AccessHolding

Access Microfinance Holding AG, often referred to as AccessHolding, is a commercial microfinance investment and holding company based in Germany. AccessHolding specializes in start-ups and early-stage microfinance institutions (MFIs). It will establish new MFIs together with other partners, and transform existing non-bank microlending institutions into full-service microfinance banks.[1]

| Joint Stock Company | |

| Industry | Development Finance |

| Founded | 2006 |

| Headquarters | Berlin, Germany |

Key people | Thomas Engelhardt Chairman |

| Products | Equity Finance Management Services |

| Total assets | €1 billion (*network 2014) |

| Website | Homepage |

Overview

AccessHolding is an investor and technical manager in a network of microfinance banks in developing and emerging countries. These banks specifically target their lending to micro, small and medium-sized enterprises, in the countries that they serve. As of June 2014, the company had eight microfinance banks in Sub-Saharan Africa, Central Asia and the Caucasus. At that time, the group banks' total assets were valued at approximately €1 billion, with shareholders' equity of about €170 million.[2]

History

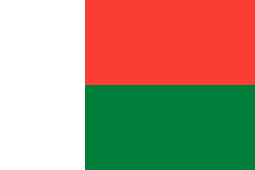

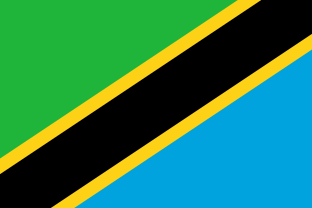

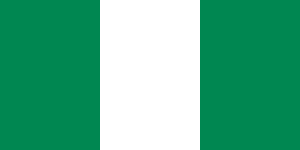

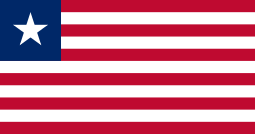

The company was founded in August 2006 by LFS Financial Systems GmbH (LFS).[3] LFS is a German business and financial consulting firm based in Berlin. It has special expertise in developing and emerging markets. It serves as the manager and technical advisor to the company as well as to the banks in which AccessHolding invests. The company is registered as a "joint stock company" under German law; with a paid-up capital of €27.8 million. As of December 2013, AccessHolding has created a total of eight microfinance banks in Azerbaijan, Madagascar, Tanzania, Nigeria, Liberia, Tajikistan, Zambia and Rwanda.[4]

AccessBank Group

The member banks of the AccessBank Group include the following:[5]

- AccessBank Azerbaijan - Baku, Azerbaijan

- AccessBank Madagascar - Antananarivo, Madagascar

- AccessBank Tanzania - Dar es Salaam, Tanzania

- AB Microfinance Bank Nigeria - Lagos, Nigeria

- AccessBank Liberia - Monrovia, Liberia

- AccessBank Tajikistan - Dushanbe, Tajikistan

- AB Bank Zambia - Lusaka, Zambia

- AB Bank Rwanda - Kigali, Rwanda

Ownership

As of December 2013, the company stock is privately owned by the following corporate entities:[7]

| AccessHolding Stock Ownership | ||||||||||||||||||||||||||||||

|

- MicroAssets GbR is the employee investment company owned by the staff of LFS Financial Systems GmbH.

See also

External links

References

- About AccessHolding

- Audited December 2012 Annual Financial Report

- "AccessHolding Was Formed On 30 October 2006". Archived from the original on 3 March 2016. Retrieved 16 September 2019.

- History of AccessHolding

- Members of the AccessBank Group

- Shareholding In AccessBank Azerbaijan

- Shareholding In AccessHolding