Laurentian Bank of Canada

The Laurentian Bank of Canada (LBC) (French: Banque Laurentienne du Canada) is a Schedule 1 bank that operates primarily in the province of Quebec, with commercial and business banking offices located in Ontario, Alberta, British Columbia, and Nova Scotia.[3] LBC's Institution Number (or bank number) is 039.

| |

| Public | |

| Traded as | TSX: LB |

| ISIN | CA51925D1069 |

| Industry | Chartered Banks |

| Founded | 1846 |

| Founder | Ignace Bourget |

| Headquarters | |

Area served | Canada |

Key people | François Desjardins (President & CEO) |

| Products | Personal and commercial banking products; brokerage |

| Services | Banking and brokerage |

| Revenue | |

Number of employees | 3,600 (2016) [2] |

| Divisions | Laurentian Bank of Canada, B2B Bank, Laurentian Bank Securities, LBC Capital, LBC Financial Services |

| Website | www.laurentianbank.ca |

History

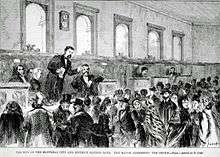

LBC's history began in 1846 with the founding of the Banque d'Épargne de la Cité et du District de Montréal, or Montreal City and District Savings Bank, by Monseigneur Ignace Bourget and a group of 15 prominent people from Montreal, Quebec. The bank’s 60 honorary directors included Louis-Hippolyte Lafontaine, Louis-Joseph Papineau, and Sir George-Étienne Cartier.[4]

In 1965, the bank listed its shares on the Montreal Stock Exchange. In 1980, the Montreal City and District Savings Bank obtained the right to expand its operations throughout Canada. This expansion led to the institution listing its shares on the Toronto Stock Exchange three years later, and in 1987, the bank was renamed Laurentian Bank of Canada.

In 1974, the bank installed an ATM system called "Bancaide". Primitive by the standards of the following decade, the nonetheless revolutionary machine dispensed cash 24 hours a day.[5]

In 1988, after more than a century (1871–1988) at 176 Saint-Jacques Street, the institution's head office moved to McGill College Avenue in Montreal.

In 1993, the bank acquired General Trust Corporation and purchased most of the Société Nationale de Fiducie’s assets from the brokerage firm BLC Rousseau, thus creating Laurentian Bank Securities (LBS).

In 2000, it acquired all Sun Life Trust Company stock in a transaction that resulted in the creation of the new B2B Trust subsidiary, now known as B2B Bank.

In 2016, the bank relocated all of its Montreal offices, including its headquarters on McGill College Avenue, into a single building on 1360 Rene Levesque Boulevard West in Montreal.[1]

Mergers and acquisitions

The bank merged with Eaton Trust Company (in 1988), purchased Standard Trust's assets (1991), acquired La Financière Coopérants Prêts-Épargne Inc., and Guardian Trust Company in Ontario (1992), acquired General Trust Corporation in Ontario, and purchased some Société Nationale de Fiducie assets and the brokerage firm BLC Rousseau (1993).

In 1993, the Desjardins-Laurentian Financial Corporation became the new majority shareholder of Laurentian Bank of Canada, following the merging of the Laurentian Group Corporation with the Desjardins Group. The bank purchased the Manulife Bank of Canada’s banking service network and the assets of Prenor Trust Company of Canada in 1994.

In 1995, the bank acquired 30 branches of the North American Trust Company.

In 1996, one of its subsidiaries acquired the parent corporation of Trust Prêt et Revenu du Canada. A few months later, the withdrawal of its main shareholder, Desjardins-Laurentian Financial Corporation, prompted the Laurentian Bank to become a Schedule 1 Bank under the Bank Act, on par with all the other large Canadian banks.

Membership

LBC is a member of the Canadian Bankers Association (CBA) and registered member with the Canada Deposit Insurance Corporation (CDIC), a federal agency insuring deposits at all of Canada's chartered banks. It is also a member of Interac.

Executive Committee

In November 2015, François Desjardins took the Bank's reins, becoming the institution's 27th President and Chief Executive Officer, succeeding Réjean Robitaille.[6][7]

The members of the executive committee are:

- François Desjardins – President and Chief Executive Officer

- François Laurin – Executive Vice President, Chief Financial Officer

- Susan Kudzman – Executive Vice President, Chief Risk Officer and Corporate Affairs

- Deborah Rose – President and Chief Executive Officer of B2B Bank, Executive Vice President, Intermediary Banking and Chief Information Officer, Laurentian Bank

- Stéphane Therrien – Executive Vice President, Personal & Commercial Banking and President & CEO of LBC Financial Services

- Michel C. Trudeau – President and Chief Executive Officer, Laurentian Bank Securities and Executive Vice President, Capital Markets, Laurentian Bank

Board of directors

- Isabelle Courville – Chairman of the Board

- Lise Bastarache – Member of the Audit Committee

- Sonia Baxendale – Member of the Audit Committee

- Richard Bélanger, FCPA, FCA – Member of the Human Resources and Corporate Governance Committee

- Michael T. Boychuk, FCPA, FCA – Chair of the Audit Committee and member of the Risk Management Committee

- Gordon Campbell, Member of the Audit Committee

- François Desjardins –President and Chief Executive Officer of the Bank

- Michel Labonté – Chair of the Risk Management Committee and member of the Human Resources and Corporate Governance Committee

- A. Michel Lavigne, FCPA, FCA – Member of the Human Resources and Corporate Governance Committee

- Michelle R. Savoy– Chair of the Human Resources and Corporate Governance Committee

- Susan Wolburgh Jenah – Member of the Risk Management Committee[8]

See also

- List of banks in Canada

References

- "Laurentian Bank of Canada relocates its Montreal offices and takes up residence at 1360 ReneLevesque Boulevard West" (PDF). Laurentian Bank of Canada. 8 August 2016. Retrieved 2 December 2019.

- Inc., SedNove. "BLC – Your bank". www.banquelaurentienne.ca. Retrieved 23 April 2018.

- https://www.laurentianbank.ca/pdf/LBC_2015_Annual_Report_1_.pdf

- Inc., SedNove. "BLC – Your bank". www.laurentianbank.ca. Retrieved 2016-07-28.

- https://www.laurentianbank.ca/en/about_lbc/my_bank/our_history.html

- Inc., SedNove. "BLC – Your bank". www.banquelaurentienne.ca. Retrieved 23 April 2018.

- https://www.banquelaurentienne.ca/en/about_lbc/my_investment/direction.html

- https://www.banquelaurentienne.ca/en/about_lbc/my_investment/membre_ca.html