China and the World Bank

China originally joined the World Bank Group(WBG) on December 27, 1945.[1] However, after the Chinese Civil War, the World Bank recognized the Republic of China as its member, until the relationship ended in 1980, when the membership was replaced by the People's Republic of China.[2] The People's Republic of China (PRC) did not become involved with the World Bank group until 1980, when it first joined the World Bank in April due to the market reforms known as reform and opening-up.[3] Prior to the economic reform and its relation with the World Bank, according to CRS, "China maintained policies that kept the economy very poor, stagnant, centrally controlled, vastly inefficient, and relatively isolated from the global economy"[4] Since its entry into the World Bank, China has transformed into a market-based economy and has experienced rapid economic and social development.[3] Currently, although China has become the world's second largest economy with 1.4 billion population, it still has a close relationship with the World Bank in areas such as poverty, environmental protection and new challenges from the reform.[3]

History

China Joining the World Bank

The partnership between China and the World Bank began in April 1980 when Deng Xiaoping first met the then president of the World Bank Robert McNamara, since then the World Bank has began its dedication in assisting China's economic development.[5] The World Bank served as a catalytic role in kick-starting China's economic development[6], when the country initially received approval of its first project loan in 1981.[7] These projects have primarily focused on financing technical assistance such as pension reform, urban housing reform, energy market reform, environmental protection, labor market development, social safety net development, interest rate liberalization and external trade liberalization.[8] Also as important, the technical assistant from the World Bank in areas such as how to appraise and implement priority projects, how to encourage innovation and introduce new technologies, and how to develop institutions and policy instruments needed for good economic management.[5] Since then, China has become one of the largest borrower of loans and recipient of technical assistant from the World Bank.

Relationship with the World Bank

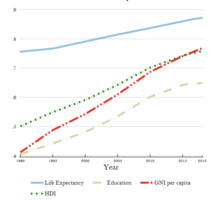

Initially, China was a recipient of International Development Association (IDA), the Bank’s low-income country arm, and received up to $9.95 billion in concessional loans until 1999. Later when China was categorized as middle-income country, it switched to International Bank for Reconstruction and Development (IBRD) as its main borrower, and had borrowed $39.8 billion until 2011.[2] Currently China is categorized as an upper-middle-income country, and work with the World Bank mainly for funding small-scale projects. According to World Bank Group’s Country Partnership Strategy, the bank's activity is classified under five pillars: "integrating China in the world economy; reducing poverty, inequality, and social exclusion; managing resource scarcity and environmental challenges; financing sustained and efficient growth; and improving public and market institutions"[2] Since the beginning of relation, there has been many success in development over 30 years, which includes economic performance since the market reforms of 1979, urbanization, social developments, and education & health services. [8]

China has also been increasing its involvement in the World Bank's administration and contribution to the bank. As China grows in its economic power, it overtook large European nations in voting power at IBRD in 2010, with a jumping increase from 2.77% to 4.42%. [9] In the end of 2019, China holds 5.05% of total votes in IBRD, behind United States (16.37%) and Japan (8.21%), while having more voting power than Germany (4.3%), UK (4%), France (4%), and India (3.11%).[10] As of 2019, China has 2 out of 32 management members on the World Bank leadership.[11] Financially, in 2016, China approved its first SDR bond issuer to IBRD by People's Bank of China, to serve its increasing involvement in international finances.[12]

Project in China

From 1999 to 2011, China borrowed near $40 billion from the IBRD. Up until December 2019, there is a total of 97 ongoing projects in China by World Bank, with $12 billion committed amount of funding.[13] Among them are primarily projects regarding to transportation, public administration, water sanitation&waste, agriculture, industry&trade, and energy&extractives.[13] Within the World Bank Group, China is one of the largest loan-taking country. From 2016 to 2018, China was the second largest borrower with $6.19 billion in loans, a number less than India ($8.05 billion) and more than Egypt ($5.23 billion).[14] As China's development solidifies, the World Bank has since shifted its objectives, and focusing on involvements that would support greener growth and sustainable energy, promote more inclusive development in all regions, and advance mutually beneficial relations with the world. [15]

IDA (International Development Association)

In 1981, IDA provided $200 million as its first loan to China for higher education, since then IDA has involved with a catalytic role in China's modernization.[16] By 2007, China was becoming a contributing partner by providing finance and policy input through the replenishment process.[16] China has graduated from IDA in the fiscal year of 1999[17], and as September 2019, China shares a 2.25% of IDA votes for its increasing role in the IDA finance contribution and technical assistant.[18]

IFC (International Finance Corporation)

Since its first investment in 1985, the International Finance Corporation (IFC) has invested and activated over $13.4 billion to support over 390 projects across 30 provinces[15], in which as of July 2017, IFC has committed $3.6 billion in China's portfolio.[19] IFC invest and mobilize capital for private sector projects which supports sustainable economic development in China , particularly those that help mitigate climate change, promotes balanced rural-urban development, and promote sustainable investments in emerging markets.[15]

MIGA (Multilateral Investment Guarantee Agency)

Created in 1988, MIGA encourages foreign direct investment in developing nations by providing political risk insurance to foreign investors and lenders, while also provides strategies for countries to attract and retain foreign direct investments.[15] Since 2000s, MIGA has been providing guarantees for investments into China, particularly for projects that involve sub-sovereign risk, such as water and waste.[15] Meanwhile, MIGA also supports its Chinese partners with their outward investments abroad, including both private lenders and governmental administration. [15]

Involvement and Controversies

China's involvement in international Finance

In 2012 at the fourth BRICS summit, the leaders of Brazil, Russia, India, China and South Africa considered the possibility of setting up a new Development Bank to mobilize resources for infrastructure and sustainable development projects in BRICS and other emerging economies, as well as in developing countries. In 2016, the New Development Bank (NDB) has become fully operational, and has approved loans involving financial assistance of over $3.4 billion for projects in the areas of green and renewable energy, transportation, water sanitation, irrigation and other areas.[20]

In 2016 China projected Asian Infrastructure Investment Bank (AIIB) as a "multilateral development bank with a mission to improve social and economic outcomes in Asia".[21] As of 2019, it has over 100 members, a co-financing framework with the World Bank and partnership with ADB, ADF, ADB, EDB, EBRD, EIB, IADB, IAIC, IsDBG, and NDB.[22]

In 2013, China proposed the Belt and Road Initiative, a transcontinental development project that includes 1/3 of world trade and GDP and over 60% of the world's population. According to World Bank, the string of infrastructure investment could "lift 32 million people out of moderate poverty conditions if implemented fully". However, as the World Bank report suggest, the cost of project might out-weight the economic benefits, while there has been a lack of transparency.[23]

Controversies of World Bank Projects

One highly controversial World Bank Project was the Gansu and Inner Mongolia Poverty Reduction Project in 1999, which included a 40-meter dam that was projected to displace around 60,000 inhabitants within Qinghai Province. This led to the World Bank ruling to withdraw funding for this section of the project to stop this controversial debate.[2] In the year 2000, the World Bank also stopped the China Western Poverty Reduction project that was originally going to resettle over 58,000 Chinese farmers into Tibet. After reports were released by inspection panel, the project was forced to be withdrawn because reports indicated that the World Bank violated social and environmental policies.[24]

References

- "Member Countries". World Bank. Retrieved 2019-12-10.

- "China and the World Bank - Bretton Woods Project". Bretton Woods Project. 2011-09-14. Retrieved 2017-06-06.

- "Overview". World Bank. Retrieved 2019-12-10.

- Wayne M, Morrison (June 2019). "China's Economic Rise: History, Trends, Challenges, and Implications for the United States" (PDF). Congressional Research Service.

- "Op-ed: A Constructive Role with China". World Bank. Retrieved 2019-12-02.

- "China and World Bank: 30 Years of Partnership". World Bank. Retrieved 2019-12-02.

- Economy, Elizabeth (1999). China Joins the World: Progress and Prospects. Council on Foreign Relations. pp. 208–210.

- Bank, The World (2012-11-11). "China - Country partnership strategy for the period FY13-FY16": 1–109. Cite journal requires

|journal=(help) - "China gains clout in World Bank vote shift". Reuters. 2010-04-25. Retrieved 2019-12-02.

- "Top 8 countries voting power | World Bank Group Finances". WBG Finances. Retrieved 2019-12-02.

- "World Bank Group Leadership". World Bank. Retrieved 2019-12-11.

- "World Bank Approved as the First SDR Bond Issuer in China". World Bank. Retrieved 2019-12-02.

- "World Bank Maps". maps.worldbank.org. Retrieved 2019-12-02.

- "Flush With Cash, China Continues to Borrow Billions From The World Bank". NPR.org. Retrieved 2019-12-11.

- "World Bank Group in China 1980-2018: Facts & Figures (pdf)" (PDF).

- Bassani, Antonella (July 2012). "The Evolving Roles of China and IDA in the Global Development System" (PDF). World Bank.

- "IDA Graduates". International Development Association - World Bank. 2016-03-28. Retrieved 2019-12-11.

- "WBG Finances - Country Details - China". financesapp.worldbank.org. Retrieved 2019-12-11.

- "IFC in China". www.ifc.org. Retrieved 2019-12-02.

- "History". New Development Bank. Retrieved 2019-12-11.

- "About AIIB Overview - AIIB". www.aiib.org. Retrieved 2019-12-11.

- "Partnerships - AIIB". www.aiib.org. Retrieved 2019-12-11.

- "World Bank: China's Belt and Road can speed development, needs transparency". Reuters. 2019-06-19. Retrieved 2019-12-11.

- "www.ciel.org/news/victory-world-bank-effort-to-support-chinas-population-transfer-into-tibet-is-defeated/". www.ciel.org. Retrieved 2017-06-06.