Banknotes of the United States dollar

Multiple types of banknotes of the United States dollar have been issued, including Federal Reserve Notes, Silver Certificates, Gold certificates and United States Notes.

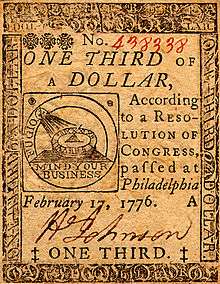

Continental Currency

Before the American Revolution, every one of the Thirteen Colonies had issued its own paper money, most often denominated in British pounds, shillings and pence. In 1776, the newly created United States issued currency which was bought by people who wanted to support the war (it was promised that the currency could be redeemed for Spanish milled dollars once the war would end). At first, the banknotes circulated at par with the stated value, however after a few months they started depreciating until they became almost worthless. In an agreement, the United States agreed to redeem the notes for treasury bonds at 1% of the face value. The issued denominations ranged from $1/6 to $80.

Treasury Notes

Treasury Notes were issued from 1812 to 1913, and were interest-bearing notes issued by the United States in times of war or financial unrest. Various notes of various denominations were issued during the War of 1812 (large and small size notes), the Panic of 1837, the Mexican–American War, the Panic of 1857, the Civil War and the Panic of 1907. From the Civil War through the Panic of 1907 they were known as "Certificates of Indebtedness".

Demand Notes

Demand Notes are considered the first paper money issued by the United States whose main purpose was to circulate. They were made because of a coin shortage as people hoarded their coins during the American Civil War and were issued in denominations of $5, $10 and $20. They were redeemable in coin. They were replaced by United States Notes in 1862. After the war ended paper money continued to circulate until present day.

United States Notes

United States Notes, also known as Legal Tender Notes, succeeded Demand Notes as the main currency form of the United States. They were not redeemable but were receivable for all taxes and debts, which is what persuaded people to circulate them. They had a red seal and were originally issued in denominations of $1, $2, $5, $10, $20, $50, $100, $500 and $1,000. $5,000 and $10,000 notes were issued in 1878 and have not been issued anytime after. United States Notes switched to small size in 1928 and were introduced in denominations of only $1, $2 and $5. In 1934, when Federal Reserve Notes stopped being redeemable in gold, the only difference between them and Legal Tender Notes was that the first were liabilities of the Federal Reserve while the latter were direct liabilities of the United States Treasury Department. The $2 and $5 were issued through 1966, and the $2 note was only available as a United States Note. In 1966 the $5 United States Note was discontinued and the $2 denomination was discontinued altogether. In 1966 a $100 US note was issued to meet legal requirements about the amount of notes in circulation. In 1971 the production of US notes was halted and they were officially discontinued in 1994.

Fractional Currency

-%240.50-Fr.1328.jpg)

During the American Civil War silver and gold coins were hoarded by the public because of uncertainty about the outcome of the war. People began to use postage stamps instead, encasing them in metal for better protection. The U.S. government decided to substitute paper currency of denominations under a dollar for coins in order to solve the problem. The denominations issued were 3¢, 5¢, 10¢, 15¢, 25¢ and 50¢. There were five issues of fractional currency.

Interest bearing note

Interest bearing notes were issued from 1863-1865 and bore a 5% or 7.3% interest per annum. The 5% notes matured at one year while the 7.3% interest notes (also known as seven-thirties) matured at three years. Their denominations were $10, $20, $50, $100, $500 and $1,000.

Compound interest treasury notes

In 1863 and 1864, compound interest treasury notes were issued. They paid out 6% annual interest compounded semi-annually 3 years after their issue. Their denominations were $10, $20, $50, $100, $500 and $1,000.

Gold Certificates

Gold certificates were issued from 1865 through 1934 and were redeemable in gold coin. Following the 1933 ban on gold ownership in the United States, they were recalled to be redeemed for United States Notes. They were issued in large size through 1929 and in small size thereafter. They were originally issued in denominations of $20, $100, $500, $1,000, $5,000 and $10,000. A $50 note was added in 1882, followed by a $10 note in 1907. A $100,000 note which was used only for inter-bank transactions was also issued in 1934 but never made available to the general public. It is still illegal to own.

National Bank Notes

National Bank Notes, unlike the other banknotes of the United States, were not directly issued by banks controlled by the United States government but were issued by banks chartered to do so by the government. The banks' charter expired after 20 years and they had to renew it if they wanted to continue to issue National Bank Notes. They were all uniform in look except for the name of the bank and were issued as three series, known as the three charter periods. The first one were notes issued from 1869-1882, the second one from 1882-1902, and the third one from 1902-1922. In 1929 the notes were resurrected as an emergency issue due to the Great Depression in small size. They were discontinued in 1933. The denominations issued were $1, $2, $5, $10, $20, $50, $100, $500 and $1,000. The $1, $2, $500 and $1,000 notes were only issued in large size during the First Charter Period. The $1 and $2 notes are common from most banks (there are exceptions). The $500 note is extremely rare; there are only three known examples, of which one is held privately, and the $1,000 note is unknown to exist.

National Gold Bank Notes

National Gold Bank Notes were issued by private banks, mostly from California. The concept is similar to that of the National Bank Notes, the difference being that National Gold Bank Notes were redeemable in gold. They were issued from 1870-1875 in denominations of $5, $10, $20, $50, $100 and $500. They are all rare with the $5 being by far the most common, with 427 examples known, and the $50 the rarest, with only 7 examples known. The $500 note is not known to exist.

Silver Certificates

Silver certificates were issued from 1878 through 1964 and were redeemable in silver coin through 1967 and thereafter in raw silver bullion. Since 1968 they are not redeemable in anything but Federal Reserve Notes. They were removed from circulation in 1964, at the same time as silver coins. They were issued in large size through 1929 and in small size thereafter. They were originally issued in denominations of $10, $20, $50, $100, $500 and $1,000. $1, $2 and $5 notes were added in 1882. Small size notes were only made in denominations of $1, $5 and $10. The small notes were made with a blue seal, except for notes made as an emergency issue for American soldiers in North Africa during World War II, which were made with a yellow seal, as well as a $1 note made for use only in Hawaii during World War II, which had a brown seal.

Refunding Certificate

Refunding Certificates, issued only in 1879 and only in the $10 denomination, were special in that their interest (4% per annum) did accrue indefinitely, which was meant as a way to persuade people into buying them. However, as very few of these notes were redeemed, in 1907 Congress passed an act stopping the accrual of interest, fixing the value of the notes at $21.30.

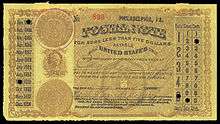

United States Postal Notes

The US postal note was a note which could be sent by mail. The sender wrote the amount of money they wanted to send, which could be any amount not exceeding $5, and sent them via mail. The fee for sending the note was face value + 3 cents and the notes required no stamp. They then could be redeemed by the receiver at the Post Office named by the sender. Starting 1887 the notes could be redeemed in coin at any post office. They were discontinued in 1894. There were five distinct types issued.

Treasury or Coin Notes

These notes were issued in 1890 and 1891 and were redeemable in coin. It was the decision of the Secretary of the Treasury whether the coin would be silver or gold. They were originally issued in denominations of $1, $2, $5, $10, $20, $100 and $1,000. $50 and $500 notes were introduced in 1891.

Federal Reserve Bank Notes

After the Federal Reserve system was created in 1914, alongside Federal Reserve Notes, which are liabilities of the Federal Reserve System as a whole, Federal Reserve Bank Notes were issued. They were liabilities of only the Federal Reserve Bank which issued them. In 1929, like other kinds of notes they switched to small size. They were discontinued in 1934 and no longer available from banks since 1945.

Federal Reserve Notes

They were first issued in 1914, different from the Federal Reserve Bank Notes in that they were liabilities of the whole Federal Reserve System. They were redeemable in gold until 1933. After that date they stopped to be redeemable in anything, much like United States Notes (which later led to the halting of the production of United States Notes). They switched to small size in 1929 and are the only type of currency in circulation today in the United States. They were originally printed in denominations of $5, $10, $20, $50, $100, $500, $1,000, $5,000 and $10,000. The $500, $1,000, $5,000 and $10,000 denominations were last printed in 1945 and discontinued in 1969, making the $100 bill the largest denomination banknote in circulation. A $1 note was added in 1963 to replace the $1 Silver Certificate after that type of currency had been discontinued. Since United States Notes were discontinued in 1971, Federal Reserve Notes are the only type of currency circulating in the US. In 1976, a $2 note was added, 10 years after the $2 denomination of United States Note was officially discontinued. The denomination proved to be unpopular and is now treated as a curiosity, although it is still being printed. Starting 1996, all notes except $1 and $2 were redesigned to have a larger portrait of the people depicted on them. Since 2004, all notes (except $1 and $2) were progressively changed to have different colors to make them more easily distinguishable from each other, until the last such note was introduced in 2013 (the $100).

| Current circulating banknotes of the United States | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Images | Value | Background color | Fluorescent strip color | Description | Date of | ||||

| Obverse | Reverse | Obverse | Reverse | Watermark | First Series | Issue | |||

|

|

$1 | Green | None | George Washington | Great Seal of the United States | None | 1963 | 1963 |

|

|

$2 | Green | None | Thomas Jefferson | Declaration of Independence by John Trumbull | None | 1976 | April 13, 1976 |

|

|

$5 | Purple | Blue | Abraham Lincoln | Lincoln Memorial | Two Watermarks of the Number "5" | 2006 | March 13, 2008 |

| Obverse of the Great Seal of the United States | |||||||||

|

|

$10 | Orange | Orange | Alexander Hamilton | Treasury Building | Alexander Hamilton | 2004 A | March 2, 2006 |

| The phrase "We the People" from the Constitution The torch of the Statue of Liberty | |||||||||

|

|

$20 | Green | Green | Andrew Jackson | White House | Andrew Jackson | 2004 | October 9, 2003 |

| Eagle | |||||||||

|

|

$50 | Pink | Yellow | Ulysses S. Grant | United States Capitol | Ulysses S. Grant | 2004 | September 28, 2004 |

| Flag of the United States | |||||||||

|

|

$100 | Teal | Pink | Benjamin Franklin | Independence Hall | Benjamin Franklin | 2009A | October 8, 2013 |

| Declaration of Independence | |||||||||

| These images are to scale at 0.7 pixel per millimetre. For table standards, see the banknote specification table. | |||||||||