 725 — Consumer Finance". www.oregonlegislature.gov. Retrieved 2020-07-18.

- "Division of Financial Regulation : Licensed payday and title lenders : Payday loans : State of Oregon". dfr.oregon.gov. Retrieved 2020-07-18.

- "Colorado Proposition 111, Limits on Payday Loan Charges Initiative (2018)". Ballotpedia. Retrieved 2020-07-18.

- "SB201 Overview". www.leg.state.nv.us. Retrieved 2020-07-18.

- "Payday lending opponents, industry clash in charged hearing over loan database". thenevadaindependent.com. Retrieved 2020-07-18.

- "Lawmakers pass bills for payday loan database, animal-tested cosmetics ban, school vaccine reporting". thenevadaindependent.com. Retrieved 2020-07-18.

- "Technical issues cause cancellation of payday lending database meeting". thenevadaindependent.com. Retrieved 2020-07-18.

- ogosenseadmin (2018-04-05). "Stop the Debt Trap: Preserve the Consumer Financial Protection Bureau's Payday Loan Rule". National Consumer Law Center. Retrieved 2020-07-18.

- www.bizjournals.com https://www.bizjournals.com/seattle/blog/2013/02/moneytree-asks-for-law-change-to-allow.html. Retrieved 2020-07-22. Missing or empty

|title=(help) - "Meet Payday Lender Dennis "Shell Game" Bassford of MoneyTree, Inc". Payday Lending Facts. 2016-06-21. Retrieved 2020-07-18.

- Valdez, Angela. "The Color of Money". The Stranger. Retrieved 2020-07-18.

- "State accuses Moneytree of skirting new law". The Columbian. Retrieved 2020-07-18.

- "Thieves Phish Moneytree Employee Tax Data — Krebs on Security". Retrieved 2020-07-18.

- Hayashi, Yuka (2016-12-16). "CFPB Fines Payday Lender Moneytree for Deceptive Advertising, Collection Practices". Wall Street Journal. ISSN 0099-9660. Retrieved 2020-05-04.

- "CFPB Takes Action Against Moneytree for Deceptive Advertising and Collection Practices". Consumer Financial Protection Bureau. Retrieved 2020-05-04.

- "Payday lending falls off a cliff as pandemic continues in Washington state". www.kuow.org. 2020-06-01. Retrieved 2020-07-18.