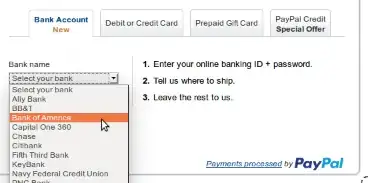

Paypal has a new payment option called "Bank Account" which says:

Enter your online banking ID + password

QUESTION: To me it sounds unsafe (ie: sends my password to a third-party organization like Paypal), but does there actually exist any security mechanism/protocol that they could be using to make this operation safe?

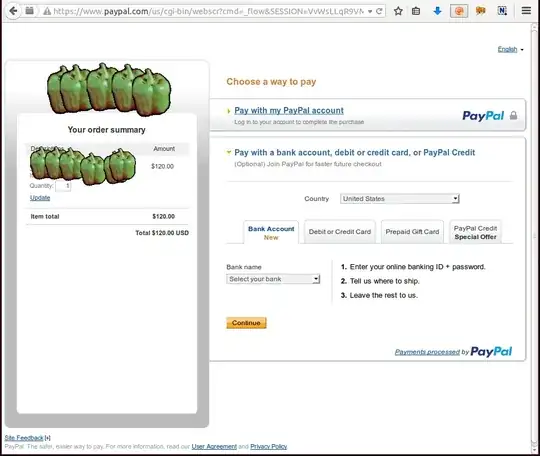

Notes: Seen from Japan, on Firefox 32.0 Ubuntu 2014.04, URL starts with https://www.paypal.com/

The warning symbol in the URL says "Connection Partially Encrypted".